Escolar Documentos

Profissional Documentos

Cultura Documentos

2 - 17004 Advocate's Recommendation

Enviado por

Matthew Daniel Nye0 notas0% acharam este documento útil (0 voto)

20 visualizações6 páginasBarfield Ethics Complaint

Título original

2_17004 Advocate's Recommendation

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoBarfield Ethics Complaint

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

20 visualizações6 páginas2 - 17004 Advocate's Recommendation

Enviado por

Matthew Daniel NyeBarfield Ethics Complaint

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

Você está na página 1de 6

FLORIDA

COMMISSION ON ETHICS

DEC 0 4 2017

BEFORE THE RECEIVED

STATE OF FLORIDA eens

COMMISSION ON ETHICS CONFIDENTIAL

Inre: Jim Barfield,

Respondent. Complaint No. 17-004

J

ADVOCATE'S RECOMMENDATION

‘The undersigned Advocate, after reviewing the Complaint and Report of Investigation filed

in this matter, submits this Recommendation in accordance with Rule 34-5,006(3), F.A.C.

RESPONDENT/COMPLAINANT

Respondent, Jim Barfield, serves as a member of the Brevard County Commission.

Complainant is Matt Nye of Melbourne, Florida,

JURISDICTION

‘The Executive Director of the Commission on Ethics determined that the Complaint was

legally sufficient and ordered a preliminary investigation for a probable cause determination as to

whether Respondent violated Article Il, Section 8, Florida Constitution, and Section 112.3144,

Florida Statutes. The Commission on Ethics has jurisdiction over this matter pursuant to Section

112.322, Florida Statutes.

‘The Report of Investigation was released on November 22, 2017.

ALLEGATION ONE

Respondent is alleged to have violated Article II, Section 8, Florida Constitution, and

Section 112.3144, Florida Statutes, by filing an inaccurate 2014 CE Form 6, “Full and Public

Disclosure of Financial Interests.”

APPLICABLE LAW

Article II, Section 8 Florida Constitution provides:

(@)_Allelected constitutional officers and candidates for such offices

and, as may be determined by law, other public officers, candidates, and

employees shall file full and public disclosure of their financial interests.

. * .

(i) Schedule-On the effective date of this amendment and until

changed by law:

(1) Full and public disclosure of financial interests shall mean filing

with the secretary of state by July 1 of cach year a swom statement showing

net worth and identifying each asset and liability in excess of $1,000 and its

value together with one of the following:

a. A copy of the person’s most recent federal income tax return;

or

b. A swom statement which identifies each separate source and

amount of income which exceeds $1,000. The forms for such source

disclosure and the rules under which they are to be filed shall be prescribed

by the independent commission established in subsection (f), and such rules

shall include disclosure of secondary sources of income.

. * .

Section 112.3144, Florida Statutes, provides as follows

(1) An officer who is required by s. 8, Art. Il of the State Constitution to

file a full and public disclosure of his or her financial interests for any calendar

or fiscal year shall file that disclosure with the Florida Commission on Ethics.

. * *

ANALYSIS

In November 2014, Respondent was elected to the Brevard County Commission. (ROI 3)

Complainant alleges that Respondent failed to properly disclose income and/or assets on his 2014

CE Form 6, “Full and Public Disclosure of Financial Interests,” filed on June 22, 2015. (ROI 1,

Complaint 4-6) On August 1, 2017, subsequent to the filing of the ethics complaint, Respondent

filed a CE Form 6X, “Amendment to Full and Public Disclosure of Financial Interests,” for 2014,

(ROL 3, 5, Exhibit B)

A review of Respondent's original form reflects that he failed to disclose his county

commission income. (ROI 5, Complaint 5) On his amended form, Respondent disclosed

$4,627.97 as his county commission income. (ROI 5, Exhibit B-6)

In addition, Respondent's original form reflects an asset identified only as “Money Market

Account” with a value of $1,400,000. (RO! 7, Complaint 6) The 2014 CE Form 6 instructions

state, “How to Identify or Describe the Asset: Intangible Property: Identify the type of property

and the business entity or person to which or to whom it relates. Do not list simply ‘stocks and

bond’ or ‘bank accounts.”” (Emphasis in original,), (ROI 6, Exhibit C)

On his amended form, Respondent listed an asset as “BB&T Investor's Deposit Account”

with a value of $1,071,717.03. (ROI 8, B-3) Respondent advised that the BB&T account is the

only money market account he had as of December 31,2014 which indicates that this is the account

that Respondent intended to identify on his original form. (ROI 8) He further advised that this

account essentially served as cash and that he was told by BB&T that this account cannot be broken

down into individual investments. (ROI 8) Respondent overstated the value of this account by

$328,282.97 on his original form. (ROI 9)

Also, Respondent's original form reflects an asset identified as “Value of retirement

account ~ 401K Plan” with a value of $160,000. (ROI 10, Complaint 6) On his amended form,

Respondent listed assets as “Individual Retirement Account Edward D Jones Custodian Prudential

Premier Retirement” valued at $93,260.09 and “Edward Jones Joint Tenants with Right of

Survivorship” valued at $25,234.03. (ROI 11, B-3) Respondent advised that these constitute all

of his retirement accounts as of December 31, 2014, (ROI 11) Respondent advised that the

Individual Retirement Account is an annuity which cannot be broken down into individual

accounts. (ROI 11) Respondent overstated the value of his retirement account(s) by $41,505.87

on his original form. (ROI 12)

‘There are items that should have been properly identified and/or disclosed which affected

the accuracy of Respondent's original disclosure form.

Therefore, based on the evidence before the Commission, I recommend that the

‘Commission find probable cause to believe that Respondent violated Article Il, Section 8, Florida

Constitution, and Section 112.3144, Florida Statutes.

ALLEGATION TWO

Respondent is alleged to have violated Article Il, Section 8, Florida Constitution, and

Section 112.3144, Florida Statutes, by filing an inaccurate 2015 CE Form 6, “Full and Public

Disclosure of Financial Interests.”

APPLICABLE LAW

Article Il, Section 8, Florida Constitution, and Section 112.3144, Florida Statutes, as set

forth under Allegation One, above.

ANALYSIS

Complainant alleges that Respondent failed to properly disclose asset(s) on his 2015 CE

Form 6, “Full and Public Disclosure of Financial Interests,” filed on July 1, 2016. (ROI 1,

Complaint 8-10) On August 1, 2017, subsequent to the filing of the ethics complaint, Respondent

filed a CE Form 6X, “Amendment to Full and Public Disclosure of Financial Interests,” for 2015.

(ROL3, 15, Exhibit D)

Respondent's original form reflects an asset identified only as “Money Market Account”

with a value of $1,300,000. (ROI 14, Complaint 10) The 2015 CE Form 6 instructions state,

“How to Identify or Describe the Asset: Intangible Property: Identify the type of property and

the business entity or person to which or to whom itrelates. Do not list simply ‘stocks and bond?

or ‘bank accounts.’”” (Emphasis in original.), (ROI 13, Complaint 13)

Respondent advised that the BB&T account is the only market account he had as of

December 31, 2015 which indicates that this is the account that Respondent intended to identify

‘on his original form. (ROI 15) On his amended form, Respondent listed an asset as “BB&T

Investor's Deposit Account” with a value of $663,638.62. (ROI 15, D-3) Respondent overstated

the value of the account by $636,361.38 on his original form. (ROI 15)

This item should have been properly identified and/or disclosed which affected the

accuracy of Respondent's original disclosure form.

Therefore, based on the evidence before the Commission, 1 recommend that the

‘Commission find probable cause to believe that Respondent violated Article Il, Section 8, Florida

Constitution, and Section 112.3144, Florida Statutes.

RECOMMENDATION

It is my recommendation that:

It is my recommendation that:

1, There is probable cause to believe that Respondent violated Article II, Section 8,

Florida Constitution, and Section 112.3144, Florida Statutes, by filing an inaccurate 2014 CE

Form 6, “Full and Public Disclosure of Financial Interests.”

2. There is probable cause to believe that Respondent violated Article Il, Section 8,

Florida Constitution, and Section 112.3144, Florida Statutes, by filing an inaccurate 2015 CE.

Form 6, “Full and Public Disclosure of Financial Interests.”

Respectfully submitted this__ 44%" _ day of December, 2017

Advocate for the Florida Commission

on Ethics

Florida Bar No. 0636045

Office of the Attorney General

‘The Capitol, PL-01

Tallahassee, Florida 32399-1050

(850) 414-3300, Ext. 3704

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Florida Medicaid Pharmacy Claims AnalysisDocumento203 páginasFlorida Medicaid Pharmacy Claims AnalysisMatthew Daniel NyeAinda não há avaliações

- Republican Liberty Caucus of Central East Florida Bylaws: Article I: NameDocumento8 páginasRepublican Liberty Caucus of Central East Florida Bylaws: Article I: NameMatthew Daniel NyeAinda não há avaliações

- Whistleblower Response ProcessDocumento4 páginasWhistleblower Response ProcessMatthew Daniel NyeAinda não há avaliações

- BREC Bylaws (As Revised On 11-08-2017)Documento5 páginasBREC Bylaws (As Revised On 11-08-2017)Matthew Daniel NyeAinda não há avaliações

- RPOF Model Constitution 04-28-17Documento9 páginasRPOF Model Constitution 04-28-17Matthew Daniel NyeAinda não há avaliações

- 2013-14 Astronuats Memorial Foundation Audited Financial StatementsDocumento28 páginas2013-14 Astronuats Memorial Foundation Audited Financial StatementsMatthew Daniel NyeAinda não há avaliações

- 4 - 17004 Report of InvestigationDocumento29 páginas4 - 17004 Report of InvestigationMatthew Daniel NyeAinda não há avaliações

- Liberty Index 2015Documento15 páginasLiberty Index 2015Matthew Daniel NyeAinda não há avaliações

- Astronaut Memorial Foundation Financials 2013-2014Documento27 páginasAstronaut Memorial Foundation Financials 2013-2014Matthew Daniel NyeAinda não há avaliações

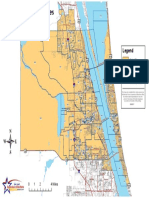

- Florida House District 52 MapDocumento1 páginaFlorida House District 52 MapMatthew Daniel NyeAinda não há avaliações

- Jim Barfield Ethics ComplaintDocumento19 páginasJim Barfield Ethics ComplaintMatthew Daniel NyeAinda não há avaliações