Escolar Documentos

Profissional Documentos

Cultura Documentos

c76 25b

Enviado por

Gie Bernal CamachoTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

c76 25b

Enviado por

Gie Bernal CamachoDireitos autorais:

Formatos disponíveis

COMMISSION ON AUDIT CIRCULAR NO.

76-25-B June 30, 1976

TO : All Heads of Departments, Bureaus and Offices of the National Government,

Managing Heads of Government-owned or controlled Corporations, Boards and

Commissions, Provincial Governors, City Mayors, Regional Directors of the COA,

Provincial and City Auditors, Provincial and City Treasurers and Others

Concerned.

SUBJECT : Policies on the payment of additional compensation, such as allowances,

honoraria, incentive fees, service fees, etc. made out of funds of government-

owned or controlled corporations.

PURPOSE : To supplement COA Circulars No. 76-25 and 76-25A dated March 31, 1976 and

June 30, 1976, respectively, so as to include within their coverage, subject to

modifications herein stated, payment of additional/extra compensation to officials

and employees of government-owned and/or controlled corporations and provide

a uniform accounting treatment and prescribe a system of processing the same.

SCOPE : The regulations prescribed in this supplementary Circular shall cover payments

of additional compensations the sources of which are derived from funds of

government-owned or controlled corporations as well as private sources for

service rendered and/or allowances given for activities which are connected with

the regular duties or functions of the official or employee concerned.

In line with the general policies prescribed in COA Circular No. 76-25 dated March 31,

1976, as re-stated/amended by COA Circular No. 76-25A dated June 30, 1976, the following

regulations are hereby prescribed for payment of additional compensation out of the funds of

government-owned or controlled corporations.

1. Additional compensation such as allowances, honoraria, service fees, incentive

fees, etc., shall be subject to the 50% limitation as prescribed in COA Circulars No.

76-25 and 76-25A when the sources thereof are derived from funds of government-

owned or controlled corporations or private sources as authorized by law. The

additional compensation herein treated does not include regular fringe benefits

ordinarily included in or attached to the regular position of the official or employee

concerned such as cost of living allowance, longevity pay, uniform allowances, etc.

2. The provisions of this Circular shall apply to payment of additional compensations

for services rendered which are part of the regular duties and functions of the

officials and employees of government-owned and controlled corporations, self-

governing boards and commissions as well as of the national and local

governments, and shall include service fees, incentive fees or commissions given

by the Government Service Insurance System and other government-owned or

controlled corporations as authorized by the President, for the remittance of

premiums, amortizations, interests, etc., as well as service fees paid by private

firms for services rendered to them.

3. The 50% limitation which is to be reckoned on the basis of the regular or basic

annual salary of the recipient official or employee shall apply only when the law,

presidential decree, presidential order or directive, granting or authorizing the

payment of additional compensation does not specifically fix the amount thereof. It

shall not include additional remunerations of national and local officials who have

been appointed or designated by the President as members of the board of

directors of government-owned or controlled corporations and those ex-officio

officials of said corporations which are explicitly provided by law and specifically

fixed and authorized by presidential directives or orders. However, such

remunerations shall be paid to the official or employee concerned through the

Cashier of his mother agency or office as provided in No. 4 below.

4. The additional compensations herein treated whether or not the same are subject

to the 50% limitation shall be remitted by the paying entity to the office of the

recipient official or employee in line with the procedure prescribed in Items 3 and 4

of the Statement of Policies under COA Circular No. 76-25A dated June 30, 1976.

5. All collections received representing additional or extra compensations of the

officials and employees concerned shall be treated as trust liabilities. Any

unallocated balance of such collections shall continue to be treated as trust

liabilities and shall be used for further strengthening the office of the recipient

official or employee.

6. The extra or additional compensation referred to in this supplementary Circular

shall be paid by payroll or voucher. The provisions of COA Circular No. 76-26

dated April 6, 1976, shall apply in the processing and payment of additional

compensation contemplated herein.

All circulars, orders, memoranda and existing rules and regulations in conflict herewith

are hereby revoked or amended accordingly.

This Circular shall take effect on July 1, 1976. Thus, the honorarium or additional

compensation received from July 1, 1976 to December 31, 1976, shall not exceed the salary for

the same six-months period. However, from January 1, 1977 to December 31, 1977 and

succeeding years, the 50% limitation shall be computed on the basis of the regular annual

salary of the grantee. Strict compliance with this Circular by all concerned is hereby enjoined.

(SGD.) FRANCISCO S. TANTUICO, JR., Acting Chairman

Você também pode gostar

- Coa C2016-005Documento11 páginasCoa C2016-005aliahAinda não há avaliações

- List of Expired Bondable Officials - As of 06.18.21 (LGU)Documento1 páginaList of Expired Bondable Officials - As of 06.18.21 (LGU)Gie Bernal CamachoAinda não há avaliações

- 04-Exercise 1 - Barangay Financial Statement and ReportsDocumento2 páginas04-Exercise 1 - Barangay Financial Statement and ReportsGie Bernal CamachoAinda não há avaliações

- Sample Aom - Delayed Bidding Beyond TimelinesDocumento3 páginasSample Aom - Delayed Bidding Beyond TimelinesGie Bernal CamachoAinda não há avaliações

- Graphite Is Harmful Because Swallowing It Could Cause Damage To The BodyDocumento1 páginaGraphite Is Harmful Because Swallowing It Could Cause Damage To The BodyGie Bernal CamachoAinda não há avaliações

- Chart of Accts - Inventory, PPE, IP and BADocumento5 páginasChart of Accts - Inventory, PPE, IP and BAGie Bernal CamachoAinda não há avaliações

- Barangay Accounting Q&A: Financial Statements and JournalsDocumento10 páginasBarangay Accounting Q&A: Financial Statements and JournalsGie Bernal CamachoAinda não há avaliações

- Sample Aom - Delayed Bidding Beyond TimelinesDocumento3 páginasSample Aom - Delayed Bidding Beyond TimelinesGie Bernal CamachoAinda não há avaliações

- 05-Suggested Solution - Exercise 1Documento1 página05-Suggested Solution - Exercise 1Gie Bernal CamachoAinda não há avaliações

- 06-Exercise 2 - Appropriation, Recording and ReportingDocumento10 páginas06-Exercise 2 - Appropriation, Recording and ReportingGie Bernal CamachoAinda não há avaliações

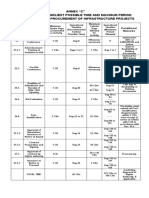

- Timelines InfrastructureDocumento1 páginaTimelines InfrastructureGie Bernal CamachoAinda não há avaliações

- Itinerary MsbernalDocumento1 páginaItinerary MsbernalGie Bernal CamachoAinda não há avaliações

- CebuDocumento1 páginaCebuGie Bernal CamachoAinda não há avaliações

- Verb Tense: Nothing A Little Prozac Wouldn't CureDocumento7 páginasVerb Tense: Nothing A Little Prozac Wouldn't CureGie Bernal CamachoAinda não há avaliações

- Retrace, Recast, Refill, Regain, and RewriteDocumento1 páginaRetrace, Recast, Refill, Regain, and RewriteGie Bernal CamachoAinda não há avaliações

- RERDocumento1 páginaRERGie Bernal CamachoAinda não há avaliações

- Verb Tense: Nothing A Little Prozac Wouldn't CureDocumento7 páginasVerb Tense: Nothing A Little Prozac Wouldn't CureGie Bernal CamachoAinda não há avaliações

- PCAB License (PCAB Categories)Documento8 páginasPCAB License (PCAB Categories)Gie Bernal CamachoAinda não há avaliações

- Office of The Municipal TreasurerDocumento2 páginasOffice of The Municipal TreasurerGie Bernal CamachoAinda não há avaliações

- Reimbursement Espense Receipt: Appendix 46Documento1 páginaReimbursement Espense Receipt: Appendix 46Gie Bernal CamachoAinda não há avaliações

- Brgy Calumpang Resolution Reallocating FundsDocumento4 páginasBrgy Calumpang Resolution Reallocating FundsGie Bernal CamachoAinda não há avaliações

- PCAB License (PCAB Categories)Documento8 páginasPCAB License (PCAB Categories)Gie Bernal CamachoAinda não há avaliações

- A. Taxation As An Inherent Power of The StateDocumento6 páginasA. Taxation As An Inherent Power of The StateGie Bernal CamachoAinda não há avaliações

- Dream HouseDocumento1 páginaDream HouseGie Bernal CamachoAinda não há avaliações

- SEC Registration Requirements for SecuritiesDocumento2 páginasSEC Registration Requirements for SecuritiesGie Bernal CamachoAinda não há avaliações

- Post QualificationDocumento4 páginasPost QualificationGie Bernal CamachoAinda não há avaliações

- (Municipalities of Aroroy, Baleno, Milagros & Mobo) : Commission On AuditDocumento1 página(Municipalities of Aroroy, Baleno, Milagros & Mobo) : Commission On AuditGie Bernal CamachoAinda não há avaliações

- PCAB CategoriesDocumento3 páginasPCAB CategoriesGie Bernal CamachoAinda não há avaliações

- Dream HouseDocumento1 páginaDream HouseGie Bernal CamachoAinda não há avaliações

- NFCCDocumento1 páginaNFCCGie Bernal CamachoAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Bar and Bench RelationsDocumento2 páginasBar and Bench RelationsPrince RajAinda não há avaliações

- PRECIOLITA V. CORLISS vs. THE MANILA RAILROAD COMPANY - Case DigestsDocumento2 páginasPRECIOLITA V. CORLISS vs. THE MANILA RAILROAD COMPANY - Case DigestsJetJuárezAinda não há avaliações

- Consent and Competence-Competence in Investment ArbitrationDocumento20 páginasConsent and Competence-Competence in Investment ArbitrationJane Blessilda FabulaAinda não há avaliações

- Lijjat Papad FinalDocumento12 páginasLijjat Papad FinalSushant S MurudkarAinda não há avaliações

- Mexico - Pestle Analysis 2018Documento68 páginasMexico - Pestle Analysis 2018Arturo100% (2)

- Labor Union Registration UpheldDocumento8 páginasLabor Union Registration UpheldRose Ann CalanglangAinda não há avaliações

- Group Assignment On "Agustawestland Scam": Prof. Ashok AdvaniDocumento11 páginasGroup Assignment On "Agustawestland Scam": Prof. Ashok AdvaniDhruv Ratan DeyAinda não há avaliações

- WWII and the Holocaust TestDocumento5 páginasWWII and the Holocaust TestLove BordamonteAinda não há avaliações

- Community Policing - The DoctrineDocumento27 páginasCommunity Policing - The Doctrine2371964Ainda não há avaliações

- Reagan BushDocumento21 páginasReagan Bushapi-243587006Ainda não há avaliações

- Legal heirs cannot be treated as complainant under CrPC Section 256(1Documento10 páginasLegal heirs cannot be treated as complainant under CrPC Section 256(1Sudeep Sharma0% (1)

- Republic of The Philippines Manila: Estate of Dulay v. Aboitiz Jebsen Maritime G.R. No. 172642Documento5 páginasRepublic of The Philippines Manila: Estate of Dulay v. Aboitiz Jebsen Maritime G.R. No. 172642Jopan SJAinda não há avaliações

- Cultural Diplomacy - Hard To Define - Schneider, CynthiaDocumento14 páginasCultural Diplomacy - Hard To Define - Schneider, CynthiaVassilis LaliotisAinda não há avaliações

- City Limits Magazine, August/September 1990 IssueDocumento32 páginasCity Limits Magazine, August/September 1990 IssueCity Limits (New York)Ainda não há avaliações

- Activity 5 To 7Documento3 páginasActivity 5 To 7Ken KanekiAinda não há avaliações

- Chapter 5: Contemporary Global GovernanceDocumento12 páginasChapter 5: Contemporary Global GovernanceEleanor MontibonAinda não há avaliações

- Reply Affidavit For Reckless ImprudenceDocumento6 páginasReply Affidavit For Reckless ImprudenceLizerMalate82% (11)

- The Black Man's Plight Is Not The White Man's BlameDocumento2 páginasThe Black Man's Plight Is Not The White Man's Blameapi-286297588Ainda não há avaliações

- Reddick v. Tift County, Georgia - Document No. 7Documento2 páginasReddick v. Tift County, Georgia - Document No. 7Justia.comAinda não há avaliações

- MCQ On French Revolution - QuestionsDocumento15 páginasMCQ On French Revolution - QuestionsSHAURYA NIGAMAinda não há avaliações

- The DPO Handbook: Guidance for ComplianceDocumento247 páginasThe DPO Handbook: Guidance for ComplianceAna BoboceaAinda não há avaliações

- Mdikec 01 Justice PDFDocumento22 páginasMdikec 01 Justice PDFJuan ManuelAinda não há avaliações

- Consensus Report SummaryDocumento20 páginasConsensus Report SummarychrsbakrAinda não há avaliações

- Manila Memorial vs. DSWD DecDocumento3 páginasManila Memorial vs. DSWD DecJeremy Ryan Chua100% (1)

- Full Download International Politics Power and Purpose in Global Affairs 3rd Edition Paul Danieri Test BankDocumento36 páginasFull Download International Politics Power and Purpose in Global Affairs 3rd Edition Paul Danieri Test Bankisaacc4sbbailey100% (37)

- CRIMINAL LAW 1 Cases To ReadDocumento2 páginasCRIMINAL LAW 1 Cases To ReadGJ LaderaAinda não há avaliações

- Keoki Webb - Research Paper TemplateDocumento5 páginasKeoki Webb - Research Paper Templateapi-550931588Ainda não há avaliações

- Comité Da Convenção Sobre o Cibercrime (2017) Termos de Referência Segundo Protocolo À Convenção Sobre o CibercrimeDocumento23 páginasComité Da Convenção Sobre o Cibercrime (2017) Termos de Referência Segundo Protocolo À Convenção Sobre o Cibercrimemargarida antunesAinda não há avaliações

- H.L. Mencken Essay on Liberty and Police PowerDocumento5 páginasH.L. Mencken Essay on Liberty and Police PowerDaniel AcheampongAinda não há avaliações

- 20th Century QuestionsDocumento5 páginas20th Century QuestionshhAinda não há avaliações