Escolar Documentos

Profissional Documentos

Cultura Documentos

Enviado por

Kishore KumarTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Enviado por

Kishore KumarDireitos autorais:

Formatos disponíveis

Roundtable

FINDING A WINNING PRIVATE

BANKING STRATEGY IN INDIA

India’s private banking and industry a more structured way to

wealth management leaders need to develop and ensure higher standards

think long term – and on a bigger – for example, creating registers of

scale than anything which exists today advisers which have been engaged in

– if they are to take full advantage of wrong-doing, in turn creating more

the many opportunities in the market. trust and confidence among clients.

This requires the industry to over- Another key challenge highlighted is

come the many challenges it faces. the fact that many firms in India en-

These include the changing dynamics gage in private wealth management –

of the market, far-reaching regulatory not private banking.

changes over the past two to three

years, high cost-income ratios, a shal- And with more than 40% of savings

low talent pool, the race for assets, going into real estate, organisations

and a limited product set. which don’t have a lending proposition

and just rely on wealth management

Collaboration is one way to achieve a or private banking might find it diffi-

consistent and united voice as a start- cult to make money.

ing point, said participants. As is pro-

active and appropriate regulation. The right business model might also

require a move away from the tradi-

These were some of the thoughts of tional and Western-style asset-gath-

chief executive officers (CEOs) and ering approach, and instead towards

other senior management in the In- ensuring profitability by only taking on

dian private banking and wealth man- client assets which yield a return on

agement market at a private round- capital.

table discussion hosted by Hubbis in

Mumbai in April 2012. A potential way the industry might

evolve is also through fragmentation

Ultimately, succeeding in Indian pri- of firms and clients – given that many

vate banking might mean building a clients are model-agnostic so pick-

new type of business, said some CEOs, and-choose what is best-in-class from

given that the industry was so focused a particular model.

pre-2008 on execution rather than

training relationship managers and In terms of some of the other emerg-

educating clients. ing opportunities, industry leaders

said there is some potential for an

For further information, This requires firms to first get togeth- external asset management model as

please contact: er to work towards the establishment a complementary offering. Further,

of a more robust industry, and there- there needs to be a shift from a prod-

Hansi Mehrotra

fore to be patient. uct strategy to a portfolio strategy to

Managing Director, India

Hubbis bring the right offering to those clients

T 91 22 4070 0371 Yet there is strong demand, it seems, who are willing to pay for advice.

E hansi.mehrotra@hubbis.com for a self-regulatory body to give the

Hansi Mehrotra | Managing Director, India | T 91 22 4070 0371 | E hansi.mehrotra@hubbis.com 1

FINDING A WINNING PRIVATE BANKING STRATEGY IN INDIA

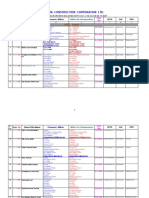

Chairperson

Hansi Mehrotra

Managing Director, India

Hubbis

Participants

Ajay Bagga Nitin Rao

Head of Private Wealth Management Senior Executive Vice President

India Private Banking Group & Third Party Products

Deutsche Bank HDFC Bank

Amit Pande Rajesh Saluja

Head Privee, Private Banking Chief Executive Officer & Managing Director

Axis Bank ASK Wealth Advisors

Anshu Kapoor Rohit Bhuta

Head, Private Wealth Management Chief Executive Officer

Edelweiss Capital Religare Macquarie Private Wealth

Anurag Seth Sameer Kaul

Head, Global Wealth Management Head & Global Market Manager, India

Quant Capital Advisors Citi Private Bank

PR Dilip Sharad Sharma

Managing Director Country Head, Wealth Management

Impetus Wealth Management BNP Paribas Wealth Management

Karan Bhagat Shiv Gupta

Managing Director & Managing Director, Private Banking India

Chief Executive Officer RBS Private Banking

IIFL Private Wealth Management

In the shorter term, therefore, it is tablishing specific plans, firms need to

about doing what it takes tactically to think shorter term with specific mile-

INDUSTRY TRENDS & achieve individual milestones so each stones. And for foreign players, global

OUTLOOK firm can meet the goals it sets as part parent companies must be supportive

of the longer term strategy. of these timeframes.

Hansi Mehrotra: As a starting point,

From our perspective, the scale needs Sharad Sharma: I have a slightly dif-

what is your outlook for the private

to be much larger than anything which ferent view after being a practitioner

banking industry in India, and how are

exists in the market today. for 10 years in the wealth manage-

you positing your organisations?

ment space as a foreign player. We

This means that the focus should be saw good growth of wealth manage-

Shiv Gupta: When I think about the

much longer than four or five years, ment business in the past, especially

outlook for private banking in India,

even if this creates forecasting and from 2004 to 2007.

we should all look at the industry as

planning difficulties.

something which we need to scale if

However, the industry now faces vari-

we are to take full advantage of the

Hansi Mehrotra: So what does long ous issues, such as changing dynam-

opportunities over the long term.

term in a private banking strategy? ics of the market and the regulatory

changes over the past two to three

This requires all market leaders to po-

Shiv Gupta: When establishing stra- years. After seeing what is happen-

sition themselves in a way which can

tegic intent, this means thinking over ing in India, my personal view is that

do this.

the next five to 10 years; but when es- banks create suitable platforms for

Hansi Mehrotra | Managing Director, India | T 91 22 4070 0371 | E hansi.mehrotra@hubbis.com 2

FINDING A WINNING PRIVATE BANKING STRATEGY IN INDIA

Nitin Rao

HDFC Bank

meeting their clients’ needs even if Rohit Bhuta: The industry has shot are asking for direction and leadership

this may require segregation of their itself in the foot. Pre-2008, it was but are not getting it simply because

private banking businesses. all about execution, and clients and there is no know how of how to.

advisers were all making money, so

With a hybrid model, there is a fair firms didn’t focus on training rela- I am looking for advisers with the right

amount of duplication that has cost tionship managers (RMs) effectively. skill-set but I can’t find them, and

and compliance implications. As a re- RMs moved from one organisation to that’s a conundrum.

sult, we have to have clear rules stat- another, receiving salary increases of

ing what is possible to do within the anywhere from 10% to 50%, and we So while having a three- to five-year

existing platforms. are now finding ourselves in a situa- outlook is great, as an industry we need

tion where the remuneration levels are to accept that while we go through the

This won’t happen quickly, so taking not in line with their underlying skill- training and education process, we will

a view over three to five years is a set. Many firms are finding that clients lose first before we gain.

reasonable timeframe.

Nitin Rao: Somebody recently asked

me whether we could grow the busi-

ness five-times in the next three years

and I almost fell out of my chair. There

are many challenges, and post-regula-

tory changes we need to build a new

type of business.

Given that the costs are high, while

income is increasingly difficult, re-

building the business has to be done

in a viable way. As a result, I see con-

solidation over the next year or so.

Then, when there is a recovery and

firms start making money, better cost-

income dynamics will make it possible Hansi Mehrotra

to grow the business. Hubbis

Hansi Mehrotra | Managing Director, India | T 91 22 4070 0371 | E hansi.mehrotra@hubbis.com 3

FINDING A WINNING PRIVATE BANKING STRATEGY IN INDIA

We must all admit first and foremost

that a robust wealth management in-

dustry has not in fact existed in India.

Acceptance is half the battle won – we

then need to get together as industry

leaders to work towards the establish-

ment of the industry. There will in-

evitably be losses before any business

of significance can be achieved – pa-

tience must be the name of the game

at least for the next 24 to 36 months.

Amit Pande: Even though Indian

private banking is clearly a long-term

business, the industry is going through

a consolidation phase right now, and

Sameer Kaul

internally every firm is going through Citi Private Bank

its own challenges at the moment,

either locally or globally, as a result Sameer Kaul: Income appears to be Further, I agree that there is a lack of

of the rising cost-income pressures. falling while costs continue to rise, and talent, and many people are not really

However, firms are are contributing to I am curious as to whether enough private bankers in the true sense, and

the increasing costs because many of firms in the industry are really think- instead just push products.

us are competing for the same amount ing about the cost-income challenge.

of manpower. For Citi, our thought process is to con-

A key challenge to address is the fact tain expenses and hire selectively peo-

The industry is facing a challenge in that most firms in India do private ple with a certain amount of vintage

scaling up the advisory calls across wealth management – not private who can add value to our clients. We

all clients because of capability is- banking. With roughly 42% of the also have a very defined target market

sues among the client relationship savings of clients in this country go- for private banking clients, and we see

side of business, therefore leading to ing into real estate, firms which don’t opportunities in terms of leveraging

deviations between model versus cli- have a lending proposition and just and real estate.

ent portfolios. This is leading to the rely on wealth management or private

dilution of value proposition which the banking will find it difficult to make Increasingly, when we start to deal

platform brings to the clients. money. with clients who have more than 50

to 100 crores which they want us to

manage, we are walking away from

transactions because there’s nothing

on the table. Further, there is increas-

ing price-cutting by some local and

multi-national players.

Shiv Gupta: I was somewhat encour-

aged when there was talk previously

in the industry about a self-regulatory

body, whether this is supervised or

not, because getting together in a

slightly more structured way would be

a forum to address these issues. For

example, creating registers of advisers

which have been engaged in wrong-

Amit Pande doing will help to strengthen the in-

Axis Bank dustry in the long run.

Hansi Mehrotra | Managing Director, India | T 91 22 4070 0371 | E hansi.mehrotra@hubbis.com 4

FINDING A WINNING PRIVATE BANKING STRATEGY IN INDIA

formance reviews – whereas a person

who is totally independent gives unbi-

ased advice which the client is able to

understand and accept.

Revenue models based on pure advi-

sory fees increase the trust-level of

the client. However, at present, advis-

ers in India don’t have much of pricing

power, partly because of the lack of

awareness about the need for prudent

financial planning or asset allocation,

and partly because of the general lack

of trust.

Anshu Kapoor I find that clients insist on meeting the

Edelweiss Capital senior-most official in the organisation,

even though other wealth managers

are very adequately experienced and

In addition, whether it is called pri- The challenges include people, in well-qualified. This creates a problem

vate banking or private wealth man- terms of trying to create a supply in terms of being able to scale up the

agement, firms need to find a vehicle chain, and also penetration, in terms business. The most sought-after ser-

which allows them to aggregate which- of trying to do more with each client vice model by UHNIs is a blend of the

ever products and services they offer given that owner-promoters have two size and scale of a large organisation

as efficiently as possible – whether balance sheets – the corporate side combined with highly personalized

these include banking, investment and the private wealth. Also, creating services of small financial boutique.

services, wealth planning, credit ser- distribution by using technology is a

vices or whatever other overlays they hurdle to overcome, for example use Nitin Rao: My approach is to take the

choose to provide. mobile offerings to deliver services or 150 people within private banking who

client experience at lower cost, and to were each providing a mix of products

So I would like to see a distinct um- provide scale. and services, and then segregating

brella regulatory framework with a their duties.

clear set of guidelines which address- Our approach has been to try to invert

es all the activities we provide and a the cost structure in some way by cre- This has involved us having 100 in-

vehicle which firm can use in an ef- ating an independent consulting mod- dividuals who have an investment

ficient way to be able to deliver that, el, where we try to find entrepreneurs

whether this is an NBFC or a bank. rather than employees and give them

access to our entire platform. We’ve

hired about five to six people to do

FINDING THE RIGHT this so far, and the results are encour-

aging. They use our brand to support

BUSINESS MODEL and train them. Because they are in-

dependent, there is no fixed cost.

Anshu Kapoor: We believe that the

PR Dilip: In my experience, the most

opportunity in India will surprise us,

effective financial adviser is one who

so we need to find the right revenue

can think independently without bear-

and business models.

ing in mind any of the his own busi-

ness imperatives while advising a

However, what’s happened to date is

client. Someone who is employed

that we’ve copied the global wealth

within an organisation works under a

management asset-gathering ap-

proach. Yet clients in India are differ-

controlled environment – often with PR Dilip

ent.

weekly, monthly and quarterly per- Impetus Wealth Management

Hansi Mehrotra | Managing Director, India | T 91 22 4070 0371 | E hansi.mehrotra@hubbis.com 5

FINDING A WINNING PRIVATE BANKING STRATEGY IN INDIA

background to operate as plain vanilla

bankers, making it possible to run a vi-

able cost-income model at that end of

Many clients, even in the UHNI

the organisation. We have then taken

the other 50 or so advisers to develop

them into mid-tie private bankers, tar-

geting the 1 to 10 crore segment. Over

that we can then build the UHNI prop-

segment, still don’t use third-party

osition and offer family office services.

This creates a feed of talent to service wealth managers and prefer to remain

dependent on their chartered accountants

the different client segments.

Rajesh Saluja: While the long-term

opportunity is clear, I don’t think the

industry has got going yet. It’s not

or tax advisers.

there either in terms of client sophisti-

cation or quality of advisers. Also, the

products we offer tend to be vanilla

most of the time.

This focus on profitability is also the and auditing the sales process, will

In the short term, therefore, the strat- case for foreign players, which used create more trust and confidence

egy for many firms is to look at offer- to have a much longer horizon in In- among client. Many clients, even in

ing alternative investments which are dia but today don’t want to accept 10 the UHNI segment, still don’t use third

proprietary in nature and for which the years of loss-making with bloated cost party wealth managers and prefer to

margins are better – especially in real structures. remain dependent on their chartered

estate and private equity. accountants or tax advisers.

This will lead to some short-term pain

A big change that I foresee going for- as firms downsize to change costly Ajay Bagga: There are various dy-

ward is a move away from the previ- structures. namics to bear in mind as we look at

ous focus on building AUM. Instead, the private banking industry. First, it

profitability is now key, so many firms Another big factor which will take the is coming off the back of multi-year

will move away from unprofitable cli- industry to a different level is clearly product non-performance, so now is

ents and from taking on AUM which regulation, where doing things like the time to look at cost-income ratios,

doesn’t yield good returns on capital. having registered advisers and firms, and it is creating a cautious mind-set.

Ajay Bagga

Deutsche Bank

Hansi Mehrotra | Managing Director, India | T 91 22 4070 0371 | E hansi.mehrotra@hubbis.com 6

FINDING A WINNING PRIVATE BANKING STRATEGY IN INDIA

Given the limited product set, firms

have to rely on technology, the

aggregation of information, and

possibly the good administration of

assets to differentiate themselves.

Karan Bhagat

IIFL Private Wealth Management

Secondly, there will always be a few el, and on mind share, which is what Going forward, most clients which are

less rational players in the industry clients are looking for. today giving us a retention of 55 to

among the 25 or so players which will 70 basis points should move towards

look to buy market share. Karan Bhagat: From a client perspec- 100 to 120 basis points. This will be

tive, average returns for the last five possible if the structure allows it and

Thirdly, the macro outlook for India years on a compounded basis, subject if we can add some kind of alpha to

has been revised negatively, so most to a client managing their portfolio the portfolio.

foreign firms are likely to explore the very well, would be in the region of

options of China and then Indonesia 7% to 9%. And that too, if two-thirds Given the limited product set, firms

before India. of their assets had most likely been in have to rely on technology, the ag-

fixed income rather than equities. As gregation of information, and possibly

Fourthly, when we look at mutual fund a result, the quantum of commissions the good administration of assets to

AUM, it has gone down to June 2009 earned will automatically be capped. differentiate themselves.

levels, and people are moving out of

the insurance sector too. This is bring-

ing a lot of pressure on fees, which is

impacting private banks.

Finally, when I look to the future,

firms need to keep a close watch on

the bottom line to ensure they can

continue to survive. I think customers

are model-agnostic and will pick and

choose what is best-in-class from a

particular model. As a result, I don’t

think there will be consolidation, and

instead we will see fragmentation of

firms and clients.

Anurag Seth: I agree that the indus-

try will stay fragmented, and firms are

struggling between focusing on mar- Shiv Gupta

ket share, through a discounting mod- RBS Private Banking

Hansi Mehrotra | Managing Director, India | T 91 22 4070 0371 | E hansi.mehrotra@hubbis.com 7

FINDING A WINNING PRIVATE BANKING STRATEGY IN INDIA

At the moment, it seems the crucial

factor is the survival as models evolve.

But I think we will see wealth manage-

ment at least in the form of preferred

banking leapfrog, in the same way as

we saw in the telecom industry.

Rajesh Saluja: We are seeing issues

around scalability in the UHNI seg-

ment. These clients want to interact

with the most senior person in the or-

ganisation, because they believe these

individuals have the knowledge and

probably will have more continuity.

Rohit Bhuta That means three or four people re-

Religare Macquarie Private Wealth gardless of how many advisers we

have. So even if we scale the business

to 50 advisers, for example, there will

With AIF guidelines and other instru- performance from a correlation per-

only be a handful of people which are

ments, I hope to see more diversity of spective, whether over a one-year or

really managing clients. This is to do

portfolios. Once that happens, clients five-year timeframe. So given the mar-

with trust, as well as a loss of faith

won’t be against paying a certain per- ket circumstances over the past year

from clients as they see RMs continu-

centage of their returns. or so, we should be realistic about the

ing to move firms. Even when we hire

extent to which any structural trans-

new advisers, we need to look at how

formation can take place.

much in AUM they actually bring with

A UNITED & Rohit Bhuta: It is important that as

them – as it is only about 10% to 20%

CONSISTENT VOICE an industry we continue to come to-

maximum.

gether on a regular basis to discuss

There are no magic answers because

our macro issues, industry issues,

Hansi Mehrotra: What would you as of the limited resources available. But

training issues and others, as a cat-

industry leaders aim to achieve if you to expand the wealth management

alyst to the establishment of a more

were to get together more often to business and acquire more clients will

formal wealth management industry.

discuss the various issues such as we

have touched on already?

It is about saying the same things in

the same language to encourage regu-

Shiv Gupta: We need to be realistic,

lators to ultimately establish this in-

in the sense that most firms enter the

dustry.

market driven by a certain amount of

self-interest, so look to do what they

This will however only work if the fo-

think is the right combination of activi-

rum is taken in the right spirit, which

ties for them and their objectives.

is for the betterment of the industry,

and not used to judge each others’

With this in mind, regulation of any

businesses.

nature – whether it is supervised or

self-regulated by the industry – will

Ajay Bagga: A key issue we face as

create higher standards in the indus-

an industry is that we call ourselves

try and improve its credibility overall.

private bankers, but we need to be

clear about what we are really offer-

One of the challenges for private bank-

ing which a small time broker in the

ing is that there is always a dispro-

local neighborhood cannot provide to Rajesh Saluja

portionate contribution from market

the investors. ASK Wealth Advisors

Hansi Mehrotra | Managing Director, India | T 91 22 4070 0371 | E hansi.mehrotra@hubbis.com 8

FINDING A WINNING PRIVATE BANKING STRATEGY IN INDIA

To be able to scale this, we would As a result, we all need to be con-

need to identify good quality people cerned about who we are putting in

in different parts of the country and front of the client, in terms of the in-

they would act as channel-partners to tegrity of that individual. The indus-

service the clients directly. try would benefit from having higher

industry standards which will make it

Rajesh Saluja: I think there is a re- more difficult for people to be wealth

quirement in the Indian market for ex- managers than is the case today.

ternal asset managers, but scalability

is an issue. Nitin Rao: We now have a more de-

tailed bank audit to make it compul-

Also, a lot of UHNIs have their own sory for our private bankers to focus

set-ups along these lines already, with on the sales processes too.

chartered accountants and chief finan-

Anurag Seth cial officers working for them. This includes checking emails and

calls, and we find that some people

Quant Capital Advisors However, it is in the mid-market and look to escape these controls by join-

for new wealth creators where the ing another organisation where these

requirement is coming from. These processes are not audited.

clients see value in independent ad-

visers, as long as they are working as I encourage regulation and such au-

rely on the average age of a private

part of an organisation. dits to be consistent so that advisers

banker to increase to around 40.

cannot move firms and work without a

Also, we need to be clear that the ex- structured process.

ternal asset management model, or

EMERGING family office as we call it in India, is a Anurag Seth: Something else the in-

OPPORTUNITIES long way at the moment from what it

is internationally.

dustry needs to debate is how to move

from a product strategy to a portfolio

strategy.

Hansi Mehrotra: To what extent will Sameer Kaul: In terms of opportuni-

the Indian follow what’s happened in ties going forward, I am seeing that Margins are coming down, but there

Europe and Singapore in the develop- clients will give money to firms who are enough clients who are willing to

ment of the external asset manage- create new ideas for them. Giving cli- pay, provided we bring them the right

ment model, given that clients want ents pass-backs is a lose-lose situa- product strategies.

their advisers to be slightly older, tion.

more experienced and better trained?

But creating ideas either through your

PR Dilip: By outsourcing the custodial own proprietary network or through

services from a reputed bank, at Im- a third party will lead to product dif-

petus we have reduced the back-office ferentiation, and the conversation

load on our organisation and increased with clients won’t be focused on pass-

the comfort-levels of our clients. backs.

As a result, we don’t need to have a A concern I have about the industry in

very big team for back-end activities. India is that the threshold for people

Instead of having separate teams for to enter it and become a wealth man-

sales, investor profiling, and portfolio ager in India is very low.

construction and implementation, if a

well-trained professional takes the in- Unlike in the US, where you have cer-

vestor through the entire process, it tification, which not everybody pass-

enhances the confidence and comfort es, the entry standards in India seem Sharad Sharma

levels of the investor. lower. BNP Paribas Wealth Management

Hansi Mehrotra | Managing Director, India | T 91 22 4070 0371 | E hansi.mehrotra@hubbis.com 9

Contact details and profiles of participants

Sameer Kaul Amit Pande Anshu Kapoor

Head & Global Market Manager, India Head Privee, Private Banking Head, Private Wealth Management

Citi Private Bank Axis Bank Edelweiss Capital

Sameer joined Citibank, India, in July Amit is currently working as Head, A CFA and a business management

1995 as a Management Associate in Privee & Investment Advisory Group. graduate from Delhi University, Anshu

Operations. In his 17 years with the He is the business head of the private brings with him over 15 years of ex-

bank, he has done various assign- bank and also is responsible for driv- perience in Private Banking, Interna-

ments across different functions and ing the research function for captive tional Financial Markets and Consumer

businesses. He set up insurance dis- / third-party products across asset Banking. At Edelweiss, he heads the

tribution for the bank, has run the classes / products covering all client Private Wealth Management business.

mortgage business and was the busi- segments for the bank. Amit also man- Prior to joining Edelweiss, Anshu was

ness head of the branch banking busi- ages the investment advisory proposi- a Director at Merrill Lynch in India,

ness running a network of 42 branch- tion for the bank where-in the finan- where he was instrumental in devel-

es across 30 cities. In January 2001, cial planning capabilities are housed oping the Private Banking Investments

as the Country Insurance Manager, from the standpoint of managing cli- Advisory platform and the cross-bor-

he spearheaded the launch of Insur- ents’ portfolios. He comes with a sig- der business that straddled the Middle

ance Business for Citibank in India. nificant amount of work experience East, Asia Pacific and North America.

He moved as the Mortgage Business spanning across 14 years in various He brings with him expertise in Inter-

Head in August 2005 and after suc- business’ viz, private bank, portfolio national Financial Markets owing to his

cessful completion of the ARR, moved management services and asset man- earlier stint with HSBC Private Bank in

to the Branch Banking business as the agement companies and has worked Dubai.

Business Manager in July 2007. He ran with firms like HSBC Private Bank,

a network of 42 branches that spans Goldman Sachs, ICICI Prudential AMC Contact details:

30 cities and a business that delivers and Franklin Templeton AMC, among E Anshu.kapoor@edelcap.com

more than US$100 million of revenue. others, in the past. He is a Post Grad-

uate Diploma in Planning & Manage-

Contact details: ment and a graduate from University

E sameer.kaul@citi.com of Delhi. He is an avid reader and

cherishes unwinding with his three-

year old daughter and by running as

he a marathoner.

Contact details:

E amit.pande@axisbank.com

Hansi Mehrotra | Managing Director, India | T 91 22 4070 0371 | E hansi.mehrotra@hubbis.com 10

Contact details and profiles of participants

Ajay Bagga Rohit Bhuta Karan Bhagat

Head of Private Wealth Management Chief Executive Officer Managing Director &

India Religare Macquarie Private Chief Executive Officer

Deutsche Bank Wealth IIFL Private Wealth Management

Ajay has 22 years of experience in With over 20 years of experience Karan is Managing Director & Chief Ex-

the financial services segment, hav- spanning seven key markets globally, ecutive Officer of IIFL Private Wealth.

ing worked with global giants like Rohit is a thought-leader in the finan- He joined India Infoline Group (now

Deutsche Bank, Citigroup and General cial services industry, with extensive re-named IIFL) to set-up IIFL Wealth

Electric, as well as asset managers like knowledge in the Wealth Manage- Management in early 2008 and is one

Pioneer ITI, Kotak Mahindra and Lo- ment space. He has worked with the of the founding members. Karan is re-

tus India Asset Management Company. Macquarie group for over 18 years in sponsible for providing direction and

He is a member of the India Execu- various capacities and geographies, leadership towards the achievement

tive Committee of Deutsche Bank. He including Australia, Singapore, Malay- of the organisation’s philosophy, mis-

also serves as a member of the Asia sia, South Africa, Hong Kong and now sion, vision and its strategic goals and

Executive Committee of Private Wealth in India. He worked in the UK (two objectives. He has built a team of ex-

Management at Deutsche Bank and is years) and New Zealand (two years) perienced and talented professionals

a Director on the Board of Deutsche prior to joining the Macquarie Group. from within and outside the industry,

India Investments. Ajay has also been Rohit joined the board of Religare who work with and for some of the

the Chairman of the Financial Planning Macquarie Private Wealth as Director most distinguished wealthy families in

Standards Board of India, and he has in June 2009, and took over the re- India and abroad. He has a decade of

served on various industry committees sponsibility of Chief Executive Officer financial services industry experience,

and think-tanks. He is a regular con- in September 2010. His strong domain starting his career with Kotak Wealth

tributor to electronic and print media technical knowledge is complemented Management. Karan holds an MBA in

on the financial markets and banking, by his high sense of empathy, logical finance from the Indian Institute of

as well as on financial planning and reasoning and coaching, placing him Management, Bangalore, and acquired

investment management. Ajay is a within an elite visionary leadership his Bachelor’s Degree in Commerce

PGDBM from XLRI, Jamshedpur, and a groups. He also sits on the board of from St. Xavier’s College, Calcutta.

CFP as well as a Certified Mutual Fund Brainwave Australia; an Australian

and Life Insurance Advisor. charity organization involved in assist- Contact details:

ing children with brain illnesses, and E karan@iiflw.com

Contact details: has also recently joined the advisory

E ajay.bagga@db.com board of Mewsic for Children, a Brett

Lee foundation set up to help under

privileged Indian children through mu-

sic.

Contact details:

E rohit.bhuta@religaremacquarie.com

Hansi Mehrotra | Managing Director, India | T 91 22 4070 0371 | E hansi.mehrotra@hubbis.com 11

Contact details and profiles of participants

Nitin Rao Rajesh Saluja Shiv Gupta

Senior Executive Vice President Chief Executive Officer & Managing Director

Private Banking Group & Managing Director Private Banking India

Third Party Products ASK Wealth Advisors RBS Private Banking

HDFC Bank

Rajesh is the CEO & Managing Director Shiv Gupta is Managing Director, Pri-

Nitin has had a career spanning across for ASK Wealth Advisors, a subsidiary vate Banking, RBS NV India. RBS

manufacturing, management consul- of the ASK Group in India. The ASK Private Banking is part of the RBS

tancy, equity research on the buy and Group, with over 28 years of experi- Wealth Division. He is also a member

sell sides, product management and ence in capital markets and equity of the RBS India Executive Committee

private banking spanning over two research, pioneered the concept of headed by Meera H. Sanyal, Country

decades. Prior to joining HDFC Bank, Discretionary Portfolio Management Executive for India. Based in Mumbai,

he had stints with organisations like Services in India in 1983. Rajesh has Shiv oversees all aspects of RBS’ Pri-

AFF Ferguson, Khandwala Securities over 23 years’ experience across sales, vate Banking business in India which

& BNP Paribas. He joined the bank in product and business management in has 85 staff including 28 private bank-

2002 and since then he has been in- the Consumer Banking, Wealth Man- ers located in four offices across the

strumental in building the award-win- agement and Private Wealth Advisory country. Shiv has been a part of the

ning private banking services. Apart industries. He joined the ASK Group in RBS Group for 11 years and as one of

from supporting the bank’s research, Dec 2006 to set up the wealth advi- the founding members of the Coutts

he has also built a strong third-party sory business for the UHNI segment in International South Asian business,

product distribution business where India and abroad. Today ASK Wealth was instrumental in growing it into

HDFC Bank is leader. Nitin’s educa- Advisors is one of India’s leading and one of the most successful in the re-

tional background includes graduating most respected wealth advisory and gion. Prior to India, he was based in

in Mechanical Engineering in 1988, fol- family office players and is credited for Singapore managing the NRI business

lowed by post-graduation in manage- pioneering the concept of fee-based in Asia Pacific in addition to the Thai-

ment from the Symbiosis Institute of wealth advisory services in India. Prior land market. Born in India, Shiv is an

Business Management, Pune, in 1992. to joining the ASK group, Rajesh was Economics graduate of the University

the Business Head, Priority Banking & of Delhi.

Contact details: Deposits for the Wealth Management

E nitin.rao@hdfcbank.com business of Standard Chartered Bank Contact details:

in India. He holds a Bachelor degree E shiv.gupta@rbs.com

in Maths & Economics and a Masters

in Marketing Management.

Contact details:

E rsaluja@askwealthadvisors.com

Hansi Mehrotra | Managing Director, India | T 91 22 4070 0371 | E hansi.mehrotra@hubbis.com 12

Contact details and profiles of participants

Anurag Seth P. R. Dilip Sharad Sharma

Head, Global Wealth Management Managing Director Country Head, Wealth Management

Quant Capital Advisors Impetus Wealth Management BNP Paribas Wealth Management

Anurag has 13 years of experience in PR Dilip is the Founder of Impetus A career banker, Sharad has over two-

Private Banking and Wealth Manage- Wealth Management, which was es- and-a-half decades of experience in the

ment. He is currently Director and tablished in 1994. He has nearly two industry. Over the years, he has worked

Head, Global Wealth Management at decades of rich experience in the In- in forex treasury, corporate banking and

Quant Capital Advisors, India , driv- dian Capital Markets in various capaci- retail banking, liability management,

ing the Wealth Management business ties, including 10 years in the Portfolio operations and most recently, in wealth

set up and advisory process. Has been Management & Wealth Management management. He is currently Country

successful in launching a holistic ad- domain. His endeavour has been to Head, Wealth Management, India and

visory model at Quant Capital, in line ensure the highest transparency and Member, Executive Management Com-

with a client-centric approach. Prior proficiency in all the businesses con- mittee, BNP Paribas India. For the past

to joining Quant Capital, Anurag had ducted by Impetus. He is a focused 10 years, he has led the wealth manage-

a long stint with Standard Chartered Portfolio Manager, who believes in ment initiative for BNP Paribas Wealth

Bank and was Head, Wealth Advisory, educating an investor before accept- Management by creating a successful

India. He was instrumental in driving ing his or her account under Portfolio model for the onshore business. He has

Wealth Advisory business during his / Wealth Management. His emphasis been with BNP Paribas since 1989 and

11-year tenure with the bank. Dur- has always been in an extensive pro- has held key management positions in

ing this time, the Wealth Management cess-driven investment approach and New Delhi, Kolkata and Mumbai during

business built momentum and was has a successful track record of having his tenure at the bank. Prior to BNP

awarded with Best Structured Product established such systems in the past. Paribas, Sharad Sharma was with the

(Distribution) award and also CNBC Identifying the right fusion of diversi- State Bank of India for seven years. He

Best Financial Advisor awards for fied asset classes is only the starting is a Member on the Board of BNP Pari-

2008 and 2011. Anurag is an INSEAD, point of his meticulous Wealth Man- bas Investment Services India Private

France Alumni and graduated from agement process. Limited and Financial Planning Stan-

SRCC, Delhi University. dards Board (FPSB), India. He holds a

Contact details: Master’s Degree in Financial Manage-

Contact details: E prdilip@impetusindia.in ment from Jamnalal Bajaj Institute of

E anurag.seth@quantcapital.co.in Management Studies, Mumbai. He is

also a Certified Associate of Indian In-

stitute of Bankers and has received CFP

certification by FPSB, India.

Contact details:

E sharad.sharma@asia.bnpparibas.com

Hansi Mehrotra | Managing Director, India | T 91 22 4070 0371 | E hansi.mehrotra@hubbis.com 13

Você também pode gostar

- Akhil SIP ReportDocumento46 páginasAkhil SIP ReportneoakhilAinda não há avaliações

- B Civil Contractors EmapnelmentDocumento2 páginasB Civil Contractors EmapnelmentSamir KhanAinda não há avaliações

- Placement Brochure - CPIBMDocumento68 páginasPlacement Brochure - CPIBMAmrut GodboleAinda não há avaliações

- List of Honorary Animal Welfare OfficersDocumento16 páginasList of Honorary Animal Welfare OfficersrohanagarwalAinda não há avaliações

- List1D PDFDocumento17 páginasList1D PDFAnonymous XMMpzpWDxAinda não há avaliações

- Citibank DSA Delhi DetailsDocumento2 páginasCitibank DSA Delhi DetailsAmeer PAinda não há avaliações

- Contact Details of Franchisee Sl. Ssa PSA Name & Address of Franchisee Name of Contact Contact No. E-Mail Fax No. No. PersonDocumento4 páginasContact Details of Franchisee Sl. Ssa PSA Name & Address of Franchisee Name of Contact Contact No. E-Mail Fax No. No. PersonRahul PaulAinda não há avaliações

- Chartered Accountantsand Tax Practitioners DirectoryDocumento3 páginasChartered Accountantsand Tax Practitioners DirectoryJash DalalAinda não há avaliações

- Ping 6Documento16 páginasPing 6Spartacus CaesarAinda não há avaliações

- Gurgaon (W)Documento39 páginasGurgaon (W)Mayank SharmaAinda não há avaliações

- CafrcallDocumento10 páginasCafrcallDhawal BarotAinda não há avaliações

- List of Approved NEEM FacilitatorsDocumento5 páginasList of Approved NEEM FacilitatorsCampus ConnectAinda não há avaliações

- The New India Assurance Co. Ltd. (Government of India Undertaking)Documento7 páginasThe New India Assurance Co. Ltd. (Government of India Undertaking)Jayanthi C RAinda não há avaliações

- Subhash Pipeline JuneDocumento6 páginasSubhash Pipeline JuneAbhishek KesarwaniAinda não há avaliações

- List of IP - I Registred Company As On 30 Sept 22 - 0Documento146 páginasList of IP - I Registred Company As On 30 Sept 22 - 0Abhishek ChimankareAinda não há avaliações

- NSDL Pan CenterDocumento16 páginasNSDL Pan CenterMahakaal Digital PointAinda não há avaliações

- List of Land Purchase Permission exceeding 10 HectaresDocumento40 páginasList of Land Purchase Permission exceeding 10 HectaresSnehal PatelAinda não há avaliações

- Dat 1Documento150 páginasDat 1Arsh AhmadAinda não há avaliações

- ENLISTMENT - JOB - WORKER OdishaDocumento74 páginasENLISTMENT - JOB - WORKER OdishaSarang MohideAinda não há avaliações

- List 1 of CA Articleship Firms in Delhi - CAknowledgeDocumento19 páginasList 1 of CA Articleship Firms in Delhi - CAknowledgeIasam Groups'sAinda não há avaliações

- Tondiyarpet Outlet DataDocumento114 páginasTondiyarpet Outlet DataSK Business groupAinda não há avaliações

- Consultants in Indian CitiesDocumento12 páginasConsultants in Indian Citiesapi-3748797100% (2)

- Ist of Organizations Offering ScholarshipsDocumento5 páginasIst of Organizations Offering ScholarshipsShivam singhAinda não há avaliações

- Near Buy DataDocumento3.379 páginasNear Buy DataNavneet GargAinda não há avaliações

- Dealers Directory of SitapurDocumento68 páginasDealers Directory of SitapurYash GuptaAinda não há avaliações

- Contact InformationDocumento11 páginasContact Informationdevraj09Ainda não há avaliações

- HrjobsDocumento15 páginasHrjobsapi-19473092Ainda não há avaliações

- POP DetailsDocumento15 páginasPOP DetailsJitender KumarAinda não há avaliações

- Empanelled Information Security Auditing Organisations by Cert-InDocumento366 páginasEmpanelled Information Security Auditing Organisations by Cert-InHari KumavatAinda não há avaliações

- Mysore & Mandya Hospital ListDocumento2 páginasMysore & Mandya Hospital ListVenkatesh NaiduAinda não há avaliações

- Allopathic Loan 2019Documento9 páginasAllopathic Loan 2019Main Sanatani HunAinda não há avaliações

- Company at A Glance - Lines InternationalDocumento30 páginasCompany at A Glance - Lines InternationalVikram GuptaAinda não há avaliações

- SL - No Name of The GSTP CategoryDocumento2.565 páginasSL - No Name of The GSTP CategorySACHIN KULKARNIAinda não há avaliações

- Lodha GroupDocumento9 páginasLodha Groupvivek ghatbandheAinda não há avaliações

- Approved Projects PDFDocumento115 páginasApproved Projects PDFmunnabhaai07Ainda não há avaliações

- Northn Zone-Delhi: List of Dic'S OfficesDocumento54 páginasNorthn Zone-Delhi: List of Dic'S OfficesvijaiviruAinda não há avaliações

- Ultra HNI 26Documento3 páginasUltra HNI 26Rafi AzamAinda não há avaliações

- Unit Data - 12Documento2 páginasUnit Data - 12Homes ElevenAinda não há avaliações

- Washingmasine Showroom in Ahmedabad 16 - February - 2023Documento28 páginasWashingmasine Showroom in Ahmedabad 16 - February - 2023VIJAY VIDEOAinda não há avaliações

- Architects OfficesDocumento3 páginasArchitects OfficesAysha DiyaAinda não há avaliações

- Client G SRIKANTHDocumento3 páginasClient G SRIKANTHMallikarjun ReddyAinda não há avaliações

- Mobile No DataDocumento167 páginasMobile No Datamanagementexperts009Ainda não há avaliações

- YES BANK Master ListDocumento75 páginasYES BANK Master ListYash MehtaAinda não há avaliações

- Consultants DelhiDocumento93 páginasConsultants DelhiPatrick AdamsAinda não há avaliações

- Speed Post vehicle details requestDocumento1 páginaSpeed Post vehicle details requestBhagirath MeenaAinda não há avaliações

- Chemical Weekly May03Documento238 páginasChemical Weekly May03devangAinda não há avaliações

- Caller NameDocumento5 páginasCaller NameCorrosion FactoryAinda não há avaliações

- Part-A: 01 KWP To 05 KWP Capcity Solar PV SystemDocumento26 páginasPart-A: 01 KWP To 05 KWP Capcity Solar PV SystemVishal NannaAinda não há avaliações

- HR Email Id of Pharmaceuticals CompanyDocumento54 páginasHR Email Id of Pharmaceuticals CompanyTikoo AdityaAinda não há avaliações

- List of Recovery Agents for Tata Capital Housing FinanceDocumento3 páginasList of Recovery Agents for Tata Capital Housing Financeoffice officeAinda não há avaliações

- List of Recovery Agencies As On 06.02.2023Documento6 páginasList of Recovery Agencies As On 06.02.2023Naina SahaAinda não há avaliações

- Top interior designers in MumbaiDocumento10 páginasTop interior designers in MumbaiJeevan PulekarAinda não há avaliações

- Ra List Report Non PDFDocumento72 páginasRa List Report Non PDFSukhjiit SinghAinda não há avaliações

- AuditorList For Class ADocumento4 páginasAuditorList For Class AArun KumarAinda não há avaliações

- Full Calling DetailDocumento33 páginasFull Calling DetailJilmil JonakAinda não há avaliações

- Finding A Winning Private Banking Strategy in India: RoundtableDocumento13 páginasFinding A Winning Private Banking Strategy in India: RoundtablenaniAinda não há avaliações

- Opportunities With ICICI Bank LTDDocumento22 páginasOpportunities With ICICI Bank LTDChandan SahAinda não há avaliações

- 3rd Annual Private Wealth Management Summit 2019Documento11 páginas3rd Annual Private Wealth Management Summit 2019Sreejit NairAinda não há avaliações

- Unlocking The 2tn Retail Opportunity in The Next Decade Rai 2024 Na DigitalDocumento72 páginasUnlocking The 2tn Retail Opportunity in The Next Decade Rai 2024 Na Digitaltarun.pahujaAinda não há avaliações

- LongTerm Value Creation Report ModifiedDocumento14 páginasLongTerm Value Creation Report Modifiedmercadia5997Ainda não há avaliações

- JanuaryDocumento60 páginasJanuaryKishore KumarAinda não há avaliações

- Franchisee Counters in KSRTC Jurisdiction in Karnataka StateDocumento12 páginasFranchisee Counters in KSRTC Jurisdiction in Karnataka StateKishore KumarAinda não há avaliações

- WLOW6 YL0 Divis Pharma ECand ECComplianceDocumento15 páginasWLOW6 YL0 Divis Pharma ECand ECComplianceKishore KumarAinda não há avaliações

- Accelerated Leadership Program PDFDocumento1 páginaAccelerated Leadership Program PDFKishore KumarAinda não há avaliações

- IqacDocumento1 páginaIqacKishore KumarAinda não há avaliações

- Andhra Pradesh Real Estate Rules, 2017Documento92 páginasAndhra Pradesh Real Estate Rules, 2017Raghu Ram80% (5)

- PMKVY Grievance Cell Contact DetailsDocumento7 páginasPMKVY Grievance Cell Contact DetailsKishore KumarAinda não há avaliações

- Prospectus Gayatri Projects Limited PDFDocumento258 páginasProspectus Gayatri Projects Limited PDFKishore KumarAinda não há avaliações

- Cement and Mineral Comanies Contacts 1 05132015173731HYD PDFDocumento535 páginasCement and Mineral Comanies Contacts 1 05132015173731HYD PDFCharan Raj100% (1)

- 01082016OT30QDIOForm1 PDFDocumento19 páginas01082016OT30QDIOForm1 PDFKishore KumarAinda não há avaliações

- Insurance Law Review 2015Documento43 páginasInsurance Law Review 2015peanut47Ainda não há avaliações

- Pro Services in Dubai - Pro Services in Abu DhabiDocumento23 páginasPro Services in Dubai - Pro Services in Abu DhabiShiva kumarAinda não há avaliações

- Irda Act 1999Documento7 páginasIrda Act 1999Bhawana SharmaAinda não há avaliações

- Archon Umipig Resume 2018 CVDocumento7 páginasArchon Umipig Resume 2018 CVMaria Archon Dela Cruz UmipigAinda não há avaliações

- Information Governance Analysis and StrategyDocumento44 páginasInformation Governance Analysis and StrategyJem MadriagaAinda não há avaliações

- Obstfeld, Taylor - Global Capital Markets PDFDocumento374 páginasObstfeld, Taylor - Global Capital Markets PDFkterink00767% (3)

- Emerging OD Approaches and Techniques for Organizational LearningDocumento16 páginasEmerging OD Approaches and Techniques for Organizational LearningDinoop Rajan100% (1)

- Condition Types Are Defined in General Using The Condition Class and in DetailDocumento11 páginasCondition Types Are Defined in General Using The Condition Class and in DetailMonk DhariwalAinda não há avaliações

- Esp Sales Executive Needs AnalysisDocumento4 páginasEsp Sales Executive Needs AnalysisChitra Dwi Rahmasari100% (1)

- This Study Resource Was: Alfresco Marketing Practice Set - Teacher'S Manual Zenaida Vera Cruz Manuel, Bba, Cpa, MbaDocumento9 páginasThis Study Resource Was: Alfresco Marketing Practice Set - Teacher'S Manual Zenaida Vera Cruz Manuel, Bba, Cpa, MbaKim Flores100% (1)

- Auditing Theory Cabrera ReviewerDocumento49 páginasAuditing Theory Cabrera ReviewerCazia Mei Jover81% (16)

- Computation of Tax On LLPS and Critical Appraisal.Documento14 páginasComputation of Tax On LLPS and Critical Appraisal.LAW MANTRAAinda não há avaliações

- Fowler Distributing Company: ProposalDocumento16 páginasFowler Distributing Company: ProposalBiswajeet MishraAinda não há avaliações

- Chapter 12Documento31 páginasChapter 12KookieAinda não há avaliações

- Investment Centers and Transfer Pricing Ch 13Documento41 páginasInvestment Centers and Transfer Pricing Ch 13Karen hapukAinda não há avaliações

- Blue Ribbon NovemberDocumento32 páginasBlue Ribbon NovemberDavid PenticuffAinda não há avaliações

- United States Court of Appeals Second Circuit.: Nos. 256-258. Docket 27146-27148Documento16 páginasUnited States Court of Appeals Second Circuit.: Nos. 256-258. Docket 27146-27148Scribd Government DocsAinda não há avaliações

- CMM-006-15536-0006 - 6 - Radar AltimeterDocumento367 páginasCMM-006-15536-0006 - 6 - Radar AltimeterDadang100% (4)

- Main - Product - Report-Xiantao Zhuobo Industrial Co., Ltd.Documento8 páginasMain - Product - Report-Xiantao Zhuobo Industrial Co., Ltd.Phyo WaiAinda não há avaliações

- National Occupational Safety and Health Profile of OmanDocumento105 páginasNational Occupational Safety and Health Profile of OmanKhizer ArifAinda não há avaliações

- Restaurant Industry Award Ma000119 Pay GuideDocumento64 páginasRestaurant Industry Award Ma000119 Pay GuidestaktikaAinda não há avaliações

- Group8 StayZIllaDocumento8 páginasGroup8 StayZIllaRibhav KhattarAinda não há avaliações

- TPM Essay - 1st PartDocumento4 páginasTPM Essay - 1st PartFernanda MarquesAinda não há avaliações

- TERM DEPOSIT ADVICEDocumento1 páginaTERM DEPOSIT ADVICEamirunnbegamAinda não há avaliações

- Form No 15GDocumento4 páginasForm No 15Graghu_kiranAinda não há avaliações

- Apple Vs SamsungDocumento10 páginasApple Vs SamsungREEDHEE2210Ainda não há avaliações

- Jwele AhmedDocumento1 páginaJwele AhmedMa Hdi ChoudhuryAinda não há avaliações

- Example LocDocumento7 páginasExample LocGraha Teknologi MandiriAinda não há avaliações

- January 2018Documento112 páginasJanuary 2018Pumper Magazine100% (1)

- BA2 PT Unit Test - 01 QuestionsDocumento2 páginasBA2 PT Unit Test - 01 QuestionsSanjeev JayaratnaAinda não há avaliações