Escolar Documentos

Profissional Documentos

Cultura Documentos

IFLEX One Pager

Enviado por

didwanias0 notas0% acharam este documento útil (0 voto)

18 visualizações1 páginaoracle

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

XLS, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentooracle

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato XLS, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

18 visualizações1 páginaIFLEX One Pager

Enviado por

didwaniasoracle

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato XLS, PDF, TXT ou leia online no Scribd

Você está na página 1de 1

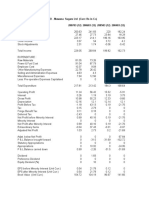

ORACLE FINANCIAL SERVICES Nifty: 2645.95 Date: 03.12.

08

Mix: 31.03.08 (In %) Rev. PBIT Price: 457.70

Products 58.28 109.49 % fall 72.75

Services 39.37 38.12 High/ Low 1679.90 405.00

KPO Services 2.00 -2.60

Joint Ventures 0.35 0.39 BSE NSE

Avg. Daily

Corporates 0.00 -45.41 Volume 17570 51693

PARTICULARS 31/03/2008 FV No. of Sh. Sh.Hold. 30.09.08 %

Rs.(In crores) (In crores)

Equity 41.88 5.00 8.38 Promoters 80.56

Reserves (excluding Rev. Reserve) 2735.16 FII 0.33

Shareholders Funds 2777.04

Book Value 331.55

Dividend % 0 PROJECTED

Market Price 457.70 440 420 400 380

Dividend Yield (%) 0.00 0.00 0.00 0.00 0.00

Market Price/ B V 1.38 1.33 1.27 1.21 1.15

Loans 0.00

Market Cap 3833.70 3685.44 3517.92 3350.40 3182.88

EV 3834 3685 3518 3350 3183

EBITDA Year end 31.03.2008 513.39

EV/ EBITDA 7.47 7.18 6.85 6.53 6.20

Running Year 31/03/2008 30/06/2008 30/09/2008 30/09/2008 31/03/2009

12 Months Q1 Q2 Q2 Q4E

Cons. Cons. Standalone Cons.

Net Sales 2380.24 631.83 544.78 707.37

Other Income 47.35 63.86 15.94 44.10

EBITDA 513.39 132.16 87.95 116.80

PAT - Excl Ext.Ord.Exp/Inc./Frx Loss 390.26 104.78 124.08 140.30

EPS - (Annualised) 46.59 50.04 59.26 67.00

PE 9.82 9.15 7.72 6.83

Extra Ord. Gain/ (Loss) (net of tax) 0.00 0.00 (46.89) (46.90)

Forex Gain/ (Loss) 17.40 0.00 34.06 0.00

*PAT is excluding Deferred Tax

Other Income and EBITDA excludes forex fluc

Remarks -

Sep, 08 Qtr consolidated results have been taken from Press Release.

Reports recommended - (Last 6 months coverage)

Report by Date Buy/ Recom. TARGET

Sell Price Price Period

Recommendation

(SAJAN DIDWANIA)

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- IRS Audit Guide For Contractors and The Construction IndustryDocumento196 páginasIRS Audit Guide For Contractors and The Construction IndustrySpringer Jones, Enrolled Agent100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Eco C12 MacroEconomicsDocumento110 páginasEco C12 MacroEconomicskane2123287450% (2)

- Extra Book - June 2015 FinalDocumento84 páginasExtra Book - June 2015 Finaldanishzafar100% (1)

- PM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)Documento22 páginasPM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)dodong123100% (1)

- Chhatrapati Shahu Ji Maharaj University, Kanpur PDFDocumento1 páginaChhatrapati Shahu Ji Maharaj University, Kanpur PDFNicunj guptaAinda não há avaliações

- Coll V Batangas Case DigestDocumento1 páginaColl V Batangas Case DigestRheaParaskmklkAinda não há avaliações

- Smart Communications, Inc. vs. Municipality of Malvar, BatangasDocumento3 páginasSmart Communications, Inc. vs. Municipality of Malvar, BatangasRaquel Doquenia100% (2)

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveDocumento8 páginasRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasAinda não há avaliações

- Rbi Allowed Banks To Increase Limit From 10 To 15 PercentDocumento10 páginasRbi Allowed Banks To Increase Limit From 10 To 15 PercentdidwaniasAinda não há avaliações

- BandhanBank 15 3 18 PLDocumento1 páginaBandhanBank 15 3 18 PLdidwaniasAinda não há avaliações

- Idfc QTR FinancialsDocumento2 páginasIdfc QTR FinancialsdidwaniasAinda não há avaliações

- 0hsie F PDFDocumento416 páginas0hsie F PDFchemkumar16Ainda não há avaliações

- Financials 7-11-08Documento6 páginasFinancials 7-11-08didwaniasAinda não há avaliações

- Information Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsDocumento8 páginasInformation Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsdidwaniasAinda não há avaliações

- Industry Report Card April 2018Documento16 páginasIndustry Report Card April 2018didwaniasAinda não há avaliações

- APL Apollo Antique Stock Broking Coverage Aprl 17Documento17 páginasAPL Apollo Antique Stock Broking Coverage Aprl 17didwaniasAinda não há avaliações

- Weekly Technical PicksDocumento4 páginasWeekly Technical PicksMaruthee SharmaAinda não há avaliações

- Sensex AnalysisDocumento2 páginasSensex AnalysisdidwaniasAinda não há avaliações

- Bandhan Bank Building Strong Franchise Through Retail FocusDocumento13 páginasBandhan Bank Building Strong Franchise Through Retail FocusdidwaniasAinda não há avaliações

- IDEA One PagerDocumento6 páginasIDEA One PagerdidwaniasAinda não há avaliações

- MARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodayDocumento2 páginasMARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodaydidwaniasAinda não há avaliações

- Sponge Iron Industry B K Oct 06 PDFDocumento30 páginasSponge Iron Industry B K Oct 06 PDFdidwaniasAinda não há avaliações

- Mawana FinancialsDocumento8 páginasMawana FinancialsdidwaniasAinda não há avaliações

- BHEL One PagerDocumento1 páginaBHEL One PagerdidwaniasAinda não há avaliações

- Shareholding Pattern BSEDocumento3 páginasShareholding Pattern BSEdidwaniasAinda não há avaliações

- 24 Jun 08 - BHELDocumento4 páginas24 Jun 08 - BHELdidwaniasAinda não há avaliações

- 'A' Grade Turnaround: Associated Cement CompaniesDocumento3 páginas'A' Grade Turnaround: Associated Cement CompaniesdidwaniasAinda não há avaliações

- IAG+ +India+Strategy+ (June+08)Documento17 páginasIAG+ +India+Strategy+ (June+08)api-3862995Ainda não há avaliações

- The Subprime Meltdown: Understanding Accounting-Related AllegationsDocumento7 páginasThe Subprime Meltdown: Understanding Accounting-Related AllegationsdidwaniasAinda não há avaliações

- Citizens Guide 2008Documento12 páginasCitizens Guide 2008DeliajrsAinda não há avaliações

- IAG+ +India+Strategy+ (June+08)Documento17 páginasIAG+ +India+Strategy+ (June+08)api-3862995Ainda não há avaliações

- Income & Growth One Pager 06302008Documento2 páginasIncome & Growth One Pager 06302008didwaniasAinda não há avaliações

- Sanjiv KaulDocumento18 páginasSanjiv KaulsdAinda não há avaliações

- HSBC Private Bank Strategy MattersDocumento4 páginasHSBC Private Bank Strategy MattersdidwaniasAinda não há avaliações

- CKP PresentationDocumento39 páginasCKP PresentationdidwaniasAinda não há avaliações

- Kpo VsbpoDocumento3 páginasKpo VsbposdAinda não há avaliações

- Notes FMDocumento42 páginasNotes FMSneha JayalAinda não há avaliações

- Crippled America PDFDocumento40 páginasCrippled America PDFGerardo Rogelio Alvarez100% (1)

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocumento3 páginasBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviAinda não há avaliações

- FMCG Sector ReportDocumento71 páginasFMCG Sector ReportAnkit JainAinda não há avaliações

- 2013 LAVCA ScorecardDocumento43 páginas2013 LAVCA ScorecardJonnattan MuñozAinda não há avaliações

- DGPS SurveyDocumento21 páginasDGPS SurveyHitesh JangidAinda não há avaliações

- 5 April 2016: Panama Papers: How Did Panama Become A Tax Haven?Documento4 páginas5 April 2016: Panama Papers: How Did Panama Become A Tax Haven?JasonDirntRottenAinda não há avaliações

- Nar Vol. 20 No. 2 CompleteDocumento517 páginasNar Vol. 20 No. 2 CompleteAudreyAinda não há avaliações

- Financial Statement Analysis Objectives & ToolsDocumento19 páginasFinancial Statement Analysis Objectives & ToolsAbhishek Raj100% (1)

- Property CasesDocumento95 páginasProperty CasesJohn Adrian MaulionAinda não há avaliações

- Gs Control Offer of Extension BoardDocumento4 páginasGs Control Offer of Extension BoardGautam MishraAinda não há avaliações

- Establishing A Financial Services Institution in The UKDocumento56 páginasEstablishing A Financial Services Institution in The UKCrowdfundInsiderAinda não há avaliações

- GST AssignmentDocumento10 páginasGST AssignmentDhroov BalyanAinda não há avaliações

- Balance Sheet and Financial Ratios for 2009 FYDocumento19 páginasBalance Sheet and Financial Ratios for 2009 FYpradeepkallurAinda não há avaliações

- Service Tax Liability: Income To Purshottam Agarwal From LBF Publications, Admanum Packing & IndividualDocumento6 páginasService Tax Liability: Income To Purshottam Agarwal From LBF Publications, Admanum Packing & Individualg26agarwalAinda não há avaliações

- 2019 Spring Ans (Q35 Ans Is C)Documento24 páginas2019 Spring Ans (Q35 Ans Is C)Zoe LamAinda não há avaliações

- Thesis Flow ChartDocumento14 páginasThesis Flow ChartJappy AlonAinda não há avaliações

- Unnati - FMCG, Consumer Durable, Retail, Brewery - 2018Documento138 páginasUnnati - FMCG, Consumer Durable, Retail, Brewery - 2018Wuzmal HanduAinda não há avaliações

- hb305 02 PHDocumento303 páginashb305 02 PHTiffany L DenenAinda não há avaliações

- MarketingDocumento16 páginasMarketingGabriel-Adrian AcasandreiAinda não há avaliações

- Assessment ProcedureDocumento8 páginasAssessment ProcedureAbhishek SharmaAinda não há avaliações

- Econ PrelimsDocumento5 páginasEcon PrelimsRamon George AtentoAinda não há avaliações

- Ease of Paying TaxesDocumento2 páginasEase of Paying TaxesLET ReviewerAinda não há avaliações