Escolar Documentos

Profissional Documentos

Cultura Documentos

Guidelines For Cashless and Reimbursement

Enviado por

Shashi Kumar MadirajuTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Guidelines For Cashless and Reimbursement

Enviado por

Shashi Kumar MadirajuDireitos autorais:

Formatos disponíveis

Health Insurance

Things you MUST Know

Insurance, claims, reimbursements, hospitalization none of us really look forward to these. And usually, youd prefer to not

have the need to know anything about them. As much as we would love you to never need this information, weve seen from

our experience that just spending a few minutes to go through some important terminologies, and keeping some important

forms handy, helps reduce the stress related to hospitalization when the need arises.

This ready reckoner is our attempt to give you all the basic information that you must know and understand about

hospitalization, health insurance and claims management. Please save this ready reckoner along with the other contents of your

Welcome Kit for future use. And, hopefully, you will not really need any of these much, except for staying healthy.

Contents

Medi Assist and You ................................................................................................................................................ 1

Hospitalization, Expenses and Claims ..................................................................................................................... 2

Hospitalization .................................................................................................................................................... 2

Hospitalization Expenses .................................................................................................................................... 2

Claims ................................................................................................................................................................. 3

Claim Processing and Settlement ........................................................................................................................... 4

Cashless Hospitalization ..................................................................................................................................... 4

Reimbursement .................................................................................................................................................. 5

Medi Assist and You

TPA? Who?

Hospitalization is like a double Oh, that was in the past. Hasnt

whammy. First its the

Medi Assist been appointed as the

suffering caused by the illness.

TPA by your organization?

And then there is the pain

caused by my insurance

Rest assured. Youre in good

company.

hands. All you need to worry about

is your recovery. Medi Assist will

handle everything else for you.

Medi Assist has been appointed as the Third Party Administrator (TPA) for health insurance benefits management by your

organization. As a privileged member of the Medi Assist family, you are now eligible for hassle-free health insurance claims

administration.

What this really means for you is that should you or any of your family members covered under your insurance policy require

hospitalization, we become the interface between you and your insurer. We handle all the paperwork related to your claim;

wherever possible, we give you the benefit of cashless hospitalization; and we ensure that your claim is settled at the earliest.

Medi Assist Integrated Web Portal (IWP) takes you one step further. Apart from hospitalization, we give you access to a range of

preventive and wellness services at our network hospitals and service providers and we make these available to you online

and over your smartphone. You might want to take a few minutes to browse through the Medi Assist IWP and IWP on Mobile

Apps or www.medibuddy.in

Medi Assist India TPA Pvt. Ltd. | www.medibuddy.in | www.mediassistindia.com

Hospitalization, Expenses and Claims

Hospitalization and claims: Things you MUST know

And did you know that while some

Did you know that you can expenses may be covered under

completely eliminate out of your policy, some others may not?

pocket expenses by getting

preauthorization for cashless

hospitalization? It never hurts to know the basics of

hospitalization, expenses and

claims. It just takes a few minutes.

Hospitalization

Hospitalization can be of two types:

Planned Hospitalization: This happens when you have ample time to plan your admission to the hospital. For example,

if your doctor advises a surgery for hernia anytime in the next few weeks, you have time to plan your hospitalization.

Emergency Hospitalization: This happens typically in case of emergencies, such as a road traffic accident. One cannot

plan for such hospitalization.

Hospitalization Expenses

Expenses associated with hospitalization can be classifies as follows:

Pre-hospitalization expenses: When youre unwell, you will most likely consult a physician first, who gets relevant

investigations done before advising hospitalization. Such medical expenses incurred before hospitalization are called

pre-hospitalization expenses.

Hospitalization expenses: All expenses incurred as part of your hospital stay as an in-patient can be termed as

hospitalization expenses.

Post-hospitalization expenses: Some part of your treatment may extend beyond your hospitalization. It may involve

follow-up visits to the doctor, prescription medication, further investigations, etc. Such medical expenses are called

post-hospitalization expenses.

Domiciliary expenses: Expenses related to healthcare that does not involve hospitalization are called domiciliary

expense. This is include investigative labs, OPD visits, minor OPD procedures such as fractures, etc.

Apart from hospitalization expenses, your health insurance policy may also cover pre- and post-hospitalization expenses, and

offer a cap for domiciliary expenses.

Medi Assist India TPA Pvt. Ltd. | www.medibuddy.in | www.mediassistindia.com

Claims

Depending on the situation and your policy coverage, you can make two types of health insurance claims:

Cashless: The essence of cashless hospitalization is that the insured need not make an upfront payment to the hospital

at the time of admission. You may not have any out-of-pocket expenses towards hospitalization in this scenario.

Cashless hospitalization can be availed only at a Medi Assist network hospital and upon approval of your

preauthorization application.

Reimbursement: A reimbursement claim is one where you pay all the expenses related to the hospitalization of the

insured and claim a reimbursement of your expenses after discharge. Reimbursement claims may be filed in the

following circumstances:

o Hospitalization at a non-network hospital

o Post-hospitalization and pre-hospitalization expenses

o Denial of preauthorization for cashless facility at a network hospital.

You would have received a list of our network hospitals as part of your Medi Assist Welcome Kit while on-boarding you onto our

Integrated Web Portal (IWP). This list may have undergone changes in the form of additions and deletions. Please check our

website, www.mediassistindia.com, for the updated list of network hospitals and also can accessed through IWP Mobile.

Medi Assist India TPA Pvt. Ltd. | www.medibuddy.in | www.mediassistindia.com

Claim Processing and Settlement

Health Insurance Claim: Make the Most of it.

Have a planned surgery?

Dont pay anything for it. What more, you can submit and

Well make it cashless. track the status of your claim online

with Medi Assist IWP and

Emergency hospitalization? Flash MediBuddy

your Medi Assist card for cashless

admission into the hospital.

Cashless or reimbursement; planned or emergency hospitalization; treatment at a network hospital or non-network hospital as

a holder of a Medi Assist card, you are eligible for hassle-free claims settlement. Heres how you can go about submitting your

claim in case of hospitalization.

Cashless Hospitalization

Cashless hospitalization can be availed only at Medi Assist network of hospitals. You can get an updated list of our network

hospitals on our website, www.mediasssistindia.com.

1. Before you leave for the hospital, ensure that you have your printed and signed Medi Assist ID card handy with you.

2. In case you dont have one, you can log into your Medi Assist IWP and click Generate E-Card to instantly generate and

print out an e-card for your family.

3. At the time of admission at a network hospital, produce your Medi Assist ID card (as proof of being covered by a health

insurance) along with any valid photo ID (as proof of identity).

4. Intimation can be registered with Medi Assist (Hospitalization- planned/unplanned) via Mobile apps,

www.medibuddy.in or SMS Claim Int to 9664172929 or mail at Claimintimation@mediassistindia.com or just give

missed call to 18067264648

5. Fill up the preauthorization form for cashless hospitalization jointly with your treating doctor. You can request for the

form at the network hospital or download the same from our website, www.mediassistindia.com. Please make sure all

the details asked in the form are completely filled. This will ensure speedy processing of your request.

6. Fax the completed form to Medi Assist on our toll free fax number18604250025

In the case of planned hospitalization, it is prudent to send the preauthorization request to Medi Assist at least

72 hours before your planned admission.

In case of emergency hospitalization, the preauthorization request can be sent to Medi Assist within four

hours after admission.

7. In case, for whatever reason, the preauthorization request cannot be approved, a letter denying preauthorization will

be sent to the hospital. In this case, you will have to settle the hospital bill in full by yourself. You must note that denial

of a preauthorization request must not be construed as denial of treatment or denial of coverage. You can go ahead

with the treatment, settle the hospital bills and submit the claim for a possible reimbursement. After discharge, you

must send/submit all the documents related to your claim to nearest branch of Medi Assist India TPA Private Limited

8. At Medi Assist, the medical team will verify your medical document and determine the admissibility of your claim based

on your policy terms and condition.

9. In case coverage is available, Medi Assist will issue a preauthorization for cashless hospitalization for a specified amount

depending on the disease, treatment, how much you are insured for, etc. This approval is sent to the hospital by fax

and1/or email (if available).

Note: Further enhancement approvals may be issued on request, subject to terms and conditions of the policy.

Medi Assist India TPA Pvt. Ltd. | www.medibuddy.in | www.mediassistindia.com

The hospital will ask you to pay for all the non-medical expenses in your bill. You will also have to pay all your pre-hospitalization

and post-hospitalization expenses. These can be claimed only after the settlement of the main hospitalization claim.

At the time of discharge, please make sure that you check and sign the original bills and the discharge summary. Please carry

home a copy of the signed bill, discharge summary and all your investigation reports. This is for your reference and will also be

useful for your future healthcare needs.

Note: In case of suppression of material facts or misrepresentation of facts by the hospital or the insured, the pre authorization

issued for the cashless facility will stand cancelled. The insured will be liable to settle the hospital bill in full.

You can also log into your Medi Assist Integrate Web Portal (IWP) to check the details of your hospitalization and your claims

status. Just click Claims > Claims Search to track a claim or view a history of all claims in the past and also through Medi Assist

Mobile App or www.medibuddy.in

Reimbursement

Although cashless hospitalization facility is available at the Medi Assist network of hospitals, you may sometimes need to use

hospitals that are not in the Medi Assist network. In such cases, you can claim a reimbursement of your hospitalization expenses

after discharge. You can also claim reimbursements for pre- and post-hospitalization expenses or for hospitalization that was not

preauthorized for cashless facility.

You can use your Medi Assist Integrate Web Portal (IWP) to raise and track your reimbursement claims.

1. Before you leave for the hospital, ensure that you have your printed and signed Medi Assist ID card handy with you.

2. In case you dont have one, you can log into your Medi Assist IWP and click Generate E-Card to instantly generate and

print out an e-card for your family.

3. Intimation can be registered with Medi Assist (Hospitalization- planned/unplanned) via Mobile apps,

www.medibuddy.in or SMS Claim Int to 9664172929 or mail at Claimintimation@mediassistindia.com or just give

missed call to 18067264648.

4. After discharge from the hospital, you can submit your reimbursement claim. Log into www.mediassistindia.net/iwp/

with your IWP username and password.

5. Click Claims > Hospitalization Claims.

6. Enter all the information in the displayed form and upload all the necessary documents duly signed. The following are

the documents that you need to upload:

Original hospital final bill

Original numbered receipts for payments made to the hospital

Complete breakup of the hospital bill

Original discharge summary

All original investigation reports

All original medicine bills with relevant prescriptions

Original signed claim form

Copy of the Medi Assist ID card or current policy copy and previous years' policy copies (if any)

Covering letter stating your complete address, contact numbers and email address (if available)

ID proof , Age Proof and address proof (Copy of DL,PAN card, Adhar card, Voter ID etc)

7. Submit the following documents for a post-hospitalization or a pre-hospitalization expenses claim:

Copy of the discharge summary of the corresponding hospitalization

All relevant doctors' prescriptions for investigations and medication

All bills for investigations done with the respective reports

All bills for medicines supported by relevant prescriptions

ID proof , Age Proof and address proof (Copy of DL,PAN card, Adhar card, Voter ID etc)

Medi Assist India TPA Pvt. Ltd. | www.medibuddy.in | www.mediassistindia.com

8. Send/submit the hard copies of all the documents related to your claim to Medi Assist India TPA Private Limited as per

teams stated by your insurer to nearest branch of Medi Assist India Pvt. Ltd.

9. At Medi Assist, the medical team will verify your medical document and determine the admissibility of your claim based

on your policy terms and condition.

10. Based on the processing of the claim, a denial or approval is executed.

In case of approval, a cheque is made out for the approved amount and sent to you at the address mentioned

in your health insurance policy. In case you have been insured through your employer, the cheque will be

dispatched based on instructions received from your employer.

In case your claim is denied, the denial letter is sent to you by courier / post / e-mail quoting the reason for

denial of your claim. In case you have been insured through your employer, the denial letter will be dispatched

based on instructions received from your employer.

You can track the progress of your claim using Integrate Web Portal (IWP). Just click Claims > Claims Search to track a claim or

view a history of all claims in the past and also through Medi Assist Mobile App or www.medibuddy.in

Should you have any questions, clarifications or concerns regarding your health insurance, please do not hesitate to get in touch

with your corporate single point of contact mentioned in your welcome email from Medi Assist. Heres to healthy living!

Medi Assist India TPA Pvt. Ltd. | www.medibuddy.in | www.mediassistindia.com

Você também pode gostar

- MediassistGuidelines PDFDocumento17 páginasMediassistGuidelines PDFSai SankalpAinda não há avaliações

- Health Insurance Ready ReckonerDocumento17 páginasHealth Insurance Ready ReckonerSüññy MäñèAinda não há avaliações

- Guidelines For Reimbursement and Cashless FacilityDocumento7 páginasGuidelines For Reimbursement and Cashless FacilitytamiyanvaradaAinda não há avaliações

- Guidelines For Reimbursement and Cashless FacilityDocumento7 páginasGuidelines For Reimbursement and Cashless FacilityPavan Kumar ReddyAinda não há avaliações

- Guidelines For Reimbursement and Cashless FacilityDocumento5 páginasGuidelines For Reimbursement and Cashless FacilityPandurangaAinda não há avaliações

- Health Insurance N TPA by Poonam N Neha BhakerDocumento44 páginasHealth Insurance N TPA by Poonam N Neha Bhakerpoonam@imsAinda não há avaliações

- Medicade - How It WorksDocumento21 páginasMedicade - How It WorksWayne CaponeAinda não há avaliações

- Introduction DekaDocumento6 páginasIntroduction Dekaidil2023Ainda não há avaliações

- Brochure PDFDocumento16 páginasBrochure PDFJackson DcostaAinda não há avaliações

- 1) What Is RCM?: HIPAA (Health Insurance Portability and Accountability Act of 1996) Is UnitedDocumento4 páginas1) What Is RCM?: HIPAA (Health Insurance Portability and Accountability Act of 1996) Is UnitedSiraj PAinda não há avaliações

- Mediclaim PolicyDocumento23 páginasMediclaim PolicyAmit GuptaAinda não há avaliações

- UAE HPHS PolicyHandbook EN03Documento40 páginasUAE HPHS PolicyHandbook EN03Afrath_nAinda não há avaliações

- FAQs On EcashlessDocumento3 páginasFAQs On EcashlessMS CRMAinda não há avaliações

- Health Insurance HandbookDocumento10 páginasHealth Insurance HandbookvinaysekharAinda não há avaliações

- Health InsuranceDocumento27 páginasHealth Insurancelittlemaster1982Ainda não há avaliações

- Health InsuranceDocumento2 páginasHealth InsuranceBindu ShreeAinda não há avaliações

- Intrax Work&Travel BrochureDocumento13 páginasIntrax Work&Travel BrochureCiprian CuleaAinda não há avaliações

- FWK 9Documento64 páginasFWK 9api-235454491Ainda não há avaliações

- Membership Guide: Health InsuranceDocumento58 páginasMembership Guide: Health InsuranceMissh Queen100% (1)

- Company Profile: Bajaj Allianz General Insurance Company LinitedDocumento27 páginasCompany Profile: Bajaj Allianz General Insurance Company Linitedsidhantha100% (1)

- FAQs For EcashlessDocumento3 páginasFAQs For EcashlessSai TejaswiAinda não há avaliações

- Care (Health Insurance Product) BrochureDocumento20 páginasCare (Health Insurance Product) BrochureNilesh PatilAinda não há avaliações

- ESC H BAND FAQsDocumento8 páginasESC H BAND FAQsRamesh DeshpandeAinda não há avaliações

- Medicare AssignmentDocumento13 páginasMedicare AssignmentmivbciwlfAinda não há avaliações

- Group Medical Insurance: FaqsDocumento4 páginasGroup Medical Insurance: FaqsVenugopal ChowdaryAinda não há avaliações

- Benefits Under My Health InsuranceDocumento4 páginasBenefits Under My Health InsuranceChhavi ChoudharyAinda não há avaliações

- 2017 UHC EPO Benefit Summary Muping Health InsuranceDocumento16 páginas2017 UHC EPO Benefit Summary Muping Health InsurancescartoonAinda não há avaliações

- FINAL Understanding Your Hospital Bill Brochure ReducedDocumento2 páginasFINAL Understanding Your Hospital Bill Brochure Reducedmr.perfectraviranjan222Ainda não há avaliações

- Unit 2 Health Insurance ProductsDocumento25 páginasUnit 2 Health Insurance ProductsShivam YadavAinda não há avaliações

- Health Insurance OverviewDocumento11 páginasHealth Insurance Overviewmansi_91Ainda não há avaliações

- Health Insurance HandbookDocumento10 páginasHealth Insurance HandbookDipsonAinda não há avaliações

- Payment Policy 11Documento1 páginaPayment Policy 11api-279009912Ainda não há avaliações

- Sisc Q ADocumento7 páginasSisc Q Aapi-204910805Ainda não há avaliações

- How Insurance WorksDocumento8 páginasHow Insurance WorksKing4RealAinda não há avaliações

- Patients ProfitDocumento2 páginasPatients ProfitPrince KumarAinda não há avaliações

- Care (Health Insurance Product) - Brochure PDFDocumento19 páginasCare (Health Insurance Product) - Brochure PDFcharul bhanAinda não há avaliações

- Travel Medical Insurance Policy Brochure: Group ID: ATR16-1611301-01TMDocumento10 páginasTravel Medical Insurance Policy Brochure: Group ID: ATR16-1611301-01TMJuanitaRamirezAinda não há avaliações

- Health Insurance MythsDocumento6 páginasHealth Insurance Mythsnavneet1107Ainda não há avaliações

- What Is Corporate Health Insurance?Documento4 páginasWhat Is Corporate Health Insurance?Muhammad RamzanAinda não há avaliações

- AXA DXB Policy Handbook - 2022 - 2023Documento44 páginasAXA DXB Policy Handbook - 2022 - 2023NSRAinda não há avaliações

- Himanshi Health InsuranceDocumento8 páginasHimanshi Health InsuranceTushar BansalAinda não há avaliações

- Insurance 101 Part 1Documento18 páginasInsurance 101 Part 1Billy JO100% (1)

- Health Insurance Inforamtion, Individual Health Insurance, Family Health Insurance InformationDocumento7 páginasHealth Insurance Inforamtion, Individual Health Insurance, Family Health Insurance Informationdjohnson418Ainda não há avaliações

- Medical Billing-Simple ManualDocumento17 páginasMedical Billing-Simple ManualKarna Palanivelu80% (25)

- Our Financial Policy: Regarding InsuranceDocumento1 páginaOur Financial Policy: Regarding Insurance224edgebAinda não há avaliações

- Healthshare Cost Sharing PlansDocumento3 páginasHealthshare Cost Sharing Plansapi-596118571Ainda não há avaliações

- Poster Planned HospitalisationDocumento1 páginaPoster Planned HospitalisationMALLAVARAPU NARASAREDDYAinda não há avaliações

- Family Health Secure Plan - 4Documento2 páginasFamily Health Secure Plan - 4Irfan OmerAinda não há avaliações

- Health InsuranceDocumento13 páginasHealth InsuranceTroy MirandaAinda não há avaliações

- Health Insurance Coverage For HospitalisationDocumento7 páginasHealth Insurance Coverage For HospitalisationQuang HuyAinda não há avaliações

- Calling Script FinalDocumento3 páginasCalling Script FinalPradeep NadarAinda não há avaliações

- AHM Black White Boost FlexiDocumento10 páginasAHM Black White Boost FlexiDani Kirky Ylagan100% (1)

- Overview of Insurance ScenarioDocumento31 páginasOverview of Insurance Scenarionirmal_satAinda não há avaliações

- Health InsuranceDocumento1 páginaHealth Insurance021Baisakhi PattnaikAinda não há avaliações

- How To Buy Health InsuranceDocumento3 páginasHow To Buy Health InsurancekalevaishaliAinda não há avaliações

- Different Types of Health Plans: How They CompareDocumento13 páginasDifferent Types of Health Plans: How They CompareWajid MalikAinda não há avaliações

- 2021 Group Brochure: Work & Travel Group Number: WT20G16500Documento5 páginas2021 Group Brochure: Work & Travel Group Number: WT20G16500Margorie MendozaAinda não há avaliações

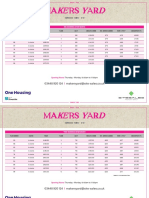

- Makers Yard PricelistDocumento3 páginasMakers Yard PricelistShashi Kumar MadirajuAinda não há avaliações

- Guidelines For Cashless and ReimbursementDocumento7 páginasGuidelines For Cashless and ReimbursementShashi Kumar MadirajuAinda não há avaliações

- Acton Works, Host BrochureDocumento18 páginasActon Works, Host BrochureShashi Kumar MadirajuAinda não há avaliações

- The One Goal Workbook PDFDocumento34 páginasThe One Goal Workbook PDFShashi Kumar Madiraju100% (2)

- Woodies CCI Ghost PatternsDocumento27 páginasWoodies CCI Ghost PatternsShashi Kumar MadirajuAinda não há avaliações

- Woodies CC IDocumento27 páginasWoodies CC Ilucnes100% (1)

- Karnataka TlgerDocumento2 páginasKarnataka TlgerShashi Kumar MadirajuAinda não há avaliações

- Heart of Ribhu GitaDocumento9 páginasHeart of Ribhu GitaakhiaddictedAinda não há avaliações

- Super Science of GayatriDocumento177 páginasSuper Science of Gayatrisksuman100% (36)

- Super Science of GayatriDocumento177 páginasSuper Science of Gayatrisksuman100% (36)

- Shiva Mahimna Stotra With MeaningDocumento14 páginasShiva Mahimna Stotra With MeaningKardamRishiAinda não há avaliações

- Mooji Satsangs TextDocumento37 páginasMooji Satsangs TextShashi Kumar Madiraju100% (1)

- Contextualized Online Search and Research SkillsDocumento24 páginasContextualized Online Search and Research SkillschiripiAinda não há avaliações

- Red Hat JBoss Enterprise Application Platform-7.1-Configuration Guide-en-US PDFDocumento479 páginasRed Hat JBoss Enterprise Application Platform-7.1-Configuration Guide-en-US PDFchakrikollaAinda não há avaliações

- Faceprep Readyreckoner AccentureDocumento24 páginasFaceprep Readyreckoner AccentureJackAinda não há avaliações

- M3500 ManualDocumento41 páginasM3500 ManualLina Espitia TorresAinda não há avaliações

- Growth Hacking CheatsDocumento2 páginasGrowth Hacking CheatsShivani GuptaAinda não há avaliações

- Discussion Assignment Unit 8 - BUS-5114 MITDocumento2 páginasDiscussion Assignment Unit 8 - BUS-5114 MITAmin Dankerlui100% (1)

- Devops ResumeDocumento5 páginasDevops ResumeEkant BajajAinda não há avaliações

- Linux FileMaker Server For Ubuntu - DB ServicesDocumento10 páginasLinux FileMaker Server For Ubuntu - DB ServicesDB ServicesAinda não há avaliações

- Media & Information Literacy (M.I.L) : Senior High School Grade 12Documento50 páginasMedia & Information Literacy (M.I.L) : Senior High School Grade 12J i nAinda não há avaliações

- Eurocode 7 Geotechnical Design PDFDocumento2 páginasEurocode 7 Geotechnical Design PDFDanielleAinda não há avaliações

- XChange Captain Manual 5.1 FinalDocumento16 páginasXChange Captain Manual 5.1 FinalAshish Nayyar100% (1)

- Resolver Case 7241101: Complaint Against Lenskart by Anuj Kumar Generated 09/05/21 at 16:05 GMTDocumento13 páginasResolver Case 7241101: Complaint Against Lenskart by Anuj Kumar Generated 09/05/21 at 16:05 GMTAvinash SharmaAinda não há avaliações

- User Manual OT BioLab v3.0Documento69 páginasUser Manual OT BioLab v3.0yashyg6Ainda não há avaliações

- Mgate 5105-Mb-Eip Quick Installation Guide: Hardware IntroductionDocumento2 páginasMgate 5105-Mb-Eip Quick Installation Guide: Hardware IntroductionGoran JovanovicAinda não há avaliações

- Desktop Publishing Lecture NotesDocumento42 páginasDesktop Publishing Lecture Notesas14jn80% (5)

- AppXtender ReportsMgmtDocumento380 páginasAppXtender ReportsMgmtShominAinda não há avaliações

- AWS Services For Devops EngineerDocumento6 páginasAWS Services For Devops Engineersathyanarayana medaAinda não há avaliações

- Impact of Social Media On Students Academic Performance ProposalDocumento10 páginasImpact of Social Media On Students Academic Performance ProposalFMTech ConsultsAinda não há avaliações

- Computer NetworkDocumento26 páginasComputer NetworkKajal GoudAinda não há avaliações

- NSO Day 2 Yang XML and Rest ApiDocumento101 páginasNSO Day 2 Yang XML and Rest ApiAla JebnounAinda não há avaliações

- Faq Qrpaybiz MerchantDocumento21 páginasFaq Qrpaybiz MerchantayerterjunAinda não há avaliações

- Bloxburg Epic Thing CrackedDocumento125 páginasBloxburg Epic Thing Cracked・一乃口丂丂ツAinda não há avaliações

- 13 Ways To Build A High Performing Remote TeamDocumento4 páginas13 Ways To Build A High Performing Remote TeamOnyinyeAinda não há avaliações

- Powermanager 5.1Documento33 páginasPowermanager 5.1Margarito MtzAinda não há avaliações

- Online Examinations Frequently Asked QuestionsDocumento5 páginasOnline Examinations Frequently Asked Questionsha LiyanaAinda não há avaliações

- ADGroup SSL VPNDocumento5 páginasADGroup SSL VPNPayal PriyaAinda não há avaliações

- MIGS Virtual Payment Client Guide Rev 2.1.0 PDFDocumento105 páginasMIGS Virtual Payment Client Guide Rev 2.1.0 PDFAhmed Reda MohamedAinda não há avaliações

- HKB-2X SpeakerStation DatasheetDocumento3 páginasHKB-2X SpeakerStation DatasheetbelAinda não há avaliações

- URC Macro Integration Guide v1.0Documento37 páginasURC Macro Integration Guide v1.0Bernardo VilelaAinda não há avaliações

- Web Technology DBMSsDocumento61 páginasWeb Technology DBMSskirank_11Ainda não há avaliações