Escolar Documentos

Profissional Documentos

Cultura Documentos

Practice Questions - TVM

Enviado por

Shekhar SinghTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Practice Questions - TVM

Enviado por

Shekhar SinghDireitos autorais:

Formatos disponíveis

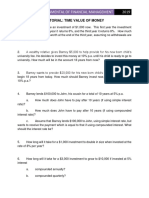

PRACTICE QUESTIONS - TVM

Q1. The Brown's have a new born daughter and have decided to start saving for her college

education. They estimate she will attend school for 4 years and her schooling will cost $30;

000 per year. They will deposit a fixed amount of money into a savings account at the end of

each year for 18 years. The $30; 000 will come due at the end of each of the 19th, 20th,

21st, and 22nd years. They estimate that they will be able to invest at a nominal interest

rate of 4% compounded annually during the entire 22 years. How much money will they

need to deposit at the end of each year for the first 18 years?

Q2. John and Jill have $20,000 cash for the down payment of a house and they can afford a

15-year mortgage payment of $2,500/month. If the best mortgage rate that they can get is

7.5% then what will be the most affordable home that they can buy by their current budget

plan?

Q3. You plan to retire 33 years from now. You expect that you will live 27 years after

retiring. You want to have enough money upon reaching retirement age to withdraw

$180,000 from the account at the beginning of each year you expect to live, and yet still

have $2,500,000 left in the account at the time of your expected death (60 years from now).

You plan to accumulate the retirement fund by making equal annual deposits at the end of

each year for the next 33 years. You expect that you will be able to earn 12% per year on

your deposits. However, you only expect to earn 6% per year on your investment after you

retire since you will choose to place the money in less risky investments. What equal annual

deposits must you make each year to reach your retirement goal?

Q4. You have been hired as a financial advisor to Michael Jordan. He has received two offers

for playing professional basketball and wants to select the best offer, based on

considerations of money only. Offer A is a $10m offer for $2m a year for 5 years. Offer B is a

$11m offer of $1m a year for four years and $7m in year 5. What is your advice?

Q5. Bryan takes out a home loan worth $250,000 today. He will repay the loan by making

equal payments at the end of each month for the next 30 years. The interest is 6.0% APR

compounded monthly. Exactly 10 years after Bryan took out his home loan, he strikes it rich.

First thing he wants to do is pay off the remaining balance on his home loan. How much will

he need to pay?

Você também pode gostar

- Problems For Topic 3Documento4 páginasProblems For Topic 3Quỳnh Anh TrầnAinda não há avaliações

- Nanyang Business School AB1201 Financial Management Seminar Questions Set 2: Time Value of Money (Common Questions)Documento7 páginasNanyang Business School AB1201 Financial Management Seminar Questions Set 2: Time Value of Money (Common Questions)cccqAinda não há avaliações

- Nanyang Business School AB1201 Financial Management Tutorial 2: Time Value of Money (Common Questions)Documento7 páginasNanyang Business School AB1201 Financial Management Tutorial 2: Time Value of Money (Common Questions)asdsadsaAinda não há avaliações

- IBF Assignment Time Value of MoneyDocumento3 páginasIBF Assignment Time Value of MoneyMuhammad HarisAinda não há avaliações

- Chapter 5 - Practice Questions Set 2Documento3 páginasChapter 5 - Practice Questions Set 2Germain LacretteAinda não há avaliações

- Time Value of Money Practice ProblemsDocumento5 páginasTime Value of Money Practice ProblemsMarkAntonyA.RosalesAinda não há avaliações

- Tutorial TVMDocumento5 páginasTutorial TVMNguyễn Quốc HưngAinda não há avaliações

- Time Value of MoneyDocumento9 páginasTime Value of Moneyelarabel abellareAinda não há avaliações

- Tutorial Time Value of MoneyDocumento5 páginasTutorial Time Value of MoneyNgọc Ngô Minh TuyếtAinda não há avaliações

- TUTORIAL TVM Feb17Documento5 páginasTUTORIAL TVM Feb17Thu Uyên Trần ThiAinda não há avaliações

- Tutorial 1 Time Value of Money PDFDocumento2 páginasTutorial 1 Time Value of Money PDFLâm TÚc NgânAinda não há avaliações

- Tutorial 2Documento4 páginasTutorial 2Funny CatAinda não há avaliações

- FINANCIAL MANAGEMENT Cases For Time Value of MoneyDocumento1 páginaFINANCIAL MANAGEMENT Cases For Time Value of MoneyAliyaaaahAinda não há avaliações

- Aiphung - 9p15p16p2Documento16 páginasAiphung - 9p15p16p2Trần Minh KhôiAinda não há avaliações

- Tutorial 1Documento4 páginasTutorial 1Thuận Nguyễn Thị KimAinda não há avaliações

- Assignment For TVMDocumento2 páginasAssignment For TVMamrit_PAinda não há avaliações

- Tutorial TVM - S2 - 2021.22Documento5 páginasTutorial TVM - S2 - 2021.22Ngoc HuynhAinda não há avaliações

- Time Value of MoneyDocumento2 páginasTime Value of MoneySakub Amin Sick'L'0% (1)

- Practice Questions On TVMDocumento5 páginasPractice Questions On TVMANUP MUNDEAinda não há avaliações

- Time Value of MoneyDocumento6 páginasTime Value of MoneyRezzan Joy Camara MejiaAinda não há avaliações

- TenNhom Lab8Documento15 páginasTenNhom Lab8Mẫn ĐứcAinda não há avaliações

- TenNhom Lab8Documento15 páginasTenNhom Lab8Mẫn ĐứcAinda não há avaliações

- Bài Tập ThêmDocumento9 páginasBài Tập ThêmK59 Vu Nguyen Viet LinhAinda não há avaliações

- Practice Questions Time Value of MoneyDocumento1 páginaPractice Questions Time Value of MoneyMethon BaskAinda não há avaliações

- Tutorial 3Documento4 páginasTutorial 3Nguyễn Quan Minh PhúAinda não há avaliações

- Tutorial 2Documento5 páginasTutorial 2K60 Trần Công KhảiAinda não há avaliações

- TVM Practice Questions With AnswersDocumento4 páginasTVM Practice Questions With AnswersAhmed NomanAinda não há avaliações

- Tutorial 2 - TVM PDFDocumento2 páginasTutorial 2 - TVM PDFChamAinda não há avaliações

- Tutorial TVMDocumento5 páginasTutorial TVMMi ThưAinda não há avaliações

- Discussion Problems 1. You Plan To Retire 33 Years From Now. You Expect That You Will Live 27 Years After RetiringDocumento10 páginasDiscussion Problems 1. You Plan To Retire 33 Years From Now. You Expect That You Will Live 27 Years After RetiringJape PreciaAinda não há avaliações

- Chapter 4 - Time Value of MoneyDocumento4 páginasChapter 4 - Time Value of MoneyTruc Khanh Pham NgocAinda não há avaliações

- Time Value of Money 1Documento5 páginasTime Value of Money 1k61.2211155018Ainda não há avaliações

- Assignment 2 - Time Value of Money - 12th MayDocumento4 páginasAssignment 2 - Time Value of Money - 12th MayBinayak AcharyaAinda não há avaliações

- Chapter 5 ExercisesDocumento4 páginasChapter 5 ExercisesShaheera Suhaimi0% (1)

- FBF Spring 2015 Inclass 4Documento2 páginasFBF Spring 2015 Inclass 4peter kongAinda não há avaliações

- Exam Financial Mathematics 15122023Documento2 páginasExam Financial Mathematics 15122023nguyen16023Ainda não há avaliações

- Tutorial For Time Value of MoneyDocumento4 páginasTutorial For Time Value of MoneyKim NgânAinda não há avaliações

- Exercises Annuities MoodleDocumento3 páginasExercises Annuities MoodleNicu BotnariAinda não há avaliações

- Es FOR TIME VALUE OF MONEYDocumento6 páginasEs FOR TIME VALUE OF MONEYphuongnhitran26Ainda não há avaliações

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDocumento4 páginasSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarAinda não há avaliações

- Question BankDocumento3 páginasQuestion BankMuhammad HasnainAinda não há avaliações

- FM Tutorial TVM 2023.24Documento5 páginasFM Tutorial TVM 2023.24Đức ThọAinda não há avaliações

- Topic 03 Problems 2020Documento4 páginasTopic 03 Problems 2020kar pingAinda não há avaliações

- TVM Exercises Chua H, Dijamco G, Legrateja R, Piad RDocumento3 páginasTVM Exercises Chua H, Dijamco G, Legrateja R, Piad RReg LagartejaAinda não há avaliações

- Engineering Economics Problem Set 1 PDFDocumento1 páginaEngineering Economics Problem Set 1 PDFMelissa Joy de GuzmanAinda não há avaliações

- Tutorial 4 TVM ApplicationDocumento4 páginasTutorial 4 TVM ApplicationTrần ThảoAinda não há avaliações

- Present ValueDocumento3 páginasPresent ValueAbbas GhaffarAinda não há avaliações

- Chapter 2 QDocumento4 páginasChapter 2 QKiều LinhAinda não há avaliações

- Assignment 1 TVM, Bonds StockDocumento2 páginasAssignment 1 TVM, Bonds StockMuhammad Ali SamarAinda não há avaliações

- Financially Yours: Assignment IDocumento3 páginasFinancially Yours: Assignment IDevesh Prasad MishraAinda não há avaliações

- Tutorial TVM - S1 - 2020.21Documento4 páginasTutorial TVM - S1 - 2020.21Bảo NhiAinda não há avaliações

- NPV HomeworkDocumento2 páginasNPV HomeworkTrinh Hai AnhAinda não há avaliações

- Time Value of Money (Sample Questions) (1) 2Documento2 páginasTime Value of Money (Sample Questions) (1) 2mintakhtsAinda não há avaliações

- TVM CWDocumento4 páginasTVM CWDua hussainAinda não há avaliações

- 1Documento2 páginas1madsparAinda não há avaliações

- The 100-Year Mortgage is Coming: How to Position Your Family to Avoid It: Financial Freedom, #218No EverandThe 100-Year Mortgage is Coming: How to Position Your Family to Avoid It: Financial Freedom, #218Ainda não há avaliações

- Turn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138No EverandTurn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138Ainda não há avaliações

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)No EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Nota: 5 de 5 estrelas5/5 (1)

- Dating with Dividends: Find Your True Love through Budgeting: Financial Freedom, #125No EverandDating with Dividends: Find Your True Love through Budgeting: Financial Freedom, #125Ainda não há avaliações

- Assignment 1Documento4 páginasAssignment 1Shekhar SinghAinda não há avaliações

- Lecture LQT (Practice Questions)Documento4 páginasLecture LQT (Practice Questions)Shekhar SinghAinda não há avaliações

- Logical and Quantitative Techniques Logical and Quantitative TechniquesDocumento2 páginasLogical and Quantitative Techniques Logical and Quantitative TechniquesShekhar SinghAinda não há avaliações

- Lecture 13 (HCF & LCM)Documento12 páginasLecture 13 (HCF & LCM)Shekhar SinghAinda não há avaliações

- Lecture 15 (HCF, LCM, Fractions-Practice Questions)Documento13 páginasLecture 15 (HCF, LCM, Fractions-Practice Questions)Shekhar SinghAinda não há avaliações

- Lecture 12 (Ratio & Proportion - Practice Questions)Documento10 páginasLecture 12 (Ratio & Proportion - Practice Questions)Shekhar SinghAinda não há avaliações

- Vice ChancellorDocumento1 páginaVice ChancellorShekhar SinghAinda não há avaliações

- Practice Qs - SMDADocumento3 páginasPractice Qs - SMDAShekhar SinghAinda não há avaliações

- Chronicle 2021 Data (SA)Documento1 páginaChronicle 2021 Data (SA)Shekhar SinghAinda não há avaliações

- APADocumento1 páginaAPAShekhar SinghAinda não há avaliações

- Practice Qs - SMDADocumento3 páginasPractice Qs - SMDAShekhar SinghAinda não há avaliações

- ME-Tut 1Documento1 páginaME-Tut 1Shekhar SinghAinda não há avaliações

- The Internet of ThingsDocumento1 páginaThe Internet of ThingsShekhar SinghAinda não há avaliações

- Cash Flows Project One Project Two Cash Flows Project One Project TwoDocumento2 páginasCash Flows Project One Project Two Cash Flows Project One Project TwoShekhar SinghAinda não há avaliações

- Remedial Class Qs 1Documento3 páginasRemedial Class Qs 1Shekhar SinghAinda não há avaliações

- 3Documento1 página3Shekhar SinghAinda não há avaliações

- 2Documento1 página2Shekhar SinghAinda não há avaliações

- Business Analysis and Techniques Tutorial 01: Data ClassificationDocumento1 páginaBusiness Analysis and Techniques Tutorial 01: Data ClassificationShekhar SinghAinda não há avaliações

- Jumbled SentencesDocumento4 páginasJumbled SentencesShekhar SinghAinda não há avaliações

- RCDocumento4 páginasRCShekhar SinghAinda não há avaliações

- ME-Tut 15Documento4 páginasME-Tut 15Shekhar SinghAinda não há avaliações

- Tut 13 Ratio and Working CapitalDocumento1 páginaTut 13 Ratio and Working CapitalShekhar SinghAinda não há avaliações

- Remedial Class Qs 2Documento4 páginasRemedial Class Qs 2Shekhar SinghAinda não há avaliações

- Tutorial 02 DCDocumento1 páginaTutorial 02 DCShekhar SinghAinda não há avaliações

- ME-Tut 2Documento2 páginasME-Tut 2Shekhar SinghAinda não há avaliações

- ME-Tut 3Documento2 páginasME-Tut 3Shekhar SinghAinda não há avaliações

- Assignment 1Documento1 páginaAssignment 1Shekhar SinghAinda não há avaliações

- ME-Tut 5Documento3 páginasME-Tut 5Shekhar SinghAinda não há avaliações

- ME-Tut 4Documento2 páginasME-Tut 4Shekhar SinghAinda não há avaliações