Escolar Documentos

Profissional Documentos

Cultura Documentos

APC Ch11sol.2014

Enviado por

Anonymous LusWvyDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

APC Ch11sol.2014

Enviado por

Anonymous LusWvyDireitos autorais:

Formatos disponíveis

CHAPTER 11

Financial Reporting and Analysis

Exercise 11-1

1. A 6. A 11. A 16. C

2. C 7. F 12. F 17. D

3. D 8. B 13. H 18. G

4. A 9. A 14. B 19. H

5. -C 10. F 15. E 20. G

Exercise 11-2

1. Cash P 320,000

Inventories 500,000

Accounts receivable 220,000

Total current assets P1,040,000

2. Accounts payable P 280,000

Interest payable 60,000

Wages payable 180,000

Total current liabilities P 520,000

3. Total current assets P1,040,000

Equipment 1,700,000

Total assets P2,740,000

4. Total assets P2,740,000

Less Total liabilities

(CL of P520,000 + NCL of P600,000) 1,520,000

Total shareholders equity P1,220,000

Less Ordinary shares 1,000,000

Retained earnings P 220,000

Exercise 11-3

1. Investing 6. Operating

2. Operating 7. Operating

3. Operating 8. Financing

4. Operating 9. Financing

5. Investing 10. None

Exercise 11-4

Reported profit P500,000

Add (deduct):

Loss on sale of equipment 10,000

Depreciation expense 50,000

Profit before working capital changes P560,000

Decrease in accounts receivable 70,000

Decrease in accounts payable (60,000)

Cash provided by operating activities P570,000

Chapter 11 APC (2014 edition) page 2

Exercise 11-5

Proceeds from issuance of bonds P4,000,000

Payment of dividends (1,000,000)

Cash provided by financing activities P3,000,000

Exercise 11-6

1. Current ratio = P1,040,000/P600,000 = 1.73:1

2. Acid-test ratio = P590,000/P600,000 = .98:1

Exercise 11-7

1. a Receivable turnover

2013 = 7,000,000 / [(650,000 +720,000) /2] = 7,000,000 / 685,000 10.22

2014 = 7,800,000 / [(720,000 + 745,000 /2] = 7,800,000 / 732,500 10.65

b. Average collection period

2013 = 365 days / 10.22 days 36 days

2014 = 365 days / 10.65 days 34 days

c. Inventory turnover

2013 = 4,450,000/925,000 4.81

2014 = 4,650,000 / 1,050,000 4.43

d. No. of days sales in inventory

2013 = 365 days / 4.81 days 76 days

2014 = 365 days / 4,43 83 days

2. Receivables are collected within the credit period of 45 days but not within the discount period of

10 days. There is efficient collection of receivables; however, the company may review further its

discount rate and discount period so as to encourage or motivate customers to avail of such.

The movement of inventories is slow it takes between 76 and 83 days for the company to sell its

inventories. Though receivables are collected within the credit period, the company may still face a

problem in the payment of its payable because of the long period it takes for inventories to be sold.

Exercise 11-8

1. Profit margin on sales P150,000 / P6,000,000 2.5%

2. Rate of return on total assets P150,000 / P3,250,000 4.6%

3. Asset turnover ratio P6,000,000 / P3,250,000 1.85

4. Rate of return on ordinary SE P150,000 / P1,142,500 13.13%

5. Gross profit ratio P1,800,000 / P6,000,000 30%

6. Receivable turnover ratio P6,000,000 / P67,250 89.22

Chapter 11 APC (2014 edition) page 3

7. Average collection period 365 days / 89.22 4 days

Problem 11-1

NOP Corporation

Statement of Financial Position

December 31, 2014

Assets

Current assets:

Cash and cash equivalents P2,400,000

Short-term investments 3,500,000

Accounts receivable, net 5,000,000

Inventories 4,970,000

Prepaid expenses 80,000 P15,950,000

Noncurrent assets:

Noncurrent receivables P1,105,000

Property, plant and equipment 6,205,000 7,310,000

Total assets P23,260,00

0

Liabilities and Shareholders Equity

Current liabilities:

Notes payable and other short-term obligations P 312,500

Accounts payable 589,500

Accrued liabilities 4,218,000

Other current liabilities 1,815,000 P 6,935,000

Noncurrent liabilities and deferred taxes 2,625,000

Total liabilities P 9,560,000

Total shareholders equity 13,700,000

Total liabilities and shareholders equity P23,260,000

Problem 11-2

Where Cash inflow, outflow

reported or no effect

a. Acquired an equipment for cash I Cash outflow

b. Paid salaries of employees O Cash outflow

c. Recorded depreciation on plant assets O Addition to profit

d. Issued ordinary shares F Cash inflow

e. Paid dividends to ordinary shareholders F Cash outflow

f. Paid bank loan F Cash outflow

g. Purchased merchandise on account NC No effect

h. Sold merchandise on account NC No effect

i. Realized a gain on sale of plant assets O Deduction from profit

j. Purchased securities classified as held-to-maturity I Cash outflow

Chapter 11 APC (2014 edition) page 4

Problem 11-3

RST Company

Statement of Cash Flows

For the Year Ended December 31, 2014

Cash flows from operating activities

Profit before tax P 800,000

Adjustments for:

Depreciation 310,000

Interest expense 60,000

Operating profit before working capital changes P1,170,000

Increase in accounts receivable ( 480,000)

Increase in merchandise inventory ( 140,000)

Increase in accounts payable 280,000

Cash generated from operations P 830,000

Interest paid ( 60,000)

Income taxes paid ( 140,000)

Net cash provided by (used in) operating activities P 630,000

Cash flows from investing activities

Proceeds from sale of equipment 170,000

Cash flows from financing activities

Proceeds from issuance of ordinary shares P 80,000

Retirement of bonds payable ( 120,000)

Payment of dividends ( 540,000)

Net cash provided by (used in) financing activities ( 580,000)

Net increase in cash P 220,000

Cash balance, beginning 400,000

Cash balance, end P 620,000

NOTE: 2012 should be 2013

Problem 11-4

1. Earnings per share P5,352,000 / 56,000 shares P95.57

2. Return on ordinary SE P5,352,000 / P10,321,000 51.86%

3. Return on assets P5,352,000 / 18,430,000 29.04%

4. Current ratio P7,928,000 / P4,270,000 1.71:1

5. Receivable turnover ratio P38,730,000 / 2,106,000 18.22

6. Average collection period 365 days / 18.22 20 days

7. Inventory turnover ratio P20,110,000 / 2,585,000 7.78

8. Number of days in inventory 365 days / 7.78 47 days

Chapter 11 APC (2014 edition) page 5

9. Number of times interest was earned P8,140,000 / P500,000 16.28 times

10. Asset turnover ratio P38,370,000 / P18,430,000 2.08

11. Debt to total assets ratio P8,470,000 / P19,804,000 .43:1

12. Debt to equity ratio P8,470,000 / P11,334,000 .75:1

13. Cash debt coverage ratio P6,040,000 / P8,109,000 .74:1

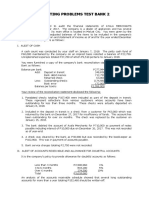

Problem 11-5

GHI JKL

1. LIQUIDITY RATIOS

a. Current ratio 1.06:1 1.08:1

b. Receivable turnover 10.05 10.06

c. Average collection period 36 days 36 days

d. Inventory turnover 6.10 8.99

e. Days in inventory 60 days 41 days

f. Current cash debt coverage r 42 32

2. SOLVENCY RATIOS

a. Debt to total assets ratio .48:1 .53:1

b. Times interest earned 31.87 times 31.63 times

c. Cash debt coverage ratio

3. PROFITABILITY RATIOS

a. Profit margin 21% 13%

b. Asset turnover .77 1.06

c. Return on assets 16.80% 14.62%

d. Return on ordinary SE 33.58% 33.31%

MULTIPLE CHOICE

1. C 5. A 9. B

2. B 6. D 10. C

3. A 7. C 11. D

4. A 8. D 12. C

Você também pode gostar

- APC Ch1solDocumento7 páginasAPC Ch1solAnonymous LusWvyAinda não há avaliações

- APC Ch10solDocumento9 páginasAPC Ch10solAzul Lacson100% (2)

- APC Ch8sol.2011Documento10 páginasAPC Ch8sol.2011dsadsadsAinda não há avaliações

- APC Ch7solDocumento20 páginasAPC Ch7solMelissa RiolaAinda não há avaliações

- APC Ch9solDocumento15 páginasAPC Ch9solKrisha Lei Sanchez90% (10)

- Win Ballada Parcor Chapter 4 ProblemDocumento2 páginasWin Ballada Parcor Chapter 4 ProblemKrngyxAinda não há avaliações

- APC Ch11sol.2011Documento6 páginasAPC Ch11sol.2011Reymilyn Sanchez100% (2)

- Answer:: TotalDocumento2 páginasAnswer:: TotalCarla Jane ApolinarioAinda não há avaliações

- Accounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 9Documento17 páginasAccounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 9AlexanderJacobVielMartinezAinda não há avaliações

- CHAPTER 7 Installment LiquidationDocumento24 páginasCHAPTER 7 Installment LiquidationJethro Ephraim San Miguel67% (9)

- Win Ballada Parcor Chapter 4 ProblemDocumento2 páginasWin Ballada Parcor Chapter 4 ProblemKrngyxAinda não há avaliações

- Prelim ExamDocumento13 páginasPrelim ExamNah HamzaAinda não há avaliações

- APC Baysa Chapter 1Documento7 páginasAPC Baysa Chapter 1Ellie Park50% (2)

- Inventories Quiz NotesDocumento7 páginasInventories Quiz NotesMikaella Nicole PechardoAinda não há avaliações

- Receivables Discussion QuestionDocumento17 páginasReceivables Discussion QuestionAngelica TalledoAinda não há avaliações

- Notes in ReceivablesDocumento9 páginasNotes in ReceivablesAnj HwanAinda não há avaliações

- Share Capital Transactions and CalculationsDocumento9 páginasShare Capital Transactions and CalculationsAnonymous LusWvy0% (1)

- Cortez Practice Set JanuaryDocumento5 páginasCortez Practice Set JanuaryChristian LapidAinda não há avaliações

- Pas 37 Provisions Contingent Liab Contingent AssetsDocumento15 páginasPas 37 Provisions Contingent Liab Contingent Assetswendy alcosebaAinda não há avaliações

- Intermediate Accounting Volume 1 Inventories by ValixDocumento33 páginasIntermediate Accounting Volume 1 Inventories by ValixPeter PiperAinda não há avaliações

- Cost of Goods Manufactured for Christian CompanyDocumento10 páginasCost of Goods Manufactured for Christian CompanyAira Santos VibarAinda não há avaliações

- Lupisan BaysaDocumento206 páginasLupisan BaysaJoselle Jan Blanco Claudio77% (52)

- Interacc Word JPDocumento28 páginasInteracc Word JPJOCELYN NUEVOAinda não há avaliações

- Accounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 7Documento21 páginasAccounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 7AlexanderJacobVielMartinezAinda não há avaliações

- 2019 Vol 1 CH 1 AnswersDocumento17 páginas2019 Vol 1 CH 1 AnswersTatangAinda não há avaliações

- PARTNERSHIP PROFITS AND LOSSESDocumento6 páginasPARTNERSHIP PROFITS AND LOSSEStrixie maeAinda não há avaliações

- Corrections: Suggested SolutionDocumento5 páginasCorrections: Suggested SolutionZairah FranciscoAinda não há avaliações

- Accounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 9Documento17 páginasAccounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 9elelai0% (1)

- Chapter 9 – Biological Assets Gain and ValuationDocumento3 páginasChapter 9 – Biological Assets Gain and Valuationma quenaAinda não há avaliações

- Cost Formulas, LCNRV, and Purchase CommitmentsDocumento6 páginasCost Formulas, LCNRV, and Purchase CommitmentsJorufel PapasinAinda não há avaliações

- Quiz#2 Problem Solving InventoryDocumento3 páginasQuiz#2 Problem Solving InventoryMyles Ninon LazoAinda não há avaliações

- APC Ch6solDocumento22 páginasAPC Ch6solAnonymous LusWvy100% (8)

- Financial Reporting and AnalysisDocumento5 páginasFinancial Reporting and AnalysisJeanette Bayona CumayasAinda não há avaliações

- APC Ch11solDocumento5 páginasAPC Ch11solDessa Dianna MadridAinda não há avaliações

- Chapter 8Documento27 páginasChapter 8Francesz VirayAinda não há avaliações

- Talisay Corporation Financial StatementsDocumento10 páginasTalisay Corporation Financial StatementsRiza Mae AlceAinda não há avaliações

- Audit of Financial Statements Part 2Documento2 páginasAudit of Financial Statements Part 2Brit NeyAinda não há avaliações

- Adv Acc 2 Sol Man 2008 BaysaDocumento8 páginasAdv Acc 2 Sol Man 2008 BaysaNorman DelirioAinda não há avaliações

- Advanced Accounting Chapter 22Documento9 páginasAdvanced Accounting Chapter 22LJ AggabaoAinda não há avaliações

- Baysa ParcorChapter 1-5 Answer KeyDocumento52 páginasBaysa ParcorChapter 1-5 Answer KeymoonjianneAinda não há avaliações

- Study Hub SECTION CDocumento10 páginasStudy Hub SECTION Cgetcultured69Ainda não há avaliações

- Financial Accounting and Reporting Mock Board 2022Documento8 páginasFinancial Accounting and Reporting Mock Board 2022Kenneth DiabordoAinda não há avaliações

- Practice Prepare FSDocumento8 páginasPractice Prepare FSĐạt LêAinda não há avaliações

- Sevilla - Unit 1 - IA3Documento14 páginasSevilla - Unit 1 - IA3Hensel SevillaAinda não há avaliações

- Final Answers (Group 1)Documento3 páginasFinal Answers (Group 1)Carl Roger AnimaAinda não há avaliações

- MOJAKOE AK1 UTS 2012 GasalDocumento15 páginasMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudAinda não há avaliações

- PFA 1 Chapter 1 Current Assets SolutionsDocumento38 páginasPFA 1 Chapter 1 Current Assets SolutionsAsi Cas Jav0% (1)

- Cfas Pfa 01Documento194 páginasCfas Pfa 01Kimberly Claire Atienza100% (1)

- Accounting 11 FS AnalysisDocumento2 páginasAccounting 11 FS AnalysisMarvin AquinoAinda não há avaliações

- Quiz - SFP With AnswersDocumento4 páginasQuiz - SFP With Answersjanus lopezAinda não há avaliações

- Mendoza - UNIT 1 - Statement of Financial PositionDocumento14 páginasMendoza - UNIT 1 - Statement of Financial PositionAim RubiaAinda não há avaliações

- 2020 Valix Answer Key Acounting 3 - CompressDocumento19 páginas2020 Valix Answer Key Acounting 3 - Compressrandomfinds864Ainda não há avaliações

- Bus. Finance W3-4 - C5 (Answer)Documento5 páginasBus. Finance W3-4 - C5 (Answer)Rory GdLAinda não há avaliações

- Chapter 08Documento26 páginasChapter 08Dan ChuaAinda não há avaliações

- Intermediate Accounting By: Valix SOLUTION MANUAL 2020 EditionDocumento19 páginasIntermediate Accounting By: Valix SOLUTION MANUAL 2020 EditionJoyce Anne Garduque100% (1)

- Additional Cash Flow Problems QuestionsDocumento3 páginasAdditional Cash Flow Problems QuestionsChelle HullezaAinda não há avaliações

- CASH FLOW AND INCOME STATEMENT PROBLEMSDocumento17 páginasCASH FLOW AND INCOME STATEMENT PROBLEMSIris MnemosyneAinda não há avaliações

- Statement of Financial Position: Assets NoteDocumento6 páginasStatement of Financial Position: Assets NoteQuiroann NalzAinda não há avaliações

- CFAS CH 11Documento6 páginasCFAS CH 11DarleneAinda não há avaliações

- Colleagues-CoDocumento9 páginasColleagues-CoSVTKhsiaAinda não há avaliações

- ADocumento1 páginaAAnonymous LusWvyAinda não há avaliações

- Auditing Theory Test BankDocumento32 páginasAuditing Theory Test BankJane Estrada100% (2)

- Identifying Types of VariablesDocumento5 páginasIdentifying Types of VariablesAnonymous LusWvyAinda não há avaliações

- BagoboDocumento1 páginaBagoboAnonymous LusWvyAinda não há avaliações

- Auditing Problems Test Bank 2Documento15 páginasAuditing Problems Test Bank 2Mark Jonah Bachao80% (5)

- APC Ch6solDocumento22 páginasAPC Ch6solAnonymous LusWvy100% (8)

- CHAPTER 7 - Products, Services and BrandsDocumento58 páginasCHAPTER 7 - Products, Services and BrandsAnonymous LusWvyAinda não há avaliações

- Cash and Cash Equivalents Sample ProblemsDocumento6 páginasCash and Cash Equivalents Sample ProblemsAmabie De Chavez50% (2)

- The Binomial DistributionDocumento19 páginasThe Binomial DistributionK Kunal RajAinda não há avaliações

- Partnership and Corp - Ch12solman.2011Documento16 páginasPartnership and Corp - Ch12solman.2011Shealalyn1Ainda não há avaliações

- APC Ch5solDocumento7 páginasAPC Ch5solAnonymous LusWvy0% (3)

- Share Capital Transactions and CalculationsDocumento9 páginasShare Capital Transactions and CalculationsAnonymous LusWvy0% (1)

- When He Who Demands Rescission Can Return Whatever He May Be Obliged To RestoreDocumento3 páginasWhen He Who Demands Rescission Can Return Whatever He May Be Obliged To RestoreAnonymous LusWvyAinda não há avaliações

- 202 Cases Partnership DissolutionDocumento1 página202 Cases Partnership DissolutionAnonymous LusWvyAinda não há avaliações

- 4.5.2.2 Final Report of Bagobo DavaoDocumento108 páginas4.5.2.2 Final Report of Bagobo DavaoAnonymous LusWvyAinda não há avaliações

- Intext CitationDocumento3 páginasIntext CitationAnonymous LusWvyAinda não há avaliações

- Chapter 2 Multiple Choice Answers and SolutionsDocumento25 páginasChapter 2 Multiple Choice Answers and SolutionsMendoza KlariseAinda não há avaliações

- Econ Problem PracticeDocumento5 páginasEcon Problem PracticeAnonymous LusWvy100% (2)

- Partnership Accounting GuideDocumento34 páginasPartnership Accounting Guideايهاب غزالةAinda não há avaliações

- CHAPTER 7 Installment LiquidationDocumento20 páginasCHAPTER 7 Installment LiquidationRaymond PascualAinda não há avaliações

- Auditing: A Risk-Based Approach To Conducting A Quality AuditDocumento42 páginasAuditing: A Risk-Based Approach To Conducting A Quality AuditJanil CambielAinda não há avaliações

- Very Imprtant For Job Match 2012 TWDS CSR General Industry Supervisory and Middle Management - DescriptionsDocumento58 páginasVery Imprtant For Job Match 2012 TWDS CSR General Industry Supervisory and Middle Management - DescriptionssharifiAinda não há avaliações

- FABM ReviewerDocumento4 páginasFABM ReviewerKrizel AtienzaAinda não há avaliações

- Cut - OffDocumento3 páginasCut - OffKipngenoAinda não há avaliações

- Title: Accounts Receivable Accountant Code:: Job DescriptionDocumento2 páginasTitle: Accounts Receivable Accountant Code:: Job DescriptionyamarideAinda não há avaliações

- Business Finance 1Documento24 páginasBusiness Finance 1Stevo papaAinda não há avaliações

- Advance Accounting Book 1Documento204 páginasAdvance Accounting Book 1JAPAinda não há avaliações

- Financial PerformanceDocumento7 páginasFinancial PerformanceJustin Ho100% (1)

- ĐỀ nklt chương 6Documento8 páginasĐỀ nklt chương 6Mai NgọcAinda não há avaliações

- The Costs and Benefits of Selling on Credit and Accounts ReceivableDocumento10 páginasThe Costs and Benefits of Selling on Credit and Accounts ReceivableFritzRobenickTabernillaAinda não há avaliações

- Solution: P7-3 (L03) Bad-Debt Reporting-Aging: InstructionsDocumento8 páginasSolution: P7-3 (L03) Bad-Debt Reporting-Aging: InstructionsHerry SugiantoAinda não há avaliações

- Akun Impor PT Surya SejahteraDocumento4 páginasAkun Impor PT Surya SejahteraDiana FransiscaAinda não há avaliações

- Cash and Receivables OverviewDocumento9 páginasCash and Receivables OverviewhamidAinda não há avaliações

- Winterschid Company 2008 year-end trial balance and financial statementsDocumento6 páginasWinterschid Company 2008 year-end trial balance and financial statementsJa Mi LahAinda não há avaliações

- CONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Documento6 páginasCONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Mitch Tokong Minglana0% (1)

- Stock & Book Debts StatementDocumento2 páginasStock & Book Debts Statementalok darakAinda não há avaliações

- How To Read Finanacial ReportsDocumento48 páginasHow To Read Finanacial ReportsdeepakAinda não há avaliações

- SAP LockboxDocumento7 páginasSAP Lockboxatlanta00100% (1)

- AFAR Final Preboard 2018 PDFDocumento22 páginasAFAR Final Preboard 2018 PDFcardos cherryAinda não há avaliações

- ARCS Admin GuideDocumento349 páginasARCS Admin GuideSunetra MoitraAinda não há avaliações

- CFO VP Finance CPA in Chicago IL Resume Michael BennettDocumento2 páginasCFO VP Finance CPA in Chicago IL Resume Michael BennettMichael BennettAinda não há avaliações

- Audit Prob - ReceivablesDocumento27 páginasAudit Prob - ReceivablesCharis Marie Urgel100% (3)

- ICARE Preweek APDocumento15 páginasICARE Preweek APjohn paulAinda não há avaliações

- Chapter 19 AnswerDocumento19 páginasChapter 19 AnswerMjVerbaAinda não há avaliações

- Example Financial StatementDocumento4 páginasExample Financial StatementKaithleen Coreen EbaloAinda não há avaliações

- Au Ia1 Midterm ExamDocumento4 páginasAu Ia1 Midterm ExamCherrylane EdicaAinda não há avaliações

- 08 Single Entry System PDFDocumento19 páginas08 Single Entry System PDFSamuel Jilowa100% (2)

- AC 3 - Intermediate Acctg' 1 (Ate Jan Ver)Documento119 páginasAC 3 - Intermediate Acctg' 1 (Ate Jan Ver)John Renier Bernardo100% (1)

- Answers Partnership ExercisesDocumento15 páginasAnswers Partnership ExercisesAldrin ZolinaAinda não há avaliações