Escolar Documentos

Profissional Documentos

Cultura Documentos

Taxation: RC NRC RA Nraeb Nraneb SA On Taxable Income On Passive Income

Enviado por

CyangenDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Taxation: RC NRC RA Nraeb Nraneb SA On Taxable Income On Passive Income

Enviado por

CyangenDireitos autorais:

Formatos disponíveis

TAXATION

SUMMARY OF SIGNIFICANT POINTS

SUMMARY OF RATES

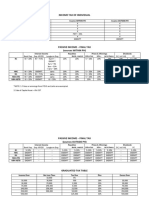

TAXPAYER

INDIVIDUAL

RC NRC RA NRAEB NRANEB SA

On taxable Income ST ST ST ST Gross Income 25% Compensation Income 15%

On Passive Income

1. Interest-FCDS 7.5% Exempt 7.5% Exempt None 7.5%

2. Interest on deposits 20% 20% 20% 20% None 20%

3. Royalties, except books-literary 20% 20% 20% 20% None 20%

4. Royalties-books 10% 10% 10% 10% None 10%

5. Prizes/winnings of more than 10,000 20% 20% 20% 20% None 20%

6. Dividends from domestic 10% 10% 10% 20% None 10%

On Capital gains

100,000 (5%) 100,000 (5%) 100,000 (5%) 100,000 (5%) 100,000 (5%) 100,000 (5%)

1. Sale of shares-not traded

>100,000 (10%) >100,000 (10%) >100,000 (10%) >100,000 (10%) >100,000 (10%) >100,000 (10%)

2. Sale of Real Property

6% on GSP or 6% on GSP or 6% on GSP or 6% on GSP or 6% on GSP or 6% on GSP or

held as CA-in the PH

FMV higher FMV higher FMV higher FMV higher FMV higher FMV higher

not a principal residence

TAXPAYER

CORPORATION

DC RF NRF SA

Depends on: Depends on: Private Educational Inst./NS-

10%TNI

a. NCIT-30%NI a. NCIT-30%NI NP Hospital

b. MCIT-2%GI b. MCIT-2%GI Resident International Carrier 2.5% GPHB

c. IAET-10% c. BRT-15% Non-resident Cinema 2.5% GI-PH

On taxable Income 30% GI

d. GIT-15% d. IAET-10%

Non-resident-Vessel 4.5% GI-PH

e. GIT-15%

Non-resident Aircraft 7.5% GI-PH

OBU 10% Interest-FCDS

On Passive Income

1. Interest-FCDS 7.5% 7.5% - -

2. Interest on deposits 20% 20% - -

3. Interest on Foreign Loans - - - 20%

4. Dividends from domestic Exempt Exempt 15% -

On Capital gains

100,000 (5%) 100,000 (5%) 100,000 (5%)

3. Sale of shares-not traded -

>100,000 (10%) >100,000 (10%) >100,000 (10%)

4. Sale of Real Property

6% on GSP or

held as CA-in the PH - - -

FMV higher

not a principal residence

Page 1 of 1

Você também pode gostar

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)No EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Nota: 3.5 de 5 estrelas3.5/5 (17)

- Regular Business/Corporate Tax: DC RFC NRFCDocumento2 páginasRegular Business/Corporate Tax: DC RFC NRFCGrace Angelie C. Asio-SalihAinda não há avaliações

- Competition Law and Economic Regulation in Southern Africa: Addressing Market Power in Southern AfricaNo EverandCompetition Law and Economic Regulation in Southern Africa: Addressing Market Power in Southern AfricaAinda não há avaliações

- Tax RatesDocumento2 páginasTax RatesSalma GurarAinda não há avaliações

- Final Withholding Tax On Passive IncomeDocumento1 páginaFinal Withholding Tax On Passive IncomeChelsea Anne VidalloAinda não há avaliações

- Passive Incomefor Both Individual and Corporation Individual CorporationDocumento4 páginasPassive Incomefor Both Individual and Corporation Individual CorporationYrolle Lynart AldeAinda não há avaliações

- Income Tax Table - Part 1 and 2Documento8 páginasIncome Tax Table - Part 1 and 2Rebecca TatadAinda não há avaliações

- Lesson 4 Final Income Taxation PDFDocumento4 páginasLesson 4 Final Income Taxation PDFErika ApitaAinda não há avaliações

- Final Tax LectureDocumento7 páginasFinal Tax LectureJefrey Jismen Ballesteros100% (1)

- Tax Notes Aug 10-11Documento15 páginasTax Notes Aug 10-11Reiner NuludAinda não há avaliações

- Yield/monetary Benefit From Deposit Substitutes Yield/monetary Benefit From Trust Funds and Similar ArrangementsDocumento1 páginaYield/monetary Benefit From Deposit Substitutes Yield/monetary Benefit From Trust Funds and Similar ArrangementsChimmy ParkAinda não há avaliações

- Final Income TaxDocumento6 páginasFinal Income TaxJñelle Faith Herrera SaludaresAinda não há avaliações

- Tax - Simplified Table of RatesDocumento5 páginasTax - Simplified Table of RatesLouAinda não há avaliações

- 1 Page Summary of NR Tax Rates-1Documento1 página1 Page Summary of NR Tax Rates-1PaulAinda não há avaliações

- Income Tax of Individual: Books, Musical 10k or Less 10k++ Luck/chanceDocumento3 páginasIncome Tax of Individual: Books, Musical 10k or Less 10k++ Luck/chanceKatherine Jane UnayAinda não há avaliações

- AppendicesDocumento8 páginasAppendicescrackheads philippinesAinda não há avaliações

- REO CPA Review: REO: Income Taxation - Final Withholding Tax TableDocumento2 páginasREO CPA Review: REO: Income Taxation - Final Withholding Tax TableCamille SingianAinda não há avaliações

- Income RC, NRC & RA Nranetb Interest Income DepositsDocumento3 páginasIncome RC, NRC & RA Nranetb Interest Income DepositsMichael AquinoAinda não há avaliações

- DC RFC NRFC General RuleDocumento3 páginasDC RFC NRFC General RuleAcads LangAinda não há avaliações

- Fit Income TaxDocumento8 páginasFit Income TaxadrianoedwardjosephAinda não há avaliações

- IT MatrixDocumento4 páginasIT MatrixVINA LORRAINE MARASIGANAinda não há avaliações

- OLD NEW: Purely Self-EmployedDocumento13 páginasOLD NEW: Purely Self-EmployedkeyelAinda não há avaliações

- Final Tax Lecture PDFDocumento7 páginasFinal Tax Lecture PDFMarlo Caluya ManuelAinda não há avaliações

- H04.1 - Final Income Tax TableDocumento2 páginasH04.1 - Final Income Tax Tablenona galidoAinda não há avaliações

- Tax Rate SummaryDocumento3 páginasTax Rate SummaryPamela Jean CuyaAinda não há avaliações

- VC Fund Tear SheetDocumento1 páginaVC Fund Tear SheetVik LAinda não há avaliações

- Tax TablesDocumento3 páginasTax TablesJimbo HotdogAinda não há avaliações

- Business Law & Taxation Income Taxation (Individuals) Compilation of NotesDocumento4 páginasBusiness Law & Taxation Income Taxation (Individuals) Compilation of NotesJeremie R. PlazaAinda não há avaliações

- Income TaxDocumento2 páginasIncome TaxRenalyn Ps MewagAinda não há avaliações

- Tax Table On Corporations (Final - TRAIN)Documento3 páginasTax Table On Corporations (Final - TRAIN)ellochoco100% (1)

- Summary of Passive Income and Capital Gains Taxes - MaupoDocumento4 páginasSummary of Passive Income and Capital Gains Taxes - MaupoMae MaupoAinda não há avaliações

- Tax RatesDocumento6 páginasTax RatesStephany PolinarAinda não há avaliações

- 8 Passive Income of Individuals LAST TOPIC BEFORE MIDTERMDocumento5 páginas8 Passive Income of Individuals LAST TOPIC BEFORE MIDTERMArgie DeguzmanAinda não há avaliações

- NIRC - Tax Table Based On Atty. Lumbera's LectureDocumento1 páginaNIRC - Tax Table Based On Atty. Lumbera's LectureRed Rose DickinsonAinda não há avaliações

- Withholding TaxDocumento20 páginasWithholding TaxAngela CanayaAinda não há avaliações

- PASSIVE INCOME Individual With CREATEDocumento2 páginasPASSIVE INCOME Individual With CREATERacelle FlorentinAinda não há avaliações

- Matrix For Individual and Corporate TaxpayersDocumento5 páginasMatrix For Individual and Corporate TaxpayersKatherine Alexandra TaranAinda não há avaliações

- Tax RatesDocumento1 páginaTax RatesMariah Jans SasumanAinda não há avaliações

- Tax Table Corporations 2022Documento4 páginasTax Table Corporations 2022Xandredg Sumpt LatogAinda não há avaliações

- Income Category: Summary of Final TaxesDocumento3 páginasIncome Category: Summary of Final TaxesKathleen Mae Salenga FontalbaAinda não há avaliações

- Chapter 05 Final Income Taxation TableDocumento4 páginasChapter 05 Final Income Taxation TablejannyAinda não há avaliações

- Taxation Notes by Angelo MonforteDocumento32 páginasTaxation Notes by Angelo Monfortemisonim.eAinda não há avaliações

- Passive Income Rc/Ra/Nrc Nra-ETB Nra - Netb DC RFC NRFCDocumento10 páginasPassive Income Rc/Ra/Nrc Nra-ETB Nra - Netb DC RFC NRFCBARBEKS 202021Ainda não há avaliações

- Quiz 5 SolutionDocumento3 páginasQuiz 5 SolutionLiaAinda não há avaliações

- FT TableDocumento4 páginasFT TableChantie BorlonganAinda não há avaliações

- Chapter 05 Final Income Taxation1Documento2 páginasChapter 05 Final Income Taxation1raven dayritAinda não há avaliações

- Undergrad Review in Income TaxationDocumento17 páginasUndergrad Review in Income TaxationJamesAinda não há avaliações

- Tax RatesDocumento2 páginasTax RatesDelaney MiramAinda não há avaliações

- Final Taxes RatesDocumento2 páginasFinal Taxes RatesPanda CocoAinda não há avaliações

- HO4Passive Income - Revision 1Documento2 páginasHO4Passive Income - Revision 1Christopher SantosAinda não há avaliações

- Bar Review Material No. 3 PDFDocumento2 páginasBar Review Material No. 3 PDFScri Bid100% (1)

- Percentage Taxes: Line of Business/ Activity Tax Base Tax RateDocumento2 páginasPercentage Taxes: Line of Business/ Activity Tax Base Tax RateMae MaupoAinda não há avaliações

- Other Percentage Tax SUMMARYDocumento1 páginaOther Percentage Tax SUMMARYMarionne GAinda não há avaliações

- Final Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldDocumento4 páginasFinal Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldJulie Mae Caling MalitAinda não há avaliações

- Final Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldDocumento4 páginasFinal Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldJulie Mae Caling MalitAinda não há avaliações

- TaxpayerDocumento4 páginasTaxpayerMickaela Jaira AlvarezAinda não há avaliações

- Tax On Certain Passive IncomeDocumento2 páginasTax On Certain Passive IncomeCristel Ann DotimasAinda não há avaliações

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocumento3 páginasManila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaAinda não há avaliações

- Inbound 2168611759498459938Documento2 páginasInbound 2168611759498459938MarielleAinda não há avaliações

- Statement of The ProblemDocumento3 páginasStatement of The ProblemCyangenAinda não há avaliações

- Formatting of ManualDocumento8 páginasFormatting of ManualCyangenAinda não há avaliações

- Statement of The ProblemDocumento3 páginasStatement of The ProblemCyangenAinda não há avaliações

- Ilagan FeasibDocumento8 páginasIlagan FeasibCyangenAinda não há avaliações

- Foreign Exchange RatesDocumento11 páginasForeign Exchange RatesCyangenAinda não há avaliações

- Admin (Type The Sender Company Name) (Type The Sender Company Address)Documento1 páginaAdmin (Type The Sender Company Name) (Type The Sender Company Address)CyangenAinda não há avaliações

- Corporation Law Memory Aid San BedaDocumento20 páginasCorporation Law Memory Aid San BedaStephanie Valentine100% (10)

- Dissolution PDFDocumento4 páginasDissolution PDFCyangenAinda não há avaliações

- 1 Introduction To Pharmaceutical Dosage Forms Part1Documento32 páginas1 Introduction To Pharmaceutical Dosage Forms Part1Joanna Carla Marmonejo Estorninos-Walker100% (1)

- Summary Studying Public Policy Michael Howlett CompleteDocumento28 páginasSummary Studying Public Policy Michael Howlett CompletefadwaAinda não há avaliações

- Sinamics gm150 sm150 Catalog d12 02 2020 enDocumento238 páginasSinamics gm150 sm150 Catalog d12 02 2020 enGo andWatchAinda não há avaliações

- OSN 8800 6800 3800 V100R011C00 Alarms and Performance Events Reference 01Documento1.544 páginasOSN 8800 6800 3800 V100R011C00 Alarms and Performance Events Reference 01Oscar Behrens ZepedaAinda não há avaliações

- PLLV Client Consent FormDocumento4 páginasPLLV Client Consent Formapi-237715517Ainda não há avaliações

- Procurement Systems and Tools RoundTable Notes (Europe) 13 Oct 2020 - 0Documento8 páginasProcurement Systems and Tools RoundTable Notes (Europe) 13 Oct 2020 - 0SathishkumarAinda não há avaliações

- Guidance - Third Party Human Capital Providers - January 2024Documento3 páginasGuidance - Third Party Human Capital Providers - January 2024rahmed78625Ainda não há avaliações

- Jicable DAS For Power Industry Applications 2015-A3-4Documento6 páginasJicable DAS For Power Industry Applications 2015-A3-4Richard KluthAinda não há avaliações

- Statement of Facts:: State of Adawa Vs Republic of RasasaDocumento10 páginasStatement of Facts:: State of Adawa Vs Republic of RasasaChristine Gel MadrilejoAinda não há avaliações

- Geometric Entities: Basic Gear TerminologyDocumento5 páginasGeometric Entities: Basic Gear TerminologyMatija RepincAinda não há avaliações

- EPM Cloud Tax Reporting Overview - EMEA Training May 2020Documento25 páginasEPM Cloud Tax Reporting Overview - EMEA Training May 2020zaymounAinda não há avaliações

- High-Definition Multimedia Interface SpecificationDocumento51 páginasHigh-Definition Multimedia Interface SpecificationwadrAinda não há avaliações

- ShapiroDocumento34 páginasShapiroTanuj ShekharAinda não há avaliações

- MushroomDocumento8 páginasMushroomAkshay AhlawatAinda não há avaliações

- Latitude 5424 Rugged Spec SheetDocumento5 páginasLatitude 5424 Rugged Spec SheetHaitemAinda não há avaliações

- DPWH Cost EstimationDocumento67 páginasDPWH Cost EstimationAj Abe92% (12)

- Title To The ProjectDocumento14 páginasTitle To The ProjectJatinChadhaAinda não há avaliações

- Gist of FIEO ServicesDocumento1 páginaGist of FIEO Servicessanjay patraAinda não há avaliações

- Research On Surface Roughness by Laser CDocumento5 páginasResearch On Surface Roughness by Laser CfatmirhusejniAinda não há avaliações

- Event MCQDocumento9 páginasEvent MCQpralay ganguly50% (2)

- Raspberry Pi Installing Noobs OSDocumento3 páginasRaspberry Pi Installing Noobs OSEXORCEAinda não há avaliações

- Agenda 9Documento46 páginasAgenda 9Bala Gangadhar TilakAinda não há avaliações

- FM - 30 MCQDocumento8 páginasFM - 30 MCQsiva sankarAinda não há avaliações

- BreakwatersDocumento15 páginasBreakwatershima sagarAinda não há avaliações

- U-Blox Parameters Setting ProtocolsDocumento2 páginasU-Blox Parameters Setting Protocolspedrito perezAinda não há avaliações

- Geotechnical Design MannulDocumento828 páginasGeotechnical Design MannulJie ZhouAinda não há avaliações

- Introduction To Content AnalysisDocumento10 páginasIntroduction To Content AnalysisfelixAinda não há avaliações

- Memorandum of AgreementDocumento6 páginasMemorandum of AgreementJomar JaymeAinda não há avaliações

- Lenovo Security ThinkShield-Solutions-Guide Ebook IDG NA HV DownloadDocumento10 páginasLenovo Security ThinkShield-Solutions-Guide Ebook IDG NA HV DownloadManeshAinda não há avaliações

- P40Agile P541 - 2 - 3 - 4 - 5 6 Guideform SpecificationDocumento15 páginasP40Agile P541 - 2 - 3 - 4 - 5 6 Guideform SpecificationprinceAinda não há avaliações