Escolar Documentos

Profissional Documentos

Cultura Documentos

AUG 06 NBC Financial Group Eco News

Enviado por

Miir Viir0 notas0% acharam este documento útil (0 voto)

36 visualizações1 páginaTotal employment decreased 9.3K in July following a rise of 93.2K in June. Significant losses were observed in full-time employment (-139.0K) while part-time jobs (+129.7K) posted a strong increase. Manufacturing, a highly cyclical industry, created 28.5K jobs in July.

Descrição original:

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoTotal employment decreased 9.3K in July following a rise of 93.2K in June. Significant losses were observed in full-time employment (-139.0K) while part-time jobs (+129.7K) posted a strong increase. Manufacturing, a highly cyclical industry, created 28.5K jobs in July.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

36 visualizações1 páginaAUG 06 NBC Financial Group Eco News

Enviado por

Miir ViirTotal employment decreased 9.3K in July following a rise of 93.2K in June. Significant losses were observed in full-time employment (-139.0K) while part-time jobs (+129.7K) posted a strong increase. Manufacturing, a highly cyclical industry, created 28.5K jobs in July.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

August 6, 2010

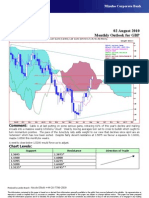

Canadian employment: a pause after an Big swings in the Canadian labour market in July

unsustainable run-up Full-time and part-time jobs

160 Monthly change (thousands)

Latest (monthly change): -9.3k (Actual); +12.5k (expected) 140 Part-time: +129.7K

Previous: +93.2k 120

100

80

FACTS: Total employment decreased 9.3K in July following 60

a rise of 93.2K in June. Significant losses were observed in 40

full-time employment (-139.0K) while part-time jobs 20

0

(+129.7K) posted a strong increase. Despite the weak -20

headline number, the goods-producing sector increased -40

-60

strongly in July (+42.0K) following two consecutive monthly -80

declines. The largest gains came from manufacturing -100

-120

(+28.5K) while utilities (+0.7K) and construction (+2.8K) -140 Full-time: -139K

lagged. Service producing sector declined 51.3K with the -160

2003 2004 2005 2006 2007 2008 2009 2010

largest losses coming from educational services (-65.3K)

and finance, insurance, real estate & leasing (-29.8K). On Goods almost offset services in July

the other hand, public administration (+18.7K) and health Monthly employment change in goods and services +42K jobs in goods-

producting sector in

care & social assistance (+13.7) were the top performers. At July…

120 %, m/m

the provincial level, five of ten provinces showed decreased 100

in employment with Quebec (-20.9K) and Ontario (-15.0K) 80

showing the largest losses. The unemployment rate 60

increased 0.1 percentage points to 8.0%. Total hours 40

worked increased 0.3% (SA) during the month and the 20

0

average hourly wage was up 0.6% m/m (SA).

-20

-40

OPINION: The Canadian labour market took a pause in -60

July, a purely natural phenomenon after having created a -80

whopping 226.6K jobs in the previous three months. Large -100 …offset by a 51.3K

loss in services

swings were observed in July with a loss of 139K full-time -120

-140

jobs and a gain of 130K part-time jobs. Educational services 2008M01 2008M07 2009M01 2009M07 2010M01 2010M07

accounted for half of job losses with a decline of 65.3K. On

a positive note, the lost of 51.3K jobs in overall services was Strong start for wage bill in Q3

almost offset by strong gains in the goods-production sector. Canadian wage bill growth (total hours worked times average hourly wage rate)

Manufacturing, a highly cyclical industry, created 28.5K jobs 12 % q/q ann.

in July, its biggest increase in 26 months, i.e. before the 10

+ 3.2% with only one

month in the quarter

recession began. With an important decline in full-time jobs,

8

the wage bill could have declined in July but this is not the

6

case. Hours worked increased 0.3% while average hourly

4

wage rate was up 0.6% on a seasonally adjusted basis.

Thus, with only one month completed in the quarter, the 2

wage bill is already up by an impressive 3.2% q/q 0

annualized, a good sign for consumption going forward. -2

Despite the slight negative headline, this morning’s report is -4

in no way a sign of weakness of the Canadian labour -6

market. Yanick Desnoyers/Matthieu Arseneau -8

00 01 02 03 04 05 06 07 08 09 10

ECONOMICS AND STRATEGY GROUP – 514.879.2529

Stéfane Marion, Chief Economist and Strategist

General: National Bank Financial (NBF) is an indirect wholly owned subsidiary of National Bank of Canada. National Bank of Canada is a public company listed on Canadian stock exchanges. ♦ The particulars contained herein were obtained

from sources which we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed are based upon our analysis and interpretation of these particulars and are not to be construed as a solicitation or offer

to buy or sell the securities mentioned herein. ♦Canadian Residents: In respect of the distribution of this report in Canada, NBF accepts responsibility for its contents. To make further inquiry related to this report or effect any transaction,

Canadian residents should contact their NBF Investment advisor. ♦ U.S. Residents: NBF Securities (USA) Corp., an affiliate of NBF, accepts responsibility for the contents of this report, subject to any terms set out above. Any U.S. person

wishing to effect transactions in any security discussed herein should do so only through NBF Securities (USA) Corp. UK Residents: In respect of the distribution of this report to UK residents, NBF has approved this financial promotion for the

purposes of Section 21(1) of the Financial Services and Markets Act 2000. NBF and/or its parent and/or any companies within or affiliates of the National Bank of Canada group and/or any of their directors, officers and employees may have or

may have had interests or long or short positions in, and may at any time make purchases and/or sales as principal or agent, or may act or may have acted as market maker in the relevant securities or related financial instruments discussed in

this report, or may act or have acted as investment and/or commercial banker with respect thereto. The value of investments can go down as well as up. Past performance will not necessarily be repeated in the future. The investments contained

in this report are not available to private customers. This report does not constitute or form part of any offer for sale or subscription of or solicitation of any offer to buy or subscribe for the securities described herein nor shall it or any part of it

form the basis of or be relied on in connection with any contract or commitment whatsoever. This information is only for distribution to non-private customers in the United Kingdom within the meaning of the rules of the Regulated by the Financial

Services Authority. ♦ Copyright: This report may not be reproduced in whole or in part, or further distributed or published or referred to in any manner whatsoever, nor may the information, opinions or conclusions contained in it be referred to

without in each case the prior express written consent of National Bank Financial.

Você também pode gostar

- AUG 11 UOB Asian MarketsDocumento2 páginasAUG 11 UOB Asian MarketsMiir ViirAinda não há avaliações

- JYSKE Bank AUG 10 Corp Orates DailyDocumento2 páginasJYSKE Bank AUG 10 Corp Orates DailyMiir ViirAinda não há avaliações

- AUG 11 DBS Daily Breakfast SpreadDocumento6 páginasAUG 11 DBS Daily Breakfast SpreadMiir ViirAinda não há avaliações

- AUG 11 UOB Global MarketsDocumento3 páginasAUG 11 UOB Global MarketsMiir ViirAinda não há avaliações

- Jyske Bank Aug 10 em DailyDocumento5 páginasJyske Bank Aug 10 em DailyMiir ViirAinda não há avaliações

- AUG 10 UOB Global MarketsDocumento3 páginasAUG 10 UOB Global MarketsMiir ViirAinda não há avaliações

- AUG-10 Mizuho Technical Analysis USD JPYDocumento1 páginaAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- Westpack AUG 11 Mornng ReportDocumento1 páginaWestpack AUG 11 Mornng ReportMiir ViirAinda não há avaliações

- AUG-10 Mizuho Technical Analysis EUR USDDocumento1 páginaAUG-10 Mizuho Technical Analysis EUR USDMiir ViirAinda não há avaliações

- AUG 10 UOB Asian MarketsDocumento2 páginasAUG 10 UOB Asian MarketsMiir ViirAinda não há avaliações

- AUG-10 Mizuho Technical Analysis GBP USDDocumento1 páginaAUG-10 Mizuho Technical Analysis GBP USDMiir ViirAinda não há avaliações

- Jyske Bank Aug 10 Market Drivers CommoditiesDocumento3 páginasJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirAinda não há avaliações

- AUG-10 Mizuho Technical Analysis EUR JPYDocumento1 páginaAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirAinda não há avaliações

- AUG-10 - Mizuho - Start The DayDocumento2 páginasAUG-10 - Mizuho - Start The DayMiir ViirAinda não há avaliações

- AUG 10 DBS Daily Breakfast SpreadDocumento8 páginasAUG 10 DBS Daily Breakfast SpreadMiir ViirAinda não há avaliações

- Jyske Bank Aug 10 Equities DailyDocumento6 páginasJyske Bank Aug 10 Equities DailyMiir ViirAinda não há avaliações

- AUG 10 Danske EMEADailyDocumento3 páginasAUG 10 Danske EMEADailyMiir ViirAinda não há avaliações

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocumento5 páginasMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirAinda não há avaliações

- Westpack AUG 10 Mornng ReportDocumento1 páginaWestpack AUG 10 Mornng ReportMiir ViirAinda não há avaliações

- AUG 10 Danske FlashCommentFOMC PreviewDocumento7 páginasAUG 10 Danske FlashCommentFOMC PreviewMiir ViirAinda não há avaliações

- Danske Daily: Key NewsDocumento4 páginasDanske Daily: Key NewsMiir ViirAinda não há avaliações

- AUG 10 DanskeTechnicalUpdateDocumento1 páginaAUG 10 DanskeTechnicalUpdateMiir ViirAinda não há avaliações

- AUG 10 Danske Commodities DailyDocumento8 páginasAUG 10 Danske Commodities DailyMiir ViirAinda não há avaliações

- AUG-02 Mizuho Monthly Outlook For USD JPYDocumento1 páginaAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirAinda não há avaliações

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocumento1 páginaAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirAinda não há avaliações

- AUG-02 Mizuho Monthly Outlook For GBP USDDocumento1 páginaAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirAinda não há avaliações

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocumento1 páginaAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirAinda não há avaliações

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocumento1 páginaAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirAinda não há avaliações

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocumento1 páginaAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirAinda não há avaliações

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocumento1 páginaAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Personalised MedicineDocumento25 páginasPersonalised MedicineRevanti MukherjeeAinda não há avaliações

- Prof Ram Charan Awards Brochure2020 PDFDocumento5 páginasProf Ram Charan Awards Brochure2020 PDFSubindu HalderAinda não há avaliações

- IoT BASED HEALTH MONITORING SYSTEMDocumento18 páginasIoT BASED HEALTH MONITORING SYSTEMArunkumar Kuti100% (2)

- Attributes and DialogsDocumento29 páginasAttributes and DialogsErdenegombo MunkhbaatarAinda não há avaliações

- NAT Order of Operations 82Documento39 páginasNAT Order of Operations 82Kike PadillaAinda não há avaliações

- PESO Online Explosives-Returns SystemDocumento1 páginaPESO Online Explosives-Returns Systemgirinandini0% (1)

- SD8B 3 Part3Documento159 páginasSD8B 3 Part3dan1_sbAinda não há avaliações

- Maj. Terry McBurney IndictedDocumento8 páginasMaj. Terry McBurney IndictedUSA TODAY NetworkAinda não há avaliações

- Column Array Loudspeaker: Product HighlightsDocumento2 páginasColumn Array Loudspeaker: Product HighlightsTricolor GameplayAinda não há avaliações

- Interpretation of Arterial Blood Gases (ABGs)Documento6 páginasInterpretation of Arterial Blood Gases (ABGs)afalfitraAinda não há avaliações

- Data Sheet: Experiment 5: Factors Affecting Reaction RateDocumento4 páginasData Sheet: Experiment 5: Factors Affecting Reaction Ratesmuyet lêAinda não há avaliações

- 3ccc PDFDocumento20 páginas3ccc PDFKaka KunAinda não há avaliações

- Survey Course OverviewDocumento3 páginasSurvey Course OverviewAnil MarsaniAinda não há avaliações

- New Education Policy 2019Documento55 páginasNew Education Policy 2019Aakarshanam VenturesAinda não há avaliações

- ConductorsDocumento4 páginasConductorsJohn Carlo BautistaAinda não há avaliações

- ServiceDocumento47 páginasServiceMarko KoširAinda não há avaliações

- Clark DietrichDocumento110 páginasClark Dietrichikirby77Ainda não há avaliações

- PointerDocumento26 páginasPointerpravin2mAinda não há avaliações

- Panel Data Econometrics: Manuel ArellanoDocumento5 páginasPanel Data Econometrics: Manuel Arellanoeliasem2014Ainda não há avaliações

- Game Rules PDFDocumento12 páginasGame Rules PDFEric WaddellAinda não há avaliações

- Rohit Patil Black BookDocumento19 páginasRohit Patil Black BookNaresh KhutikarAinda não há avaliações

- Additional Help With OSCOLA Style GuidelinesDocumento26 páginasAdditional Help With OSCOLA Style GuidelinesThabooAinda não há avaliações

- DIN Flange Dimensions PDFDocumento1 páginaDIN Flange Dimensions PDFrasel.sheikh5000158Ainda não há avaliações

- Software Requirements Specification: Chaitanya Bharathi Institute of TechnologyDocumento20 páginasSoftware Requirements Specification: Chaitanya Bharathi Institute of TechnologyHima Bindhu BusireddyAinda não há avaliações

- Sysmex Xs-800i1000i Instructions For Use User's ManualDocumento210 páginasSysmex Xs-800i1000i Instructions For Use User's ManualSean Chen67% (6)

- UNIT FOUR: Fundamentals of Marketing Mix: - Learning ObjectivesDocumento49 páginasUNIT FOUR: Fundamentals of Marketing Mix: - Learning ObjectivesShaji ViswambharanAinda não há avaliações

- Fernandez ArmestoDocumento10 páginasFernandez Armestosrodriguezlorenzo3288Ainda não há avaliações

- Skuld List of CorrespondentDocumento351 páginasSkuld List of CorrespondentKASHANAinda não há avaliações

- JurnalDocumento9 páginasJurnalClarisa Noveria Erika PutriAinda não há avaliações

- Liebert PSP: Quick-Start Guide - 500VA/650VA, 230VDocumento2 páginasLiebert PSP: Quick-Start Guide - 500VA/650VA, 230VsinoAinda não há avaliações