Escolar Documentos

Profissional Documentos

Cultura Documentos

2015 Mark Scheme 21 PDF

Enviado por

SKTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

2015 Mark Scheme 21 PDF

Enviado por

SKDireitos autorais:

Formatos disponíveis

Page 1 Mark Scheme Syllabus Paper

Cambridge International AS/A Level May/June 2015 9706 21

CAMBRIDGE INTERNATIONAL EXAMINATIONS

Cambridge International Advanced Subsidiary and Advanced Level

MARK SCHEME for the May/June 2015 series

9706 ACCOUNTING

9706/21 Paper 2 (Structured Questions Core),

maximum raw mark 90

This mark scheme is published as an aid to teachers and candidates, to indicate the requirements of

the examination. It shows the basis on which Examiners were instructed to award marks. It does not

indicate the details of the discussions that took place at an Examiners meeting before marking began,

which would have considered the acceptability of alternative answers.

Mark schemes should be read in conjunction with the question paper and the Principal Examiner

Report for Teachers.

Cambridge will not enter into discussions about these mark schemes.

Cambridge is publishing the mark schemes for the May/June 2015 series for most

Cambridge IGCSE, Cambridge International A and AS Level components and some

Cambridge O Level components.

Cambridge International Examinations 2015

Page 2 Mark Scheme Syllabus Paper

Cambridge International AS/A Level May/June 2015 9706 21

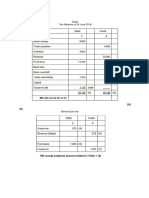

1 (a)

Patels Income statement for the year ended 31 December 2014

$ $

Sales: Credit (156 420 + 13 690 14 670) 155 440 (1)OF

Cash (20 700 + 4800 800 + 950) 25 650 (2)OF

181 090

Less cost of sales

Inventory at 1 Jan 2014 21 750

Purchases (109 620 + 14 900 16 750) 107 770 (2)OF 1 both creds I o/f total

Less goods for own use (2 600) (1)

126 920

Less inventory at 31 December 2014 (22 450) 104 470

Gross profit 76 620 (1)OF

Less expenses

Wages (22 670 + 1400 1200) 22 870 (1)

Rent 16 000

Electricity 8 650

General expenses 4 750

Loss on motor vehicle (2880 1500) 1 380 (1)

Depreciation on: motor vehicles (7600 2880(1) +

16 400) 0.2

4 224 (1)OF

fixtures and fittings 1 500 (1)

Provision for doubtful debts (13 690 750) 0.05 647 (1)

Bad debts written off 750 (1) (60 771)

Profit for the year 15 849 (1)OF

[15]

Cambridge International Examinations 2015

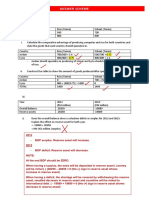

Page 3 Mark Scheme Syllabus Paper

Cambridge International AS/A Level May/June 2015 9706 21

Patels Statement of financial position at 31 December 2014

$ $ $

Non-current assets

Land and buildings 50 000 (1) for L&b & FF

Motor vehicles (7600 2880(1) + 16400 4224(1) 16 896

Fixtures and fittings 4 500

71 396

Current assets

Inventory 22 450

Trade receivables (13 690 750 647) 12 293 (1)OF

Rent in advance (1000 + 19 000 16 000) 4 000 (1)

Cash at bank 14 510

Cash 950

54 203

Total assets 125 599

Capital and liabilities

Opening capital (W1) 100 850 (1)

Add profit for the year 15 849

116 699

Less drawings (4800 (1) + 2600 (1)) 7 400

109 299

Current liabilities

Trade payables 14 900

Wages 1 400

16 300 (1)C/F

Total capital and liabilities 125 599

Working notes

W1

Capital at 1 January 2013

Bank 16 980

Land and buildings 50 000 Trade 16 750

payables

Fixtures and fittings 6 000 Wages 1 200

Motor vehicles 7 600

Trade receivables 14 670

Inventory 21 750

Cash 800

Rent 1 000

118 800 17 950

Capital 100 850

[9]

Cambridge International Examinations 2015

Page 4 Mark Scheme Syllabus Paper

Cambridge International AS/A Level May/June 2015 9706 21

(c) Five year loan

Advantage:

Fixed rate of interest

Helps plan cash flow

Disadvantage:

May pay more interest if rates fall

Interest payable for whole period

May be secured on assets

Bank overdraft

Advantage

No interest charged if not used

Can be paid off whenever you like

Disadvantage

Higher rate of interest than loan

Can be called in by the bank at any time

1 mark for each advantage and disadvantage.

1 mark x 2 for development.

[Total: 30]

Cambridge International Examinations 2015

Page 5 Mark Scheme Syllabus Paper

Cambridge International AS/A Level May/June 2015 9706 21

2 (a) Mark up expresses the gross profit (1) as a percentage of cost price of the goods sold (1).

[2]

(b) Trading section of income statement for the year ended 31 March 2014.

$ $

Revenue 100 000 420 000

Cost of sales

Opening inventory 40 000 (1)

Purchases 340 000 (1)OF

Closing inventory* (80 000) (4) 300 000 (1)

Gross profit (1) 120 000 (1)OF

[9]

[*300000 (1) / 5 (1) = 60000 2 (1) 40000 (1)]

(c) (Gross profit / Revenue) (1) both 100 (1) [2]

(d) (i) It shows the efficiency of assets to generate income (1). It shows how much every dollar

of non- current assets (1) generates in sales revenue (1). A higher value indicates better

utilisation of resources (1). [4]

(ii)

Ratio Formula Calculation

Non-current asset Sales revenue / non-current 420 000 (1) = $0.76 (1) times

turnover asset NRV(1) 550 000

[3]

(e) 1 Avoid overstating trade receivables

2 Be prudent.

3 Anticipate that some customers may not pay and become bad debts.

4 Application of matching principle [Max 3]

[3]

$ $

Income statement 250 (1) Bal b/d 1650 (1)

Bal c/d 1400

1650 1650

Bal c/d 1400 (1)

(f) Provision for doubtful debts account

[3]

(g) (i) $250 is to be added below gross profit in the income statement (1) as a decrease in the

provision for doubtful debts. (1) [2]

Cambridge International Examinations 2015

Page 6 Mark Scheme Syllabus Paper

Cambridge International AS/A Level May/June 2015 9706 21

(ii) $1400 is to be shown as a deduction of trade receivables (1) in current assets (1) in the

statement of financial position. [2]

[Total: 30]

Cambridge International Examinations 2015

Page 7 Mark Scheme Syllabus Paper

Cambridge International AS/A Level May/June 2015 9706 21

3 (a) Variable costs labour: $233 000 $65 000 = $168 000 / 70 000 units = $2.40 per unit

Variable costs overheads: $190 000 $36 000 = $154 000 / 70 000 units = $2.20 per unit

Selling price 12.00

Materials ($259 000 / 70 000) 3.70 (1)

Labour 2.40 (1)

Overheads 2.20 (1) 8.30

Contribution $3.70 (1) [4]

(b) Variable costs labour: $372 000 $48 000 = $324 000 / 90 000 units = $3.60 per unit

Variable costs overheads: $207 000 $45 000 = $162 000 / 90 000 units = $1.80 per unit

Selling price 8.00

Materials ($180 000 / 90 000) 2.00 (1)

Labour 3.60 (1)

Overheads 1.80 (1) 7.40

Contribution $0.60 (1) [4]

(c) Breakeven point = ($48 000 + $45 000 (1)) / $0.60 (1)OF = 155 000 units [2]

(d) Breakeven point = 155 000 units (1)OF $8 = $1 240 000 (1)OF [2]

(e) Margin of safety = (90 000 155 000) (1)OF $8 = $(520 000) (1)OF [2]

(f) Proposal 1

Revised sales of Zed: 90 000 95% = 85 500 units

Revised contribution of Zed: $0.60 + $1.20 = $1.80

$

Contribution Zed (85 500 (1) $1.80 (1)) 153 900

Fixed overheads ($48 000 + $45 000) 93 000 (1)

Revised profit Zed 60 900 (1)

Profit Wye 158 000

Revised profit 218 900 (1) [5]

(g) Proposal 2

$

Original profit Wye 158 000 (1)

Additional contribution (70 000 40%) $3.70 103 600 (1)

Less: Additional fixed costs redundancy (20 000) (1)

Zed overheads (45 000) (1)

Revised profit 196 600 (1)OF [5]

Accept revised profit of $148 600 if existing fixed costs of $48 000 are not stated.

Cambridge International Examinations 2015

Page 8 Mark Scheme Syllabus Paper

Cambridge International AS/A Level May/June 2015 9706 21

(h) Company should choose proposal 1 / continue producing Zed (1)OF

Reasons

Year 1 profit is higher by $22 300 (1)

Subsequent years profits are higher by additional $20 000 (1) due to no further

redundancy costs (1)

But may lose customers for Wye due to not being able to supply Zed (1)

May encounter bad publicity because of the redundancies (1)

Forecast 40% increase in Wye sales may not be accurate (1)

[max 5 for reasons and 1 for decistion] [6]

[Total: 30]

Cambridge International Examinations 2015

Você também pode gostar

- Ratios Q1 AnsDocumento2 páginasRatios Q1 AnsSAADAinda não há avaliações

- 15 Sole Trader - 2020Documento34 páginas15 Sole Trader - 2020Philile NkwanyanaAinda não há avaliações

- Fac2601-2013-10 - Answers PDFDocumento12 páginasFac2601-2013-10 - Answers PDFcandiceAinda não há avaliações

- Financial Accounting and Reporting: IFRS - 2015 December MSDocumento18 páginasFinancial Accounting and Reporting: IFRS - 2015 December MSMarchella LukitoAinda não há avaliações

- 9706 Accounting: MARK SCHEME For The October/November 2015 SeriesDocumento8 páginas9706 Accounting: MARK SCHEME For The October/November 2015 Seriestecho2345Ainda não há avaliações

- Nur Qaseh SDN BHD Soci CorrectedDocumento5 páginasNur Qaseh SDN BHD Soci CorrectedSyza LinaAinda não há avaliações

- Mark Scheme (Results) June 2011: GCE Accounting (6001) Paper 01Documento19 páginasMark Scheme (Results) June 2011: GCE Accounting (6001) Paper 01Fahrin NehaAinda não há avaliações

- MARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocumento4 páginasMARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaAinda não há avaliações

- Mark Scheme With Examiners' Report: GCE A Level Accounting (9011)Documento16 páginasMark Scheme With Examiners' Report: GCE A Level Accounting (9011)hisakofelixAinda não há avaliações

- O Level Important Questions PDFDocumento55 páginasO Level Important Questions PDFibrahoAinda não há avaliações

- FAC 2602 - 2023 - S1 - Assessment 3 SolutionDocumento9 páginasFAC 2602 - 2023 - S1 - Assessment 3 SolutionlennoxhaniAinda não há avaliações

- Answer Key Accounting Paper 2 Term 3 Form 4Documento8 páginasAnswer Key Accounting Paper 2 Term 3 Form 4Aejaz MohamedAinda não há avaliações

- Answer Key Accounting Paper 2 Term 3 Form 4Documento8 páginasAnswer Key Accounting Paper 2 Term 3 Form 4Aejaz MohamedAinda não há avaliações

- Financial Accounting and Reporting: IFRS - 2016 June MSDocumento17 páginasFinancial Accounting and Reporting: IFRS - 2016 June MSMarchella LukitoAinda não há avaliações

- Solution Far410 Dec - 2019 - 1 - PDFDocumento8 páginasSolution Far410 Dec - 2019 - 1 - PDF2022478048Ainda não há avaliações

- Eacc1614 Test 2 Memo 2021 AdjDocumento10 páginasEacc1614 Test 2 Memo 2021 AdjshabanguntandoyenkosiAinda não há avaliações

- AFS SolutionsDocumento19 páginasAFS SolutionsRolivhuwaAinda não há avaliações

- 9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersDocumento7 páginas9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of Teacherspridegwatidzo2Ainda não há avaliações

- 9706 Accounting: MARK SCHEME For The March 2016 SeriesDocumento8 páginas9706 Accounting: MARK SCHEME For The March 2016 SeriesEn DimunAinda não há avaliações

- Mark Scheme (Results) Series 2 2014: Pearson LCCI Level 2 Book-Keeping and Accounts (ASE2007)Documento13 páginasMark Scheme (Results) Series 2 2014: Pearson LCCI Level 2 Book-Keeping and Accounts (ASE2007)sincere sincereAinda não há avaliações

- PYQ June 2018Documento4 páginasPYQ June 2018Nur Amira NadiaAinda não há avaliações

- LCCI Level One Final AcctDocumento2 páginasLCCI Level One Final AcctStpmTutorialClassAinda não há avaliações

- Bacc 126 Assignment 1 Aug - Dec 2023Documento11 páginasBacc 126 Assignment 1 Aug - Dec 2023TarusengaAinda não há avaliações

- Group 5Documento8 páginasGroup 5Doreen OngAinda não há avaliações

- T7 - Answer Scheme BopDocumento5 páginasT7 - Answer Scheme BopAkai GunnerAinda não há avaliações

- ACCOUNTING P1 GR10 MEMO NOV2020 - EnglishDocumento6 páginasACCOUNTING P1 GR10 MEMO NOV2020 - EnglishMolemo mabeleAinda não há avaliações

- MARCH 2020 AnswerDocumento16 páginasMARCH 2020 AnswerXianFa WongAinda não há avaliações

- Facn311 Test 1 Solution 2019Documento10 páginasFacn311 Test 1 Solution 20196lackzamokuhleAinda não há avaliações

- P64571RA Lcci Level 4 Certificate in Financial Accounting ASE20101 RB Sep 2020Documento8 páginasP64571RA Lcci Level 4 Certificate in Financial Accounting ASE20101 RB Sep 2020Musthari KhanAinda não há avaliações

- Fac1601 Exam Pack 2018Documento98 páginasFac1601 Exam Pack 2018OlebogengPAinda não há avaliações

- FAC1602 Exam PackDocumento25 páginasFAC1602 Exam PackNthabeza De Ntha MogaleAinda não há avaliações

- Question 2 - EDWIN JOSES (GROUP ASSIGNMENT)Documento3 páginasQuestion 2 - EDWIN JOSES (GROUP ASSIGNMENT)Hareen JuniorAinda não há avaliações

- 9706 Accounting: MARK SCHEME For The May/June 2014 SeriesDocumento5 páginas9706 Accounting: MARK SCHEME For The May/June 2014 SeriesMateeh-ur -rehmanAinda não há avaliações

- AccountingDocumento8 páginasAccountingfarhan anwarAinda não há avaliações

- Ans Jan 2018 Far410Documento8 páginasAns Jan 2018 Far4102022478048Ainda não há avaliações

- OCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocumento4 páginasOCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaAinda não há avaliações

- 4ac1 02 Rms 20220825Documento10 páginas4ac1 02 Rms 20220825attackdfg2002Ainda não há avaliações

- 4 5807634410916285735Documento5 páginas4 5807634410916285735magwazagroup33Ainda não há avaliações

- Class Handout-2Documento3 páginasClass Handout-2AdityaDhruvMansharamaniAinda não há avaliações

- Topic 6 Test ISBS 3E4Documento5 páginasTopic 6 Test ISBS 3E4LynnHanAinda não há avaliações

- AccntsDocumento10 páginasAccntsLav RamgopalAinda não há avaliações

- 2021 - A2S2 Solution-OplossingDocumento19 páginas2021 - A2S2 Solution-OplossingmeghdyckAinda não há avaliações

- Problem 7 AlkDocumento8 páginasProblem 7 AlkAldi HerialdiAinda não há avaliações

- Coursebook Chapter 9 AnswersDocumento5 páginasCoursebook Chapter 9 AnswersAhmed Zeeshan92% (12)

- Solution Far510 - Jun 2015Documento8 páginasSolution Far510 - Jun 2015azila aliasAinda não há avaliações

- Grade 10 Provincial Exam Accounting p1 AnswersDocumento7 páginasGrade 10 Provincial Exam Accounting p1 AnswershobyanevisionAinda não há avaliações

- Balgownie LTD Solution 2021 - V2Documento12 páginasBalgownie LTD Solution 2021 - V2Ludmila DorojanAinda não há avaliações

- GR10 Accounting Practice Exam Memorandum November Paper 1Documento7 páginasGR10 Accounting Practice Exam Memorandum November Paper 1morukakgothatso5Ainda não há avaliações

- Mark Scheme (Results) January 2022Documento28 páginasMark Scheme (Results) January 2022Fahim AhmedAinda não há avaliações

- AMD Assignment: Q1. in The Books of Zee Ltd. Vertical Balance Sheet As On 31.3.09Documento18 páginasAMD Assignment: Q1. in The Books of Zee Ltd. Vertical Balance Sheet As On 31.3.09Varun AadharshAinda não há avaliações

- Solutions PDFDocumento5 páginasSolutions PDFprim2698Ainda não há avaliações

- Sample Nonprofit Budget TemplateDocumento15 páginasSample Nonprofit Budget TemplateMandy NormanAinda não há avaliações

- Accounting Assigment 1 WordDocumento7 páginasAccounting Assigment 1 WordlemisiatulihaleniAinda não há avaliações

- December 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocumento4 páginasDecember 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaAinda não há avaliações

- Solution Dec 2015Documento7 páginasSolution Dec 2015anis izzatiAinda não há avaliações

- Solution Past Year Exam Financial Statements GCDocumento12 páginasSolution Past Year Exam Financial Statements GCFara husnaAinda não há avaliações

- Day 1 (Sole Trader Final Account)Documento7 páginasDay 1 (Sole Trader Final Account)Han Thi Win KoAinda não há avaliações

- Financial Accounting IFRS Student Mark Plan June 2019Documento16 páginasFinancial Accounting IFRS Student Mark Plan June 2019scottAinda não há avaliações

- 9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersDocumento6 páginas9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersProto Proffesor TshumaAinda não há avaliações

- Unemployment Poverty and Income Disparity in Urban China. Asian Economic JournalDocumento23 páginasUnemployment Poverty and Income Disparity in Urban China. Asian Economic JournalSKAinda não há avaliações

- The Impact of Changes in Human Fertility On Poverty The Journal of Development StudiesDocumento30 páginasThe Impact of Changes in Human Fertility On Poverty The Journal of Development StudiesSKAinda não há avaliações

- Economic Growth Inequality and Poverty Estimating The Growth Elasticity of PovertyDocumento26 páginasEconomic Growth Inequality and Poverty Estimating The Growth Elasticity of PovertySKAinda não há avaliações

- Course Syllabus Business English 20172018Documento6 páginasCourse Syllabus Business English 20172018SKAinda não há avaliações

- Does Financial Development Contribute To Poverty Reduction. Journal of Development Studies, 41 (4), 636-656.Documento21 páginasDoes Financial Development Contribute To Poverty Reduction. Journal of Development Studies, 41 (4), 636-656.SKAinda não há avaliações

- Undergraduate Prospectus 2022 - 3Documento71 páginasUndergraduate Prospectus 2022 - 3SKAinda não há avaliações

- The Effect of Economic Growth On Poverty in Eastern Europe. Zarządzanie PubliczneDocumento8 páginasThe Effect of Economic Growth On Poverty in Eastern Europe. Zarządzanie PubliczneSKAinda não há avaliações

- Burnout!: Why Is It So Prevalent in The Healthcare Sector?Documento20 páginasBurnout!: Why Is It So Prevalent in The Healthcare Sector?SKAinda não há avaliações

- M3685 UG Prospectus 2021 - PDF - Update - 100620Documento168 páginasM3685 UG Prospectus 2021 - PDF - Update - 100620BorderBREAinda não há avaliações

- Postgraduate Prospectus 2021: World ChangersDocumento35 páginasPostgraduate Prospectus 2021: World ChangersSKAinda não há avaliações

- Ucl Undergraduate Prospectus 2021entryDocumento102 páginasUcl Undergraduate Prospectus 2021entrySKAinda não há avaliações

- Undergraduate Prospectus 2021Documento172 páginasUndergraduate Prospectus 2021SKAinda não há avaliações

- Assignment No. 1: Deciding On An International Brand Communication StrategyDocumento1 páginaAssignment No. 1: Deciding On An International Brand Communication StrategySKAinda não há avaliações

- Learning' With No Feedback in A Competitiveguessing GameDocumento11 páginasLearning' With No Feedback in A Competitiveguessing GameSKAinda não há avaliações

- Medical School: Brighton and SussexDocumento40 páginasMedical School: Brighton and SussexSKAinda não há avaliações

- Harmful Cocktail: Bsms Bsms Bsms BsmsDocumento20 páginasHarmful Cocktail: Bsms Bsms Bsms BsmsSKAinda não há avaliações

- Module Date List 2020 2021 For Website 21 01 21Documento1 páginaModule Date List 2020 2021 For Website 21 01 21SKAinda não há avaliações

- Reutlingen University General Study and Examination Regulations 20210205 1Documento17 páginasReutlingen University General Study and Examination Regulations 20210205 1SKAinda não há avaliações

- Sussex Prospectus 201718Documento52 páginasSussex Prospectus 201718SKAinda não há avaliações

- Rent Collector SummaryDocumento5 páginasRent Collector SummarySK0% (1)

- 7 - Case Study Enron PDFDocumento1 página7 - Case Study Enron PDFSKAinda não há avaliações

- Guidelines For Writing Academic Papers at ESB 2018-09-13Documento25 páginasGuidelines For Writing Academic Papers at ESB 2018-09-13SKAinda não há avaliações

- ESB Business School International Business Curriculum and Syllabi Handbook WS1920Documento160 páginasESB Business School International Business Curriculum and Syllabi Handbook WS1920SKAinda não há avaliações

- EUJUS15A 1628 I01 EqualPayDayfactsheetsupdate2017 Countryfiles EuropeanUnion en V01 LRPDFDocumento1 páginaEUJUS15A 1628 I01 EqualPayDayfactsheetsupdate2017 Countryfiles EuropeanUnion en V01 LRPDFSKAinda não há avaliações

- Greenwashing or Going GreenDocumento4 páginasGreenwashing or Going GreenSKAinda não há avaliações

- Masan Meatlife Corporation ("Masan Meatlife") Annual Report 2020Documento38 páginasMasan Meatlife Corporation ("Masan Meatlife") Annual Report 2020Trà Giang VõAinda não há avaliações

- Wal-Mart - 2002: A. Case AbstractDocumento13 páginasWal-Mart - 2002: A. Case Abstractmustafa-memon-7379Ainda não há avaliações

- Blaine Kitchenware, Inc. - Capital Structure DATADocumento5 páginasBlaine Kitchenware, Inc. - Capital Structure DATAShashank Gupta100% (1)

- Week 1 22107 - Lecture 1 - AUT2019Documento52 páginasWeek 1 22107 - Lecture 1 - AUT2019Michelle ChenAinda não há avaliações

- BAb 6Documento75 páginasBAb 6kkamjonginnAinda não há avaliações

- Chapter 5 PowerpointDocumento37 páginasChapter 5 Powerpointapi-248607804Ainda não há avaliações

- Chapter 13 To 15Documento13 páginasChapter 13 To 15Cherry Mae GecoAinda não há avaliações

- Final Financial Analyst ReportDocumento18 páginasFinal Financial Analyst ReportLello PacellaAinda não há avaliações

- Published AccountsDocumento31 páginasPublished AccountsGraceii Mecayer CuizonAinda não há avaliações

- COI Narinder Bhatia 22-23Documento5 páginasCOI Narinder Bhatia 22-23Ashwani KumarAinda não há avaliações

- Ratio Analysis of LMLDocumento3 páginasRatio Analysis of LMLkasliwal_hiteshAinda não há avaliações

- Wire and Cable Industry Analysis 2015-2018 For Global and ChinaDocumento8 páginasWire and Cable Industry Analysis 2015-2018 For Global and ChinaBettyKruegerAinda não há avaliações

- 2014 Mock Exam - AM - AnswersDocumento25 páginas2014 Mock Exam - AM - Answers12jdAinda não há avaliações

- Notes From Cases For CFEDocumento8 páginasNotes From Cases For CFEdarknessmindAinda não há avaliações

- Alpha Graphics Company Was Organized On January 1,...Documento10 páginasAlpha Graphics Company Was Organized On January 1,...Saima NargisAinda não há avaliações

- Sample MotorolaDocumento9 páginasSample MotorolaLesley LiAinda não há avaliações

- Executive Summary: Market Analysis of Potato Value Chain in 3 Target Countries of East AfricaDocumento22 páginasExecutive Summary: Market Analysis of Potato Value Chain in 3 Target Countries of East AfricaMukasa NassarAinda não há avaliações

- FM Unit 2 Tutorial - Finanacial Statement Analysis Revised 2019Documento4 páginasFM Unit 2 Tutorial - Finanacial Statement Analysis Revised 2019Tanice WhyteAinda não há avaliações

- Class Work Journal EntryDocumento16 páginasClass Work Journal EntryRishabh ChawlaAinda não há avaliações

- RMC 102-2017 HighlightsDocumento3 páginasRMC 102-2017 HighlightsmmeeeowwAinda não há avaliações

- Cold Storage - Jayashree Shanbhag 2Documento20 páginasCold Storage - Jayashree Shanbhag 2Shreyans Tejpal ShahAinda não há avaliações

- Kieso IFRS4 TB ch17Documento68 páginasKieso IFRS4 TB ch17Scarlet WitchAinda não há avaliações

- Makerere University: Nansana Municipal CouncilDocumento41 páginasMakerere University: Nansana Municipal CouncilddhgdhgAinda não há avaliações

- Assignment in Specialized AccountingDocumento18 páginasAssignment in Specialized Accounting143incomeAinda não há avaliações

- Chapter 13 Solutions ManualDocumento110 páginasChapter 13 Solutions ManualMohammad ali HassanAinda não há avaliações

- F2-03 Cost ClassificationDocumento18 páginasF2-03 Cost ClassificationManirulAinda não há avaliações

- Market Outlook 13th January 2012Documento6 páginasMarket Outlook 13th January 2012Angel BrokingAinda não há avaliações

- Liberi V Taitz Plaintiffs Request For Judicial Notice Doc 466Documento107 páginasLiberi V Taitz Plaintiffs Request For Judicial Notice Doc 466nocompromisewtruthAinda não há avaliações

- Final Accounts of CompaniesDocumento66 páginasFinal Accounts of CompaniesLakshmi Sowjanya AkurathiAinda não há avaliações

- Accounting For Home Office and BranchDocumento12 páginasAccounting For Home Office and BranchJohn Rey LabasanAinda não há avaliações