Escolar Documentos

Profissional Documentos

Cultura Documentos

Debt Ratio For Industry

Enviado por

Younity0 notas0% acharam este documento útil (0 voto)

139 visualizações6 páginasTítulo original

Debt Ratio for Industry

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

XLS, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato XLS, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

139 visualizações6 páginasDebt Ratio For Industry

Enviado por

YounityDireitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato XLS, PDF, TXT ou leia online no Scribd

Você está na página 1de 6

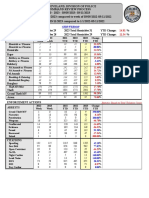

Industry Name Number of Firms MV Debt Ratio BV Debt Ratio Effective Tax Rate

Advertising 36 42.11% 59.46% 13.01%

Aerospace/Defense 67 18.66% 43.95% 20.05%

Air Transport 44 41.43% 72.93% 17.63%

Apparel 56 19.10% 35.30% 16.54%

Auto & Truck 22 60.70% 80.87% 13.25%

Auto Parts 54 33.88% 49.16% 12.09%

Bank 481 66.47% 69.25% 17.50%

Bank (Canadian) 7 14.12% 26.06% 14.94%

Bank (Midwest) 39 52.50% 62.43% 20.65%

Beverage 41 14.47% 48.93% 12.12%

Biotechnology 121 12.88% 36.23% 4.46%

Building Materials 53 45.59% 50.61% 14.56%

Cable TV 24 46.01% 63.26% 21.86%

Canadian Energy 10 23.58% 37.94% 26.99%

Chemical (Basic) 17 16.92% 41.87% 21.59%

Chemical (Diversified) 31 16.56% 42.71% 20.84%

Chemical (Specialty) 97 22.49% 46.75% 12.86%

Coal 21 19.15% 51.47% 13.15%

Computer Software/Svc 333 5.32% 22.15% 10.12%

Computers/Peripherals 129 9.86% 34.33% 8.65%

Diversified Co. 121 58.12% 74.94% 18.93%

Drug 337 11.18% 29.66% 5.62%

E-Commerce 56 8.04% 25.93% 13.50%

Educational Services 38 6.73% 27.51% 24.06%

Electric Util. (Central) 23 50.71% 60.94% 32.27%

Electric Utility (East) 24 43.10% 57.38% 33.77%

Electric Utility (West) 14 47.37% 55.58% 32.45%

Electrical Equipment 87 14.46% 32.38% 14.07%

Electronics 183 20.87% 30.75% 10.63%

Entertainment 95 36.23% 47.74% 11.78%

Entertainment Tech 35 10.49% 17.27% 6.28%

Environmental 91 33.07% 55.29% 14.27%

Financial Svcs. (Div.) 296 75.31% 88.93% 16.53%

Food Processing 121 22.67% 50.28% 17.29%

Foreign Electronics 9 22.55% 25.64% 10.71%

Funeral Services 5 36.11% 52.95% 24.34%

Furn/Home Furnishings 35 27.82% 39.25% 17.48%

Healthcare Information 33 11.95% 40.62% 17.80%

Heavy Construction 14 7.05% 13.04% 33.76%

Homebuilding 28 50.58% 59.34% 1.42%

Hotel/Gaming 74 46.21% 65.30% 12.93%

Household Products 23 18.28% 45.33% 24.87%

Human Resources 30 11.64% 22.92% 23.63%

Industrial Services 168 25.35% 49.51% 17.89%

Information Services 29 19.14% 37.67% 19.37%

Insurance (Life) 31 26.91% 35.39% 22.47%

Insurance (Prop/Cas.) 85 19.38% 21.99% 15.68%

Internet 239 2.23% 10.92% 5.94%

Investment Co. 19 37.21% -177.78% 0.00%

Investment Co.(Foreign 16 8.58% 12.57% 2.10%

Machinery 130 31.88% 53.73% 20.41%

Manuf. Housing/RV 15 3.83% 5.74% 14.80%

Maritime 53 61.47% 64.19% 9.70%

Medical Services 162 30.12% 46.56% 18.84%

Medical Supplies 264 10.20% 28.22% 11.24%

Metal Fabricating 36 15.82% 30.30% 18.10%

Metals & Mining (Div.) 79 12.87% 36.11% 7.41%

Natural Gas (Div.) 32 32.36% 47.45% 25.01%

Natural Gas Utility 24 44.61% 59.21% 24.87%

Newspaper 15 35.75% 63.36% 27.26%

Office Equip/Supplies 25 36.24% 59.10% 22.62%

Oil/Gas Distribution 19 38.06% 58.49% 7.15%

Oilfield Svcs/Equip. 113 20.61% 37.11% 22.05%

Packaging & Container 31 38.01% 65.23% 18.18%

Paper/Forest Products 39 46.37% 60.65% 7.70%

Petroleum (Integrated) 24 12.62% 22.31% 33.00%

Petroleum (Producing) 198 21.27% 32.41% 11.27%

Pharmacy Services 21 16.72% 33.27% 24.36%

Power 77 50.88% 69.69% 7.00%

Precious Metals 78 7.82% 18.11% 8.41%

Precision Instrument 98 13.06% 24.52% 10.50%

Property Management 20 65.74% 80.49% 9.03%

Public/Private Equity 9 62.92% 52.24% 0.80%

Publishing 30 41.29% 106.54% 15.54%

R.E.I.T. 143 40.28% 70.57% 0.72%

Railroad 15 24.79% 43.83% 27.39%

Recreation 65 33.23% 45.09% 16.86%

Reinsurance 8 15.03% 17.38% 4.17%

Restaurant 68 18.36% 53.01% 19.86%

Retail (Special Lines) 157 13.85% 31.45% 18.49%

Retail Automotive 15 30.83% 54.34% 32.68%

Retail Building Supply 7 16.05% 31.94% 27.05%

Retail Store 43 21.25% 41.90% 18.42%

Retail/Wholesale Food 32 20.74% 48.30% 30.39%

Securities Brokerage 30 73.76% 80.13% 20.49%

Semiconductor 125 7.46% 19.52% 10.85%

Semiconductor Equip 14 6.79% 14.87% 16.66%

Shoe 19 3.43% 9.74% 22.11%

Steel (General) 20 23.55% 35.76% 22.29%

Steel (Integrated) 15 28.21% 36.69% 22.94%

Telecom. Equipment 115 9.83% 23.45% 13.79%

Telecom. Services 140 31.99% 49.64% 12.80%

Thrift 227 17.86% 20.34% 11.90%

Tobacco 12 18.66% 61.71% 26.03%

Toiletries/Cosmetics 19 20.84% 68.31% 26.27%

Trucking 33 46.03% 67.24% 30.87%

Utility (Foreign) 5 50.31% 46.36% 12.11%

Water Utility 15 46.80% 56.64% 31.16%

Wireless Networking 60 16.55% 48.70% 9.92%

Total Market 7036 33.33% 54.52% 14.07%

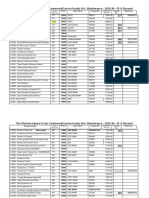

Insider Holdings Std Deviation in Prices EBITDA/Value Fixed Assets/BV of Capital Capital Spending/BV of Capital

13.70% 121.35% 13.10% 14.54% 3.11%

6.22% 66.36% 14.97% 29.84% 6.55%

4.69% 81.01% 16.17% 107.74% 13.66%

14.16% 76.57% 14.10% 23.25% 6.29%

3.10% 90.53% 15.46% 39.24% 8.73%

6.11% 74.38% 20.39% 48.22% 8.88%

3.86% 49.04% 15.91% 0.00% 0.00%

1.00% 28.26% 19.41% 0.00% 0.00%

8.08% 45.15% 18.35% 0.26% 0.00%

13.29% 73.45% 9.75% 37.74% 6.50%

11.20% 104.46% 5.18% 19.94% 3.49%

7.36% 85.39% 16.01% 59.85% 5.95%

5.12% 73.64% 23.04% 40.76% 10.06%

1.73% 36.29% 27.89% 114.90% 22.80%

1.74% 53.62% 15.17% 57.21% 10.43%

5.65% 56.56% 13.47% 51.83% 9.14%

9.39% 82.15% 15.48% 52.93% 8.83%

1.33% 62.27% 14.47% 106.21% 14.82%

7.08% 81.44% 9.23% 13.27% 4.48%

5.65% 95.69% 10.96% 21.45% 6.91%

7.03% 66.46% 11.20% 15.68% 3.07%

7.39% 106.23% 12.12% 23.19% 3.43%

8.03% 65.57% 5.90% 16.61% 5.90%

11.11% 66.15% 9.16% 29.01% 6.73%

1.00% 29.47% 16.10% 101.97% 12.82%

0.00% 28.68% 17.02% 97.34% 12.73%

0.00% 25.06% 18.13% 105.78% 13.49%

4.73% 80.10% 12.46% 31.01% 6.67%

8.10% 94.87% 14.92% 25.42% 5.70%

28.43% 93.66% 16.79% 22.73% 3.83%

11.72% 90.65% 4.03% 10.77% 1.96%

8.32% 93.51% 15.12% 52.72% 5.58%

12.32% 85.56% 6.18% 2.57% 1.40%

11.07% 56.31% 12.43% 31.80% 5.54%

1.00% 36.76% 22.67% 40.32% 11.21%

5.48% 40.49% 14.08% 40.62% 4.00%

12.50% 81.55% 15.14% 35.74% 4.92%

8.31% 73.79% 8.11% 13.26% 4.33%

5.14% 51.88% 15.72% 19.28% 5.29%

10.88% 80.36% -10.92% 3.58% 0.30%

17.62% 104.09% 12.45% 73.21% 11.07%

8.00% 48.71% 10.62% 25.82% 4.29%

10.17% 68.14% 14.03% 12.74% 4.52%

9.60% 74.47% 15.23% 33.14% 8.76%

12.91% 54.92% 11.87% 8.79% 3.81%

2.78% 81.20% 56.33% 1.02% 0.77%

8.00% 40.47% 0.77% 2.43% 0.65%

15.32% 111.16% 5.70% 15.71% 7.02%

1.00% 43.18% 0.00% -44.44% -77.78%

0.00% 36.18% 2.21% 1.66% 0.37%

7.16% 68.56% 15.39% 27.93% 7.08%

13.68% 78.83% 10.62% 28.64% 2.43%

11.73% 76.15% 17.42% 80.38% 16.10%

9.74% 79.09% 16.84% 22.33% 4.60%

7.64% 79.82% 10.26% 19.94% 4.79%

4.74% 81.30% 14.11% 40.24% 10.29%

5.49% 116.66% 13.95% 92.72% 14.79%

4.85% 52.52% 21.48% 105.63% 27.53%

2.14% 29.74% 16.13% 90.04% 8.42%

26.13% 89.84% 18.15% 45.18% 5.07%

2.96% 63.47% 16.82% 23.80% 4.76%

9.70% 55.25% 11.65% 88.70% 16.69%

8.05% 57.28% 17.87% 63.15% 14.28%

5.07% 63.84% 18.26% 60.89% 7.44%

3.41% 80.18% 15.38% 68.75% 5.98%

3.80% 45.16% 27.86% 88.08% 21.03%

3.49% 89.88% 28.38% 104.94% 26.55%

2.78% 51.58% 11.80% 26.18% 6.01%

6.66% 96.52% 13.95% 85.52% 14.41%

0.65% 79.62% 7.31% 88.02% 13.07%

9.57% 68.69% 11.11% 16.77% 3.17%

15.52% 51.41% 11.38% 95.18% 6.29%

8.78% 79.62% 5.34% 0.00% 1.08%

11.51% 65.19% 16.21% 30.89% 5.20%

5.87% 61.39% 6.57% 82.34% 7.38%

3.06% 43.76% 15.19% 134.21% 10.07%

16.17% 96.94% 15.41% 74.63% 10.72%

7.47% 35.62% 1.01% 0.00% 0.10%

11.34% 75.60% 12.86% 85.80% 12.44%

14.62% 81.24% 15.45% 45.25% 10.87%

15.55% 54.23% 11.74% 47.85% 7.42%

5.70% 38.69% 14.06% 88.56% 9.44%

12.84% 69.17% 14.50% 80.57% 10.06%

8.59% 43.97% 13.60% 75.54% 12.01%

7.48% 66.47% 16.72% 1.65% 0.76%

4.53% 75.05% 13.79% 42.75% 9.09%

6.78% 64.97% 10.49% 24.68% 6.00%

42.75% 56.36% 10.04% 21.04% 5.71%

10.42% 53.15% 20.67% 44.83% 8.92%

2.36% 67.12% 23.41% 58.91% 6.96%

6.40% 80.02% 9.66% 11.39% 3.28%

16.87% 82.51% 26.68% 55.18% 11.77%

9.99% 46.79% 18.51% 7.05% 0.00%

1.15% 63.16% 12.13% 17.64% 2.54%

13.11% 68.11% 10.66% 27.39% 7.13%

12.11% 55.24% 18.13% 36.87% 44.97%

0.00% 33.85% 19.47% 104.02% 12.66%

2.80% 47.29% 12.50% 109.38% 11.79%

6.25% 84.03% 7.75% 36.96% 6.15%

9.03% 74.99% 15.61% 37.33% 7.27%

Você também pode gostar

- HDFC Bank Statement Summary for Zye TelecomDocumento7 páginasHDFC Bank Statement Summary for Zye TelecomPDRK BABIUAinda não há avaliações

- Hot-Accounts Google FinanceDocumento5 páginasHot-Accounts Google Financerbp_1973Ainda não há avaliações

- Asian Financial CrisisDocumento5 páginasAsian Financial Crisisapi-574456094Ainda não há avaliações

- Crm Services India Payslip July 2022Documento1 páginaCrm Services India Payslip July 2022Parveen SainiAinda não há avaliações

- PSIC Industry VAT RatesDocumento4 páginasPSIC Industry VAT RatesMark Aguinaldo50% (2)

- Institutions International Financial: by Sachin N. ShettyDocumento33 páginasInstitutions International Financial: by Sachin N. ShettyPrasseedha Raghavan100% (1)

- Industry Name Number of Firms EBITDASG&A/Sales EBITDA/Sales EBIT/SalesDocumento6 páginasIndustry Name Number of Firms EBITDASG&A/Sales EBITDA/Sales EBIT/Salesruchi gulatiAinda não há avaliações

- Industry Name Number of Firms ROC Book D/E Non-Cash ROE ROEDocumento3 páginasIndustry Name Number of Firms ROC Book D/E Non-Cash ROE ROEriacardodAinda não há avaliações

- Industry Name Number of Firms ROC Book D/E ROEDocumento3 páginasIndustry Name Number of Firms ROC Book D/E ROEruchi gulatiAinda não há avaliações

- Industry Name Number of Firms ROC Book D/E ROEDocumento3 páginasIndustry Name Number of Firms ROC Book D/E ROEruchi gulatiAinda não há avaliações

- Gross MarginsDocumento30 páginasGross MarginsMark Angelo NeriAinda não há avaliações

- Margin EuropeDocumento15 páginasMargin Europedeepdp webAinda não há avaliações

- Industry Name Number of Firms ROC Book D/E ROEDocumento3 páginasIndustry Name Number of Firms ROC Book D/E ROEruchi gulatiAinda não há avaliações

- Number of Firms Gross Margin Industry NameDocumento15 páginasNumber of Firms Gross Margin Industry Namemark angelo neriAinda não há avaliações

- Value DataDocumento41 páginasValue DataWendy FernándezAinda não há avaliações

- Tasa de Crecimiento Historica (CAGR) Por IndustriaDocumento4 páginasTasa de Crecimiento Historica (CAGR) Por IndustriaMatias NavarreteAinda não há avaliações

- Date Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsDocumento6 páginasDate Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable Definitionseka juliAinda não há avaliações

- Industry Name Number of Firms ROC Reinvestment Rate Expected Growth in EBITDocumento3 páginasIndustry Name Number of Firms ROC Reinvestment Rate Expected Growth in EBITruchi gulatiAinda não há avaliações

- Date Updated: 5-Jan-14 Aswath Damodaran: To Update This Spreadsheet, Enter The FollowingDocumento9 páginasDate Updated: 5-Jan-14 Aswath Damodaran: To Update This Spreadsheet, Enter The FollowingTony BrookAinda não há avaliações

- Betas DamodaranDocumento312 páginasBetas DamodaranJoseLuisTangaraAinda não há avaliações

- Industry Financial RatiosDocumento6 páginasIndustry Financial RatiosAndres ZAinda não há avaliações

- Aggregate Market Data for Various IndustriesDocumento3 páginasAggregate Market Data for Various IndustriesVadinee TailorAinda não há avaliações

- Examen FinalDocumento44 páginasExamen FinalBETTY STEFFANY PAZ CELISAinda não há avaliações

- Managing RocDocumento9 páginasManaging Rocmichael odiemboAinda não há avaliações

- Industry Name Number of Firms Beta D/E Ratio Tax RateDocumento6 páginasIndustry Name Number of Firms Beta D/E Ratio Tax RateIngebusas IngebusasAinda não há avaliações

- BetasDocumento8 páginasBetasHillary DayanAinda não há avaliações

- Caso 1Documento28 páginasCaso 1Daniel CalderónAinda não há avaliações

- Tabla 01 - Beta Del SectorDocumento2 páginasTabla 01 - Beta Del SectorGambi LopezAinda não há avaliações

- Date Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsDocumento6 páginasDate Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsJose Hines-AlvaradoAinda não há avaliações

- Gloria-Grupo 5Documento424 páginasGloria-Grupo 5giban mendozaAinda não há avaliações

- ControlvalueDocumento15 páginasControlvaluePro ResourcesAinda não há avaliações

- BetasDocumento4 páginasBetasRICARDO ANDRES ROJAS ALARCONAinda não há avaliações

- Dtms 2023031255kj Paf Data RequestDocumento6 páginasDtms 2023031255kj Paf Data RequestJoey Rivamonte Ched-roviiAinda não há avaliações

- Bottom-Up BetaDocumento15 páginasBottom-Up BetaMihael Od SklavinijeAinda não há avaliações

- Betas by SectorDocumento2 páginasBetas by SectorTrose Li100% (1)

- Betas by Industry and Sector AnalysisDocumento4 páginasBetas by Industry and Sector AnalysisVanessa José Claudio IsaiasAinda não há avaliações

- Betas DamodaranDocumento2 páginasBetas DamodaranFabiola Brigida Yauri QuispeAinda não há avaliações

- Valoracion Por Multiplos - EstudiantesDocumento12 páginasValoracion Por Multiplos - EstudiantesJuLi Cañas HassellAinda não há avaliações

- End Game: Number of Firms Gross Margin Net Margin Pre-Tax, Pre-Stock Compensation Operating MarginDocumento18 páginasEnd Game: Number of Firms Gross Margin Net Margin Pre-Tax, Pre-Stock Compensation Operating MarginДАВААЖАРГАЛ БямбасүрэнAinda não há avaliações

- Scribd - Leader PostDocumento6 páginasScribd - Leader Postpittman021Ainda não há avaliações

- Vinati Organics Ltd financial analysis and key metrics from 2011 to 2020Documento30 páginasVinati Organics Ltd financial analysis and key metrics from 2011 to 2020nhariAinda não há avaliações

- Company Name ROE (%) Payout Ratio (%) Retention Ratio (%) : Regression StatisticsDocumento19 páginasCompany Name ROE (%) Payout Ratio (%) Retention Ratio (%) : Regression StatisticsSHIKHA CHAUHANAinda não há avaliações

- Base Case - Financial ModelDocumento52 páginasBase Case - Financial Modeljuan.farrelAinda não há avaliações

- Dividend Policy of Indian OrganizationsDocumento14 páginasDividend Policy of Indian OrganizationsAnupam ChaplotAinda não há avaliações

- Indicadores 2023 08Documento21 páginasIndicadores 2023 08Maria Fernanda TrigoAinda não há avaliações

- Finance Beta - IndiaDocumento4 páginasFinance Beta - Indiag9573407Ainda não há avaliações

- Financail Statement Ratios Tata Motors RNo 89-90-91 SecBDocumento8 páginasFinancail Statement Ratios Tata Motors RNo 89-90-91 SecBchirag100% (1)

- Boat CaseDocumento5 páginasBoat CaseYugant BeheraAinda não há avaliações

- IAS 36 WACC Calculation ExampleDocumento36 páginasIAS 36 WACC Calculation ExampleJessyRityAinda não há avaliações

- Bottom up unlevered beta calculationDocumento18 páginasBottom up unlevered beta calculationTimothy NguyenAinda não há avaliações

- Date Updated: 5-Jan-14 Aswath DamodaranDocumento3 páginasDate Updated: 5-Jan-14 Aswath DamodaranHillary DayanAinda não há avaliações

- FINANCIAL MODELLING GROUP 1Documento31 páginasFINANCIAL MODELLING GROUP 1Jayash KaushalAinda não há avaliações

- CalculationsDocumento38 páginasCalculationsRizviAinda não há avaliações

- Cleveland Crime StatisticsDocumento25 páginasCleveland Crime StatisticsWKYC.comAinda não há avaliações

- Bottom Up Unlevered BetaDocumento12 páginasBottom Up Unlevered BetaUyen HoangAinda não há avaliações

- Q2 Tle Te Level of ProgressDocumento15 páginasQ2 Tle Te Level of ProgressHarold JethroAinda não há avaliações

- Laurus LabsDocumento33 páginasLaurus Labsnidhul07Ainda não há avaliações

- Sector industry weights TSX JSI TSX60Documento2 páginasSector industry weights TSX JSI TSX60EarthlyPowers61Ainda não há avaliações

- Ratios Tell A StoryDocumento2 páginasRatios Tell A StoryJose Arturo Rodriguez AlemanAinda não há avaliações

- Common Size P&L - VEDANTA LTDDocumento20 páginasCommon Size P&L - VEDANTA LTDVANSHAJ SHAHAinda não há avaliações

- Ratios Tell A StoryDocumento3 páginasRatios Tell A StoryJose Arturo Rodriguez AlemanAinda não há avaliações

- Date Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsDocumento7 páginasDate Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsvicoraulAinda não há avaliações

- United States Census Figures Back to 1630No EverandUnited States Census Figures Back to 1630Ainda não há avaliações

- Weekly Capital Market Report - Week Ending 31.12.2021Documento2 páginasWeekly Capital Market Report - Week Ending 31.12.2021Fuaad DodooAinda não há avaliações

- Porter's Diamond Model French Wine IndustryDocumento2 páginasPorter's Diamond Model French Wine Industrycharu.bhuratAinda não há avaliações

- The Economy in Spanish Speaking CountriesDocumento4 páginasThe Economy in Spanish Speaking CountriesMUHAMMAD HAQIEM BIN KARIMAinda não há avaliações

- Al Mada (Holding) - WikipediaDocumento15 páginasAl Mada (Holding) - WikipediaOtmane ArabyAinda não há avaliações

- Top Ten States With The Lowest Tax BurdenDocumento3 páginasTop Ten States With The Lowest Tax BurdenAndreea Anamaria WAinda não há avaliações

- REGIONAL GDP OF KLATEN REGENCYDocumento10 páginasREGIONAL GDP OF KLATEN REGENCYEvan Sakti HAinda não há avaliações

- Major Resources and Globalization in the Philippines and CanadaDocumento2 páginasMajor Resources and Globalization in the Philippines and CanadaJoseph ObchigueAinda não há avaliações

- Hero Honda SplitDocumento1 páginaHero Honda SplitMuthu VigneshAinda não há avaliações

- Operations Manual Policies and ProceduresDocumento4 páginasOperations Manual Policies and ProceduresUmidjon MuydinovAinda não há avaliações

- Income Statement - FacebookDocumento6 páginasIncome Statement - FacebookFábia RodriguesAinda não há avaliações

- PFMS PaymentDocumento14 páginasPFMS PaymentDTO HailakandiAinda não há avaliações

- Oil and Gas Resources of Sindh-Naseer MemonDocumento10 páginasOil and Gas Resources of Sindh-Naseer MemonSaeed Memon0% (1)

- Short-Seller Jim Chanos - If You Invest in China, You're 'Participating in A Scheme' PDFDocumento1 páginaShort-Seller Jim Chanos - If You Invest in China, You're 'Participating in A Scheme' PDFsnnAinda não há avaliações

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento39 páginasDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancemayur bhargaAinda não há avaliações

- Dahod IIDocumento8 páginasDahod IIrajuAinda não há avaliações

- Tax InvoiceDocumento1 páginaTax InvoiceSanjay KumarAinda não há avaliações

- Main 201bbbbbb9 20 Bank Cheque & Receipt No 1Documento12 páginasMain 201bbbbbb9 20 Bank Cheque & Receipt No 1Govind ThakorAinda não há avaliações

- Introducing Aggregate DemandDocumento1 páginaIntroducing Aggregate DemandMr Aycock100% (1)

- Comparing The Compensation of A PSU and A StartupDocumento11 páginasComparing The Compensation of A PSU and A Startuphuga lalaAinda não há avaliações

- Principles and Practices of Banking: RBI - Functions and PoliciesDocumento7 páginasPrinciples and Practices of Banking: RBI - Functions and Policiespassion481Ainda não há avaliações

- Government Securities Market Weekly Summary of Primary & Secondary Market Transactions - 12/12/2012Documento1 páginaGovernment Securities Market Weekly Summary of Primary & Secondary Market Transactions - 12/12/2012randoralkAinda não há avaliações

- NRECDocumento2 páginasNRECFhandy Andreson RihiAinda não há avaliações

- HDFC Bank - Research Insight 3Documento7 páginasHDFC Bank - Research Insight 3Sancheet BhanushaliAinda não há avaliações

- Agreement On AgricultureDocumento6 páginasAgreement On Agricultureshahid khan100% (1)

- CDVDocumento14 páginasCDVShraddha PatelAinda não há avaliações

- Universal Basic Income SpeechDocumento23 páginasUniversal Basic Income SpeechMaximilianAinda não há avaliações