Escolar Documentos

Profissional Documentos

Cultura Documentos

Documentacion de Swift

Enviado por

Polanco Monero Lucía0 notas0% acharam este documento útil (0 voto)

97 visualizações6 páginasEl documento describe la estructura básica de un mensaje SWIFT que consta de 5 bloques. El bloque de encabezado básico incluye el número de sesión y secuencia. El bloque de encabezado de aplicación incluye el tipo de mensaje, prioridad y período de obsolescencia. El bloque de usuario contiene un código de prioridad bancaria y referencia del usuario. El bloque de texto incluye campos para la fecha, moneda, monto, cuentas y detalles adicionales. El quinto y último bloque es el

Descrição original:

uju

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoEl documento describe la estructura básica de un mensaje SWIFT que consta de 5 bloques. El bloque de encabezado básico incluye el número de sesión y secuencia. El bloque de encabezado de aplicación incluye el tipo de mensaje, prioridad y período de obsolescencia. El bloque de usuario contiene un código de prioridad bancaria y referencia del usuario. El bloque de texto incluye campos para la fecha, moneda, monto, cuentas y detalles adicionales. El quinto y último bloque es el

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

97 visualizações6 páginasDocumentacion de Swift

Enviado por

Polanco Monero LucíaEl documento describe la estructura básica de un mensaje SWIFT que consta de 5 bloques. El bloque de encabezado básico incluye el número de sesión y secuencia. El bloque de encabezado de aplicación incluye el tipo de mensaje, prioridad y período de obsolescencia. El bloque de usuario contiene un código de prioridad bancaria y referencia del usuario. El bloque de texto incluye campos para la fecha, moneda, monto, cuentas y detalles adicionales. El quinto y último bloque es el

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 6

Documentacion de swift

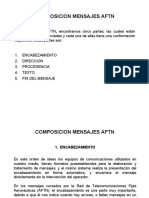

El mensaje Swift consiste en 4 o 5 partes basicamente:

Basic Header Block o Bloque cabecera basico

Esta es la parte 1 la cual tiene como subpartes:

a) Block ID:

Este siempre sera igual a 1 ya que es el primer bloque.

Ejemplo: {1: }

b) Aplication ID:

F = FIN (Financial application (aplicacion finanicier))

A = GPA (General purpose application (aplicacion

para propositos generales)

L = GPA (General purpose application (Para logins, y

asi sucesivamente)

Ejemplo: {1:F}

c) Service ID:

01 = FIN/GPA

21 = ACK/NAK (Acknowledge (acuse de recibo) /Not

acknowledge (acuse de recibo negativo))

Ejemplo: {1:F01}

d) Logical terminal (LT) (Entidad por lo cual un usuario recibe

y manda un FIN message)

Ejemplo:

e) 2222 = Session number. It is generated by the user's

computer and is padded with zeros.

f) 123456 = Sequence number that is generated by the user's

computer. It is padded with zeros.

{2: Application Header Block}

Esta es la parte 2 la cual tiene como subpartes:

a) Block ID:

Este siempre sera igual a 1 ya que es el primer bloque.

Ejemplo: {2: }

b) I||O -> Informs you that youre in Input mode (i.e. the

Sender), O would indicate Output mode so you would be

the recipient of the message

c) Message type

Ejemplo:{3:I103}

d) Receiver's address with X in position 9/ It is padded

with Xs if no branch is required.

Ejemplo: {3:I103BANKDEFFXXXX }

e) U = the message priority as follows:

S = System

N = Normal

U = Urgent

Ejemplo: {3:I103BANKDEFFXXXXU }

f) 3 = Delivery monitoring field is as follows:

1 = Non delivery warning (MT010)

2 = Delivery notification (MT011)

3 = Both valid = U1 or U3, N2 or N

g) 003 = Obsolescence period. It specifies when a non-

delivery notification is generated as follows:

Valid for U = 003 (15 minutes)

Valid for N = 020 (100 minutes)

h)

{3: User Header Block}

a) 3: = Block ID (always 3)

b) 113:xxxx = Optional banking priority code

c) This is the Message User Reference (MUR) used by

applications for reconciliation with ACK.

Ejemplos: {3: {113:xxxx} {108:abcdefgh12345678}

}

{4: Text Block or body}

a) {4: \r\n (CRLF --> CR (retorno de carro) y LF (salto de

lnea)

b) Campo 20 Sender reference

00028

c) Campo 23B Bank Operation Code

Ejemplo: CRED||..

d) Campo 32A : Value Date, Currency Code, Amt

Fecha: YYMMDD

Divisa: USD|| DOP||EUR

MONTO: 0000,00 (es con coma)

Ejemplo: 32A:000612USD5443,99

e) Campo 50k: Account, name, address format

Cuenta del usuario

Nombre del usuario

Direccion??

i. Ejemplo: 50K: 133122111 //Primera la linea

i. Puesto del Bolsa //Segun

f) Campo 54 Receiver's Correspondent (Bank)

BIC {codigo)

g) Campo 59 cliente beneficiario:

Account (Cuenta en BCRD entidad receptora)

Nombre de la entidad receptora

Cedula /RNC/Pasaporte

Address 2

Address 3

Country

Ejemplo:

i.

h) Campo 71A :Details of Charges

BEN, means you do not pay any charge

SHA (shared) means you only pay your bank's outgoing transfer charge

OUR means you pay all transfer charges

i) Campo 72 sender to receiver info (detalles adicionales

para quien recibe el mensake)

ACC Instructions following are for the account with

institution.

INS The institution which instructed the Sender to

execute the transaction.

INT Instructions following are for the intermediary

institution.

REC Instructions following are for the Receiver of

the message.

Nota: Codes must be placed between slashes and at the beginning of a

line. Additional explanatory information, which may be continued in the

next lines, is preceded by a double slash '//'.

Ejemplo:

i. /REC/**TP//<Mas detalles>

**TP = Transferencia Puesto de Bolsa

{5: Trailer Block}

Você também pode gostar

- Guía de Remisión Remitente XML 2.1Documento32 páginasGuía de Remisión Remitente XML 2.1Mario Lopez50% (2)

- Pedimento Aduanal: Manual práctico para su elaboraciónNo EverandPedimento Aduanal: Manual práctico para su elaboraciónNota: 5 de 5 estrelas5/5 (1)

- S12.s2-Lab-Comunicaciones TCP y UDPDocumento8 páginasS12.s2-Lab-Comunicaciones TCP y UDPCyntia peredaAinda não há avaliações

- 01.05 Plan de Desvios y Mantenimiento de TransitoDocumento6 páginas01.05 Plan de Desvios y Mantenimiento de Transitocarlos100% (1)

- Q 931Documento9 páginasQ 931Gerardo AgonizanteAinda não há avaliações

- Iso 8583Documento12 páginasIso 8583Carlos MandujanoAinda não há avaliações

- ISO 8583 EsDocumento19 páginasISO 8583 Eswilliam culi gabrielAinda não há avaliações

- Trabajo Final de PythonDocumento13 páginasTrabajo Final de PythonJose Luis Hurtado Cova0% (1)

- ISO8583Documento9 páginasISO8583geopoAinda não há avaliações

- Efecto PU-RDSIDocumento13 páginasEfecto PU-RDSIMoni Fue FarraAinda não há avaliações

- Iso8583 ResumenDocumento9 páginasIso8583 Resumendamahoj412Ainda não há avaliações

- Deteccion de Errores en Redes WifiDocumento19 páginasDeteccion de Errores en Redes WifisopencoAinda não há avaliações

- Bloques FuncionalesDocumento10 páginasBloques FuncionalesAlexis Javier Hernandez VelázquezAinda não há avaliações

- Manual EDI Desde Menu WediDocumento41 páginasManual EDI Desde Menu Wediotracuentaaux4Ainda não há avaliações

- Protocolo de Enlace de Tres ViasDocumento12 páginasProtocolo de Enlace de Tres ViasmeibismavoAinda não há avaliações

- Sesion 11 Mensaje AftnDocumento16 páginasSesion 11 Mensaje AftncontroladoraereoAinda não há avaliações

- Detector de Errores InformeDocumento3 páginasDetector de Errores InformeVanechka PaterninaAinda não há avaliações

- Detección de Errores y Códigos de Corrección D ADocumento6 páginasDetección de Errores y Códigos de Corrección D AArtur Faby Jimenez BonillaAinda não há avaliações

- Codificador CmiDocumento14 páginasCodificador CmiMichael Bernal PerezAinda não há avaliações

- Mfcr2 Asterisk UnicallDocumento10 páginasMfcr2 Asterisk UnicallFreddy ContrerasAinda não há avaliações

- Paso3 Grupo29 Wilson ReinaDocumento18 páginasPaso3 Grupo29 Wilson ReinaKatterin HoyosAinda não há avaliações

- Course SS-7 PDFDocumento23 páginasCourse SS-7 PDFtibisandresAinda não há avaliações

- Protocolo de Comunicación Rfid CR10MWDocumento9 páginasProtocolo de Comunicación Rfid CR10MWPatin PeñaherreraAinda não há avaliações

- Programacion de Sistemas Digitales Con VHDLDocumento35 páginasProgramacion de Sistemas Digitales Con VHDLNicolas CastilloAinda não há avaliações

- Fase 3 Cristian Ruiz SDocumento12 páginasFase 3 Cristian Ruiz SCristian RuizAinda não há avaliações

- 02 Fundamentos CDocumento56 páginas02 Fundamentos Cdavizinho5Ainda não há avaliações

- Reprint From MFA-0000-000000Documento2 páginasReprint From MFA-0000-000000Adrian MacayaAinda não há avaliações

- Señalización CASDocumento8 páginasSeñalización CASJeison Sanchez MaciasAinda não há avaliações

- Entradas y Salidas DigitalesDocumento13 páginasEntradas y Salidas DigitaleskeyMaster menAinda não há avaliações

- Comunicación de TCP y UdpDocumento6 páginasComunicación de TCP y UdpTumblin OrangeAinda não há avaliações

- Actividad de Repaso Del Tema Lenguaje Grafico VHDL2.0 (1) 1Documento11 páginasActividad de Repaso Del Tema Lenguaje Grafico VHDL2.0 (1) 1XimenaAinda não há avaliações

- Formatos de Comunicación para Centrales de MonitoreoDocumento2 páginasFormatos de Comunicación para Centrales de MonitoreoMarcelo0% (1)

- Documentación Del Desarrollo de Facturación ElectrónicaDocumento3 páginasDocumentación Del Desarrollo de Facturación ElectrónicaChristian Yataco TasaycoAinda não há avaliações

- Decodificadores Multiplexores DemultiplexoresDocumento10 páginasDecodificadores Multiplexores Demultiplexoreslgrome73Ainda não há avaliações

- Solucion Taller1Documento10 páginasSolucion Taller1angelica eliana leon galloAinda não há avaliações

- Entrada y Salida de Datos en C++Documento3 páginasEntrada y Salida de Datos en C++Evelyn PaucarAinda não há avaliações

- Compilador CCS y Proteus 1er ResumenDocumento34 páginasCompilador CCS y Proteus 1er ResumenEmmanuel AlvizAinda não há avaliações

- Programacion en C 2da ParteDocumento10 páginasProgramacion en C 2da ParterickypinaAinda não há avaliações

- Unidad 8, Nivel IntermedioDocumento6 páginasUnidad 8, Nivel IntermedioliiaangaarciaAinda não há avaliações

- Principio de Multiplexado DUOC UCDocumento86 páginasPrincipio de Multiplexado DUOC UCfrancisco1938Ainda não há avaliações

- Solucion Taller1Documento10 páginasSolucion Taller1angelica eliana leon galloAinda não há avaliações

- Codificadores y DecodificadoresDocumento38 páginasCodificadores y Decodificadoreszoru_hatakeAinda não há avaliações

- Practicas en CDocumento18 páginasPracticas en CJaime SabinesAinda não há avaliações

- Cocomo IiDocumento7 páginasCocomo IiEmiliano TorresAinda não há avaliações

- Cliente Servidor TCP IPDocumento7 páginasCliente Servidor TCP IPcayetanojcmAinda não há avaliações

- Paso Mensajes Handout 6Documento7 páginasPaso Mensajes Handout 6Janet Silva GarciaAinda não há avaliações

- Decodificando IEC 61850, Informes y Bloques de Control de Reportes Axon GroupDocumento1 páginaDecodificando IEC 61850, Informes y Bloques de Control de Reportes Axon Groupadgar15Ainda não há avaliações

- Informe TXDocumento13 páginasInforme TXeduardo gordonAinda não há avaliações

- Libreria LCD Printf y SprintfDocumento4 páginasLibreria LCD Printf y Sprintfjhon alexAinda não há avaliações

- Diseno Procesador 4 BitsDocumento5 páginasDiseno Procesador 4 BitsSantos GarzaAinda não há avaliações

- Errores de Dev CDocumento18 páginasErrores de Dev CJeska_AmaterasuAinda não há avaliações

- E1 Cas MFC r2 TriohmtecDocumento34 páginasE1 Cas MFC r2 TriohmtecAntonio SainzAinda não há avaliações

- Pro Ats 03Documento57 páginasPro Ats 03Aeronautic BoyAinda não há avaliações

- Practica 9Documento103 páginasPractica 9JacobaOlivanAinda não há avaliações

- Lab 14 Cliente Servidor TCP IPDocumento6 páginasLab 14 Cliente Servidor TCP IPRubenPerezAinda não há avaliações

- S12 s2 SCD Material - Codigo Convolucionales 2023-2Documento15 páginasS12 s2 SCD Material - Codigo Convolucionales 2023-2neointelperu.backofficeAinda não há avaliações

- Coria Rodrigo PracticaOrganizacionyArquitecturaDocumento9 páginasCoria Rodrigo PracticaOrganizacionyArquitecturaRodrigo CoriaAinda não há avaliações

- Practica 2 Adq DatosDocumento3 páginasPractica 2 Adq Datos10malgamerAinda não há avaliações

- Instalaciones de telefonía y comunicación interior. ELES0108No EverandInstalaciones de telefonía y comunicación interior. ELES0108Ainda não há avaliações

- Mantenimiento de redes eléctricas aéreas de baja tensión. ELEE0109No EverandMantenimiento de redes eléctricas aéreas de baja tensión. ELEE0109Ainda não há avaliações

- Creación de contratos inteligentes en la Red Blockchain de Ethereum con SolidityNo EverandCreación de contratos inteligentes en la Red Blockchain de Ethereum con SolidityAinda não há avaliações

- Microeconomia Parkin Cap 9Documento17 páginasMicroeconomia Parkin Cap 9Polanco Monero Lucía0% (2)

- Segunda PrácticaDocumento4 páginasSegunda PrácticaPolanco Monero LucíaAinda não há avaliações

- Mensajes Swift Por Sistema LBTRDocumento5 páginasMensajes Swift Por Sistema LBTRPolanco Monero LucíaAinda não há avaliações

- Ejercicios de Sapag Y SapagDocumento15 páginasEjercicios de Sapag Y SapagPolanco Monero LucíaAinda não há avaliações

- Caso I, Investigacion en IngenieriaDocumento6 páginasCaso I, Investigacion en IngenieriaPolanco Monero LucíaAinda não há avaliações

- Rit CorpsicDocumento26 páginasRit CorpsicRenzoGarciaEstebanAinda não há avaliações

- Plan de Área Inglés Grado 8°Documento1 páginaPlan de Área Inglés Grado 8°Diana Alejandra Sanchez PeraltaAinda não há avaliações

- Trabajo en EquipoDocumento12 páginasTrabajo en EquipoFelipe Trujillo GomezAinda não há avaliações

- Guía Práctica Del Ordenamiento Territorial en ColombiaDocumento3 páginasGuía Práctica Del Ordenamiento Territorial en ColombiaNicole Adalis Perez Martinez100% (1)

- Manual de Propedeutico TSU Matematicas PDFDocumento42 páginasManual de Propedeutico TSU Matematicas PDFOmar Jesús Lopez FelixAinda não há avaliações

- Modelo Productivo SocialistaDocumento4 páginasModelo Productivo SocialistamariaAinda não há avaliações

- Estado Situacional Diciembre 2021Documento11 páginasEstado Situacional Diciembre 2021Centro de Altos Estudios y Desarrollo ProfesionalAinda não há avaliações

- 8753 - Guia 1 Tercer Periodo Ciencias Economicas UndecimoDocumento4 páginas8753 - Guia 1 Tercer Periodo Ciencias Economicas UndecimoEco VidaAinda não há avaliações

- Problemas PPL1Documento2 páginasProblemas PPL1RG RonyAinda não há avaliações

- Subdivisiones de Pomatantas y DemasDocumento10 páginasSubdivisiones de Pomatantas y DemasLucas Castrejon JulcaAinda não há avaliações

- Curso de Ing. Economica Excel 2015Documento164 páginasCurso de Ing. Economica Excel 2015Jose Pablo Chavez Paucar100% (1)

- Dinamica de Fluidos Unidad IIDocumento65 páginasDinamica de Fluidos Unidad IICarlos Zamora50% (2)

- Apu Partidas NuevasDocumento51 páginasApu Partidas NuevasMaguiber ChvAinda não há avaliações

- Norma General Técnica #199 Sobre Esterilización y Desinfección de Alto Nivel y Uso de Artículo Médicos EstérilesDocumento26 páginasNorma General Técnica #199 Sobre Esterilización y Desinfección de Alto Nivel y Uso de Artículo Médicos EstérilesJoel Cruz NeciosupAinda não há avaliações

- Convocatoria Capítulos de Libro - AsterraDocumento4 páginasConvocatoria Capítulos de Libro - AsterragramarianiAinda não há avaliações

- Percepcion Visual PorterosDocumento17 páginasPercepcion Visual Porterosjuanjoromi100% (1)

- Sistema de Tres EcuacionesDocumento33 páginasSistema de Tres EcuacionesyoandrisAinda não há avaliações

- Brochure GecolsaDocumento12 páginasBrochure GecolsaluisferAinda não há avaliações

- Vdocuments - MX Teoria Intuitiva de Conjuntos 8a Ed Paul R Halmos 568c0d720f5e8 2Documento134 páginasVdocuments - MX Teoria Intuitiva de Conjuntos 8a Ed Paul R Halmos 568c0d720f5e8 2arturohcuervo100% (1)

- 2 Liporace Resumen PsicometricasDocumento30 páginas2 Liporace Resumen PsicometricasCarla GragnoliAinda não há avaliações

- Dia Del IdiomaDocumento4 páginasDia Del IdiomaJogherson VillarAinda não há avaliações

- Gonzalez Juan MicroDocumento3 páginasGonzalez Juan MicroJuan GlezAinda não há avaliações

- Ensayo de La Gorda.2pdfDocumento5 páginasEnsayo de La Gorda.2pdfJan Oswaldo Juarez OrganistaAinda não há avaliações

- Fracturas Causales y La ConcausaDocumento2 páginasFracturas Causales y La ConcausaAlipio Chanca Coquil100% (1)

- Sned Periodo 2022-2023Documento14 páginasSned Periodo 2022-2023Victor FigueroaAinda não há avaliações

- Cotización Providencia - MD IIDocumento2 páginasCotización Providencia - MD IIAngel SisoAinda não há avaliações

- 1nGuiandenAprendizajenGestinnnndenIncidentes 42602c27800c8eaDocumento8 páginas1nGuiandenAprendizajenGestinnnndenIncidentes 42602c27800c8eaCamila Marquez GutierrezAinda não há avaliações

- Pablollumiluisa Estadística 7Documento7 páginasPablollumiluisa Estadística 7Pablo Llumiluisa100% (1)

- Mapa Conceptual de Riesgos QuimicosDocumento1 páginaMapa Conceptual de Riesgos QuimicosNiver Marquez SarmientoAinda não há avaliações