Escolar Documentos

Profissional Documentos

Cultura Documentos

Lexsteel Accounts Payable Audit Recommends Improved Controls

Enviado por

Wulan PragustiTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Lexsteel Accounts Payable Audit Recommends Improved Controls

Enviado por

Wulan PragustiDireitos autorais:

Formatos disponíveis

5.

10 Lexsteel, a manufacturer of steel furniture, has facilities throughout the

United States. Problems with the accounts payable system have prompted

Lexsteel’s external auditor to recommend a detailed study to determine the

company’s exposure to fraud and to identify ways to improve internal

control. Lexsteel’s controller assigned the study to Dolores Smith. She

interviewed Accounts Payable employees and created the flowchart of the

current system shown in Figure 5-3.

Lexsteel’s purchasing, production control, accounts payable, and cash

disbursements functions are centralized at corporate headquarters. The

company mainframe at corporate headquarters is linked to the computers

at each branch location by leased telephone lines.

The mainframe generates production orders and the bills of material

needed for the production runs. From the bills of material, purchase orders

for raw materials are generated and e-mailed to vendors. Each purchase

order tells the vendor which manufacturing plant to ship the materials to.

When the raw materials arrive, the manufacturing plants produce the

items on the production orders received from corporate headquarters.

The manufacturing plant checks the goods received for quality, counts

them, reconciles the count to the packing slip, and e-mails the receiving

data to Accounts Payable. If raw material deliveries fall behind production,

each branch manager can send emergency purchase orders directly to

vendors. Emergency order data and verification of materials received are e-

mailed to Accounts Payable. Since the company employs a computerized

perpetual inventory system, periodic physical counts of raw materials are

not performed.

Vendor invoices are e-mailed to headquarters and entered by Accounts

Payable when received. This often occurs before the branch offices transmit

the receiving data. Payments are due 10 days after the company receives

the invoices. Using information on the invoice, Data Entry calculates the

final day the invoice can be paid, and it is entered as the payment due date.

Once a week, invoices due the following week are printed in chronological

entry order on a payment listing, and the corresponding checks are drawn.

The checks and payment listing are sent to the treasurer’s office for

signature and mailing to the payee. The check number is printed by the

computer, displayed on the check and the payment listing, and validated as

the checks are signed. After the checks are mailed, the payment listing is

returned to Accounts Payable for filing. When there is insufficient cash to

pay all the invoices, the treasurer retains certain checks and the payment

listing until all checks can be paid. When the remaining checks are mailed,

the listing is then returned to Accounts Payable. Often, weekly check

mailings include a few checks from the previous week, but rarely are there

more than two weekly listings involved.

When Accounts Payable receives the payment listing from the treasurer’s

office, the expenses are distributed, coded, and posted to the appropriate

cost center accounts. Accounts Payable processes weekly summary

performance reports for each cost center and branch location. Adapted fro

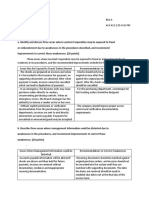

1. Discuss three ways Lexsteel is exposed to fraud and recommend

improvements to correct these weaknesses.

Weakness Recommendation

There are no controls over branch managers issuing A procedure for expediting emergency

emergency purchase orders. The branch manager orders should be developed for the

can decide when an "emergency" exists and she is purchasing department that contains

permitted to choose a vendor subjectively. This appropriate controls.

opens the door to fraud and errors.

Invoices are paid without agreeing them to purchase Require proper authorizations and

orders and receiving reports. Making payments verification documentation (agreement

without this comparison could result in payments of invoices, purchase orders, and

for goods that were not ordered or that were not receiving report) prior to payment.

received.

There is no supporting documentation attached to Checks sent to the Treasurer for

the checks when they are forwarded to the treasurer signature should be accompanied by all

for payment. original supporting documents (invoice,

purchase order and receiving report) so

the Treasurer can verify that the

payment is valid and appropriate.

The supporting documents are not canceled after The invoices and other supporting

payment, allowing the possibility of a second documents should be canceled after the

payment of the same invoice. checks are signed.

2. Describe three ways management information could be distorted

and recommend improvements to correct these weaknesses.

Weakness Recommendation

1. Cash balances are distorted when checks are Checks should be drawn only when cash

drawn when due but are not mailed until sufficient is available and mailed immediately.

cash is available. Cash management will also be Procedures should be established for

affected by inaccurate due dates, lack of taking advantage of vendor discounts

procedures for taking vendor discounts, and when appropriate.

inaccurate information for EOQ calculations.

2. Accounts payable information is distorted by Invoices should not be entered into the

drawing checks and then holding them for future system until matched with supporting

payment, by entering invoices without supporting documents, and receiving documents

documentation, and by inaccurate receiving should be matched against original

documentation. purchase orders.

3. Inventory balances are likely to be misstated Periodically count inventory and

because of no physical counts. reconcile the counts to inventory records.

4. Calculating due dates by hand and using the The system should calculate due dates

invoice date instead of the date the goods are from the date goods are received, not

received could lead to inaccurate due dates that based on the date they are invoiced.

could damage vendor relations.

The lack of control over emergency orders could Implement appropriate controls to

distort inventory balances and cause duplicate prevent duplicate purchases, such as

purchases. immediate entry of emergency orders so

the system has a record of them.

3. Identify and explain three strengths in Lexsteel’s procedures

The company has a centralized EDP system and database in place.

This eliminates duplication of effort and data redundancy while

improving data integrity, efficiency, productivity, and timely

management information.

Most purchase orders are issued by the centralized purchasing

department from computerized production orders or bills of material.

This limits overstocking of materials inventory and employs the

specialized expertise in the purchasing function.

The functions of purchasing, production control, accounts payable,

and cash disbursements are centralized at the corporate headquarters.

This improves management control and avoids a duplication of

efforts. The separated departments help maintain internal control by

the segregation of duties for authorization, payment, and coding.

Você também pode gostar

- Case 7: Expenditure CycleDocumento2 páginasCase 7: Expenditure CycleDika KurAinda não há avaliações

- Expenditure Cycle Case - GARCIADocumento3 páginasExpenditure Cycle Case - GARCIAARLENE GARCIAAinda não há avaliações

- Auditing Expenditure Cycle CaseDocumento2 páginasAuditing Expenditure Cycle CaseARLENE GARCIAAinda não há avaliações

- Auditing Expenditure Cycle CaseDocumento2 páginasAuditing Expenditure Cycle CaseCatrina Joanna AmonsotAinda não há avaliações

- Chapter 5 Accounting Information SystemDocumento9 páginasChapter 5 Accounting Information SystemRica de guzmanAinda não há avaliações

- Assessment Aol Case 1Documento6 páginasAssessment Aol Case 1Gusti PanduAinda não há avaliações

- Expenditure Cycle Case - GARCIADocumento2 páginasExpenditure Cycle Case - GARCIAARLENE GARCIAAinda não há avaliações

- Improving Expenditure Cycle EfficiencyDocumento21 páginasImproving Expenditure Cycle EfficiencyJuan Rafael FernandezAinda não há avaliações

- 13.10 Last Year The Diamond Manufacturing Company Purchased Over $10 Million Worth ofDocumento7 páginas13.10 Last Year The Diamond Manufacturing Company Purchased Over $10 Million Worth ofJara TakuzawaAinda não há avaliações

- Week 13 Exercise With AnswersDocumento10 páginasWeek 13 Exercise With Answersmaria fernAinda não há avaliações

- Share Mary Ann V Domincel Chapter 5Documento2 páginasShare Mary Ann V Domincel Chapter 5MA ValdezAinda não há avaliações

- Auditing The Expenditure Cycle SummaryDocumento7 páginasAuditing The Expenditure Cycle SummaryHimaya Sa KalipayAinda não há avaliações

- Accounting Information System: The Expenditure CycleDocumento11 páginasAccounting Information System: The Expenditure CycleRatu ShaviraAinda não há avaliações

- Accounting Information System: The Expenditure Cycle Part 1 Walker Inc. Case 4Documento7 páginasAccounting Information System: The Expenditure Cycle Part 1 Walker Inc. Case 4Ratu ShaviraAinda não há avaliações

- Auditing Expenditure Cycle Chapter 10Documento12 páginasAuditing Expenditure Cycle Chapter 10Wendelyn TutorAinda não há avaliações

- AIS Chpter. 5 6 7 8Documento14 páginasAIS Chpter. 5 6 7 8MA ValdezAinda não há avaliações

- The Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresDocumento7 páginasThe Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresJanica BerbaAinda não há avaliações

- Jawaban SIDocumento8 páginasJawaban SIfhadli kunAinda não há avaliações

- Expenditure SubsystemDocumento30 páginasExpenditure SubsystemChristian AribasAinda não há avaliações

- AP Packet Documents and EvidenceDocumento4 páginasAP Packet Documents and EvidenceRizza L. MacarandanAinda não há avaliações

- Accounts Receivable ControlsDocumento11 páginasAccounts Receivable Controlsjessamp33Ainda não há avaliações

- Module 16Documento3 páginasModule 16AstxilAinda não há avaliações

- Chapter 4: The Revenue CycleDocumento4 páginasChapter 4: The Revenue CycleKrissha100% (1)

- Auditing The Expenditure CycleDocumento56 páginasAuditing The Expenditure CycleJohn Lexter Macalber100% (1)

- AIS Chap 5 NotesDocumento3 páginasAIS Chap 5 NotesKrisshaAinda não há avaliações

- 3.1 Ais HazelgamillaDocumento6 páginas3.1 Ais HazelgamillaHazel Malveda GamillaAinda não há avaliações

- Process Accounts Payable RCMDocumento5 páginasProcess Accounts Payable RCMgeereddy venkata sasidhar reddy100% (1)

- CashDisbursementCycle ReDocumento5 páginasCashDisbursementCycle ReKenneth Joshua Cinco NaritAinda não há avaliações

- Cash Disbursements ProceduresDocumento13 páginasCash Disbursements ProceduresSheila Mae AramanAinda não há avaliações

- Share CHAPTER 4 ICT14 Mary Ann DomincelDocumento4 páginasShare CHAPTER 4 ICT14 Mary Ann DomincelMA ValdezAinda não há avaliações

- MODULE 05 EXPENDITURE CYCLE COMPUTER-BASED PURCHASES and CASH DISBURSEMENTS APPLICATIONSDocumento8 páginasMODULE 05 EXPENDITURE CYCLE COMPUTER-BASED PURCHASES and CASH DISBURSEMENTS APPLICATIONSRed ReyesAinda não há avaliações

- Chapter 5-Expenditure DiscussionDocumento44 páginasChapter 5-Expenditure DiscussionBeryll BethAinda não há avaliações

- Internal Control Over Cash TransactionsDocumento18 páginasInternal Control Over Cash TransactionsEYOB AHMEDAinda não há avaliações

- Chapter 5Documento6 páginasChapter 5Jane LubangAinda não há avaliações

- Seminar03 - Controls Discussion QuestionsDocumento3 páginasSeminar03 - Controls Discussion QuestionsC.TangibleAinda não há avaliações

- Chapter 5 PPT (AIS - James Hall)Documento10 páginasChapter 5 PPT (AIS - James Hall)Nur-aima Mortaba50% (2)

- Proposed Disbursement ProcessDocumento4 páginasProposed Disbursement ProcessmarvinceledioAinda não há avaliações

- SpecialExercise-1Documento2 páginasSpecialExercise-1akmalilham1508Ainda não há avaliações

- Us DFDTN 15 8c Controlling RevenueDocumento5 páginasUs DFDTN 15 8c Controlling RevenueKhairul Ikhwan DalimuntheAinda não há avaliações

- Section: Expenditure Subsystem Subsection: 060-01 Subsection: Overview Page 1 of 2Documento2 páginasSection: Expenditure Subsystem Subsection: 060-01 Subsection: Overview Page 1 of 2Clea Marie MissionAinda não há avaliações

- AP PROCESSDocumento9 páginasAP PROCESSSuhas YadavAinda não há avaliações

- CH 8 Student SolutionsDocumento3 páginasCH 8 Student SolutionsBelinda SinieAinda não há avaliações

- Auditing The Expenditure CycleDocumento2 páginasAuditing The Expenditure CycleBella PatriceAinda não há avaliações

- Auditing Liabilities AssertionsDocumento7 páginasAuditing Liabilities AssertionsSanjeevParajuliAinda não há avaliações

- 10 Auditing The Expenditure CycleDocumento9 páginas10 Auditing The Expenditure CycleJude AlbaniaAinda não há avaliações

- Accist ReviewerDocumento8 páginasAccist ReviewerAngel MesiasAinda não há avaliações

- Chapter 5 (Cando & Lascona)Documento51 páginasChapter 5 (Cando & Lascona)brennaAinda não há avaliações

- NotesDocumento9 páginasNoteschrist maryAinda não há avaliações

- Inventory Subsidiary Ledger AccountsDocumento2 páginasInventory Subsidiary Ledger AccountsNhuy NguyenAinda não há avaliações

- Day 24-1Documento11 páginasDay 24-1Reem JavedAinda não há avaliações

- Day 24Documento7 páginasDay 24Reem JavedAinda não há avaliações

- Chapter 1Documento8 páginasChapter 1Jarra AbdurahmanAinda não há avaliações

- IT Audit 4ed SM Ch10Documento45 páginasIT Audit 4ed SM Ch10randomlungs121223Ainda não há avaliações

- I Am Reign Gagalac: Hello!Documento34 páginasI Am Reign Gagalac: Hello!Rundhille AndalloAinda não há avaliações

- Accounting Information Systems, 6: Edition James A. HallDocumento40 páginasAccounting Information Systems, 6: Edition James A. HallDianne NolascoAinda não há avaliações

- Paper Tech IndustriesDocumento20 páginasPaper Tech IndustriesMargaret TaylorAinda não há avaliações

- Fundamentals of Acct - I, Lecture Note - Chapter 5-1Documento13 páginasFundamentals of Acct - I, Lecture Note - Chapter 5-1Kiya GeremewAinda não há avaliações

- Textbook of Urgent Care Management: Chapter 13, Financial ManagementNo EverandTextbook of Urgent Care Management: Chapter 13, Financial ManagementAinda não há avaliações

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNo EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNota: 5 de 5 estrelas5/5 (1)

- Download Byculla To Bangkok EpubDocumento3 páginasDownload Byculla To Bangkok EpubSurajit MondalAinda não há avaliações

- DCPO Pretest SCRDocumento5 páginasDCPO Pretest SCRWill Larsen33% (3)

- Adams Bash ForthDocumento7 páginasAdams Bash ForthChAdnanUlQamarAinda não há avaliações

- Cdrom File System For Vxworks 5.5.1Documento13 páginasCdrom File System For Vxworks 5.5.1Nitesh SinghAinda não há avaliações

- Atm Web Application: Presented By: Varshitha Bayya 18G21A05C2 Project Guide: MS.M.Bhargavi ProfessorDocumento36 páginasAtm Web Application: Presented By: Varshitha Bayya 18G21A05C2 Project Guide: MS.M.Bhargavi ProfessorVarshitha BayyaAinda não há avaliações

- En Acs800 Motioncontrol FM Rev ADocumento234 páginasEn Acs800 Motioncontrol FM Rev AdeepakAinda não há avaliações

- Manual OJSDocumento142 páginasManual OJSMariela HerreroAinda não há avaliações

- GPS GSM Tracker GT 280Documento45 páginasGPS GSM Tracker GT 280Mladen Jankovic DjomlaAinda não há avaliações

- Xiaomi Mobile Phone Profile and Its SWOT AnalysisDocumento13 páginasXiaomi Mobile Phone Profile and Its SWOT AnalysisAshish InaniAinda não há avaliações

- Fujitsu Siemens Amilo Pro V2055 (LM7W+)Documento55 páginasFujitsu Siemens Amilo Pro V2055 (LM7W+)eren3700Ainda não há avaliações

- Login - Ufone Technical Department - Login Creation - Access - Form - HammadDocumento1 páginaLogin - Ufone Technical Department - Login Creation - Access - Form - HammadhammadAinda não há avaliações

- How to Create Local Reports with RDLC and BarcodesDocumento24 páginasHow to Create Local Reports with RDLC and BarcodesGustavo Adolfo Sotomayor LagoAinda não há avaliações

- Unreal Engine 4 TutorialDocumento52 páginasUnreal Engine 4 TutorialGiorgio D. BaraditAinda não há avaliações

- Manual de GoniometríaDocumento4 páginasManual de GoniometríaEd RománAinda não há avaliações

- Information and Communication Technology (Ict) and DisabilityDocumento40 páginasInformation and Communication Technology (Ict) and Disabilityabey.mulugetaAinda não há avaliações

- Syllabus - Data Mining Solution With WekaDocumento5 páginasSyllabus - Data Mining Solution With WekaJaya WijayaAinda não há avaliações

- Numerical Solution Using Newton-Raphson MethodDocumento10 páginasNumerical Solution Using Newton-Raphson MethodhuynhnhuAinda não há avaliações

- AutoCAD PLANT 3D 2015 System Tools Variables CadgroupDocumento24 páginasAutoCAD PLANT 3D 2015 System Tools Variables CadgroupperoooAinda não há avaliações

- LPTv4 Module 18 External Penetration Testing PDFDocumento116 páginasLPTv4 Module 18 External Penetration Testing PDFo7952612Ainda não há avaliações

- CV VeeraBhadraDocumento2 páginasCV VeeraBhadraAnish Kumar DhirajAinda não há avaliações

- C Programming Questions SolvedDocumento31 páginasC Programming Questions SolvedMohan Kumar MAinda não há avaliações

- E-Tech Lesson 1 - 3Documento5 páginasE-Tech Lesson 1 - 3Jeandra VillanuevaAinda não há avaliações

- Siri Bercakap Dengan Jin Tamar Jalis PDFDocumento5 páginasSiri Bercakap Dengan Jin Tamar Jalis PDFSirrApakAinda não há avaliações

- Oracle RAC DBA Resume With 4+expDocumento6 páginasOracle RAC DBA Resume With 4+expreddy007Ainda não há avaliações

- Machine Learning Algorithms in Depth (MEAP V09) (Vadim Smolyakov) (Z-Library)Documento550 páginasMachine Learning Algorithms in Depth (MEAP V09) (Vadim Smolyakov) (Z-Library)AgalievAinda não há avaliações

- DSA456 Midterm Dilli PDFDocumento8 páginasDSA456 Midterm Dilli PDFnavneetkaur12482Ainda não há avaliações

- Yuzu Emulator Installer LogsDocumento5 páginasYuzu Emulator Installer LogsMN GGAinda não há avaliações

- AVC Metric Definition GuideDocumento68 páginasAVC Metric Definition GuideGregg HarrisAinda não há avaliações

- 971SmartRadarLTi ServMan 416716 Rev3Documento56 páginas971SmartRadarLTi ServMan 416716 Rev3HeshamEl-naggarAinda não há avaliações

- Evermotion Archmodels 79 PDFDocumento2 páginasEvermotion Archmodels 79 PDFKimAinda não há avaliações