Escolar Documentos

Profissional Documentos

Cultura Documentos

Management accounting reports for internal decision making

Enviado por

cara0925100%(1)100% acharam este documento útil (1 voto)

1K visualizações2 páginasFinancial Statement Analysis

Título original

FSA- Cost Accounting Reviewer

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoFinancial Statement Analysis

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

100%(1)100% acharam este documento útil (1 voto)

1K visualizações2 páginasManagement accounting reports for internal decision making

Enviado por

cara0925Financial Statement Analysis

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 2

Management accounting o SEMI-VARIABLE: with fix and variable

- accumulation and preparation of financial components

reports for internal users only

- needed by management in planning, ANALYZING MIXED COSTS

controlling and evaluating the entitys o Scattergraph:

operations - subjective and inexact

- produce budgets, performance evaluations - simple and intuitive

and cost reports o High-low method:

- subjective, relevant, future oriented - uses only two data points, which may not

- reports as needed represent the general trend in the data

- decision making o Least square regression:

- requires more data and assumptions

Financial accounting - proper interpretation of results is critical

- concerned with recording of business - uses all data points

transactions and the eventual preparation

of financial statements ACCOUNTING PERIOD

- intended for internal and external users o Capital expenditure:

- produce financial statements according to - benefit more than one accounting periods

GAAP - asset

- objective, reliable, historical o Revenue expenditure:

- reports periodically - benefit current period only

- company as a whole - expense

COST CONCEPTS AND BEHAVIOR PLANNING AND CONTROL

o Standard costs:

Cost: cash or cash equivalent value sacrificed for

- predetermined cost for DM, DL & FO

goods and services that are expected to bring a

o Opportunity cost:

current or future benefit to the organization

- benefit given up when one alternative is

chosen over the other

DIRECT INDIRECT

o Differential cost:

Can be directly and Cannot be directly

- cost that is present under one alternative

conveniently traced to the and conveniently

but absent in whole or part under another

cost object traced to the object

alternative

MANUFACTURING/ NON- o Relevant cost:

PRODUCT MANUFACTURING/ - potential to influence a decision; it must

Producing a physical PERIOD occur in the future and differ between the

product Running the alternatives

o Direct materials: business and selling o Out of pocket cost:

material inputs that can the product

- cost that requires the payment of money

be directly and o Distribution

(or other assets)

conveniently traced to costs o Sunk cost:

each unit of product o Administrative

- a cost of which an outlay has already been

o Direct labor: expenses made and it cannot be changed by any or

employees who o Finance costs present future decision

physically convert

materials to finished COST VOLUME PROFIT ANALYSIS

products

o Manufacturing o Contribution Margin Income Statement

overhead: indirect Sales

costs incurred to Variable cost

produce products. Contribution Margin

(Fixed costs)

TOTAL MANUFACTURING COST= direct materials Net income

+ direct labor+ manufacturing overhead o Focuses on interactions between the five

elements:

Prime cost= direct materials + direct labor

- price of products

- volume or level of activity

Conversion cost= direct labor + manufacturing

- variable cost per unit

overhead

- total fixed costs

- mix of products sold

COST CLASSIFICATION

MARGIN OF SAFETY

o VARIABLE: change in total, in relation to

- the amount by which sales could decrease

volume before losses are incurred

o FIXED: remain constant, in total, MOS= Actual sales Breakeven sales

irrespective of the volume

MOS

MOS ratio= Actual Sales

OPERATING LEVERAGE

- potential effect of the risk that sales will fall

short of planned levels as influenced by the

relative proportion of fixed to variable

manufacturing costs

Contribution Margin

DOL= Net income

Você também pode gostar

- 03 Accounting For LaborDocumento26 páginas03 Accounting For LaborRey Joyce Abuel100% (1)

- Sample Questions - Accounting For OverheadDocumento4 páginasSample Questions - Accounting For OverheadRedAinda não há avaliações

- CA4 Just in Time and Backlush AccountingDocumento9 páginasCA4 Just in Time and Backlush AccountinghellokittysaranghaeAinda não há avaliações

- Kinney8e PPT Ch06Documento43 páginasKinney8e PPT Ch06Christian GoAinda não há avaliações

- Commercial Property Management Director in Los Angeles CA Resume Michael KeurjianDocumento3 páginasCommercial Property Management Director in Los Angeles CA Resume Michael KeurjianMichaelKeurjian2Ainda não há avaliações

- Differential Cost Analysis Relevant CostingDocumento10 páginasDifferential Cost Analysis Relevant CostingBSIT 1A Yancy CaliganAinda não há avaliações

- CHAPTER 4: Differential Cost Analysis (Relevant Costing) KaebDocumento6 páginasCHAPTER 4: Differential Cost Analysis (Relevant Costing) KaebMark Gelo WinchesterAinda não há avaliações

- Mas Ho No. 2 Relevant CostingDocumento7 páginasMas Ho No. 2 Relevant CostingRenz Francis LimAinda não há avaliações

- CFA Questions and SolutionsDocumento16 páginasCFA Questions and Solutionsvip_thb_2007100% (1)

- Cost Concepts and Classifications (Final)Documento3 páginasCost Concepts and Classifications (Final)Mica R.Ainda não há avaliações

- Module 4 Absorption and Variable Costing NotesDocumento3 páginasModule 4 Absorption and Variable Costing NotesMadielyn Santarin Miranda100% (3)

- Chapter 10 Lessons From Market History: Corporate Finance, 12e (Ross)Documento35 páginasChapter 10 Lessons From Market History: Corporate Finance, 12e (Ross)EnciciAinda não há avaliações

- Accountancy Refresher Course on Quantitative TechniquesDocumento4 páginasAccountancy Refresher Course on Quantitative Techniquesshamel marohom100% (2)

- Just in Time Jit Back FlushDocumento16 páginasJust in Time Jit Back FlushSunsong31Ainda não há avaliações

- Process CostingDocumento49 páginasProcess CostingAccounting Files100% (2)

- 04 x04 Cost-Volume-Profit RelationshipsDocumento11 páginas04 x04 Cost-Volume-Profit RelationshipscassandraAinda não há avaliações

- Cost Accounting Systems and ClassificationsDocumento45 páginasCost Accounting Systems and ClassificationsracabrerosAinda não há avaliações

- Chapter 2Documento6 páginasChapter 2Roann Bargola100% (5)

- Cost Accounting Reviewer (Finals)Documento11 páginasCost Accounting Reviewer (Finals)Cho AndreaAinda não há avaliações

- Ipsas Software ProposalDocumento5 páginasIpsas Software ProposalDahiru MahmudAinda não há avaliações

- Corporate Governance Business Ethics Risk Management and Internal Control CH 1 2 PDFDocumento11 páginasCorporate Governance Business Ethics Risk Management and Internal Control CH 1 2 PDFEu NiceAinda não há avaliações

- Cost Accounting Practice TestDocumento27 páginasCost Accounting Practice Testaiswift100% (1)

- Strategic cost management self-testDocumento7 páginasStrategic cost management self-testAlyssa CaddawanAinda não há avaliações

- LogisticsDocumento38 páginasLogisticscara0925Ainda não há avaliações

- MAS ReviewerDocumento46 páginasMAS ReviewerjustjadeAinda não há avaliações

- Ebook PDF Supply Chain Management A Logistics Perspective 10th PDFDocumento42 páginasEbook PDF Supply Chain Management A Logistics Perspective 10th PDFrobert.wymer101100% (38)

- Chapter 1 Introduction To Cost AccountingDocumento42 páginasChapter 1 Introduction To Cost AccountingPotato FriesAinda não há avaliações

- LP5 Standard Costing and Variance AnalysisDocumento23 páginasLP5 Standard Costing and Variance AnalysisGwynette DalawisAinda não há avaliações

- Executive Performance Measures and CompensationDocumento16 páginasExecutive Performance Measures and CompensationCarlo manejaAinda não há avaliações

- Corporate Level Strategy - SMCDocumento5 páginasCorporate Level Strategy - SMCChelsea Sabado100% (4)

- Standard Costing, Operational Performance Measures, and The Balanced Scorecard (SoftCopy - Solman)Documento40 páginasStandard Costing, Operational Performance Measures, and The Balanced Scorecard (SoftCopy - Solman)Hannah Grace JustoAinda não há avaliações

- CVPDocumento13 páginasCVPResty VillaroelAinda não há avaliações

- CVP AnalysisDocumento51 páginasCVP AnalysisMonaliza MalapitAinda não há avaliações

- Variable Costing - Cost Accounting QuizDocumento2 páginasVariable Costing - Cost Accounting QuizRizza Mae RodriguezAinda não há avaliações

- Borrowing Cost Capitalization RulesDocumento2 páginasBorrowing Cost Capitalization RulesAlexander Dimalipos100% (1)

- Chapter 10 Average and FIFO CostingDocumento34 páginasChapter 10 Average and FIFO CostingJeana SegumalianAinda não há avaliações

- Chapter 1 IADocumento43 páginasChapter 1 IAEloisaAinda não há avaliações

- Cost Segregation and Estimation (Final)Documento4 páginasCost Segregation and Estimation (Final)Laut Bantuas IIAinda não há avaliações

- Mas 02 - Variable Absorption Costing & BudgetingDocumento11 páginasMas 02 - Variable Absorption Costing & BudgetingCriane DomineusAinda não há avaliações

- AFAR 1 COST ACCOUNTINGDocumento5 páginasAFAR 1 COST ACCOUNTINGJessica IslaAinda não há avaliações

- Intermediate Accounting 3 - Statement of Financial PositionDocumento6 páginasIntermediate Accounting 3 - Statement of Financial PositionLuisitoAinda não há avaliações

- Activity-Based Costing True-False StatementsDocumento5 páginasActivity-Based Costing True-False StatementsSuman Paul ChowdhuryAinda não há avaliações

- Agamata Answer KeyDocumento5 páginasAgamata Answer KeyBromanineAinda não há avaliações

- CHAPTER 5 Product and Service Costing: A Process Systems ApproachDocumento30 páginasCHAPTER 5 Product and Service Costing: A Process Systems ApproachMudassar HassanAinda não há avaliações

- 4 Probability AnalysisDocumento11 páginas4 Probability AnalysisLyca TudtudAinda não há avaliações

- UAS-ACCT6130-cost Accounting-Latihan persiapan-PJJDocumento4 páginasUAS-ACCT6130-cost Accounting-Latihan persiapan-PJJOlim BariziAinda não há avaliações

- MOCK QUALIFYING QUIZ 1 - OBLICONDocumento6 páginasMOCK QUALIFYING QUIZ 1 - OBLICONIrene SheeranAinda não há avaliações

- IA2 10 01 Employee Benefits PDFDocumento17 páginasIA2 10 01 Employee Benefits PDFAzaria MatiasAinda não há avaliações

- Decision Making and Relevant InformationDocumento61 páginasDecision Making and Relevant InformationSUBMERIN100% (1)

- Management Advisory Services - Part 1Documento35 páginasManagement Advisory Services - Part 1For AcadsAinda não há avaliações

- FAR - RQ - Investment in AssociatesDocumento2 páginasFAR - RQ - Investment in AssociatesKriane Kei50% (2)

- Non-Routine Decision Making (Lecture Notes) : Types of DecisionsDocumento20 páginasNon-Routine Decision Making (Lecture Notes) : Types of DecisionsJosh BustamanteAinda não há avaliações

- Advance AccountingDocumento12 páginasAdvance AccountingunknownAinda não há avaliações

- Cost Accounting ReviewerDocumento2 páginasCost Accounting ReviewerHenry Cadano HernandezAinda não há avaliações

- Chapter 11: Allocation of Joint Costs and Accounting For By-ProductsDocumento100 páginasChapter 11: Allocation of Joint Costs and Accounting For By-Productsmoncarla lagonAinda não há avaliações

- Chapter 1-Introduction To Cost AccountingDocumento25 páginasChapter 1-Introduction To Cost AccountingjepsyutAinda não há avaliações

- Review Questions: Cost Concepts and ClassificationsDocumento6 páginasReview Questions: Cost Concepts and ClassificationsArah Opalec64% (11)

- PAS 38 Intangible Assets PowerpointDocumento18 páginasPAS 38 Intangible Assets PowerpointYassi CurtisAinda não há avaliações

- Cash Flow and Financial PlanningDocumento48 páginasCash Flow and Financial PlanningIsmadth2918388100% (1)

- Management Accounting Concept and Application by Cabrera PDFDocumento29 páginasManagement Accounting Concept and Application by Cabrera PDFChristine Joy BoliverAinda não há avaliações

- Finished Goods Inventory: Exercise 1-1 (True or False)Documento16 páginasFinished Goods Inventory: Exercise 1-1 (True or False)Isaiah BatucanAinda não há avaliações

- Ch07 Standard Costing and Variance Analysis PDFDocumento16 páginasCh07 Standard Costing and Variance Analysis PDFjdiaz_646247Ainda não há avaliações

- Chapter 8 - Standard CostingDocumento8 páginasChapter 8 - Standard CostingJoey LazarteAinda não há avaliações

- 01 CashandCashEquivalentsNotesDocumento7 páginas01 CashandCashEquivalentsNotesVeroAinda não há avaliações

- Finman ReviewerDocumento89 páginasFinman Reviewersharon5lotino100% (1)

- Cost TerminologyDocumento2 páginasCost TerminologyChristine TutorAinda não há avaliações

- An Introduction To Cost Terms and PurposesDocumento33 páginasAn Introduction To Cost Terms and PurposesAi LatifahAinda não há avaliações

- FINALS - Global FinDocumento11 páginasFINALS - Global Fincara0925100% (1)

- Business EthicsDocumento3 páginasBusiness Ethicscara0925Ainda não há avaliações

- QuestionsDocumento1 páginaQuestionscara0925Ainda não há avaliações

- Financial Statement AnalysisDocumento2 páginasFinancial Statement Analysiscara0925Ainda não há avaliações

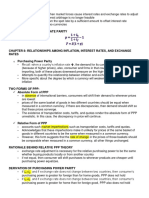

- CHAPTER 8 - Global FinDocumento2 páginasCHAPTER 8 - Global Fincara0925Ainda não há avaliações

- Global FinanceDocumento3 páginasGlobal Financecara0925Ainda não há avaliações

- Business EthicsDocumento3 páginasBusiness Ethicscara0925Ainda não há avaliações

- International Corporate FinanceDocumento10 páginasInternational Corporate Financecara0925Ainda não há avaliações

- CHAPTER 8 - Global FinDocumento2 páginasCHAPTER 8 - Global Fincara0925Ainda não há avaliações

- International Corporate FinanceDocumento10 páginasInternational Corporate Financecara0925Ainda não há avaliações

- BankingDocumento2 páginasBankingcara0925Ainda não há avaliações

- Chap007 HWK 2Documento14 páginasChap007 HWK 2cara0925Ainda não há avaliações

- LawDocumento15 páginasLawcara0925Ainda não há avaliações

- Obli ConDocumento16 páginasObli Concara0925Ainda não há avaliações

- 03 Audit of Historical Financial InformationDocumento10 páginas03 Audit of Historical Financial InformationJohn Patrick AnyayahanAinda não há avaliações

- Development Economics-Module 2iiDocumento16 páginasDevelopment Economics-Module 2iimaleeha shahzadAinda não há avaliações

- ANSWER SHEET - Project-1-Piecewise-FunctionsDocumento6 páginasANSWER SHEET - Project-1-Piecewise-Functionseve lopezAinda não há avaliações

- Iirup FormDocumento1 páginaIirup FormAlfie BurbosAinda não há avaliações

- I-Vocabulary (4 X 5 20 Marks) A) Choose The Correct Answer From (A, B, C and D)Documento2 páginasI-Vocabulary (4 X 5 20 Marks) A) Choose The Correct Answer From (A, B, C and D)Hamada BakheetAinda não há avaliações

- Government of India Central Water Commission Snow Hydrology DivisionDocumento4 páginasGovernment of India Central Water Commission Snow Hydrology DivisionRajat SharmaAinda não há avaliações

- Working Capital Management in Textile IndustryDocumento7 páginasWorking Capital Management in Textile IndustryAmaan KhanAinda não há avaliações

- Exceptional Service Grading Company: A Case Study On Employing Financial Ratio Analysis As A Basis For Business ExpansionDocumento5 páginasExceptional Service Grading Company: A Case Study On Employing Financial Ratio Analysis As A Basis For Business ExpansionRyan S. AngelesAinda não há avaliações

- Almost A Crime, This Editorial Space Is Left Blank On Quaid-i-Azam's Birthday, To Speak More Eloquently Than Words". @dawn NewsDocumento1 páginaAlmost A Crime, This Editorial Space Is Left Blank On Quaid-i-Azam's Birthday, To Speak More Eloquently Than Words". @dawn NewsNascent OnrAinda não há avaliações

- Entrepreneurship Chapter 4 QuizDocumento2 páginasEntrepreneurship Chapter 4 QuizBrian DuelaAinda não há avaliações

- Morawczynski & Pickens 2009 Poor People Using Mobile Financial ServicesDocumento4 páginasMorawczynski & Pickens 2009 Poor People Using Mobile Financial ServicesTanakaAinda não há avaliações

- Module 5 PPE Book Answers Part 2Documento2 páginasModule 5 PPE Book Answers Part 2Felsie Jane PenasoAinda não há avaliações

- CFP Young Scholar Conference 2019Documento2 páginasCFP Young Scholar Conference 2019Tanmoy dasAinda não há avaliações

- STE Media KitDocumento11 páginasSTE Media KitAaron DuncanAinda não há avaliações

- Demographic ProfileDocumento1 páginaDemographic Profilebernadette cabilingAinda não há avaliações

- Answers - Chapter 4Documento3 páginasAnswers - Chapter 4Nazlı YumruAinda não há avaliações

- Consumers' Attitudes To Frozen Meat: Irlni Tzimitra - KalogianniDocumento4 páginasConsumers' Attitudes To Frozen Meat: Irlni Tzimitra - KalogianniSiddharth Singh TomarAinda não há avaliações

- Institute of Management, Nirma UniversityDocumento6 páginasInstitute of Management, Nirma UniversityRushabh RamaniAinda não há avaliações

- Incubator Leadership and MangementDocumento32 páginasIncubator Leadership and MangementAnshuman SinghAinda não há avaliações

- Jeevan Saral Surrender Analysis: To Convince Policyholders To Continue The PolicyDocumento11 páginasJeevan Saral Surrender Analysis: To Convince Policyholders To Continue The Policykrishna-almightyAinda não há avaliações

- International Finance NoteDocumento35 páginasInternational Finance Noteademoji00Ainda não há avaliações

- CASP LAB Syllabus DiplomaDocumento7 páginasCASP LAB Syllabus DiplomaAnjaiah GundigiAinda não há avaliações

- QIMA Sourcing Survey 2023Documento37 páginasQIMA Sourcing Survey 2023Pravin ThombreAinda não há avaliações

- Different Types of Loan Products Offered by Private Commercial Banks in Bangladesh - A Case Study On Modhumoti Bank LimitedDocumento16 páginasDifferent Types of Loan Products Offered by Private Commercial Banks in Bangladesh - A Case Study On Modhumoti Bank LimitedSharmin Mehenaz TonneeAinda não há avaliações

- Terminologies in Petroleum IndustryDocumento7 páginasTerminologies in Petroleum Industryarvind_dwivedi100% (1)