Escolar Documentos

Profissional Documentos

Cultura Documentos

Duopoly PDF

Enviado por

RHassaniHassaniTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Duopoly PDF

Enviado por

RHassaniHassaniDireitos autorais:

Formatos disponíveis

ANTIT R U S T

The Case of Duopoly

Industry structure is not a sufficient basis for imposing regulation.

By Erwin A. Blackstone, Temple University

Larry F. Darby, Darby and Associates

and Joseph P. Fuhr, Jr., Widener University

T

he economic literature is filled with different theories analysis, empirical research, and experimental research. None

of oligopoly and duopoly ranging from perfect collu- support the proposition that duopoly, per se, is tantamount to

sion to cutthroat price competition. However, many market failure and sufficient grounds for remedial government

policymakers speak as if concentrated industries are actions. Simply stated, duopoly is not always undesirable.

automatically bad and therefore expect government to take

action based on market structure alone. Some people have Theoretical research | The economic theory of market con-

branded concentrated industries as “cozy duopolies” and thus duct and performance under duopoly market structures is

condemn them based on structure without examining any subsumed in a larger literature focused on the economics of

empirical evidence on industry conduct and performance. “few sellers” or oligopoly. The economic literature addressing

In this article we examine duopolies: what factors may be the relationship between market structure, conduct, and per-

important for competition in these markets and whether these formance is voluminous. It is generally inconclusive and lamen-

markets can achieve desirable market outcomes. While this tably bereft of guidance for policymakers faced with decisions

article focuses on duopolies—markets in which market shares about what, if any, elements of market conduct should be

are exhausted (or nearly so) by two firms—the discussion can be constrained by the power of the state.

applied easily to somewhat less concentrated markets, including The problem is not a paucity of theory or modeling efforts. To

other oligopoly markets. the contrary, there are literally thousands of theoretical models of

oligopoly/duopoly behavior. The problem is the lack of a model

that predicts firm behavior in particular contexts and does so

The Problems with Market Structure with sufficient accuracy and reliability to warrant its being used

The principle rationale for the regulation of market structure as the basis for policy decisions about whether, how, and under

is too few competitors, which reduces consumer welfare. The what circumstances the government ought to intervene and

relationship between market structure and market conduct has impose economic regulation.

been explored in different types of studies, including theoretical Further, some economic models suggest that even duopolists

can produce equilibria approaching, or at, the competitive equi-

Erwin A. Blackstone is professor of economics at Temple University. librium. The Bertrand model, in which each duopolist sets price,

Larry F. Darby (deceased) was a Federal Communications Commission can produce almost the competitive equilibrium if the products

economist and founder of the telecom consulting firm Darby and Associ-

ates. Joseph P. Fuhr, Jr. is professor of economics at Widener University. are close substitutes. The Cournot output-setting model requires

All three are affiliated with The American Consumer Institute. relatively few oligopolists to achieve close to the competitive out-

12 | Regulation | Winter 2011‑2012

Illustration by Morgan Ballard

put. Finally, the contestable market theory claims that if both University of California, Berkeley economist Carl Shapiro like-

entry and exit are free or unimpeded, even a monopolist would wise writes:

produce the competitive output.

Before embarking on the analysis, it is best to provide the reader with

The conclusions of formal models provide clear warnings

a word of warning[:] … there is no single theory of oligopoly…. I do

that they are not intended to be public policy tools. For example,

not expect oligopoly theory … to give tight inter-industry predictions

Kennedy School professor F. M. Scherer wrote in the first edition

regarding the extent of competition or collusion.

of his popular industrial organization textbook:

After 40 years and thousands of articles in journals of law or

Economists have developed literally dozens of oligopoly pricing theo- economics, Nobel economist George Stigler concluded, “No

ries—some simple, some marvels of mathematical complexity. This one has the right, few the ability, to lure economists into read-

proliferation of theories is mirrored by an equally rich array of behav- ing another article on oligopoly theory without some advance

ioral patterns actually observed under oligopoly. Casual observation indication of its alleged contribution.” That admonition applies

suggests that virtually anything can happen. a fortiori today. Again, from Scherer, “The most that can be

Winter 2011‑2012 | Regulation | 13

Antitrust

hoped for is a kind of soft determinism; predictions correct on tion. Indeed, the contrary is frequently suggested. There is much

the average, but subject occasionally to substantial errors.” In support for a modified Schumpeterian hypothesis that some

summarizing his review of the literature and long litany of the market power is needed to assure the optimal rate of technical

assumptions and outcomes of dozens of oligopoly models, Sha- progress. The literature is vast and complex and not given to

piro calls attention to the forgoing caveat and then concludes, easy summary, but it is fair to say that market concentration,

“What we are most in need of now are further tests of the empiri- market rivalry, and technological opportunity are the key driv-

cal validity of these various theories of strategic behavior.” ers of innovation.

There seems to be consensus on what might be characterized

Empirical research | If economic theory is unhelpful as a guide as “competitive oligopoly” wherein competition between a few

to policy on oligopoly, so too is the body of empirical research dominant firms provides the spur and their oligopoly status

linking duopoly structure with anticompetitive conduct and provides the reward necessary to compensate for, and incentivize,

performance. Two chapters in Elsevier’s Industrial Organization risk taking. Thus, in the words of Georgetown law professor and

Handbook, one by MIT economist Richard Schmalensee and economist Howard Shelanski:

the other by Stanford economist Timothy Bresnahan, expressly

The comparative performance benefits of oligopoly over monopoly

consider empirical studies of the relationship between market

for technological innovation also have empirical support. It is well

structure, market conduct, market performance, and consumer

established in the economic and competition policy literature that

welfare. Readers are hard-pressed to come away from the chap-

the link between market structure and innovation is much less

ters with any categorical or even roughly generally applicable

predictable…. But there is reasonably good evidence that neither

conclusions that might be used to inform policy in, say, the

monopoly nor perfect competition is particularly beneficial for invest-

broadband communications context.

ment in research and development or deployment of new technology.

Efforts to link market structure with market conduct and

performance in matters related to prices and the price-setting

process have not been notably successful. Thus, Oxford econo- Experimental research | The behavior of oligopolists in general

mist Donald Hay and Oriel College (Oxford) provost Derek Mor- and duopolists in particular has been the subject of consider-

ris, in their popular industrial organization textbook, offer this able interest and analysis by experimental economists who

conclusion to a lengthy review of empirical efforts to establish undertake to simulate market behavior with economically

these linkages: motivated and constrained lab participants. A recent survey

article by Max Planck Institute scholar Christoph Engel iden-

[T]he relationship between industrial structure and price setting over

tifies more than 150 published papers in recent years dealing

time remains very unclear…. [I]t is difficult to avoid concluding that,

with one or more different experiments designed to test the

if any such links do exist, they are far from obvious and unlikely to be

market behavior (mainly price and quantity of output) of oli-

powerful…. Industrial structure may have an important influence on

gopolists—almost always duopolists—under a large and very

price procedures … but it does not seem to play a central role in the

diverse array of circumstances. This review of the literature

pattern of price changes that develops through time.

found experiments covering more than 500 different parameter

Similarly, there has been a notable lack of success in estab- constellations.

lishing a relationship between market structure and profits. It is difficult in a short space to do justice to such a detailed

Early studies of structure and performance relationships iden- review of such a comprehensive and diverse literature, but the

tified links between concentration and profitability. The main main results are easy to state:

thrust of subsequent analysis and results has been to call into

question the validity of the early studies. This analysis insists ■■ Duopoly behavior is highly circumstantial.

that concentration is only one of several variables (including ■■ Performance varies along a continuum bounded by perfect

growth rates, diversification, buyer concentration, techno- competition and perfect monopoly, but not in predictable

logical change, conditions of entry, degree of regulation, cost ways.

conditions, capital intensity, and numerous others) influencing ■■ Many of the experiments had indeterminate outcomes.

profits and that there is no reliable one-to-one link between ■■ Many of the results were weak and not significant statisti-

concentration and profit. A major analytical problem is that cally.

the causal relationships between structure and profits and ■■ A surprising number of the outcomes were inconsistent with

other variables are not clearly established either in theory or by received theory and, indeed, with economic intuition.

observation. Thus, any correlation between structure and profit

does not imply causation.

Empirically validated relationships between market struc- Evidence from Sectors Served by

ture and innovation are even more tenuous than for pricing Two Dominant Firms

practices and profits. The literature provides no support for Duopoly is quite common in the general economy. In the small-

believing in general that concentration is a barrier to innova- est markets, local businesses are often near-monopolies, with

14 | Regulation | Winter 2011‑2012

competition limited by spatial considerations. Monopoly and crews and maintenance and repair of aircraft are facilitated by

duopoly are quite common in small- to medium-sized commu- such a policy.

nities and in rural areas in particular. Service provision is often The duopoly also competes to a great extent in developing

limited to one or two suppliers in such industries as medicine, new and improved airplanes. For example, Airbus was the first to

legal services, specialized retail, motor fuel, etc. These markets make extensive use of composite materials in the 1970s, and in

illustrate the impact of market size, which limits the number the 1980s it was the first to introduce “fly by wire” census. Boeing

of sustainable competitors. was the first to “launch a full-sized commercial aircraft with com-

A small number of sellers—duopoly in particular—is also com- posite wings and fuselage.” The companies devote a substantial

mon in regional and national markets. We have identified various percentage of their revenues to research and development. Airbus

duopolies and the effectiveness of rivalry in them. Specifically, we in particular has been highly innovative as it has tried to increase

have searched for evidence of market failures sufficient to warrant its market share. It has also been a relatively low-price firm. It is

substantial government involvement in constraining or obligat- clear that competition is strong in this market.

ing market behavior. What we found was that these oligopolies

were often characterized by innovation and competition. Below Transparent adhesive tape | The transparent adhesive tape

are some of our findings. industry has long been dominated by 3M’s Scotch brand, with

a market share in excess of 90 percent as late as the early 1990s.

Carbonated beverages | The carbonated beverage industry is Up to that time, 3M Co. sold only Scotch-brand tape, not offer-

essentially a duopoly with two firms, Coca-Cola Co. and Pep- ing retailers private-label tape that could be sold under the

siCo Inc., controlling about 75 percent of the market. In spite retailer’s label. Typically, private-label products are lower-priced

of such high concentration, the two firms compete vigorously and more profitable for the retailer than the branded product.

in a variety of ways. LePage’s 2000 Inc. entered the market in the 1980s, offering

Coke and Pepsi engage in substantial non-price rivalry, includ- both a “second brand” and a private-label tape to compete with

ing advertising and competing for product placement and celeb- Scotch. By 1992, LePage’s had gained 88 percent of private-label

rity endorsements. Especially intense rivalry occurs as the two tape sales and 14.1 percent of overall transparent tape sales. In

firms try to become the exclusive seller in restaurants, universities, response, 3M began offering private-label tape and a “second”

and other such venues. They also compete through introducing brand tape, Highland. The competition offered by LePage’s was

new varieties of soft drinks and through promotions to retailers clearly instrumental in increasing retailer and consumer choice.

or directly to consumers. For example, between 1997 and 2004, The rivalry between LePage’s and 3M provides clear benefits to

Coke and Pepsi introduced 22 new brands. society. Had the rivalry provided by LePage’s not been a “thorn in

Concerning price competition, one study concludes that a the side” of 3M, there would have been no reason for 3M to have

merger of the two firms would raise prices by between 16 and engaged in the behavior it did. Indeed, 3M’s actions to stifle the

17 percent, suggesting the advantage of duopoly. The price per- competition from LePage’s in the form of bundled rebates show

formance of the carbonated beverage market over time has been the advantages of duopoly and the desirability of maintaining

good. The Consumer Price Index (base of 100 in 1967) for the such rivalry.

category of non-alcoholic beverages, which includes carbonated

beverages as an important component, was 169 in 2009. That is Sports | Professional sports leagues for most of their history

far below the 214 for all consumer items or the 215 for all food have been monopolies. However, when a new league emerged

and beverages. This means that the real price of such beverages in a given sport, the duopoly resulted in intense competition

declined by about 21 percent over the 1967–2010 period. Further- for players, coaches, and fans.

more, PepsiCo in 2011 decided not to raise prices in spite of ris- In most cases, the incumbent league would act as a cartel prior

ing input prices, choosing to cut earning estimates, presumably to the entry of a competing league. Team owners would establish

because of stiff competition. rules and other institutions to protect themselves from compet-

ing for players. Contract reserve clauses (which bound players

Aircraft (mainframe) manufacturing | The mainframe air- to their teams even after their contracts expired), the entry draft,

craft manufacturing industry is a duopoly between U.S.-based and the lack of free agency for players, coupled with the lack of

Boeing Co. and Europe-based Airbus SAS, a division of the players’ unions until the 1970s, kept players’ salaries below mar-

European aerospace firm EADS. The duopoly exhibits a high ket value. But this cozy arrangement would be disrupted when a

degree of competitive behavior in spite of difficult entry in part competing league would form. Players suddenly had an option of

because of learning-by-doing economics. teams to play for, and bidding wars would break out for the top

The two companies engage in vigorous rivalry to obtain the players. For example, in 1966, just before the American Basket-

business of the airlines. Airline orders tend to be large and infre- ball Association was formed, the incumbent National Basketball

quent, so it is important to compete vigorously to try to get the Association median salary was $20,000; by 1971 the median sal-

contract. Further, airlines generally want to have the same plane ary had risen to $90,000.

because it is usually efficient and less costly to do so. Training of The emergence of new leagues also benefited fans. New

Winter 2011‑2012 | Regulation | 15

Antitrust

leagues would compete for market share locally and nationally,

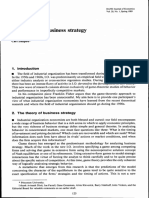

Figure 1

resulting in innovations. In many cases, the new league would

adopt rule changes or other product improvements in an effort Real Wireless Local Monthly Bill

to make their version of play more exciting. For example, the (Indexed 1988 = 100)

ABA introduced the three-point shot, a more free-wheeling style

$120

of play, and a multi-colored Railroad

basketball, whereas the upstart

Airline

American Football League introduced the two-point conversion 100

Trucking

to professional football. Also ofPrivate

benefit

businessto fans, new leagues often

place teams in cities that the incumbent league had ignored, or 80

else prompts the incumbent league to do so. For example, the

Dollars

incumbent National Football League expanded to Dallas and 60

Minneapolis when it believed that the AFL was going to place

teams in those appealing markets. The rivalry between the 40

leagues led to product improvements and more cities with teams,

showing the competitive advantages of a duopoly. 20

It was during periods of league duopoly that innovation and

competition flourished. Appropriate public policy may well be 0

highly skeptical about mergers from duopoly to monopoly. ’88 1990 1995 2000 2005 2010

Physicians | Unbeknown to most people, the physicians’ required more spectrum, the evidence suggests that the original

services industry is a duopoly. There are two groups of fully duopoly had been competitive. To demonstrate this, we can

licensed physicians, Medical Doctors (MDs) and Doctors of compare the price decline during the duopoly to the latter period

Osteopathy (DOs). The existence of osteopathic physicians, when additional providers entered the market.

who currently comprise 6 percent of all physicians, has pro- Using the annual data available from the business association

vided substantial benefits to society. The group has filled mar- of wireless providers, CTIA, we determined that the average wire-

ket niches not satisfied by MDs. less phone monthly bill, adjusted for inflation, fell by 61 percent

Specifically, MDs emphasized specialization during the 1960s from 1988 to 1996— a decline of 11 percent per year. In contrast,

and 1970s, neglecting general or family practice. This void pro- during the subsequent period when several more wireless pro-

vided an opportunity that DOs exploited. They also practiced in viders began offering service, the average wireless monthly bill,

rural areas and small towns where MDs were scarce. DOs have adjusted for inflation, fell just 2 percent per year. (See Figure 1.)

countered the power of MDs in dealing with insurance com- Over the earlier period, geographic coverage of cellular service

panies, supported some health initiatives that MDs opposed, and other dimensions of quality also improved greatly.

pioneered continuing education, and accepted applicants who The decline in prices reflects, to a large extent, the economies

were discriminated against by MD schools. of scale and possibly learning-by-doing achieved by these net-

More recently, DOs countered the restriction of output of works under duopoly. These economies of scale resulted in reduc-

MDs. MDs were concerned about an impending physicians tions in per-unit costs for the industry. Because of competition

surplus in the 1970s and 1980s, and encouraged their medical between the two wireless providers, these cost reductions were

schools to keep the number of graduates constant at about passed along to consumers in the form of lower prices. Therefore,

17,000. Osteopaths took advantage of that policy and increased effective competition can be achieved with a very small number

their output from 1,724 in 1986–1987 to 2,535 in 1995–1996. of providers.

Had there not been this competition, the current shortage of phy-

sicians would have been more severe. This underscores that even

a small competitor in a duopoly can compete and benefit society. Antitrust Considerations

The Federal Trade Commission and the Antitrust Division of

Cellular telephone services | On April 9, 1981, the Federal the Department of Justice, which are tasked with enforcing

Communications Commission decided that wireless telecom- federal antitrust laws, have recognized the importance of exam-

munications services would operate as a duopoly, with one ining conduct and performance in an antitrust investigation

license going jointly to the incumbent local Bell Telephone and do not base public policy solely on industry structure. This

companies (the “B” license) and the other to a competitor (the policy was formalized in the recently adopted New Horizontal

“A” license). The FCC later revised that policy, auctioning off C, Merger Guidelines, which raised the Herfindahl-Hirschman

E, and F licenses between 1994 and 1997. This opened up the Index thresholds for various levels of market concentration.

nation to competition between several cellular carriers. Specifically, the revised merger guidelines raise the “unconcen-

While the latter increase in competition provided consum- trated” boundary from an HHI of 1,000 to 1,500, essentially

ers with more choices and the ensuing explosion in subscribers implying that a market with about seven firms will be consid-

16 | Regulation | Winter 2011‑2012

ered unconcentrated, whereas the previous threshold was more

than 10 firms. The “highly concentrated” range now begins

Conclusion

with markets of fewer than four firms instead of the previous We have found nothing of consequence to support a case for

number of between five and six. regulation based only on market structure. Common sense

What is most noteworthy about the guidelines is that they suggests that such regulation should be based on a thorough

consider market structure only as a “guide,” recognizing that a consumer-welfare-oriented cost-benefit analysis of the con-

certain structure by itself is not necessarily bad. That is, all the duct and performance of markets and of the well-known infir-

facts must be taken into consideration. Furthermore, the anti- mities of government efforts to manage competitive processes.

trust authorities, as well as the courts, have recognized the rule It is important to note that policies that maximize the num-

of reason in dealing with monopoly. The structure of monopoly ber of competitors are not necessarily congruent with policies

alone does not constitute the need for regulation or antitrust that will lead to greater willingness and ability to compete or

remedies. Thus, facts concerning not only structure but also incentivize firms to invest. The reasons are well known and

conduct and performance are used to decide public policy for a related to the relationships between the burden of fixed costs,

monopoly and the same criteria should be employed with duo- optimal scale, size of the market, and the number of competi-

polies and concentrated oligopolies. tors sustainable in the long run. Where there are substantial

Illustrative of the concern about duopoly is the now-abandoned economies of scale (that is, where minimum efficient firm size

proposal to merge baby food maker Beech-Nut, a division of Mil- is large relative to the size of the market), where fixed costs

not Holding Corp., with H. J. Heinz Co. The merger would have are a substantial part of total cost, and where marginal cost

joined the large, efficient Heinz plant with the well-regarded Beech- is low and below average cost, government should have very

Nut brand name, yielding a firm that could compete with industry little impact on the number of competitors. Its role should be

heavyweight Gerber Products Co., which held a 60 percent market limited to permitting as many as feasible, but it cannot force

share at the time the merger proposal was announced in 2000. long-term existence of more competitors than dictated by the

Federal authorities moved to block the merger because it would relationship between the size of the market and the structure

result in a duopoly. Freed from the would-be competitor, Gerber’s of cost. With respect to the number and concentration of

share of the baby food market rose to roughly 80 percent by 2008, sellers, markets trump regulation. While consumers are in

while Beech-Nut’s fell to 11 percent and Heinz’s to just 2 percent. general made better off with more choice, it does not follow

This strongly suggests the merger denial was undesirable. that government attempts to force an increase in the number

Other evidence from the antitrust experience also suggests of options will in turn increase welfare in instances where the

that duopolies or highly concentrated industries often compete economics of cost and demand warrant otherwise.

intensely. The rivalry between Intel and Advanced Micro Devices Most economists would agree that the behavior of a given

in computer chips has been so intense that the FTC and Euro- oligopoly or duopoly is indeterminate. That is, multiple out-

pean Union have investigated and challenged Intel’s behavior. comes, ranging from those associated with monopoly to perfect

Again, even a duopoly with a dominant firm can have substantial competition, are possible. Our work suggests that neither theory

rivalry. Additionally, the fact that most collusive agreements nor empirical evidence supports the notion that duopoly or high

involve markets with a few firms suggests that, absent such agree- concentration is per se undesirable. Thus, sound public policy

ments, competition can be substantial in these markets. should be based on empirical evidence and not rhetoric.

Pociask. ConsumerGram, The American Consumer ■■ Market Structure and Innovation, by Morton

Readings

Institute, April 2011. Kamien and Nancy L. Schwartz. Cambridge Uni-

■■ “A Critique of Concepts of Workable Competi-

■■ “How Much Collusion? A Meta-Analysis of

versity Press, 1982.

tion,” by Stephen H. Sosnick. Quarterly Journal of ■■ “The Evolution of the Baby Food Industry,” by

Oligopoly Experiments,” by Christoph Engel. Max

Economics, Vol. 72, No. 3 (1958). Viola Chen. Journal of Competition Law and Econom-

Planck Society, 2006.

■■ “A Tale of Two Doctors,” by Erwin A. Blackstone. ics, Vol. 6, No. 2 (2009).

■■ Industrial Economics and Organization: Theory and

Regulation, Vol. 33, No. 2 (2010). ■■ “The Timing of Innovation: Research, Develop-

Evidence, by Donald A. Hay and Derek J. Morris.

■■“A Theory of Oligopoly,” by George J. Stigler. Oxford University Press, 1991. ment, and Diffusion,” by Jennifer F. Reinganum.

Journal of Political Economy, Vol. 72 (1964). In Handbook of Industrial Organization, Vol. 1, edited

■■ Industrial Market Structure and Economic Perfor-

by Richard Schmalensee and Robert Willig. Else-

■■“Adjusting Regulation to Competition: Toward mance, 1st ed., by F. M. Scherer. Rand McNally, vier, 1989.

a New Model for U.S. Telecommunications,” by 1970.

■■ “Theories of Oligopoly Behavior,” by Carl Sha-

Howard A. Shelanski. Yale Journal on Regulation, Vol. ■■“Innovation and Market Structure,” by W. M. piro. In Handbook of Industrial Organization, Vol. 1,

24 (2007).

Cohen and R. C. Levin. In Handbook of Industrial edited by Richard Schmalensee and Robert Willig.

■■ “Empirical Studies of Industries with Market Organization, Vol. 1, edited by Richard Schmalensee Elsevier, 1989.

Power,” by Timothy Bresnahan. In Handbook of and Robert Willig. Elsevier, 1989.

■■ “To Regulate or Not to Regulate: Where Is the

Industrial Organization, Vol. 1, edited by Richard ■■ “Inter-Industry Studies of Structure and Per- Broadband Market Failure?” by Larry F. Darby.

Schmalensee and Robert Willig. Elsevier, 1989.

formance, by Richard Schmalensee. In Handbook In The Consequences of Net Neutrality on Broadband

■■ “Finding Effective Competition: A Look at the of Industrial Organization, Vol. 1, edited by Richard Investment and Consumer Welfare. The American

Wireless Telecommunications Market,” by Steve Schmalensee and Robert Willig. Elsevier, 1989. Consumer Institute, 2009.

Winter 2011‑2012 | Regulation | 17

Você também pode gostar

- Business Process ImprovementDocumento16 páginasBusiness Process ImprovementNathan Montgomery100% (3)

- 133 College Essay Examples For 15 Schools + Expert AnalysisDocumento19 páginas133 College Essay Examples For 15 Schools + Expert AnalysisRHassaniHassaniAinda não há avaliações

- Principles of EconomicsDocumento412 páginasPrinciples of Economicstheimbach73% (11)

- PC Hotel LahoreDocumento175 páginasPC Hotel LahoreRahman Rasool75% (8)

- Microeconomics: Key Concepts and TheoriesDocumento98 páginasMicroeconomics: Key Concepts and TheoriesJellane Seletaria100% (1)

- AndreW LoDocumento34 páginasAndreW LoJulio Cesar Juica CcapaAinda não há avaliações

- ALDI Competitive Advantage Through EfficiencyDocumento6 páginasALDI Competitive Advantage Through Efficiencynobleconsultants100% (1)

- Turchin - Economic ModelsDocumento5 páginasTurchin - Economic ModelsSaad Irshad Cheema100% (2)

- Michael Porter's 5 Forces Model ExplainedDocumento4 páginasMichael Porter's 5 Forces Model ExplainedSheetal Siyodia100% (2)

- Strategies to Ensure Starbucks Future ProfitabilityDocumento10 páginasStrategies to Ensure Starbucks Future ProfitabilityA.k. Aditya33% (3)

- Educational Marketing Strategies On The Market of Higher Education ServicesDocumento11 páginasEducational Marketing Strategies On The Market of Higher Education ServicesGlobal Research and Development ServicesAinda não há avaliações

- Sport Management ERASMUS CompleteDocumento219 páginasSport Management ERASMUS CompleteAttila KajosAinda não há avaliações

- CHAPTER 5. Types of StrategiesDocumento23 páginasCHAPTER 5. Types of StrategiesAiralyn RosAinda não há avaliações

- The Economics of Education and EmploymentDocumento4 páginasThe Economics of Education and Employmentjeffrey elad0% (1)

- Understanding Technological Innovation: Enabling the Bandwagon for Hydrogen TechnologyNo EverandUnderstanding Technological Innovation: Enabling the Bandwagon for Hydrogen TechnologyAinda não há avaliações

- DuopolyDocumento6 páginasDuopolyStani Jude JohnAinda não há avaliações

- Internal Control Questionnaire 2Documento7 páginasInternal Control Questionnaire 2RHassaniHassani100% (1)

- Handbook of Industrial Organization,. Vol. 2Documento605 páginasHandbook of Industrial Organization,. Vol. 2Luis TandazoAinda não há avaliações

- Group 6 Far Written ReportDocumento45 páginasGroup 6 Far Written ReportKaren AlonsagayAinda não há avaliações

- Strategic cost management for quality and valueDocumento24 páginasStrategic cost management for quality and valuesai500Ainda não há avaliações

- Netflix External AnalysisDocumento12 páginasNetflix External AnalysisHaroon Ghani67% (3)

- New Anti-Merger Theories - A CritiqueDocumento21 páginasNew Anti-Merger Theories - A CritiqueKashif Munir IdreesiAinda não há avaliações

- Static and Dynamic Theoretical Analysis and Empirical VerificationDocumento17 páginasStatic and Dynamic Theoretical Analysis and Empirical Verificationshivani singhAinda não há avaliações

- Strategy EconomyDocumento9 páginasStrategy EconomyIreneApriliaAinda não há avaliações

- Chapter 6 Theories of Oligopoly BehaviorDocumento86 páginasChapter 6 Theories of Oligopoly BehaviorErasmo Antonio Henríquez PontilloAinda não há avaliações

- Situational Determinism in Economics : Brit. J. Phil. Set. 23 (1972), 207-245 Printed in Great Britain 20 JDocumento39 páginasSituational Determinism in Economics : Brit. J. Phil. Set. 23 (1972), 207-245 Printed in Great Britain 20 JLazar MilinAinda não há avaliações

- 315-327 Joan Esteban Ing RDocumento11 páginas315-327 Joan Esteban Ing RManuel CámacAinda não há avaliações

- Oligopoly in The LabDocumento43 páginasOligopoly in The Labeconomics6969Ainda não há avaliações

- Oxford University PressDocumento15 páginasOxford University PressMichelle Miranda GonzálezAinda não há avaliações

- Seccion V Nelson 1985Documento55 páginasSeccion V Nelson 1985Diego Andrés Riaño PinzónAinda não há avaliações

- Theory, Strategy, and EntrepreneurshipDocumento22 páginasTheory, Strategy, and EntrepreneurshipAlexander CameronAinda não há avaliações

- This Content Downloaded From 217.248.61.125 On Fri, 02 Apr 2021 08:51:51 UTCDocumento22 páginasThis Content Downloaded From 217.248.61.125 On Fri, 02 Apr 2021 08:51:51 UTCGiovanni MurabitoAinda não há avaliações

- Competitive Markets Spur Innovation More Than MonopoliesDocumento8 páginasCompetitive Markets Spur Innovation More Than Monopoliestefi_699Ainda não há avaliações

- Adam Martin Market PaperDocumento25 páginasAdam Martin Market PaperAdam MartinAinda não há avaliações

- On The Origins of The Concept of Natural Monopoly: Economies of Scale and CompetitionDocumento38 páginasOn The Origins of The Concept of Natural Monopoly: Economies of Scale and Competitionanferi1109Ainda não há avaliações

- A Legal Theory of Economic PowerDocumento34 páginasA Legal Theory of Economic PowerAnna Júlia CostaAinda não há avaliações

- Market Failures and Public Policy: American Economic Review 2015, 105 (6) : 1665-1682Documento18 páginasMarket Failures and Public Policy: American Economic Review 2015, 105 (6) : 1665-1682brunoorsiscribdAinda não há avaliações

- Innovation Policy Implications of Inter-Firm LinkagesDocumento13 páginasInnovation Policy Implications of Inter-Firm LinkagesJorge Luis MarquezAinda não há avaliações

- THE Economic Journal: Increasing Returns and The Foundations of Unemployment TheoryDocumento18 páginasTHE Economic Journal: Increasing Returns and The Foundations of Unemployment TheorygunjanjainghsAinda não há avaliações

- Texto 1Documento14 páginasTexto 1vghAinda não há avaliações

- Policies & Founder Characteristics of New Technology A Comparison Between British & Indian FirmsDocumento47 páginasPolicies & Founder Characteristics of New Technology A Comparison Between British & Indian Firmspearll86Ainda não há avaliações

- multi-pageDocumento38 páginasmulti-pageTeemo MainAinda não há avaliações

- A fresh look at industry and market analysis evolvesDocumento8 páginasA fresh look at industry and market analysis evolvesAkhil SoniAinda não há avaliações

- Text 4 - Teece Competition & InnovationDocumento32 páginasText 4 - Teece Competition & InnovationPoubelle MailAinda não há avaliações

- Five Force Model in Theory and Practice: Analysis From An Emerging EconomyDocumento12 páginasFive Force Model in Theory and Practice: Analysis From An Emerging EconomyRavi BaravaliyaAinda não há avaliações

- Looking For Mr. Schumpeter: Where Are We in The Competition-Innovation Debate?Documento57 páginasLooking For Mr. Schumpeter: Where Are We in The Competition-Innovation Debate?potatoAinda não há avaliações

- Green Away 1991 New Growth TheoryDocumento15 páginasGreen Away 1991 New Growth TheoryPREM KUMARAinda não há avaliações

- Journal - Average-Costpricing - Some Evidence and ImplicationsDocumento16 páginasJournal - Average-Costpricing - Some Evidence and ImplicationsSirajudin HamdyAinda não há avaliações

- Final Project: Economics 1Documento5 páginasFinal Project: Economics 1Shanica Rosaldo CariñoAinda não há avaliações

- The Institutions of InnovationDocumento32 páginasThe Institutions of Innovationbugmeme7464Ainda não há avaliações

- Four Models of Competition and Their Implications For Marketing StrategyDocumento11 páginasFour Models of Competition and Their Implications For Marketing StrategyLinol P LoranceAinda não há avaliações

- Behavioral Economics, Consumer Protection, and Antitrust. Michael SalingerDocumento23 páginasBehavioral Economics, Consumer Protection, and Antitrust. Michael SalingerdesignerxtrAinda não há avaliações

- Chapter 4Documento42 páginasChapter 4Qurat-ul-ain NasirAinda não há avaliações

- Toward A Macroeconomics of The Medium RunDocumento8 páginasToward A Macroeconomics of The Medium RunWalter ArceAinda não há avaliações

- Open Innovation As A Competitive StrategyDocumento20 páginasOpen Innovation As A Competitive Strategyajax980Ainda não há avaliações

- Raghuram Rajan - Why An Orthodox Economic Model May Not Be The BestDocumento2 páginasRaghuram Rajan - Why An Orthodox Economic Model May Not Be The BestdragandragoonAinda não há avaliações

- O. Andriychuk Does Competition Matter? An Attempt of Analytical Unbundling' of Competition From Consumer Welfare: A Response To MiąsikDocumento16 páginasO. Andriychuk Does Competition Matter? An Attempt of Analytical Unbundling' of Competition From Consumer Welfare: A Response To Miąsikcsair1Ainda não há avaliações

- Theory of Industrial Organization Book ReviewDocumento9 páginasTheory of Industrial Organization Book ReviewMatias LopezAinda não há avaliações

- Facto by The Untested Theorem That Market Institutions Will "Fail" in TheDocumento15 páginasFacto by The Untested Theorem That Market Institutions Will "Fail" in ThePrieto PabloAinda não há avaliações

- Indusry Economics OneDocumento197 páginasIndusry Economics OnesamiAinda não há avaliações

- Porter's Five Forces vs Downes' Three ForcesDocumento4 páginasPorter's Five Forces vs Downes' Three ForcesJosé Luís NevesAinda não há avaliações

- The Economics of Bounded RationalityDocumento17 páginasThe Economics of Bounded RationalityJeff CacerAinda não há avaliações

- Jamessing MajokDocumento6 páginasJamessing Majokjamessingmajok1705Ainda não há avaliações

- Empirical Industrial Organization: A Progress Report: Liran Einav and Jonathan LevinDocumento21 páginasEmpirical Industrial Organization: A Progress Report: Liran Einav and Jonathan LevinJosé-Manuel Martin CoronadoAinda não há avaliações

- Bloch, H. (2000) - Schumpeter and Steindl On The Dynamics of Competition. Journal of Evolutionary Economics, 10 (3) .Documento11 páginasBloch, H. (2000) - Schumpeter and Steindl On The Dynamics of Competition. Journal of Evolutionary Economics, 10 (3) .lcr89100% (1)

- What An Industry Economist Needs To Know: 1 What Is Industrial Economics?Documento13 páginasWhat An Industry Economist Needs To Know: 1 What Is Industrial Economics?Core ResearchAinda não há avaliações

- Market Structures - in Prodctuin EconomicsDocumento48 páginasMarket Structures - in Prodctuin EconomicsDaniboy BalinawaAinda não há avaliações

- Competition Law: Lerner's IndexDocumento7 páginasCompetition Law: Lerner's IndexRakshit Raj SinghAinda não há avaliações

- This Content Downloaded From 202.43.95.117 On Mon, 05 Oct 2020 12:21:50 UTCDocumento5 páginasThis Content Downloaded From 202.43.95.117 On Mon, 05 Oct 2020 12:21:50 UTCsafira larasAinda não há avaliações

- Section 3 General Issues in Management: The False Expectations of Michael Porter's Strategic Management FrameworkDocumento20 páginasSection 3 General Issues in Management: The False Expectations of Michael Porter's Strategic Management FrameworkJean AntonioAinda não há avaliações

- Capm and EmhDocumento29 páginasCapm and EmhNguyễn Viết ĐạtAinda não há avaliações

- Eichner - 1973 - A Theory of The Determination of The Mark-Up UnderDocumento18 páginasEichner - 1973 - A Theory of The Determination of The Mark-Up Underçilem günerAinda não há avaliações

- Adaptive Markets Hypothesis From An Evolutionary Perspective 2004Documento33 páginasAdaptive Markets Hypothesis From An Evolutionary Perspective 2004scribdrameshAinda não há avaliações

- Johnson BA MB Five ForcesDocumento15 páginasJohnson BA MB Five ForcesdeepAinda não há avaliações

- How State-owned Enterprises Drag on Economic Growth: Theory and Evidence from ChinaNo EverandHow State-owned Enterprises Drag on Economic Growth: Theory and Evidence from ChinaAinda não há avaliações

- Central Bank Autonomy: in Developed CountriesDocumento14 páginasCentral Bank Autonomy: in Developed CountriesRHassaniHassaniAinda não há avaliações

- Stat A IntroDocumento157 páginasStat A IntroleonardmakuvazaAinda não há avaliações

- Sigar 14-16-Ar PDFDocumento17 páginasSigar 14-16-Ar PDFRHassaniHassaniAinda não há avaliações

- I.M.F. Cautions Against Tax Cuts For Wealthy As Republicans Consider Them - The New York TimesDocumento5 páginasI.M.F. Cautions Against Tax Cuts For Wealthy As Republicans Consider Them - The New York TimesRHassaniHassaniAinda não há avaliações

- OligopolyDocumento11 páginasOligopolyRHassaniHassaniAinda não há avaliações

- Malcolm BaldrigeDocumento102 páginasMalcolm Baldrigeeko4fxAinda não há avaliações

- Article Organizational CompetitivenessDocumento18 páginasArticle Organizational CompetitivenessEva Nur Faedah RohmawatiAinda não há avaliações

- MKT Term Paper (8) FINALLYDocumento34 páginasMKT Term Paper (8) FINALLYMaria MarjanunAinda não há avaliações

- MarriottDocumento10 páginasMarriottimwkyaAinda não há avaliações

- International Business ManagementDocumento166 páginasInternational Business ManagementLusajo Mwakibinga100% (1)

- Activity # 3: Corporate Strategies: Questions 5.1Documento5 páginasActivity # 3: Corporate Strategies: Questions 5.1Jonela LazaroAinda não há avaliações

- Cost Concepts and Design EconomicsDocumento13 páginasCost Concepts and Design EconomicsOscar Jr SaturninoAinda não há avaliações

- General Mills: New Product Introduction Marketing PlanDocumento111 páginasGeneral Mills: New Product Introduction Marketing PlanProvat XubaerAinda não há avaliações

- Daimler Integrity CodeDocumento28 páginasDaimler Integrity Codemanojkumar024Ainda não há avaliações

- Product and BrandDocumento3 páginasProduct and BrandChetan SinhaAinda não há avaliações

- The Concept of Strategic Intent A CompanyDocumento19 páginasThe Concept of Strategic Intent A CompanyppghoshinAinda não há avaliações

- New Product Development Process Explained in DetailDocumento40 páginasNew Product Development Process Explained in DetailAlnasif AlamAinda não há avaliações

- Marketing and Operations of The Banking SectorDocumento36 páginasMarketing and Operations of The Banking SectorVineeth MudaliyarAinda não há avaliações

- Chap 5 Pcs Bm3303Documento40 páginasChap 5 Pcs Bm3303Kayula Carla ShulaAinda não há avaliações

- Business Policy and StrategyDocumento30 páginasBusiness Policy and StrategysaraAinda não há avaliações

- Human Resource Management and InnovationDocumento6 páginasHuman Resource Management and InnovationMaier DorinAinda não há avaliações

- Tata Steel: Q1. Apply PESTLE, FIVE FORCES & SWOT Analysis On Following Tata BusinessDocumento51 páginasTata Steel: Q1. Apply PESTLE, FIVE FORCES & SWOT Analysis On Following Tata BusinessAnsh AnandAinda não há avaliações

- 08 - KRC Sales Performance Management PDFDocumento10 páginas08 - KRC Sales Performance Management PDFaastha aroraAinda não há avaliações