Escolar Documentos

Profissional Documentos

Cultura Documentos

Receipt of House Rent: Revenue Stamp

Enviado por

mahalaxmi1Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Receipt of House Rent: Revenue Stamp

Enviado por

mahalaxmi1Direitos autorais:

Formatos disponíveis

RECEIPT OF HOUSE RENT

(Under Section 10 (13A) of Income Tax Act)

Received with thanks from Mr. / Ms. / Mrs. ___________________________________________,

who is an employee of Aricent Technologies (Holdings) Limited.

He/She is currently residing on Rent at the below mentioned address

_____________________________________________________________________________

_____________________________________________________________________________.

Received Monthly Rent of Rs.________.00

(Rupees_______________________________________________________________________)

Received Rent for the Month of _____________________

(Affix One Rupee Revenue Stamp)

Revenue

Stamp

Date: _____ / _____ / _____ Signature of the Landlord

Landlord Name _______________________________

Landlord PAN # _______________________________

Landlord Address: _______________________________

_________________________________________________

_________________________________________________

_________________________________________________

Note :

1. Print only Page 1 while submitting the proofs. The below information is for your

reference only.

Employees need to submit/upload the below documents to claim tax exemption on HRA

Employees paying house rent of less than INR 100,000/- per annum (INR 8,333/- per month or

below) and claiming HRA benefit are required to furnish the following documents to claim HRA

exemption:

a. Rent receipts

b. Photocopy of the rental agreement (Not mandatory)

Employees paying house rent of more than INR 100,000/- per annum (above INR 8,333/- per

month) and claiming HRA benefit are required to furnish the following documents to claim HRA

exemption:

a. Rent receipts

b. Photocopy of the rental agreement (to substantiate the relation between the PAN

cardholder (landlord) and the tenant in a rental agreement).

c. Photocopy of the landlord’s Permanent Account Number (PAN)

i. In case the landlord does not have a PAN, a declaration to this effect from the

landlord, along with his name and address, is required. (Refer declaration Form 60).

This can be downloaded from Function > Finance > Download Center > Form 60.pdf

ii. Landlord identity proof copy to be attached along with the Form No. 60

Você também pode gostar

- Joint Declaration LetterDocumento1 páginaJoint Declaration LetterST COMMNICATIONAinda não há avaliações

- HRA Future Payment Declaration FormDocumento1 páginaHRA Future Payment Declaration FormGaurav KumarAinda não há avaliações

- Free Rent Receipt TemplateDocumento1 páginaFree Rent Receipt TemplateApril WoodsAinda não há avaliações

- Rent Receipt Format For HRA Declaration and HRA Excemption in Income Tax IndiaDocumento1 páginaRent Receipt Format For HRA Declaration and HRA Excemption in Income Tax IndiaJeeva KannanAinda não há avaliações

- Employability Interview 1Documento2 páginasEmployability Interview 1api-311426100Ainda não há avaliações

- HRA Declaration FormDocumento1 páginaHRA Declaration FormNiranjanAryanAinda não há avaliações

- Payroll Check ExplainedDocumento3 páginasPayroll Check Explainedfriendresh1708Ainda não há avaliações

- GOP Reps' Fraud Letter To DiNapoliDocumento3 páginasGOP Reps' Fraud Letter To DiNapoliNew York PostAinda não há avaliações

- Bankers Verification Form20170619 084455Documento1 páginaBankers Verification Form20170619 084455VenkateshAinda não há avaliações

- View PPF / SSY Account Statement: Sukanya Samriddhi Yojana Account No.: 55100000510427, ANNA NAGAR IDocumento1 páginaView PPF / SSY Account Statement: Sukanya Samriddhi Yojana Account No.: 55100000510427, ANNA NAGAR IManas MeherAinda não há avaliações

- Calculating Costs of New Employee Recruitment: Student Date PeriodDocumento8 páginasCalculating Costs of New Employee Recruitment: Student Date PeriodIbrah1mov1chAinda não há avaliações

- FakeDocumento11 páginasFakearthithaAinda não há avaliações

- Used Cars For Sale Offer FormDocumento3 páginasUsed Cars For Sale Offer FormRaymond GabrielAinda não há avaliações

- House Rent SlipDocumento1 páginaHouse Rent Slipmuhammad qasimAinda não há avaliações

- Form E-2 - For Initials+signaturesDocumento4 páginasForm E-2 - For Initials+signaturesAlexa KarolinskiAinda não há avaliações

- Employee VerificationDocumento1 páginaEmployee VerificationRajiv Poplai100% (2)

- Application For GED TestingDocumento2 páginasApplication For GED TestingNISAR_786Ainda não há avaliações

- Pensioner Signature/Thumb ImpressionDocumento1 páginaPensioner Signature/Thumb ImpressionSalaar AnsarAinda não há avaliações

- Letter of ConfirmationDocumento1 páginaLetter of Confirmationphilipjudeacidre100% (1)

- Printable Rent ReceiptsDocumento1 páginaPrintable Rent ReceiptsDiana Krishna KumarAinda não há avaliações

- 15 Day Notice Per AB832 Rev727201Documento3 páginas15 Day Notice Per AB832 Rev727201BrianAinda não há avaliações

- Non MarriageDocumento1 páginaNon Marriagemariamajeed9090100% (1)

- Nasa Umbrella - HANDBOOK (1104)Documento21 páginasNasa Umbrella - HANDBOOK (1104)b1gdeanoAinda não há avaliações

- Rental ApplicationDocumento6 páginasRental ApplicationJoy FrieseAinda não há avaliações

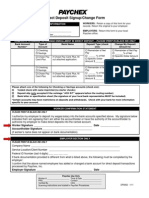

- Direct Deposit Signup FormDocumento1 páginaDirect Deposit Signup FormMiguel RendonAinda não há avaliações

- PRQ Version 1 FinalDocumento2 páginasPRQ Version 1 Finaljoshuabcastillo100% (1)

- Inspiration ArmorDocumento2 páginasInspiration ArmorRichard Rivera0% (1)

- Endorsment LetterDocumento1 páginaEndorsment LetterdushakilAinda não há avaliações

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Documento2 páginasFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyAinda não há avaliações

- Change of Landlord Agent FormDocumento2 páginasChange of Landlord Agent FormimiescribdAinda não há avaliações

- Roommate QuestionnaireDocumento1 páginaRoommate QuestionnaireJennifer MooreAinda não há avaliações

- Hotel Lock Management System ManualDocumento125 páginasHotel Lock Management System ManualYeik ThaAinda não há avaliações

- Income Tax ActDocumento273 páginasIncome Tax ActromAinda não há avaliações

- Wa State Rental Lease TemplateDocumento7 páginasWa State Rental Lease Templatekristin17170% (1)

- 1-8 Florida Commercial Landlord Tenant Law - 8.02Documento27 páginas1-8 Florida Commercial Landlord Tenant Law - 8.02kcyesqAinda não há avaliações

- House Rent Receipt - FormatDocumento2 páginasHouse Rent Receipt - Formatshruthi shruAinda não há avaliações

- (Under Section 10 (13A) of Income Tax Act) : Receipt of House RentDocumento1 página(Under Section 10 (13A) of Income Tax Act) : Receipt of House RentArun KumarAinda não há avaliações

- HRA Self Declaration - 231220 - 131019Documento2 páginasHRA Self Declaration - 231220 - 131019sivaAinda não há avaliações

- Rent FormatDocumento1 páginaRent FormatT Sandeep KumarAinda não há avaliações

- Rent ReceiptsDocumento1 páginaRent Receiptsimamitkumar1988Ainda não há avaliações

- Haryana Vidyut Prasaran Nigam LimitedDocumento10 páginasHaryana Vidyut Prasaran Nigam Limitedaloo leoAinda não há avaliações

- AnnexureDocumento3 páginasAnnexurekalanidhieeeAinda não há avaliações

- Credit ApplicationDocumento3 páginasCredit ApplicationALSIRAT CONTRACTINGAinda não há avaliações

- Indemnity Bond Affidavit DuplicateDocumento6 páginasIndemnity Bond Affidavit DuplicateKirti Bhushan KapilAinda não há avaliações

- House rent receipt templateDocumento1 páginaHouse rent receipt templatemurali krishnaAinda não há avaliações

- House Rent Receipt PanDocumento1 páginaHouse Rent Receipt PanDestination MusicAinda não há avaliações

- Rent Receipt FormatDocumento1 páginaRent Receipt FormatSeshadri VenkatAinda não há avaliações

- Rent Receipt FormatDocumento1 páginaRent Receipt FormatSeshadri Venkat100% (1)

- Rental ApplicationDocumento1 páginaRental ApplicationAnonymous AUPkvmQVJpAinda não há avaliações

- HRA Tax Benefit Self DeclarationDocumento1 páginaHRA Tax Benefit Self DeclarationRajshree SamantrayAinda não há avaliações

- Application Form For Cars/Two WheelersDocumento2 páginasApplication Form For Cars/Two WheelersArvindAinda não há avaliações

- HRA - Rent Receipt Format-Actual and Future DeclarationDocumento2 páginasHRA - Rent Receipt Format-Actual and Future Declarationmadhu gandheAinda não há avaliações

- Application To Rent GL FormDocumento2 páginasApplication To Rent GL Formgeorgelange100% (2)

- Application Form CorpDocumento3 páginasApplication Form CorpFort Nico Fajardo BuensucesoAinda não há avaliações

- Last Pay CertificateDocumento2 páginasLast Pay Certificatekingfairgod100% (1)

- Rent Receipt FormatDocumento1 páginaRent Receipt FormatGayathri PoppasaniAinda não há avaliações

- House Rent Receipt Form 1Documento1 páginaHouse Rent Receipt Form 1ksmk1006Ainda não há avaliações

- Non-Corp Buyer Doc ChecklistDocumento1 páginaNon-Corp Buyer Doc ChecklistPaul Arman MurilloAinda não há avaliações

- 8 LPC-format PDFDocumento2 páginas8 LPC-format PDFBilal Ahmed Barbhuiya0% (1)

- Transfer of Ownership PDFDocumento1 páginaTransfer of Ownership PDFSachin DivateAinda não há avaliações

- Bharatanatyam As A Global Dance: Some Issues in Research, Teaching, and PracticeDocumento20 páginasBharatanatyam As A Global Dance: Some Issues in Research, Teaching, and Practicemahalaxmi1Ainda não há avaliações

- 10 - Chapter 2Documento25 páginas10 - Chapter 2mahalaxmi1Ainda não há avaliações

- Rent Receipt TemplateDocumento1 páginaRent Receipt Templatemahalaxmi1Ainda não há avaliações

- 5G - Non Standalone - 3GPP PDFDocumento311 páginas5G - Non Standalone - 3GPP PDFNoura Sayed AbdraboAinda não há avaliações

- Introduction To Embedded Systems Using Windows Embedded CeDocumento294 páginasIntroduction To Embedded Systems Using Windows Embedded CeUddipta BgohainAinda não há avaliações

- UGC Indian Culture Paper 2 December 2004Documento22 páginasUGC Indian Culture Paper 2 December 2004mahalaxmi1Ainda não há avaliações

- Xaam - In-Varjiram Mains POLITICAL SCIENCE TEST 1 Political Theory Paper I Section A With Detailed AnswerDocumento13 páginasXaam - In-Varjiram Mains POLITICAL SCIENCE TEST 1 Political Theory Paper I Section A With Detailed Answermahalaxmi1Ainda não há avaliações

- 05591697Documento8 páginas05591697mahalaxmi1Ainda não há avaliações

- 1-Evolution of India's World-ViewDocumento10 páginas1-Evolution of India's World-ViewSandeep O Positive SharmaAinda não há avaliações

- Ias Our Dream Geography NotesDocumento106 páginasIas Our Dream Geography Notesmahalaxmi1Ainda não há avaliações

- C EssentialsDocumento45 páginasC EssentialssuchitraprasannaAinda não há avaliações

- Study PlanDocumento7 páginasStudy Planmahalaxmi1Ainda não há avaliações

- Disaster ManagementDocumento98 páginasDisaster ManagementNUNNAVENKATESHAinda não há avaliações

- Solar SystemDocumento2 páginasSolar Systemmahalaxmi1Ainda não há avaliações

- Solar SystemDocumento2 páginasSolar Systemmahalaxmi1Ainda não há avaliações

- Group 1 Syllabus and PatternDocumento7 páginasGroup 1 Syllabus and Patternsai198Ainda não há avaliações

- VerilogDocumento24 páginasVerilogMaheshwar ReddyAinda não há avaliações

- Chapter 12 Complex GroupsDocumento18 páginasChapter 12 Complex GroupsrhinoAinda não há avaliações

- Consultants discuss new program for delayed construction projectDocumento2 páginasConsultants discuss new program for delayed construction projectSitche ZisoAinda não há avaliações

- Entry Level Financial Analyst in New York City Resume Jibran ShahDocumento1 páginaEntry Level Financial Analyst in New York City Resume Jibran ShahJibranShahAinda não há avaliações

- DGPR-The Death of Portfolio DiversificationDocumento6 páginasDGPR-The Death of Portfolio DiversificationdevnevAinda não há avaliações

- InfosysDocumento44 páginasInfosysSubhendu GhoshAinda não há avaliações

- Yeo Hiap Seng (Malaysia) Berhad Annual Report 2011Documento134 páginasYeo Hiap Seng (Malaysia) Berhad Annual Report 2011Pei Jia100% (1)

- Logistic & Supply Chain ManagementDocumento3 páginasLogistic & Supply Chain ManagementIvan BacklashAinda não há avaliações

- Standardization and GradingDocumento26 páginasStandardization and GradingHiral JoysarAinda não há avaliações

- 16 - 1the Malaysian Grid CodeDocumento1 página16 - 1the Malaysian Grid CodezohoAinda não há avaliações

- Chola MS Insurance Annual Report 2019 20Documento139 páginasChola MS Insurance Annual Report 2019 20happy39Ainda não há avaliações

- Monetary Policy and Fiscal PolicyDocumento15 páginasMonetary Policy and Fiscal Policycarmella klien GanalAinda não há avaliações

- Parkin Chap. 6Documento22 páginasParkin Chap. 6Erika Mae IsipAinda não há avaliações

- Consumer Protection Act summarized in 35 charactersDocumento34 páginasConsumer Protection Act summarized in 35 charactersyogesh shakyaAinda não há avaliações

- Topic 3 International Convergence of Financial Reporting 2022Documento17 páginasTopic 3 International Convergence of Financial Reporting 2022Nguyễn Minh ĐứcAinda não há avaliações

- Monetary Policy and Central Banking - MRCDocumento9 páginasMonetary Policy and Central Banking - MRCEleine Taroma AlvarezAinda não há avaliações

- Chapter One Overview of Governmental and Not For Profit Organizations 1.0. Learning ObjectivesDocumento24 páginasChapter One Overview of Governmental and Not For Profit Organizations 1.0. Learning ObjectivesshimelisAinda não há avaliações

- Buy Refurbished Smartphones through Local Vendors with OLD is GOLDDocumento4 páginasBuy Refurbished Smartphones through Local Vendors with OLD is GOLDManish ManjhiAinda não há avaliações

- O/W: Mayne To Reward The Willing: Mayne Pharma Group (MYX)Documento8 páginasO/W: Mayne To Reward The Willing: Mayne Pharma Group (MYX)Muhammad ImranAinda não há avaliações

- Demand in EconomicsDocumento20 páginasDemand in EconomicsmjkhumaloAinda não há avaliações

- Basin Planning For WRMDocumento47 páginasBasin Planning For WRMFadhiel MuhammadAinda não há avaliações

- Chapter 2 Solutions: Solutions To Questions For Review and DiscussionDocumento31 páginasChapter 2 Solutions: Solutions To Questions For Review and DiscussionAlbert CruzAinda não há avaliações

- Supreme Steel Vs Nagkakaisang Manggagawa Sa SupremeDocumento28 páginasSupreme Steel Vs Nagkakaisang Manggagawa Sa SupremeChristle CorpuzAinda não há avaliações

- Bài tập writtingDocumento7 páginasBài tập writtingDuc Anh TruongAinda não há avaliações

- G9 AP Q3 Week 3 Pambansang KitaDocumento29 páginasG9 AP Q3 Week 3 Pambansang KitaRitchelle BenitezAinda não há avaliações

- Marketing (MBA 7003) Assignment 2 - N02Documento24 páginasMarketing (MBA 7003) Assignment 2 - N02Tun Izlinda Tun BahardinAinda não há avaliações

- Case 5 - Merchendising Perpetual and PeriodicDocumento2 páginasCase 5 - Merchendising Perpetual and PeriodicNajla Aura KhansaAinda não há avaliações

- Challenges in Devising A Compensation PlanDocumento6 páginasChallenges in Devising A Compensation PlanPrithwiraj Deb0% (1)

- Statement of Employment Expenses For Working at Home Due To COVID-19Documento2 páginasStatement of Employment Expenses For Working at Home Due To COVID-19Igor GoesAinda não há avaliações

- NumericalReasoningTest4 Solutions PDFDocumento31 páginasNumericalReasoningTest4 Solutions PDFAlexandra PuentesAinda não há avaliações

- IDBI Federal Life InsuranceDocumento15 páginasIDBI Federal Life InsuranceAiswarya Johny RCBSAinda não há avaliações