Escolar Documentos

Profissional Documentos

Cultura Documentos

Tax Reform Law Chart: Prior Law vs. New Law

Enviado por

Aaron Frank Torres0 notas0% acharam este documento útil (0 voto)

232 visualizações1 página2018 Prior Law vs. New Law

Título original

2018_TaxReformLawChart

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documento2018 Prior Law vs. New Law

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

232 visualizações1 páginaTax Reform Law Chart: Prior Law vs. New Law

Enviado por

Aaron Frank Torres2018 Prior Law vs. New Law

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

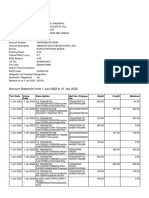

Tax Reform Law Chart: Prior Law vs.

New Law

Provisions of Interest to Real Estate Professionals

Prior Law New Law

Mortgage Interest Capped at $1,000,000 Capped at $750,000

Deduction

State and Local Tax Unlimited The total of income, sales and property

Deduction tax deductions is capped at $10,000

Capital Gains Exemption Exclusion of up to $250,000 No change

on Sale of Primary ($500,000 if married) of gain

Residence realized on sale or exchange

of principal residence if lived

in for 2 of last 5 years

1031 Like-Kind Exchanges Applied to all classes of Limits non-recognition of gain to real

property (e.g., personal and property

real)

Personal Deduction Allowed Eliminated

Standard Deduction $6,350 individual and $12,000 individual and $24,000 if

$12,700 if married married

MID for second Homes Capped at $1,000,000 Capped at $750,000

Home Equity Loan Capped at $100,000 Not deductible unless the proceeds are

Deduction used to substantially improve the

property

Moving Expense Exclusion Deduction for moving Eliminated except for members of

and Deduction expenses incurred in armed forces on active duty that move

connection with change in pursuant to military orders

work place

Child Tax Credit $1,000 for each child $2,000 for each child

Deduction for Qualified None 20% deduction of taxable income

Business Income of Pass- phased out above $157,000 ($315,000 if

Through Entities including married) for brokerage services

independent contractors

Depreciation Recovery Recovery period is 27.5 years No change

Period for Real Property

(Residential Rental)

Depreciation Recovery Recovery period is 39 years No change

Period for Real Property

(nonresidential)

Depreciation Recovery Recovery period is 15 years No change

Period for Real Property

(leasehold improvements)

Document updated 12/28/2017

525 S. Virgil Avenue • Los Angeles, CA 90020-1403 •213-739-8200• www.car.org

Você também pode gostar

- Tax Cuts & Jobs Act Implications for IndividualsDocumento4 páginasTax Cuts & Jobs Act Implications for IndividualsgodardsfanAinda não há avaliações

- Taxation 1 ReviewerDocumento5 páginasTaxation 1 ReviewerEISEN BELWIGANAinda não há avaliações

- CAF-06 RISE Tax Complete Book by Sir Adnan RaufDocumento417 páginasCAF-06 RISE Tax Complete Book by Sir Adnan RaufSaim KhanAinda não há avaliações

- 2011 Cash Flow EvaluatorDocumento42 páginas2011 Cash Flow EvaluatorEddie AyalaAinda não há avaliações

- Chapter 9-Debt Restructure: Journal EntryDocumento6 páginasChapter 9-Debt Restructure: Journal EntrySymon AngeloAinda não há avaliações

- Study Unit 20Documento13 páginasStudy Unit 20Hazem El SayedAinda não há avaliações

- Statement of Cashflows For The Year Ended XYZ Cash Flows From Operating ActivitiesDocumento27 páginasStatement of Cashflows For The Year Ended XYZ Cash Flows From Operating ActivitieszeeshanAinda não há avaliações

- Estate Tax PayableDocumento8 páginasEstate Tax PayableHazel Jane Esclamada100% (2)

- Cheque Payment Voucher Format in ExcelDocumento2 páginasCheque Payment Voucher Format in ExcelAhmed Farouk Al ShuwaikhAinda não há avaliações

- Account Statement SummaryDocumento4 páginasAccount Statement SummaryC.A. Ankit JainAinda não há avaliações

- Manila Mandarin Hotels Vs CommissionerDocumento2 páginasManila Mandarin Hotels Vs CommissionerEryl Yu100% (1)

- Emet Anceaume ProposalDocumento9 páginasEmet Anceaume ProposaldianavalenciausaAinda não há avaliações

- Sample Test Mid SolutionsDocumento3 páginasSample Test Mid SolutionsRirin Eka MustikasariAinda não há avaliações

- South Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFDocumento45 páginasSouth Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFSarahSweeneyjpox100% (7)

- Chapters 10 and 11 OutlineDocumento11 páginasChapters 10 and 11 OutlineHamzah B ShakeelAinda não há avaliações

- Computation of Net Taxable Estate and Tax DueDocumento13 páginasComputation of Net Taxable Estate and Tax DueKristine Mae CalataAinda não há avaliações

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual DownloadDocumento17 páginasSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual DownloadGregory Brown100% (21)

- Problem 8-9 Akl 2Documento4 páginasProblem 8-9 Akl 2andi nanaAinda não há avaliações

- Estate Tax: Sample ComputationDocumento24 páginasEstate Tax: Sample ComputationMarkein Dael VirtudazoAinda não há avaliações

- 4Documento13 páginas4mariyha PalangganaAinda não há avaliações

- Addition Urgent Ist OctDocumento7 páginasAddition Urgent Ist Octজয়দীপ সেনAinda não há avaliações

- Residential Strata Program Summary of CoveragesDocumento1 páginaResidential Strata Program Summary of CoveragesChristie YeungAinda não há avaliações

- Rahadatul Aishy's accounting and finance documentsDocumento6 páginasRahadatul Aishy's accounting and finance documentsrahadatul aishyAinda não há avaliações

- Inputs Applicant Details: State Domesticsta Dependents ScoreDocumento7 páginasInputs Applicant Details: State Domesticsta Dependents Scorejeanzen brillantesAinda não há avaliações

- Donors Tax Handout 3Documento5 páginasDonors Tax Handout 3Xerez SingsonAinda não há avaliações

- Problems Problem 10.1: © John Wiley and Sons Australia, LTD 2010 10.21Documento5 páginasProblems Problem 10.1: © John Wiley and Sons Australia, LTD 2010 10.21alfaressAinda não há avaliações

- Citizen & Resident Within Without Within Within Within Within Within Within Within WithinDocumento4 páginasCitizen & Resident Within Without Within Within Within Within Within Within Within WithinVon Andrei MedinaAinda não há avaliações

- Chapter 06 - SamplesDocumento3 páginasChapter 06 - SamplesJessica ZhangAinda não há avaliações

- Cash Flow Statement AnalysisDocumento2 páginasCash Flow Statement AnalysisJC Del MundoAinda não há avaliações

- Kabul Star Hotel FinancialsDocumento7 páginasKabul Star Hotel FinancialsElham JabarkhailAinda não há avaliações

- Chapter 2 AssignmentDocumento3 páginasChapter 2 AssignmentJasmin MarreroAinda não há avaliações

- Taxable Income Lecturer: Mr. S.RameshDocumento4 páginasTaxable Income Lecturer: Mr. S.RameshthineshlaraAinda não há avaliações

- Taxn03b DrillDocumento1 páginaTaxn03b Drillsmosaldana.cvtAinda não há avaliações

- Rental Properties - Sastha Enterprises LLCDocumento9 páginasRental Properties - Sastha Enterprises LLCramu_mavsfanAinda não há avaliações

- Quote - GeicoDocumento3 páginasQuote - GeicoKarina ReyesAinda não há avaliações

- Solution Ultimate Sample Paper 2Documento7 páginasSolution Ultimate Sample Paper 2Nitin KumarAinda não há avaliações

- BCom Business Taxation Income Tax and Sales Tax Numerical 2018Documento5 páginasBCom Business Taxation Income Tax and Sales Tax Numerical 2018AHSAN LASHARIAinda não há avaliações

- Affiliated Business (RESPA)Documento1 páginaAffiliated Business (RESPA)Thomas JordanAinda não há avaliações

- General Rules in Income TaxationDocumento6 páginasGeneral Rules in Income TaxationLee SuarezAinda não há avaliações

- 441 CHP 14 On Line in Class Problems Day 21Documento17 páginas441 CHP 14 On Line in Class Problems Day 21KNVS Siva KumarAinda não há avaliações

- XLSXDocumento10 páginasXLSXezar zacharyAinda não há avaliações

- Whips Policy Brief Property Tax Reform Final PassageDocumento10 páginasWhips Policy Brief Property Tax Reform Final PassagerealmiamibeachAinda não há avaliações

- Homework #3-Business Transfer TaxesDocumento9 páginasHomework #3-Business Transfer TaxesQuendrick SurbanAinda não há avaliações

- 2021 Tax Year - Virtual Tax Solutions LLCDocumento14 páginas2021 Tax Year - Virtual Tax Solutions LLCgregAinda não há avaliações

- AKL - Kasus Chapter 6 (P6-45)Documento5 páginasAKL - Kasus Chapter 6 (P6-45)raqhelziuAinda não há avaliações

- PA HomeworkDocumento2 páginasPA HomeworkHương ThưAinda não há avaliações

- IAS 20 - Government GrantsDocumento2 páginasIAS 20 - Government GrantsDawar Hussain (WT)Ainda não há avaliações

- TAX 25-9-2020 DeductionsDocumento3 páginasTAX 25-9-2020 DeductionsChitraAinda não há avaliações

- Exercises On Estate Tax Additional ProblemsDocumento8 páginasExercises On Estate Tax Additional ProblemsMidas Troy VictorAinda não há avaliações

- Debt RestructureDocumento9 páginasDebt RestructureEdielyn VillarandaAinda não há avaliações

- Additional Illustration-19Documento1 páginaAdditional Illustration-19Gulneer LambaAinda não há avaliações

- SolutionsDocumento16 páginasSolutionsapi-3817072100% (2)

- Tax P97Documento1 páginaTax P97Shiela DimaculanganAinda não há avaliações

- Financial Leverage One DriveDocumento30 páginasFinancial Leverage One DrivemeraheAinda não há avaliações

- B215 AC15 in Asia - 6th Presentation - 17jul2009Documento41 páginasB215 AC15 in Asia - 6th Presentation - 17jul2009tohqinzhiAinda não há avaliações

- CAF 06 - TaxationDocumento7 páginasCAF 06 - TaxationKhurram ShahzadAinda não há avaliações

- Tutorial 7 Solutions PDFDocumento4 páginasTutorial 7 Solutions PDFmusuotaAinda não há avaliações

- Question:-: Solution:-Computation of The Classified Year End Balance SheetDocumento4 páginasQuestion:-: Solution:-Computation of The Classified Year End Balance SheetShadowmaster LegendAinda não há avaliações

- Marcela S. Velandres: To: Address: !Documento3 páginasMarcela S. Velandres: To: Address: !Honeybunch MelendezAinda não há avaliações

- Estate Ni JonaDocumento2 páginasEstate Ni Jonalov3m350% (2)

- Susquehanna Equipment Rentals-New DataDocumento14 páginasSusquehanna Equipment Rentals-New Datalaale dijaanAinda não há avaliações

- Financial Needs AnalysisDocumento7 páginasFinancial Needs Analysisapi-385117572Ainda não há avaliações

- Chapter 6. Income From Property v2Documento6 páginasChapter 6. Income From Property v2LEARN FROM MEAinda não há avaliações

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsNo EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsAinda não há avaliações

- Voltas 1.5 Ton 3 Star Split AC - White: Grand Total 25999.00Documento1 páginaVoltas 1.5 Ton 3 Star Split AC - White: Grand Total 25999.00DevAinda não há avaliações

- MP6 y IIAex ZOex 7 YaDocumento6 páginasMP6 y IIAex ZOex 7 YaSrikanth MarrapuAinda não há avaliações

- What Is Tax?Documento3 páginasWhat Is Tax?Aque LangtoeAinda não há avaliações

- GST ProjectDocumento24 páginasGST ProjectPratyush DeroliaAinda não há avaliações

- 5010 XXXXXX 32021Documento3 páginas5010 XXXXXX 32021SHIVALAYA CONSTRUCTIONAinda não há avaliações

- Mireillenkuansambumiss DiavuaDocumento3 páginasMireillenkuansambumiss DiavuaMayamona Nkuansambu LikeAinda não há avaliações

- Screenshot 2023-12-12 at 2.34.53 PMDocumento1 páginaScreenshot 2023-12-12 at 2.34.53 PMshashikumarsk0711Ainda não há avaliações

- 1 MondayDocumento6 páginas1 MondayCeline Marie Libatique AntonioAinda não há avaliações

- TIN Application ProcedureDocumento3 páginasTIN Application ProcedureJuan Dela CruzAinda não há avaliações

- Acct Statement - XX2055 - 09102022Documento4 páginasAcct Statement - XX2055 - 09102022Medhanshu KaushikAinda não há avaliações

- Fiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATDocumento2 páginasFiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATCharlieEleerAinda não há avaliações

- Your Order Receipt: We Have Received Your Order. Order Date: Oct 22, 2019 Order Number: WEB70000018405360Documento1 páginaYour Order Receipt: We Have Received Your Order. Order Date: Oct 22, 2019 Order Number: WEB70000018405360maxgospel1983Ainda não há avaliações

- A Global Guide To M&A - India: by Vivek Gupta and Rohit BerryDocumento14 páginasA Global Guide To M&A - India: by Vivek Gupta and Rohit BerryvinaymathewAinda não há avaliações

- Solved Adrian Was Awarded An Academic Scholarship To State University For PDFDocumento1 páginaSolved Adrian Was Awarded An Academic Scholarship To State University For PDFAnbu jaromiaAinda não há avaliações

- Invoice 299379 PDFDocumento2 páginasInvoice 299379 PDFAmirul Amin IVAinda não há avaliações

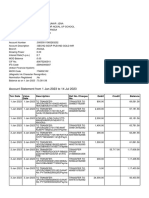

- Account Statement From 1 Jan 2023 To 14 Jul 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento14 páginasAccount Statement From 1 Jan 2023 To 14 Jul 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAmit Kumar JenaAinda não há avaliações

- Non-Members With Accumulated Reserves and Undivided Net Savings of Not More Than Ten Million Pesos (P10,000,000.00)Documento2 páginasNon-Members With Accumulated Reserves and Undivided Net Savings of Not More Than Ten Million Pesos (P10,000,000.00)Fairy Ann PeñanoAinda não há avaliações

- TOEFL Additional Score Report Request FormDocumento2 páginasTOEFL Additional Score Report Request Formvishwa tejaAinda não há avaliações

- Challan Form For Written Test Fee Payment (POLICE CONSTABLE)Documento1 páginaChallan Form For Written Test Fee Payment (POLICE CONSTABLE)Rashid Abbas0% (1)

- L63 MobDocumento35 páginasL63 MobLove AmbienceAinda não há avaliações

- Tax Invoice for Sony HeadphonesDocumento1 páginaTax Invoice for Sony HeadphonesShyam SundarAinda não há avaliações

- Demand SurveyDocumento4 páginasDemand SurveySunilkumar CeAinda não há avaliações

- Accounting Entries Under GSTDocumento6 páginasAccounting Entries Under GSTmadhu100% (1)

- Materi Sebelum UTS Praktikum Akuntansi RemedDocumento51 páginasMateri Sebelum UTS Praktikum Akuntansi Remedannisa rochmahAinda não há avaliações

- Beps 6.michael LangDocumento11 páginasBeps 6.michael Langflordeliz12100% (1)

- 1-12 Inv-Gb-123115881-2023-14512 33.64Documento1 página1-12 Inv-Gb-123115881-2023-14512 33.64pravasunfilteredAinda não há avaliações