Escolar Documentos

Profissional Documentos

Cultura Documentos

FBR Notice US 147 New PDF

Enviado por

Lbg TanvirTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

FBR Notice US 147 New PDF

Enviado por

Lbg TanvirDireitos autorais:

Formatos disponíveis

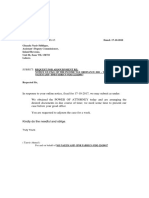

DEPUTY COMMISSIONER INLAND REVENUE, UNIT-04,

ZONE-VII, CORPORATE REGIONAL TAX OFFICE,

TAX HOUSE, NABHA ROAD, LAHORE.

No 1B7i 04 ated - 31 05.2A17

To

THE PRINCIPAL OFFICER

HNR FABRICS

RAIWIND ROAD DEFENCE ROAD BHUPTIAN

CHCWK

145g76a

Subject. PAYMENT OF 4TI INSTALLMENT OF ADVANCE TAX UNDER SECTION

147 OF THE INCOME TAX ORDINANCE. 2OO1 FOR TAX YEAR 2017.

KeIh.,-reiluu d-uove.

1. ln pursuance of Part-V, Division-1. of section 147(4) of lncome Tax Ordinance,

2001 you were under obligation to pay 4th installment of advance tax for the TAX YEAR

2017 calculated on the basis of turnover declared which is as under:-

Turnover for I Advance Tax

Expected Sale in 4th Liability uls Due Date for

the Quarter

Quarter (As per sales

Quarter (based on 3 14714), Payment

Quarters average) For 4th Quarter

tax_!_qlgrr,)_

April to i 18,446,000 8,787,314 87,873 15t0612017

June-201 7

2. Last date of payment of 4tn installment of advance tax is 15.0Q.2017. With this letter it

is re-iterated that in case, the payment has already been made, you are requested to furnish

cooies of challans / deductions on or before 15.06.2017 on the format mentioned in

paragraph No 1 as above,

3. ln case, the advance tax liability has not been discharged so for, you are requested

to please make payment of due advance tax by 15.06.20'17 besides furnishing the

information on the pattern detailed above.

4 Please note that as per sub-section (7) of section 147 of the lncome Tax Ordinance,

2001. provisions of this ordinance shall apply to any advance tax due as if the amount due

were tax due under an assessment order.

5. lt may further be noted that non/belated payment of advance tax is subject to default

surcharge u/s 205, punitive action 191(1Xb) and recovery measures uls 138 of the lncome

Tax Ordinance, 2001.

Looking forward for your cooperation with the revenue administration.

i.,i Commissioner lnland Revenue

!r l Unit-04, Zone-Vll, CRTO, Lahore

Você também pode gostar

- 1040 Exam Prep: Module II - Basic Tax ConceptsNo Everand1040 Exam Prep: Module II - Basic Tax ConceptsNota: 1.5 de 5 estrelas1.5/5 (2)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4No EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Ainda não há avaliações

- FD 941 Apr-Jun 2017 PDFDocumento3 páginasFD 941 Apr-Jun 2017 PDFScott WinklerAinda não há avaliações

- Schedule Se (Form 1040)Documento2 páginasSchedule Se (Form 1040)Vita Volunteers WebmasterAinda não há avaliações

- Exemption Certificate - SalesDocumento2 páginasExemption Certificate - SalesExecutive F&ADADUAinda não há avaliações

- 2013 AgriSafe 990Documento28 páginas2013 AgriSafe 990AgriSafeAinda não há avaliações

- 8850 Wotc Tax FormDocumento2 páginas8850 Wotc Tax Formapi-127186411Ainda não há avaliações

- 2010 Income Tax ReturnDocumento2 páginas2010 Income Tax ReturnCkey ArAinda não há avaliações

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Documento2 páginasFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyAinda não há avaliações

- Foreign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyDocumento3 páginasForeign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyballsinhandAinda não há avaliações

- Hong Thien PhuocBui2018Documento6 páginasHong Thien PhuocBui2018Thien BaoAinda não há avaliações

- Annual Income Tax Return: BrianDocumento4 páginasAnnual Income Tax Return: BrianChristine ViernesAinda não há avaliações

- Benfitsform Starbucks BeanstockDocumento1 páginaBenfitsform Starbucks BeanstockAndrew Christopher CaseAinda não há avaliações

- ECDC 2009 Tax ReturnDocumento27 páginasECDC 2009 Tax ReturnNC Policy WatchAinda não há avaliações

- Screenshot 2023-10-16 at 11.38.24 AMDocumento1 páginaScreenshot 2023-10-16 at 11.38.24 AMappurajan51Ainda não há avaliações

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Documento1 páginaW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Andres AlcantarAinda não há avaliações

- Income Tax Information 2023Documento4 páginasIncome Tax Information 2023Village of new londonAinda não há avaliações

- Cash FlowDocumento1 páginaCash Flowpawan_019Ainda não há avaliações

- PDFDocumento1 páginaPDFharessh100% (1)

- 2017 NoVo 990Documento216 páginas2017 NoVo 990Noam BlumAinda não há avaliações

- When To Hire A Tax ProfessionalDocumento7 páginasWhen To Hire A Tax ProfessionalMaimai Durano100% (1)

- FIRE 2011 Form 990Documento36 páginasFIRE 2011 Form 990FIREAinda não há avaliações

- P010 636211442428322820 T14385011dupD1 PDFDocumento1 páginaP010 636211442428322820 T14385011dupD1 PDFAnonymous pY5EUXUpaAinda não há avaliações

- MV 441 EdlDocumento4 páginasMV 441 Edltuan nguyenAinda não há avaliações

- Statement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GDocumento1 páginaStatement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GClifton WilsonAinda não há avaliações

- New JErsey Resident Return NJ-1040Documento68 páginasNew JErsey Resident Return NJ-1040Stephen HallickAinda não há avaliações

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocumento42 páginas2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Documento2 páginasChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Sarah KuldipAinda não há avaliações

- U.S. Departing Alien Income Tax Return: Print or TypeDocumento4 páginasU.S. Departing Alien Income Tax Return: Print or TypeDavid WebbAinda não há avaliações

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocumento11 páginasAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerdtoxidAinda não há avaliações

- Income Tax Return FormDocumento3 páginasIncome Tax Return FormTru TaxAinda não há avaliações

- Tax ReturnDocumento26 páginasTax ReturnjoshuaharaldAinda não há avaliações

- Pyw223s EeDocumento1 páginaPyw223s Eedanielman956Ainda não há avaliações

- Windward Fund's 2018 Tax FormsDocumento49 páginasWindward Fund's 2018 Tax FormsJoe SchoffstallAinda não há avaliações

- Request For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429Documento2 páginasRequest For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429DrmookieAinda não há avaliações

- Monetary Determination Pandemic Unemployment Assistance: Michael L PresleyDocumento3 páginasMonetary Determination Pandemic Unemployment Assistance: Michael L PresleyDylan VanslochterenAinda não há avaliações

- Early Evidence On The Use of Foreign Cash Following The Tax Cuts and Jobs Act of 2017Documento53 páginasEarly Evidence On The Use of Foreign Cash Following The Tax Cuts and Jobs Act of 2017GlennKesslerWPAinda não há avaliações

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDocumento3 páginasTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezAinda não há avaliações

- Federal 2016 :DDocumento15 páginasFederal 2016 :DAnguila Angel Anguila AngelAinda não há avaliações

- Paula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Documento2 páginasPaula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Natural Beauty LaserAinda não há avaliações

- 2021 - TaxReturn 2pagessignedDocumento3 páginas2021 - TaxReturn 2pagessignedDedrick RiversAinda não há avaliações

- GKEDC Form 990 Page 1 For 2013 Through 2019Documento7 páginasGKEDC Form 990 Page 1 For 2013 Through 2019Don MooreAinda não há avaliações

- Frantz Raymond TaxDocumento1 páginaFrantz Raymond Taxjoseph GRAND-PIERREAinda não há avaliações

- Profit or Loss From Business: Schedule C (Form 1040) 09Documento2 páginasProfit or Loss From Business: Schedule C (Form 1040) 09Braeylnn bookerAinda não há avaliações

- W9 FormDocumento1 páginaW9 FormChris GreeneAinda não há avaliações

- Payroll Insights - Farsight IT SolutionsDocumento1 páginaPayroll Insights - Farsight IT SolutionsyogeshAinda não há avaliações

- General Instructions For Forms W-2 and W-3: (Including Forms W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2c, and W-3c)Documento35 páginasGeneral Instructions For Forms W-2 and W-3: (Including Forms W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2c, and W-3c)tarles666Ainda não há avaliações

- CertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245Documento1 páginaCertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245c phelpsAinda não há avaliações

- Sample Profit and Loss StatementDocumento2 páginasSample Profit and Loss StatementElisabet Halida WahyarsiAinda não há avaliações

- Quarterly Percentage Tax Return - 1st QuarterDocumento2 páginasQuarterly Percentage Tax Return - 1st QuarterJo HernandezAinda não há avaliações

- Form1095a 2017 PDFDocumento8 páginasForm1095a 2017 PDFTina ReyesAinda não há avaliações

- State of Georgia G-4 PDFDocumento2 páginasState of Georgia G-4 PDFJames BoyerAinda não há avaliações

- Schedule 1 For 2019 Form 1040Documento1 páginaSchedule 1 For 2019 Form 1040CNBC.comAinda não há avaliações

- Instructions For Form 1120Documento31 páginasInstructions For Form 1120A.F. GRANADAAinda não há avaliações

- Fairmount Heights - Documents 1 PDFDocumento88 páginasFairmount Heights - Documents 1 PDFAri AsheAinda não há avaliações

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocumento72 páginasInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001Ainda não há avaliações

- Oji 2Documento2 páginasOji 2brent_barthanyAinda não há avaliações

- Circularno 24 CGSTDocumento4 páginasCircularno 24 CGSTHr legaladviserAinda não há avaliações

- Akbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanDocumento1 páginaAkbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanSaad KhanAinda não há avaliações

- Reply For Hashim KhanDocumento2 páginasReply For Hashim Khanhamza awan0% (1)

- 732 2012Documento5 páginas732 2012Lbg TanvirAinda não há avaliações

- FBR Notice US 147Documento1 páginaFBR Notice US 147Lbg TanvirAinda não há avaliações

- Adjournment HNR FabricsDocumento1 páginaAdjournment HNR FabricsLbg TanvirAinda não há avaliações

- FBR Notice US 147Documento1 páginaFBR Notice US 147Lbg TanvirAinda não há avaliações

- United States Court of Appeals, Third CircuitDocumento27 páginasUnited States Court of Appeals, Third CircuitScribd Government DocsAinda não há avaliações

- Fundamentals of Corporate Finance Test BDocumento188 páginasFundamentals of Corporate Finance Test Bengel044100% (2)

- Ajanta Pharma LTD.: Net Fixed AssetsDocumento4 páginasAjanta Pharma LTD.: Net Fixed AssetsDeepak DashAinda não há avaliações

- MCQ On Financial ManagementDocumento23 páginasMCQ On Financial Managementsvparo0% (1)

- Proposal Form RinRaksha 01122017Documento3 páginasProposal Form RinRaksha 01122017Shashank ThakurAinda não há avaliações

- BillDocumento10 páginasBillAlok TiwariAinda não há avaliações

- Ottoville Council Discusses GIS Use: The Delphos HeraldDocumento14 páginasOttoville Council Discusses GIS Use: The Delphos HeraldThe Delphos HeraldAinda não há avaliações

- International Payment MethodsDocumento4 páginasInternational Payment MethodsPrabhujot SinghAinda não há avaliações

- Business in Short (Ebook), Abdulwahab A. Al Al MaimaniDocumento88 páginasBusiness in Short (Ebook), Abdulwahab A. Al Al MaimaniAl Muhandis Integrated ServicesAinda não há avaliações

- NTB Annual Report 2015Documento288 páginasNTB Annual Report 2015Sajith PrasangaAinda não há avaliações

- FM CH 2Documento38 páginasFM CH 2Sahil Aggarwal100% (1)

- IDRBT Conference DeckDocumento12 páginasIDRBT Conference DeckAbhinav GargAinda não há avaliações

- 28 Usc 3002 Federal Debt Collection DefinitionsDocumento10 páginas28 Usc 3002 Federal Debt Collection Definitionsruralkiller100% (1)

- PF Form 19 & 10CDocumento6 páginasPF Form 19 & 10CJatinChadhaAinda não há avaliações

- Guaranty Case DigestsDocumento5 páginasGuaranty Case DigestsKim EcarmaAinda não há avaliações

- AssignmentDocumento11 páginasAssignmentMawar BerduriAinda não há avaliações

- CA Intermediate Paper-1Documento366 páginasCA Intermediate Paper-1Anand_Agrawal19Ainda não há avaliações

- Partnership Operations: Review of The Accounting CycleDocumento8 páginasPartnership Operations: Review of The Accounting CycleAlloysius ParilAinda não há avaliações

- Insular Bank V IAC (DADO)Documento1 páginaInsular Bank V IAC (DADO)Kylie Kaur Manalon DadoAinda não há avaliações

- Table Mat 1st Page (!)Documento1 páginaTable Mat 1st Page (!)paultanAinda não há avaliações

- RA 4726 and PD 957Documento3 páginasRA 4726 and PD 957remingiiiAinda não há avaliações

- Affordable Housing in ChinaDocumento2 páginasAffordable Housing in ChinannafosAinda não há avaliações

- BSP c1041Documento2 páginasBSP c1041Maya Julieta Catacutan-EstabilloAinda não há avaliações

- 1st InternalDocumento20 páginas1st InternalAmrit TejaniAinda não há avaliações

- RockRiverTimes 03282018 CLASSDocumento2 páginasRockRiverTimes 03282018 CLASSShane NicholsonAinda não há avaliações

- PNB v. Sta. MariaDocumento2 páginasPNB v. Sta. MariaElle MichAinda não há avaliações

- High-Ticket Phone Scripts: Online Business BuilderDocumento6 páginasHigh-Ticket Phone Scripts: Online Business BuilderPatricia Lauron100% (1)

- Law Act 4 Employees Social Security Act 1969Documento140 páginasLaw Act 4 Employees Social Security Act 1969epeguamAinda não há avaliações

- Insurance Cases DigestDocumento14 páginasInsurance Cases DigestheymissrubyAinda não há avaliações

- Charges Upon Obligations of Absolute Community Property (ACP) and Conjugal Property of Gains (CPG)Documento13 páginasCharges Upon Obligations of Absolute Community Property (ACP) and Conjugal Property of Gains (CPG)Bianca de GuzmanAinda não há avaliações