Escolar Documentos

Profissional Documentos

Cultura Documentos

PreferenceShares - March 27 2018

Enviado por

Tiso Blackstar Group0 notas0% acharam este documento útil (0 voto)

16 visualizações1 páginaPreferenceShares - March 27 2018

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoPreferenceShares - March 27 2018

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

16 visualizações1 páginaPreferenceShares - March 27 2018

Enviado por

Tiso Blackstar GroupPreferenceShares - March 27 2018

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

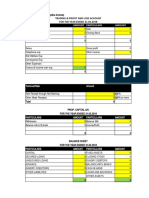

Markets and Commodity figures

27 March 2018

Company Close (cents)

Day move (cents)

Day move (%)

High Low Volume trade

12m

(000)

% move12m high 12m low Market cap Yield

(R'm) P/E ratio

KRUGER RANDS 0 0 0 0 0 0 0 0 0 0 0 0 0

KR 1650000 0 0 0 0 0 -0.6 1940000 1600010 0 0 0 0

KRHALF 825000 0 0 0 0 0 3.1 890000 800000 0 0 0 0

KRQRTR 419000 0 0 0 0 0 -16.2 510000 400000 0 0 0 0

KRTENTH 150000 0 0 0 0 0 -13.3 180000 150000 0 0 0 0

EXCHANGE TRADED PRODUCTS

0 0 0 0 0 0 0 0 0 0 0 0 0

2YRDOLLARCST 114785 -245 -0.2 114785 114785 0 -19.4 142510 1 18.4 0 0 0

AFRICAGOLD 15437 -172 -1.1 15605 15437 0 -2.7 18346 15172 93.7 0 0 0

AFRICAPALLAD 11175 -145 -1.3 11286 11175 0 11.5 14392 7266 2903.6 0 0 0

AFRICAPLATIN 10815 -191 -1.7 11006 10815 0 -11.6 13451 10815 1639.9 0 0 0

AFRICARHODIU 22880 69 0.3 23454 22880 0 78.7 29900 11500 585.2 0 0 0

AGLSBY 11 0 0 11 11 0 -65.6 32 9 11 0 0 0

AGLSBZ 33 -1 -2.9 33 33 0 0 43 27 34 0 0 0

AMIBIG50EX-S 1310 -5 -0.4 1330 1310 1 9.7 7315 986 16 0 0 1.9

AMSSBP 42 -1 -2.3 42 42 0 27.3 48 33 43 0 0 0

ANGSBR 31 2 6.9 31 31 0 -11.4 37 20 29 0 0 0

ASHBURTONGBL 3596 30 0.8 3654 3587 36 -11.5 4460 3550 153.3 0 0 0.5

ASHBURTONINF 2120 30 1.4 2120 2086 1038 0.6 2414 1812 1049.2 0 0 2.6

ASHBURTONMID 769 -1 -0.1 786 765 4857 -3.1 892 695 308 0 0 3.1

ASHBURTONTOP 4981 -10 -0.2 5069 4818 175 10.9 5886 4222 618.3 0 0 1.6

ASHBURTONWOR 596 -3 -0.5 603 596 11 0 622 592 58.9 0 0 0

BATSBP 96 -7 -6.8 96 96 0 190.9 103 28 103 0 0 0

BILSBR 38 -1 -2.6 38 38 0 22.6 43 23 39 0 0 0

BILSBS 35 0 0 35 35 0 0 35 31 35 0 0 0

CORE DIVTRAX 2970 -46 -1.5 3064 2970 10 0.6 3275 2700 284.7 0 0 1.8

CORE EWTOP40 4933 5 0.1 5015 4900 10 0.3 5450 4680 167.3 0 0 2

CORE GLPROP 2785 -35 -1.2 2891 2785 53 -13.4 3855 2785 276.1 0 0 5.4

CORE LVOLTRX 2688 3 0.1 2688 2679 0 -3.5 2896 2530 18.4 0 0 2.7

CORE PREF 804 -1 -0.1 805 800 17 -14.6 975 765 274.3 0 0 8.5

CORE S&P500 3110 10 0.3 3150 3106 6 3 3998 2810 470.7 0 0 2.3

CORE SAPY 5728 -31 -0.5 5825 5701 15 -14 7345 5585 145.2 0 0 6.4

CORE TOP50 2294 -1 0 2330 2294 5 11.5 2632 2008 794.1 0 0 1.3

CORESHARESGL 941 7 0.7 943 936 37 -1.2 1033 934 73.4 0 0 0

CORESHARESPR 1787 -8 -0.4 1815 1786 11 -15.4 2319 1779 256.9 0 0 6.6

DOLLARCSTDL 108900 -195 -0.2 108900 108900 0 -11 140850 10900 92.7 0 0 1.9

DSYSBQ 26 1 4 26 26 0 -18.8 48 21 25 0 0 0

ESPIBI 1081270 0 0 0 0 0 17.9 1273455 917418 148.9 0 0 0

ESPIBK 1486782 0 0 1486782 1486782 0 15 1497989 1283390 82.7 0 0 0

ESPIBO 1161687 191 0 1161687 1161687 0 -2.5 1469937 1161496 133.4 0 0 0

EXXSBP 32 -1 -3 32 32 0 0 40 14 33 0 0 0

EXXSBQ 62 0 0 62 62 0 82.4 69 34 62 0 0 0

FSRSBR 9 1 12.5 9 9 0 -47.1 22 6 8 0 0 0

FSRSBS 39 3 8.3 39 39 0 0 39 35 36 0 0 0

GFISBS 35 0 0 35 35 0 6.1 45 31 35 0 0 0

HARSBR 16 0 0 16 16 0 -48.4 33 16 16 0 0 0

IMPSBP 41 2 5.1 41 41 0 0 41 34 39 0 0 0

KIOSBP 7 1 16.7 7 7 0 -77.4 31 5 6 0 0 0

KIOSBQ 21 2 10.5 21 21 0 -36.4 33 11 19 0 0 0

KIOSBR 41 2 5.1 41 41 0 20.6 41 25 39 0 0 0

KIOSBS 35 2 6.1 35 35 0 0 35 32 33 0 0 0

KRCSTDLCRTFC 1645550 -18550 -1.1 1645550 1645550 0 -2.7 1954950 17255 1418.9 0 0 0

MRPSBS 7 1 16.7 7 7 0 -66.7 28 6 6 0 0 0

MRPSBT 29 2 7.4 29 29 0 0 34 27 27 0 0 0

MTNSBT 34 -4 -10.5 34 34 0 0 39 24 38 0 0 0

NEWFUNDSEQUI 3044 -3 -0.1 3064 3044 1 1.6 3800 2700 73.1 0 0 0.3

NEWFUNDSGOVI 6246 -27 -0.4 6286 6240 181 15.3 6748 5280 368.5 0 0 6.5

NEWFUNDSILBI 6905 -21 -0.3 6905 6849 7 3.8 6974 6302 62.3 0 0 2.3

NEWFUNDSMAPP 2183 -1 0 2183 2183 0 12.8 10000 1001 39.5 0 0 1.6

NEWFUNDSNEWS 5133 -15 -0.3 5133 5133 0 8.3 5636 2001 39.8 0 0 1.3

NEWFUNDSS&P 3740 -6 -0.2 3759 3740 2 -5 4095 3699 49.5 0 0 1.8

NEWFUNDSSHAR 296 3 1 296 296 0 1.7 420 255 45.6 0 0 1.4

NEWFUNDSSWIX 1754 -2 -0.1 1759 1754 0 13.9 1941 1416 17.6 0 0 0.6

NEWFUNDSTRAC 2331 1 0 2331 2326 67 7 2350 2129 119.2 0 0 5.7

NEWGOLD 10747 -197 -1.8 10908 10710 3 -11.7 13327 10710 9006.9 0 0 0

NEWGOLDISSUE 14843 -91 -0.6 14950 14789 1108 -2.6 17677 14547 14542.4 0 0 0

NEWGOLDPLLDM 11174 -70 -0.6 11293 11102 183 11.5 14305 9751 1583.7 0 0 0

NFEQUITYVALU 988 1 0.1 993 988 5 0 1064 983 0 0 0 0

NFLOWVLTLTY 989 -1 -0.1 993 989 5 0 993 989 0 0 0 0

NPNSBR 18 0 0 18 18 0 -41.9 31 8 18 0 0 0

NPNSBS 35 0 0 35 35 0 20.7 47 17 35 0 0 0

NPNSBT 44 0 0 44 44 0 0 44 33 44 0 0 0

SATRIX40PRTF 4993 7 0.1 5195 4985 995 11.3 5592 4442 7663.1 0 0 1

SATRIXDIVIPL 250 -2 -0.8 258 250 648 14.7 274 196 1633.9 0 0 1.9

SATRIXFINI 1782 -10 -0.6 1814 1782 277 16.8 1905 1341 844.7 0 0 3.1

SATRIXILBI 575 1 0.2 575 575 0 2 644 394 23 0 0 2.8

SATRIXINDI 7440 -10 -0.1 7528 7440 391 9.2 8850 6730 2234.1 0 0 1.1

SATRIXMSCI 3128 20 0.6 3229 3128 45 -4.3 3974 3100 266.4 0 0 0

SATRIXMSCIEM 3617 2 0.1 3739 3600 85 0.6 4400 3336 378.6 0 0 0

SATRIXPRTFL 1889 -15 -0.8 1923 1889 16 -13.5 2593 1820 66.1 0 0 5.9

SATRIXQLTY 964 0 0 980 960 1249 25.5 1086 763 107.4 0 0 0.1

SATRIXRAFI40 1389 2 0.1 1407 1370 126 12.7 1502 1171 958.1 0 0 1.2

SATRIXRESI 3563 28 0.8 3592 3563 263 12.1 4072 2985 303.6 0 0 2.7

SATRIXS&P500 3010 47 1.6 3079 2975 53 -2.4 3850 2935 185.9 0 0 0

SATRIXSWIXTO 1135 4 0.4 1147 1135 23 11.4 1344 1005 485.4 0 0 1.2

SBKSBS 9 1 12.5 9 9 0 -60.9 28 8 8 0 0 0

SBKSBT 34 1 3 34 34 0 0 34 32 33 0 0 0

SGLSBQ 42 -2 -4.5 42 42 0 20 49 16 44 0 0 0

SHPSBP 36 1 2.9 36 36 0 0 36 33 35 0 0 0

SOLSBW 7 -1 -12.5 7 7 0 -76.7 32 5 8 0 0 0

SOLSBX 16 -2 -11.1 16 16 0 -50 33 11 18 0 0 0

SOLSBY 32 -2 -5.9 32 32 0 10.3 39 21 34 0 0 0

STANLIB 5602 -10 -0.2 5668 5585 36 -14.1 7748 5536 99.1 0 0 8

STANLIBG7GOV 6449 -28 -0.4 6501 6449 0 0 6629 6401 6 0 0 0

STANLIBGLOBA 1396 2 0.1 1436 1396 0 0 1536 1371 6.2 0 0 0

STANLIBMSCI 3126 33 1.1 3163 3126 0 0 3322 3080 6.6 0 0 0

STANLIBS&P50 14966 192 1.3 14966 14966 0 0 16500 14774 13 0 0 0

STANLIBSWIX4 1133 -4 -0.4 1138 1133 1 11.4 1410 958 2036.3 0 0 1.3

STANLIBTOP40 4974 -19 -0.4 5041 4974 0 10.8 5895 4425 689.4 0 0 1.3

SYGNIAITRIX 1965 23 1.2 1986 1965 39 -11.9 2320 1917 202.6 0 0 0

SYGNIAITRIXG 2922 22 0.8 2948 2922 9 -20.3 3898 2775 270.7 0 0 0.4

SYGNIAITRIXS 3174 40 1.3 3208 3174 346 -10.6 3838 3118 772.2 0 0 0.2

SYGNIAITRIXT 4978 -8 -0.2 5057 4978 0 -6.8 5527 4882 199.5 0 0 0

TOPSBX 37 1 2.8 37 35 75 2.8 52 12 36 0 0 0

TOPSBY 75 2 2.7 75 75 0 78.6 90 26 73 0 0 0

TOPSBZ 57 1 1.8 57 57 0 0 57 41 56 0 0 0

TOPSKQ 1251 10 0.8 1251 1251 0 201.4 1419 160 1241 0 0 0

TOPSKR 1443 11 0.8 1443 1443 0 145.4 1520 333 1432 0 0 0

TOPSKS 1059 15 1.4 1059 910 1 0 1072 495 1044 0 0 0

TRUSBP 22 1 4.8 22 22 0 0 29 21 21 0 0 0

DEBT 0 0 0 0 0 0 0 0 0 0 0 0 0

ABSA 69800 0 0 69800 69800 0 -10.6 78900 64001 3451.5 35.3 0 10.4

AECI5,5% 1400 0 0 0 0 0 -21.3 1775 1300 42 0 0 7.1

AFRICANOVER 1052 0 0 0 0 0 -24.9 1500 1050 2.9 0 0 1.1

AFRICANPHNX 2300 0 0 2300 2195 50 -37.2 3660 2195 311 0 0 0

BARWORLD6%PR 121 0 0 0 0 0 -7.6 137 121 0.5 0 0 9.9

CAPITEC-P 8000 105 1.3 8000 7885 11 -11 9750 7361 98.7 0 0 10.8

CAXTON-P 19000 0 0 0 0 0 0 19000 19000 9.5 0 0 3

CULLINAN 107 0 0 0 0 0 0 0 0 0.5 0 0 10.3

DISC-B-P 8050 0 0 8050 8050 0 -16.8 10200 7690 644 0 0 12.9

FIRSTRANDB-P 7300 20 0.3 7350 7300 57 -10.4 8200 6750 3276 0 0 10.7

FOSCHINI 124 0 0 0 0 0 -27.1 170 124 0.2 0 0 10.5

GRINDRODPREF 6901 1 0 6905 6750 12 -11.5 7821 6499 510.6 0 0 13.2

IBRDMBLPRF1 101406 78 0.1 101406 101406 0 1.2 101960 100094 346.3 0 0 4.4

ILRDMBLPRF2 101328 0 0 0 0 0 0 102054 100326 215.8 0 0 5.7

IMPERIALPREF 6765 -110 -1.6 6800 6765 1 -11 7899 6750 312.1 0 0 12.7

INVESTEC 7250 150 2.1 7250 7155 12 -13.7 8650 6900 1096.8 0 0 12

INVESTECPREF 8800 0 0 0 0 0 5.4 11100 7900 242.4 0 0 2.6

INVICTA-P 8370 -30 -0.4 8370 8370 1 -10.7 9925 8020 630 0 0 13.7

LIBERTY11C 108 0 0 0 0 0 -2.7 150 101 16.2 0 0 10.2

NAMPAK6%PREF 125 0 0 0 0 0 -28.2 174 125 0.5 0 0 9.6

NAMPAK6,5%PR 111 0 0 0 0 0 -26 150 111 0.1 0 0 11.7

NEDBANKPREF 880 36 4.3 880 840 104 -5.9 945 810 3023.9 0 0 9.8

NETCAREPREF 6800 75 1.1 6800 6800 3 -20.9 9050 6500 437.1 0 0 12.7

PSGSERV 6600 -80 -1.2 6680 6600 17 -14.3 8050 6400 1163.4 0 0 13.1

RECMANDCLBR 2000 100 5.3 2000 1850 41 -20 2550 1850 900.6 0 0 0

REXTRFRM 200 0 0 0 0 0 31.6 200 100 0.3 0 0 6

SASFIN-P 7040 0 0 7040 7040 0 -11.8 8200 7028 126.5 0 0 12.2

STANDARD-P 7899 -1 0 7900 7800 17 -3.7 8500 7202 4185.6 0 0 10.1

STD 70 -4 -5.4 74 70 35 -12.5 86 70 5.9 0 0 9.3

STEINHOFF-P 4401 0 0 0 0 0 -45 8100 1750 660.2 0 0 19.7

ZAMBEZIRF 6130 0 0 0 0 0 16.8 6425 5250 9802.2 0 0 0

OTHER 0 0 0 0 0 0 0 0 0 0 0 0 0

DBSTBXX6 3541 0 0 3541 3541 13 0 6956 2915 170.9 0 0 46.7

INVLTD 1083737 -619 -0.1 1083737 1083737 0 15.4 1131404 9962 11.9 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

ADBEE(RF) 5550 -50 -0.9 5599 5300 3 28.2 5900 3700 1447.2 0 0 0

DBMSCIAFETN 11336 -2 0 11336 11298 0 12.2 12250 8018 2267.6 0 0 0

DBMSCICHETN 7110 77 1.1 7194 7110 40 29.6 41275 5300 1406.6 0 0 0

DBMSCIEMETN 5988 25 0.4 5988 5988 0 14.2 47325 4237 1192.6 0 0 0

FRKBONDGOLD 1641950 -19200 -1.2 1641950 1641950 0 -1.4 1942200 1612300 2319.3 0 0 0

FRSFRPT9JUN1 112350 -2000 -1.7 112350 112350 0 -10.4 138800 112350 841.3 0 0 0

GOLDCMMDTY-L 17175 -196 -1.1 17175 17175 0 -3.5 20534 16911 173.7 0 0 0

IBLUSDZAROCT 117183 -147 -0.1 117183 117183 0 -8.5 145570 116000 410.7 0 0 1

IBSWX40TR2ET 18368 -44 -0.2 18368 18368 0 -2.3 20256 1 920.6 0 0 0

IBTOP40CLIQU 124667 800 0.6 124667 124667 0 6.1 130581 110223 1.2 0 0 0

IBTOP40TR2ET 7066 -8 -0.1 7066 7066 0 -3.9 7819 1 901.9 0 0 0

ZA084 77700 0 0 0 0 0 0 0 0 108.8 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

ADBEE(RF) 4815 -80 -1.6 4895 4815 2 45.8 5200 3100 1265 0 0 0

DBGLOBE 19739 0 0 0 0 0 0 0 0 2 0 0 0

DBHAVEN 31452 0 0 0 0 0 0 0 0 3.1 0 0 0

DBMSCIAFETN 11274 6 0.1 11274 11274 0 2.9 55585 8018 2253.6 0 0 0

DBMSCICHETN 6894 47 0.7 6894 6880 0 26.8 7497 5038 1369.4 0 0 0

DBMSCIEMETN 6027 5 0.1 6027 6005 0 16.3 6300 4237 1204.4 0 0 0

FRKBONDGOLD 1774000 -13800 -0.8 1774000 1774000 0 -5.4 1988900 1611900 2496.1 0 0 0

FRSFRPT9JUN1 132050 -400 -0.3 132050 132050 0 -12.1 155600 65901 974.4 0 0 0

GOLDCMMDTY-L 18889 -134 -0.7 18946 18889 0 13 21485 16711 190.2 0 0 0

IBETNT1CT46 1389135 0 0 0 0 0 0.1 1403037 1385563 48.6 0 0 0

IBGOLDENETN 12654 -25 -0.2 12654 12654 0 -18.6 17000 1 352.2 0 0 0

IBLUSDZAROCT 132475 -725 -0.5 132475 132475 0 -1.2 144142 125059 466.2 0 0 0

IBSWX40TRI 17697 32 0.2 17697 17697 0 5.7 17941 12618 883.3 0 0 0

SILVERCOMMOD 14894 -77 -0.5 14894 14894 0 -26.2 22935 13989 74.9 0 0 0

SBCOPPERETN 1329 -4 -0.3 1329 1329 0 8 1439 911 133.3 0 0 0

SBCORNETN 820 -46 -5.3 820 820 0 -16.2 979 765 43.3 0 0 0

SBWHEATETN 764 -41 -5.1 764 764 0 -10.7 856 618 40.3 0 0 0

SBWTIOIL 830 -1 -0.1 830 830 0 -20 1124 750 290.9 0 0 0

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

Você também pode gostar

- Government Publications: Key PapersNo EverandGovernment Publications: Key PapersBernard M. FryAinda não há avaliações

- PreferenceShares - February 21 2018Documento1 páginaPreferenceShares - February 21 2018Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - April 11 2018Documento1 páginaPreference Shares - April 11 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceShares - February 22 2018Documento1 páginaPreferenceShares - February 22 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- Preference Shares - October 29 2018Documento1 páginaPreference Shares - October 29 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceShares - June 23 2017Documento1 páginaPreferenceShares - June 23 2017Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - February 27 2018Documento1 páginaPreference Shares - February 27 2018Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - June 11 2018Documento1 páginaPreference Shares - June 11 2018Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - October 25 2018Documento1 páginaPreference Shares - October 25 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceShares - March 28 2018Documento1 páginaPreferenceShares - March 28 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- PreferenceShares - June 26 2017Documento1 páginaPreferenceShares - June 26 2017Tiso Blackstar GroupAinda não há avaliações

- PreferenceShares - February 19 2018Documento1 páginaPreferenceShares - February 19 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceShares - April 10 2018Documento1 páginaPreferenceShares - April 10 2018Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - October 23 2018Documento1 páginaPreference Shares - October 23 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- Preference Shares - May 26 2019Documento1 páginaPreference Shares - May 26 2019Lisle Daverin BlythAinda não há avaliações

- Preference Shares - October 3 2019Documento1 páginaPreference Shares - October 3 2019Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - July 25 2018Documento1 páginaPreference Shares - July 25 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceShares PDFDocumento1 páginaPreferenceShares PDFTiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- Preference Shares - March 14 2018Documento1 páginaPreference Shares - March 14 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceShares - April 5 2018Documento1 páginaPreferenceShares - April 5 2018Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - July 30 2018Documento1 páginaPreference Shares - July 30 2018Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - September 1 2019Documento1 páginaPreference Shares - September 1 2019Anonymous 6g229lSxAinda não há avaliações

- Preference Shares - May 17 2018Documento1 páginaPreference Shares - May 17 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceShares - April 4 2018Documento1 páginaPreferenceShares - April 4 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- Preference Shares - October 24 2018Documento1 páginaPreference Shares - October 24 2018Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - September 17 2019Documento1 páginaPreference Shares - September 17 2019Tiso Blackstar GroupAinda não há avaliações

- PreferenceShares - December 20 2017Documento1 páginaPreferenceShares - December 20 2017Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - March 17 2019Documento1 páginaPreference Shares - March 17 2019Tiso Blackstar GroupAinda não há avaliações

- PreferenceShares - February 15 2018Documento1 páginaPreferenceShares - February 15 2018Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - February 23 2018Documento1 páginaPreference Shares - February 23 2018Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - September 9 2019Documento1 páginaPreference Shares - September 9 2019Lisle Daverin BlythAinda não há avaliações

- Preference Shares - July 23 2018Documento1 páginaPreference Shares - July 23 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceShares Metals - February 28 2018Documento1 páginaPreferenceShares Metals - February 28 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceShares - June 27 2018Documento1 páginaPreferenceShares - June 27 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- Preference Shares - July 27 2018Documento1 páginaPreference Shares - July 27 2018Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - June 28 2018Documento1 páginaPreference Shares - June 28 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- Preference Shares - June 19 2017Documento1 páginaPreference Shares - June 19 2017Tiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- PreferenceShares PDFDocumento1 páginaPreferenceShares PDFTiso Blackstar GroupAinda não há avaliações

- Preference Shares - March 26 2018Documento1 páginaPreference Shares - March 26 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- Preference Shares - July 31 2018Documento1 páginaPreference Shares - July 31 2018Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - July 12 2018Documento1 páginaPreference Shares - July 12 2018Tiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- PreferenceShares - March 22 2018Documento1 páginaPreferenceShares - March 22 2018Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - May 10 2018Documento1 páginaPreference Shares - May 10 2018Tiso Blackstar GroupAinda não há avaliações

- Preference Shares - March 24 2019Documento1 páginaPreference Shares - March 24 2019Anonymous 7A1d7fjj3Ainda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- PreferenceSharesDocumento1 páginaPreferenceSharesTiso Blackstar GroupAinda não há avaliações

- Preference Shares - May 29 2019Documento1 páginaPreference Shares - May 29 2019Tiso Blackstar GroupAinda não há avaliações

- Shoprite Food Index 2023Documento19 páginasShoprite Food Index 2023Tiso Blackstar GroupAinda não há avaliações

- Ramaphosa's Letter To MkhwebaneDocumento1 páginaRamaphosa's Letter To MkhwebaneTiso Blackstar GroupAinda não há avaliações

- Anti Corruption Working GuideDocumento44 páginasAnti Corruption Working GuideTiso Blackstar GroupAinda não há avaliações

- Ramaphosa's Letter To MkhwebaneDocumento1 páginaRamaphosa's Letter To MkhwebaneTiso Blackstar GroupAinda não há avaliações

- Ramaphosa's Letter To MkhwebaneDocumento1 páginaRamaphosa's Letter To MkhwebaneTiso Blackstar GroupAinda não há avaliações

- Shoprite Food Index 2023Documento19 páginasShoprite Food Index 2023Tiso Blackstar GroupAinda não há avaliações

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Documento2 páginasArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupAinda não há avaliações

- Collective InsightDocumento10 páginasCollective InsightTiso Blackstar GroupAinda não há avaliações

- Statement From The SA Tourism BoardDocumento1 páginaStatement From The SA Tourism BoardTiso Blackstar GroupAinda não há avaliações

- JP Verster's Letter To African PhoenixDocumento2 páginasJP Verster's Letter To African PhoenixTiso Blackstar GroupAinda não há avaliações

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Documento2 páginasLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupAinda não há avaliações

- Open Letter To President Ramaphosa - FinalDocumento3 páginasOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupAinda não há avaliações

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Documento2 páginasLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupAinda não há avaliações

- BondsDocumento3 páginasBondsTiso Blackstar GroupAinda não há avaliações

- Sanlam Stratus Funds - July 15 2020Documento2 páginasSanlam Stratus Funds - July 15 2020Lisle Daverin BlythAinda não há avaliações

- JudgmentDocumento30 páginasJudgmentTiso Blackstar GroupAinda não há avaliações

- FuelPricesDocumento1 páginaFuelPricesTiso Blackstar GroupAinda não há avaliações

- Sanlam Stratus Funds - August 6 2020Documento2 páginasSanlam Stratus Funds - August 6 2020Lisle Daverin BlythAinda não há avaliações

- FairbairnDocumento2 páginasFairbairnTiso Blackstar GroupAinda não há avaliações

- LibertyDocumento1 páginaLibertyTiso Blackstar GroupAinda não há avaliações

- Tobacco Bill - Cabinet Approved VersionDocumento41 páginasTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupAinda não há avaliações

- LibertyDocumento1 páginaLibertyTiso Blackstar GroupAinda não há avaliações

- Collective Insight September 2022Documento14 páginasCollective Insight September 2022Tiso Blackstar GroupAinda não há avaliações

- FuelPricesDocumento1 páginaFuelPricesTiso Blackstar GroupAinda não há avaliações

- Critical Skills List - Government GazetteDocumento24 páginasCritical Skills List - Government GazetteTiso Blackstar GroupAinda não há avaliações

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocumento1 páginaMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupAinda não há avaliações

- The ANC's New InfluencersDocumento1 páginaThe ANC's New InfluencersTiso Blackstar GroupAinda não há avaliações

- BondsDocumento3 páginasBondsTiso Blackstar GroupAinda não há avaliações

- Sanlam Stratus Funds - June 1 2021Documento2 páginasSanlam Stratus Funds - June 1 2021Lisle Daverin BlythAinda não há avaliações

- Bonds - June 8 2022Documento3 páginasBonds - June 8 2022Lisle Daverin BlythAinda não há avaliações

- Sources of FundsDocumento6 páginasSources of FundsNeetika KalyaniAinda não há avaliações

- Tema 11 ADODocumento74 páginasTema 11 ADORenzo Rivero FernándezAinda não há avaliações

- Financial Statements Analysis of "Alhaj Textile Mills Limited"Documento24 páginasFinancial Statements Analysis of "Alhaj Textile Mills Limited"Rohol Amin RajuAinda não há avaliações

- 3 - Introduction To Fixed Income Valuation-UnlockedDocumento53 páginas3 - Introduction To Fixed Income Valuation-UnlockedAditya NugrohoAinda não há avaliações

- Adfina 2Documento3 páginasAdfina 2Kenneth Lim OlayaAinda não há avaliações

- 001 - Sah Mill DPRDocumento23 páginas001 - Sah Mill DPRsatyamyadav44uAinda não há avaliações

- Do It!: Rules of OwnershipDocumento12 páginasDo It!: Rules of OwnershipJehan CodanteAinda não há avaliações

- Quiz 3Documento4 páginasQuiz 3ErionAinda não há avaliações

- Takeover and Defence TacticsDocumento31 páginasTakeover and Defence TacticsSachinGoelAinda não há avaliações

- Security Analysis and Portfolio - S. KevinDocumento595 páginasSecurity Analysis and Portfolio - S. KevinShubham Verma100% (1)

- Cheque Collection PolicyDocumento9 páginasCheque Collection Policynitu kumariAinda não há avaliações

- Profit and Loss and Balance SheetDocumento2 páginasProfit and Loss and Balance SheetmuditAinda não há avaliações

- Bajaj Electrical: (Bajele)Documento9 páginasBajaj Electrical: (Bajele)premAinda não há avaliações

- History of IFRS 7: Reclassification of Financial Assets (Amendments To IAS 39 and IFRS 7) IssuedDocumento5 páginasHistory of IFRS 7: Reclassification of Financial Assets (Amendments To IAS 39 and IFRS 7) IssuedTin BatacAinda não há avaliações

- Valix 17 20 MCQ and Theory Emp Ben She PDFDocumento48 páginasValix 17 20 MCQ and Theory Emp Ben She PDFMitchie FaustinoAinda não há avaliações

- Assignment of Financial ManagementDocumento7 páginasAssignment of Financial Managementhyder imamAinda não há avaliações

- Chapter 8 - Tangible Non-Current AssetsDocumento23 páginasChapter 8 - Tangible Non-Current AssetsSyed Huzaifa SamiAinda não há avaliações

- Financial Statements Analysis: Author: Tănase Alin-Eliodor, EVERET România DistributionDocumento12 páginasFinancial Statements Analysis: Author: Tănase Alin-Eliodor, EVERET România Distributionعبد المؤمنAinda não há avaliações

- Subsidize The Project To Bring Its IRR To 25%Documento4 páginasSubsidize The Project To Bring Its IRR To 25%Aprva100% (1)

- Marisa IklanDocumento30 páginasMarisa IklanFadell FmAinda não há avaliações

- Auditing The Expenditure Cycle: Chapter 15 (Tutor Financial Audit)Documento15 páginasAuditing The Expenditure Cycle: Chapter 15 (Tutor Financial Audit)Himawan TanAinda não há avaliações

- Buy Back of SharesDocumento32 páginasBuy Back of SharesSiddhant Raj PandeyAinda não há avaliações

- Nucleon Case Solution - WorkingDocumento2 páginasNucleon Case Solution - WorkingRitik MaheshwariAinda não há avaliações

- Pocket Tax Book 2023Documento120 páginasPocket Tax Book 2023Hary GunawanAinda não há avaliações

- Investment and Portfolio Management Midterms ReviewerDocumento7 páginasInvestment and Portfolio Management Midterms ReviewerJerome ReboccaAinda não há avaliações

- 1.cash Flow Material - T S Grewal 01.12.2018Documento78 páginas1.cash Flow Material - T S Grewal 01.12.2018Upendra bhati100% (1)

- Moody's A Rms Ratings of Ping An Life, Ping An P&C, and POAH Outlook Stable A RM Ratings of Ping An Bank Changes Outlook To Stable From PositiveDocumento16 páginasMoody's A Rms Ratings of Ping An Life, Ping An P&C, and POAH Outlook Stable A RM Ratings of Ping An Bank Changes Outlook To Stable From PositivechongjhuangAinda não há avaliações

- Cash Receipt PDFDocumento1 páginaCash Receipt PDFMarsa ArrahmanAinda não há avaliações

- Guese, Christian Nicolas A FM 2-3 Financial Management Practice Problem MidtermDocumento1 páginaGuese, Christian Nicolas A FM 2-3 Financial Management Practice Problem MidtermGuese, Christian Nicolas AAinda não há avaliações

- Cash Flow Brigham SolutionDocumento14 páginasCash Flow Brigham SolutionShahid Mehmood100% (4)