Escolar Documentos

Profissional Documentos

Cultura Documentos

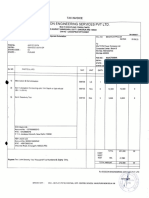

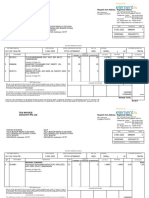

Isgec Heavy Engineering Limited: Earnings Deductions

Enviado por

rohanZorbaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Isgec Heavy Engineering Limited: Earnings Deductions

Enviado por

rohanZorbaDireitos autorais:

Formatos disponíveis

WebPay 4.

2 Page 1 of 1

ISGEC HEAVY ENGINEERING LIMITED

A-4, Sector 24 , NOIDA - 201 301

UTTAR PRADESH

Pay Slip for the month of November 2016

All amounts in INR

Emp Code : 2778 Location : Noida

Emp Name : ROHAN TYAGI Bank/MICR :

Department : Design Bank A/c No. : 250601501581 (ICICI Noida)

Designation : Senior Engineer Company : ISGEC NOIDA

Gender : Male PAN : AKXPT8957A

DOB : 06 Jan 1988 DOJ : 01 Jul 2015 Payable Days : 29.50 PF No. : 39248

Grade_test : VIII

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

BASIC 19000.00 18683.00 0.00 18683.00 INCOME TAX 1300.00

HRA 7600.00 7473.00 0.00 7473.00 PF 2242.00

CCA 2375.00 2335.00 0.00 2335.00 Imprest 8392.00

Adhoc Allowance 4800.00 4720.00 0.00 4720.00 Death Deduction 40.00

Adhoc Allowance II 5000.00 4917.00 0.00 4917.00

Special Allowance 9000.00 8850.00 0.00 8850.00

Special Allowance (P) 2850.00 2803.00 0.00 2803.00

GROSS EARNINGS 50625.00 49781.00 0.00 49781.00 GROSS DEDUCTIONS 11974.00

Net Pay : 37807.00 (THIRTY SEVEN THOUSAND EIGHT HUNDRED SEVEN ONLY)

Income Tax Worksheet for the Period April 2016 - March 2017

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation(Non-Metro)

BASIC 226121.00 0.00 226121.00 Investments u/s 80C Rent Paid 0.00

HRA 90447.00 0.00 90447.00 Provident Fund 27134.00 From: 01/04/2016

CCA 28265.00 0.00 28265.00 To: 31/03/2017

Adhoc Allowance 57126.00 0.00 57126.00 1. Actual HRA 90447.00

Adhoc Allowance II 59505.00 0.00 59505.00 2. 40% or 50% of Basic 90448.00

Special Allowance 107110.00 0.00 107110.00 3. Rent > 10% Basic 0.00

Special Allowance (P) 33918.00 0.00 33918.00 Least of above is exempt 0.00

Taxable HRA 90447.00

Gross 602492.00 0.00 602492.00 Total Investments u/s 80C 27134.00 TDS Deducted Monthly

Tax Working U/S 80C 27134.00 Month Amount

Total Ded Under Chapter VI-A 27134.00 April-2016 500.00

Previous Employer Taxable Income 0.00

Previous Employer Professional Tax 0.00 May-2016 400.00

June-2016 400.00

Professional Tax 0.00

July-2016 400.00

Under Chapter VI-A 27134.00

August-2016 400.00

Any Other Income 0.00

Taxable Income 575358.00 September-2016 400.00

October-2016 400.00

Total Tax 40072.00

November-2016 1300.00

Tax Rebate u/s 87a 0.00

Tax Deducted on Perq. 0.00

Surcharge 0.00

Total 4200.00

Tax Due 0.00

Educational Cess 1202.00

Net Tax 41274.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 4200.00

Tax to be Deducted 37074.00

Tax per month 1300.00

Tax on Non-Recurring Earnings 0.00

Tax Deduction for this month 1300.00 Total Any Other Income 0.00

Personal Note: This is a system generated payslip, does not require any signature.

http://192.9.200.169/Webpay/Empuser/PreEmpSalSlipTaxDetail.aspx?id=urv+0OkieYb/wpPp7SLNTYyA4ej8TDytAvEJuD8dHYIgWVP4GTWAhPZL53eq3kC8 10-12-2016

Você também pode gostar

- System ProjectDocumento1 páginaSystem ProjectRam CharlieAinda não há avaliações

- Fixed Deposit Confirmation AdviceDocumento1 páginaFixed Deposit Confirmation AdviceSureka SwaminathanAinda não há avaliações

- Bill-28 TataDocumento1 páginaBill-28 TataEsscon Engineering Services Pvt. Ltd.Ainda não há avaliações

- Class 1 ADocumento5 páginasClass 1 Arakesh chandraAinda não há avaliações

- Daily Work Schedule Plan 29.08.2022Documento1 páginaDaily Work Schedule Plan 29.08.2022MufeesAinda não há avaliações

- Ab - Sub-14-06-06 - Acmv-01 - 1ST Sty Plan Rev0-09 - B-A1Documento1 páginaAb - Sub-14-06-06 - Acmv-01 - 1ST Sty Plan Rev0-09 - B-A1Naveen RAinda não há avaliações

- Megha KuhikarDocumento1 páginaMegha KuhikarsecunsharmaAinda não há avaliações

- HVAC CDocs PDFDocumento9 páginasHVAC CDocs PDFAiron Jay MangabatAinda não há avaliações

- Sample Copy 3Documento1 páginaSample Copy 3Random NameAinda não há avaliações

- SampleDocumento1 páginaSampleRandom NameAinda não há avaliações

- Sample Copy 2Documento1 páginaSample Copy 2Random NameAinda não há avaliações

- SampleDocumento1 páginaSampleRandom NameAinda não há avaliações

- Sample Copy 4Documento1 páginaSample Copy 4Random NameAinda não há avaliações

- SampleDocumento1 páginaSampleRandom NameAinda não há avaliações

- Daily Work Schedule Plan 28.08.2022Documento1 páginaDaily Work Schedule Plan 28.08.2022MufeesAinda não há avaliações

- Dutch-Bangla Bank Limited Bashundhara Branch K 3/1-C, Jogonnathpur Bashundhara Dhaka BangladeshDocumento3 páginasDutch-Bangla Bank Limited Bashundhara Branch K 3/1-C, Jogonnathpur Bashundhara Dhaka BangladeshNur NobiAinda não há avaliações

- Nippon India MF PDFDocumento1 páginaNippon India MF PDFneomiAinda não há avaliações

- 11-Guest BupDocumento1 página11-Guest BupMark Nathan Sta. MonicaAinda não há avaliações

- Email - : 24-D Bahar Shah RoadDocumento3 páginasEmail - : 24-D Bahar Shah RoadgamelymodAinda não há avaliações

- Name of Project:: 2 X 4.4Mw Rudi Khola HepDocumento2 páginasName of Project:: 2 X 4.4Mw Rudi Khola HepapsAinda não há avaliações

- Tax Invoice Element14 Pte LTD: Registered Address Despatch From AddressDocumento12 páginasTax Invoice Element14 Pte LTD: Registered Address Despatch From AddressRaihan Muhammad SyahranAinda não há avaliações

- Daily Work Schedule Plan 27.08.2022Documento1 páginaDaily Work Schedule Plan 27.08.2022MufeesAinda não há avaliações

- Hazmi UNIFI2020Documento3 páginasHazmi UNIFI2020Nor ainAinda não há avaliações

- Acct Statement - XX4512 - 21052022Documento1 páginaAcct Statement - XX4512 - 21052022Deepak kumar M RAinda não há avaliações

- Invoice #ATPL/20-21/B246: Autocratic Technosoft PVT LTDDocumento1 páginaInvoice #ATPL/20-21/B246: Autocratic Technosoft PVT LTDPrabal Frank NandwaniAinda não há avaliações

- PR22050092 N67-S81 Toucan WhiteDocumento1 páginaPR22050092 N67-S81 Toucan WhiteIzzah 'AtirahAinda não há avaliações

- Flow Sheet HEP Mass Production LineDocumento1 páginaFlow Sheet HEP Mass Production LinesudiroAinda não há avaliações

- 12, 15, 18 - Keerti, Diksha, Lokeshwar WDDocumento21 páginas12, 15, 18 - Keerti, Diksha, Lokeshwar WD37 Kumar HarshAinda não há avaliações

- Prakash S YadavDocumento2 páginasPrakash S YadavAnil kadamAinda não há avaliações

- 34 - 36 Electric DrawingDocumento206 páginas34 - 36 Electric DrawingMohamedAl-gamalAinda não há avaliações

- Statement of AccountDocumento1 páginaStatement of AccountSevuga RajanAinda não há avaliações

- GIT Pocket GuideDocumento1 páginaGIT Pocket GuideSandeep TeotiaAinda não há avaliações

- HDBMB 2583652 PaySlip 10 2022Documento1 páginaHDBMB 2583652 PaySlip 10 2022PriyanshuAinda não há avaliações

- Img 20210303 0002Documento1 páginaImg 20210303 0002shafiq shafiqAinda não há avaliações

- Toilet Sanitary Items-SdDocumento1 páginaToilet Sanitary Items-SdNeal JohnsonAinda não há avaliações

- ThesisDocumento17 páginasThesisAnnie SainiAinda não há avaliações

- Transaction Statement1626153268Documento2 páginasTransaction Statement1626153268Rohit PalAinda não há avaliações

- Southern Peru Cooper Corp.: Weight (KG) Quantity Profile Length (MM) Quality S1 W12X72 11660 1 A992 1274.9 Assembly A287Documento1 páginaSouthern Peru Cooper Corp.: Weight (KG) Quantity Profile Length (MM) Quality S1 W12X72 11660 1 A992 1274.9 Assembly A287Mark AnthonyAinda não há avaliações

- TWP 93272105 IffcoTokioDocumento2 páginasTWP 93272105 IffcoTokioSudeep Kumar67% (3)

- Payslip Agust 2022 PDFDocumento2 páginasPayslip Agust 2022 PDFNandini DarekarAinda não há avaliações

- Drawing 20'GP - Office Container Type C (Rev-28042022)Documento2 páginasDrawing 20'GP - Office Container Type C (Rev-28042022)Najmudin 703Ainda não há avaliações

- Daily Work Schedule Plan 30.08.2022Documento1 páginaDaily Work Schedule Plan 30.08.2022MufeesAinda não há avaliações

- Asbuilt Drawing MHTG JCI Chiller 8-9-2022Documento13 páginasAsbuilt Drawing MHTG JCI Chiller 8-9-2022Abraham LalangAinda não há avaliações

- Design Calculation of Security Building at Allipuram: L&T ConstructionDocumento33 páginasDesign Calculation of Security Building at Allipuram: L&T Constructionjuliyet strucAinda não há avaliações

- Posisi Penangkal Petir-Model PDFDocumento1 páginaPosisi Penangkal Petir-Model PDFMochamad MukminAinda não há avaliações

- Turbine Trip ValuesDocumento1 páginaTurbine Trip ValuesPugazhendhi SAinda não há avaliações

- Su Japanese Restaurant: Date: 2023.09.08 18:12:31 - 04'00'Documento1 páginaSu Japanese Restaurant: Date: 2023.09.08 18:12:31 - 04'00'Engr Mohammad AbdullahAinda não há avaliações

- Date: 2023.09.08 18:31:55 - 04'00': Su Japanese RestaurantDocumento1 páginaDate: 2023.09.08 18:31:55 - 04'00': Su Japanese RestaurantEngr Mohammad AbdullahAinda não há avaliações

- Payslip October 2022 PDFDocumento2 páginasPayslip October 2022 PDFNandini DarekarAinda não há avaliações

- Payslip September 2022 PDFDocumento2 páginasPayslip September 2022 PDFNandini DarekarAinda não há avaliações

- India Today 27.05.19Documento180 páginasIndia Today 27.05.19ISO SRCAS0% (1)

- Duvf - U QHN (: LT ChairmanDocumento2 páginasDuvf - U QHN (: LT ChairmanDipen ShahAinda não há avaliações

- Invoice WS 50356Documento1 páginaInvoice WS 50356Muhammad IbraheemAinda não há avaliações

- Swimming Pool E-01Documento1 páginaSwimming Pool E-01Madelo, Allysa Mae, M.Ainda não há avaliações

- Jaswant GurjarDocumento4 páginasJaswant GurjarNOOB FIREAinda não há avaliações

- Drawing 20 Feet Office ModboxDocumento1 páginaDrawing 20 Feet Office ModboxArdi FebriansyahAinda não há avaliações

- BeneficiaryDetailForSocialAuditReport PMAYG 3146005 2020-2021Documento7 páginasBeneficiaryDetailForSocialAuditReport PMAYG 3146005 2020-2021bestbiryaniwala1Ainda não há avaliações

- SCAN & PAY Through Paytm Fill Details & Complete: (Authorised Signatory)Documento1 páginaSCAN & PAY Through Paytm Fill Details & Complete: (Authorised Signatory)ashishAinda não há avaliações

- 13 Projeto FundaçãoDocumento1 página13 Projeto FundaçãoTico de PaulaAinda não há avaliações

- He605560 Atk SBR XX - BX5281 DR CB 000001Documento1 páginaHe605560 Atk SBR XX - BX5281 DR CB 000001rohanZorbaAinda não há avaliações

- Mohit Kumar-7Documento6 páginasMohit Kumar-7rohanZorbaAinda não há avaliações

- Getting Through All Lessons ActivitiesDocumento9 páginasGetting Through All Lessons ActivitiesrohanZorbaAinda não há avaliações

- Getting Through All Lessons ActivitiesDocumento9 páginasGetting Through All Lessons ActivitiesrohanZorba100% (1)

- Sundays'StestDocumento3 páginasSundays'StestrohanZorbaAinda não há avaliações

- 1 MsmardiDocumento2 páginas1 MsmardirohanZorbaAinda não há avaliações

- Tenses Explanation: Present Uses One: We Use The Present Simple When Something Is Generally or Always TrueDocumento3 páginasTenses Explanation: Present Uses One: We Use The Present Simple When Something Is Generally or Always TruerohanZorbaAinda não há avaliações

- 1AS 1stDocumento2 páginas1AS 1strohanZorbaAinda não há avaliações

- Bren 2006 159 1 35Documento8 páginasBren 2006 159 1 35rohanZorbaAinda não há avaliações

- 199582558 كل مذكرات السنة الأولى في الانجليزيةDocumento32 páginas199582558 كل مذكرات السنة الأولى في الانجليزيةBilal SergAinda não há avaliações

- Interrogative Affirmative Interrogative Affirmative: InterrogativeDocumento3 páginasInterrogative Affirmative Interrogative Affirmative: InterrogativerohanZorba100% (1)

- Lets Go 1 Student Book 4edDocumento75 páginasLets Go 1 Student Book 4edrohanZorbaAinda não há avaliações

- A Systematic Review On Effectiveness of Rajyoga Meditation On Chronic Tension Type HeadacheDocumento7 páginasA Systematic Review On Effectiveness of Rajyoga Meditation On Chronic Tension Type HeadacherohanZorbaAinda não há avaliações

- The International CentreDocumento1 páginaThe International CentrerohanZorbaAinda não há avaliações

- Student Assessment in Online Learning: Challenges and Effective PracticesDocumento11 páginasStudent Assessment in Online Learning: Challenges and Effective PracticesUmmi SyafAinda não há avaliações

- Final English Test: TeenagersDocumento8 páginasFinal English Test: TeenagersrohanZorbaAinda não há avaliações

- Practice One: Listen To The Speaker and Spell Her / His NameDocumento5 páginasPractice One: Listen To The Speaker and Spell Her / His NamerohanZorbaAinda não há avaliações

- Summary of All Sequences For 4MS 2021Documento8 páginasSummary of All Sequences For 4MS 2021rohanZorba100% (3)

- Programme Discourse Society and CultureDocumento1 páginaProgramme Discourse Society and CulturerohanZorbaAinda não há avaliações

- The Second Term English Test: Family Name: .. ............. Surname: .Documento2 páginasThe Second Term English Test: Family Name: .. ............. Surname: .Wassim AravAinda não há avaliações

- Assessing Listening Worksheet 0Documento6 páginasAssessing Listening Worksheet 0rohanZorbaAinda não há avaliações

- Assessing Listening in The Language Classroom PDFDocumento8 páginasAssessing Listening in The Language Classroom PDFNicolas OjedaAinda não há avaliações

- S2-Seminar 8 ADocumento4 páginasS2-Seminar 8 ArohanZorbaAinda não há avaliações

- Rewrite These Sentences in The Passive Voice.: SpentDocumento2 páginasRewrite These Sentences in The Passive Voice.: SpentrohanZorbaAinda não há avaliações

- Dell Hymes and The Ethnography of Communication: January 2010Documento19 páginasDell Hymes and The Ethnography of Communication: January 2010Mayrogan27Ainda não há avaliações

- Lesson 1 Principes of Effective Teaching and LearningDocumento4 páginasLesson 1 Principes of Effective Teaching and LearningrohanZorbaAinda não há avaliações

- Lesson 3 Classroom InteractionDocumento4 páginasLesson 3 Classroom InteractionrohanZorbaAinda não há avaliações

- Lesson 5 Promoting MetacognitionDocumento2 páginasLesson 5 Promoting MetacognitionrohanZorbaAinda não há avaliações

- Lesson2 Strategies For Teaching Different Types of LearnersDocumento2 páginasLesson2 Strategies For Teaching Different Types of LearnersrohanZorbaAinda não há avaliações

- Lesson 6 Fostering Learner AutonomyDocumento2 páginasLesson 6 Fostering Learner AutonomyrohanZorbaAinda não há avaliações

- Peace Corps Deputy Director of Management & Operations (DDMO)Documento5 páginasPeace Corps Deputy Director of Management & Operations (DDMO)Accessible Journal Media: Peace Corps DocumentsAinda não há avaliações

- G.R. No. 155098 September 16, 2005 Capitol Medical Center, Inc. and Dr. Thelma Navarette-CLEMENTE, Petitioners, vs. DR. CESAR E. MERIS, RespondentDocumento21 páginasG.R. No. 155098 September 16, 2005 Capitol Medical Center, Inc. and Dr. Thelma Navarette-CLEMENTE, Petitioners, vs. DR. CESAR E. MERIS, RespondentKristine DiamanteAinda não há avaliações

- Revenue Recognition:: Franchise AccountingDocumento20 páginasRevenue Recognition:: Franchise AccountingMarvin San JuanAinda não há avaliações

- Limketkai Sons MillingDocumento2 páginasLimketkai Sons MillingPantera's GatesAinda não há avaliações

- Possible Legal BasisDocumento2 páginasPossible Legal BasisMitchi BarrancoAinda não há avaliações

- R. A. No. 10361Documento1 páginaR. A. No. 10361Pia SarconAinda não há avaliações

- Pacrim Careers Provides Training To Individuals Who Pay Tuition DirectlyDocumento1 páginaPacrim Careers Provides Training To Individuals Who Pay Tuition DirectlyTaimour HassanAinda não há avaliações

- Itad Bir Ruling No. 168-12Documento7 páginasItad Bir Ruling No. 168-12Karla TigaronitaAinda não há avaliações

- Sps Wilfredo Vs BenedictoDocumento5 páginasSps Wilfredo Vs BenedictoSophiaFrancescaEspinosaAinda não há avaliações

- 1 Ansay-v-NDCDocumento1 página1 Ansay-v-NDCluigimanzanares100% (1)

- Week 3 and 4 FLII - SM-2Documento291 páginasWeek 3 and 4 FLII - SM-2PriyankaAinda não há avaliações

- Sales Case 2Documento6 páginasSales Case 2manol_salaAinda não há avaliações

- Regular Income TaxDocumento11 páginasRegular Income Taxwhat ever100% (4)

- 1492066084transfer of Property Act - DS PDFDocumento22 páginas1492066084transfer of Property Act - DS PDFcharvin100% (1)

- Castro vs. Miat Art 1088Documento18 páginasCastro vs. Miat Art 1088HeidiAinda não há avaliações

- Capital and Rental Valuation of Hotels in Asia IP 1st EditionDocumento18 páginasCapital and Rental Valuation of Hotels in Asia IP 1st EditionSithick MohamedAinda não há avaliações

- Win-Win or HardballDocumento3 páginasWin-Win or HardballPerla AguilarAinda não há avaliações

- Delos Santos vs. Jebsen Maritime Case DigestDocumento2 páginasDelos Santos vs. Jebsen Maritime Case DigestAtheena Marie Palomaria100% (2)

- MOA - (Addendum) HI & Psalm Prop Ventures & Dev Corp MyvrsDocumento3 páginasMOA - (Addendum) HI & Psalm Prop Ventures & Dev Corp MyvrscarlgerAinda não há avaliações

- Risk and Insurance: Biyani's Think TankDocumento122 páginasRisk and Insurance: Biyani's Think TankFaiz Ur RehmanAinda não há avaliações

- Asia Trust V TubleDocumento3 páginasAsia Trust V TubleHNicdaoAinda não há avaliações

- Republic V FNCBDocumento6 páginasRepublic V FNCBMp Cas100% (1)

- Document 588372663738Documento1 páginaDocument 588372663738JacobAinda não há avaliações

- Affidavit of Lost Promissory Note and Indemnity AgreementDocumento5 páginasAffidavit of Lost Promissory Note and Indemnity Agreementinpropriapersona100% (1)

- NEW Idm - DSL - ApplicationDocumento3 páginasNEW Idm - DSL - ApplicationTHYBOSSAinda não há avaliações

- Bihar Rules1.312131927Documento2 páginasBihar Rules1.312131927gsethuanandhAinda não há avaliações

- Overview of Premium Financed Life InsuranceDocumento17 páginasOverview of Premium Financed Life InsuranceProvada Insurance Services100% (1)

- Contract of Sale of Vesse LDocumento7 páginasContract of Sale of Vesse LArcide Rcd ReynilAinda não há avaliações

- Bautista v. BorromeoDocumento2 páginasBautista v. BorromeoMaria Resper67% (3)

- FBR Tax FilingDocumento48 páginasFBR Tax FilingMuhammad Waqas Hanif100% (1)