Escolar Documentos

Profissional Documentos

Cultura Documentos

Cir Vs Aichi

Enviado por

jeandpmdTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Cir Vs Aichi

Enviado por

jeandpmdDireitos autorais:

Formatos disponíveis

G.R. No.

184823 October 6, 2010

COMMISSIONER OF INTERNAL REVENUE, Petitioner, vs. AICHI FORGING COMPANY OF ASIA,

INC., Respondent.

FACTS:

AICHI, a corp duly organize and existing under the laws of the phils, Vat entity. Its products are registered

with the Board of Investments as Pioneer status.

SEPT 30, 2004 : respondent filed a claim for refund/credit of input VAT for the period July 1, 2002 to

September 30, 2002 in the total amount of 3,891,123.82 thru DOF One-Stop Shop Inter-Agency Tax

Credit and Duty Drawback Center. On even date, it filed a petition fore review with the CTA for the

refund/credit of the same inout VAT.

CIR: one of its affirmative defenses: Petitioner must prove that the claim was filed within the two (2) year

period prescribed in Section 229 of the Tax Code.

After trial, decision: JAN 4, 2008: petitioner has sufficiently proved that it is entitled to a refund or

issuance of a tax credit certificate representing unutilized excess input VAT payments for the period July 1,

2002 to September 30, 2002, which are attributable to its zero-rated sales for the same period, but in the

reduced amount of 3,239,119.25. CIR claims that the administrative and judicial claims were filed

beyond the period allowed by law and hence, the honorable Court has no jurisdiction over the same.

JULY 30, 2008: CTA EN BANC: affirmed 2nd div decision.

ISSUE: 1. when to reckon the 2 year prescriptive period?

2. WON the admin claim was timely filed

SC DECISION:

1. Section 112 (A) NIRC: "[P]rescriptive period commences from the close of the taxable quarter

when the sales were made and not from the time the input VAT was paid nor from the time the official

receipt was issued."

In Commissioner of Internal Revenue v. Mirant Pagbilao Corporation, where we ruled that Section 112(A)

of the NIRC is the applicable provision in determining the start of the two-year period for claiming a

refund/credit of unutilized input VAT, and that Sections 204(C) and 229 of the NIRC are inapplicable as

"both provisions apply only to instances of erroneous payment or illegal collection of internal revenue

taxes.

2. Between the Civil Code, which provides that a year is equivalent to 365 days, and the Administrative

Code of 1987, which states that a year is composed of 12 calendar months, it is the latter that must

prevail following the legal maxim, Lex posteriori derogat priori.50 Thus:

Both Article 13 of the Civil Code and Section 31, Chapter VIII, Book I of the Administrative Code of 1987

deal with the same subject matter the computation of legal periods. Under the Civil Code, a year is

equivalent to 365 days whether it be a regular year or a leap year. Under the Administrative Code of

1987, however, a year is composed of 12 calendar months. Needless to state, under the Administrative

Code of 1987, the number of days is irrelevant.

Applying this to the present case, the two-year period to file a claim for tax refund/credit for the

period July 1, 2002 to September 30, 2002 expired on September 30, 2004. Hence, respondents

administrative claim was timely filed.

Você também pode gostar

- BANK OF AMERICA v. ArcDocumento2 páginasBANK OF AMERICA v. ArcChariAinda não há avaliações

- Diamante V People of The PhilippinesDocumento2 páginasDiamante V People of The PhilippinesWhere Did Macky GallegoAinda não há avaliações

- CIR v CTA Tax Refund Case Overturned Due to Outstanding Tax LiabilitiesDocumento39 páginasCIR v CTA Tax Refund Case Overturned Due to Outstanding Tax LiabilitiesAnonymous r1cRm7FAinda não há avaliações

- Hidalgo vs. Hidalgo, 33 SCRA 105, May 29, 1970Documento16 páginasHidalgo vs. Hidalgo, 33 SCRA 105, May 29, 1970Edryd RodriguezAinda não há avaliações

- CBK Power Co. Ltd. v. CIR, G.R. Nos. 198729-30Documento15 páginasCBK Power Co. Ltd. v. CIR, G.R. Nos. 198729-30BernsAinda não há avaliações

- Hilad vs. David, G.R. No. L-961, September 21, 1949.Documento12 páginasHilad vs. David, G.R. No. L-961, September 21, 1949.MykaAinda não há avaliações

- Case Digests STAT CONDocumento7 páginasCase Digests STAT CONraynald_lopezAinda não há avaliações

- Court rules conviction for violating municipal ordinance bars naturalizationDocumento2 páginasCourt rules conviction for violating municipal ordinance bars naturalizationPu Pujalte100% (1)

- Titan 544 SCRA 466Documento23 páginasTitan 544 SCRA 466Rodolfo TobiasAinda não há avaliações

- People V Delos Reyes Case DigestDocumento8 páginasPeople V Delos Reyes Case DigestCamille Joy AtencioAinda não há avaliações

- Tax Refund Case at Clark Air BaseDocumento2 páginasTax Refund Case at Clark Air BaseAtheena MondidoAinda não há avaliações

- Ma. Vilma F. Maniquiz vs. Atty. Danilo C. Emelo A.C. No. 8968, September 26, 2017 FactsDocumento2 páginasMa. Vilma F. Maniquiz vs. Atty. Danilo C. Emelo A.C. No. 8968, September 26, 2017 FactsEduardAinda não há avaliações

- Supreme Court ruling on coconut levy funds caseDocumento10 páginasSupreme Court ruling on coconut levy funds caseRafaelAndreiLaMadridAinda não há avaliações

- 1 SMI-ED vs. CIRDocumento27 páginas1 SMI-ED vs. CIRNia Coline Macala MendozaAinda não há avaliações

- The Decision Appealed From Is Affirmed, With Costs Against Appellant. So OrderedDocumento6 páginasThe Decision Appealed From Is Affirmed, With Costs Against Appellant. So OrderedEinnasujLesiuqAinda não há avaliações

- COMELEC Resolution on 2013 Election Ad Rules Challenged in SCDocumento55 páginasCOMELEC Resolution on 2013 Election Ad Rules Challenged in SCMark De JesusAinda não há avaliações

- G.R. No. 14129, July 31, 1962 People Vs ManantanDocumento5 páginasG.R. No. 14129, July 31, 1962 People Vs ManantanJemard FelipeAinda não há avaliações

- People v. Mabug-At 51 PHIL 967Documento5 páginasPeople v. Mabug-At 51 PHIL 967Anonymous0% (1)

- 3 Inherent Powers of the State: Police, Eminent Domain & TaxationDocumento12 páginas3 Inherent Powers of the State: Police, Eminent Domain & TaxationFRANCO, Monique P.Ainda não há avaliações

- Jover v. BorraDocumento1 páginaJover v. BorraCarissa CruzAinda não há avaliações

- People vs. Hernandez, L-6025-26Documento11 páginasPeople vs. Hernandez, L-6025-26ewnesssAinda não há avaliações

- Court Rules YMCA Income Tax ExemptDocumento10 páginasCourt Rules YMCA Income Tax ExemptDario TorresAinda não há avaliações

- G.R. No. L-22560 January 29, 1925 THE PEOPLE OF THE PHILIPPINE ISLANDS, Plaintiff-Appellee, vs. JOSE S. DIZON, Defendant-Appellant. FactsDocumento2 páginasG.R. No. L-22560 January 29, 1925 THE PEOPLE OF THE PHILIPPINE ISLANDS, Plaintiff-Appellee, vs. JOSE S. DIZON, Defendant-Appellant. FactsLotsee ElauriaAinda não há avaliações

- X 27 Garcia vs. SandiganbayanDocumento3 páginasX 27 Garcia vs. SandiganbayanMelgenAinda não há avaliações

- Module 3Documento8 páginasModule 3Jim M. MagadanAinda não há avaliações

- Mercado v. PeopleDocumento8 páginasMercado v. PeopleKrizha PrudenciadoAinda não há avaliações

- People v. Carillo Supreme Court Murder CaseDocumento6 páginasPeople v. Carillo Supreme Court Murder CaseTerence ValdehuezaAinda não há avaliações

- Case Digests CIR V CADocumento2 páginasCase Digests CIR V CAEna Ross EscrupoloAinda não há avaliações

- Introductory Chapter: (1) Law Considered As Instructions From The MakerDocumento5 páginasIntroductory Chapter: (1) Law Considered As Instructions From The MakerElmer Et DiestaAinda não há avaliações

- SOJ V LantionDocumento2 páginasSOJ V LantionAthina Maricar CabaseAinda não há avaliações

- Evolution of Philippine LawsDocumento5 páginasEvolution of Philippine LawsHarry AresAinda não há avaliações

- Abueva vs. Wood, 45 Phil 612Documento13 páginasAbueva vs. Wood, 45 Phil 612fjl_302711Ainda não há avaliações

- Filipinas Synthetic Fiber Corp. Vs CA, CTA and CIRDocumento3 páginasFilipinas Synthetic Fiber Corp. Vs CA, CTA and CIRNathalie YapAinda não há avaliações

- (9b) Claudio v. COMELEC DigestDocumento3 páginas(9b) Claudio v. COMELEC DigestNicole CruzAinda não há avaliações

- Constitutional Law Cases on De Facto Governments and Legitimacy of Aquino GovernmentDocumento10 páginasConstitutional Law Cases on De Facto Governments and Legitimacy of Aquino GovernmentLady BancudAinda não há avaliações

- Nicanor Jimenez Vs Bartolome CabangbangDocumento1 páginaNicanor Jimenez Vs Bartolome Cabangbanghukai_09Ainda não há avaliações

- 15&43-Mendoza v. Paule G.R. No. 175885 February 13, 2009Documento8 páginas15&43-Mendoza v. Paule G.R. No. 175885 February 13, 2009Jopan SJ100% (1)

- Division of Case DigestDocumento3 páginasDivision of Case DigestDiane JulianAinda não há avaliações

- C1. Bagatsing v. Ramirez DigestDocumento2 páginasC1. Bagatsing v. Ramirez DigestMichael VillalonAinda não há avaliações

- Susan Go and The People of The PhilippinesDocumento11 páginasSusan Go and The People of The PhilippinesSam ting wongAinda não há avaliações

- People Vs SitonDocumento13 páginasPeople Vs SitonCattleya100% (1)

- COA Circular 92-382 Local Government FundsDocumento13 páginasCOA Circular 92-382 Local Government FundsDenni Dominic Martinez LeponAinda não há avaliações

- Eg. Class Notes, Research Papers, Presentations: My Heart Went OpsDocumento2 páginasEg. Class Notes, Research Papers, Presentations: My Heart Went OpsEnzoGarciaAinda não há avaliações

- Puyat & Sons, Inc. vs. City of Manila, G.R. No. L-17447, April 30, 1963Documento1 páginaPuyat & Sons, Inc. vs. City of Manila, G.R. No. L-17447, April 30, 1963May Angelica TenezaAinda não há avaliações

- Rural Bank Stock Ownership DisputeDocumento18 páginasRural Bank Stock Ownership DisputeLawAinda não há avaliações

- Trillanes v. PimentelDocumento2 páginasTrillanes v. PimentelMarl Dela ROsaAinda não há avaliações

- Modes of Judicial Review: ProhibitionDocumento5 páginasModes of Judicial Review: Prohibitionkim_santos_20Ainda não há avaliações

- People Vs Lamhang DigestDocumento1 páginaPeople Vs Lamhang DigestChristian SicatAinda não há avaliações

- G.R. No. 77648 August 7, 1989 CETUS DEVELOPMENT, INC., Petitioner, vs. COURT OF APPEALS and ONG TENG, RespondentsDocumento2 páginasG.R. No. 77648 August 7, 1989 CETUS DEVELOPMENT, INC., Petitioner, vs. COURT OF APPEALS and ONG TENG, RespondentskarlAinda não há avaliações

- Crim Cases Digested by One and OnlyDocumento20 páginasCrim Cases Digested by One and OnlyPrince Dkalm PolishedAinda não há avaliações

- 2 - Us v. Loo Hoe, 36 Phil 867Documento1 página2 - Us v. Loo Hoe, 36 Phil 867gerlie22Ainda não há avaliações

- LMGLABR NotesDocumento31 páginasLMGLABR NotesKarl Cyrille BelloAinda não há avaliações

- Central Bank's Authority to Engage Special CounselDocumento3 páginasCentral Bank's Authority to Engage Special CounselMarkAinda não há avaliações

- 2020 Revised Peso Survey FormDocumento8 páginas2020 Revised Peso Survey FormDaanbantayan PESOAinda não há avaliações

- 15 Alban Vs Comelec Case Digest AnchetaDocumento10 páginas15 Alban Vs Comelec Case Digest Anchetajanice leeAinda não há avaliações

- Fort Bonifacio Development Corporation vs. Commissioner of Internal RevenueDocumento28 páginasFort Bonifacio Development Corporation vs. Commissioner of Internal RevenueAriel AbisAinda não há avaliações

- Dingcong Vs GuingonaDocumento4 páginasDingcong Vs GuingonaAbigael DemdamAinda não há avaliações

- Bayan vs. Executive SecretaryDocumento49 páginasBayan vs. Executive SecretaryJerry SerapionAinda não há avaliações

- Accra V CaDocumento5 páginasAccra V Caherbs22221473Ainda não há avaliações

- 2 Cir V Aichi Forging Company of Asia, IncDocumento9 páginas2 Cir V Aichi Forging Company of Asia, IncShanne Sandoval-HidalgoAinda não há avaliações

- Bishop of Calbayog Vs Director of LandsDocumento1 páginaBishop of Calbayog Vs Director of LandsjeandpmdAinda não há avaliações

- Polido Notes Civ Rev Cases MPRDocumento11 páginasPolido Notes Civ Rev Cases MPRjeandpmdAinda não há avaliações

- POLIDO NOTES Marriages DigestsDocumento11 páginasPOLIDO NOTES Marriages DigestsjeandpmdAinda não há avaliações

- Manual For ProsecutorsDocumento51 páginasManual For ProsecutorsArchie Tonog0% (1)

- Code 01Documento1 páginaCode 01jeandpmdAinda não há avaliações

- Brondial Syllabus Polido NotesDocumento4 páginasBrondial Syllabus Polido NotesjeandpmdAinda não há avaliações

- Using PrepositionsDocumento2 páginasUsing PrepositionsCarme Callejon FontAinda não há avaliações

- R.A. 9262 Violence Against Women and Children With I.R.R.Documento99 páginasR.A. 9262 Violence Against Women and Children With I.R.R.Dilbert Spine100% (8)

- CIR v. Asalus Corporation, GR 221590, Feb. 22, 2017Documento14 páginasCIR v. Asalus Corporation, GR 221590, Feb. 22, 2017jeandpmdAinda não há avaliações

- CIR v. Asalus Corporation, GR 221590, Feb. 22, 2017Documento14 páginasCIR v. Asalus Corporation, GR 221590, Feb. 22, 2017jeandpmdAinda não há avaliações

- Code 02Documento1 páginaCode 02jeandpmdAinda não há avaliações

- PAO Speedy Trial RuleDocumento6 páginasPAO Speedy Trial RuleJay Ronwaldo Talan JuliaAinda não há avaliações

- Barangay Conciliation Proceedingsv2Documento26 páginasBarangay Conciliation Proceedingsv2jeandpmdAinda não há avaliações

- Commissioner of Internal GDocumento1 páginaCommissioner of Internal GjeandpmdAinda não há avaliações

- Asnwer With CCDocumento5 páginasAsnwer With CCjeandpmdAinda não há avaliações

- Case No. 8Documento11 páginasCase No. 8JoelebieAinda não há avaliações

- Cir Vs AichiDocumento1 páginaCir Vs AichijeandpmdAinda não há avaliações

- Using Prepositions PDFDocumento2 páginasUsing Prepositions PDFjeandpmdAinda não há avaliações

- CivPro D136 Hongkong ShanghaiDocumento2 páginasCivPro D136 Hongkong ShanghaijeandpmdAinda não há avaliações

- Lourdes Vs EristingcolDocumento12 páginasLourdes Vs EristingcoljeandpmdAinda não há avaliações

- Duero Vs CaDocumento6 páginasDuero Vs CajeandpmdAinda não há avaliações

- R.A. 9262 Violence Against Women and Children With I.R.R.Documento99 páginasR.A. 9262 Violence Against Women and Children With I.R.R.Dilbert Spine100% (8)

- 1987 - G.R. No. 75919, (1987-05-07)Documento5 páginas1987 - G.R. No. 75919, (1987-05-07)jeandpmdAinda não há avaliações

- G.R. No. 129742 September 16, 1998 Fabian vs. Desierto FactsDocumento1 páginaG.R. No. 129742 September 16, 1998 Fabian vs. Desierto FactsjeandpmdAinda não há avaliações

- San Dig An BayanDocumento26 páginasSan Dig An BayanjeandpmdAinda não há avaliações

- CivPro - D005 - Neypes v. Court of AppealsDocumento3 páginasCivPro - D005 - Neypes v. Court of AppealsERNIL L BAWAAinda não há avaliações

- Duero Vs CaDocumento6 páginasDuero Vs CajeandpmdAinda não há avaliações

- CivPro D118 Re Request of Heirs of Passengers of Dona PazDocumento2 páginasCivPro D118 Re Request of Heirs of Passengers of Dona PazjeandpmdAinda não há avaliações

- Unfair Labor PracticeDocumento2 páginasUnfair Labor PracticejeandpmdAinda não há avaliações

- 09-PhilSCA09 Part2-Observations and RecommendationsDocumento31 páginas09-PhilSCA09 Part2-Observations and RecommendationsMelanie AnnAinda não há avaliações

- DENR Authority Over Small-Scale MiningDocumento3 páginasDENR Authority Over Small-Scale MiningAdrian SimanganAinda não há avaliações

- Preliminary Injunction For Jerry LettDocumento13 páginasPreliminary Injunction For Jerry LettMontgomery AdvertiserAinda não há avaliações

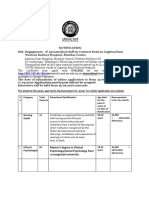

- Applications Sent by Post Will Not Be AcceptedDocumento4 páginasApplications Sent by Post Will Not Be AcceptedMunshi KamrulAinda não há avaliações

- Atty. Bagabuyo Suspension for Criticizing Judge's RulingDocumento15 páginasAtty. Bagabuyo Suspension for Criticizing Judge's RulingChienette MedranoAinda não há avaliações

- Municipality of Malabang V BenitoDocumento3 páginasMunicipality of Malabang V BenitoAweGooseTreeAinda não há avaliações

- Alkmaar Lawyersqiuvf PDFDocumento4 páginasAlkmaar Lawyersqiuvf PDFlayeradult9Ainda não há avaliações

- Land Use ChargeDocumento25 páginasLand Use ChargeOmoniyiOmoniyiAinda não há avaliações

- Defense Attorney SERGIO J. LOPEZ Exonerated of Criminal WrongdoingDocumento2 páginasDefense Attorney SERGIO J. LOPEZ Exonerated of Criminal WrongdoingSergio J LopezAinda não há avaliações

- Evidence NotesDocumento51 páginasEvidence NotesAngela DudleyAinda não há avaliações

- A.C. No. 5581Documento5 páginasA.C. No. 5581Jon SantiagoAinda não há avaliações

- Federal Register / Vol. 78, No. 1 / Wednesday, January 2, 2013 / NoticesDocumento1 páginaFederal Register / Vol. 78, No. 1 / Wednesday, January 2, 2013 / NoticescouncilkAinda não há avaliações

- UK visa granted for dependent partnerDocumento5 páginasUK visa granted for dependent partnerMALEH TIMOTHY TIMTIAinda não há avaliações

- Affidavit of Loss of IDs & DocumentsDocumento1 páginaAffidavit of Loss of IDs & DocumentsCarlie MaeAinda não há avaliações

- Full Evidence AssignmentDocumento21 páginasFull Evidence AssignmentDarwin LimAinda não há avaliações

- General Scientific Corporation v. Quality Aspirators - ComplaintDocumento32 páginasGeneral Scientific Corporation v. Quality Aspirators - ComplaintSarah BursteinAinda não há avaliações

- Debit Order FormDocumento1 páginaDebit Order Formgewmn7futAinda não há avaliações

- Cawayanan Resolution Change SignatoryDocumento3 páginasCawayanan Resolution Change SignatoryGoldie AnnAinda não há avaliações

- Ungab Vs CusiDocumento11 páginasUngab Vs CusiPia Christine BungubungAinda não há avaliações

- Ged 412 - Week - 4-6Documento48 páginasGed 412 - Week - 4-6Hime CaylaAinda não há avaliações

- Amgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 807Documento82 páginasAmgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 807Justia.comAinda não há avaliações

- Extra Judicial Settlement of EstateDocumento3 páginasExtra Judicial Settlement of EstatesweetjhoAinda não há avaliações

- Aquino Vs Sss DigestDocumento2 páginasAquino Vs Sss Digestkatherine magbanuaAinda não há avaliações

- Land Retention Rights (GRP 26)Documento65 páginasLand Retention Rights (GRP 26)Christine C. Reyes100% (1)

- Gabe Kaimowitz v. The Florida Bar, Its Agents, Employees and Assignees, 996 F.2d 1151, 11th Cir. (1993)Documento7 páginasGabe Kaimowitz v. The Florida Bar, Its Agents, Employees and Assignees, 996 F.2d 1151, 11th Cir. (1993)Scribd Government DocsAinda não há avaliações

- Legal citations made simpleDocumento42 páginasLegal citations made simpleTanushkaAinda não há avaliações

- Student Internship Program in The Philippines (Sipp)Documento7 páginasStudent Internship Program in The Philippines (Sipp)ELMERAinda não há avaliações

- Philippines v. Genuival Cagas, Wilson Butin and Julio Astillero."Documento6 páginasPhilippines v. Genuival Cagas, Wilson Butin and Julio Astillero."Rahl SulitAinda não há avaliações

- Board Resolution - Selling of SharesDocumento2 páginasBoard Resolution - Selling of ShareschisengaAinda não há avaliações

- RTC Branch 105 Quezon City Formal Offer of Exhibit in Petition for Cancellation of EncumbranceDocumento3 páginasRTC Branch 105 Quezon City Formal Offer of Exhibit in Petition for Cancellation of EncumbranceHerzl Hali V. HermosaAinda não há avaliações