Escolar Documentos

Profissional Documentos

Cultura Documentos

Brief Contents: Introduction and Background

Enviado por

penelopegerhard0 notas0% acharam este documento útil (0 voto)

23 visualizações1 páginaThis document contains a table of contents for a textbook on public finance. The textbook is divided into four parts that cover different topics in public finance. Part I provides an introduction and background on why public finance is studied and the theoretical and empirical tools used. Part II examines externalities and public goods. Part III analyzes social insurance and redistribution programs. Finally, Part IV discusses theories and practices of taxation.

Descrição original:

Public Finance

Título original

p08

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThis document contains a table of contents for a textbook on public finance. The textbook is divided into four parts that cover different topics in public finance. Part I provides an introduction and background on why public finance is studied and the theoretical and empirical tools used. Part II examines externalities and public goods. Part III analyzes social insurance and redistribution programs. Finally, Part IV discusses theories and practices of taxation.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

23 visualizações1 páginaBrief Contents: Introduction and Background

Enviado por

penelopegerhardThis document contains a table of contents for a textbook on public finance. The textbook is divided into four parts that cover different topics in public finance. Part I provides an introduction and background on why public finance is studied and the theoretical and empirical tools used. Part II examines externalities and public goods. Part III analyzes social insurance and redistribution programs. Finally, Part IV discusses theories and practices of taxation.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

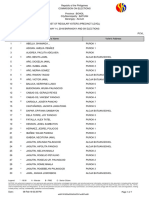

Brief Contents

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . xxvii

PART I Introduction and Background

1 Why Study Public Finance? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1

2 Theoretical Tools of Public Finance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .25

3 Empirical Tools of Public Finance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .63

4 Budget Analysis and Deficit Financing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .91

PART II Externalities and Public Goods

5 Externalities: Problems and Solutions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .121

6 Externalities in Action: Environmental and Health Externalities . . . . . . . . . . . .149

7 Public Goods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .181

8 Cost-Benefit Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .205

9 Political Economy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .227

10 State and Local Government Expenditures . . . . . . . . . . . . . . . . . . . . . . . . . .261

11 Education . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .289

PART III Social Insurance and Redistribution

12 Social Insurance: The New Function of Government . . . . . . . . . . . . . . . . . . .319

13 Social Security . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .353

14 Unemployment Insurance, Disability Insurance, and Workers Compensation .389

15 Health Insurance I: Health Economics and Private Health Insurance . . . . . . . .419

16 Health Insurance II: Medicare, Medicaid, and Health Care Reform . . . . . . . . .453

17 Income Distribution and Welfare Programs . . . . . . . . . . . . . . . . . . . . . . . . .489

PART IV Taxation in Theory and Practice

18 Taxation in the United States and Around the World . . . . . . . . . . . . . . . . . . .523

19 The Equity Implications of Taxation: Tax Incidence . . . . . . . . . . . . . . . . . . . .557

20 Tax Inefficiencies and Their Implications for Optimal Taxation . . . . . . . . . . . .589

21 Taxes on Labor Supply . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .623

22 Taxes on Savings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .647

23 Taxes on Risk Taking and Wealth . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .675

24 Corporate Taxation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .701

25 Fundamental Tax Reform . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .737

Glossary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . G-1

References . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . R-1

Name Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . NI-1

Subject Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . SI-1

vi

Você também pode gostar

- 2024 - Budget - and - Fiscal - Plan British ColumbiaDocumento170 páginas2024 - Budget - and - Fiscal - Plan British Columbiad4vankAinda não há avaliações

- CNCS 2011 Congressional Budget Justification - Corporation For National and Community Service CBJ 2011Documento96 páginasCNCS 2011 Congressional Budget Justification - Corporation For National and Community Service CBJ 2011Accessible Journal Media: Peace Corps DocumentsAinda não há avaliações

- Infrastructure Financing in KazakhstanDocumento51 páginasInfrastructure Financing in KazakhstanJohnson JamesAinda não há avaliações

- 2018 19 Goa Annual Report PDFDocumento116 páginas2018 19 Goa Annual Report PDFRoberto de LeonAinda não há avaliações

- 2022 Budget and Fiscal PlanDocumento194 páginas2022 Budget and Fiscal PlanPatrick D HayesAinda não há avaliações

- Aa TocDocumento5 páginasAa TocCj Isaiah FerrerAinda não há avaliações

- Object Class Analysis: Budget of The U.S. GovernmentDocumento128 páginasObject Class Analysis: Budget of The U.S. GovernmentlosangelesAinda não há avaliações

- PSIP Trinidad 2018Documento213 páginasPSIP Trinidad 2018Rossana CairaAinda não há avaliações

- The Economic Effects of 9 - 11Documento60 páginasThe Economic Effects of 9 - 11rajeev.sumanAinda não há avaliações

- 2017 AFR GCs Volume I PDFDocumento897 páginas2017 AFR GCs Volume I PDFJessica Aldea100% (1)

- MINICOM Made in Rwanda PolicyDocumento45 páginasMINICOM Made in Rwanda PolicyJ-Claude DougAinda não há avaliações

- 2013 Fuel Cell Technology Market ReportDocumento72 páginas2013 Fuel Cell Technology Market ReportIsaac RodriguezAinda não há avaliações

- Sustainable Infrastructure Policy PaperwebfinalDocumento50 páginasSustainable Infrastructure Policy PaperwebfinalYohanes Eki ApriliawanAinda não há avaliações

- Indigenous Income Support PDFDocumento170 páginasIndigenous Income Support PDFainad1219Ainda não há avaliações

- Opportunities For PakistanDocumento227 páginasOpportunities For PakistanUrooj KhanAinda não há avaliações

- Approved FIN STATEMENT 2023-24 For Printing 30-1-2024Documento82 páginasApproved FIN STATEMENT 2023-24 For Printing 30-1-2024vjrbtmm7fmAinda não há avaliações

- Table of Contents - Chapter 14Documento80 páginasTable of Contents - Chapter 14MATIULLAHAinda não há avaliações

- BMTC AnalysisDocumento68 páginasBMTC AnalysisPAinda não há avaliações

- 2014 Manitoba Estimates of Revenue and ExpenditureDocumento168 páginas2014 Manitoba Estimates of Revenue and ExpendituretessavanderhartAinda não há avaliações

- Introduction To Taxation Law (PDFDrive)Documento196 páginasIntroduction To Taxation Law (PDFDrive)Kurnia WijayantiAinda não há avaliações

- Treasury Regulations For Departments, Trading Entities, Constitutional Institutions and Public EntitiesDocumento103 páginasTreasury Regulations For Departments, Trading Entities, Constitutional Institutions and Public EntitiesDineo MkeAinda não há avaliações

- Guide To Public Financial ManagementDocumento124 páginasGuide To Public Financial Managementmorisrav23Ainda não há avaliações

- Iraq Economic Monitor Navigating The Perfect Storm Redux PDFDocumento50 páginasIraq Economic Monitor Navigating The Perfect Storm Redux PDFsinan. translationAinda não há avaliações

- Needs Assessment Final 8.22 Print To PDFDocumento124 páginasNeeds Assessment Final 8.22 Print To PDFLacatus OlimpiuAinda não há avaliações

- Program Related Investments: The JFN Edition of The Guide by Mission Investors ExchangeDocumento60 páginasProgram Related Investments: The JFN Edition of The Guide by Mission Investors ExchangeJewish Funders NetworkAinda não há avaliações

- Taxes in SwedenDocumento40 páginasTaxes in SwedenMilanka JurjevicAinda não há avaliações

- Description: Tags: 0203V6TOCDocumento2 páginasDescription: Tags: 0203V6TOCanon-724911Ainda não há avaliações

- Budget Credibility in The Philippines' Health SectorDocumento67 páginasBudget Credibility in The Philippines' Health SectorMike TeeAinda não há avaliações

- Annual Public Debt Management Report 2019-2020Documento59 páginasAnnual Public Debt Management Report 2019-2020Olympus MonsAinda não há avaliações

- Ghana:: Long Term Growth, Atrophy, and RecoveryDocumento126 páginasGhana:: Long Term Growth, Atrophy, and RecoveryAmbright MullerAinda não há avaliações

- Strategic Plan For National Construction Authority White Sands VersionDocumento52 páginasStrategic Plan For National Construction Authority White Sands VersionLucas Adwera100% (3)

- DCA Ethiopia EvaluationDocumento52 páginasDCA Ethiopia EvaluationMetekia TigroAinda não há avaliações

- Summary Sheet - Growth Development Lyst5924Documento59 páginasSummary Sheet - Growth Development Lyst5924swasat duttaAinda não há avaliações

- Budget Manual: First EditionDocumento140 páginasBudget Manual: First EditionKhurram SherazAinda não há avaliações

- Austerity The New Normal Ortiz Cummins 6 Oct 2019Documento78 páginasAusterity The New Normal Ortiz Cummins 6 Oct 2019HiromiIijimaCruzAinda não há avaliações

- Financial Trend Monitoring System: Prepared by The Finance DepartmentDocumento52 páginasFinancial Trend Monitoring System: Prepared by The Finance DepartmentkokiAinda não há avaliações

- Forum On Tax Administration Tax Repayments: Maintaining The Balance Between Refund Service Delivery, Compliance and IntegrityDocumento101 páginasForum On Tax Administration Tax Repayments: Maintaining The Balance Between Refund Service Delivery, Compliance and IntegrityAbuki TemamAinda não há avaliações

- MoH Strategic Plan 2020 - 25Documento188 páginasMoH Strategic Plan 2020 - 25GodwinAinda não há avaliações

- Health System Innovation in Lesotho: Design and Early Operations of The Maseru Public-Private Integrated PartnershipDocumento60 páginasHealth System Innovation in Lesotho: Design and Early Operations of The Maseru Public-Private Integrated PartnershipkemalAinda não há avaliações

- AEU Spring21Documento72 páginasAEU Spring21daniel.prinzAinda não há avaliações

- Object Class Analysis: Office of Management and BudgetDocumento124 páginasObject Class Analysis: Office of Management and BudgetlosangelesAinda não há avaliações

- 2019 Mid-Year Budget Review Final PDFDocumento129 páginas2019 Mid-Year Budget Review Final PDFBrettAinda não há avaliações

- The Civic Federations's Analysis and Recommendation For The Proposed 2019 CPS BudgetDocumento96 páginasThe Civic Federations's Analysis and Recommendation For The Proposed 2019 CPS BudgetRummana HussainAinda não há avaliações

- RPF REPORT - P167897 - Final FordisclosureDocumento137 páginasRPF REPORT - P167897 - Final FordisclosureBertarg71Ainda não há avaliações

- MTDP III Vol. 1Documento114 páginasMTDP III Vol. 1aj ogayonAinda não há avaliações

- Nygb 2019 Business PlanDocumento77 páginasNygb 2019 Business PlanSutanu PatiAinda não há avaliações

- Sweden PensionDocumento62 páginasSweden Pensionnanayaw asareAinda não há avaliações

- EnglishDocumento265 páginasEnglishOpenFileTOAinda não há avaliações

- The AMA of Due DiligencyDocumento85 páginasThe AMA of Due DiligencySanjay Rathi100% (2)

- Annual Report 201819inhouseDocumento436 páginasAnnual Report 201819inhouseDeon Van AardeAinda não há avaliações

- Guidelines On Asset and Liability Management in The Public Sector (2020 Version)Documento127 páginasGuidelines On Asset and Liability Management in The Public Sector (2020 Version)Major General Adekunle AdeyinkaAinda não há avaliações

- TEST-8: Lesson 2 Growth & DevelopmentDocumento58 páginasTEST-8: Lesson 2 Growth & DevelopmentDeepak ShahAinda não há avaliações

- 83rd Annual Report: 1 April 2012-31 March 2013Documento204 páginas83rd Annual Report: 1 April 2012-31 March 2013IoproprioioAinda não há avaliações

- Commonwealth of Pennsylvania Potential Budget Initiatives - McKinseyDocumento79 páginasCommonwealth of Pennsylvania Potential Budget Initiatives - McKinseysto rmAinda não há avaliações

- Business Plan Chopped VeggDocumento36 páginasBusiness Plan Chopped VeggIqra JamalAinda não há avaliações

- Governance Institutional Risks Challenges Nepal ASIAN DEVELOPMENT BANKDocumento130 páginasGovernance Institutional Risks Challenges Nepal ASIAN DEVELOPMENT BANKRanjan KCAinda não há avaliações

- Dbe Annual Report Print Version 27 Sep 09h27Documento294 páginasDbe Annual Report Print Version 27 Sep 09h27Theo MoyoAinda não há avaliações

- My Getting Ready For 1st Grade Math Summer PracticeBook CommoDocumento10 páginasMy Getting Ready For 1st Grade Math Summer PracticeBook CommopenelopegerhardAinda não há avaliações

- Division Worksheet PacketDocumento16 páginasDivision Worksheet Packetpenelopegerhard100% (1)

- 2018 Curriculum Guide CompleteDocumento139 páginas2018 Curriculum Guide Completepenelopegerhard100% (3)

- 20 Things Kids Need To Know To Live Financially Smart Lives: Make ChoicesDocumento1 página20 Things Kids Need To Know To Live Financially Smart Lives: Make ChoicespenelopegerhardAinda não há avaliações

- An Overview of Health Care in The United StatesDocumento1 páginaAn Overview of Health Care in The United StatespenelopegerhardAinda não há avaliações

- Health Insurance I: Health Economics and Private Health InsuranceDocumento1 páginaHealth Insurance I: Health Economics and Private Health InsurancepenelopegerhardAinda não há avaliações

- Social Insurance and RedistributionDocumento1 páginaSocial Insurance and RedistributionpenelopegerhardAinda não há avaliações

- p98 PDFDocumento1 páginap98 PDFpenelopegerhardAinda não há avaliações

- p03 PDFDocumento1 páginap03 PDFpenelopegerhardAinda não há avaliações

- This Page Intentionally Left BlankDocumento1 páginaThis Page Intentionally Left BlankpenelopegerhardAinda não há avaliações

- p99 PDFDocumento1 páginap99 PDFpenelopegerhardAinda não há avaliações

- Rawlsian Social Welfare Function: Choosing An Equity CriterionDocumento1 páginaRawlsian Social Welfare Function: Choosing An Equity CriterionpenelopegerhardAinda não há avaliações

- Equity: Introduction and BackgroundDocumento1 páginaEquity: Introduction and BackgroundpenelopegerhardAinda não há avaliações

- Welfare Implications of Benefit Reductions: The TANF Example ContinuedDocumento1 páginaWelfare Implications of Benefit Reductions: The TANF Example ContinuedpenelopegerhardAinda não há avaliações

- p91 PDFDocumento1 páginap91 PDFpenelopegerhardAinda não há avaliações

- FFY 2023 CalFresh Benefit Issuance TableDocumento61 páginasFFY 2023 CalFresh Benefit Issuance TableMat ElveeeeeeAinda não há avaliações

- Public Policy AdvocacyDocumento23 páginasPublic Policy AdvocacyNONI ZERIMAR100% (1)

- Certificate TemplateDocumento50 páginasCertificate TemplateGilmar BaunAinda não há avaliações

- 7th Grade Civics Eoc Essential Questions Quick GuideDocumento1 página7th Grade Civics Eoc Essential Questions Quick Guideapi-374843811Ainda não há avaliações

- Economics As An Applied ScienceDocumento14 páginasEconomics As An Applied ScienceJamaicka HawiliAinda não há avaliações

- FS 05 2018 0054Documento28 páginasFS 05 2018 0054Yuyun SeptiyaningsihAinda não há avaliações

- Hca-600-Week 4 Assignment - Health Care Policy IssuesDocumento5 páginasHca-600-Week 4 Assignment - Health Care Policy Issuesapi-290742611Ainda não há avaliações

- Baps 09 Block 01Documento51 páginasBaps 09 Block 01Md ShamiAinda não há avaliações

- C4 Fiscal PolicyDocumento6 páginasC4 Fiscal PolicyPhong Lê Trần ĐăngAinda não há avaliações

- List of Institute Including IrmaDocumento4 páginasList of Institute Including Irmadevasish lahkarAinda não há avaliações

- Aug05.2014 Chouse Approves Magna Carta of The PoorDocumento2 páginasAug05.2014 Chouse Approves Magna Carta of The Poorpribhor2Ainda não há avaliações

- Senator Schumer - Federal Aid Request LetterDocumento2 páginasSenator Schumer - Federal Aid Request LetterDaily FreemanAinda não há avaliações

- Invoice 2023Documento2 páginasInvoice 2023Ankit GuptaAinda não há avaliações

- Unit 2 International Marketing PDFDocumento6 páginasUnit 2 International Marketing PDFMuhammad owais FaizAinda não há avaliações

- Public Admini ExamsDocumento24 páginasPublic Admini Examsbwire stephenAinda não há avaliações

- Pro and Cons of Single Payer Health PlanDocumento10 páginasPro and Cons of Single Payer Health PlanHihiAinda não há avaliações

- Research Method - Mihaela ArseneDocumento9 páginasResearch Method - Mihaela ArseneMihaela NistorAinda não há avaliações

- Presentation Communication Strategies 2Documento13 páginasPresentation Communication Strategies 2MarinaAinda não há avaliações

- Dawn + 02 July, 2020 by M.Usman and Rabia KalhoroDocumento25 páginasDawn + 02 July, 2020 by M.Usman and Rabia KalhoromdmsAinda não há avaliações

- SHS 4-Storey Building: Emergency Evacuation PlanDocumento24 páginasSHS 4-Storey Building: Emergency Evacuation PlanJetro BonbonAinda não há avaliações

- Aakash NBTS Test 03 SolutionDocumento8 páginasAakash NBTS Test 03 SolutionVirat ValiAinda não há avaliações

- 2 Story Modified 2019 ElectricalDocumento10 páginas2 Story Modified 2019 ElectricalRoner AbanilAinda não há avaliações

- Objectives: at The End of This Module, The Students Should Be Able ToDocumento3 páginasObjectives: at The End of This Module, The Students Should Be Able ToJanine100% (1)

- PCVL Brgy 1207001Documento14 páginasPCVL Brgy 1207001Yes Tirol DumaganAinda não há avaliações

- FemaDocumento12 páginasFemavinay jodAinda não há avaliações

- HBCI-HBGI Historical FundingDocumento1 páginaHBCI-HBGI Historical FundingWUSA9-TV80% (5)

- Between Politics and Science AssuringDocumento232 páginasBetween Politics and Science AssuringVanessa AbantoAinda não há avaliações

- Department of Education: Republic of The PhilippinesDocumento7 páginasDepartment of Education: Republic of The PhilippinesCasio Karl D.Ainda não há avaliações

- Policy Research in The Context of Diffuse Decision MakingDocumento22 páginasPolicy Research in The Context of Diffuse Decision MakingGabriela YañezAinda não há avaliações

- TripoliDocumento30 páginasTripoliwendel raguindinAinda não há avaliações

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingNo EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingNota: 5 de 5 estrelas5/5 (3)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesNo EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesNota: 4 de 5 estrelas4/5 (9)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProNo EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProNota: 4.5 de 5 estrelas4.5/5 (43)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesAinda não há avaliações

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthAinda não há avaliações

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessNo EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessNota: 5 de 5 estrelas5/5 (5)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideNo EverandTax Savvy for Small Business: A Complete Tax Strategy GuideNota: 5 de 5 estrelas5/5 (1)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyAinda não há avaliações

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessAinda não há avaliações

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyNo EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyNota: 4 de 5 estrelas4/5 (52)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNo EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionAinda não há avaliações

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.No EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.Ainda não há avaliações

- The Payroll Book: A Guide for Small Businesses and StartupsNo EverandThe Payroll Book: A Guide for Small Businesses and StartupsNota: 5 de 5 estrelas5/5 (1)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)No EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Nota: 4.5 de 5 estrelas4.5/5 (43)

- Tax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfNo EverandTax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfNota: 5 de 5 estrelas5/5 (1)

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesNo EverandThe Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesAinda não há avaliações

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesNo EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesNota: 3 de 5 estrelas3/5 (3)

- Beyond Frontiers: U.S. Taxes for International Self-Published AuthorsNo EverandBeyond Frontiers: U.S. Taxes for International Self-Published AuthorsNota: 1 de 5 estrelas1/5 (1)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNo EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNota: 4 de 5 estrelas4/5 (5)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionNo EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionNota: 5 de 5 estrelas5/5 (27)

![The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties](https://imgv2-2-f.scribdassets.com/img/audiobook_square_badge/711600370/198x198/d63cb6648d/1712039797?v=1)