Escolar Documentos

Profissional Documentos

Cultura Documentos

Baby Freedom Case Study 2018

Enviado por

Rohit VermaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Baby Freedom Case Study 2018

Enviado por

Rohit VermaDireitos autorais:

Formatos disponíveis

BabyFreedom:

STAKEHOLDERS,

STRATEGY, AND

QUALITATIVE

ANALYSIS

By KIMBERLY A. ZAHLLER

AND MARGARET BERANEK

70 / STRATEGIC FINANCE / August 2017

2018

STUDENT CASE

COMPETITION

The Student Case Competition is

sponsored annually by IMA to

provide an opportunity for students

to interpret, analyze, evaluate,

synthesize, and communicate a

solution to a management

accounting problem.

August 2017 / STRATEGIC FINANCE / 71

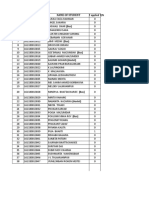

Table 1:

CURRENT PRICES AND COSTS

B

ased in Austin, Texas, BabyFreedom

produces a line of organic-certified

clothing for infants and children. The

company founder and president,

Jennifer Thurman, started making

the clothing when her niece was

FOR SELECTED PRODUCTS

born with extreme sensitivity to the

PRODUCT DESCRIPTION PRICE ABSORPTION COST

chemicals and dyes used in commer-

cial children’s clothing. The organic Infant, 0–24 months

clothing led to dramatic improvements in her niece’s con-

Kimono style shirt $15.00 $8.25

dition. Jennifer then began to receive requests for her cloth-

ing from the neonatal intensive care unit (NICU) of the local Roll waist pants 20.00 11.00

children’s hospital and from parents referred by her niece’s Layette set (T-shirt, roll waist pants) 30.00 16.50

pediatrician. As these requests increased, Jennifer rented a

small office and production area in a commercial park, Side-snap layette 50.00 32.50

hired her first employees, and started commercial produc- Convertible jumper 60.00 39.00

tion of the clothing. Within two years, a full-time account-

ant and controller, an operations manager, and a marketing Leggings with feet 40.00 26.00

and sales manager were hired. Cardigan 50.00 32.50

Toddler, 2–4 years

Company Info Jacket $100.00 $65.00

BabyFreedom considers itself to be a mission-driven and

Dress 60.00 39.00

stakeholder-focused organization. The company’s mission

statement identifies three primary stakeholder groups: Leggings 25.00 13.75

customers, business partners, and employees.

T-shirt 25.00 13.75

The company’s primary market is “medically necessary”

clothing, subdivided into NICU and home orders, with both Pajama set 40.00 26.00

providing the option to customize clothing to accommodate Pullover 50.00 32.50

medical devices. BabyFreedom’s management team is also

developing a “natural clothing” product line to complement Cardigan 80.00 52.00

the medical market. Marketed primarily to parents inter-

ested in sustainably sourced and organically produced

products, the natural clothing line for children is the

fastest-growing market segment with a projected potential

demand greater than the combined “medically necessary”

segments. Table 1 presents a list of the most popular cloth-

ing items, their sales prices, and their costs.

Customers are extremely loyal to the company. Surveys

indicate that customers greatly value ethi-

cal, trustworthy companies that are

socially and environmentally responsible

and that they perceive BabyFreedom to

BABYFREEDOM have those qualities. Customers for the

natural clothing line (nonmedically neces-

sary) are especially concerned with issues

MISSION STATEMENT

While seeking a fair profit, we are a socially and

of sustainability, fair trade, and social

responsibility. To address these concerns,

BabyFreedom’s website includes a great

environmentally responsible company. We provide the deal of information about its suppliers and

employees, including photos and inter-

highest-quality product possible for the health of our views. The company also regularly solicits

smallest stakeholders while maintaining a superior level customer comments and suggestions on

of integrity in interactions with our business partners and its website and from flyers included with

product packaging.

associates. We provide a work environment where our

Throughout its existence, BabyFreedom

employees can thrive in an atmosphere of excellence. has emphasized good relationships with

suppliers. It also maintains a policy of

selecting suppliers with reputations for

being ethical and socially responsible. To

72 / STRATEGIC FINANCE / August 2017

The company has a

reputation for being

an excellent place to

work. Voluntary

turnover at the

company is almost

nonexistent.

that end, company managers regularly visit supplier sites high enough to justify an investment in highly automated

and make a point of speaking with employees there to production. Furthermore, an automated system can’t handle

ensure the suppliers’ reputations are based on fact. The the frequent customization required for the “medically nec-

suppliers tend to be smaller, family-run businesses, and essary” clothing.

BabyFreedom is usually their largest customer. To ensure The company has a small administrative staff and a

reliability of supply and to build strong supplier relation- single production shift currently working at full capacity.

ships, BabyFreedom pays a premium for high-quality BabyFreedom is in the process of hiring and training a small

materials. second shift with plans to reach full strength within three

The company also has a reputation for being an excel- years. Because the company is fiscally conservative and has

lent place to work. Jennifer insists on safe, comfortable a policy of avoiding layoffs, production continues at a

working conditions and provides healthcare coverage for all steady rate throughout the year, with minimal fluctuations

employees. The employees are mostly Mexican and Asian in the volume of finished goods inventory. Since the special

immigrant women, often with small children, and materials are so critical to BabyFreedom’s product lines,

BabyFreedom provides a company daycare room for pre- raw materials inventory includes large safety stocks.

school children and an after-school tutor for school-age During the previous year, management focused on the

children. Workers also are encouraged to continue their need to improve efficiency in both production and inven-

education. As a result of this culture, voluntary turnover at tory management. A key piece in this effort was upgrading

the company is almost nonexistent, and several production BabyFreedom’s computer systems. The old systems had

workers have taken on increasing responsibility in staff been added piecemeal as the company grew, and it was dif-

functions in accounting, supply chain management, and ficult to share information among the inventory manage-

operations. ment, production scheduling, accounting, and customer

management programs. In response, BabyFreedom has

Operations and Information Technology recently invested in a new, integrated system that can col-

Infrastructure lect, share, and store data across all departments. The new

BabyFreedom leases a large building with combined pro- system can also interface with BabyFreedom’s internet sales

duction, warehouse, and office space in a small industrial portal and with the website used by BabyFreedom’s ship-

park. The production process is very labor-intensive. ping company. The goal is to have the new system fully

Although product demand is high and increasing, it isn’t integrated and operational before the new second shift

August 2017 / STRATEGIC FINANCE / 73

Table 2:

BABYFREEDOM PRO FORMA INCOME

reaches full strength.

Currently, the new accounting and

customer relationship management

(CRM) modules are working well.

There are still issues with the inven-

tory management and production

STATEMENT FOR FISCAL YEAR

planning modules since BabyFree-

dom’s small suppliers don’t have the

ability to integrate with the company’s

ENDING DECEMBER 31, 201X

computer systems. As a result, incom- TOTAL $ % OF SALES

ing shipments must still be inspected,

compared to invoices and purchase Net sales $5,013,879 100.0%

orders, and then manually entered Cost of goods sold 2,921,034 58.3%

into the inventory module. The opera-

tions manager is testing bar code read- Gross profit $2,092,845 41.7%

ers as a way to automate this process.

Selling, general, and administrative expenses 1,754,858 35.0%

Once bar codes are integrated into the

new inventory management module, Operating income $337,987 6.7%

BabyFreedom plans to help its suppli-

Interest expense (6.25%) 36,527 0.7%

ers begin bar-coding shipments by

supplying the special printers and Income before income taxes $301,460 6.0%

labelers. This will allow BabyFreedom

to quickly link the inventory module Provision for income taxes (40%) 120,584 2.4%

to both the production scheduling and Net income $180,876 3.6%

accounting modules.

Prices and Cost Structure

BabyFreedom carefully sources its raw

Table 3:

materials to ensure that they haven’t

been exposed to chemicals at any

point in the growing, harvesting, dye-

ing, or weaving process. Because these

BABYFREEDOM PRO FORMA BALANCE

materials are costlier to produce and

process, and because the suppliers are SHEET FOR FISCAL YEAR ENDING

DECEMBER 31, 201X

small, independent companies,

BabyFreedom’s material costs are

greater than those experienced by

manufacturers of standard children’s

clothing. The labor-intensive nature of

the manufacturing process as well as ASSETS:

the company’s commitment to a living Current assets

wage, healthcare, and socially respon- Cash and cash equivalents $381,209

sible employee benefits contribute to Accounts receivable (net) 207,570

higher labor and overhead costs. As a Inventories 469,934

result, BabyFreedom’s prices are Prepaid expenses and other current assets 38,672

higher than those associated with reg- Total current assets $1,097,385

ular children’s clothing. Nevertheless, Property, plant, and equipment (net) 871,704

the company tries to keep profit mar- Total assets $1,969,089

gins low (less than 5%) to make the

clothing as affordable as possible while LIABILITIES:

still ensuring it can maintain its social Current liabilities

responsibility initiatives and reputa- Accounts payable $730,259

tion for a high-quality product. Based Other current liabilities 105,070

on current operations and plans, Total current liabilities $835,329

BabyFreedom’s management team Loan 584,431

created a pro forma income statement Total liabilities $1,419,760

and balance sheet for the coming year, Capital account 549,329

as shown in Tables 2 and 3. But then Total liabilities and

an exciting new offer was made that stockholders’ equity $1,969,089

could change everything.

74 / STRATEGIC FINANCE / August 2017

ship” implementation of RFID technology, where a supplier

simply attaches an RFID tag programmed with basic infor-

mation prior to shipping the product to the retailer (with no

attempt by the supplier to capture, analyze, or store data

generated by the RFID tag). Though this would comply with

the Walmart mandate, BabyFreedom would be unable to

use the large quantity of data the RFID tags generate. To do

that, it would need to purchase middleware—software that

enables communication and management of data in dis-

tributed applications—and make expensive upgrades to the

new inventory module while significantly expanding server

capacity. It’s doubtful BabyFreedom would use the full

level of detail generated by RFID; the company needs only

basic data that could also be provided by bar code readers.

The New Opportunity: Figure 1 presents basic information for the cost of both

implementation options.

A Major Offer from Walmart’s offer is for an initial contract of five years

with a subsequent renewal option. BabyFreedom’s pro-

Walmart jected net cash flows for the five-year contract period,

given a 40% tax rate and a 6.25% weighted average cost of

Toward the end of the current year, Walmart approached capital (after-tax discount rate), resulted in a positive net

BabyFreedom about carrying the natural children’s clothing present value (NPV) calculation. If the contract is renewed

line in its stores. The potential business with Walmart at the end of the five-year period, BabyFreedom would

would nearly double sales volume, but some changes would have to expand its facilities and infrastructure immediately

be required. Walmart is heavily invested in Radio Fre- to meet expected growth in its other market segments.

quency Identification (RFID) technology in its distribution

chain and requires all suppliers to use the technology. To

accept the contract with Walmart, BabyFreedom would

have to invest in and implement RFID technology, at least at

The Concerns

Although the Walmart contract would result in accelerated

a basic tagging level, and Walmart wouldn’t help with this growth for BabyFreedom over the next five years, there are

cost. Further, BabyFreedom couldn’t increase clothing important concerns to be addressed. If BabyFreedom can’t

prices to cover the increased cost since Walmart also would quickly expand capacity with a second shift, fulfilling the

require prices to be lowered significantly (sector apparel Walmart contract might create shortages and missed sales

gross margin percentages are approximately 46.4%; Wal- from BabyFreedom’s current channels. The relationship

mart would mandate reductions to 29.8%). The new lower could create opportunities for expansion into other product

prices would effectively eliminate profit margins, and lines; however, management is concerned that Walmart

BabyFreedom would have to reduce or eliminate its might not be a good channel for “natural” clothing (and the

employee benefits and social responsibility programs. premium prices required by such products) and that Wal-

To meet demand for both the Walmart contract and sales mart would begin to press for a less expensive, lower-quality

through current channels, BabyFreedom would have to product line with the BabyFreedom brand name. Manage-

increase production capacity significantly. The new ment is also concerned that shrinking profit margins would

increased demand could be met by bringing on a full sec- significantly alter how the company chooses to do business

ond shift immediately and gradually adding a third shift. It’s and its ability to maintain stakeholder relationships.

estimated that using three shifts would provide enough

production capacity for the next five years; after that, the

company would need to lease additional production facili- The Analysis

ties and expand shift size. After reviewing the offer and the issues associated with

The RFID tags could be integrated into the new system, adopting RFID technology, Jennifer summarized the situa-

either in addition to or instead of the bar code readers. Both tion in a special management meeting:

systems could provide the data necessary to manage inven- The Walmart contract is a great opportunity—the potential

tories. They also would provide more detailed data that increase in sales is tremendous. We’ve done the analysis and feel we

would enable BabyFreedom to allocate shared costs across can meet the production and tagging requirements and still make a

product lines more accurately. With a little assistance, profit. But we need to be sure that this is a good cultural and strate-

BabyFreedom’s suppliers could begin effectively using gic fit for our company. I’m very proud of our reputation for ethical

printed bar codes; the suppliers wouldn’t be able to adopt behavior and the trust our employees and customers have in us—we

RFID technology. As a result, BabyFreedom employees need to be very careful not to hurt that reputation. From a purely

would need to scan the bar codes at the dock and then financial standpoint, we can sign the contract, but I’m concerned

manually apply RFID tags. whether we should do so from a nonfinancial perspective.

Realistically, over at least the next five years, the com- The management team is tasked with reviewing the cur-

pany would be able to afford only the most basic “slap and rent pro forma financials, the projected costs of RFID

August 2017 / STRATEGIC FINANCE / 75

Figure 1:

PROJECTED COSTS OF ALTERNATIVE STRATEGIES FOR

IMPLEMENTING RFID TECHNOLOGY AT BABYFREEDOM

BabyFreedom is evaluating two viable levels of investment in RFID technology to meet Walmart’s requirements. Here are brief

descriptions of each level, along with descriptions of certain key cost items.

1. Compliance level: at least $25,000 in initial acquisition cost for small companies

l Basic system of readers, tags, automated label printers, applicators, and software

l No data integration

l “Slap and ship” with handheld readers only

l Doesn’t allow for future changes in customer requirements

l Selected costs:

s Tags: $0.10 each (basic, passive RFID tags)

s Passive, handheld readers: $3,000 each

n Human being waves the scanner near assets

n Great for manual auditing of a location

n BabyFreedom would require three units (one at the entrance to the finished goods warehouse, one in

the shipping area, and one back-up unit)

s RFID tag printers: $2,500 each

n BabyFreedom would require two printers (one at the entrance to the finished goods warehouse plus

one back-up unit)

s Ongoing costs for technology and maintenance (annual): approximately 15%-20% of initial acquisition cost

2. Conservative level: approximately $250,000 in initial acquisition cost

l Basic system, plus investment in middleware, server capacity, and ongoing service costs for third-party software

l Provides basic data integration and storage for manufacturer

l Provides more permanent installation

l Allows for basic technology consultation and implementation, but not for future changes in customer requirements

l Selected costs:

s Tags: $0.10 each (basic, passive RFID tags)

s Passive, handheld readers: $3,000 each

n Human being waves the scanner near assets

n Great for manual auditing of a location

n BabyFreedom would require three units (one at the entrance to the finished goods warehouse, one in

the shipping area, and one back-up unit)

s Passive, fixed-position readers: $20,000 each

n Portal readers installed in doorways to detect assets moving through

n Cost includes hardware, installation, and configuration

n For conservative-level implementation, BabyFreedom would require two units (one at the entrance to

the finished goods warehouse and the other in the shipping area) in addition to the handheld scanners

s RFID tag printers: $2,500 each

n BabyFreedom would require two printers (one at the entrance to the finished goods warehouse plus

one back-up unit)

s Basic middleware package for small operation: $25,000

s Initial technology consultation and implementation: $50,000

s Additional hardware and server capacity investment: $50,000

s Ongoing costs for technology and maintenance (annual): approximately 15%-20% of initial acquisition cost

76 / STRATEGIC FINANCE / August 2017

implementation, and the qualitative and ethical aspects of BabyFreedom must maintain the same gross

the Walmart opportunity over the next week. In addition to margin percentage for all revenues (in other

doubling sales volume, assumptions to be used in the words, it can’t charge a different, higher price to

analysis include a 15% across-the-board reduction in sell- its “medically necessary” or natural clothing

ing price; a reduction in selling, general, and administrative customers).

expenses to 25% of revenue; 80% financing of the compli- b. The initial report stated that there’s a positive

ance option of RFID implementation (the remaining 20% NPV for the first five-year contract period with

will come from cash on hand); and 20% of acquisition cost Walmart. Verify this by using Excel and the pro

for ongoing support and maintenance of the RFID equip- forma income statement constructed in 2(a) to

ment and software. Following a discussion of the outcome calculate the NPV value, given a 40% tax rate

in next week’s management meeting, Jennifer will reply to and 6.25% weighted average cost of capital.

the Walmart offer. c. Michael Porter’s generic competitive strategies

As part of the management team, you are expected to classify companies by how those companies

provide relevant information that will help inform the ulti- pursue a competitive advantage across a chosen

mate decision. The following questions will help you market. Which of Porter’s three strategies (cost

address the key issues. Be sure to provide support for each leadership, differentiation, or focus/niche) does

of your responses. BabyFreedom use? Which competitive strategy

1. All companies need good information to be competi- does Walmart use? Would a contract between

tive. Technology, especially in the areas of data gath- the two companies be a good strategic fit? Why

ering, analysis, and data warehousing, continues to or why not? Do you think BabyFreedom’s prod-

evolve to meet this need. Good information enables ucts in Walmart stores will alter how its brand is

an organization to successfully develop and imple- perceived? Explain.

ment a strategy to achieve its mission. Yet there are d. BabyFreedom has a reputation for being a com-

important qualitative (including ethical) issues that pany with a strong sense of corporate social

must be addressed when evaluating investment in, responsibility. BabyFreedom’s natural (nonmed-

and use of, these technologies. ically necessary) clothing customer base is

a. Visit IMA’s website (www.imanet.org) and strongly oriented toward issues of sustainability,

research the relationship between management social responsibility, and ethical corporate

accounting systems and strategy implementa- behavior and is very focused on the company’s

tion. What is an accounting information sys- reputation. Jennifer has stated that she doesn’t

tem? Give some examples of how BabyFreedom want to alter her company’s mission or values.

could use its accounting information system to Do you think a supplier relationship with Wal-

implement and monitor a competitive strategy. mart reflects those values? Why or why not?

b. Refer to the Confidentiality section of the IMA e. Beyond questions of strategic fit and company

Statement of Ethical Professional Practice. What eth- mission, are there other qualitative factors that

ical issues are raised by adopting RFID technol- should be considered in the decision? If the

ogy? Should there be limitations on the RFID technology wasn’t an issue, do you think

customer information gathered or what’s done BabyFreedom should accept the Walmart con-

with such information? What internal controls tract? Why or why not? List and discuss alter-

could BabyFreedom implement to ensure that native partners or sales channels that

its use of RFID technology complies with the BabyFreedom could use to grow the company.

IMA Statement of Ethical Professional Practice? 3. BabyFreedom is positioned as a socially responsible

c. Is BabyFreedom able to control the use of RFID company producing high-quality natural clothing. List

technology attached to its clothing once the the stakeholders affected by the decision to accept or

shipment leaves its dock? Why or why not? not accept the Walmart contract and implement basic

What implications does this have for customer RFID technology, and identify how they would be

relations and BabyFreedom’s image? How could affected by the decision.

BabyFreedom’s management address customer 4. Based on your analysis, what is your recommendation

concerns about privacy and the use of RFID tags regarding whether or not to accept the Walmart

on BabyFreedom’s packaging? offer? SF

2. While the Walmart contract is large and would result

in greater sales, there are many important quantita-

tive and qualitative factors to consider, including Kimberly A. Zahller, Ph.D., is an assistant professor of accounting at

strategic fit and stakeholder perceptions. Appalachian State University and an IMA member. You can contact her at

a. Using the assumptions given to BabyFreedom’s zahllerka@appstate.edu.

management team and an initial acquisition

cost of $25,000, construct a pro forma income

statement incorporating the effects of accepting Margaret Beranek, Ph.D., is an associate professor in information sys-

the Walmart contract. Use the mandated Wal- tems and the team lead for business analysis at the University of Colorado

mart gross margin of 29.8%, and assume that Colorado Springs. You can contact her at mberanek@uccs.edu.

August 2017 / STRATEGIC FINANCE / 77

Você também pode gostar

- Organizational culture issues at Triple H Film ProductionsDocumento18 páginasOrganizational culture issues at Triple H Film ProductionsRaihana Baharom50% (2)

- GARDENIA COMPANY PROFILEDocumento4 páginasGARDENIA COMPANY PROFILECHE AHMAD SYAHIR BIN CHE AZMI MoeAinda não há avaliações

- SWOT Analysis: Strengths Weaknesses InternalDocumento4 páginasSWOT Analysis: Strengths Weaknesses InternalSugar Bun100% (2)

- Acc106 Feb2021 Question Set 1Documento15 páginasAcc106 Feb2021 Question Set 1Fara husna0% (1)

- Introduction of Impiana Hotels BerhadDocumento2 páginasIntroduction of Impiana Hotels BerhadAlia NursyifaAinda não há avaliações

- Bbaw2103 Financial AccountingDocumento15 páginasBbaw2103 Financial AccountingSimon RajAinda não há avaliações

- 03FM SM Ch3 1LPDocumento6 páginas03FM SM Ch3 1LPjoebloggs18880% (1)

- PKFZ Scandal Cost Government BillionsDocumento4 páginasPKFZ Scandal Cost Government Billionsemmy100% (1)

- MAF 451 Suggested SolutionDocumento7 páginasMAF 451 Suggested Solutionanis izzatiAinda não há avaliações

- Case Study Maf661Documento12 páginasCase Study Maf661Nur Dina AbsbAinda não há avaliações

- Short Term Decision Making: Management Accounting & ControlDocumento36 páginasShort Term Decision Making: Management Accounting & ControlNur Hidayatul ShafiqahAinda não há avaliações

- MGT430 - Reflective Case StudyDocumento20 páginasMGT430 - Reflective Case StudyAISHAH HUDA AHMAD DAUD100% (1)

- Fin420 540Documento11 páginasFin420 540Zam Zul0% (1)

- My DinDocumento11 páginasMy DinHaFiza MarkaliAinda não há avaliações

- Revision of Published Accounts Format With Selected Mfrs Reference-May2019Documento12 páginasRevision of Published Accounts Format With Selected Mfrs Reference-May2019Amin OthmanAinda não há avaliações

- Opm530 Individual Assignment (Marsya Azalea Mazlan)Documento20 páginasOpm530 Individual Assignment (Marsya Azalea Mazlan)Marsya AzaleaAinda não há avaliações

- Case Study VandivierDocumento1 páginaCase Study VandivierMuhamad alif ammarAinda não há avaliações

- Sta104 Tutorial 1Documento3 páginasSta104 Tutorial 1Ahmad Aiman Hakimi bin Mohd Saifoul ZamzuriAinda não há avaliações

- Hock Cheong TransportDocumento11 páginasHock Cheong TransportSamson Jaygen Chettiar KorindasamyAinda não há avaliações

- Industry Market AnalysisDocumento11 páginasIndustry Market AnalysisYogen YAinda não há avaliações

- CTU351Documento13 páginasCTU351Angeline TanAinda não há avaliações

- Infographic FIN346 Chapter 5Documento2 páginasInfographic FIN346 Chapter 5AmaninaYusri100% (2)

- Slide BenchmarkDocumento20 páginasSlide BenchmarkYayaYongAinda não há avaliações

- TAX Treatment For TAX267 and TAX317 Budget 2019Documento5 páginasTAX Treatment For TAX267 and TAX317 Budget 2019nonameAinda não há avaliações

- Petronas Gas PGB PDFDocumento34 páginasPetronas Gas PGB PDFAhmad Aiman100% (5)

- Delima ReportDocumento16 páginasDelima ReportEstrada Alf100% (7)

- Assigment Account FullDocumento16 páginasAssigment Account FullFaid AmmarAinda não há avaliações

- Term Project: Offered On The Shelves But Not Really Aware by Consumers. You HaveDocumento2 páginasTerm Project: Offered On The Shelves But Not Really Aware by Consumers. You HaveSyi Sya100% (1)

- Driving Revenue Enhancement Campaigns The Maxis ExperienceDocumento22 páginasDriving Revenue Enhancement Campaigns The Maxis ExperienceakashindiaAinda não há avaliações

- MFRS110 Events of Malaysian CompaniesDocumento34 páginasMFRS110 Events of Malaysian CompaniesMeena SyadaAinda não há avaliações

- G. Problems N SolutionDocumento2 páginasG. Problems N SolutionAmirul NorisAinda não há avaliações

- Mark Wilson Creates A Different Kind of TelemarketerDocumento14 páginasMark Wilson Creates A Different Kind of TelemarketerMd Mostafizur RahamanAinda não há avaliações

- Ocean Management's Modus Operandi: Lease-Purchase is Best OptionDocumento25 páginasOcean Management's Modus Operandi: Lease-Purchase is Best OptionNur SyafiqahAinda não há avaliações

- ASM452 Cover Letter AssignmentDocumento1 páginaASM452 Cover Letter AssignmentKhairi Izuan100% (1)

- Week 1.basis Period Change in Accounting Dates - With Q ADocumento39 páginasWeek 1.basis Period Change in Accounting Dates - With Q Asahrasaqsd0% (1)

- Ab5.49 - Report Group A - HLB2013Documento12 páginasAb5.49 - Report Group A - HLB2013alya farhana100% (1)

- Assignment Maf201Documento7 páginasAssignment Maf201miyrasallyAinda não há avaliações

- Group 1 Fitters Diversified Berhad BA 242 4BDocumento42 páginasGroup 1 Fitters Diversified Berhad BA 242 4BMohd Harith100% (1)

- Craven Books Case ReportDocumento16 páginasCraven Books Case ReportLukas Ostjen100% (1)

- Assignment 2Documento6 páginasAssignment 2fatin atiqahAinda não há avaliações

- Micro Accounting SystemDocumento1 páginaMicro Accounting SystemkhanAinda não há avaliações

- SERVICE AssignmentDocumento25 páginasSERVICE Assignment何名传Ainda não há avaliações

- Assignment 1 - Part 1Documento16 páginasAssignment 1 - Part 1Mnridz50% (4)

- Individual Assignment FIN533Documento16 páginasIndividual Assignment FIN533SHAHRIZMAN INDRAAinda não há avaliações

- Padini Holdings' Organizational Structure and StrategiesDocumento14 páginasPadini Holdings' Organizational Structure and Strategiesnur_azian_6Ainda não há avaliações

- Maf651 Cpa ReportDocumento15 páginasMaf651 Cpa ReportQema Jue100% (1)

- Report TPT 250 Mara LinerDocumento12 páginasReport TPT 250 Mara LinerMaznie HaninAinda não há avaliações

- Presentation MGT430Documento13 páginasPresentation MGT430Esther MAinda não há avaliações

- Pos Malaysia Berhad Swot Analysis BacDocumento7 páginasPos Malaysia Berhad Swot Analysis BacNour Ly100% (1)

- Asm453 - Article ReviewDocumento8 páginasAsm453 - Article ReviewFerene Lanyau50% (2)

- MALAYSIA TOURISM PROMOTION STRATEGIESDocumento7 páginasMALAYSIA TOURISM PROMOTION STRATEGIESmeeyaAinda não há avaliações

- Transmile Group Assignment - Project Paper SampleDocumento42 páginasTransmile Group Assignment - Project Paper SampleRied-Zall Hasan100% (11)

- ZuriDocumento2 páginasZuriNur AfiqahAinda não há avaliações

- Price Price: Tutorial 2: Elasticity of DemandDocumento4 páginasPrice Price: Tutorial 2: Elasticity of DemandMuhammad Firdaus Bin Abdul Jalil H20A1279Ainda não há avaliações

- Digi TelecommuicationDocumento3 páginasDigi Telecommuicationriddan100% (1)

- Tax317 Group Project SSTDocumento23 páginasTax317 Group Project SSTNik Syarizal Nik MahadhirAinda não há avaliações

- MAF 671 Integrated Case Study Case Study 1: Wirte Up AssignmentDocumento2 páginasMAF 671 Integrated Case Study Case Study 1: Wirte Up Assignmentannastasia luyahAinda não há avaliações

- OPM 533 c1 NotesDocumento2 páginasOPM 533 c1 NotesMuhammad AsyrafAinda não há avaliações

- Corporate Social Responsibility: Leading The Examined LifeDocumento7 páginasCorporate Social Responsibility: Leading The Examined LifereghzchAinda não há avaliações

- Fec-27 S-3 ProjectDocumento24 páginasFec-27 S-3 ProjectLipi SinghAinda não há avaliações

- 122 FileDocumento1 página122 FileRohit VermaAinda não há avaliações

- 5th Semester CEDocumento13 páginas5th Semester CERohit VermaAinda não há avaliações

- Data On Yearly Exports From 1949-2012Documento6 páginasData On Yearly Exports From 1949-2012Rohit VermaAinda não há avaliações

- Exam Fee ChallanDocumento1 páginaExam Fee ChallanRohit VermaAinda não há avaliações

- Digital Marketing - Canara Bank School of Management Studies PDFDocumento56 páginasDigital Marketing - Canara Bank School of Management Studies PDFRohit VermaAinda não há avaliações

- Leasing NumericalDocumento5 páginasLeasing NumericalRohit VermaAinda não há avaliações

- Revised o LevelDocumento108 páginasRevised o LevelvedzzAinda não há avaliações

- Electricity Bill Upto Sep, 16Documento1 páginaElectricity Bill Upto Sep, 16Rohit VermaAinda não há avaliações

- ExpensesDocumento10 páginasExpensesRohit VermaAinda não há avaliações

- Ugcnotification05may2016 PDFDocumento12 páginasUgcnotification05may2016 PDFPretty TopnoAinda não há avaliações

- Revised A LevelDocumento180 páginasRevised A LevelmohitadmnAinda não há avaliações

- ExpensesDocumento10 páginasExpensesRohit VermaAinda não há avaliações

- NET Application StatusDocumento1 páginaNET Application StatusRohit VermaAinda não há avaliações

- Physics Department Pre-Ph.D. Coursework PDFDocumento5 páginasPhysics Department Pre-Ph.D. Coursework PDFsunuprvunlAinda não há avaliações

- Links To Other Papers Who Needs It and WhyDocumento1 páginaLinks To Other Papers Who Needs It and WhyRohit VermaAinda não há avaliações

- Links To Some Other PapersDocumento1 páginaLinks To Some Other PapersRohit VermaAinda não há avaliações

- Customs ActDocumento126 páginasCustoms ActRohit VermaAinda não há avaliações

- APMC Act regulates agricultural marketsDocumento5 páginasAPMC Act regulates agricultural marketssahelricksAinda não há avaliações

- Links To Other PapersDocumento1 páginaLinks To Other PapersRohit VermaAinda não há avaliações

- Links To Other PapersDocumento1 páginaLinks To Other PapersRohit VermaAinda não há avaliações

- Agriculture Law: RL33204Documento43 páginasAgriculture Law: RL33204AgricultureCaseLaw100% (1)

- Sylviane Granger, Gaëtanelle Gilquin, Fanny Meunier - The Cambridge Handbook of Learner Corpus Research-Cambridge University Press (2015)Documento618 páginasSylviane Granger, Gaëtanelle Gilquin, Fanny Meunier - The Cambridge Handbook of Learner Corpus Research-Cambridge University Press (2015)Joyce CheungAinda não há avaliações

- Types of Errors and Coding TechniquesDocumento11 páginasTypes of Errors and Coding TechniquesTiffany KagsAinda não há avaliações

- A Study on Student Budgeting HabitsDocumento41 páginasA Study on Student Budgeting Habitsbornak BonalasAinda não há avaliações

- DeKalb Pay Raise Summary July 6 2022Documento8 páginasDeKalb Pay Raise Summary July 6 2022Janet and JamesAinda não há avaliações

- 2004 Swamee, Prabhata K. Rathie, Pushpa N. - Exact Solutions For Normal Depth ProblemDocumento9 páginas2004 Swamee, Prabhata K. Rathie, Pushpa N. - Exact Solutions For Normal Depth Problemjosue.angelo9459Ainda não há avaliações

- Interpretative Translation Theory EvaluationDocumento13 páginasInterpretative Translation Theory EvaluationAnastasia MangoAinda não há avaliações

- Daß Ich Erkenne, Was Die Welt Im Innersten Zusammenhält (Lines 382-83) So That I Know What Holds The Innermost World TogetherDocumento2 páginasDaß Ich Erkenne, Was Die Welt Im Innersten Zusammenhält (Lines 382-83) So That I Know What Holds The Innermost World TogetherEmanuel MoşmanuAinda não há avaliações

- Ore Pass Design and Placement Koivisto Mikko PDFDocumento105 páginasOre Pass Design and Placement Koivisto Mikko PDFasepdayat100% (1)

- Analogs of Quantum Hall Effect Edge States in Photonic CrystalsDocumento23 páginasAnalogs of Quantum Hall Effect Edge States in Photonic CrystalsSangat BaikAinda não há avaliações

- Anthony Browder - The Mysteries of MelaninDocumento4 páginasAnthony Browder - The Mysteries of MelaninHidden Truth82% (11)

- Computerised Accounting SystemDocumento14 páginasComputerised Accounting SystemramneekdadwalAinda não há avaliações

- Certification Exam: Take A Business OnlineDocumento15 páginasCertification Exam: Take A Business OnlineezerkaAinda não há avaliações

- (SAC, BIC, XOR, LAT, AWD) On Some Cryptographic Properties of Rijndael (Yucel)Documento12 páginas(SAC, BIC, XOR, LAT, AWD) On Some Cryptographic Properties of Rijndael (Yucel)Alsita Putri IrianaAinda não há avaliações

- Boston Consulting CV TipsDocumento29 páginasBoston Consulting CV TipsAmu Ahmann100% (2)

- IvanhoeDocumento17 páginasIvanhoeRob Collins100% (4)

- Diffie Hellman WriteupDocumento3 páginasDiffie Hellman WriteupSumitThoratAinda não há avaliações

- New Tribological WaysDocumento516 páginasNew Tribological Waysskippytheclown100% (2)

- Fiber Optics: By: Engr. Syed Asad AliDocumento20 páginasFiber Optics: By: Engr. Syed Asad Alisyedasad114Ainda não há avaliações

- Activity 13Documento13 páginasActivity 13Lielannie CarasiAinda não há avaliações

- The Philosophy of EmoDocumento2 páginasThe Philosophy of EmoTed RichardsAinda não há avaliações

- DR Raudhah Ahmadi KNS1633 Engineering Mechanics Civil Engineering, UNIMASDocumento32 páginasDR Raudhah Ahmadi KNS1633 Engineering Mechanics Civil Engineering, UNIMASAriff JasniAinda não há avaliações

- QDEGNSWDocumento2 páginasQDEGNSWSnehin PoddarAinda não há avaliações

- Practices For Improving The PCBDocumento35 páginasPractices For Improving The PCBmwuestAinda não há avaliações

- Essay Language TestingDocumento6 páginasEssay Language TestingSabrina OktariniAinda não há avaliações

- Pathology PLE SamplexDocumento5 páginasPathology PLE SamplexAileen Castillo100% (1)

- Call HandlingDocumento265 páginasCall HandlingABHILASHAinda não há avaliações

- BSIA - Access ControlDocumento16 páginasBSIA - Access ControlSayed HashemAinda não há avaliações

- AEF3 File4 TestADocumento5 páginasAEF3 File4 TestAdaniel-XIIAinda não há avaliações

- GSP Action PlanDocumento2 páginasGSP Action PlanTen Victa-Milano100% (3)

- Person On The StreetDocumento12 páginasPerson On The StreetalyssajdorazioAinda não há avaliações