Escolar Documentos

Profissional Documentos

Cultura Documentos

Ratio Analysis Formulas

Enviado por

Clarisse AnnDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ratio Analysis Formulas

Enviado por

Clarisse AnnDireitos autorais:

Formatos disponíveis

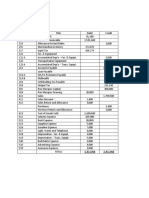

Liquidity Ratios Liquidity Ratios Liquidity Ratios

1. Current Ratio = Current Assets / Current Liabilities 1. Current Ratio = Current Assets / Current Liabilities 1. Current Ratio = Current Assets / Current Liabilities

2. Acid Test Ratio = Current Assets-Inventory-Prepaid Expenses / Current Liabilities 2. Acid Test Ratio = Current Assets-Inventory-Prepaid Expenses / Current Liabilities 2. Acid Test Ratio = Current Assets-Inventory-Prepaid Expenses / Current Liabilities

3. Cash Ratio = ( Cash + Marketable Securities ) / Current Liabilities 3. Cash Ratio = ( Cash + Marketable Securities ) / Current Liabilities 3. Cash Ratio = ( Cash + Marketable Securities ) / Current Liabilities

4. Net Working Capital = Current Assets - Current Liabilities 4. Net Working Capital = Current Assets - Current Liabilities 4. Net Working Capital = Current Assets - Current Liabilities

Management Efficiency Ratios Management Efficiency Ratios Management Efficiency Ratios

1. Receivable Turnover = Net Credit Sales / Average Accounts Receivable 1. Receivable Turnover = Net Credit Sales / Average Accounts Receivable 1. Receivable Turnover = Net Credit Sales / Average Accounts Receivable

2. Days Sales Outstanding = 360 Days / Receivable Turnover 2. Days Sales Outstanding = 360 Days / Receivable Turnover 2. Days Sales Outstanding = 360 Days / Receivable Turnover

3. Average Collection Period = Average AR/ Average Daily Sales 3. Average Collection Period = Average AR/ Average Daily Sales 3. Average Collection Period = Average AR/ Average Daily Sales

4. Inventory Turnover = Cost of Sales / Average Inventory 4. Inventory Turnover = Cost of Sales / Average Inventory 4. Inventory Turnover = Cost of Sales / Average Inventory

5. Days Inventory Outstanding = 360 Days / Inventory Turnover 5. Days Inventory Outstanding = 360 Days / Inventory Turnover 5. Days Inventory Outstanding = 360 Days / Inventory Turnover

6. Accounts Payable Turnover = Net Credit Purchases / Ave. Accounts Payable 6. Accounts Payable Turnover = Net Credit Purchases / Ave. Accounts Payable 6. Accounts Payable Turnover = Net Credit Purchases / Ave. Accounts Payable

7. Days Payable Outstanding = 360 Days / Accounts Payable Turnover 7. Days Payable Outstanding = 360 Days / Accounts Payable Turnover 7. Days Payable Outstanding = 360 Days / Accounts Payable Turnover

8. Operating Cycle = Days Inventory Outstanding + Days Sales Outstanding 8. Operating Cycle = Days Inventory Outstanding + Days Sales Outstanding 8. Operating Cycle = Days Inventory Outstanding + Days Sales Outstanding

9. Cash Conversion Cycle = Operating Cycle - Days Payable Outstanding 9. Cash Conversion Cycle = Operating Cycle - Days Payable Outstanding 9. Cash Conversion Cycle = Operating Cycle - Days Payable Outstanding

10. Total Asset Turnover = Net Sales / Average Total Assets 10. Total Asset Turnover = Net Sales / Average Total Assets 10. Total Asset Turnover = Net Sales / Average Total Assets

Leverage Ratios Leverage Ratios Leverage Ratios

1. Debt Ratio = Total Liabilities / Total Assets 1. Debt Ratio = Total Liabilities / Total Assets 9. Debt Ratio = Total Liabilities / Total Assets

2. Equity Ratio = Total Equity / Total Assets 2. Equity Ratio = Total Equity / Total Assets 1. Equity Ratio = Total Equity / Total Assets

3. Debt-Equity Ratio = Total Liabilities / Total Equity 3. Debt-Equity Ratio = Total Liabilities / Total Equity 2. Debt-Equity Ratio = Total Liabilities / Total Equity

4. Times Interest Earned = EBIT / Interest Expense 4. Times Interest Earned = EBIT / Interest Expense 3. Times Interest Earned = EBIT / Interest Expense

5. Fixed Charged Coverage = (EBIT + Fixed Charges)/ (Interest Charges + Fixed Charges) 5. Fixed Charged Coverage = (EBIT + Fixed Charges)/ (Interest Charges + Fixed Charges) 4. Fixed Charged Coverage = (EBIT + Fixed Charges)/ (Interest Charges + Fixed Charges)

6. Cash Flow Coverage Ratio = (EBIT + Fixed Charges + Depreciation)/ [Interest Charges + Fixed 6. Cash Flow Coverage Ratio = (EBIT + Fixed Charges + Depreciation)/ [Interest Charges + Fixed 5. Cash Flow Coverage Ratio = (EBIT + Fixed Charges + Depreciation)/ [Interest Charges + Fixed

Charges + (Preferred Stock Dividend/1- Tax Rate) + (Debt Repayment/1-Tax Rate)] Charges + (Preferred Stock Dividend/1- Tax Rate) + (Debt Repayment/1-Tax Rate)] Charges + (Preferred Stock Dividend/1- Tax Rate) + (Debt Repayment/1-Tax Rate)]

7. Book Value of Securities (Bonds/ Preferred Stock/ Common Stocks) = Value of each security/ 7. Book Value of Securities (Bonds/ Preferred Stock/ Common Stocks) = Value of each security/ 6. Book Value of Securities (Bonds/ Preferred Stock/ Common Stocks) = Value of each security/

each number of shares outstanding each number of shares outstanding each number of shares outstanding

8. Capitalization Ratios = the proportion of the face value of a particular type of security to the 8. Capitalization Ratios = the proportion of the face value of a particular type of security to the 7. Capitalization Ratios = the proportion of the face value of a particular type of security to the

companys total equity companys total equity companys total equity

Profitability Ratios Profitability Ratios Profitability Ratios

1. Profit Margin on Sales = Net Income Available To Common Stock/ Sales 1. Profit Margin on Sales = Net Income Available To Common Stock/ Sales 1. Profit Margin on Sales = Net Income Available To Common Stock/ Sales

2. Gross Profit Rate = Gross Profit / Net Sales 2. Gross Profit Rate = Gross Profit / Net Sales 2. Gross Profit Rate = Gross Profit / Net Sales

3. Return on Sales = Net Income / Net Sales 3. Return on Sales = Net Income / Net Sales 3. Return on Sales = Net Income / Net Sales

4. Return on Assets = Net Income / Average Total Assets 4. Return on Assets = Net Income / Average Total Assets 4. Return on Assets = Net Income / Average Total Assets

5. Return on Stockholders' Equity = Net Income / Average Stockholders' Equity 5. Return on Stockholders' Equity = Net Income / Average Stockholders' Equity 5. Return on Stockholders' Equity = Net Income / Average Stockholders' Equity

6. Basic Earning Power = EBIT/ Average Total Assets 6. Basic Earning Power = EBIT/ Average Total Assets 6. Basic Earning Power = EBIT/ Average Total Assets

7. Earnings per Share = ( Net Income - Preferred Dividends ) / Average Common Shares 7. Earnings per Share = ( Net Income - Preferred Dividends ) / Average Common Shares 7. Earnings per Share = ( Net Income - Preferred Dividends ) / Average Common Shares

Outstanding Outstanding Outstanding

8. Book Value per Share = Common SHE / Average Common Shares 8. Book Value per Share = Common SHE / Average Common Shares 8. Book Value per Share = Common SHE / Average Common Shares

9. Dividend Pay-out Ratio = Dividend per Share / Earnings per Share 9. Dividend Pay-out Ratio = Dividend per Share / Earnings per Share 9. Dividend Pay-out Ratio = Dividend per Share / Earnings per Share

10. Dividend Per Share = Dividends Paid to Common Stock/ Common Shares Outstanding 10. Dividend Per Share = Dividends Paid to Common Stock/ Common Shares Outstanding 10. Dividend Per Share = Dividends Paid to Common Stock/ Common Shares Outstanding

Analyzing the Retained Earnings Analyzing the Retained Earnings Analyzing the Retained Earnings

1. Price-Earnings Ratio = Market Price per Share / Earnings per Share 1. Price-Earnings Ratio = Market Price per Share / Earnings per Share 1. Price-Earnings Ratio = Market Price per Share / Earnings per Share

2. Market Book Ratio = Market Price Per Share/ Book Value Per Share 2. Market Book Ratio = Market Price Per Share/ Book Value Per Share 2. Market Book Ratio = Market Price Per Share/ Book Value Per Share

3. Dividend Yield Ratio = Dividend per Share / Market Price per Share 3. Dividend Yield Ratio = Dividend per Share / Market Price per Share 3. Dividend Yield Ratio = Dividend per Share / Market Price per Share

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Chapter 23Documento2 páginasChapter 23Clarisse AnnAinda não há avaliações

- SALESDocumento1 páginaSALESClarisse AnnAinda não há avaliações

- Chapter 3Documento6 páginasChapter 3Clarisse AnnAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Chapter 9Documento1 páginaChapter 9Clarisse AnnAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Chapter 1Documento7 páginasChapter 1Clarisse AnnAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Chapter 26Documento2 páginasChapter 26Clarisse AnnAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Cash and Cash EquivalentsDocumento2 páginasCash and Cash EquivalentsClarisse AnnAinda não há avaliações

- Average Propensity To Consume SurveyDocumento1 páginaAverage Propensity To Consume SurveyClarisse AnnAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Pom CH 1-2Documento3 páginasPom CH 1-2Clarisse AnnAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Law - IntroductionDocumento3 páginasLaw - IntroductionClarisse AnnAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Impairment Loss Sample ProblemsDocumento5 páginasImpairment Loss Sample ProblemsClarisse AnnAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Obligations and ContractsDocumento1 páginaObligations and ContractsClarisse AnnAinda não há avaliações

- POM ReviwerDocumento9 páginasPOM ReviwerClarisse AnnAinda não há avaliações

- DAO 2010 21 Consolidated DAODocumento144 páginasDAO 2010 21 Consolidated DAOcecilemarisgozalo98100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Philippine DepartmentsDocumento1 páginaPhilippine DepartmentsClarisse AnnAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- #01 Accounting ProcessDocumento3 páginas#01 Accounting ProcessZaaavnn VannnnnAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Philippine Accounting SummaryDocumento4 páginasPhilippine Accounting SummaryClarisse AnnAinda não há avaliações

- Audit of ReceivablesDocumento4 páginasAudit of ReceivablesClarisse AnnAinda não há avaliações

- Financial Formulas - Ratios (Sheet)Documento3 páginasFinancial Formulas - Ratios (Sheet)carmo-netoAinda não há avaliações

- Audtheo CH 1Documento3 páginasAudtheo CH 1Clarisse AnnAinda não há avaliações

- Basketball DiagramDocumento1 páginaBasketball DiagramClarisse AnnAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- BOA Syllabus MASDocumento3 páginasBOA Syllabus MASElizabeth YgotAinda não há avaliações

- DONORS TAX - Theory 1 of 5Documento5 páginasDONORS TAX - Theory 1 of 5Joey Acierda BumagatAinda não há avaliações

- Law - IntroductionDocumento3 páginasLaw - IntroductionClarisse AnnAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Good News (The Last Supper) ActivityDocumento4 páginasGood News (The Last Supper) ActivityClarisse AnnAinda não há avaliações

- Principle No. 6 - Cooperation Among Cooperatives (Pre-Final)Documento42 páginasPrinciple No. 6 - Cooperation Among Cooperatives (Pre-Final)Clarisse AnnAinda não há avaliações

- Adjusting EntriesDocumento1 páginaAdjusting EntriesClarisse AnnAinda não há avaliações

- Supply, Demand & EquilibriumDocumento4 páginasSupply, Demand & EquilibriumClarisse AnnAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- Accountancy ImpQ CH04 Admission of A Partner 01Documento18 páginasAccountancy ImpQ CH04 Admission of A Partner 01praveentyagiAinda não há avaliações

- WWF Tanzania Vacancies AugustDocumento24 páginasWWF Tanzania Vacancies AugustSaumu MbanoAinda não há avaliações

- S4H - 458 Test Script TemplateDocumento18 páginasS4H - 458 Test Script TemplateAhmed ElhawaryAinda não há avaliações

- Internal and Governmental Financial Auditing and Operational AuditingDocumento26 páginasInternal and Governmental Financial Auditing and Operational AuditingNisa sudinkebudayaanAinda não há avaliações

- Understanding Cash Flows StaDocumento30 páginasUnderstanding Cash Flows StaAshraf GeorgeAinda não há avaliações

- Module 2 BE & CGDocumento174 páginasModule 2 BE & CGMital ParmarAinda não há avaliações

- CH 04Documento25 páginasCH 04Beast aAinda não há avaliações

- Trial Balance February 28, 20X1Documento3 páginasTrial Balance February 28, 20X1Angelica MaeAinda não há avaliações

- VIDYA SAGAR Analysis-CA Final AuditDocumento15 páginasVIDYA SAGAR Analysis-CA Final AuditRUBY SHARMAAinda não há avaliações

- Consolidation TheoryDocumento22 páginasConsolidation TheorySmruti RanjanAinda não há avaliações

- 08 Identifying & Assessing The Risks of Material MisstatementDocumento5 páginas08 Identifying & Assessing The Risks of Material Misstatementrandomlungs121223Ainda não há avaliações

- ACC-303 Discussion QuestionsDocumento15 páginasACC-303 Discussion QuestionsVivek Surana100% (1)

- Kieso IFRS4 TB ch02Documento67 páginasKieso IFRS4 TB ch023ooobd1234Ainda não há avaliações

- June 2014Documento1 páginaJune 2014Deepak GuptaAinda não há avaliações

- PT Unitex LaptahunanDocumento108 páginasPT Unitex LaptahunanbereniceAinda não há avaliações

- Financial Statement Model For The Clorox Company: Company Name Latest Fiscal YearDocumento10 páginasFinancial Statement Model For The Clorox Company: Company Name Latest Fiscal YearArslan HafeezAinda não há avaliações

- Answer in Act. 2 For Cash-receivables-InventoriesDocumento10 páginasAnswer in Act. 2 For Cash-receivables-InventoriesPaupauAinda não há avaliações

- Long Quiz 2Documento8 páginasLong Quiz 2KathleenAinda não há avaliações

- BAV Lecture 4Documento25 páginasBAV Lecture 4Fluid TrapsAinda não há avaliações

- IRS Publication Form 8594Documento2 páginasIRS Publication Form 8594Francis Wolfgang UrbanAinda não há avaliações

- Latihan Soal Sap Finance Lengkap Ada JawabanDocumento6 páginasLatihan Soal Sap Finance Lengkap Ada JawabanRio Irmayanto59% (17)

- Primary Books of AccountsDocumento16 páginasPrimary Books of AccountsSaptha Gowda100% (1)

- Hospital Management by Mahboob Ali KhanDocumento47 páginasHospital Management by Mahboob Ali KhanMahboob Ali KhanAinda não há avaliações

- Solution Manual03Documento68 páginasSolution Manual03yellowberries100% (2)

- Introduction To Accounting: Discussion QuestionsDocumento3 páginasIntroduction To Accounting: Discussion QuestionsOfelia RagpaAinda não há avaliações

- Understanding Accruals R12 05012013Documento58 páginasUnderstanding Accruals R12 05012013prasanthbab7128Ainda não há avaliações

- Finance Overview:: Financial Accounting (Fi)Documento38 páginasFinance Overview:: Financial Accounting (Fi)Suraj MohapatraAinda não há avaliações

- Inspera Exam Question Set - Blank Without Solutions - 16-2-2023Documento21 páginasInspera Exam Question Set - Blank Without Solutions - 16-2-2023МаринаAinda não há avaliações

- Chapters 1 To 5Documento30 páginasChapters 1 To 5Kazel PascualAinda não há avaliações