Escolar Documentos

Profissional Documentos

Cultura Documentos

AUG 05 UOB Global Markets

Enviado por

Miir ViirDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

AUG 05 UOB Global Markets

Enviado por

Miir ViirDireitos autorais:

Formatos disponíveis

UOB Economic-Treasury Research

www.uob.com.sg/research

Company Reg No. 193500026Z

Thursday, 05 August 2010 Global Markets

News Highlights

Foreign Exchange Rates (as at 04 Aug 2010)

As at 05 Aug Asian High Asian Low NY High NY Low

JPY 86.32 85.91 85.32 86.39 85.39 n US ISM non-manufacturing composite index for July came

EUR 1.3156 1.3240 1.3194 1.3233 1.3131 in at 54.3, slightly higher than consensus expectations of

GBP 1.5885 1.5965 1.5916 1.5961 1.5857 53.0. The index shows service companies have been

CHF 1.0531 1.0434 1.0398 1.0555 1.0381 expanding every month this year, but at a less robust pace

AUD 0.9159 0.9147 0.9095 0.9184 0.9107 than the manufacturing sector. The service sector accounts

NZD 0.7286 0.7355 0.7318 0.7356 0.7298

for about 80% of US employment. The index showed

CAD 1.0182 1.0261 1.0232 1.0271 1.0163

businesses reporting new orders grew faster last month.

Interest Rates

Current Next CB Meet UOB’s Forecast n The ADP employment change stood at 42k in July, above

USD Fed Funds Rate 0.25% 10 Aug 0.00-0.25% consensus estimates of 30k and from a revised gain of 19k

EUR Refinancing Rate 1.00% 05 Aug 1.00% in June. The original June ADP figure was 13k jobs. Private

GBP Repo Rate 0.50% 05 Aug 0.50% payroll saw the small gains as large businesses added no

AUD Official Cash Rate 4.50% 07 Sep 4.50% new workers. The report serves as a precursor to Friday's

NZD Official Cash Rate 3.00% 16 Sep 3.00%

CAD Overnight Rate 0.75% 08 Sep 1.00%

jobs report. Today, the US government will release its weekly

JPY Official Cash Rate 0.10% 10 Aug 0.10% jobless claims data (consensus: 459k), and on Friday the

much-anticipated US nonfarm payrolls report. Market

Stock Indices (as at 04 Aug 2010) participants did not revise their expectations for Friday's

Closing % chg employment report after the solid data yesterday. The median

Dow Jones Industrial Average 10680.43 +0.41 forecast is still a drop of 60k jobs because of Census layoffs,

S&P 500 1127.24 +0.61

but the report is expected to show a gain of around 100k

NASDAQ Composite 2303.57 +0.88

Tokyo Nikkei 225 9489.34 -2.11

jobs in the private sector alone. The non-farm payrolls is

London FTSE 100 5386.16 -0.19 expected to report a fall of 70k for July after declining 125k

Frankfurt DAX 6331.33 +0.37 in June after taking into consideration Census workers.

All Ordinaries 4559.7 -0.58 Private sector payrolls are expected to rise by 95k on Friday,

and the unemployment rate to move higher to 9.6%.

Commodities (as at 04 Aug2010)

However, the slight upside surprise on the ADP employment

Closing % chg

NYMEX Crude (September) 82.47 -0.10 change numbers, can be seen as boding well for the key

Comex Gold (July) 1193.7 +0.72 release of the non-farm payroll data on US Friday morning.

Reuters CRB Index 278.98 +0.85

n US Mortgage Bankers Association data showed mortgage

applications rose by 1.3% in the week ended July 30,

Bond Yields (as at 04 Aug2010)

Closing Net chg possibly due to lower interest rates which fueled demand

US 2-Year Bond 0.57% +4 for home refinancing loans, thus providing a glimmer of

US 10-Year Long Bond 2.95% +4 positive news for the beleaguered housing market. The

JP 10-Year JGB 1.01% -3 report stated that low rates buoyed demand for home

EU 10-Year Bund 2.60% -1 refinancing loans. The 4 week moving average of mortgage

UK 10-Year Long Gilt 3.29% +1

applications was up 0.3%. Borrowing costs on 30 year fixed

rate mortgages, excluding fees averaged 4.60%, down

Key Events 0.09% points from week before.

Date Event

05 Aug BoE Monetary Policy Committee Decision at 1100GMT n Key US equity indices had a wobbly start but began to

05 Aug Fed Trichet speaks at ECB Monthly News Conference at stabilize in positive territory in the afternoon and ended

1230GMT

well in the black as markets responded to positive ADP

and ISM data releases and the fact that the overall

momentum of corporate earnings releases remains

decidedly positive. The DJIA climbed 44.05 points (0.41%),

to 10680.43. The Nasdaq advanced 20.05 (0.88%), to

2303.57. The S&P added 6.78 (0.61%), to 1127.24, with

Global Markets

Thursday, 05 August 2010

p2

the consumer-discretionary sector leading the climb. Today to policy rates. Today’s eurozone key news release would

several corporate earnings releases including a key one from be Germany’s factory orders s.a. m/m (Jun) (consensus

Kraft. 1.4%).

n The USD took a breather yesterday on the back of slightly n US Treasuries backed up a bit yesterday, with the

better than expected ISM services sector and ADP jobs data. benchmark 2-year yield rising from near record lows of

The general uncertainty ahead of the key US labor market 0.522% to hit an intra-day high of 0.57%, after the positive

data due on Friday and the FOMC meeting next week may US economic data. Treasurys were also lower after word

have also led to some profit taking on short-USD positions. from the US government about its next round of auctions in

The USD rose again the major currencies except the the coming week. The government said it will sell a total of

commodity-linked currencies. The USD/JPY rose to 86.27 $74bn in new notes and bonds, as expected. It will offer

from 85.79. The AUD/USD was up slightly t o 0.9166 from $16bn 30-years on Thursday, $24bn 10-years on

0.9128, the USD/CAD was down to 1.0180 from 1.0234, Wednesday and $34bn 3-years on Tuesday, a decrease of

whilst the NZD/USD was at 0.7348 from 0.7340. But traders $1bn. The two-year Treasury note yield was up 3bps to

remain cautious ahead of July nonfarm payroll data on Friday 0.562%, while the 10-year rose 5bps to yield 2.95%.

as they wait for more definitive signs of a sustained recovery

in the U.S. labor market and the broader economy. The EUR/ n Oil prices were only slightly higher despite conflicting

USD fell to 1.3162 from 1.3231 as the latest euro-zone data signals yesterday such as the US Energy Department data

yesterday showed that EU retail sales were flat in June down showing US gasoline inventories unexpectedly increased

from a 0.4% ruse in May - disappointed growth prospects and a stronger USD as well as encouraging economic data.

and lowered inflation expectations for the region. ECB’s The Aug prompt-month Nymex crude oil futures contract

Trichet could also put renewed pressure on the USD today rose to $82.55/bbl from $81.34/bbl. Gold prices settled

if he hints of a divergence between euro-zone monetary higher at $1193.7/oz from $1185.2/oz amid speculation

policy and US policy after the ECB meeting. The ECB and about further easing of US monetary policy and the chance

BOE policy meeting today is unlikely to lead to any changes of an increase in Chinese demand yesterday.

Economic Indicators

Local Time Indicators Mth Actual UOB Forecast Mkt Forecast Previous

04/08

0500 US ABC Consumer Confidence Aug 1 -50 - -46 -48

0500 US Domestic Vehicle Sales Jul 8.94 - 8.90 8.57m

0500 US Total Vehicle Sales Jul 11.56 - 11.60 11.08m

1600 EU PMI Composite Jul F 56.7 - 56.7 56.7

1700 EZ Retail Sales y/y Jun 0.4 - 0.1 0.6%

1700 EZ Retail Sales m/m Jun 0.0 - 0.0 0.4%

2015 US ADP Employment Change Jul 42 - 30 19k

2200 US ISM Non-Manf. Composite Jul 54.3 - 53.0 53.8

05/08

1800 Gmn Factory Orders m/m sa Jun - 1.4 -0.5%

1800 Gmn Factory Orders y/y nsa Jun - 21.6 24.8%

1900 GBP Repo Rate Aug 5 0.50 0.50 0.50%

1945 EUR Refinancing Rate Aug 5 1.00 1.00 1.00%

2030 CA Building Permits m/m Jun - 1.8 -10.8%

2030 US Initial Jobless Claims Jul 31 - 455 457k

2030 US Continuing Claims Jul 24 - 4514 4565k

Jimmy Koh Lee Sue Ann Saktiandi Supaat

(65) 6539 3545 (65) 6539 3549 (65) 6539 8930

Jimmy.KohCT@UOBgroup.com Lee.SueAnn@UOBgroup.com Saktiandi.Supaat@UOBgroup.com

Disclaimer: This analysis is based on information available to the public. Although the information contained herein is believed to be reliable, UOB Group makes no representation as to the

accuracy or completeness. Also, opinions and predictions contained herein reflect our opinion as of date of the analysis and are subject to change without notice. UOB Group may have

positions in, and may effect transactions in, currencies and financial products mentioned herein. Prior to entering into any proposed transaction, without reliance upon UOB Group or its

affiliates, the reader should determine, the economic risks and merits, as well as the legal, tax and accounting characterizations and consequences, of the transaction and that able to assume

these risks. This document and its contents are proprietary information and products of UOB Group and may not be reproduced or otherwise.

URL: www.uob.com.sg/research

Email: EcoTreasury.Research@UOBgroup.com

Você também pode gostar

- AUG 06 UOB Global MarketsDocumento2 páginasAUG 06 UOB Global MarketsMiir ViirAinda não há avaliações

- AUG 04 UOB Global MarketsDocumento3 páginasAUG 04 UOB Global MarketsMiir ViirAinda não há avaliações

- AUG 10 UOB Global MarketsDocumento3 páginasAUG 10 UOB Global MarketsMiir ViirAinda não há avaliações

- AUG 11 UOB Global MarketsDocumento3 páginasAUG 11 UOB Global MarketsMiir ViirAinda não há avaliações

- Fiscal Cliff Averted: Morning ReportDocumento3 páginasFiscal Cliff Averted: Morning Reportnaudaslietas_lvAinda não há avaliações

- US Nonfarm Payrolls: Dow 12,092.15 +29.89 0.25% S&P 500 1,310.87 +3.77 0.29% Nasdaq 2,769.30 +15.42 0.56%Documento7 páginasUS Nonfarm Payrolls: Dow 12,092.15 +29.89 0.25% S&P 500 1,310.87 +3.77 0.29% Nasdaq 2,769.30 +15.42 0.56%Andre SetiawanAinda não há avaliações

- Equities Update: MorningDocumento2 páginasEquities Update: MorningsfarithaAinda não há avaliações

- Promising US Data: Morning ReportDocumento3 páginasPromising US Data: Morning Reportnaudaslietas_lvAinda não há avaliações

- Morning Call - June 3 2010Documento7 páginasMorning Call - June 3 2010chibondkingAinda não há avaliações

- Westpack JUL 01 Mornng ReportDocumento1 páginaWestpack JUL 01 Mornng ReportMiir ViirAinda não há avaliações

- ScotiaBank AUG 04 Daily PointsDocumento2 páginasScotiaBank AUG 04 Daily PointsMiir ViirAinda não há avaliações

- Towards Stabilization in China: Morning ReportDocumento3 páginasTowards Stabilization in China: Morning Reportnaudaslietas_lvAinda não há avaliações

- Chinese PMI Disappoints: Morning ReportDocumento3 páginasChinese PMI Disappoints: Morning Reportnaudaslietas_lvAinda não há avaliações

- MRE121015Documento3 páginasMRE121015naudaslietas_lvAinda não há avaliações

- Westpack AUG 05 Mornng ReportDocumento1 páginaWestpack AUG 05 Mornng ReportMiir ViirAinda não há avaliações

- JUL 15 DanskeDailyDocumento3 páginasJUL 15 DanskeDailyMiir ViirAinda não há avaliações

- Market Outlook, 20th February, 2013Documento13 páginasMarket Outlook, 20th February, 2013Angel BrokingAinda não há avaliações

- Mre121213 PDFDocumento3 páginasMre121213 PDFnaudaslietas_lvAinda não há avaliações

- In Focus: .DJI 12,285.15 (+14.16) .SPX 1,314.52 (+0.11) .IXIC 2,760.22 (-1.30)Documento6 páginasIn Focus: .DJI 12,285.15 (+14.16) .SPX 1,314.52 (+0.11) .IXIC 2,760.22 (-1.30)Andre SetiawanAinda não há avaliações

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocumento2 páginasRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470Ainda não há avaliações

- Bank of Japan With More Stimulus: Morning ReportDocumento3 páginasBank of Japan With More Stimulus: Morning Reportnaudaslietas_lvAinda não há avaliações

- Market Outlook Market Outlook: Dealer's DiaryDocumento12 páginasMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- US Job Data Disappoint: Morning ReportDocumento3 páginasUS Job Data Disappoint: Morning Reportnaudaslietas_lvAinda não há avaliações

- Non-Farm Payrolls May Surprise: Morning ReportDocumento3 páginasNon-Farm Payrolls May Surprise: Morning Reportnaudaslietas_lvAinda não há avaliações

- ScotiaBank JUL 30 Daily PointsDocumento2 páginasScotiaBank JUL 30 Daily PointsMiir ViirAinda não há avaliações

- Ranges (Up Till 11.28am HKT) : Currency CurrencyDocumento3 páginasRanges (Up Till 11.28am HKT) : Currency Currencyapi-290371470Ainda não há avaliações

- Morning Call June 16 2010Documento4 páginasMorning Call June 16 2010chibondkingAinda não há avaliações

- Central Banks Centre of Attention: Morning ReportDocumento3 páginasCentral Banks Centre of Attention: Morning Reportnaudaslietas_lvAinda não há avaliações

- Merkel Finally Gave In: Morning ReportDocumento4 páginasMerkel Finally Gave In: Morning Reportnaudaslietas_lvAinda não há avaliações

- Growth in The US Picks Up: Morning ReportDocumento3 páginasGrowth in The US Picks Up: Morning Reportnaudaslietas_lvAinda não há avaliações

- Norges Bank Will Lower Rate Path: Morning ReportDocumento3 páginasNorges Bank Will Lower Rate Path: Morning Reportnaudaslietas_lvAinda não há avaliações

- Market Research Nov 11 - Nov 15Documento2 páginasMarket Research Nov 11 - Nov 15FEPFinanceClubAinda não há avaliações

- Slower Growth in China: Morning ReportDocumento4 páginasSlower Growth in China: Morning Reportnaudaslietas_lvAinda não há avaliações

- Jyske Bank Aug 02 em DailyDocumento6 páginasJyske Bank Aug 02 em DailyMiir ViirAinda não há avaliações

- We Didn 'T Mean It That Way: Morning ReportDocumento3 páginasWe Didn 'T Mean It That Way: Morning Reportnaudaslietas_lvAinda não há avaliações

- Market Research Jan 20 - Jan 24Documento2 páginasMarket Research Jan 20 - Jan 24FEPFinanceClubAinda não há avaliações

- Daily Comment RR 06jul11Documento3 páginasDaily Comment RR 06jul11timurrsAinda não há avaliações

- Stock Tips For The WeekDocumento9 páginasStock Tips For The WeekDasher_No_1Ainda não há avaliações

- US Companies Earned 10% of GDP in Q3: Morning ReportDocumento3 páginasUS Companies Earned 10% of GDP in Q3: Morning Reportnaudaslietas_lvAinda não há avaliações

- Market Outlook Market Outlook: Dealer's DiaryDocumento12 páginasMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Non-Farm Payrolls Disappointed: Morning ReportDocumento3 páginasNon-Farm Payrolls Disappointed: Morning Reportnaudaslietas_lvAinda não há avaliações

- Inside Debt: Markets Today Chart of The DayDocumento6 páginasInside Debt: Markets Today Chart of The Dayitein74Ainda não há avaliações

- July 3 The Small-Cap BeatDocumento6 páginasJuly 3 The Small-Cap BeatStéphane Solis100% (2)

- US Unemployment Continue To Fall: Morning ReportDocumento3 páginasUS Unemployment Continue To Fall: Morning Reportnaudaslietas_lvAinda não há avaliações

- Figure of The Day: Norwegian GDP: Morning ReportDocumento3 páginasFigure of The Day: Norwegian GDP: Morning Reportnaudaslietas_lvAinda não há avaliações

- Jyske Bank Aug 09 em DailyDocumento5 páginasJyske Bank Aug 09 em DailyMiir ViirAinda não há avaliações

- Morning Call July 7 2010Documento4 páginasMorning Call July 7 2010chibondkingAinda não há avaliações

- For Impact: BracingDocumento6 páginasFor Impact: BracingAndre_Setiawan_1986Ainda não há avaliações

- IMF Cautiously Optimistic For The US: Morning ReportDocumento4 páginasIMF Cautiously Optimistic For The US: Morning Reportnaudaslietas_lvAinda não há avaliações

- Monitor Markets 20230908Documento2 páginasMonitor Markets 20230908Kicki AnderssonAinda não há avaliações

- No Surprises From Ecb or Boe: Morning ReportDocumento3 páginasNo Surprises From Ecb or Boe: Morning Reportnaudaslietas_lvAinda não há avaliações

- PHPV ZAQKbDocumento9 páginasPHPV ZAQKbfred607Ainda não há avaliações

- Weekly Market Research Oct 27-Oct 31Documento2 páginasWeekly Market Research Oct 27-Oct 31FEPFinanceClubAinda não há avaliações

- New Debt Solution in Place For Greece: Morning ReportDocumento3 páginasNew Debt Solution in Place For Greece: Morning Reportnaudaslietas_lvAinda não há avaliações

- Daily FX STR Europe 30 June 2011Documento9 páginasDaily FX STR Europe 30 June 2011timurrsAinda não há avaliações

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDocumento5 páginasRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470Ainda não há avaliações

- Ready To Recapitalize Banks: Morning ReportDocumento3 páginasReady To Recapitalize Banks: Morning Reportnaudaslietas_lvAinda não há avaliações

- Market Outlook Market Outlook: Dealer's DiaryDocumento15 páginasMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Fake Money, Real Danger: Protect Yourself and Grow Wealth While You Still CanNo EverandFake Money, Real Danger: Protect Yourself and Grow Wealth While You Still CanAinda não há avaliações

- Westpack AUG 11 Mornng ReportDocumento1 páginaWestpack AUG 11 Mornng ReportMiir ViirAinda não há avaliações

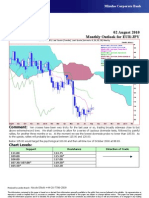

- AUG-10 Mizuho Technical Analysis EUR JPYDocumento1 páginaAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirAinda não há avaliações

- AUG-10 Mizuho Technical Analysis EUR USDDocumento1 páginaAUG-10 Mizuho Technical Analysis EUR USDMiir ViirAinda não há avaliações

- AUG-10 Mizuho Technical Analysis USD JPYDocumento1 páginaAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG 11 UOB Asian MarketsDocumento2 páginasAUG 11 UOB Asian MarketsMiir ViirAinda não há avaliações

- AUG 11 DBS Daily Breakfast SpreadDocumento6 páginasAUG 11 DBS Daily Breakfast SpreadMiir ViirAinda não há avaliações

- AUG-10 Mizuho Technical Analysis GBP USDDocumento1 páginaAUG-10 Mizuho Technical Analysis GBP USDMiir ViirAinda não há avaliações

- AUG 10 UOB Asian MarketsDocumento2 páginasAUG 10 UOB Asian MarketsMiir ViirAinda não há avaliações

- Jyske Bank Aug 10 Equities DailyDocumento6 páginasJyske Bank Aug 10 Equities DailyMiir ViirAinda não há avaliações

- AUG-10 - Mizuho - Start The DayDocumento2 páginasAUG-10 - Mizuho - Start The DayMiir ViirAinda não há avaliações

- AUG 10 DBS Daily Breakfast SpreadDocumento8 páginasAUG 10 DBS Daily Breakfast SpreadMiir ViirAinda não há avaliações

- JYSKE Bank AUG 10 Corp Orates DailyDocumento2 páginasJYSKE Bank AUG 10 Corp Orates DailyMiir ViirAinda não há avaliações

- AUG 10 Danske EMEADailyDocumento3 páginasAUG 10 Danske EMEADailyMiir ViirAinda não há avaliações

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocumento5 páginasMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirAinda não há avaliações

- Jyske Bank Aug 10 Market Drivers CommoditiesDocumento3 páginasJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirAinda não há avaliações

- AUG 10 DanskeTechnicalUpdateDocumento1 páginaAUG 10 DanskeTechnicalUpdateMiir ViirAinda não há avaliações

- AUG-02 Mizuho Monthly Outlook For USD JPYDocumento1 páginaAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirAinda não há avaliações

- Jyske Bank Aug 10 em DailyDocumento5 páginasJyske Bank Aug 10 em DailyMiir ViirAinda não há avaliações

- Danske Daily: Key NewsDocumento4 páginasDanske Daily: Key NewsMiir ViirAinda não há avaliações

- AUG 10 Danske FlashCommentFOMC PreviewDocumento7 páginasAUG 10 Danske FlashCommentFOMC PreviewMiir ViirAinda não há avaliações

- AUG 10 Danske Commodities DailyDocumento8 páginasAUG 10 Danske Commodities DailyMiir ViirAinda não há avaliações

- Westpack AUG 10 Mornng ReportDocumento1 páginaWestpack AUG 10 Mornng ReportMiir ViirAinda não há avaliações

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocumento1 páginaAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirAinda não há avaliações

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocumento1 páginaAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirAinda não há avaliações

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocumento1 páginaAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirAinda não há avaliações

- AUG-02 Mizuho Monthly Outlook For GBP USDDocumento1 páginaAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirAinda não há avaliações

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocumento1 páginaAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirAinda não há avaliações

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocumento1 páginaAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirAinda não há avaliações

- Learning Dynamics and Vibrations by MSC AdamsDocumento80 páginasLearning Dynamics and Vibrations by MSC AdamsFrancuzzo DaniliAinda não há avaliações

- Solution: Wireshark Lab: HTTPDocumento7 páginasSolution: Wireshark Lab: HTTPHaoTian YangAinda não há avaliações

- Java 9 Real - TimeDocumento57 páginasJava 9 Real - TimeDiego AmayaAinda não há avaliações

- ''Adhibeo'' in LatinDocumento5 páginas''Adhibeo'' in LatinThriw100% (1)

- Soal Dan Jawaban Audit IIDocumento22 páginasSoal Dan Jawaban Audit IIsantaulinasitorusAinda não há avaliações

- Cbseskilleducation Com Digital Presentation Class 9Documento11 páginasCbseskilleducation Com Digital Presentation Class 9riscomputersirAinda não há avaliações

- Bank Details and Payment MethodsDocumento1 páginaBank Details and Payment Methodsetrit0% (1)

- BA Trolley AMC PO Vijay Sabre Cont - PrintDocumento7 páginasBA Trolley AMC PO Vijay Sabre Cont - PrintParag ChandankhedeAinda não há avaliações

- PneumaxDocumento2 páginasPneumaxandresAinda não há avaliações

- Apayao Quickstat: Indicator Reference Period and DataDocumento4 páginasApayao Quickstat: Indicator Reference Period and DataLiyan CampomanesAinda não há avaliações

- FEW Tapping Drill Sizes PDFDocumento1 páginaFEW Tapping Drill Sizes PDFrefaeAinda não há avaliações

- Curriculum Vitae: Career ObjectiveDocumento2 páginasCurriculum Vitae: Career ObjectiveNasir AhmedAinda não há avaliações

- Special Power of AttorneyDocumento1 páginaSpecial Power of Attorneywecans izza100% (1)

- Sweet Delight Co.,Ltd.Documento159 páginasSweet Delight Co.,Ltd.Alice Kwon100% (1)

- A Cost Estimation Approach For IoT Projects PDFDocumento9 páginasA Cost Estimation Approach For IoT Projects PDFGuru VelmathiAinda não há avaliações

- 34-Samss-718 (12-02-2015)Documento14 páginas34-Samss-718 (12-02-2015)Mubin100% (1)

- Type DG Mod 320 Part No. 952 013: Figure Without ObligationDocumento1 páginaType DG Mod 320 Part No. 952 013: Figure Without Obligationsherub wangdiAinda não há avaliações

- From 1-73Documento95 páginasFrom 1-73Shrijan ChapagainAinda não há avaliações

- Manual de Serviços QQ PDFDocumento635 páginasManual de Serviços QQ PDFLéo Nunes100% (1)

- Tan vs. CincoDocumento2 páginasTan vs. CincoKing Badong67% (3)

- Economic History of The PhilippinesDocumento21 páginasEconomic History of The PhilippinesBench AndayaAinda não há avaliações

- Raghad Kamel's ResumeDocumento7 páginasRaghad Kamel's ResumeMostafa Mohamed GamalAinda não há avaliações

- LabVIEW Core 3 2013 - Course ManualDocumento135 páginasLabVIEW Core 3 2013 - Course Manualtalaindio100% (2)

- Hullabaloo (TV Series)Documento3 páginasHullabaloo (TV Series)ozAinda não há avaliações

- 01 FundamentalsDocumento20 páginas01 FundamentalsTay KittithatAinda não há avaliações

- Annexure - IV (SLD)Documento6 páginasAnnexure - IV (SLD)Gaurav SinghAinda não há avaliações

- Guillang Vs Bedania and SilvaDocumento2 páginasGuillang Vs Bedania and Silvajdg jdgAinda não há avaliações

- Siningbayan Field Book PDFDocumento232 páginasSiningbayan Field Book PDFnathaniel zAinda não há avaliações

- Hyperformance Plasma: Manual GasDocumento272 páginasHyperformance Plasma: Manual GasSinan Aslan100% (1)

- Holiday Activity UploadDocumento6 páginasHoliday Activity UploadmiloAinda não há avaliações