Escolar Documentos

Profissional Documentos

Cultura Documentos

Unknown 1

Enviado por

Anonymous pKsr5vDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Unknown 1

Enviado por

Anonymous pKsr5vDireitos autorais:

Formatos disponíveis

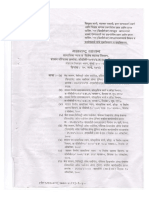

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Name : ARUN RAMAKANT SHRIVASTAV DESG/ESG : Addl Exe Engineer

Empl ID : 6495 Birth Date :10.01.1977 PG/EG : Grade A Employee

CPF No./UAN: 02227550 / 100090954474 Retire Due :31.01.2035 LAP Avl/Bal: 0 / 202

PAN No. : AXEPS8309P Due Incr Dt :18.07.2018 SCL Avl/Bal: 0 / 41

Pay Period : 01.11.2017 - 30.11.2017 Basic Rate : 35,385.00 HAP Avl/Bal: 0 / 280

Bank Ac No : 053810008030 Emp.Status :Active Comm Avl : 0

Bank Name : DENA BANK Seniority No: 325 ADD EXE ENG-GRA EOL Avl : 0

Pay Scale : MG16 - 31725-1220-37825-1385-68295 Absent(C/P): 0 / 0

PSA :TPS CHANDRAP

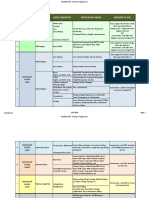

Earnings Deductions Loan Balances

Basic Salary 34,260.00 Ee PF contribution 9,702.00 Computer Principal 31,500.00

Dearness Allow 46,594.00 Er Pension contribution 1,250.00

Special Compen Allow 250.00 Prof Tax - split period 200.00

Elec. Charges Allow 300.00 Quarter Rent 88.00

Factory Allowance 400.00 Income Tax 8,407.00

Conveyence Allowance 1,053.00 Electricity Charges 1,802.00

Tech J A / Book Allow 440.00 Staff Welfare Fund 10.00

Entertainment Allow 335.00 Revenue Stamp 1.00

FB Generation Allow 700.00 LIC 1,997.00 Deductions not taken in the month

Emp Dep Wel T Fund 30.00

Computer Principal 1,125.00

Engineer CCSoc Nagpur 1,800.00

Adjustments 0.00

Total 84,332.00 Total 25,162.00 Take Home Pay 59,170.00

Perks/Exemption Other Income/Deduction Form 16 summary Form 16 summary

Loan Int Perk 3,328.32 Deds S24 (Int 7,859.00- Ann Reg Incom 997121.00 Gross Salary 1,141,762.90

Housing Perk 73,829.85 Annual Perk 77,158.17 Exemption U/S 10 17,743.00

Any other Inc 7,859.00- Ann Irr Incom 19,100.00 Balance 1,124,020.00

Conveyance An 12,464.00 Prev Yr Incom 48,383.73 Empmnt tax (Prof Tax) 2,400.00

Other Exempti 5,279.00 Gross Salary 1141762.90 Incm under Hd Salary 1,121,620.00

Any other Income 7,859.00-

Gross Tot Income 1,113,761.00

Agg of Chapter VI 150,000.00

Total Income 963,761.00

Tax on total Income 105,252.20

Tax payable and surcharg 108,410.00

Annual Tax paid by Er. 15,894.00

Tax payable by Ee. 92,516.00

Tax deducted so far 50,479.00

Income Tax 8,407.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! SUBMIT PROPOSED INVESTMENT FOR INCOME TAX 2017-2018!

Date:07.01.2018

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Manual Jib 25 10 02Documento256 páginasManual Jib 25 10 02Luis Jose LlobanAinda não há avaliações

- Plumber PDFDocumento68 páginasPlumber PDFshehanAinda não há avaliações

- Steam Turbine Governing Systems OverviewDocumento11 páginasSteam Turbine Governing Systems Overviewdrmsrmurty80% (5)

- Process Control Fundamentals 2Documento73 páginasProcess Control Fundamentals 2Otuekong Ukpong100% (2)

- Case Study MMDocumento3 páginasCase Study MMayam0% (1)

- Res FormDocumento1.320 páginasRes FormAnonymous pKsr5vAinda não há avaliações

- JE AE Advt - Publish On WebsiteDocumento11 páginasJE AE Advt - Publish On WebsiteAnonymous pKsr5vAinda não há avaliações

- 24 HR Report Boiler Side DateDocumento3 páginas24 HR Report Boiler Side DateAnonymous pKsr5vAinda não há avaliações

- Maharashtra State Power Generation Co. Ltd. C.S.T.P.S., ChandrapurDocumento1 páginaMaharashtra State Power Generation Co. Ltd. C.S.T.P.S., ChandrapurAnonymous pKsr5vAinda não há avaliações

- Protections MD BFP Protections S. No. Descriptions Normal Alarm Trip RemarksDocumento1 páginaProtections MD BFP Protections S. No. Descriptions Normal Alarm Trip RemarksAnonymous pKsr5vAinda não há avaliações

- Turbine Side Staff List, U5 Sr. No. Name Designation Sap Id CCW Pump House, U5Documento2 páginasTurbine Side Staff List, U5 Sr. No. Name Designation Sap Id CCW Pump House, U5Anonymous pKsr5vAinda não há avaliações

- Mdindia Healthcare Services (Tpa) Pvt. LTDDocumento1 páginaMdindia Healthcare Services (Tpa) Pvt. LTDAnonymous pKsr5vAinda não há avaliações

- Unitwise Performance 2016-17Documento20 páginasUnitwise Performance 2016-17Anonymous pKsr5vAinda não há avaliações

- Subject:-Evs Level: A1 (Class I) Lesson1: Relationships Worksheet 1Documento20 páginasSubject:-Evs Level: A1 (Class I) Lesson1: Relationships Worksheet 1Anonymous pKsr5vAinda não há avaliações

- Ems CircularDocumento1 páginaEms CircularAnonymous pKsr5vAinda não há avaliações

- Gurumayi's Birthday 2016 - Center EmailDocumento2 páginasGurumayi's Birthday 2016 - Center EmailAnonymous pKsr5vAinda não há avaliações

- Maharashtra Government GR 2013 PDFDocumento32 páginasMaharashtra Government GR 2013 PDFAnonymous pKsr5vAinda não há avaliações

- MAHAGENCO RegisteredDetailsSBSDocumento3 páginasMAHAGENCO RegisteredDetailsSBSAnonymous pKsr5vAinda não há avaliações

- 4Documento44 páginas4sreejith2786Ainda não há avaliações

- Mahanagari EXP 11067 Saket Express 21067 PBH RBL Exp 15017 Gorakhpur EXPDocumento1 páginaMahanagari EXP 11067 Saket Express 21067 PBH RBL Exp 15017 Gorakhpur EXPAnonymous pKsr5vAinda não há avaliações

- Happy Birthday Mr. D.M.Chandavle: Wishing A VeryDocumento1 páginaHappy Birthday Mr. D.M.Chandavle: Wishing A VeryAnonymous pKsr5vAinda não há avaliações

- Protocol: Following Control Valve Trail Takenand Status Found AsDocumento1 páginaProtocol: Following Control Valve Trail Takenand Status Found AsAnonymous pKsr5vAinda não há avaliações

- Departmental Exam Schedule From June 2016 To Dec 2016-1Documento10 páginasDepartmental Exam Schedule From June 2016 To Dec 2016-1Anonymous pKsr5vAinda não há avaliações

- FF 0970 A Application For Allotment of Residential Accommodation at CSTPS Chandrapur ColonyDocumento2 páginasFF 0970 A Application For Allotment of Residential Accommodation at CSTPS Chandrapur ColonyAnonymous pKsr5vAinda não há avaliações

- JE AE Advt - Publish On WebsiteDocumento10 páginasJE AE Advt - Publish On WebsiteAnonymous pKsr5vAinda não há avaliações

- Vacuum Breaker ValveDocumento3 páginasVacuum Breaker ValvejnmanivannanAinda não há avaliações

- Advt - 02feb2016 - Technician III Online Test Result - FinalDocumento3 páginasAdvt - 02feb2016 - Technician III Online Test Result - FinalAnonymous pKsr5vAinda não há avaliações

- MD IndiaDocumento1 páginaMD IndiaAnonymous pKsr5vAinda não há avaliações

- ResultDocumento3 páginasResultAnonymous pKsr5vAinda não há avaliações

- Mumbai Cap 1 Open 2014-15 PDFDocumento2 páginasMumbai Cap 1 Open 2014-15 PDFAnonymous pKsr5vAinda não há avaliações

- Birthday Celebration 2016 Schedule HINDIDocumento1 páginaBirthday Celebration 2016 Schedule HINDIAnonymous pKsr5vAinda não há avaliações

- Admin Transfer of Ce - 02.06.16Documento1 páginaAdmin Transfer of Ce - 02.06.16Anonymous pKsr5vAinda não há avaliações

- Father of Different Fields of Science & Technology PDFDocumento3 páginasFather of Different Fields of Science & Technology PDFJacob PrasannaAinda não há avaliações

- WAUZZZ8K0BA159120Documento10 páginasWAUZZZ8K0BA159120Vedad VedaddAinda não há avaliações

- Trash Chute-Compliance Sheet Sangir)Documento5 páginasTrash Chute-Compliance Sheet Sangir)Li LiuAinda não há avaliações

- MS Fresher HR DocumentDocumento4 páginasMS Fresher HR DocumentJahanvi KambojAinda não há avaliações

- Plain and Laminated Elastomeric Bridge Bearings: Standard Specification ForDocumento4 páginasPlain and Laminated Elastomeric Bridge Bearings: Standard Specification ForFRANZ RICHARD SARDINAS MALLCOAinda não há avaliações

- Compositional Changes of Crude Oil SARA Fractions Due To Biodegradation and Adsorption Supported On Colloidal Support Such As Clay Susing IatroscanDocumento13 páginasCompositional Changes of Crude Oil SARA Fractions Due To Biodegradation and Adsorption Supported On Colloidal Support Such As Clay Susing IatroscanNatalia KovalovaAinda não há avaliações

- High Resolution Computed Tomography of The Lungs - UpToDateDocumento83 páginasHigh Resolution Computed Tomography of The Lungs - UpToDatejjjkkAinda não há avaliações

- I. Choose The Meaning of The Underlined Words Using Context CluesDocumento4 páginasI. Choose The Meaning of The Underlined Words Using Context CluesMikko GomezAinda não há avaliações

- Hemorrhagic Shock (Anestesi)Documento44 páginasHemorrhagic Shock (Anestesi)Dwi Meutia IndriatiAinda não há avaliações

- Streptococcus Pneumoniae Staphylococci Faculty: Dr. Alvin FoxDocumento32 páginasStreptococcus Pneumoniae Staphylococci Faculty: Dr. Alvin Foxdanish sultan100% (1)

- Breastfeeding PlanDocumento7 páginasBreastfeeding Planapi-223713414Ainda não há avaliações

- Lem Cyclop Ewt Owner S Manual 10Documento10 páginasLem Cyclop Ewt Owner S Manual 10josep_garcía_16Ainda não há avaliações

- Narrative Report On Conduct of Classes-October 2021Documento1 páginaNarrative Report On Conduct of Classes-October 2021Jansen Roy D. JaraboAinda não há avaliações

- Comparative Study of Financial Statements of Company, Oil and Gas.Documento105 páginasComparative Study of Financial Statements of Company, Oil and Gas.Ray Brijesh AjayAinda não há avaliações

- Wetted Wall Gas AbsorptionDocumento9 páginasWetted Wall Gas AbsorptionSiraj AL sharifAinda não há avaliações

- Ball Bearing Units Stainless SeriesDocumento5 páginasBall Bearing Units Stainless SeriesRicardo KharisAinda não há avaliações

- JAMB Biology Past Questions 1983 - 2004Documento55 páginasJAMB Biology Past Questions 1983 - 2004Keith MooreAinda não há avaliações

- Commented (JPF1) : - The Latter Accused That Rizal HasDocumento3 páginasCommented (JPF1) : - The Latter Accused That Rizal HasLor100% (1)

- Mercury II 5000 Series Encoders: High Performance Encoders With Digital OutputDocumento21 páginasMercury II 5000 Series Encoders: High Performance Encoders With Digital OutputRatnesh BafnaAinda não há avaliações

- Pediatric Medication Dosing GuildelinesDocumento2 páginasPediatric Medication Dosing GuildelinesMuhammad ZeeshanAinda não há avaliações

- CRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2020Documento48 páginasCRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2020MohitAinda não há avaliações

- NANOGUARD - Products and ApplicationsDocumento2 páginasNANOGUARD - Products and ApplicationsSunrise VenturesAinda não há avaliações

- Activity 2: College of EngineeringDocumento3 páginasActivity 2: College of EngineeringMa.Elizabeth HernandezAinda não há avaliações

- Electrical Rooms Fire FightingDocumento2 páginasElectrical Rooms Fire Fightingashraf saidAinda não há avaliações

- English CV Chis Roberta AndreeaDocumento1 páginaEnglish CV Chis Roberta AndreeaRoby ChisAinda não há avaliações

- Exercise 3 ASC0304 - 2019-1Documento2 páginasExercise 3 ASC0304 - 2019-1Nuraina NabihahAinda não há avaliações

- Chapter 2Documento5 páginasChapter 2ERICKA MAE NATOAinda não há avaliações