Escolar Documentos

Profissional Documentos

Cultura Documentos

5 Minute Guide To Stock Investing PDF

Enviado por

Henzkel CanoyTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

5 Minute Guide To Stock Investing PDF

Enviado por

Henzkel CanoyDireitos autorais:

Formatos disponíveis

5 minute guide to stock investing for beginners

For the person who has interest in investing in the stock market, this page will show you the advantage/benefits of

investing in stocks and how to execute trade transactions.

What are the returns on stock investment?

How much do I need to invest in stocks?

What is the structure of stock investing?

What are

What are the

the returns

returns on

on stock

stock investment?

investment?

The basic appeal of investing in stocks is the potential attractive returns.

Here are two examples:

Capital gain: Profit from a price increase, buying low and selling high

Income gain: Dividends. The firm will return some of the profits quarterly, semiannually, or annually to

shareholders

Risk and return are two sides of the same coin. It is a hard and fast rule in the investment world. Stocks are no

exception. The possibility of stock prices going down after buying stocks is a likely scenario. Listed companies

may also go into bankruptcy, but the attraction of stock investing is not only pecuniary return. Investors can also

gain corresponding rights as stockholders. For example, wield the right to vote at a general meeting of

stockholders and join the companys decision-making. Also, through the volatility of stock markets, investors

develop an interest in economics and socio-political happenings. Investors also get to learn to analyze financial

statements of the companies whose stocks they buy. These are by-products to make informed investment

decisions.

How much do I need to invest in stocks?

Do you have an impression that stock investing is only for the rich people? Actually, you can start to invest even

without a large amount of money.

The minimum amount required for trading depends on the lot size. The minimum lot, on the other hand, depends

on the stock price. Below are few examples of the minimum amount required based on The Board Lot table of

PSE (Philippines Stock Exchange):

(1) Php 2.00 (Share price) X 1000 shares(Minimum lot)=Php 2,000

(2) Php 2.00 (Share price) X 1000 shares(Minimum lot)=Php 2,000

(3) Php 6.00 peso (Share price) X 100 shares(Minimum lot)=Php 600

(4) Php 51.00 peso (Share price) X 10 shares(Minimum lot)=Php 510

(5) Php 2100 peso (Share price) X 5 shares(Minimum lot)=Php 10,500

*There are additional costs for the trading commission.

1

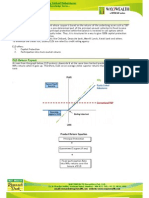

The Board Lot Table

PRICE TICK SIZE LOT SIZE PRICE TICK SIZE LOT SIZE

From To From To

0.0001 0.0099 0.0001 1,000,000 50 99.95 0.05 10

0.01 0.049 0.001 100,000 100 199.9 0.1 10

0.05 0.249 0.001 10,000 200 499.8 0.2 10

0.25 0.495 0.005 10,000 500 999.5 0.5 10

0.5 4.99 0.01 1,000 1000 1999 1 5

5 9.99 0.01 100 2000 4998 2 5

10 19.98 0.02 100 5000 UP 5 5

20 49.95 0.05 100

What is the structure of stock investing?

Stocks are issued publicly to raise the capital for businesses. Buying stocks means that investors invest their

money in the company through its stocks, which in turn increases the capital of the business that can further be

used by the company for expansion.

What should I do when I want to buy stocks? Although the stock issuer is a company, investors dont buy from

companies directly. This is because trading stocks is centralized in the stock exchange.

ORDER ORDER

Investors Brokerage company Stock Excahage (PSE)

Investors must first open an account in brokerage firms which are the intermediary companies between the stock

exchange and the investors. Once the account is opened, investors fund the account so they can buy stocks.

Stock exchange efficiently executes multiple orders from different brokerage companies in accordance with the

fixed rule. The transaction is executed safely and investors settle their trades through the brokerage companies.

DisclaimerThis presentation is being issued solely for information purposes. This presentation does not contain all of the information required by a

party to evaluate the prospects of participating or utilizing the proposed financial products. Potential participants must conduct their own

investigations and analysis and rely on the results of such investigation in coming up with a decision to participate in any of the proposed financial

products. The data and information presented and included in this presentation do not purport to be complete and exhaustive. They have not been

independently verified as to their veracity and timeliness. BDO Nomura Securities, Inc. (formerly PCIB Securities, Inc.), including their respective

allied entities, as well as their respective agents, advisers, directors, officers, employees or representatives make no warranty or representation,

express or implied as to the accuracy or completeness of the contents of the presentation. This disclaimer extends to any statements, opinions or

conclusions contained in, or any omissions from, the presentation or in respect or in respect of written or oral communications transmitted or

otherwise made available to the prospective participants, and no representation or warranty is made in respect of any such statements, opinions or

conclusions. The contents of this presentation are strictly private and confidential. Accordingly, except with the prior written consent of BDO Nomura

Securities, Inc. (formerly PCIB Securities, Inc.), the information contained in the presentation must be held in complete confidence.

2

Você também pode gostar

- MakeOver5PercentAWeekReport PDFDocumento12 páginasMakeOver5PercentAWeekReport PDFGaro Ohanoglu100% (1)

- Private Equity QuestionsDocumento74 páginasPrivate Equity QuestionsKumar PrashantAinda não há avaliações

- Options Trading Strategies For ADocumento25 páginasOptions Trading Strategies For Aaryalee100% (2)

- How To Begin Investing In The Stock Market: Obtaining Financial FreedomNo EverandHow To Begin Investing In The Stock Market: Obtaining Financial FreedomAinda não há avaliações

- Ebook - TradeLikeChamp - ReportDocumento33 páginasEbook - TradeLikeChamp - ReportRoberto Passero100% (1)

- Making Money with Binary Options Trading Starter KitNo EverandMaking Money with Binary Options Trading Starter KitNota: 2 de 5 estrelas2/5 (1)

- Eric Khrom of Khrom Capital 2013 Q1 LetterDocumento4 páginasEric Khrom of Khrom Capital 2013 Q1 LetterallaboutvalueAinda não há avaliações

- 10 Steps To Invest in Equity - SFLBDocumento3 páginas10 Steps To Invest in Equity - SFLBSudhir AnandAinda não há avaliações

- Child Care Business PlanDocumento15 páginasChild Care Business Plandeepakpinksurat100% (5)

- Ian Marcouse - Marie Brewer - Andrew Hammond - AQA Business Studies For AS - Revision Guide-Hodder Education (2010)Documento127 páginasIan Marcouse - Marie Brewer - Andrew Hammond - AQA Business Studies For AS - Revision Guide-Hodder Education (2010)Talisson BonfimAinda não há avaliações

- Jrooz Review Center: Tried and Tested Tips For The IELTS ExamDocumento12 páginasJrooz Review Center: Tried and Tested Tips For The IELTS ExamJameston BostreAinda não há avaliações

- DayTrade Gaps SignalsDocumento30 páginasDayTrade Gaps SignalsJay SagarAinda não há avaliações

- Stock Market Investing Blueprint: Your Best Stock Investing Guide: Simple Strategies to Build a Significant Income: Perfect for Beginners - Forex, Dividend, Options Trading InformationNo EverandStock Market Investing Blueprint: Your Best Stock Investing Guide: Simple Strategies to Build a Significant Income: Perfect for Beginners - Forex, Dividend, Options Trading InformationAinda não há avaliações

- Stock Market Investing Strategies For Beginners A Simple Trading Guide On Investing In Stocks And How To Start Making Profits On Your Money TodayNo EverandStock Market Investing Strategies For Beginners A Simple Trading Guide On Investing In Stocks And How To Start Making Profits On Your Money TodayAinda não há avaliações

- Investor GuideDocumento7 páginasInvestor Guidefaisalshafiq1100% (1)

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.No EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Ainda não há avaliações

- Chapter 36Documento28 páginasChapter 36api-3743202Ainda não há avaliações

- Basics of Share MarketDocumento15 páginasBasics of Share MarketashutoshAinda não há avaliações

- Risk and Return AnalysisDocumento38 páginasRisk and Return AnalysisAshwini Pawar100% (1)

- Free Masons Forerunners of DajjalDocumento19 páginasFree Masons Forerunners of Dajjalapi-3709309100% (4)

- FXST Economics 101 - 2012 EditionDocumento8 páginasFXST Economics 101 - 2012 EditionDaniel GuerreroAinda não há avaliações

- TCSDocumento19 páginasTCSswapvj100% (3)

- Stock Market Investing: How to Make Money and Build WealthNo EverandStock Market Investing: How to Make Money and Build WealthAinda não há avaliações

- Case Study (Capital Conundrum) (19!07!11)Documento4 páginasCase Study (Capital Conundrum) (19!07!11)sanhack10050% (2)

- Swot Analysis of JapanDocumento20 páginasSwot Analysis of JapanSandeep Mittal80% (5)

- Advantages and Disadvantages of Investing in The Stock MarketDocumento5 páginasAdvantages and Disadvantages of Investing in The Stock MarketZundrixKyleCarantoAinda não há avaliações

- Income From SalariesDocumento28 páginasIncome From SalariesAshok Kumar Meheta100% (2)

- Dividend Investing I Complete Beginner’s Guide to Learn How to Create Passive Income by Trading Dividend Stocks I Start Achieving Financial Freedom and Planning Your Early RetirementNo EverandDividend Investing I Complete Beginner’s Guide to Learn How to Create Passive Income by Trading Dividend Stocks I Start Achieving Financial Freedom and Planning Your Early RetirementAinda não há avaliações

- Investment and Portfolio Management AssignmentDocumento29 páginasInvestment and Portfolio Management AssignmentLiaAinda não há avaliações

- The Sales ProcessDocumento23 páginasThe Sales ProcessArun Mishra100% (1)

- Dividend Investing: The Ultimate Guide to Create Passive Income Using Stocks. Make Money Online, Gain Financial Freedom and Retire Early Earning Double-Digit ReturnsNo EverandDividend Investing: The Ultimate Guide to Create Passive Income Using Stocks. Make Money Online, Gain Financial Freedom and Retire Early Earning Double-Digit ReturnsAinda não há avaliações

- Director Ecommerce Software Development in United States Resume Brendan MoranDocumento2 páginasDirector Ecommerce Software Development in United States Resume Brendan MoranBrendan MoranAinda não há avaliações

- Why Invest? and Why Invest in The Colombo Stock Market?: Investor InformationDocumento12 páginasWhy Invest? and Why Invest in The Colombo Stock Market?: Investor InformationmilansaAinda não há avaliações

- High Dividend Yield StocksDocumento3 páginasHigh Dividend Yield StocksJaya SudhakarAinda não há avaliações

- Derivatives Report, 21 March 2013Documento3 páginasDerivatives Report, 21 March 2013Angel BrokingAinda não há avaliações

- 3.1. Problem Statement: Supply DemandDocumento29 páginas3.1. Problem Statement: Supply DemandAysha LipiAinda não há avaliações

- Of Investing in Unit Trusts and Investment-Linked Polices (ILPs)Documento29 páginasOf Investing in Unit Trusts and Investment-Linked Polices (ILPs)RK50% (2)

- SHORT WRITE ABOUT STOCK SHARE AND RISK Electiva CPCDocumento7 páginasSHORT WRITE ABOUT STOCK SHARE AND RISK Electiva CPCyarima paterninaAinda não há avaliações

- Negen Angel Fund FAQsDocumento8 páginasNegen Angel Fund FAQsAnil Kumar Reddy ChinthaAinda não há avaliações

- Investing in The Philippine Stock MarketDocumento13 páginasInvesting in The Philippine Stock MarketJohn Carlo AquinoAinda não há avaliações

- Fidelity South-East Asia Fund, A Sub-Fund of Fidelity Investment Funds, A Accumulation Shares (ISIN: GB0003879185)Documento2 páginasFidelity South-East Asia Fund, A Sub-Fund of Fidelity Investment Funds, A Accumulation Shares (ISIN: GB0003879185)Nais BAinda não há avaliações

- What Is A Risk Profile FormDocumento4 páginasWhat Is A Risk Profile FormMahmood 786Ainda não há avaliações

- Equity Market Basic ZDocumento26 páginasEquity Market Basic Zu10ce061Ainda não há avaliações

- Shares Course 4Documento10 páginasShares Course 4engrwaqas_11Ainda não há avaliações

- New To Mutual FundsDocumento46 páginasNew To Mutual FundssandeepkakAinda não há avaliações

- Getting Started in Shares: The Australian SharemarketDocumento20 páginasGetting Started in Shares: The Australian SharemarketreachernieAinda não há avaliações

- Knowledge Series : Typical Payoff Scenario Typical Payoff ScenarioDocumento2 páginasKnowledge Series : Typical Payoff Scenario Typical Payoff ScenarioAvinash NairAinda não há avaliações

- What Is An Investment TrustDocumento13 páginasWhat Is An Investment TrustSewale AbateAinda não há avaliações

- Iapm NotesDocumento45 páginasIapm NotesBhai ho to dodoAinda não há avaliações

- W3M3 - HANDOUT Trading Securities - Market MechanicsDocumento7 páginasW3M3 - HANDOUT Trading Securities - Market MechanicsMICHELLE MILANAAinda não há avaliações

- Why Share Prices Move Up and DownDocumento5 páginasWhy Share Prices Move Up and Downranjit666Ainda não há avaliações

- 4 Reasons of Why You Should Invest in SharesDocumento8 páginas4 Reasons of Why You Should Invest in SharesAdvisesure.comAinda não há avaliações

- Thesis Unit Trust Management FundsDocumento7 páginasThesis Unit Trust Management Fundsgjhs6kjaAinda não há avaliações

- Investors Guide PDFDocumento8 páginasInvestors Guide PDFadeelshahzadqureshi8086Ainda não há avaliações

- How To Invest in Stocks For The First Time: A Beginner's GuideDocumento6 páginasHow To Invest in Stocks For The First Time: A Beginner's GuideKevin Johan OlarteAinda não há avaliações

- Derivatives Report, 28 February 2013Documento3 páginasDerivatives Report, 28 February 2013Angel BrokingAinda não há avaliações

- MF EducationDocumento5 páginasMF EducationVikash ChaurasiaAinda não há avaliações

- Elss Funds:-: Equity Mutual FundDocumento13 páginasElss Funds:-: Equity Mutual FundMohit BalaniAinda não há avaliações

- ChapterDocumento90 páginasChapterRavi SharmaAinda não há avaliações

- Case Study - Put OptionsDocumento3 páginasCase Study - Put OptionsMartijn ReekAinda não há avaliações

- Mutual FundDocumento10 páginasMutual FundIndraneel BishayeeAinda não há avaliações

- Sip Report On Investment OptionsDocumento17 páginasSip Report On Investment OptionsSravani Reddy BodduAinda não há avaliações

- Mutual FundDocumento5 páginasMutual FundVikas JhaAinda não há avaliações

- Stock Trading GuideDocumento4 páginasStock Trading GuideJuneil M. GoAinda não há avaliações

- Nism Va Mutual Fund Distributor ExaminationDocumento130 páginasNism Va Mutual Fund Distributor ExaminationKrishna JhaAinda não há avaliações

- Derivatives Report, 08 Feb 2013Documento3 páginasDerivatives Report, 08 Feb 2013Angel BrokingAinda não há avaliações

- Are You InvestingDocumento10 páginasAre You InvestingShailesh BansalAinda não há avaliações

- Tilson Funds Annual Report 2005Documento28 páginasTilson Funds Annual Report 2005josepmcdalena6542Ainda não há avaliações

- Stock Market (PHL)Documento15 páginasStock Market (PHL)Kaly RieAinda não há avaliações

- Derivatives Report, 12 April 2013Documento3 páginasDerivatives Report, 12 April 2013Angel BrokingAinda não há avaliações

- Jumpstart Your UITF InvestmentDocumento2 páginasJumpstart Your UITF InvestmentJameston BostreAinda não há avaliações

- Technical Analysis: DisclaimerDocumento5 páginasTechnical Analysis: DisclaimerJameston BostreAinda não há avaliações

- HyperthyroidDocumento5 páginasHyperthyroidJameston BostreAinda não há avaliações

- NeuroemDocumento51 páginasNeuroemJameston BostreAinda não há avaliações

- Med, Legal, and Ethical IssuesDocumento30 páginasMed, Legal, and Ethical IssuesJameston BostreAinda não há avaliações

- 1: Introduction To Emergency Medical CareDocumento19 páginas1: Introduction To Emergency Medical CareJameston BostreAinda não há avaliações

- Antibiotics by ClassVITEK-Bus-Module-1-Antibiotic-Classification-and-Modes-of-Action-1.pDocumento6 páginasAntibiotics by ClassVITEK-Bus-Module-1-Antibiotic-Classification-and-Modes-of-Action-1.pJameston BostreAinda não há avaliações

- 1: Introduction To Emergency Medical CareDocumento19 páginas1: Introduction To Emergency Medical CareJameston BostreAinda não há avaliações

- Entrepreneur: Warren BuffetDocumento12 páginasEntrepreneur: Warren BuffetAnadi GuptaAinda não há avaliações

- MATRIX Hervás-Oliver, J. L., Parrilli, M. D., Rodríguez-Pose, A., & Sempere-Ripoll, F. (2021)Documento7 páginasMATRIX Hervás-Oliver, J. L., Parrilli, M. D., Rodríguez-Pose, A., & Sempere-Ripoll, F. (2021)Wan LinaAinda não há avaliações

- NeocolonialismDocumento1 páginaNeocolonialismManny De MesaAinda não há avaliações

- Midterm Macro 1Documento5 páginasMidterm Macro 1huong quynhAinda não há avaliações

- Registration of PartnershipFirm in Pakistan-Sample Partnership Deed-Rehan Aziz Shervani (Advocate High Court) - 0333-4324961-For Registration Process See 99 Lectures On Business LawDocumento3 páginasRegistration of PartnershipFirm in Pakistan-Sample Partnership Deed-Rehan Aziz Shervani (Advocate High Court) - 0333-4324961-For Registration Process See 99 Lectures On Business LawrehanshervaniAinda não há avaliações

- UTS Akmen - Ahmad RoyhaanDocumento5 páginasUTS Akmen - Ahmad RoyhaanOppa Massimo MorattiAinda não há avaliações

- Retail Foods - The Hague - Netherlands - 06-30-2020Documento10 páginasRetail Foods - The Hague - Netherlands - 06-30-2020sb AgrocropsAinda não há avaliações

- 06 PPC Ch6 Capacity PlanningDocumento20 páginas06 PPC Ch6 Capacity PlanningziadatzAinda não há avaliações

- Pavilion-cum-Convention Centre DesignDocumento5 páginasPavilion-cum-Convention Centre DesignHarman VirdiAinda não há avaliações

- Mary Michelle R. MayladDocumento3 páginasMary Michelle R. Mayladmichie_rm26Ainda não há avaliações

- Importance of Sales PromotionDocumento3 páginasImportance of Sales PromotionHajra KhanAinda não há avaliações

- Screenshot 2023-04-17 at 15.46.54Documento28 páginasScreenshot 2023-04-17 at 15.46.54psgq68kfykAinda não há avaliações

- MarketWars Case StudyDocumento15 páginasMarketWars Case StudyABILESH R 2227204Ainda não há avaliações

- AIU EssayDocumento17 páginasAIU EssayGodfred AbleduAinda não há avaliações

- Future Research Directions in Tourism MarketingDocumento13 páginasFuture Research Directions in Tourism MarketingSanti Gopal TolaniAinda não há avaliações

- Thị Trường Tiền Tệ Và Thị Trường Trái Phiếu Tiếng AnhDocumento32 páginasThị Trường Tiền Tệ Và Thị Trường Trái Phiếu Tiếng AnhHuỳnh Thị Thu HiềnAinda não há avaliações

- Minor Project ReportDocumento53 páginasMinor Project ReportVishlesh 03014901819Ainda não há avaliações

- Share Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessDocumento17 páginasShare Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessBabu babuAinda não há avaliações

- 2.theory of Demand and SupplyDocumento39 páginas2.theory of Demand and SupplyMuhammad TarmiziAinda não há avaliações

- Barringer E4 PPT 03GEfeasibility AnalysisDocumento28 páginasBarringer E4 PPT 03GEfeasibility AnalysisraktimbeastAinda não há avaliações