Escolar Documentos

Profissional Documentos

Cultura Documentos

Connecticut Municipal Aid 20170818 Municipal Aid Press Summary

Enviado por

Helen BennettDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Connecticut Municipal Aid 20170818 Municipal Aid Press Summary

Enviado por

Helen BennettDireitos autorais:

Formatos disponíveis

Major Sources of Municipal Aid

FY 2018 Revised

FY 2018 FY 2018 Executive Executive Order

Payment Under 8/18 Revised FY 2017 Governor's Order Resource Resource

Executive Order Resource Estimated Revised Budget Allocation Plan Allocation Plan

Major Statutory Formula Grants Statutory Payment Date Allocation Plan Expenditures 5/15 6/26 8/18

State Owned PILOT Fully paid in September No grant will be made 66,730,438 55,705,079 - -

Private College and Hospital PILOT Fully paid in September No grant will be made 114,950,767 54,909,446 - -

One third paid in January, April, and

Mashantucket Pequot and Mohegan Fund Grant June No grant will be made 58,076,610 - - -

66% paid in August and balance in Two - thirds is paid in August and

Adult Education May balance in May 20,284,988 20,284,988 20,284,988 20,284,988

25% paid in October, 25% paid in 25% paid in October, 25% paid in

Education Cost Sharing January, and 50% paid in April January, and 50% paid in April 2,017,587,098 1,580,002,003 See Note 1,511,749,344 1,460,559,375

MRSA: Municipal Revenue Sharing Grant 100% paid in October No grant will be made 127,851,808 - 109,267,688 -

MRSA: Additional Payments in Lieu of Taxes No payment date specified No grant will be made 44,101,081 - 46,101,081 -

MRSF: Urban Stabilization New New - 50,000,000 - -

MRSA revenue balance will be

sufficient in October to pay motor

MRSA: Motor Vehicle Property Tax Grant 100% paid in August vehicle grant payments at 37 mills - - 77,969,733 40,631,340

TOTAL $ 2,449,582,790 $ 1,760,901,516 $ 1,765,372,834 $ 1,521,475,703

Note: The Governor's May budget proposal shifted 22% of ECS related to special education to the Special Education grant.

Você também pode gostar

- Banga Executive Summary 2018 PDFDocumento5 páginasBanga Executive Summary 2018 PDFMohammadAinda não há avaliações

- Budget Briefs: Swachh Bharat Mission - Urban (SBM-U)Documento10 páginasBudget Briefs: Swachh Bharat Mission - Urban (SBM-U)Siva RayuduAinda não há avaliações

- Union Budget - Demands For Grants PDFDocumento119 páginasUnion Budget - Demands For Grants PDFhariveerAinda não há avaliações

- Full Disclosure Lgu PadadaDocumento7 páginasFull Disclosure Lgu PadadaErwin April MidsapakAinda não há avaliações

- KMC Budget English 2019 2020 PDFDocumento58 páginasKMC Budget English 2019 2020 PDFAbhishek SatpathyAinda não há avaliações

- 2019-06-25 Item 39 FY 2020 and FY 2021 Biennial BudgetDocumento570 páginas2019-06-25 Item 39 FY 2020 and FY 2021 Biennial Budgetkarim karimAinda não há avaliações

- Agriculture DFG 2023-24Documento13 páginasAgriculture DFG 2023-24venucoldAinda não há avaliações

- Draft AIP 2018 PDFDocumento30 páginasDraft AIP 2018 PDFYajar ZehcnasAinda não há avaliações

- Executive Summary: A. IntroductionDocumento5 páginasExecutive Summary: A. IntroductionAlicia NhsAinda não há avaliações

- Kenya Gazette Supplement: ACTS, 2020Documento6 páginasKenya Gazette Supplement: ACTS, 2020walalrAinda não há avaliações

- Website BudgetDocumento4 páginasWebsite BudgetVivek LuckyAinda não há avaliações

- Ahmedabad or Amdavad Municipal Corporation Budget 2018 19Documento4 páginasAhmedabad or Amdavad Municipal Corporation Budget 2018 19free democratAinda não há avaliações

- Nepal Budget Highlights 2078Documento36 páginasNepal Budget Highlights 2078shankarAinda não há avaliações

- AAAG AGRlDocumento158 páginasAAAG AGRl786myemailsAinda não há avaliações

- Butuan City Executive Summary 2020Documento10 páginasButuan City Executive Summary 2020aisu aisuAinda não há avaliações

- 04-B660A 2019 Part1-IntroductionDocumento3 páginas04-B660A 2019 Part1-IntroductionVal Escobar MagumunAinda não há avaliações

- FRB 6 Revised Acctg For Jss Grant 15 JulyDocumento13 páginasFRB 6 Revised Acctg For Jss Grant 15 Julycheezhen5047Ainda não há avaliações

- Go 1957Documento25 páginasGo 1957Sunder RajagopalanAinda não há avaliações

- PSDP 2019-20 FinalDocumento84 páginasPSDP 2019-20 FinalfslmanzoorAinda não há avaliações

- DFG Analysis Agriculture 2022-23Documento16 páginasDFG Analysis Agriculture 2022-23Ankit SinghAinda não há avaliações

- Govt Acctg ExamDocumento6 páginasGovt Acctg ExamJohn Paul LappayAinda não há avaliações

- Apac BFP 2015-16Documento202 páginasApac BFP 2015-16derr barrAinda não há avaliações

- Basco Executive Summary 2016Documento3 páginasBasco Executive Summary 2016REGGIE MARG MENDOZAAinda não há avaliações

- Motiong Executive Summary 2017Documento7 páginasMotiong Executive Summary 2017Ronel CadelinoAinda não há avaliações

- NIFA Report 2018-20Documento26 páginasNIFA Report 2018-20zaka khanAinda não há avaliações

- Gov. Maura Healey's Budget ProposalDocumento4 páginasGov. Maura Healey's Budget ProposalNBC 10 WJARAinda não há avaliações

- Tigbauan Executive Summary 2020Documento8 páginasTigbauan Executive Summary 2020cpa126235Ainda não há avaliações

- Elrich Savings PlanDocumento12 páginasElrich Savings PlanDaniel SchereAinda não há avaliações

- FRB 6 Acctg For Jss GrantDocumento12 páginasFRB 6 Acctg For Jss Grantcheezhen5047Ainda não há avaliações

- Altavas Executive Summary 2015 PDFDocumento6 páginasAltavas Executive Summary 2015 PDFThe ApprenticeAinda não há avaliações

- My Presentation PartDocumento11 páginasMy Presentation Partjk lmAinda não há avaliações

- Citizens'/Service Charter of Department of Rural DevelopmentDocumento30 páginasCitizens'/Service Charter of Department of Rural DevelopmentAbhishek kumarAinda não há avaliações

- Alcala Pangasinan ES2016Documento5 páginasAlcala Pangasinan ES2016attycadornaAinda não há avaliações

- Pleasanton City Council Report On Budget Revisions 4/15/2020Documento7 páginasPleasanton City Council Report On Budget Revisions 4/15/2020Courtney TeagueAinda não há avaliações

- 2019fin MS19Documento4 páginas2019fin MS19ShanmukhamAinda não há avaliações

- FRB 6 Revised Sep 2020 Acctg For Jss GrantDocumento16 páginasFRB 6 Revised Sep 2020 Acctg For Jss GrantKellenJaneHernandezAinda não há avaliações

- Corporation Commission: Operating BudgetDocumento2 páginasCorporation Commission: Operating BudgetTJSAinda não há avaliações

- Circular 06072023 1Documento4 páginasCircular 06072023 1Maira ShahAinda não há avaliações

- DA-Order - 24.50 To 27.25 W.E.F 01 Jan 2022 To 31 June 2022Documento3 páginasDA-Order - 24.50 To 27.25 W.E.F 01 Jan 2022 To 31 June 2022MICO EMPLOYEES CO OPERATIVE SOCIETY LTDAinda não há avaliações

- Amendment in Tax Laws by Budget 20761Documento60 páginasAmendment in Tax Laws by Budget 20761Mukunda BhusalAinda não há avaliações

- 10 Quiz 1Documento1 página10 Quiz 1Lovise DevanAinda não há avaliações

- FY19 Financial Forecast Combined DocumentsDocumento77 páginasFY19 Financial Forecast Combined DocumentsAnonymous Pb39klJAinda não há avaliações

- 2021-2022 Duluth Public Schools BudgetDocumento22 páginas2021-2022 Duluth Public Schools BudgetDuluth News TribuneAinda não há avaliações

- SLTC - CLTC - 25628171Documento15 páginasSLTC - CLTC - 25628171Sidhartha SethiAinda não há avaliações

- City Manager's Memo To CouncilDocumento9 páginasCity Manager's Memo To CouncilToronto StarAinda não há avaliações

- Abr Balingoan 0000000018 5208Documento82 páginasAbr Balingoan 0000000018 5208gerlie22Ainda não há avaliações

- Josefina Executive Summary 2017Documento8 páginasJosefina Executive Summary 2017Virgo Philip Wasil ButconAinda não há avaliações

- Wednesday HoaglandDocumento29 páginasWednesday HoaglandNational Press FoundationAinda não há avaliações

- Final BudgetDocumento4 páginasFinal BudgetJeremy TurleyAinda não há avaliações

- Malay Executive Summary 2017Documento7 páginasMalay Executive Summary 2017RM Rea RebAinda não há avaliações

- AP GIS GO NO 131 W.E.F Oct 2018 - 30-06-2019Documento6 páginasAP GIS GO NO 131 W.E.F Oct 2018 - 30-06-2019Sivareddy50% (2)

- Government of Andhra PradeshDocumento4 páginasGovernment of Andhra PradeshBalu Mahendra Susarla0% (1)

- SCCE Cascade - February 2019 (Compatibility Mode)Documento19 páginasSCCE Cascade - February 2019 (Compatibility Mode)zohib shaikhAinda não há avaliações

- Dimensions of The Proposed 2024 NG Budget - FinalDocumento25 páginasDimensions of The Proposed 2024 NG Budget - FinalNichole SimblanteAinda não há avaliações

- Statement: Annual BudgetDocumento76 páginasStatement: Annual Budgetshani2010Ainda não há avaliações

- UNION BUDGET-2010-2011: Vision & ObjectiveDocumento32 páginasUNION BUDGET-2010-2011: Vision & ObjectivemanishgondhalekarAinda não há avaliações

- 18 19 Budget Q and A - 05 01 18vFINALDocumento8 páginas18 19 Budget Q and A - 05 01 18vFINALAnthony PetrosinoAinda não há avaliações

- 2018 PERS Valuation ReportDocumento48 páginas2018 PERS Valuation Reportthe kingfishAinda não há avaliações

- Analisis Kinerja Pemerintah Desa Dengan Pendekatan Kuantitatif Dan Kualitatif (Studi Pada Desa Di Kecamatan Ingin Jaya Kabupaten Aceh Besar)Documento15 páginasAnalisis Kinerja Pemerintah Desa Dengan Pendekatan Kuantitatif Dan Kualitatif (Studi Pada Desa Di Kecamatan Ingin Jaya Kabupaten Aceh Besar)AuahsuksesAinda não há avaliações

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersAinda não há avaliações

- 17-12-03 RE04 21-09-17 EV Motion (4.16.2024 FILED)Documento22 páginas17-12-03 RE04 21-09-17 EV Motion (4.16.2024 FILED)Helen BennettAinda não há avaliações

- Pura Decision 230132re01-022124Documento12 páginasPura Decision 230132re01-022124Helen BennettAinda não há avaliações

- PURA 2023 Annual ReportDocumento129 páginasPURA 2023 Annual ReportHelen BennettAinda não há avaliações

- West Hartford Proposed Budget 2024-2025Documento472 páginasWest Hartford Proposed Budget 2024-2025Helen BennettAinda não há avaliações

- TBL LTR ReprimandDocumento5 páginasTBL LTR ReprimandHelen BennettAinda não há avaliações

- Commission Policy 205 RecruitmentHiringAdvancement Jan 9 2024Documento4 páginasCommission Policy 205 RecruitmentHiringAdvancement Jan 9 2024Helen BennettAinda não há avaliações

- 20240325143451Documento2 páginas20240325143451Helen BennettAinda não há avaliações

- Hunting, Fishing, and Trapping Fees 2024-R-0042Documento4 páginasHunting, Fishing, and Trapping Fees 2024-R-0042Helen BennettAinda não há avaliações

- 75 Center Street Summary Suspension SignedDocumento3 páginas75 Center Street Summary Suspension SignedHelen BennettAinda não há avaliações

- Analysis of Impacts of Hospital Consolidation in CT 032624Documento41 páginasAnalysis of Impacts of Hospital Consolidation in CT 032624Helen BennettAinda não há avaliações

- District 1 0171 0474 Project Locations FINALDocumento7 páginasDistrict 1 0171 0474 Project Locations FINALHelen BennettAinda não há avaliações

- Hartford CT Muni 110723Documento2 páginasHartford CT Muni 110723Helen BennettAinda não há avaliações

- Finn Dixon Herling Report On CSPDocumento16 páginasFinn Dixon Herling Report On CSPRich KirbyAinda não há avaliações

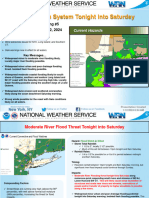

- National Weather Service 01122024 - Am - PublicDocumento17 páginasNational Weather Service 01122024 - Am - PublicHelen BennettAinda não há avaliações

- Be Jar Whistleblower DocumentsDocumento292 páginasBe Jar Whistleblower DocumentsHelen BennettAinda não há avaliações

- 2024 Budget 12.5.23Documento1 página2024 Budget 12.5.23Helen BennettAinda não há avaliações

- CT State of Thebirds 2023Documento13 páginasCT State of Thebirds 2023Helen Bennett100% (1)

- South WindsorDocumento24 páginasSouth WindsorHelen BennettAinda não há avaliações

- District 3 0173 0522 Project Locations FINALDocumento17 páginasDistrict 3 0173 0522 Project Locations FINALHelen BennettAinda não há avaliações

- District 4 0174 0453 Project Locations FINALDocumento6 páginasDistrict 4 0174 0453 Project Locations FINALHelen BennettAinda não há avaliações

- Crime in Connecticut Annual Report 2022Documento109 páginasCrime in Connecticut Annual Report 2022Helen BennettAinda não há avaliações

- Voices For Children Report 2023 FinalDocumento29 páginasVoices For Children Report 2023 FinalHelen BennettAinda não há avaliações

- PEZZOLO Melissa Sentencing MemoDocumento12 páginasPEZZOLO Melissa Sentencing MemoHelen BennettAinda não há avaliações

- University of Connecticut Audit: 20230815 - FY2019,2020,2021Documento50 páginasUniversity of Connecticut Audit: 20230815 - FY2019,2020,2021Helen BennettAinda não há avaliações

- Hurley Employment Agreement - Final ExecutionDocumento22 páginasHurley Employment Agreement - Final ExecutionHelen BennettAinda não há avaliações

- PEZZOLO Melissa Govt Sentencing MemoDocumento15 páginasPEZZOLO Melissa Govt Sentencing MemoHelen BennettAinda não há avaliações

- 04212023final Report MasterDocumento25 páginas04212023final Report MasterHelen BennettAinda não há avaliações

- Final West Haven Tier IV Report To GovernorDocumento75 páginasFinal West Haven Tier IV Report To GovernorHelen BennettAinda não há avaliações

- 2023lco07279 R00 AmdbDocumento8 páginas2023lco07279 R00 AmdbHelen BennettAinda não há avaliações

- No Poach RulingDocumento19 páginasNo Poach RulingHelen BennettAinda não há avaliações

- Register-A-Civil-Partnership-Submission 2:13:2021Documento5 páginasRegister-A-Civil-Partnership-Submission 2:13:2021Theresa WorkmanAinda não há avaliações

- Legion Magazine - Sept Oct 2013 CADocumento100 páginasLegion Magazine - Sept Oct 2013 CAionut11111100% (1)

- Sanborn On PrisonDocumento2 páginasSanborn On PrisonMatt StadnikAinda não há avaliações

- APC FormDocumento3 páginasAPC FormAana SamsAinda não há avaliações

- An Assestment of The Trinidad and Tobago Health Care SystemDocumento4 páginasAn Assestment of The Trinidad and Tobago Health Care SystemMarli MoiseAinda não há avaliações

- Star-Advertiser 2010 Hawaii General Election GuideDocumento32 páginasStar-Advertiser 2010 Hawaii General Election GuideHonolulu Star-AdvertiserAinda não há avaliações

- Edristi Navatra May 2021Documento158 páginasEdristi Navatra May 2021Vikramaditya Singh SurehraAinda não há avaliações

- Pamphlet RightsDocumento8 páginasPamphlet RightspulahogaAinda não há avaliações

- CRC Infographic-2015.2 0Documento1 páginaCRC Infographic-2015.2 0Abel GarciaAinda não há avaliações

- Steno Tips PDFDocumento68 páginasSteno Tips PDFGabriel CruzAinda não há avaliações

- Certified Dental AssistantDocumento22 páginasCertified Dental AssistantRoxana Larisa CiobotaruAinda não há avaliações

- Federal Laws of EthiopiaDocumento42 páginasFederal Laws of EthiopiaSolomon Tekalign100% (2)

- 3 CBMSDocumento55 páginas3 CBMSKadz SeroAinda não há avaliações

- Transportation Systems SSP WebDocumento346 páginasTransportation Systems SSP WebMark ReinhardtAinda não há avaliações

- Response To Employee Request For Family or Medical LeaveDocumento2 páginasResponse To Employee Request For Family or Medical LeaveavatuanAinda não há avaliações

- Affidavit of ConsentDocumento2 páginasAffidavit of ConsentLucille TevesAinda não há avaliações

- Associate Certificate in Environmental Management: Course OverviewDocumento5 páginasAssociate Certificate in Environmental Management: Course OverviewTwi HseAinda não há avaliações

- GO236 - 01.06.2009 - Finance Department (Pay Cell)Documento6 páginasGO236 - 01.06.2009 - Finance Department (Pay Cell)elanthamizhmaranAinda não há avaliações

- 2018 Study Guide PDFDocumento110 páginas2018 Study Guide PDFNolibo33% (3)

- Confidential Draft Complaint - Embargoed - Bhattarai v. HoodDocumento41 páginasConfidential Draft Complaint - Embargoed - Bhattarai v. HoodRuss LatinoAinda não há avaliações

- Physicians For Human Rights-Israel: A Legacy of Injustice - A Critique of Israeli Approaches To The Right To Health - November 2002Documento80 páginasPhysicians For Human Rights-Israel: A Legacy of Injustice - A Critique of Israeli Approaches To The Right To Health - November 2002PHR IsraelAinda não há avaliações

- Chapter 2 OSH Management SystemDocumento26 páginasChapter 2 OSH Management SystemAtilya MahidanAinda não há avaliações

- Fact Opinion QuizDocumento57 páginasFact Opinion QuizAffirahs NurRaijeanAinda não há avaliações

- FINAL DRAFT TBR Dental Hygiene NC IV (Amended, (As of Jan9) )Documento3 páginasFINAL DRAFT TBR Dental Hygiene NC IV (Amended, (As of Jan9) )eddiethehead1968Ainda não há avaliações

- Philippine Politics and SportsDocumento2 páginasPhilippine Politics and SportsNoel IV T. BorromeoAinda não há avaliações

- Notice: Meetings: Petitions Received ListDocumento10 páginasNotice: Meetings: Petitions Received ListJustia.comAinda não há avaliações

- Pay & Pay & Pay & Pay & Pe PE PE Pensions Nsions Nsions NsionsDocumento1 páginaPay & Pay & Pay & Pay & Pe PE PE Pensions Nsions Nsions Nsionsapi-216295060Ainda não há avaliações

- Joint Land Use Draft ReportDocumento152 páginasJoint Land Use Draft ReportArielle BreenAinda não há avaliações

- Right To Health As A Constitutional Mandate in IndiaDocumento7 páginasRight To Health As A Constitutional Mandate in IndiaAmarendraKumarAinda não há avaliações

- Project Child Labour PDFDocumento16 páginasProject Child Labour PDFAmanSethiyaAinda não há avaliações