Escolar Documentos

Profissional Documentos

Cultura Documentos

GO (P) No 409-2014-Fin Dated 23-09-2014

Enviado por

sooji456Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

GO (P) No 409-2014-Fin Dated 23-09-2014

Enviado por

sooji456Direitos autorais:

Formatos disponíveis

GOVERNMENT OF KERALA

Abstract

Mobilisation of additional resources for the State - Revision of non tax revenue

items - Orders issued.

FINANCE (REVENUE MONITORING CELL) DEPARTMENT

G.O (P)No. 409/2014iFIN Dated, Thiruvananthapuram, 231 09 I 2014.

ORDER

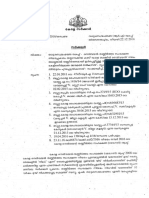

The State Government has been realizing various fees/user charges in

connection with various services/facilities rendered by Government Departments in

the State. Major Non Tax Revenue items in Government Departments are Various

Fees, Fines, Service charges, Receipts under various Acts, Sale proceeds/cost of

various form / applications/ documents/ publications/ manufactured/ agricultural

products, Rents, User charges for using Government utilities/amenities, Receipts

from patients for hospitalanddispensary services, Hire charges, Examination fee of

Kerala Public Service Commission, Traffic Fee/ Fine receipts, Royalties etc.

2) A revision of same is highly essential at this point of time to maintain

minimum standard of service rendered by the Government. Government have

to enhance prevailing user charges / fees in all Government

therefore decided

Departments (other than educational fees / chargeq) as detailed below.

Accordingly the rates of user charges/fees under the Revenue Receipts Heads of

Account fr.om 0051 to 1475 are revised at the following rates with effect from

01,110120t4 onwards.

Existing Fee / Charge Rate of Revision suggested

Up to and including ? 10 No revision

Morethan?10- ?1000 50o/o

Morethan?1000- ?10000 25o/o

Above ? 10000 t\o/o

3) The revision will be applicable only to those items whose rates have not been

enhanced after 01/041Z0IZ.

a) The rates shall be calculated after rounding off the amount to the nearest

higher rupee.

5) No separate orders need be issued from the Administrative Department

concerned in this regard to effect the enhanced rate.

6) All fees administered under the education sector such as tuition fee, special fee,

laboratory fee, library fee, magazine fee, athletic fee, hostel fee including rent,

electricity charge, water charge collected from studentsandany charge leviable from

schools, colleges, polytechnics, ITI, ITC or any other training institutions in the

Government or Aided sector are exempted from the present revision.

7) All Heads of the Departments should monitor the non tax revenue collection on

weekly basis and furnish a report to the Additional Chief Secretary (Finance) on

t0th of every month from November 2014 onwards.

By Order of the Governor,

DR.K.M.ABRAHAM, IAS.

Additional Chief Secretary (Finance).

To

The Principal Accountant General (A & E), Kerala, Thiruvananthapuram.

The Principal Accountant General (G & ssA), Kerala, Thiruvananthapuram.

The Accountant General (E & RSA), Kerala, Thiruvananthapuram.

All Departments (All Sections) of the Secretariat including Law Department.

All Head of Departments.

The Secretary.KPSC, Thiruvananthapuram (with CUL)

The Registrar of High Court, Ernakulam (wirh C/L)

The Private Secretary to chief Ministers and other Ministers.

The PA to Chief Secrerary.

All Additional Chief Secretaries/ Principal Secretaries/ Special Secretaries /

SecretariesiAdditional Secretaries/Joint Secretaries/ Deputy Secretaries /

Under Secretaries to Government.

The Director of Public Relations.

-/

, ff" No dal Officer, www. finance. kerala. gov.in

The Stock file/ Office Copy.

Forwarded by Order

Você também pode gostar

- AP govt extends contract staff tenure to Dec 2014Documento2 páginasAP govt extends contract staff tenure to Dec 2014arjunmeruguAinda não há avaliações

- Ap SSR 2015-16Documento372 páginasAp SSR 2015-16Vijay Rama RajuAinda não há avaliações

- Escalation Etc For AP Irrigation Projects G.O. Ms No.13 Dt.07-02-2014 With Necessary Enclosers PDFDocumento32 páginasEscalation Etc For AP Irrigation Projects G.O. Ms No.13 Dt.07-02-2014 With Necessary Enclosers PDFRavi KumarAinda não há avaliações

- 12Documento54 páginas12Maddhu DusariAinda não há avaliações

- Office Memorandum No - DGW/MAN/221 Issued by Authority of Director General of WorksDocumento14 páginasOffice Memorandum No - DGW/MAN/221 Issued by Authority of Director General of WorksreddytlnAinda não há avaliações

- AP GoO: Lease Buildings Rent Enhancement 18-04-2011Documento2 páginasAP GoO: Lease Buildings Rent Enhancement 18-04-2011Guru Prasad88% (8)

- SSR 2012 PDFDocumento550 páginasSSR 2012 PDFArshad Hussain100% (1)

- Masigaon 2Documento163 páginasMasigaon 2seshu kvss1Ainda não há avaliações

- Dispensing Insurance and Overheads and Contractors Profit in Works Circ1453Documento7 páginasDispensing Insurance and Overheads and Contractors Profit in Works Circ1453PAO TPT PAO TPTAinda não há avaliações

- Government of Andhra Pradesh Revises Rates for Drilling BorewellsDocumento3 páginasGovernment of Andhra Pradesh Revises Rates for Drilling BorewellsPAO TPT PAO TPTAinda não há avaliações

- Government of Andhra PradeshDocumento20 páginasGovernment of Andhra PradeshAnonymous 9Yv6n5qvS100% (2)

- Method of Assessment of Property Tax in Andhra Pradesh MunicipalitiesDocumento7 páginasMethod of Assessment of Property Tax in Andhra Pradesh MunicipalitiesgokedaAinda não há avaliações

- Types of TA, LTC and eligibility rules for Andhra Pradesh Government employeesDocumento34 páginasTypes of TA, LTC and eligibility rules for Andhra Pradesh Government employeesmrraee4729Ainda não há avaliações

- Indicative DPRDocumento331 páginasIndicative DPRtrilokAinda não há avaliações

- AP Accounts Code Volume1 BookDocumento96 páginasAP Accounts Code Volume1 BookPydi Chakravarthy0% (1)

- Contractor Labour Act LicenceDocumento2 páginasContractor Labour Act LicenceMohd Azam/DPG/DELAinda não há avaliações

- Format For Inspection of Maintenance Aspects of Completed PMGSY Works by Third Tier of QMDocumento4 páginasFormat For Inspection of Maintenance Aspects of Completed PMGSY Works by Third Tier of QMAtul mishraAinda não há avaliações

- Covid Relief For ContractorsDocumento7 páginasCovid Relief For ContractorsGobinder Singh VirdeeAinda não há avaliações

- 2020.02.03 - Draft To PD Reg. Utility ShiftingDocumento1 página2020.02.03 - Draft To PD Reg. Utility ShiftingDPJAIN INFRASTRUCTUREAinda não há avaliações

- Office of The Engineer-in-Chief (Irrigation)Documento8 páginasOffice of The Engineer-in-Chief (Irrigation)Ashajyothi PalavaliAinda não há avaliações

- Gurgaon Police Domestic Help Verification FormDocumento2 páginasGurgaon Police Domestic Help Verification FormHimanshuAinda não há avaliações

- Government of Telangana Irrigation & Cad DepartmentDocumento95 páginasGovernment of Telangana Irrigation & Cad Departmentsantosh yevvariAinda não há avaliações

- AP Financial CodeDocumento25 páginasAP Financial Codeyounusbasha143Ainda não há avaliações

- Kerala PWA CodeDocumento444 páginasKerala PWA CodeHIVETECHAinda não há avaliações

- Memo On Foreign Exchange Re PrintDocumento5 páginasMemo On Foreign Exchange Re PrintmaruthikumarteraAinda não há avaliações

- Encashment of EL & HPL Single BillDocumento15 páginasEncashment of EL & HPL Single Billshabbir ahamed SkAinda não há avaliações

- Andhra Pradesh issues revised guidelines for 25 lakh housing schemeDocumento3 páginasAndhra Pradesh issues revised guidelines for 25 lakh housing schemeMungara SrinivasAinda não há avaliações

- GOs of All Kinds Leave PDFDocumento16 páginasGOs of All Kinds Leave PDFchinthalapani jayapalreddyAinda não há avaliações

- Old G.O 65Documento22 páginasOld G.O 65Mohammed AzharAinda não há avaliações

- Site Order & Measurement BooksDocumento7 páginasSite Order & Measurement Booksamresh gunjanAinda não há avaliações

- Memorandum MODDocumento21 páginasMemorandum MODrajeshd006100% (2)

- MoRTH - DPR ChecklistDocumento8 páginasMoRTH - DPR ChecklistGanesh GuptaAinda não há avaliações

- AP PWD CodeDocumento208 páginasAP PWD CodesnehaAinda não há avaliações

- Datas 2012 13Documento101 páginasDatas 2012 13thummadharani6698Ainda não há avaliações

- West Bengal Panchayat Rules AmendmentsDocumento36 páginasWest Bengal Panchayat Rules AmendmentsPrantik Adhar Samanta67% (3)

- Government of Andhra Pradesh: Irrigation and Cad (Pw-Cod) DepartmentDocumento7 páginasGovernment of Andhra Pradesh: Irrigation and Cad (Pw-Cod) DepartmentPasha100% (1)

- Go 94Documento36 páginasGo 94Pasha100% (5)

- G.O.ms - No.84 AEs GazettedDocumento2 páginasG.O.ms - No.84 AEs GazettedVarma Chintamaneni100% (1)

- Form 16a New FormatDocumento2 páginasForm 16a New FormatJayAinda não há avaliações

- Date of Written Test: 22.01.2012: K Vijayanand Managing DirectorDocumento24 páginasDate of Written Test: 22.01.2012: K Vijayanand Managing DirectorSyed NayabAinda não há avaliações

- EPC Compodium - 194-196 PDFDocumento3 páginasEPC Compodium - 194-196 PDFRajaAinda não há avaliações

- Running AccountBill Form-97Documento10 páginasRunning AccountBill Form-97singhAinda não há avaliações

- PHDocumento4 páginasPHkowsar02121Ainda não há avaliações

- CPWD Guest HouseDocumento10 páginasCPWD Guest HouseAmit Kumar100% (1)

- RCC Construction Rates for BuildingsDocumento16 páginasRCC Construction Rates for BuildingssooricivilAinda não há avaliações

- Local Conveyance Claim Form-SumitDocumento5 páginasLocal Conveyance Claim Form-SumitsumkthakurAinda não há avaliações

- Estimate of Building FormatDocumento6 páginasEstimate of Building FormatGaganAinda não há avaliações

- Types of Leave for Government EmployeesDocumento33 páginasTypes of Leave for Government EmployeesPAO TPT PAO TPT0% (2)

- AP Public Accounts Code PDFDocumento239 páginasAP Public Accounts Code PDFgangaraju0% (1)

- Annexure - II and TR-18Documento7 páginasAnnexure - II and TR-18Hem Ch DeuriAinda não há avaliações

- Endt No 123Documento2 páginasEndt No 123Rajesh Babu100% (4)

- GO.63 Enhancement of Retirement Age To 60 Years For AP EmployeesDocumento1 páginaGO.63 Enhancement of Retirement Age To 60 Years For AP Employeesgangaraju0% (1)

- AppscDocumento42 páginasAppscct021Ainda não há avaliações

- Kerala govt raises HBA loan ceiling to Rs. 40 lakhDocumento2 páginasKerala govt raises HBA loan ceiling to Rs. 40 lakhdeepusvvpAinda não há avaliações

- Kerala Govt Clarifies Service Tax Rules for Construction WorksDocumento3 páginasKerala Govt Clarifies Service Tax Rules for Construction WorksViswalal ViswanathanAinda não há avaliações

- TA Ceiling GO (P) No 137-2016-Fin Dated 09-09-2016Documento4 páginasTA Ceiling GO (P) No 137-2016-Fin Dated 09-09-2016Ayoob P VAinda não há avaliações

- TA Ceiling GO (P) No 137-2016-Fin Dated 09-09-2016Documento4 páginasTA Ceiling GO (P) No 137-2016-Fin Dated 09-09-2016Ayoob P VAinda não há avaliações

- Government Clarifies Additional Performance Guarantee RulesDocumento2 páginasGovernment Clarifies Additional Performance Guarantee Ruleshari vAinda não há avaliações

- KSEB Tariff KeralaDocumento16 páginasKSEB Tariff KeralaSangeeth Kavil PAinda não há avaliações

- Logo EntryDocumento1 páginaLogo Entrysooji456Ainda não há avaliações

- MEETING AGENDADocumento66 páginasMEETING AGENDAsooji456100% (1)

- Worksheets LKG Ukg - 2 PDFDocumento4 páginasWorksheets LKG Ukg - 2 PDFsooji456Ainda não há avaliações

- Kerala Town and Country Ordinance (No.16 of 2014)Documento76 páginasKerala Town and Country Ordinance (No.16 of 2014)sooji456Ainda não há avaliações

- 74 TH Constitutional AmendmentDocumento8 páginas74 TH Constitutional Amendmentsooji456Ainda não há avaliações

- KPBR Regularization OrderDocumento46 páginasKPBR Regularization Ordersooji456Ainda não há avaliações

- KMBR Regularization OrderDocumento46 páginasKMBR Regularization Ordersooji456100% (1)

- The Environment (Protection) Rules, 1986 PDFDocumento11 páginasThe Environment (Protection) Rules, 1986 PDFsooji456Ainda não há avaliações

- KSR Vol IDocumento230 páginasKSR Vol IneenarajeshAinda não há avaliações

- Date Sheet For December 2016 ExaminationDocumento3 páginasDate Sheet For December 2016 Examinationsooji456Ainda não há avaliações

- Covering Letter015 PDFDocumento1 páginaCovering Letter015 PDFsooji456Ainda não há avaliações

- Covering Letter015Documento1 páginaCovering Letter015sooji456Ainda não há avaliações

- Departmental Test - SyllabusDocumento20 páginasDepartmental Test - Syllabussooji456Ainda não há avaliações

- D A Chart2Documento2 páginasD A Chart2sooji456Ainda não há avaliações

- Paddy Land December - 16 GODocumento4 páginasPaddy Land December - 16 GOsooji456Ainda não há avaliações

- Fundamentals of EntrepreneurshipDocumento2 páginasFundamentals of EntrepreneurshipCaCs Piyush SarupriaAinda não há avaliações

- Pay 3Documento94 páginasPay 3sooji456Ainda não há avaliações

- Chegg SolutionDocumento2 páginasChegg SolutionOmkar100% (1)

- CGICOP Dasu Project Planning, Surveyor & Civil Engineer PositionsDocumento3 páginasCGICOP Dasu Project Planning, Surveyor & Civil Engineer PositionsAsad ZamanAinda não há avaliações

- City Beautiful Movement (1893) : Daniel Hudson BurnhamDocumento3 páginasCity Beautiful Movement (1893) : Daniel Hudson BurnhamKo Gabalunos MontañoAinda não há avaliações

- The Wall Street Journal - 17.10.2022Documento38 páginasThe Wall Street Journal - 17.10.2022renzo salasAinda não há avaliações

- GST ChallanDocumento2 páginasGST ChallanAjayGuptaAinda não há avaliações

- Analysis of Benefits and Risks of Mutual FundsDocumento24 páginasAnalysis of Benefits and Risks of Mutual Fundspratik0909Ainda não há avaliações

- Ambuja CementsDocumento6 páginasAmbuja Cementspragatigupta14Ainda não há avaliações

- Solution Manual For Business Ethics Ethical Decision Making and Cases Full Chapter PDFDocumento36 páginasSolution Manual For Business Ethics Ethical Decision Making and Cases Full Chapter PDFrhonda.mcrae352100% (10)

- Kebs 102Documento31 páginasKebs 102snsmiddleschool2020Ainda não há avaliações

- Project Report Bata ShoesDocumento61 páginasProject Report Bata ShoesAakash vatsAinda não há avaliações

- Ecommerce Project ReportDocumento11 páginasEcommerce Project ReportElsadig Osman100% (2)

- Your Adv Plus Banking: Account SummaryDocumento6 páginasYour Adv Plus Banking: Account SummaryedgarAinda não há avaliações

- Civics Notes Market Around US: I. Tick The Correct OptionDocumento8 páginasCivics Notes Market Around US: I. Tick The Correct OptionSHOOT NROCKSSSAinda não há avaliações

- Kingonomics 2016 Presentation - Feb 26 - 28 - AtlantaDocumento24 páginasKingonomics 2016 Presentation - Feb 26 - 28 - AtlantaRodney SampsonAinda não há avaliações

- CAI Model Test Paper Vol. II TextDocumento456 páginasCAI Model Test Paper Vol. II TextChittiappa ChendrimadaAinda não há avaliações

- Pest & Swot AnalysisDocumento4 páginasPest & Swot Analysisankita2610Ainda não há avaliações

- Human Resources in Balance SheetDocumento15 páginasHuman Resources in Balance SheetDheerajAinda não há avaliações

- Impact of Human Resource Planning & Development in OrganizationDocumento5 páginasImpact of Human Resource Planning & Development in OrganizationIjcams PublicationAinda não há avaliações

- NEO BookletDocumento48 páginasNEO BookletVishakha SinglaAinda não há avaliações

- CPA Firm Involved AdelphiaDocumento2 páginasCPA Firm Involved AdelphiaHenny FaustaAinda não há avaliações

- Resume 2024Documento1 páginaResume 2024api-698834731Ainda não há avaliações

- Greentree Servicing Llc. P.O. BOX 94710 PALATINE IL 60094-4710Documento4 páginasGreentree Servicing Llc. P.O. BOX 94710 PALATINE IL 60094-4710Andy Craemer100% (1)

- 3 Grade Michigan Economy Unit PlanDocumento30 páginas3 Grade Michigan Economy Unit Planapi-510016786Ainda não há avaliações

- Methods of BudgetingDocumento30 páginasMethods of BudgetingShinjiAinda não há avaliações

- Rural Banking and Financial Inclusion Reflection Memo # 3 Shivani Tannu, 1811439Documento2 páginasRural Banking and Financial Inclusion Reflection Memo # 3 Shivani Tannu, 1811439Harshal WankhedeAinda não há avaliações

- 018.ValueInvestorInsight of Sound MindDocumento18 páginas018.ValueInvestorInsight of Sound MindFeynman2014Ainda não há avaliações

- Hustlers FundDocumento13 páginasHustlers FundSamir KingaAinda não há avaliações

- Sales Management Process of Coca ColaDocumento18 páginasSales Management Process of Coca ColaParth Chopra100% (1)

- Ricardo Semler and Semco S.A.Documento10 páginasRicardo Semler and Semco S.A.Sarah RuenAinda não há avaliações

- Public Sector Management Accounting and ControlDocumento16 páginasPublic Sector Management Accounting and ControlWong Yong Sheng WongAinda não há avaliações