Escolar Documentos

Profissional Documentos

Cultura Documentos

Working Capital Management Efficiency: A Study On Selected Pharmaceutical Companies in India

Enviado por

ijire publicationTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Working Capital Management Efficiency: A Study On Selected Pharmaceutical Companies in India

Enviado por

ijire publicationDireitos autorais:

Formatos disponíveis

INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH EXPLORER ISSN NO: 2347-6060

Working Capital Management Efficiency: A Study on Selected

Pharmaceutical Companies in India

Dr.R.Siva Rama Prasad#1, B.Hima Lakshmi*2

#Headof the Department, DCBA, Acharya Nagarjuna University,

*Research Scholar, DCBA, Acharya Nagarjuna University

1raminenisivaram@yahoo.co.in, 2boppanahimalakshmi@gmail.com

Abstract— The present study made with an attempt to evaluate the efficiency of working capital in the

selected companies in pharmaceutical industry in India. The secondary data was collected from annual reports

of selected 15 companies in pharmaceutical sector. These fifteen companies was selected randomly and

classified into three groups, i.e. large size, medium size and small size. To analyse the efficiency of the working

capital management in these companies’ three indices were used namely performance index of working capital

management, utilization index of working capital management and efficiency index of working capital

management. The study reveals that overall performance of selected pharmaceutical companies was average,

but the individual performance of these companies varied during the study period of 2006 – 2016.

Keywords— working capital management, performance index, utilization index, efficiency index

I. INTRODUCTION

The efficient and effective working capital management is one of the most important decisions in the financial

management and an important tool to enhance the firm’s performance and profitability situation. The efficient

management of working capital is one of the key segments in firm’s corporate strategy. Thus efficient management of

working capital is inevitable at the best level to remain the firm’s growth in terms of profitability and risk management.

The traditional financial management is focused on long term financial decisions, namely capital budgeting decisions,

capital structure decisions and dividends decisions, but now in the modern times short term financial decisions like

working capital management is one of the key areas to be concentrate. In the light of the above, an attempt is made in this

study to look into the efficiency of the working capital management of pharmaceutical firms.

Though accounting ratios has played a key role in most of earlier empirical studies, but a choice of ratios or group of

ratios is often a difficult task due to the absence of a proper theory of ratio analysis (Bhattacharya, 1997). To overcome

this problem, Bhattacharya (1997) has developed an alternative ratio model for the measurement and to evaluate the

efficiency of working capital management. He decomposed the total efficiency index of the working capital management

into working capital management performance index and working capital management utilization index. The present study

adopts the efficiency index developed by Bhattacharya in order to measure the working capital performance and utilization

as well as total efficiency in the case of pharmaceutical firms.

The Indian pharmaceutical industry ranks 14th in the world by value of pharmaceutical products. With a well-

established domestic manufacturing base and low-cost skilled manpower, India is emerging as a global hub for pharma

products and the industry continues to be on a growth trajectory. Moreover, India is significantly ahead in providing

chemistry services such as analogue preparation, analytical chemistry and structural drug design, which will provide it

ample scope in contract research and other emerging segments in the pharmaceutical industry.

VOLUME 5, ISSUE 1, JAN/2018 40 http://ijire.org/

INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH EXPLORER ISSN NO: 2347-6060

The Indian Pharmaceutical Industry currently heads the list among India‘s science based industries with wide ranging

capabilities in the complex field of drug manufacture and technology. It holds the distinction of being a highly organized

sector, and is estimated to be worth 36.7 billion (dollars). In terms of technology, quality and the range of medicines that

are manufactured, it ranks very high among all the third world countries.

II. REVIEW OF LITERATURE

Jayarathne (2014) studied on the impact of the efficient working capital management on profitability and summarized

on the study results that the liberal credit policy will influence the profitability of the firm and suggests that manufacturing

companies can make more profit if they can manage the efficient working capital management.

Madhavi K. (2015) makes an empirical study of the co-relation between liquidity position and profitability of the paper

mills in Andhra Pradesh. It has been observed that inefficient working capital management makes a negative impact on

profitability and liquidity position of the paper mills.

Joseph Jisha (2014) closely examines the study of working capital management in Ashok Leyland and points out that the

liquidity and profitability position of the company is not satisfactory, and needed to be strengthened in order to be able to

meet its obligations in time.

Akoto Richard K., Vitor Dadson A. and Angmor Peter L. (2013) closely study the relationship between working capital

management policies and profitability of the thirteen listed manufacturing firms in Ghana. At the end of the study, a

significantly negative relationship between profitability and accounts receivable days is found to exist. Profitability is

significantly positively influenced by the firms cash conversion cycle (CCC), current assets ratio and current asset turnover.

It is also suggested that managers can create value for the shareholders by creating incentives to reduce their accounts

receivable to 30 days.

Singh Moirangthem B. and Singh Tejmani N. (2013) emphasize on the efficient management of working capital.

According to them it means proper management of various components of working capital due to which adequate amount

of working capital and liquidity is maintained in the larger interest of successful running of an enterprise.

III. OBJECTIVES OF THE STUDY

The main objective of the study is to know the management of working capital in the selected pharmaceutical

companies. However, the study will specifically look into the following objectives:

To examine the efficiency of working capital management of selected pharmaceutical companies

IV. METHODOLOGY OF THE STUDY

The study analyses the efficiency of the selected pharmaceutical companies in India. A sample of 15 companies was

selected for the period from 2006 to 2016. The data extracted from the annual reports of the respective companies. For

the measurement of WCM Efficiency, this study adopted the index develop by Bhattacharya (1997).

Bhattacharya developed another tools for the measurement and examining the efficiency of the working capital

management due to obstacles during implementation of the accounting ratios, such as lack of data and difficult task due to

the missing theory (Bhattacharya, 1997).

VOLUME 5, ISSUE 1, JAN/2018 41 http://ijire.org/

INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH EXPLORER ISSN NO: 2347-6060

Traditionally, based on the previous studies it shows that accounting ratios are the most important tools to measure the

efficiency. Nonetheless, Bhattacharya (1997) has composed an index, known as total efficiency index of the working

capital management that was develop from the performance index, and utilization index. This study differentiated from

the previous study by using the Index based on sample that was never been tested previously.

Bhattacharya (1997) suggest that to measure the whole efficiency of the working capital management, the first analysis

was to calculate the Performance Index of Working Capital Management (PIWCM) using the following mode

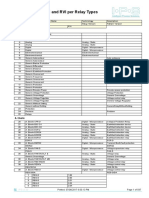

Table 1 report the descriptive analysis of selected pharmaceutical companies for Performance Index (PIWCM),

Utilization Index (UIWCM) and Efficiency Index (EIWCM) of working capital management. PIWCM shows the average

performance index of the various items in current asset, UIWCM defines as the ability of company to generate sales by

utilize the current asset and EIWCM is a calculation of performance that consists of PIWCM and UIWCM.

Performance Index (PIWCM)

Generally, performance index > 1 show the working capital management is properly managed. The results for PIWCM

on the table 1 depicted that the selected sample less efficient in managing the working capital. For a sample if performance

index is less than 1(< 1) indicating that the sales generated by the companies was less than the amount of Working Capital

used.

Utilization Index, UIWCM

The UIWCM indicates the degree of utilization of current assets of a company. Any increase in current assets that was

substantiate with an increase in the sales representing an effective utilization of currents assets.

Efficiency Index, EIWCM

Efficiency index is a measurement of ultimate efficiency level since this index is multiplication of performance and

utilization index.

VOLUME 5, ISSUE 1, JAN/2018 42 http://ijire.org/

INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH EXPLORER ISSN NO: 2347-6060

V. DATA ANALYSIS AND INTERPRETATION

TABLE NO 1: CALCULATED VALUES OF PI, UI AND EI

PI UI EI

S No COMPANY NAME

Avg Max Min Avg Max Min Avg Max Min

LARGE GROUP COMPANIES

1 Aurobindo Pharma Ltd 1.18 1.67 0.63 1.04 1.19 0.92 1.24 1.91 0.63

2 Cadila Healthcare Ltd 1.03 1.41 0.80 1.01 1.11 0.88 1.04 1.47 0.74

3 Cipla Ltd 1.52 4.78 0.73 1.04 1.49 0.84 1.62 4.94 0.78

4 Dr Reddy's Laboratories Ltd 1.12 2.18 0.33 0.97 1.08 0.85 1.08 1.86 0.30

5 Piramal Enterprises Ltd 1.68 17.30 -7.23 1.32 4.58 0.12 -1.20 17.36 -33.09

MEDIUM GROUP COMPANIES

6 Granules India Ltd 2.63 0.47 1.02 1.44 0.79 1.01 2.82 0.37 1.04

7 Unichem Laboratories Ltd 1.02 1.36 0.68 1.01 1.16 0.86 1.04 1.57 0.59

8 Sequent Scientific 1.03 3.92 -0.72 1.01 1.43 0.82 1.16 5.62 -0.68

9 FDC Ltd 1.18 2.33 0.14 1.01 1.22 0.39 1.30 2.85 0.05

10 Suven Life Sciences Ltd 1.93 11.00 0.18 0.98 1.55 0.60 2.23 13.46 0.16

SMALL GROUP COMPANIES

11 Hikal Ltd. 0.40 7.18 -4.22 1.04 1.28 0.82 0.32 6.56 -4.39

12 Neuland Laboratories Ltd 0.61 2.38 -2.07 1.01 1.29 0.83 0.70 2.82 -1.72

13 Novartis India Ltd 0.94 1.01 0.78 0.94 1.04 0.78 0.88 1.05 0.61

14 Aarti Drugs Ltd -1.83 1.29 -19.32 1.03 1.23 0.85 -1.47 1.58 -16.42

15 Anuh Pharma Ltd 1.13 3.33 0.43 1.05 1.55 0.76 1.21 3.41 0.44

Source: Calculated from annual reports of the companies

Interpretation for Performance Index:

For large size companies

The Performance Index of all the companies in large group is greater than (>1). It implies that the firms were good at

maintaining working capital very effectively. The sales generated by the companies were greater than the amount of

working capital.

For medium size companies

The Performance Index of all the companies in medium group is greater than (>1). It implies that the firms were good

at maintaining working capital very effectively. The sales generated by the companies were greater than the amount of

working capital.

VOLUME 5, ISSUE 1, JAN/2018 43 http://ijire.org/

INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH EXPLORER ISSN NO: 2347-6060

For small size companies

The performance Index of small group is less than 1 (<1) except Anuh Pharma ltd. It indicates that the firms were not

maintaining the working capital efficiently.

Interpretation for Utilization Index:

For large size companies

The Utilization Index of the companies in large group is greater than (>1) except Dr Reddy Laboratories Ltd. It implies

that the remaining firms were utilizing its current assets efficiently.

For medium size companies

The Utilization Index of the companies in medium group is greater than (>1) except Suven Life Sciences Ltd. It implies

that the remaining firms were utilizing its current assets efficiently.

For small size companies

The Utilization Index of the companies in small group is greater than (>1) except Novartis India Ltd. It implies that the

remaining firms were utilizing its current assets efficiently.

Interpretation for Efficiency Index:

For large size companies

The Efficiency Index of the companies in large group is greater than (>1) except Piramal Enterprises Ltd. It implies that

the remaining firms were maintaining working capital efficiently.

For medium size companies

The Efficiency Index of all the companies in medium group is greater than (>1). It indicates that all the firms were good

at maintain working capital very effectively.

For small size companies

The Efficiency Index of the companies in small group is greater than (>1) for only Anuh Pharma ltd., remaining firms

reported below one it indicates that the firms were not maintain the working capital efficiently, rather than these firms

were doing in a riskier situation.

VI. CONCLUSIONS

The efficiency Index is an indicator for how the firms were maintain its working capital. During the study period the

researcher found that majority of the firms were good at maintain the working capital. Primal enterprises ltd, Hikal Ltd,

Neuland Laboratories Ltd, Novartis India Ltd, Aarti Drugs Ltd reported less than one which indicates the efficiency of the

working capital is not optimal. From the sample of 15 companies 10 companies were good at maintaining the working

capital while the remaining 5 companies need to improve the working capital management.

REFERENCES

[1] Aktas, N., Croci, Ee., Petmezas, D., 2015. Is working capital management value-enhancing? Evidence from firm performance and

investments, Journal of Corporate Finance 30, 98–113.

[2] Alipour, M., 2011. Working capital management and corporate profitability: Evidence from Iran. World Applied Sciences Journal

12(7), 1093– 1099.

[3] Bhattacharya, H., Total Management By Ratios, New Delhi, Sage Publication India Pvt. Ltd., 1997.

[4] Chisti KhalidAshraf., 2012. The Relationship between Working Capital 11(3), 839–849.

VOLUME 5, ISSUE 1, JAN/2018 44 http://ijire.org/

INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH EXPLORER ISSN NO: 2347-6060

[5] Eljelly, A. M. A., 2004. Liquidity-Profitability Tradeoff: An Empirical Investigation in an Emerging Market. International Journal

of Commerce and Management 14(2), 48-61.

[6] Ganesan, V., 2007.An analysis of working capital management efficiency in telecommunication equipment industry. Rivier Academic

Journal 3(2), 1–10.

[7] Advanced Financial Accounting-Theory and Practice” by S.P.Agarwal and S.P.Jain, Wiley Eastern Limited, New Delhi, 1992.

[8] Financial Management” by V.K.Bhalla, Khosla Publishing House, Delhi, 1987.

[9] Fundamentals of Financial Management” by Vyuptakesh Sharan, Published by Dorling Kindersley (India) Pvt.Ltd. 2012

[10] Fundamentals of International Financial Management” by S. Kevin, published by PHI, Learning Private Limited, New Delhi, 2009.

VOLUME 5, ISSUE 1, JAN/2018 45 http://ijire.org/

Você também pode gostar

- Virtualization Security For Cloud ComputingDocumento13 páginasVirtualization Security For Cloud Computingijire publicationAinda não há avaliações

- Authorized Auditing of Dynamic Big-Data On CloudDocumento7 páginasAuthorized Auditing of Dynamic Big-Data On Cloudijire publicationAinda não há avaliações

- An Open Bound Estimator Under Channel Diversity in Heterogeneous NetworkDocumento6 páginasAn Open Bound Estimator Under Channel Diversity in Heterogeneous Networkijire publicationAinda não há avaliações

- Reduction of Hub Diameter Variation by Using SQC TechniqueDocumento9 páginasReduction of Hub Diameter Variation by Using SQC Techniqueijire publicationAinda não há avaliações

- Video Enhancement Using Contrast Limited Adaptive Histogram EqualizationDocumento14 páginasVideo Enhancement Using Contrast Limited Adaptive Histogram Equalizationijire publicationAinda não há avaliações

- A Study On Performance of Indian Mutual Fund Schemes Based On Risk Adjusted Performance Indices: Treynor, Sharpe and Jensen Approaches HTTPDocumento11 páginasA Study On Performance of Indian Mutual Fund Schemes Based On Risk Adjusted Performance Indices: Treynor, Sharpe and Jensen Approaches HTTPijire publicationAinda não há avaliações

- Analysis of Energy Efficient Tracking in Wireless Sensor NetworksDocumento6 páginasAnalysis of Energy Efficient Tracking in Wireless Sensor Networksijire publicationAinda não há avaliações

- Non-Conventional Low Power Circuit Design TechniquesDocumento9 páginasNon-Conventional Low Power Circuit Design Techniquesijire publicationAinda não há avaliações

- Erection /installation of Mechanical Devices &comparative Study of Electro Static Pricipitator in Super Thermal Power Plant HTTPDocumento14 páginasErection /installation of Mechanical Devices &comparative Study of Electro Static Pricipitator in Super Thermal Power Plant HTTPijire publicationAinda não há avaliações

- Estimation of Some Biomass Species and Thier Properties For Power Generation PotentialsDocumento11 páginasEstimation of Some Biomass Species and Thier Properties For Power Generation Potentialsijire publicationAinda não há avaliações

- A Low Frequency Noise Cancellation Vlsi Circuit Design Using Lms Adaptive Filter For In-Ear Headphones.Documento7 páginasA Low Frequency Noise Cancellation Vlsi Circuit Design Using Lms Adaptive Filter For In-Ear Headphones.ijire publicationAinda não há avaliações

- A Framework For Underwater Image Enhancement and Object DetectionDocumento6 páginasA Framework For Underwater Image Enhancement and Object Detectionijire publicationAinda não há avaliações

- Creative Thinking Ability of Tribal Elementary School Students of West Kameng, Arunachal Pradesh: A Comparative Study HTTPDocumento4 páginasCreative Thinking Ability of Tribal Elementary School Students of West Kameng, Arunachal Pradesh: A Comparative Study HTTPijire publicationAinda não há avaliações

- Future-Realistic Flying CarDocumento5 páginasFuture-Realistic Flying Carijire publicationAinda não há avaliações

- Factors of Life Insurance at Household Level: A Case Study HTTPDocumento14 páginasFactors of Life Insurance at Household Level: A Case Study HTTPijire publicationAinda não há avaliações

- An Analytical Study On Issues of Handloom Industry in Undivided State of Andhra Pradesh HTTPDocumento10 páginasAn Analytical Study On Issues of Handloom Industry in Undivided State of Andhra Pradesh HTTPijire publicationAinda não há avaliações

- Energy-Efficient Secure Data Aggregation Framework (Esdaf) Protocol in Heterogeneous Wireless Sensor NetworksDocumento10 páginasEnergy-Efficient Secure Data Aggregation Framework (Esdaf) Protocol in Heterogeneous Wireless Sensor Networksijire publicationAinda não há avaliações

- The Role of Demographics in Online Shopping - An Exploratory StudyDocumento11 páginasThe Role of Demographics in Online Shopping - An Exploratory Studyijire publicationAinda não há avaliações

- Skill Development Necessities To Achieve Employability in The States of AP & Telangana - A Review HTTPDocumento16 páginasSkill Development Necessities To Achieve Employability in The States of AP & Telangana - A Review HTTPijire publicationAinda não há avaliações

- Design of I.C.Engine Air Cooling Fins Using Fea AnalysisDocumento13 páginasDesign of I.C.Engine Air Cooling Fins Using Fea Analysisijire publicationAinda não há avaliações

- The Exas Method An Education Initiative HTTPDocumento8 páginasThe Exas Method An Education Initiative HTTPijire publicationAinda não há avaliações

- A Structural Equation Modeling On Factors Affecting E-RetailingDocumento9 páginasA Structural Equation Modeling On Factors Affecting E-Retailingijire publicationAinda não há avaliações

- Rating of Kinematic Chains Using Genetic AlgorithmDocumento5 páginasRating of Kinematic Chains Using Genetic Algorithmijire publicationAinda não há avaliações

- A Consumers Perspective of Innovations in Indian Retail IndustryDocumento8 páginasA Consumers Perspective of Innovations in Indian Retail Industryijire publicationAinda não há avaliações

- Analysis of Helicalcum Pinfin Heat ExchangerDocumento11 páginasAnalysis of Helicalcum Pinfin Heat Exchangerijire publicationAinda não há avaliações

- Achieving Customer Loyalty Through Service Value in Indian Mobile Telephone SectorDocumento10 páginasAchieving Customer Loyalty Through Service Value in Indian Mobile Telephone Sectorijire publicationAinda não há avaliações

- To Measure The Liquidity of Selected Private Sector Pharmaceutical Companies in IndiaDocumento7 páginasTo Measure The Liquidity of Selected Private Sector Pharmaceutical Companies in Indiaijire publicationAinda não há avaliações

- Smart Helmet With Accident Avoidance SystemDocumento7 páginasSmart Helmet With Accident Avoidance Systemijire publicationAinda não há avaliações

- Study On Wind and PV Hybrid Renewable Energy SystemsDocumento6 páginasStudy On Wind and PV Hybrid Renewable Energy Systemsijire publicationAinda não há avaliações

- Effectiveness of R&D: Analysis of Indian Msme's With Specific Reference To Manufacturing Sector HTTPDocumento12 páginasEffectiveness of R&D: Analysis of Indian Msme's With Specific Reference To Manufacturing Sector HTTPijire publicationAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- GMP-Inspection Report 2391Documento5 páginasGMP-Inspection Report 2391ajitjoshi950Ainda não há avaliações

- Procedural Due Process - Refers To The Mode of Procedure Which GovernmentDocumento13 páginasProcedural Due Process - Refers To The Mode of Procedure Which GovernmentCharlene M. GalenzogaAinda não há avaliações

- EN - 1.2 Introduction To Entrepreneurship TestDocumento4 páginasEN - 1.2 Introduction To Entrepreneurship TestMichelle LiwagAinda não há avaliações

- Importance of TransportationDocumento24 páginasImportance of TransportationGiven Dave LayosAinda não há avaliações

- IPS-ENERGY - Available Relay ModelsDocumento597 páginasIPS-ENERGY - Available Relay Modelsbrahim100% (2)

- Tools and Techniques of Cost ReductionDocumento27 páginasTools and Techniques of Cost Reductionপ্রিয়াঙ্কুর ধর100% (2)

- Comparison BOO BOT IndiaDocumento26 páginasComparison BOO BOT IndiaDhanes PratitaAinda não há avaliações

- Switch Out of Band ManagementDocumento10 páginasSwitch Out of Band ManagementswsloanAinda não há avaliações

- GSK b2c109575 Clinical Study Report Redact PDFDocumento1.524 páginasGSK b2c109575 Clinical Study Report Redact PDFdhananjayAinda não há avaliações

- US V RuizDocumento2 páginasUS V RuizCristelle Elaine ColleraAinda não há avaliações

- Soal B. Inggris Kelas Xii 2016 Nuruzam.Documento7 páginasSoal B. Inggris Kelas Xii 2016 Nuruzam.osri rozaliAinda não há avaliações

- Fact Sheet How To Manage Confidential Business InformationDocumento12 páginasFact Sheet How To Manage Confidential Business InformationMihail AvramovAinda não há avaliações

- Sampling MethodsDocumento34 páginasSampling MethodsJoie Marie Caballero33% (3)

- HP MOQ Traditional BPC Mar'21 Pricelist - FTPDocumento8 páginasHP MOQ Traditional BPC Mar'21 Pricelist - FTPrachamreddyrAinda não há avaliações

- ISO 26262 for Functional Safety Critical ProjectsDocumento24 páginasISO 26262 for Functional Safety Critical ProjectsZidane Benmansour100% (1)

- Official Secrets ActDocumento3 páginasOfficial Secrets ActPrashant RohitAinda não há avaliações

- IVMS Pharmacology Flash FactsDocumento8.250 páginasIVMS Pharmacology Flash FactsMarc Imhotep Cray, M.D.Ainda não há avaliações

- NWLP Approved 2006 - Section1Documento164 páginasNWLP Approved 2006 - Section1sis_simpsonAinda não há avaliações

- P2E ProfileDocumento10 páginasP2E Profilepr1041Ainda não há avaliações

- Uy Vs Gonzales DigestDocumento2 páginasUy Vs Gonzales DigestFrancis De CastroAinda não há avaliações

- Simulink Kalman Filter PDFDocumento3 páginasSimulink Kalman Filter PDFjlissa5262Ainda não há avaliações

- BeamSmokeDetectors AppGuide BMAG240 PDFDocumento8 páginasBeamSmokeDetectors AppGuide BMAG240 PDFMattu Saleen100% (1)

- NBFC Playbook: Understanding Non-Banking Financial CompaniesDocumento13 páginasNBFC Playbook: Understanding Non-Banking Financial CompaniesAkshay TyagiAinda não há avaliações

- Summary of Sales Report: Dranix Distributor IncDocumento6 páginasSummary of Sales Report: Dranix Distributor Incshipmonk7Ainda não há avaliações

- Difference Between Baseband and Broadband TransmissionDocumento3 páginasDifference Between Baseband and Broadband Transmissionfellix smithAinda não há avaliações

- Procedure For Loading ASI On Existing Robot and Keeping All Programs and SettingsDocumento4 páginasProcedure For Loading ASI On Existing Robot and Keeping All Programs and SettingsRafael Ramírez MedinaAinda não há avaliações

- Contribution Collection List: Quarter EndingDocumento2 páginasContribution Collection List: Quarter EndingBevs Al-OroAinda não há avaliações

- AWS CWI Training Program PDFDocumento22 páginasAWS CWI Training Program PDFDjamelAinda não há avaliações

- Consumer Preference Towards Suagr and SpiceDocumento67 páginasConsumer Preference Towards Suagr and SpiceShorabh MastanaAinda não há avaliações

- Magnetic Separator GuideDocumento31 páginasMagnetic Separator GuideMNButt100% (1)