Escolar Documentos

Profissional Documentos

Cultura Documentos

Altman Form 6 - 2016

Enviado por

Matthew Daniel Nye0 notas0% acharam este documento útil (0 voto)

29 visualizações7 páginasAltman Form 6 - 2016

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoAltman Form 6 - 2016

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

29 visualizações7 páginasAltman Form 6 - 2016

Enviado por

Matthew Daniel NyeAltman Form 6 - 2016

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

Você está na página 1de 7

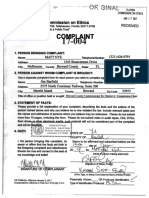

FULL AND PUBLIC DISCLOSURE

OF FINANCIAL INTERESTS

HAND DELIVERED

6 1D Code NM

IDNo. 74566

FOR OFFICE USE ONLY:

Hon Thirrel (Thad) Adolphus Altman Be

State Senator, 16 Distt RECSIVED

‘Senate

Elected Constitutional Officer 46 JUN23 AMI:

2237 Rocxledge Dr

Rockledge FL 32955-5403,

lh fehl abel eel ita

‘CHECK IF THIS IS A FILING BY & CANDIDATE

WoRTH

conf. Code

Altman , Thirrel (Thad) Adolphus

PART A—NE

Please enter the value of your net worth as of December 31, 2015 or a more current date. (Note: Net worth is not cal-

culated by subtracting your reported liabilities from your reported assets, so please see the instructions on page 3.]

my net worth as of Maral 21 2010 wass_ 1,070,236

PART B- ASSETS

HOUSEHOLD GOODS AND PERSONAL EFFECTS:

Household goods and pereonaleffacte may be reported ina lump sum i ther aggregate value exceeds $1.000, This category includes any ofthe

fotowing, # not held for investment purposes: jewelry. cafections of stamps, guns, and numusmaic lems: at objects; household equipment anc

‘umishinge: othing; other househeW lems: and vehicles for personal use, wher ouned ar leased.

‘The aggragate value of my household goouss and personal effects (described above) iss | 22, Ot

[ASSETS INDIVIDUALLY VALUED AT OVER $1,000:

ce pets escrito ig required - 568 nsructons pA) VALUE OF Asser

uA WW

See ach mort "AY Ane "2

PART C ~ LIABILITIES,

LIABILITIES IN EXCESS OF $1,000 (See instructions on page 4)

NAME AND ADDRESS OF CREDITOR AMOUNT OF LIABILITY

Bee MMadimont “C*

“JOINT AND SEVERAL LIABILITIES NOT REPORTED ABOVE?

NAME ANO ADDRESS OF CREDITOR AMOUNT OF LIABILITY

TEFORUG- Eheane remy | 208 Tandon ey PRGET

Ieorarbes oy nirte a Puke M200 FAC.

PART D ~ INCOME

Ionty each separate sourae and amount of income which exceeded $1,000 during the year, including sacondary sources ofincome, Or aliach a complete

‘copy of your 2015 federal income tax relur, including all W2s, schedules, and attachments, Please redact any socal secur oF account numbers Deter

laltaching your retns, as the aw requires these documents bo posted tthe Commasens webste,

Detect o fie copy of my 2015 federal income tax relum and all W2', schedules, are! atachments,

[you check this box and tach a copy of your 2015 tax return, yOu need nol complete the remainder of Part D)

[PRIMARY SOURCES OF INCOME (Soe instructions on page 5):

NAME OF SOURCE OF INCOME EXCEEDING $1,900 AQDRESS OF SOURCE OF INCOME aMouNT

ur

SECONDARY SOURCES OF INCOME {Msior customers cents, ec, of businesses owned by reporting person ~see itructions on nage Sh

NAME OF NAME OF MAJOR SOURCES ADDRESS PRINCIPAL BUSINESS

susiness ENTITY OF SUSINESS INCOME or SoURGE ASHVINY OF SOURCE

PART E ~ INTERESTS IN SPECIFIED BUSINESSES [Instructions on page 6|

USIESS ENTITY At BUSINESS ENTITY #2 BUSINESS ENTITY #9

Wane OF

SOSINESS ENTITY

‘ADDRESS OF

GUSIESS ENTITY

PRINGIPAL BUSINESS

ASiviny : ie :

POSTION FETS

warrenty

TOWN MORE THEN A

INTEREST NL THe BOSIESS

NATURE OF HY

OWNERSHIP INTEREST

PART F - TRAINING

For oficers required to complete annual ethics training pursuant to section 112.3142, FS,

| CERTIFY THAT | HAVE COMPLETED THE REQUIRED TRAINING.

STATE OF FLORIDA Gy |

OATH counrvor Grewed ee

1 he preon whose name appears athe ‘Swain to (ordre) and subscribed belore me tia_ 27" day ot

beginning of this for, do depose on oath ar affrrnabon ne hive! Ndulpnvs Amen Te.

June so yy Jal va

and sy ha the information dslosed on this form Zs

and any attachments hereto i tue, acourae, mn

fom te -Sate of Fray

ana comek cer Pub. Sale

ate Awyondye Cra ei rei

(iit Type, o Stamp Commissioned Name of N oy come. 20K

}

Personally Known __ OR Prosed ETTon

SIGNATURE OF REPORTING OFFICIAL OR CANDIDATE Type of Kentfoaton Produced __FL.

fa certified public accountant licensed under Chapter 473, or attomey in good standing with the Florida Bar prepared this form for you, he or

she must complete te following statement:

. prepared the CE Form 6 in accordance with Art. Sec. 8, Florida Constitution,

‘and the instructions 1 the form, Upon my reasonable knowledge and belt, the disclosure herein is tue

Signature Date

Preparation of this form by a CPA or attorney does not relieve the filer of the responsibility to sign the form under oath,

IF ANY OF PARTS A THROUGH E ARE CONTINUED ON A SEPARATE SHEET, PLEASE CHECK HERE

CEFORWE. Efoave fen 15078 PACED

Soper iy orone Rae S48 0020), FAC.

2106 Lionel Drive, Melbourne, FL 32940 (Residential)

2287 Rockledge Drive Rockledge, FL. 32955 (Residential)

‘The Pines Resort LLC (Parcel {D 27-37-11-00-00264.0-0000.00) 114 Snead Road A-F,

Indian Harbour Beach, FL 32937 (15% Ownership, Banana River Dr. Resort LLC)

‘Surrender Value of life Insurance Genworth Lite Insurance Company 3100 Albert

Langford Drive, Lynchburg, Virginia 24501

Surrender Value of Life Insurance State Farm 366 N. Babcock Street, Suite 102,

‘Melbourne, FL 32935-6800

TIAA (Retirement Portfolio) “SEE ATTACHMENT B”

Bank of America (Checking) 175 E NASA Blvd. Melbourne, FL 32901

‘Space Coast Credit Union (Savings) 20 § Wickham Rd. Melbourne, FL 32904

184,080

617,350

697,500

55,017

‘11,092

40,036

9456

1,648

TI AA \ Kevmenrt ewer

ASTRONAUTS MEMORIAL FOUNDATION

This plan includes the following annuity contracts and other investments. The annuity contracts are indicated with

either TIAA or CREF followed by a number.

Summary of your activity

Balance as of Jan 1, 2016 $38,099.60

Employer contributions 2,750.00

Gains/Loss 814.15

Balance as of Mar 34,2016 ‘$40,035.45

What you have vested

‘our omployor's contributions

Anny contacts andthe estes

Annuity Convacts 300% $40,035.45

a ee é oe a ot

Total $40,035.45

Your investments

Sumber Unsere pee

mat contracts and other nvestmets unta/anret_—_asofMar 34 2018,

PreTax investments

Equities

CREF Stock R1 (CREF V23550G-0) 16.9502 $361.3146 $6,124.35 15.30%

TIAA Acc Int! Eq T4 (TIAA D235506-3) 307.5405 (24,2837 7,468.22 18.65%

TIM Ace Ma-Cap Gr T4 (TAR 184.3670 42.7928 7,989.54 19.71%

D235506-3)

TAA Reo Sr-Cap Eq T4 (IAA 322.1016 37.4690 12,088.82 30.15%

238506-3)

TIAA Acc Lg-Cap Gr T4 (TIAA 132.6984 48,8666 6,484.52 16.19%

D235506-3)

Total Equities $40,035.45 400.0%

Total value of your investments $40,035.45 100%

ASTRONAUTS MEMORIAL FOUNDATION (Continued)

Account holder: THIRREL A ALTMAN JR

How the value of your investments changed this period

To view the current performance for your specific investmonts, og in to your account at tiaa.org or you can visit

{isa.or8/pertormance for general performance information.

Value a8 of Net cesut of TAA nteresty

tevostments Jan, 2038 transactions Gainortoss

CREF Stock Ri $5,692.77 $412.50 $19.08 $6,124.35

TIAA Ace Intl Eq Ta 6,972.52 $50.00 54.30 7,468.22

TIAA Ace Md-Cap Gr T4 7,618.98 $50.00 -279.44 7,889.54

TIAA Ace SmCap Eq T4 11,510.34 825.00 - 266.52 12,068.82

TIAA Acc Le-Cap Gr T4 6,304.99 412.50 _ 232.97 6,484.52

Total value of your investments $38,099.60 $2,750.00 “$814.15 $40,035.45

Your transaction details

Processing Efecto Number of vay

ate date Dosciption snits/shares shave ioe Amount

Employer

2/1/2016 2/1/2016 Contribution (CREF V235506-0), 0.6071 $339.7045 $206.25

CREF Stock Ri

2/1/2016 2/1/2016 Contribution (TIAA D235506-3) 11.7816 23.3415 275.00

TIAA Ace Intl Eq T4.

2/1/2016 2/1/2016 Contribution (TIAA D235506-3) 6.7748 405917 275.00

TIAA Ace Ma-Cap Gr T4

2/1/2016 2/1/2016 Contribution (TIAA D235506-3) 41.7531 35.0971 412.50

TIAA Ace Smm-Cap Eq T4

2/1/2016 2/1/2016 Contribution (TIAA 0235506-3) 4.3648 47.2530 206.25

TIAA Ace Lg Cap Gr T4

3/3/2016 3/3/2016 Contribution (CREF V235506.0) 05913 348.8106 206.25

CREF Stock RA

3/3/2016 3/3/2016 Contribution (TIAA D235506-3) 11.6589 23.6872 275.00

TIAA Ace Int! Eq TA

3/3/2016 3/3/2016 Contribution (TIAA 0235506-3) 66658 41.2551 275.00

TIAA Ace Md-Cap Gr T4

3/3/2016 3/3/2016 Contribution (TIAA D235506-3) 11.4299 36.0894 412.50

TIAA Ace SmCap Eq T4

3/3/2016 3/3/2016 Contribution (TIAA 0235506-3) 4.3887 47.3195 206.28

TIAA Ace Lg-Cap Gr T4

Total employer contributions $2,750.00

Space Coast Credit Union 8045 N. Wickham Rd. Melbourne, FL 32940 (Car| « en

Loan) 7

| Space Coast Credit Union 8045 N. Wickham Rd, Melbourne, FL.32940 | ¢ err

(Car Loan) ;

Nissan Motor Acceptance Corp. P. 0. Box 660360 (Car Loan) s 6,136

Altman, Thirrel A TR, P.O. Box 360911, Melburne, FL32936 (Mortgage) | $ 600,005

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Item I.1., Civility Ordinance and Policy - D3Documento4 páginasItem I.1., Civility Ordinance and Policy - D3Matthew Daniel NyeAinda não há avaliações

- Florida Medicaid Pharmacy Claims AnalysisDocumento203 páginasFlorida Medicaid Pharmacy Claims AnalysisMatthew Daniel NyeAinda não há avaliações

- Whistleblower Response ProcessDocumento4 páginasWhistleblower Response ProcessMatthew Daniel NyeAinda não há avaliações

- Matt Nye For Florida House 2020 NRA Candidate QuestionnaireDocumento5 páginasMatt Nye For Florida House 2020 NRA Candidate QuestionnaireMatthew Daniel NyeAinda não há avaliações

- Republican Liberty Caucus of Central East Florida Bylaws: Article I: NameDocumento8 páginasRepublican Liberty Caucus of Central East Florida Bylaws: Article I: NameMatthew Daniel NyeAinda não há avaliações

- 2014-15 Astronauts Memorial Foundation Audited Financial StatementsDocumento26 páginas2014-15 Astronauts Memorial Foundation Audited Financial StatementsMatthew Daniel NyeAinda não há avaliações

- RPOF Model Constitution 04-28-17Documento9 páginasRPOF Model Constitution 04-28-17Matthew Daniel NyeAinda não há avaliações

- BREC Bylaws (As Revised On 11-08-2017)Documento5 páginasBREC Bylaws (As Revised On 11-08-2017)Matthew Daniel NyeAinda não há avaliações

- 2015-16 Astronauts Memorial Foundation Audited Financial StatementsDocumento26 páginas2015-16 Astronauts Memorial Foundation Audited Financial StatementsMatthew Daniel NyeAinda não há avaliações

- Whistleblower WB18-001 Investigation - Final ReportDocumento12 páginasWhistleblower WB18-001 Investigation - Final ReportMatthew Daniel Nye100% (1)

- 2013-14 Astronuats Memorial Foundation Audited Financial StatementsDocumento28 páginas2013-14 Astronuats Memorial Foundation Audited Financial StatementsMatthew Daniel NyeAinda não há avaliações

- District 4 County Commission Office Time Cards PPE 180907Documento3 páginasDistrict 4 County Commission Office Time Cards PPE 180907Matthew Daniel NyeAinda não há avaliações

- Altman 2018 Form 6 Financial DisclosureDocumento8 páginasAltman 2018 Form 6 Financial DisclosureMatthew Daniel NyeAinda não há avaliações

- 2 - 17003 Advocate's RecommendationDocumento7 páginas2 - 17003 Advocate's RecommendationMatthew Daniel NyeAinda não há avaliações

- 3 - 17003 Report of InvestigationDocumento27 páginas3 - 17003 Report of InvestigationMatthew Daniel NyeAinda não há avaliações

- 1 - 17003 Pre-Probable Cause Joint StipulationDocumento5 páginas1 - 17003 Pre-Probable Cause Joint StipulationMatthew Daniel NyeAinda não há avaliações

- Astronaut Memorial Foundation Financials 2013-2014Documento27 páginasAstronaut Memorial Foundation Financials 2013-2014Matthew Daniel NyeAinda não há avaliações

- 5 17003 ComplaintDocumento19 páginas5 17003 ComplaintMatthew Daniel NyeAinda não há avaliações

- 2 - 17004 Advocate's RecommendationDocumento6 páginas2 - 17004 Advocate's RecommendationMatthew Daniel NyeAinda não há avaliações

- 5 - 17004 Order To InvestigateDocumento2 páginas5 - 17004 Order To InvestigateMatthew Daniel NyeAinda não há avaliações

- 6 17004 ComplaintDocumento19 páginas6 17004 ComplaintMatthew Daniel NyeAinda não há avaliações

- Altman Form 6 - 2011Documento2 páginasAltman Form 6 - 2011Matthew Daniel NyeAinda não há avaliações

- Altman Form 6 - 2014Documento8 páginasAltman Form 6 - 2014Matthew Daniel NyeAinda não há avaliações

- 4 - 17004 Report of InvestigationDocumento29 páginas4 - 17004 Report of InvestigationMatthew Daniel NyeAinda não há avaliações

- 1 - 17004 Pre-Probable Cause Joint StipulationDocumento4 páginas1 - 17004 Pre-Probable Cause Joint StipulationMatthew Daniel NyeAinda não há avaliações

- 120517-Add-On VI.F.2Documento5 páginas120517-Add-On VI.F.2Matthew Daniel NyeAinda não há avaliações

- Altman Form 6 - 2013Documento9 páginasAltman Form 6 - 2013Matthew Daniel NyeAinda não há avaliações

- FL Chapter 2013-235 TRDA RemovedDocumento3 páginasFL Chapter 2013-235 TRDA RemovedMatthew Daniel NyeAinda não há avaliações