Escolar Documentos

Profissional Documentos

Cultura Documentos

BPI Vs SPS YU

Enviado por

NormzWabanTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

BPI Vs SPS YU

Enviado por

NormzWabanDireitos autorais:

Formatos disponíveis

BPI vs SPS YU

Doctrine: Truth in Lending Act; substantial compliance with truth in lending

act

Facts:

1.Respondents Norman and Angelina Yu (the Yus), doing business as Tuanson

Trading, and Tuanson Builders Corporation (Tuanson Builders) borrowed

various sums totaling P75 million from Far East Bank and Trust Company.

2.For collateral, they executed real estate mortgages over several of their

properties,1 including certain lands in Legazpi City owned by Tuanson

Trading.2

3.In 1999, unable to pay their loans, the Yus and Tuanson Builders requested

a loan restructuring,3 which the bank, now merged with Bank of the Philippine

Islands (BPI), granted.4

4. In this case, although BPI failed to state the penalty charges in the

disclosure statement, the promissory note that the Yus signed, on the same

date as the disclosure statement, contained a penalty clause that said: "I/We

jointly and severally, promise to further pay a late payment charge on any

overdue amount herein at the rate of 3% per month."

5.Despite the restructuring, however, the Yus still had difficulties paying their

loan. They asked BPI to release some of the mortgaged lands since their total

appraised value far exceeded the amount of the remaining debt.

6. When BPI ignored their request, the Yus withheld payments on their

amortizations.

7.Thus, BPI extrajudicially foreclosed6 the mortgaged properties in Legazpi City

and in Pili, Camarines Sur.

8. On October 24, 2003 the Yus filed their new complaint before the Regional

Trial Court (RTC) of Legazpi City, Branch 1, in Civil Case 10286 against BPI for

recovery of alleged excessive penalty charges, attorneys fees, and foreclosure

expenses that the bank caused to be incorporated in the price of the auctioned

properties.

9. Furthermore, they demanded that the penalty be deleted for violation of

Truth in Lending Act and that the interest be reduced because it is inequitable.

Issue: WON the BPI is in violation of the truth in Lending Act?

WON the penalty is unconscionable

Ruling:

1. BPI did not violate the truth in lending act because it made substantial

compliance.

. Both the RTC and CA decisions cited BPIs alleged violation of the Truth

in Lending Act and the ruling of the Court in New Sampaguita Builders

Construction, Inc. v. Philippine National Bank40 to justify their deletion

of the penalty charges. Section 4 of the Truth in Lending Act states that:

SEC. 4. Any creditor shall furnish to each person to whom credit is

extended, prior to the consummation of the transaction, a clear

statement in writing setting forth, to the extent applicable and in

accordance with rules and regulations prescribed by the Board, the

following information:

(1) the cash price or delivered price of the property or service to be

acquired;

(2) the amounts, if any, to be credited as down payment and/or trade-in;

(3) the difference between the amounts set forth under clauses (1) and

(2);

(4) the charges, individually itemized, which are paid or to be paid by

such person in connection with the transaction but which are not

incident to the extension of credit;

(5) the total amount to be financed;

(6) the finance charge expressed in terms of pesos and centavos; and

(7) the percentage that the finance bears to the total amount to be

financed expressed as a simple annual rate on the outstanding unpaid

balance of the obligation.

Penalty charge, which is liquidated damages resulting from a breach,41

falls under item (6) or finance charge. A finance charge "represents the

amount to be paid by the debtor incident to the extension of credit."42

The lender may provide for a penalty clause so long as the amount or

rate of the charge and the conditions under which it is to be paid are

disclosed to the borrower before he enters into the credit agreement.

The question is whether or not the reference to the penalty charges in the

promissory note constitutes substantial compliance with the disclosure

requirement of the Truth in Lending Act.

Yes there is substantial compliance.

The RTC and CA relied on the ruling in New Sampaguita as authority

that the non-disclosure of the penalty charge renders its imposition

illegal. But New Sampaguita is not attended by the same circumstances.

The Court has affirmed that financial charges are amply disclosed if

stated in the promissory note in the case of Development Bank of the

Philippines v. Arcilla, Jr.49 The Court there said, "Under Circular 158 of

the Central Bank, the lender is required to include the information

required by R.A. 3765 in the contract covering the credit transaction or

any other document to be acknowledged and signed by the borrower. In

addition, the contract or document shall specify additional charges, if

any, which will be collected in case certain stipulations in the contract

are not met by the debtor." In this case, the promissory notes signed

by the Yus contained data, including penalty charges, required by

the Truth in Lending Act. The promissory note is an

acknowledgment of a debt and commitment to repay it on the date

and under the conditions that the parties agreed on.43 It is a valid

contract absent proof of acts which might have vitiated consent.

They cannot avoid liability based on a rigid interpretation of the

Truth in Lending Act that contravenes its goal.

In short, they wanted the penalty be deleted on account that it was not

stated in exact figures, for example 10 thousand. In this case, it was only

mentioned as percentage. The supreme court said there was substantial

compliance.

2. The penalty is unconscionable

Nonetheless, the courts have authority to reduce penalty charges when

these are unreasonable and iniquitous.50 Considering that BPI had

already received over P2.7 million in interest and that it seeks to impose

the penalty charge of 3% per month or 36% per annum on the total

amount dueprincipal plus interest, with interest not paid when due

added to and becoming part of the principal and also bearing interest at

the same ratethe Court finds the ruling of the RTC in its original

decision51 reasonable and fair. Thus, the penalty charge of 12% per

annum or 1% per month52 is imposed.

Você também pode gostar

- Usury and Unconscionable Interest RatesDocumento6 páginasUsury and Unconscionable Interest RatesClauds GadzzAinda não há avaliações

- Pantaleon V AmexDocumento18 páginasPantaleon V Amexrgtan3Ainda não há avaliações

- 13.) ABACUS SECURITIES CORPORATION, Petitioner, vs. RUBEN U. AMPIL, RespondentDocumento4 páginas13.) ABACUS SECURITIES CORPORATION, Petitioner, vs. RUBEN U. AMPIL, RespondentIyahAinda não há avaliações

- SPOUSES Oliveros and Cabuyao Commercial Center Vs Presiding Judge of RTC Laguna and Metropolitan Bank GR 165963Documento2 páginasSPOUSES Oliveros and Cabuyao Commercial Center Vs Presiding Judge of RTC Laguna and Metropolitan Bank GR 165963Law StudentAinda não há avaliações

- Phil. Trust Co. Vs Rivera (G.R. No. L-19761)Documento1 páginaPhil. Trust Co. Vs Rivera (G.R. No. L-19761)Ayvee BlanchAinda não há avaliações

- Articles of Incorporation and By-Laws - Non Stock CorporationDocumento10 páginasArticles of Incorporation and By-Laws - Non Stock CorporationenzoAinda não há avaliações

- Sia Vs PeopleDocumento1 páginaSia Vs PeopleEJ SantosAinda não há avaliações

- Demand For Loan Restructure - BTBDocumento5 páginasDemand For Loan Restructure - BTBwrmarleyAinda não há avaliações

- Manila Banking V TeodoroDocumento2 páginasManila Banking V Teodoroluiz ManieboAinda não há avaliações

- Union Bank VDocumento5 páginasUnion Bank VGlyza Kaye Zorilla PatiagAinda não há avaliações

- Credit Transactions DoctinesDocumento18 páginasCredit Transactions Doctinesmanol_salaAinda não há avaliações

- St. Lukes V NotarioDocumento3 páginasSt. Lukes V NotarioKelly ThompsonAinda não há avaliações

- PNB Vs CA and Delfin PerezDocumento2 páginasPNB Vs CA and Delfin PerezCes DavidAinda não há avaliações

- Metropolitan Bank and Trust Company vs. Centro Development PDFDocumento20 páginasMetropolitan Bank and Trust Company vs. Centro Development PDFsinigangAinda não há avaliações

- NIL Digested CasesDocumento11 páginasNIL Digested CasestatskoplingAinda não há avaliações

- Case #11 - Delos Santos Vs MetrobankDocumento1 páginaCase #11 - Delos Santos Vs MetrobankMichelle CatadmanAinda não há avaliações

- Credit Transactions Sample CasesDocumento7 páginasCredit Transactions Sample CasesDavidAinda não há avaliações

- Benny Hung v. BPI Finance Corp.Documento7 páginasBenny Hung v. BPI Finance Corp.ryanmeinAinda não há avaliações

- Commercial Law Review Cases Batch 2Documento42 páginasCommercial Law Review Cases Batch 2KarmaranthAinda não há avaliações

- March 30 2011 CasesDocumento16 páginasMarch 30 2011 CasesBruce WayneAinda não há avaliações

- Uniform Loan and Mortgage Agreement (Real Estate)Documento12 páginasUniform Loan and Mortgage Agreement (Real Estate)Maria Francheska GarciaAinda não há avaliações

- Sample ComplaintDocumento6 páginasSample ComplaintFrancess Mae AlonzoAinda não há avaliações

- Quieting of TitleDocumento5 páginasQuieting of TitleIZZA GARMAAinda não há avaliações

- Collector Vs HendersonDocumento1 páginaCollector Vs HendersonLisa GarciaAinda não há avaliações

- 144 - Ong vs. Court of AppealsDocumento2 páginas144 - Ong vs. Court of AppealsIan Joshua RomasantaAinda não há avaliações

- Legal Forms - Assignment 1Documento39 páginasLegal Forms - Assignment 1Aianna Bianca Birao (fluffyeol)Ainda não há avaliações

- IX. Q. B. DBP vs. Licuanan (Duron)Documento2 páginasIX. Q. B. DBP vs. Licuanan (Duron)Krizea Marie Duron100% (1)

- Tang Ho v. Board of Tax Appeals DigestDocumento4 páginasTang Ho v. Board of Tax Appeals DigestJelena SebastianAinda não há avaliações

- Facts:: Allied Banking Corporation, Petitioner Versus Lim Sio Wan, Metropolitan Bank and Trust Co., RespondentsDocumento7 páginasFacts:: Allied Banking Corporation, Petitioner Versus Lim Sio Wan, Metropolitan Bank and Trust Co., RespondentsNadzlah BandilaAinda não há avaliações

- Vda. de Chua V CADocumento16 páginasVda. de Chua V CAOdette JumaoasAinda não há avaliações

- Torts ComplaintDocumento4 páginasTorts ComplaintIsaiah CalumbaAinda não há avaliações

- Holder For Value and Holder in Due CourseDocumento1 páginaHolder For Value and Holder in Due CoursechstuAinda não há avaliações

- Nego Week 15Documento13 páginasNego Week 15akosiquetAinda não há avaliações

- Customer Information SheetDocumento4 páginasCustomer Information SheetgracechristianbaptistAinda não há avaliações

- 39 Carpo v. ChuaDocumento2 páginas39 Carpo v. ChuaAngelette BulacanAinda não há avaliações

- Bautista v. Auto Plus TradersDocumento12 páginasBautista v. Auto Plus TraderseieipayadAinda não há avaliações

- #38. Allan Vs PNBDocumento37 páginas#38. Allan Vs PNBeizAinda não há avaliações

- Usufruct CasesDocumento1 páginaUsufruct CasesShammah Rey MahinayAinda não há avaliações

- Carodan Vs China Bank SolidaryDocumento2 páginasCarodan Vs China Bank SolidaryleslieAinda não há avaliações

- BPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988Documento7 páginasBPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988Jolet Paulo Dela CruzAinda não há avaliações

- CRISTOBAL BONNEVIE, ET AL., Plaintiffs-Appellants, vs. JAIME HERNANDEZ, Defendant-Appellee. G.R. No. L-5837 FactsDocumento2 páginasCRISTOBAL BONNEVIE, ET AL., Plaintiffs-Appellants, vs. JAIME HERNANDEZ, Defendant-Appellee. G.R. No. L-5837 FactsMayoree FlorencioAinda não há avaliações

- Credit TransDocumento3 páginasCredit Transalliah SolitaAinda não há avaliações

- Legal Forms FinalsDocumento51 páginasLegal Forms FinalsAlyza Montilla BurdeosAinda não há avaliações

- CIR V SAN MIGUEL CORPORATIONDocumento3 páginasCIR V SAN MIGUEL CORPORATIONMareja ArellanoAinda não há avaliações

- RA 3765 Truth in Lending ActDocumento2 páginasRA 3765 Truth in Lending ActEmil BautistaAinda não há avaliações

- Agreement of SuretyshipDocumento1 páginaAgreement of SuretyshipKay AvilesAinda não há avaliações

- United Coconut Planters Bank V Samuel & BelusoDocumento45 páginasUnited Coconut Planters Bank V Samuel & BelusoQuennie Jane SaplagioAinda não há avaliações

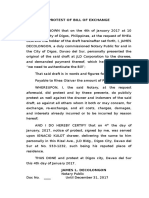

- Protest of Bill of Exchange and Notice of ProtestDocumento3 páginasProtest of Bill of Exchange and Notice of ProtestJames Decolongon33% (3)

- Llorin vs. CA, G.R. No. 103592 February 4, 1993 (218 SCRA 436)Documento6 páginasLlorin vs. CA, G.R. No. 103592 February 4, 1993 (218 SCRA 436)CLark Barcelon100% (1)

- Atrium Management Corp. V. CA (2001) : G.R. No. 109491Documento2 páginasAtrium Management Corp. V. CA (2001) : G.R. No. 109491Thoughts and More ThoughtsAinda não há avaliações

- Credit Transactions Week 1 DigestDocumento15 páginasCredit Transactions Week 1 DigestJesse Myl MarciaAinda não há avaliações

- Tax Admin and EnforcementDocumento5 páginasTax Admin and EnforcementPeanutButter 'n JellyAinda não há avaliações

- Truth in LendingDocumento5 páginasTruth in LendingJexelle Marteen Tumibay PestañoAinda não há avaliações

- Banking Laws - DizonDocumento26 páginasBanking Laws - DizonZsa-shimi FranciscoAinda não há avaliações

- 06.06 - Molina vs. Court of Appeals, 398 SCRA97 (2003)Documento8 páginas06.06 - Molina vs. Court of Appeals, 398 SCRA97 (2003)JMarcAinda não há avaliações

- New Frontier Sugar Corp. Vs RTC of Iloilo GR 165001 Jan 31, 2007Documento3 páginasNew Frontier Sugar Corp. Vs RTC of Iloilo GR 165001 Jan 31, 2007Mesuella Bugao100% (1)

- Pua Casim v. NeumarkDocumento4 páginasPua Casim v. NeumarkElizabeth Joy CortezAinda não há avaliações

- Broad Power of AttorneyDocumento6 páginasBroad Power of Attorneyanon_974142023Ainda não há avaliações

- BPI vs. SPS Yu DigestDocumento3 páginasBPI vs. SPS Yu DigestMary Louisse RulonaAinda não há avaliações

- Ucpb vs. Samuel & BelusoDocumento3 páginasUcpb vs. Samuel & BelusoJenine QuiambaoAinda não há avaliações

- Second Division Maria Virginia V. Remo, G.R. No. 169202 PetitionerDocumento8 páginasSecond Division Maria Virginia V. Remo, G.R. No. 169202 PetitionerBianca Margaret TolentinoAinda não há avaliações

- Salient Provisions MuncorDocumento18 páginasSalient Provisions MuncorNormzWabanAinda não há avaliações

- Insurace CodalDocumento23 páginasInsurace CodalNormzWabanAinda não há avaliações

- 2014 Bar Examinations InsuranceDocumento3 páginas2014 Bar Examinations InsuranceNormzWabanAinda não há avaliações

- Admin Law CasesDocumento71 páginasAdmin Law CasesNormzWabanAinda não há avaliações

- Drilon Vs LIm DigestDocumento2 páginasDrilon Vs LIm DigestNormzWaban100% (7)

- Coca Cola Vs Manila DigestDocumento2 páginasCoca Cola Vs Manila DigestNormzWaban50% (2)

- Ai O. Eyana vs. Philippine Transmarine Carriers, Inc., Alain A. Garillos, Celebrity Cruises, Inc. (U.S.a.)Documento48 páginasAi O. Eyana vs. Philippine Transmarine Carriers, Inc., Alain A. Garillos, Celebrity Cruises, Inc. (U.S.a.)NormzWabanAinda não há avaliações

- Spec Com First BatchDocumento59 páginasSpec Com First BatchNormzWabanAinda não há avaliações

- Angeles City Vs Angeles DigestDocumento1 páginaAngeles City Vs Angeles DigestNormzWabanAinda não há avaliações

- Alvin S. Feliciano vs. Atty. Carmelita Bautista-LozadaDocumento18 páginasAlvin S. Feliciano vs. Atty. Carmelita Bautista-LozadaNormzWabanAinda não há avaliações

- Supreme CourtDocumento7 páginasSupreme CourtNormzWabanAinda não há avaliações

- Acratomy S. Guarin vs. Atty. Christine A.C. LimpinDocumento21 páginasAcratomy S. Guarin vs. Atty. Christine A.C. LimpinNormzWabanAinda não há avaliações

- List JudgesDocumento254 páginasList JudgesPerry Solano100% (1)

- Provisional Remedies Ateneo PDFDocumento13 páginasProvisional Remedies Ateneo PDFIrish PDAinda não há avaliações

- Case Digest SampleDocumento12 páginasCase Digest SampleFairybelle LiwayanAinda não há avaliações

- LAW299Documento3 páginasLAW299NURSYAFIKA MASROMAinda não há avaliações

- CIR v. CitytrustDocumento2 páginasCIR v. Citytrustpawchan02Ainda não há avaliações

- Fraud Alert!: "@ril - VC" and "@ril - Sg". TheseDocumento2 páginasFraud Alert!: "@ril - VC" and "@ril - Sg". TheseHhhhAinda não há avaliações

- 7-Susi vs. Razon, G.R. No. L-24066Documento2 páginas7-Susi vs. Razon, G.R. No. L-24066Tin CaddauanAinda não há avaliações

- People vs. GuillenDocumento4 páginasPeople vs. GuillensakuraAinda não há avaliações

- Willie Davis v. Joseph Norwood, 3rd Cir. (2015)Documento7 páginasWillie Davis v. Joseph Norwood, 3rd Cir. (2015)Scribd Government DocsAinda não há avaliações

- Verified Petition For DissolutionDocumento3 páginasVerified Petition For Dissolutionsapphirealmonds80% (5)

- Sterling Products International Inc V SolDocumento2 páginasSterling Products International Inc V Solav783Ainda não há avaliações

- Minimum Wages Act, 1948Documento19 páginasMinimum Wages Act, 1948CatAinda não há avaliações

- 8th KIMCC Moot PropositionDocumento11 páginas8th KIMCC Moot PropositionsagarAinda não há avaliações

- Motion To Amend Complaint - KilbyDocumento2 páginasMotion To Amend Complaint - KilbyGrepah Cristy Gomez IlogonAinda não há avaliações

- Subsidiary Legislation PDFDocumento18 páginasSubsidiary Legislation PDFHairulanuar Suli100% (2)

- Case Digest 1Documento1 páginaCase Digest 1Marjurie QuinceAinda não há avaliações

- Regional Trial Court: The Proceeding) Were Drinking in Front of His House in Manila WhenDocumento4 páginasRegional Trial Court: The Proceeding) Were Drinking in Front of His House in Manila WhenOrlando DatangelAinda não há avaliações

- EDCA Publishing v. Santos, 184 SCRA 614 (1990) .Documento3 páginasEDCA Publishing v. Santos, 184 SCRA 614 (1990) .Angela AquinoAinda não há avaliações

- Current Principal Place of Business: Entity Name: THE 327 ISLAND, LLCDocumento1 páginaCurrent Principal Place of Business: Entity Name: THE 327 ISLAND, LLCJAMESAinda não há avaliações

- Writ of Habes CorpusDocumento3 páginasWrit of Habes CorpusChristian Jade HensonAinda não há avaliações

- Order Discussing Appropriate Notices of Supplemental AuthorityDocumento4 páginasOrder Discussing Appropriate Notices of Supplemental AuthoritysouthfllawyersAinda não há avaliações

- The Law As A Guide in The Performance of Police DutiesDocumento17 páginasThe Law As A Guide in The Performance of Police DutiesState House NigeriaAinda não há avaliações

- Bayang Vs CA Rule 3Documento2 páginasBayang Vs CA Rule 3Rowela Descallar100% (1)

- Before The Hon'Ble Supreme Court of India New Delhi: Case Concering Murder and Private DefenceDocumento13 páginasBefore The Hon'Ble Supreme Court of India New Delhi: Case Concering Murder and Private DefencePrashant Paul KerkettaAinda não há avaliações

- Ostensible Under TpaDocumento16 páginasOstensible Under TpaanamtaAinda não há avaliações

- NDA - Signed - Mobile BankingDocumento7 páginasNDA - Signed - Mobile BankingKaran PanchalAinda não há avaliações

- AdawaDocumento5 páginasAdawaKim EcarmaAinda não há avaliações

- Bea Hotels NV V Bellway LLC (2007) EWHC 1363 (Comm) (12 June 2007)Documento13 páginasBea Hotels NV V Bellway LLC (2007) EWHC 1363 (Comm) (12 June 2007)mameemooskbAinda não há avaliações

- Dir 2 Consent DirectorDocumento5 páginasDir 2 Consent DirectorPravat Kumar NayakAinda não há avaliações

- Remedies in TortDocumento9 páginasRemedies in TortZaitoon ButtAinda não há avaliações

- Sps Yusay vs. CaDocumento15 páginasSps Yusay vs. CanomercykillingAinda não há avaliações