Escolar Documentos

Profissional Documentos

Cultura Documentos

Error Correction

Enviado por

Jana Lingcay0 notas0% acharam este documento útil (0 voto)

85 visualizações1 páginaPrior period errors are corrected by retrospectively adjusting the earliest period presented in the financial statements. There are three types of accounting errors: balance sheet errors affect real accounts only, income statement errors affect nominal accounts only, and combined errors affect both the statement of financial position and income statement. Examples provided demonstrate correcting a balance sheet error by adjusting asset accounts and correcting an income statement error by adjusting expense accounts since nominal accounts are closed at the end of each period.

Descrição original:

Correction for Accounting Errors

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoPrior period errors are corrected by retrospectively adjusting the earliest period presented in the financial statements. There are three types of accounting errors: balance sheet errors affect real accounts only, income statement errors affect nominal accounts only, and combined errors affect both the statement of financial position and income statement. Examples provided demonstrate correcting a balance sheet error by adjusting asset accounts and correcting an income statement error by adjusting expense accounts since nominal accounts are closed at the end of each period.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

85 visualizações1 páginaError Correction

Enviado por

Jana LingcayPrior period errors are corrected by retrospectively adjusting the earliest period presented in the financial statements. There are three types of accounting errors: balance sheet errors affect real accounts only, income statement errors affect nominal accounts only, and combined errors affect both the statement of financial position and income statement. Examples provided demonstrate correcting a balance sheet error by adjusting asset accounts and correcting an income statement error by adjusting expense accounts since nominal accounts are closed at the end of each period.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 1

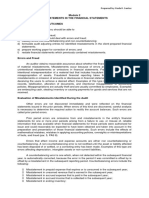

ERROR CORRECTION BALANCE SHEET ERRORS

Prior Period Errors are omissions and Case Example: (Note: For simplification, we will

misstatements in the entity’s financial statements ignore taxes)

for one or more periods

In 2016, a building was purchased for cash and the

TREATMENT entry was:

A prior period error shall be corrected by Machine xxxx

retrospective statement, meaning, if comparative Cash xxxx

statements are presented, the prior year statements The error was discovered in 2017. The correction is:

are restated to correct the error.

Building xxxx

The correction of the prior period error is an Machine xxxx

adjustment of the beginning balance of

RETAINED ERRORS of the earliest period

presented. INCOME STATEMENT ERRORS

TYPES OF ERRORS Case Example:

1. Balance Sheet Errors In 2016, the payment of a telephone bill was debited

2. Income statement errors to Advertising Expense.

3. Combined statement of financial position

If the error is discovered this year, the correction

and income statement errors

would be:

a. Counterbalancing Errors

b. Noncounterbalancing Errors Telephone Expense xxxx

Advertising Expense xxxx

Balance Sheet Errors – affect the real accounts only

If the error is discovered after this year, no

Income statement Errors – affect the nominal correction would be needed since these accounts

accounts only have been closed.

Combined balance sheet and income statement

Errors –affect both the statement of financial

COMBINED BALANCE SHEET AND

position and income statement

INCOME STATEMENT ERRORS

Counterbalancing errors –are errors which, if not

o Overstatement of Ending Inventory

detected, are automatically, counterbalanced or

corrected in the next accounting period On December 31, 2016, the physical count was

overstated by Php50,000.

Noncounterbalancing errors - are errors which, if

not detected, are not automatically counterbalanced

or corrected in the next accounting period.

Você também pode gostar

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017No EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017Ainda não há avaliações

- Fa 3 Chapter 15 Error CorrectionDocumento5 páginasFa 3 Chapter 15 Error CorrectionKristine Florence Tolentino100% (1)

- Guide to Japan-Born Inventory and Accounts Receivable Freshness Control for Managers 2017 (English Version)No EverandGuide to Japan-Born Inventory and Accounts Receivable Freshness Control for Managers 2017 (English Version)Ainda não há avaliações

- Notes On Correction of ErrorsDocumento11 páginasNotes On Correction of ErrorsEustaquio Jr., Felix C.Ainda não há avaliações

- Notes On Correction of Errors With AnswerDocumento12 páginasNotes On Correction of Errors With AnswerprelandgAinda não há avaliações

- Topic Overview: Error CorrectionDocumento33 páginasTopic Overview: Error Correctionadarose romaresAinda não há avaliações

- Handouts. Correction of ErrorsDocumento2 páginasHandouts. Correction of ErrorsGia Sarah Barillo BandolaAinda não há avaliações

- Correction of Errors Cash and AccrualDocumento5 páginasCorrection of Errors Cash and AccrualELIZA BELL HUNGAYAinda não há avaliações

- 01 - Correction of ErrorsDocumento4 páginas01 - Correction of ErrorsMikaela SalvadorAinda não há avaliações

- Errors IA3Documento24 páginasErrors IA3mddddddAinda não há avaliações

- Summary Notes - Correction of Errors, Cash and AccrualDocumento1 páginaSummary Notes - Correction of Errors, Cash and AccrualShin MelodyAinda não há avaliações

- Module I. Prior Period ErrorsDocumento4 páginasModule I. Prior Period ErrorsMelanie SamsonaAinda não há avaliações

- CHAPTER 16 - IaDocumento2 páginasCHAPTER 16 - IaValentina Tan DuAinda não há avaliações

- Chapter-2 Rectification of ErrorDocumento8 páginasChapter-2 Rectification of ErrorprascribdAinda não há avaliações

- Module 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSDocumento7 páginasModule 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSNiño Mendoza MabatoAinda não há avaliações

- Correction of ErrorsDocumento4 páginasCorrection of Errorsjustine Kiel Sorrosa100% (1)

- Example of Prior Period ErrorDocumento2 páginasExample of Prior Period ErrorMjhayeAinda não há avaliações

- Module 1 Correction of ErrorsDocumento14 páginasModule 1 Correction of Errorschuchu tvAinda não há avaliações

- Module 015 Week005-Finacct3 Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and ErrorsDocumento6 páginasModule 015 Week005-Finacct3 Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and Errorsman ibeAinda não há avaliações

- Correction of ErrorDocumento2 páginasCorrection of ErrorAKINYEMI ADISA KAMORUAinda não há avaliações

- Illustrative Example PDFDocumento16 páginasIllustrative Example PDFTanvir AhmedAinda não há avaliações

- Notes - Prior Period Errors PDFDocumento6 páginasNotes - Prior Period Errors PDFESTRADA, Angelica T.Ainda não há avaliações

- 04 Handout 1Documento3 páginas04 Handout 1Adrasteia ZachryAinda não há avaliações

- Rectification of Accounting ErrorsDocumento21 páginasRectification of Accounting ErrorsSami AhmadAinda não há avaliações

- Error CorrectionDocumento5 páginasError CorrectionBea ChristineAinda não há avaliações

- ERROR FinalDocumento21 páginasERROR FinalDebbie Grace Latiban LinazaAinda não há avaliações

- 02 - REO Correction of Errors2 PDFDocumento8 páginas02 - REO Correction of Errors2 PDFARISAinda não há avaliações

- MistatetementDocumento24 páginasMistatetementGina Bernardez del CastilloAinda não há avaliações

- SUBJECT: Accounting 20 NC Descriptive Title: Operation AuditingDocumento5 páginasSUBJECT: Accounting 20 NC Descriptive Title: Operation AuditingandreaAinda não há avaliações

- Rectificationoferrors 141209100948 Conversion Gate02Documento29 páginasRectificationoferrors 141209100948 Conversion Gate02LakshmiRengarajanAinda não há avaliações

- RectificationDocumento12 páginasRectificationTushar JaiswalAinda não há avaliações

- ACYASEDocumento3 páginasACYASEJasperAinda não há avaliações

- Financial Statements Recognition Disclosure: Error CorrectionDocumento9 páginasFinancial Statements Recognition Disclosure: Error CorrectionWild FlowerAinda não há avaliações

- AP-01B Correction of ErrorsDocumento6 páginasAP-01B Correction of ErrorsmarkAinda não há avaliações

- Adjusting EntryDocumento24 páginasAdjusting EntryHypa100% (1)

- Q3 Module 1Documento15 páginasQ3 Module 1shamrockjusayAinda não há avaliações

- Audit of Prior Errors and Accounting ChangesDocumento3 páginasAudit of Prior Errors and Accounting ChangesNEstandaAinda não há avaliações

- Accounting ErrorssDocumento5 páginasAccounting ErrorssJuvilynAinda não há avaliações

- Activity 5 1Documento13 páginasActivity 5 1Trice DomingoAinda não há avaliações

- Correction of ErrorsDocumento2 páginasCorrection of ErrorsZvioule Ma FuentesAinda não há avaliações

- Correction of Errors SampleDocumento7 páginasCorrection of Errors SampleRyan Prado Andaya100% (1)

- Adjusting Entries in Accounting - Introduction: Accounting Cycle Preparing A Trial BalanceDocumento4 páginasAdjusting Entries in Accounting - Introduction: Accounting Cycle Preparing A Trial BalanceJayne Carly CabardoAinda não há avaliações

- Correction of Errors PDFDocumento7 páginasCorrection of Errors PDFKylaSalvador0% (2)

- Correction of ErrorsDocumento9 páginasCorrection of ErrorsJaneAinda não há avaliações

- Financial Accounting - Ch06 - Finalisation EntriesDocumento13 páginasFinancial Accounting - Ch06 - Finalisation EntriesRameshKumarMuraliAinda não há avaliações

- Accruals and Prepayments: in This ChapterDocumento6 páginasAccruals and Prepayments: in This ChapterMuhammad Zubair YounasAinda não há avaliações

- Accounting ChangesDocumento3 páginasAccounting Changesmary aligmayoAinda não há avaliações

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDocumento16 páginasFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoAinda não há avaliações

- Error CorrectionDocumento7 páginasError CorrectionRizzel SubaAinda não há avaliações

- Handout 2 Audit IntegDocumento6 páginasHandout 2 Audit IntegJung JeonAinda não há avaliações

- Journal Entry For Correction of Errors and CounterbalancingDocumento9 páginasJournal Entry For Correction of Errors and CounterbalancingsharbularsAinda não há avaliações

- Specimen & Key Points of The Chapter: Errors Causing Disagreement of Trial BalanceDocumento10 páginasSpecimen & Key Points of The Chapter: Errors Causing Disagreement of Trial BalanceArham RajpootAinda não há avaliações

- Suspense Accounts and Error CorrectionDocumento5 páginasSuspense Accounts and Error CorrectionNozimanga ChiroroAinda não há avaliações

- Chapter 12 - EDocumento10 páginasChapter 12 - EbahuAinda não há avaliações

- FABM1 Q4 M1 Preparing-Adjusting-EntriesDocumento14 páginasFABM1 Q4 M1 Preparing-Adjusting-EntriesXedric JuantaAinda não há avaliações

- Las Q4 Fabm 1 GagalacDocumento26 páginasLas Q4 Fabm 1 GagalacAira Venice GuyadaAinda não há avaliações

- Chap 2 - FA2 (NOTES) 2Documento3 páginasChap 2 - FA2 (NOTES) 2jeyaAinda não há avaliações

- Final Accounts-AdjustmentsDocumento197 páginasFinal Accounts-AdjustmentsRaviSankarAinda não há avaliações

- To Be Uploaded 1 Fabm 1 PS 11 Q4 1005Documento73 páginasTo Be Uploaded 1 Fabm 1 PS 11 Q4 1005Kristoffer AngAinda não há avaliações

- 08-Rectification-Of-Errors Good OneDocumento54 páginas08-Rectification-Of-Errors Good OneAejaz MohamedAinda não há avaliações

- Parkinson Hoehn and Yahr ScaleDocumento3 páginasParkinson Hoehn and Yahr ScaleCarol Artigas GómezAinda não há avaliações

- APA 6th Edition - Citation Styles APA, MLA, Chicago, Turabian, IEEE - LibGuDocumento2 páginasAPA 6th Edition - Citation Styles APA, MLA, Chicago, Turabian, IEEE - LibGuJan Louis SalazarAinda não há avaliações

- Mrr2 Why The Future Doesnt Need UsDocumento3 páginasMrr2 Why The Future Doesnt Need UsSunshine Glory EgoniaAinda não há avaliações

- RHEL 9.0 - Configuring Device Mapper MultipathDocumento59 páginasRHEL 9.0 - Configuring Device Mapper MultipathITTeamAinda não há avaliações

- Euronext Derivatives How The Market Works-V2 PDFDocumento106 páginasEuronext Derivatives How The Market Works-V2 PDFTomAinda não há avaliações

- Guide: Daily ReferenceDocumento8 páginasGuide: Daily ReferenceGalina TodorovaAinda não há avaliações

- Determination of Iron in Water - SpectrophotometryDocumento4 páginasDetermination of Iron in Water - Spectrophotometryhanif ahmadAinda não há avaliações

- RCD - SEF (Liquidating)Documento40 páginasRCD - SEF (Liquidating)Chie NemzAinda não há avaliações

- Dragon Ball Z Project: R1 and R2J Dragon Boxes Merge: AcknowledgementsDocumento11 páginasDragon Ball Z Project: R1 and R2J Dragon Boxes Merge: Acknowledgements8ASergio GamarraAinda não há avaliações

- 3.3 (B) Mole N MassDocumento20 páginas3.3 (B) Mole N MassFidree AzizAinda não há avaliações

- Cutting Conics AsDocumento3 páginasCutting Conics Asbabe09Ainda não há avaliações

- Ponce vs. Court of AppealsDocumento7 páginasPonce vs. Court of AppealsMp CasAinda não há avaliações

- BVP651 Led530-4s 830 Psu DX10 Alu SRG10 PDFDocumento3 páginasBVP651 Led530-4s 830 Psu DX10 Alu SRG10 PDFRiska Putri AmirAinda não há avaliações

- FTP Booster Training Plan OverviewDocumento1 páginaFTP Booster Training Plan Overviewwiligton oswaldo uribe rodriguezAinda não há avaliações

- GlobalisationDocumento8 páginasGlobalisationdummy12345Ainda não há avaliações

- Chapter 4Documento20 páginasChapter 4Vandan GundaleAinda não há avaliações

- Energy Management Assignment #01: Submitted BY Shaheer Ahmed Khan (MS2019198019)Documento15 páginasEnergy Management Assignment #01: Submitted BY Shaheer Ahmed Khan (MS2019198019)shaheer khanAinda não há avaliações

- Radiology PearlsDocumento2 páginasRadiology PearlsSalman Rashid100% (2)

- Chapter 04 - Motion and Force - DynamicsDocumento24 páginasChapter 04 - Motion and Force - DynamicsMohamad SyazwanAinda não há avaliações

- 3 - RA-Erecting and Dismantling of Scaffolds (WAH) (Recovered)Documento6 páginas3 - RA-Erecting and Dismantling of Scaffolds (WAH) (Recovered)hsem Al EimaraAinda não há avaliações

- WRhine-Main-Danube CanalDocumento6 páginasWRhine-Main-Danube CanalbillAinda não há avaliações

- Financial Statements Ias 1Documento34 páginasFinancial Statements Ias 1Khalid AzizAinda não há avaliações

- LIP Reading Using Facial Feature Extraction and Deep LearningDocumento5 páginasLIP Reading Using Facial Feature Extraction and Deep LearningInternational Journal of Innovative Science and Research TechnologyAinda não há avaliações

- Exponential Smoothing-Trend and SeasonalDocumento11 páginasExponential Smoothing-Trend and SeasonalsuritataAinda não há avaliações

- Attention: 6R60/6R75/6R80 Installation GuideDocumento4 páginasAttention: 6R60/6R75/6R80 Installation GuideEdwinferAinda não há avaliações

- (Application Transfer Manual Volume: Be The CadreDocumento2 páginas(Application Transfer Manual Volume: Be The CadreVishnu MuralidharanAinda não há avaliações

- Fundamentals of Heat and Mass Transfer 7Th Edition Incropera Solutions Manual Full Chapter PDFDocumento68 páginasFundamentals of Heat and Mass Transfer 7Th Edition Incropera Solutions Manual Full Chapter PDFbrainykabassoullw100% (10)

- 2008 IASS SLTE 2008 Chi Pauletti PDFDocumento10 páginas2008 IASS SLTE 2008 Chi Pauletti PDFammarAinda não há avaliações

- Augusta Issue 1145 - The Jail ReportDocumento24 páginasAugusta Issue 1145 - The Jail ReportGreg RickabaughAinda não há avaliações

- 5EMA BB Dem&Sup VW Bu&Se - 2.35&48&PDDocumento13 páginas5EMA BB Dem&Sup VW Bu&Se - 2.35&48&PDkashinath09Ainda não há avaliações