Escolar Documentos

Profissional Documentos

Cultura Documentos

Tim Duy

Enviado por

Anonymous Ht0MIJDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Tim Duy

Enviado por

Anonymous Ht0MIJDireitos autorais:

Formatos disponíveis

Tim Duys

Fed Watch october 4, 2017

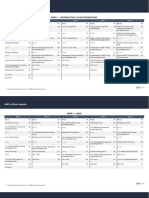

Hurricanes Help Boost Data While Powell ISM Manufacturing Indexes

Reportedly Rises to The Top of The Pack Above 50 Indicates Expansion

ISM Manufacturing ISM Manufacturing

PMI Composite Index Production Index

The ISM manufacturing report for Septem-

65 65

60 60

55

ber came in stronger than expected. To be

55

50

50

45

sure, hurricane impacts accounted for some

Index

Index

45

40

40

35

of the boost, particularly in supplier deliver- 35

30

30

25

ies and prices; anecdotal responses made 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

this clear. But it isnt all hurricanes. Man-

ISM Manufacturing ISM Manufacturing

New Orders Index Employment Index

70 65

ufacturing has been gaining steam since

60

60

55

last year. The sector continues to throw off

50

50

45

Index

Index

40

the 2015/2016 weakness associated with

40

35

30

the oil price decline and rise in the dollar. I

30

20 25

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

often feel this improvement has been over- Web: economistsview.typepad.com/timduy/ * Twitter: @TimDuy * Data via Quandl * Chart created: 10/03/2017 13:49

looked. Light Weight Vehicle Sales

Autos & Light Trucks, Millions of Units, Annual Rate

22

The Fed, however, will not overlook this

data. The strong showing is consistent with 20

the Feds belief that the underlying pace of 18

activity remains sufficient to support further

16

improvement in the job market, and thus is

supportive of a December rate hike. But it 14

doesnt at this point support a faster pace 12

of rate hikes. The Fed will see some of the 10

improvement as temporary and expect that

it will fade as supply chains disrupted by the 8

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

hurricanes gradually revert to normal. And Web: economistsview.typepad.com/timduy/ * Twitter: @TimDuy * Data via FRED * Chart created: 10/03/2017 13:51

then there is that pesky low inflation prob-

lem as well. fretted in a blog post that inflation expectations had fallen

and would like to see rate hikes put on hold until they see

Speaking of hurricane-impacted data, auto sales jump in clear and convincing evidence that inflation will return to

September to an estimated annual rate of 18.4 million. target. Meanwhile, Dallas Federal Reserve President Rob-

While again likely only temporary (eventually households ert Kaplan is also looking for stronger data to justify a rate

will replace the vehicles damage by the storms), the sales hike. From Reuters:

came at a good time for the industry. Car makers had been

struggling with high inventories after sales slowed this Weve got room to raise rates, but not as much as peo-

year; presumably the extra activity will help correct that ple might think, Kaplan said. We are going to have

problem. to look hard at whether we should take further action

in December. I have an open mind about it.

Fedspeak this week has tended toward the dovish

side. Minneapolis Federal Reserve President Neel Kashkari Now, lets do the math here. Vice Chair Stanley Fischer

Tim Duys FED WATCH october 4, 2017

resigned, effective later this month. That leaves eight

FOMC members. By my count four members Kashkari, Timothy A. Duy

Kaplan, Chicago Federal Reserve President Charles Evans, Professor of Practice

and Federal Reserve Governor Lael Brainard all have or Oregon Economic Forum, Senior Director

are getting very cold feet about a December hike. Thats Department of Economics

an even split. University of Oregon

But assume nominee Randal Quarles is confirmed by De- Professor Duy received his B.A. in Economics in 1991

cember, and further assume he sides with the more hawk- from the University of Puget Sound, and his M.S. and

ish side of the committee. That leaves a divided commit- Ph.D. in Economics in 1998 from the University of

tee, but one that still supports a rate hike. Oregon. Following graduate school, Tim worked in

Washington, D.C. for the United States Department

That said, I dont think that a large subset of the of Treasury as an economist in the International Affairs

committee would dissent en masse if Federal Reserve division and later with the G7 Group, a political and

Chair Janet Yellen was pushing for a rate hike. Not at a economic consultancy for clients in the financial

meeting that would conclude with likely her last press industry. In the latter position, he was responsible

conference. Moreover, even if some members have for monitoring the activities of the Federal Reserve

cold feet now, they would likely be warmed by solid and currency markets. Tim returned to the University

data on jobs and the economy, even if inflation remains

of Oregon in 2002. He is the Senior Director of the

weak. So, bottom line, odds still favor a rate hike at the

Oregon Economic Forum and the author of the

December meeting.

University of Oregon Statewide Economic Indicators,

Regional Economic Indicators, and the Central Oregon

Separately, Politico reports that they:

Business Index. Tim has published in the Journal of

spoke to a couple of other sources close to the Fed Economics and Business and is currently a member of

Chair selection process and they confirmed Kevin the Oregon Governors Council of Economic Advisors

Warsh and Jerome Powell as the current front-run- and the State Debt Policy Advisory Commission. Tim

ners with Treasury Secretary Steven Mnuchin said is a prominent commentator on the Federal Reserve.

to be favoring Powell. Thats something of a head MarketWatch describes his blog as influential, the

scratcher to outside observers of the process who Huffington Post identified him has one of the top

did not have Powell on short-lists before the process 26 economists to follow on Twitter, and he is listed

began. Warsh was always viewed as a top contender on StreetEye as one of the top 100 people to follow

though he does not really know President Trump. to discover finance news on Twitter. Major national

and international news outlets frequently quote

Rumor mill has it that Wall Street doesnt want Warsh. I him, including the New York Times, the Washington

think many market participants are understandably wary of Post, the Financial Times, the Wall Street Journal,

the possibility of a Fed chair who appears at odds with the and Bloomberg. He also writes a regular column for

current regime at the Fed. Not only does it call into ques- Bloomberg Prophets.

tion Warshs analytic ability, but also Wall Street tends to

loath uncertainty. Even if Warsh is just putting on a show to Notice: This newsletter is commentary, not investment

garner speaking fees and will come back into the fold once advice.

he is back at Constitution Avenue, we dont know that will

be the case.

duy@uoregon.edu

In contrast, Wall Street, I think, would welcome Powells

nomination. He might be viewed as somewhat more hawk- 541-346-4660

ish than Yellen, but also as reasonably hawkish in that likely ECON

to be data dependent and will shift dovish should the need @TimDuy Economics

arise. Of all the candidates reportedly under consider-

ation, excluding Yellen, Powell would be the most likely

oregon

economic

to maintain policy consistency.

forum

2017 University of Oregon; Tim Duy. All rights reserved. 2

Você também pode gostar

- ISMnon Manufacturing December 2008Documento1 páginaISMnon Manufacturing December 2008International Business TimesAinda não há avaliações

- AUG 04 Danske Global BCM Aug 2010Documento7 páginasAUG 04 Danske Global BCM Aug 2010Miir ViirAinda não há avaliações

- IHS Markit Brazil Manufacturing PMI®: Factory Orders and Output Contract For Second Straight Month in AprilDocumento2 páginasIHS Markit Brazil Manufacturing PMI®: Factory Orders and Output Contract For Second Straight Month in AprilRafa BorgesAinda não há avaliações

- ISM Manufacturing Release - 09-01-09Documento3 páginasISM Manufacturing Release - 09-01-09JaphyAinda não há avaliações

- 2021 IR Sustainability ReportDocumento84 páginas2021 IR Sustainability Reportmanish pandeyAinda não há avaliações

- Rapport Annuel Cosumar 2019 Web en - ReduceDocumento58 páginasRapport Annuel Cosumar 2019 Web en - ReduceVyrax FalconAinda não há avaliações

- Chief Executive Officer (CEO) : Job DescriptionDocumento7 páginasChief Executive Officer (CEO) : Job Descriptiongabriela_gabbyAinda não há avaliações

- Ihs Markit / Bme Germany Manufacturing Pmi®: News ReleaseDocumento2 páginasIhs Markit / Bme Germany Manufacturing Pmi®: News ReleaseValter SilveiraAinda não há avaliações

- GB Jobs ENG 1106 PanelDocumento8 páginasGB Jobs ENG 1106 PanelhelenproctorAinda não há avaliações

- Q2 2019 Latin Summary English 1Documento17 páginasQ2 2019 Latin Summary English 1CHRISS GONZALEZAinda não há avaliações

- Economic Update: Tracking The World Economy, The Semiconductor Cycle and The Malaysian Economy - 15/04/2010Documento8 páginasEconomic Update: Tracking The World Economy, The Semiconductor Cycle and The Malaysian Economy - 15/04/2010Rhb InvestAinda não há avaliações

- Digitalisation On EconomyDocumento20 páginasDigitalisation On EconomyMacsim BogdanAinda não há avaliações

- Egypt PMI: Second Consecutive Month of Positive Growth: EconomicsDocumento4 páginasEgypt PMI: Second Consecutive Month of Positive Growth: EconomicsAnonymous TmOUycChAinda não há avaliações

- ARLANXEO Product Brochure PVC Modification Baymod N XL 33.61Documento6 páginasARLANXEO Product Brochure PVC Modification Baymod N XL 33.61ahmetAinda não há avaliações

- 2021 Strategy & PlanDocumento27 páginas2021 Strategy & PlanBuchi MadukaAinda não há avaliações

- Performance in The Toughest Conditions Quality Trusted For GenerationsDocumento6 páginasPerformance in The Toughest Conditions Quality Trusted For GenerationsNahuel EgüesAinda não há avaliações

- Agriculture: PlannerDocumento61 páginasAgriculture: PlannerNikhil GowdaAinda não há avaliações

- BBA Syllabus 2018 From PrinterDocumento42 páginasBBA Syllabus 2018 From PrinterSruthi RameshAinda não há avaliações

- Spiva Us Mid Year 2021Documento36 páginasSpiva Us Mid Year 2021Gábor ZsédelyAinda não há avaliações

- 14.an Overview of Ug Coal mining-WCL HQDocumento30 páginas14.an Overview of Ug Coal mining-WCL HQkatta_sridharAinda não há avaliações

- R Ramyashree 20222mls0108 ScaDocumento25 páginasR Ramyashree 20222mls0108 ScaTharun KsAinda não há avaliações

- AWS Re/start Agenda: Week 1 - Introduction, Cloud FoundationsDocumento12 páginasAWS Re/start Agenda: Week 1 - Introduction, Cloud FoundationsWaqas M AwanAinda não há avaliações

- Analysis of ProductivityDocumento31 páginasAnalysis of ProductivityShreya AAinda não há avaliações

- Grain Size Distribution: Client Mbits Project Name Po1 Project Number Po1Documento1 páginaGrain Size Distribution: Client Mbits Project Name Po1 Project Number Po1Dileep K NambiarAinda não há avaliações

- Restart v301 AgendaDocumento12 páginasRestart v301 AgendaDavid BenoitAinda não há avaliações

- Hisex White Production Report Cage Production System Vs1408aDocumento2 páginasHisex White Production Report Cage Production System Vs1408aleonardollatAinda não há avaliações

- 5S Best PracticeDocumento85 páginas5S Best PracticeyogshastriAinda não há avaliações

- 4th Sem Supply Chain AnalyticsDocumento12 páginas4th Sem Supply Chain AnalyticsNayanashree NAinda não há avaliações

- New Zealand: Prosperity Score 81.2 (7th)Documento15 páginasNew Zealand: Prosperity Score 81.2 (7th)Jonathan Steve Norato PinzónAinda não há avaliações

- Group 3 SIDM ProjectDocumento23 páginasGroup 3 SIDM Projectanany guptaAinda não há avaliações

- Dr. Hur AI and Future of Work (J. Hur For APO Conference) - 2019.8.23Documento27 páginasDr. Hur AI and Future of Work (J. Hur For APO Conference) - 2019.8.23Roland CruzAinda não há avaliações

- Sistema ExcretorDocumento10 páginasSistema ExcretorpengenheiroAinda não há avaliações

- Manitou MRT 2150: Click Here To Request A QuoteDocumento2 páginasManitou MRT 2150: Click Here To Request A QuoteGoran MatovicAinda não há avaliações

- CEIL AnnualReport 2019 20Documento49 páginasCEIL AnnualReport 2019 20zarreenmahiAinda não há avaliações

- Cut To The Chase The Labour Income Share in New ZealandDocumento4 páginasCut To The Chase The Labour Income Share in New ZealandFrederico CraveiroAinda não há avaliações

- You Exec - Annual Report Part2 FreeDocumento9 páginasYou Exec - Annual Report Part2 FreejpereztmpAinda não há avaliações

- Ia202102 DLDocumento69 páginasIa202102 DLErwin YuliantoAinda não há avaliações

- Unilever ChartsDocumento16 páginasUnilever ChartsdrketakibhorAinda não há avaliações

- Aurora 914 Series 250 G.P.M.: 50 HZ Vertical Turbine Fire PumpDocumento26 páginasAurora 914 Series 250 G.P.M.: 50 HZ Vertical Turbine Fire PumpDONGTA123100% (1)

- Sokkelaret 2017 Engelsk PresentasjonDocumento25 páginasSokkelaret 2017 Engelsk PresentasjonHải Thân NgọcAinda não há avaliações

- AWS Re/start Agenda: Week 1 - Introduction, Cloud FoundationsDocumento12 páginasAWS Re/start Agenda: Week 1 - Introduction, Cloud Foundationsbambangtu bamabangAinda não há avaliações

- Business PlanDocumento131 páginasBusiness PlanMikha BorcesAinda não há avaliações

- Cuba - Year 46 PDFDocumento57 páginasCuba - Year 46 PDFUyen HoangAinda não há avaliações

- Modifying Factors and Optimized Cut-Off Grade DetermonationDocumento1 páginaModifying Factors and Optimized Cut-Off Grade DetermonationВиталий ДроздовAinda não há avaliações

- Clivet VRFDocumento70 páginasClivet VRFremigius yudhiAinda não há avaliações

- 4th Sem Supply Chain AnalyticsDocumento5 páginas4th Sem Supply Chain AnalyticsNayanashree NAinda não há avaliações

- JAD Construction Limited Liftboats Employee Retention Rate CalculatorDocumento3 páginasJAD Construction Limited Liftboats Employee Retention Rate CalculatorsinghajitbAinda não há avaliações

- Code of Ethics - DraftDocumento55 páginasCode of Ethics - DraftSantosh Thapa ChhetriAinda não há avaliações

- ME Group8Documento10 páginasME Group8Somesh RoyAinda não há avaliações

- EWH Dan Target by Fleet - Juli 2020Documento9 páginasEWH Dan Target by Fleet - Juli 2020anugrahAinda não há avaliações

- Grain Size Distribution: Client Mbits Project Name P05 Project Number Po5Documento1 páginaGrain Size Distribution: Client Mbits Project Name P05 Project Number Po5Dileep K NambiarAinda não há avaliações

- Caixin China General Services PMI Press ReleaseDocumento5 páginasCaixin China General Services PMI Press ReleaseDinheirama.comAinda não há avaliações

- Robert Pindyck Microeconomics - Book Solution - ECO101Documento1 páginaRobert Pindyck Microeconomics - Book Solution - ECO101wqewqe0% (1)

- Corporate India Steady Course Amid Challenges H1FY24 ReportDocumento39 páginasCorporate India Steady Course Amid Challenges H1FY24 ReportPankaj MaryeAinda não há avaliações

- BMW DF 2006Documento197 páginasBMW DF 2006JORGE100% (1)

- HSE Weekly Report #63 (28 NOV - 4 DEC 2020)Documento6 páginasHSE Weekly Report #63 (28 NOV - 4 DEC 2020)Brings MotoVlogAinda não há avaliações

- JPMorgan Global Manufacturing PMI May 2023Documento3 páginasJPMorgan Global Manufacturing PMI May 2023Phileas FoggAinda não há avaliações

- Methodology SP Bse IndicesDocumento57 páginasMethodology SP Bse IndicesEdwin ChanAinda não há avaliações

- INFWS052018 European-Bank PDFDocumento25 páginasINFWS052018 European-Bank PDFIspitAinda não há avaliações

- NetflixDocumento4 páginasNetflixAnonymous Ht0MIJAinda não há avaliações

- Citron SnapDocumento7 páginasCitron SnapAnonymous Ht0MIJAinda não há avaliações

- As 061818Documento4 páginasAs 061818Anonymous Ht0MIJAinda não há avaliações

- Inogen CitronDocumento8 páginasInogen CitronAnonymous Ht0MIJAinda não há avaliações

- SlidesDocumento70 páginasSlidesAnonymous Ht0MIJAinda não há avaliações

- As 010818Documento5 páginasAs 010818Anonymous Ht0MIJAinda não há avaliações

- Where Are We in The Credit Cycle?: Gene Tannuzzo, Senior Portfolio ManagerDocumento1 páginaWhere Are We in The Credit Cycle?: Gene Tannuzzo, Senior Portfolio ManagerAnonymous Ht0MIJAinda não há avaliações

- Gundlach SlideshowDocumento68 páginasGundlach SlideshowZerohedge100% (6)

- Gmo Quarterly LetterDocumento22 páginasGmo Quarterly LetterAnonymous Ht0MIJAinda não há avaliações

- Fixed Income Weekly CommentaryDocumento3 páginasFixed Income Weekly CommentaryAnonymous Ht0MIJAinda não há avaliações

- Bittles Market Notes PDFDocumento3 páginasBittles Market Notes PDFAnonymous Ht0MIJAinda não há avaliações

- As 121117Documento4 páginasAs 121117Anonymous Ht0MIJAinda não há avaliações

- 2018 Economic and Stock Market OutlookDocumento8 páginas2018 Economic and Stock Market OutlookAnonymous Ht0MIJAinda não há avaliações

- As 120417Documento5 páginasAs 120417Anonymous Ht0MIJAinda não há avaliações

- MCCM 3Q2017 Market OutlookDocumento75 páginasMCCM 3Q2017 Market OutlooksuperinvestorbulletiAinda não há avaliações

- Pershing Square 3Q17 Investor Letter November 2017 PSHDocumento21 páginasPershing Square 3Q17 Investor Letter November 2017 PSHAnonymous Ht0MIJAinda não há avaliações

- Bittles Market NotesDocumento4 páginasBittles Market NotesAnonymous Ht0MIJAinda não há avaliações

- Proper AdjectivesDocumento3 páginasProper AdjectivesRania Mohammed0% (2)

- (Dan Stone) The Historiography of The HolocaustDocumento586 páginas(Dan Stone) The Historiography of The HolocaustPop Catalin100% (1)

- Challenges For Omnichannel StoreDocumento5 páginasChallenges For Omnichannel StoreAnjali SrivastvaAinda não há avaliações

- #6 Decision Control InstructionDocumento9 páginas#6 Decision Control InstructionTimothy King LincolnAinda não há avaliações

- Lead Workplace CommunicationDocumento55 páginasLead Workplace CommunicationAbu Huzheyfa Bin100% (1)

- Time Interest Earned RatioDocumento40 páginasTime Interest Earned RatioFarihaFardeenAinda não há avaliações

- Nahs Syllabus Comparative ReligionsDocumento4 páginasNahs Syllabus Comparative Religionsapi-279748131Ainda não há avaliações

- Spiritual Transcendence in Transhumanism PDFDocumento10 páginasSpiritual Transcendence in Transhumanism PDFZeljko SaricAinda não há avaliações

- SEx 3Documento33 páginasSEx 3Amir Madani100% (4)

- Radio Network Parameters: Wcdma Ran W19Documento12 páginasRadio Network Parameters: Wcdma Ran W19Chu Quang TuanAinda não há avaliações

- MuzicaDocumento3 páginasMuzicaGiurcanas AndreiAinda não há avaliações

- 576 1 1179 1 10 20181220Documento15 páginas576 1 1179 1 10 20181220Sana MuzaffarAinda não há avaliações

- Technique Du Micro-Enseignement Une Approche PourDocumento11 páginasTechnique Du Micro-Enseignement Une Approche PourMohamed NaciriAinda não há avaliações

- A Guide To Relativity BooksDocumento17 páginasA Guide To Relativity Bookscharles luisAinda não há avaliações

- Catastrophe Claims Guide 2007Documento163 páginasCatastrophe Claims Guide 2007cottchen6605100% (1)

- MINIMENTAL, Puntos de Corte ColombianosDocumento5 páginasMINIMENTAL, Puntos de Corte ColombianosCatalina GutiérrezAinda não há avaliações

- Philosophy of Education SyllabusDocumento5 páginasPhilosophy of Education SyllabusGa MusaAinda não há avaliações

- Bakhtin's Chronotope On The RoadDocumento17 páginasBakhtin's Chronotope On The RoadLeandro OliveiraAinda não há avaliações

- 04 RecursionDocumento21 páginas04 RecursionRazan AbabAinda não há avaliações

- Final Report - Solving Traveling Salesman Problem by Dynamic Programming Approach in Java Program Aditya Nugroho Ht083276eDocumento15 páginasFinal Report - Solving Traveling Salesman Problem by Dynamic Programming Approach in Java Program Aditya Nugroho Ht083276eAytida Ohorgun100% (5)

- Analog Electronic CircuitsDocumento2 páginasAnalog Electronic CircuitsFaisal Shahzad KhattakAinda não há avaliações

- Hercules Industries Inc. v. Secretary of Labor (1992)Documento1 páginaHercules Industries Inc. v. Secretary of Labor (1992)Vianca MiguelAinda não há avaliações

- CEI and C4C Integration in 1602: Software Design DescriptionDocumento44 páginasCEI and C4C Integration in 1602: Software Design Descriptionpkumar2288Ainda não há avaliações

- Chinese AstronomyDocumento13 páginasChinese Astronomyss13Ainda não há avaliações

- Affirmative (Afirmativa) Long Form Short Form PortuguêsDocumento3 páginasAffirmative (Afirmativa) Long Form Short Form PortuguêsAnitaYangAinda não há avaliações

- Validator in JSFDocumento5 páginasValidator in JSFvinh_kakaAinda não há avaliações

- Old San Agustin NHS MSISAR Sept 2021Documento2 páginasOld San Agustin NHS MSISAR Sept 2021ERICSON SABANGANAinda não há avaliações

- Brochure - Digital Banking - New DelhiDocumento4 páginasBrochure - Digital Banking - New Delhiankitgarg13Ainda não há avaliações

- Accounting 110: Acc110Documento19 páginasAccounting 110: Acc110ahoffm05100% (1)

- 01ESS - Introducing Siebel ApplicationsDocumento24 páginas01ESS - Introducing Siebel ApplicationsRajaAinda não há avaliações