Escolar Documentos

Profissional Documentos

Cultura Documentos

AUG-04 Mizuho Technical Analysis GBP USD

Enviado por

Miir ViirDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

AUG-04 Mizuho Technical Analysis GBP USD

Enviado por

Miir ViirDireitos autorais:

Formatos disponíveis

Mizuho Corporate Bank

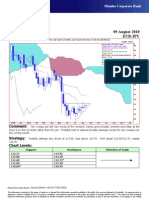

Technical Analysis 04 August 2010

GBP

GBP=D3, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Weekly

01Aug09 - 09Feb11

Pr

GBP=D3 , Last Quote, Candle

08Aug10 1.5710 1.5968 1.5695 1.5939 1.7

GBP=D3 , Last Quote, Tenkan Sen 9

08Aug10 1.5157

GBP=D3 , Last Quote, Kijun Sen 26 1.68

08Aug10 1.5098

GBP=D3 , Last Quote, Senkou Span(a) 52

30Jan11 1.5128 1.66

GBP=D3 , Last Quote, Senkou Span(b) 52

30Jan11 1.5554

GBP=D3 , Last Quote, Chikou Span 26 1.64

14Feb10 1.5939

1.62

1.6

61.8

1.58

1.56

50.0

1.54

38.2

1.52

1.5

1.48

1.46

1.44

1.42

Aug09 Sep Oct Nov Dec Jan10 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan11 Feb

Comment: Retracing over 61% of this year’s decline, a particularly impressive move considering the massive

weekly Ichimoku ‘cloud’ which looks set to be tested imminently. Sterling is more overbought than it has been since

June 2009 and likewise bullish momentum. On the Bank of England’s Trade Weighted basis sterling is still at the

same sort of level it has been since January 2009 underlining the fact that the move is caused predominantly by US

dollar weakness.

Strategy: Attempt small longs at 1.5930 adding to 1.5860; stop well below 1.5695. First target 1.6000/1.6070,

then 1.6450.

Chart Levels:

Support Resistance Direction of Trade

1.5900 1.5907

1.5860 1.5950

1.5800 1.6000

1.5695 1.6070

1.5545* 1.6125

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

Você também pode gostar

- Westpack AUG 11 Mornng ReportDocumento1 páginaWestpack AUG 11 Mornng ReportMiir ViirAinda não há avaliações

- AUG-10 Mizuho Technical Analysis GBP USDDocumento1 páginaAUG-10 Mizuho Technical Analysis GBP USDMiir ViirAinda não há avaliações

- AUG 11 UOB Global MarketsDocumento3 páginasAUG 11 UOB Global MarketsMiir ViirAinda não há avaliações

- AUG 11 DBS Daily Breakfast SpreadDocumento6 páginasAUG 11 DBS Daily Breakfast SpreadMiir ViirAinda não há avaliações

- AUG-10 Mizuho Technical Analysis EUR JPYDocumento1 páginaAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirAinda não há avaliações

- AUG 10 UOB Global MarketsDocumento3 páginasAUG 10 UOB Global MarketsMiir ViirAinda não há avaliações

- AUG 10 DBS Daily Breakfast SpreadDocumento8 páginasAUG 10 DBS Daily Breakfast SpreadMiir ViirAinda não há avaliações

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocumento5 páginasMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirAinda não há avaliações

- AUG 10 UOB Asian MarketsDocumento2 páginasAUG 10 UOB Asian MarketsMiir ViirAinda não há avaliações

- JYSKE Bank AUG 10 Corp Orates DailyDocumento2 páginasJYSKE Bank AUG 10 Corp Orates DailyMiir ViirAinda não há avaliações

- AUG 10 Danske EMEADailyDocumento3 páginasAUG 10 Danske EMEADailyMiir ViirAinda não há avaliações

- AUG-09 Mizuho Technical Analysis EUR JPYDocumento1 páginaAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirAinda não há avaliações

- AUG 10 Danske FlashCommentFOMC PreviewDocumento7 páginasAUG 10 Danske FlashCommentFOMC PreviewMiir ViirAinda não há avaliações

- Westpack AUG 10 Mornng ReportDocumento1 páginaWestpack AUG 10 Mornng ReportMiir ViirAinda não há avaliações

- ScotiaBank AUG 09 Daily FX UpdateDocumento3 páginasScotiaBank AUG 09 Daily FX UpdateMiir ViirAinda não há avaliações

- Danske Daily: Key NewsDocumento4 páginasDanske Daily: Key NewsMiir ViirAinda não há avaliações

- AUG-09-DJ European Forex TechnicalsDocumento3 páginasAUG-09-DJ European Forex TechnicalsMiir ViirAinda não há avaliações

- JYSKE Bank AUG 09 Corp Orates DailyDocumento2 páginasJYSKE Bank AUG 09 Corp Orates DailyMiir ViirAinda não há avaliações

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocumento5 páginasJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirAinda não há avaliações

- Jyske Bank Aug 09 em DailyDocumento5 páginasJyske Bank Aug 09 em DailyMiir ViirAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Bloomberg - Technical Analysis Handbook PDFDocumento129 páginasBloomberg - Technical Analysis Handbook PDFLina100% (1)

- My Trading Diary 2010Documento10 páginasMy Trading Diary 2010bokugrahamAinda não há avaliações

- Weeklys Using The Ichimoku CloudDocumento48 páginasWeeklys Using The Ichimoku CloudYogesh Chhetty100% (1)

- KTS Free Ver 2Documento16 páginasKTS Free Ver 2Nam NguyenAinda não há avaliações

- Ichimoku GlanceDocumento13 páginasIchimoku Glanceviswaa.anupindi100% (1)

- Fibonacci Trading (PDFDrive)Documento148 páginasFibonacci Trading (PDFDrive)ARK WOODYAinda não há avaliações

- Using ADX With Ichimoku Kinko HyoDocumento2 páginasUsing ADX With Ichimoku Kinko Hyoanon_240301517Ainda não há avaliações

- KT Ichimoku EADocumento7 páginasKT Ichimoku EAdnsptra_580883023Ainda não há avaliações

- Cloud Chart Secrets Volume 1Documento87 páginasCloud Chart Secrets Volume 1hansondrew100% (1)

- Basics of Ichimoku Kinko Hyo by Zaw FXDocumento16 páginasBasics of Ichimoku Kinko Hyo by Zaw FXAh JiaoAinda não há avaliações

- Estrategias IchimokuDocumento5 páginasEstrategias IchimokuLeonardo Marin100% (1)

- Ichimoku Kinko Hyo - A Japanese Technical ToolDocumento3 páginasIchimoku Kinko Hyo - A Japanese Technical ToolMadhu50% (2)

- KIJUN Sen Cross StrategyDocumento14 páginasKIJUN Sen Cross Strategyghcardenas67% (3)

- Kumo TraderDocumento3 páginasKumo Traderhenrykayode4Ainda não há avaliações

- IndicatorsDocumento22 páginasIndicatorsManda Satyanarayana ReddyAinda não há avaliações

- Learn Trading For BeginnersDocumento3 páginasLearn Trading For BeginnerssaptovicnemanjaAinda não há avaliações

- Trading Forex With Ichimoku Kinko HyoDocumento48 páginasTrading Forex With Ichimoku Kinko HyoAntony George Sahayaraj100% (1)

- Trading The Ichimoku WayDocumento4 páginasTrading The Ichimoku Waysaa6383Ainda não há avaliações

- IchimokuDocumento3 páginasIchimokuneeltambeAinda não há avaliações

- Jason FielderDocumento16 páginasJason FielderVijay KadamAinda não há avaliações

- Technical TradingDocumento9 páginasTechnical Tradingviníciusg_65Ainda não há avaliações

- Ichimoku Kinko Hyo SoulDocumento38 páginasIchimoku Kinko Hyo SoulPhạm Nam86% (7)

- BEST ICHIMOKU STRATEGY For QUICK PROFITS For BITFINEX - BTCUSD by Tradingstrategyguides - TradingViewDocumento3 páginasBEST ICHIMOKU STRATEGY For QUICK PROFITS For BITFINEX - BTCUSD by Tradingstrategyguides - TradingViewhenrykayode40% (2)

- Technical Analysis OscillatorsDocumento18 páginasTechnical Analysis Oscillatorsbrijeshagra100% (1)

- G5-T9 Ichimoku Kinko HyoDocumento6 páginasG5-T9 Ichimoku Kinko HyoThe ShitAinda não há avaliações

- Kiss Forex How To Trade Ichimoku PDFDocumento72 páginasKiss Forex How To Trade Ichimoku PDFSastryassociates Chartered100% (3)

- How To Make Money Trading The: Ichimoku SystemDocumento12 páginasHow To Make Money Trading The: Ichimoku SystemYatharth DassAinda não há avaliações

- Trading Diary MarchDocumento10 páginasTrading Diary MarchbokugrahamAinda não há avaliações

- 2 IndicatorDocumento3 páginas2 IndicatorViswanath PalyamAinda não há avaliações

- Intermediate Noble Impulse Strategy Moving AverageDocumento13 páginasIntermediate Noble Impulse Strategy Moving AverageFadzurrahman YusofAinda não há avaliações