Escolar Documentos

Profissional Documentos

Cultura Documentos

Chapter V

Enviado por

Jezel roldan0 notas0% acharam este documento útil (0 voto)

22 visualizações5 páginasFeasibility Study

Título original

CHAPTER V

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoFeasibility Study

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

22 visualizações5 páginasChapter V

Enviado por

Jezel roldanFeasibility Study

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 5

CHAPTER V

SUMMARY OF FINDINGS, CONCLUSIONS, AND RECOMMENDATIONS

This chapter presents the summary of findings, conclusions, and

recommendations.

Summary of Findings

The major findings in the study are the following:

1. The profile of the respondents are follows: in terms of the age, 45

years and above has a frequency of 52 or 46.4% while the least of

them belongs to 25 years and above with a frequency of 11 or 9.8%.

In terms of sex category, majority of the respondents are female with

a frequency of 67 or 59.8% while the least of them are male with a

frequency of 45 or 40.2%. In terms of civil status, majority of the

respondents are married with a frequency of 68 or 68.7% while the

least of them are separated with a frequency of 5 or 4.5%. In terms

of highest educational attainment, majority of the respondents are

high school graduate with a frequency of 40 or 35.7% while the least

of them are elementary level with a frequency of 3 or 2.7%.

2. The respondents business profile in terms of type of business,

majority of the respondents are fish and ginamos (brined anchovies)

vendors with a frequency of both 9 or 8.0% while the least of them

48

are fruit and native delicacies vendor with a frequency of both 7 or

6.2%. There are also 9 different types of vendors who has a

frequency of 8 or 7.1% each. In terms of years in operation, majority

of the respondents operate their business for more than 8 years and

above with a frequency of 41 or 36.6% while least of them operates

their business for less than 1 year with a frequency of 10 or 8.9%.

In terms of start-up capital of Php 10,001 and above with a

frequency of 51 or 45.5%. In terms of sources of loan, CARD has the

most frequency of 22 or 19.6%.

3. As to extent of microfinance institutions contribution on the

business operation of the respondents in terms of profitability, it was

found out that the business profit of the respondents has increased

after availing loan from Microfinance Institutions with a mean of

4.31 and very high rating. In terms of productivity, respondents were

able to sell more items of their products through Microfinance

Institutions with a frequency of 4.36 and very high rating. This

implies that Microfinance Institutions contribute to the profitability

and productivity of respondents business.

4. There is no significant difference on the extent of microfinance

institutions contribution on business operation when analyzed

according to the business profile.

5. For the expectations of the respondents in terms of their business,

respondents were asked if they wanted to be a vendor all of their

49

lives. Majority or 60.7% with a frequency of 60 said Yes because they

wanted to save money. The least or 39.3% with a frequency of 44 of

them said No because they wanted to do something else or to change

the business. Respondents were asked if they encourage their

friends to sell on market, 84 of them said Yes while 28 said No.

Respondents were asked if they encourage their children to sell on

market, 28 of them said Yes while 84 said No. Respondents were

asked if they encourage any other than their friends and children to

sell on market, 62 of them said Yes while 50 said No.

6. Sale of product (too much completion) is the most problem that the

respondents encountered. The overall problems encountered by the

market vendors has an average (Moderate) effects.

7. The study found out that majority of the respondents said they

wanted to be a market vendor all of their lives with a frequency of

68 or 60.71% and the reason is they want to save money with a

frequency of 60 or 53.6%. The least of them said that they dont want

to be a market vendor all of their lives with a frequency of 44 or

39.3% because they wanted to do something else/change the

business with a frequency of 30 or 26.8%. Table 5.4 shows that there

are 84 respondents who encouraged their friends to sell on market,

28 respondents who encouraged their children to sell on market,

and there are 62 respondents who encouraged any other than their

friends and children to sell on market. The top 3 majority of

50

challenges faced by the respondents are sale of product too much

competition; lack of space- adapted premises; and financial

difficulties- lack of access to capital and credit which are rated as

average and interpreted as Moderate. Majority of the respondents

said they are successful in their business and the successful

factors are hardworking, self-confidence and good relationship with

buyers. The failure factors are lack of financial planning (Cost-profit

calculation), highest interest to pay and self-confidence.

Conclusions

Based on the findings of the study, the researchers concluded that

Microfinance Institutions improve the profitability and productivity on the

business operations of market vendors in Kidapawan City, Mega Market.

Recommendations

The following recommendations are hereby proposed:

1. The DTI (Department of Trade and Industry) should look for training

and development for market vendors in Kidapawan City, Mega

Market.

2. Microfinance institutions should offer credits with reasonable

interest to their clients (market vendors) to minimize/eliminate the

lack of access to capital and credit they are facing.

51

3. Lastly, further studies on the impact of microfinance institutions

on the business operation of market vendors using other variables

may be conducted by future researchers.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Fundamental and Technical Analysis of - Dabur IndiaDocumento24 páginasFundamental and Technical Analysis of - Dabur Indiaramji80% (5)

- BudgetDocumento3 páginasBudgetkawalkaurAinda não há avaliações

- Case Study Pakistan State OilDocumento4 páginasCase Study Pakistan State OilDavidparkash Mirza100% (1)

- Factors Attracting Mncs in IndiaDocumento17 páginasFactors Attracting Mncs in Indiarishi100% (1)

- GST TEST 1 by Vivek GabaDocumento3 páginasGST TEST 1 by Vivek GabaAnkit KumarAinda não há avaliações

- BCPC Functionality - Dilg MC 2008-126Documento1 páginaBCPC Functionality - Dilg MC 2008-126Barangay Panoloon100% (1)

- Ray Dalio - The CycleDocumento20 páginasRay Dalio - The CyclePhương LộcAinda não há avaliações

- Walmart Economic IndicatorsDocumento10 páginasWalmart Economic IndicatorsJennifer Scott100% (1)

- VP Director IT Professional Services in Detroit MI Resume Rick PaulDocumento3 páginasVP Director IT Professional Services in Detroit MI Resume Rick PaulRickPaulAinda não há avaliações

- KSB Pumps - Key Officials With ContactsDocumento3 páginasKSB Pumps - Key Officials With ContactsCatherine JovitaAinda não há avaliações

- Establishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesDocumento7 páginasEstablishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesJean Placide BarekeAinda não há avaliações

- Catalogo GROFE IngDocumento50 páginasCatalogo GROFE IngAlvaro Antonio Cristobal AtencioAinda não há avaliações

- Welcome To Indian Railway Passenger Reservation EnquiryDocumento2 páginasWelcome To Indian Railway Passenger Reservation EnquiryChhaviAinda não há avaliações

- Ntse Social Science - The Age of IndustrialisationDocumento7 páginasNtse Social Science - The Age of IndustrialisationMohitAinda não há avaliações

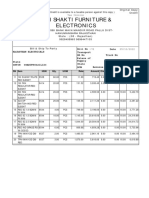

- Shri Shakti Furniture & Electronics: Credit OrginalDocumento1 páginaShri Shakti Furniture & Electronics: Credit OrginalRahul BansalAinda não há avaliações

- BS en 288-4-1992Documento30 páginasBS en 288-4-1992CocaCodaAinda não há avaliações

- Boq 3Documento2 páginasBoq 3China AlemayehouAinda não há avaliações

- Bangalore Architects and Builders 2014-15 Edition - ArchitectsDocumento4 páginasBangalore Architects and Builders 2014-15 Edition - ArchitectsAnisha LaluAinda não há avaliações

- AttachmentDocumento34 páginasAttachmentSiraj ShaikhAinda não há avaliações

- Multiple Choice Questions Distrubution Logistic PDFDocumento14 páginasMultiple Choice Questions Distrubution Logistic PDFYogesh Bantanur50% (2)

- 08 LSF - Load Momment IndicatorDocumento4 páginas08 LSF - Load Momment IndicatorenharAinda não há avaliações

- Agreement For Use of NABL Accredited CAB Combined ILAC MRA MarkDocumento2 páginasAgreement For Use of NABL Accredited CAB Combined ILAC MRA MarkKiranAinda não há avaliações

- Paper One Exam Practice Questions - Tragakes 1Documento12 páginasPaper One Exam Practice Questions - Tragakes 1api-260512563100% (1)

- Capg English - 2Documento5 páginasCapg English - 2Anurag UpadhyayAinda não há avaliações

- Bir Hisar Reject Kharif 2022 Insured PolicyDocumento2 páginasBir Hisar Reject Kharif 2022 Insured PolicyJ StudioAinda não há avaliações

- Studi Kasus LorealDocumento3 páginasStudi Kasus LorealDesni0% (1)

- Panama Natural ResourcesDocumento80 páginasPanama Natural Resourcesgreat2readAinda não há avaliações

- CRUDIFY - The Best Crude Oil Intraday Trading StrategyDocumento11 páginasCRUDIFY - The Best Crude Oil Intraday Trading StrategyRajeswaran DhanagopalanAinda não há avaliações

- Barbados Co-opLIFE Credit Union Funeral InsuranceDocumento11 páginasBarbados Co-opLIFE Credit Union Funeral InsuranceKammie100% (1)

- Maybank Annual Report 2011Documento555 páginasMaybank Annual Report 2011rizza_jamahariAinda não há avaliações