Escolar Documentos

Profissional Documentos

Cultura Documentos

How To Write A Great Business Plan

Enviado por

Ricardo AhumadaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

How To Write A Great Business Plan

Enviado por

Ricardo AhumadaDireitos autorais:

Formatos disponíveis

Business Plan

4interdependent factors critical to every new venture:

1. The People. The men and women starting and running the venture, as well as the outside

parties providing key services or important resources for it, such as its lawyers, accountants,

and suppliers.

What has the team done in the past that would suggest it would be successful in the future, and so

on?

experienced, energetic managerial team from the top to the bottom worked successfully together

in the past.

2. The Opportunity. A profile of the business itself what it will sell and to whom, whether

the business can grow and how fast, what its economics are, who and what stand in the way

of success.

product or service should be fully analyzed in terms of its opportunity and context.

an attractive, sustainable business modelcompetitive edge and defend it.

3. The Context. The big picture the regulatory environment, interest rates, demographic

trends, inflation, and the like basically, factors that inevitably change but cannot be

controlled by the entrepreneur.

context is favorable with respect to both the regulatory and the macroeconomic environments.

4. Risk and Reward. An assessment of everything that can go wrong and right, and a

discussion of how the entrepreneurial team can respond.

Risk is understood, and the team has considered ways to mitigate the impact of difficult events.

.ideas are a dime a dozen: only execution skills count!

The People

Thats where most intelligent investors focus their attention.

First, because without the right team,

none of the other parts really matters.

What do they know?

Whom do they know? Who Are These People, Anyway?

How well are they known? Fourteen Personal Questions Every Business Plan Should

Answer

1. Where are the founders from?

Should candidly describe each 2. Where have they been educated?

3. Where have they worked and for whom?

team members knowledge of the 4. What have they accomplished professionally and personally

new ventures type of product or in the past?

service; 5. What is their reputation within the business community?

6. What experience do they have that is directly relevant to

its production processes;

the opportunity they are pursuing ?

and the market itself, from 7. What skills, abilities, and knowledge do they have?

competitors to customers. 8. How realistic are they about the ventures chances for

It also helps to indicate whether success and the tribulations it will face ?

9. Who else needs to be on the team?

the team members have worked 10.Are they prepared to recruit high-quality people?

together before. 11.How will they respond to adversity?

12.Do they have the mettle to make the inevitable hard

choices that have to be made ?

Talk about the people 13.How committed are they to this venture?

14.What are their motivations?

exhaustively.

The Opportunity

Try hard to identify high-growth-potential markets early in their evolution:

thats where the big payoffs are.

Is the total market for the

ventures product or service large,

rapidly growing, or both? The Opportunity of a Lifetime or Is It?

Is the industry now, or can it Nine Questions About the Business Every Business Plan

become, structurally attractive? Should Answer

1. Who is the new ventures customer?

1. Make sure they are entering an 2. How does the customer make decisions about buying this

industry that is large and/or growing, product or service?

and one thats structurally attractive. 3. To what degree is the product or service a compelling

2. Make sure their business plan purchase for the customer?

rigorously describes how this is the 4. How will the product or service be priced?

case. If it isnt the case, their business 5. How will the venture reach all the identified customer

segments?

plan needs to specify how the

6. How much does it cost (in time and resources) to acquire a

venture will still manage to make customer?

enough of a profit. 7. How much does it cost to produce and deliver the product

3. How the company will build and or service?

launch its product or service into the 8. How much does it cost to support a customer?

marketplace. 9. How easy is it to retain a customer?

4. Demonstrate that careful

consideration has been given to the

new ventures pricing scheme.

The Opportunity II

Whatever the reason, better mousetrap businesses have an uncanny way of

malfunctioning.

1. Demonstrate and analyze

how an opportunity can grow Cash flow implications of pursuing an

how the new venture can opportunity

expand its range of products or

services, customer base, or 1. When does the business have to buy resources, such as

geographic scope. supplies, raw materials, and people?

How wont fall into some 2. When does the business have to pay for them?

common opportunity traps. 3. How long does it take to acquire a customer?

4. How long before the customer sends the business a check?

5. How much capital equipment is required to support a dollar

of sales?

About Competition

1. Who are the new ventures current competitors?

2. What resources do they control?

3. What are their strengths and weaknesses?

Business is like chess: 4. How will they respond to the new ventures decision to

enter the business?

to be successful, you 5. How can the new venture respond to its competitors

response?

must anticipate several 6. Who else might be able to observe and exploit the same

opportunity?

moves in advance. 7. Are there ways to co-opt potential or actual competitors

by forming alliances?

The Context

1. The macroeconomic

environment

Level of economic activity, inflation,

exchange rates, and interest rates.

2. The wide range of government

Every business plan should contain certain

rules and regulations

that affect the opportunity and how pieces of evidence related to context

resources are marshaled to exploit

it. 1. Should show a heightened awareness of the new ventures

context and how it helps or hinders their specific proposal.

3. Factors like technology

2. Demonstrate they know the ventures context will

that define the limits of what a

inevitably change and describe how those changes might

business or its competitors can

affect the business.

accomplish.

3. Should spell out what management can (and will) do in the

event the context grows unfavorable.

4. Should explain the ways (if any) in which management can

affect context in a positive way.

Risk and Reward

Best business plans are like movies of the future

1. They show the people, the

opportunity, and the context

from multiple angles.

2. They offer a plausible, coherent It means that the plan must unflinchingly

story of what lies ahead. confront the risks ahead

3. They unfold possibilities of action

and reaction. 1. What happens if one of the new ventures leaders leaves?

4. Discuss people, opportunity, and 2. What happens if a competitor responds with more ferocity

than expected?

context as a moving target. 3. What happens if there is a revolution in Namibia, the

All three factors (and the source of a key raw material? What will management

relationship among them) are likely actually do?

to change over time as a company 4. How will the investor eventually get money out of the

evolves from start-up to ongoing business, assuming it is successful, even if only marginally

enterprise. so?

5. Graphs: IPOable, Can the company be taken public at some

amount of money needed to launch the point in the future?

new venture, time to positive cash flow, wide range of exit options.

and the expected magnitude of the payoff.

the range of possible returns and the

likelihood of achieving them.

True entrepreneurs want to capture all the reward and

give all the risk to others.

The Deal and Beyond

From whom you raise capital is often more important than the terms.

1. Unsophisticated investors panic, get angry,

and often refuse to advance the company

more money.

2. Sophisticated investors, by contrast, roll up

their sleeves and help the company solve sensible deals have the following six

its problems.

3. Often, theyve had lots of experience characteristics:

saving sinking ships.

4. They are typically process literate. 1. They are simple.

5. They understand how to craft a sensible 2. They are fair.

business strategy and a strong tactical 3. They emphasize trust rather than legal ties.

plan. 4. They do not blow apart if actual differs slightly from plan.

6. They know how to recruit, compensate, 5. They do not provide perverse incentives that will cause one

and motivate team members. or both parties to behave destructively.

7. They are also familiar with the Byzantine 6. They are written on a pile of papers no greater than one-

ins and outs of going public an event most quarter inch thick.

entrepreneurs face but once in a lifetime.

8. This kind of know-how is worth the money

needed to buy it.

New ventures are inherently risky, as Ive noted; what can go

wrong will

The Deal and Beyond II

capital acquisition as a dynamic process

1. treat the new venture as a series of

experiments.

Before launching the whole show,

launch a little piece of it.

Convene a focus group to test the Beware the Albatross

product, build a prototype and

watch it perform, conduct a regional

or local rollout of a service. Such an

exercise reveals the true economics 1. a business plan must be a call for action

of the business and can help 2. fix what is broken proactively and in real time.

enormously in determining how 3. Risk management is the key, always tilting the venture in

much money the new venture favor of reward and away from risk.

actually requires and in what stages. 4. A plan must demonstrate mastery of the entire

Entrepreneurs should raise enough, entrepreneurial process, from identification of opportunity

and investors should invest enough, to harvest.

capital to fund each major

experiment. Experiments,

Among the many sins committed by business plan writers is

arrogance.

Business Model

that shows the entrepreneurial team has thought through the

key drivers to success or failure.

In manufacturing

yield on a production process

In magazine publishing

the anticipated renewal rate

In software

the impact of using various distribution channels.

break-even issue: At what level of sales does the business begin to make a profit? And

even more important, When does cash flow turn positive?

Tracking

How is the ENTREPRENEURS new venture doing relative to

projections?

What decisions has the team made in response to new

information?

Have changes in the context made additional funding

necessary?

How could the team have predicted those changes?

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Selected Tax Issues Involving Blank Check CompaniesDocumento21 páginasSelected Tax Issues Involving Blank Check Companiesph.alvinAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Conference Program Version1Documento10 páginasConference Program Version1glenfieldgroupAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Azcis Interests Based Assessment Results ReflectionDocumento5 páginasAzcis Interests Based Assessment Results Reflectionapi-322248033Ainda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Potentials and Challenges of Blockchain Application in FinTech in The Developing Countries - A Mauritius ExperienceDocumento7 páginasThe Potentials and Challenges of Blockchain Application in FinTech in The Developing Countries - A Mauritius ExperienceThe IjbmtAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Technology Entrepreneurship Today Trends, Opportunities, Challenges-20230619123645Documento33 páginasTechnology Entrepreneurship Today Trends, Opportunities, Challenges-20230619123645kaisario damar ihsaniAinda não há avaliações

- ItsTime EbookDocumento365 páginasItsTime EbookPelatihan Terus100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Bimtech Noida Placement Cover ReportDocumento68 páginasBimtech Noida Placement Cover ReportBimtech CollegeAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Entrepreneurship For Freshman Individual, and Group AssignmentDocumento16 páginasEntrepreneurship For Freshman Individual, and Group Assignmenttedy yidegAinda não há avaliações

- MBA Brochure 2011 - 12 (48th Batch)Documento50 páginasMBA Brochure 2011 - 12 (48th Batch)Saad Bin AslamAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- Business Opportunities in The CommunityDocumento14 páginasBusiness Opportunities in The CommunityTeacher AnnaAinda não há avaliações

- Child Relief and You-Cry (India) : A Case StudyDocumento40 páginasChild Relief and You-Cry (India) : A Case StudySynergos InstituteAinda não há avaliações

- BDA 31203 Notes (Student Version - Printable) Sem II 2017 - 2018Documento10 páginasBDA 31203 Notes (Student Version - Printable) Sem II 2017 - 2018Mohd AzriAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Wooden Furniture - GujratDocumento11 páginasWooden Furniture - GujratMehdiAinda não há avaliações

- Module 1 - (2) Common and Core CompetenciesDocumento22 páginasModule 1 - (2) Common and Core CompetenciesnissamagbagoAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- CPP - Lesson PlanDocumento7 páginasCPP - Lesson Plan29blinkGacha mishameAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- SM Unit IV &VDocumento106 páginasSM Unit IV &VKarthick MuruganAinda não há avaliações

- Book of Proceedings EsdBaku2021 OnlineDocumento1.224 páginasBook of Proceedings EsdBaku2021 OnlineDiana Pintea100% (1)

- BOM ProjectDocumento22 páginasBOM ProjectHarshita DhamijaAinda não há avaliações

- Summit Partners 2011Documento20 páginasSummit Partners 2011Colin MisteleAinda não há avaliações

- SMALL BUSINESS FUNDAMENTALSDocumento56 páginasSMALL BUSINESS FUNDAMENTALSAhmed HonestAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Entrepreneurship and Business: Mrs. Desiree T. CastilloDocumento11 páginasEntrepreneurship and Business: Mrs. Desiree T. CastilloJKcristovalAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Virgin Group Case StudyDocumento2 páginasVirgin Group Case Studytej_doradoAinda não há avaliações

- Net Impact - Business As UNusual 2011Documento349 páginasNet Impact - Business As UNusual 2011Tameron EatonAinda não há avaliações

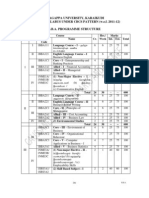

- Alagappa University, Karaikudi Revised Syllabus Under Cbcs Pattern (W.E.F. 2011-12) B.B.A. Programme StructureDocumento23 páginasAlagappa University, Karaikudi Revised Syllabus Under Cbcs Pattern (W.E.F. 2011-12) B.B.A. Programme StructureMathan NaganAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- NVCA Yearbook 2011 FinalDocumento115 páginasNVCA Yearbook 2011 FinalGreg DraconAinda não há avaliações

- Art. Key Decisions and Changes Inter. Small Bussines PDFDocumento21 páginasArt. Key Decisions and Changes Inter. Small Bussines PDFjcgarriazoAinda não há avaliações

- Social Science 106Documento9 páginasSocial Science 106Frederick W GomezAinda não há avaliações

- Entrepreneurial Finance 5th Edition Leach Solutions ManualDocumento25 páginasEntrepreneurial Finance 5th Edition Leach Solutions ManualRandyLittlekcrg100% (53)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Entrepreneurship: Mr. Ibrahim Mohamed Ali Bba, Mba (HRM) Human Resource Director Hormuud University Mogadishu-SomaliaDocumento24 páginasEntrepreneurship: Mr. Ibrahim Mohamed Ali Bba, Mba (HRM) Human Resource Director Hormuud University Mogadishu-SomaliaAbduahi asadAinda não há avaliações

- Entrep Lesson 2Documento4 páginasEntrep Lesson 2Rose Marie SalazarAinda não há avaliações