Escolar Documentos

Profissional Documentos

Cultura Documentos

ACX3150 TUTE 5 - Accounting Analysis

Enviado por

FelDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ACX3150 TUTE 5 - Accounting Analysis

Enviado por

FelDireitos autorais:

Formatos disponíveis

ACX3150 TUTE 5 – ACCOUNTING ANALYSIS

Chapter 3: Q2,4,7

Q2)

Fred argues: ‘The standards that I like most are the ones that eliminate all management discretion in reporting – that way I get

uniform numbers across all companies and don’t have to worry about doing accounting analysis.’ Do you agree? Why or why

not?

Disagree –

If you use the same standards, you’re assuming that standards are one size fit all – not a true representation of the firm’s

business performance.

Managers have special knowledge about how the company is performing – so better to have them do the reporting as they

could provide more accurate information about the underlying economic reality of the business.

Giving managers some leeway to report numbers based on their own discretion is important and beneficial due to their special

knowledge about the company. But if you give them too much discretion, they can report numbers to suit themselves. But

unlike what Fred argues, if you don’t give them any discretion at all, they’ll be forced by the standards to report numbers that

aren’t reflective of the underlying reality either.

Q4)

Cash ratio – provides info about liquidity – with a higher ratio, company is more liquid.

Q7)

Management change = bad news

Might be changing policy on depreciation –

CASE STUDY

Analyse each segment of the business – look at each success factor to identify red flags

3) NPAT and Operating CF aren’t following the same trend/align with each other – so need to investigate for any manipulation

4) Usually NPAT should be less than operating CF because expenses like COGS and depreciation will reduce the NPAT.

For assignment:

Go on data premium analysis database

Você também pode gostar

- Summary of Scott Wise's Actionable Profitability AnalyticsNo EverandSummary of Scott Wise's Actionable Profitability AnalyticsAinda não há avaliações

- Limitation of Ratio AnalysisDocumento5 páginasLimitation of Ratio AnalysisMir Wajahat AliAinda não há avaliações

- Module3: Sbrs and Economic CensusDocumento15 páginasModule3: Sbrs and Economic CensustrismawatyAinda não há avaliações

- Class12 Accountancy2Documento42 páginasClass12 Accountancy2Arunima RaiAinda não há avaliações

- Meaning of Accounting RatiosDocumento12 páginasMeaning of Accounting RatiosAkash PradhanAinda não há avaliações

- Meaning of Accounting RatiosDocumento12 páginasMeaning of Accounting RatiosAkash PradhanAinda não há avaliações

- Financial & Ratio AnalysisDocumento46 páginasFinancial & Ratio AnalysisParvej KhanAinda não há avaliações

- Accounting Ratios: Inancial Statements Aim at Providing FDocumento47 páginasAccounting Ratios: Inancial Statements Aim at Providing Fabc100% (1)

- Accounting Ratios Accounting Ratios Accounting Ratios Accounting Ratios Accounting RatiosDocumento47 páginasAccounting Ratios Accounting Ratios Accounting Ratios Accounting Ratios Accounting Ratiosviswa100% (1)

- General Finance Interview Tips: #1 Behavioral and Fit Questions Relate More ToDocumento6 páginasGeneral Finance Interview Tips: #1 Behavioral and Fit Questions Relate More ToNneha BorkarAinda não há avaliações

- 6 Management Reporting Best Practices To Create Effective Reports PDFDocumento12 páginas6 Management Reporting Best Practices To Create Effective Reports PDFAnang FakhruddinAinda não há avaliações

- Ratio Analysis Meaning of Accounting RatiosDocumento7 páginasRatio Analysis Meaning of Accounting RatiosShirsendu MondolAinda não há avaliações

- What Does Ratio Analysis Tell Us ?Documento1 páginaWhat Does Ratio Analysis Tell Us ?StrikerAinda não há avaliações

- The Five Traps of Performance ManagementDocumento3 páginasThe Five Traps of Performance ManagementAditi AggarwalAinda não há avaliações

- L13Documento10 páginasL13Matthew MaAinda não há avaliações

- Accounting Ratios: Inancial Statements Aim at Providing FDocumento45 páginasAccounting Ratios: Inancial Statements Aim at Providing FNIKK KICKAinda não há avaliações

- Accounting RatiosDocumento42 páginasAccounting RatiosApollo Institute of Hospital AdministrationAinda não há avaliações

- Ratio Analysis KayzadDocumento13 páginasRatio Analysis KayzadPrachi DalalAinda não há avaliações

- A Studty On Accounting Ratio Anaysis OF Bombay Stock Exchange CompaniesDocumento60 páginasA Studty On Accounting Ratio Anaysis OF Bombay Stock Exchange CompaniesnishaAinda não há avaliações

- What Is Oracle FinancialsDocumento262 páginasWhat Is Oracle FinancialsSrimannarayana KasthalaAinda não há avaliações

- Ratio AnalysisDocumento15 páginasRatio AnalysisChandana DasAinda não há avaliações

- CH - 5 Accounting RatiosDocumento47 páginasCH - 5 Accounting RatiosAaditi V100% (1)

- Performance Audit in The Educational InstitutionDocumento3 páginasPerformance Audit in The Educational InstitutionDhani Shanker ChaubeyAinda não há avaliações

- Tips For The Emerson Electric CaseDocumento3 páginasTips For The Emerson Electric CaseCahyo Priyatno0% (1)

- Case Analysis Isn't Always BetterDocumento13 páginasCase Analysis Isn't Always BetterZion EliAinda não há avaliações

- Profitability and LiquidityDocumento5 páginasProfitability and LiquidityEdu TainmentAinda não há avaliações

- Analysis of AccountDocumento3 páginasAnalysis of AccountDavid SianiparAinda não há avaliações

- Ratio Analysis of BGPPLDocumento53 páginasRatio Analysis of BGPPLmayurAinda não há avaliações

- Notes Chapter WiseDocumento55 páginasNotes Chapter WiseBitan SahaAinda não há avaliações

- Zendesk Benchmark Report 2014Documento18 páginasZendesk Benchmark Report 2014Eduardo RodriguesAinda não há avaliações

- Understand Financial Statements - Harvard ManageMentorDocumento14 páginasUnderstand Financial Statements - Harvard ManageMentorSAROJAinda não há avaliações

- To Be TransferredDocumento8 páginasTo Be TransferredShaina Shanee CuevasAinda não há avaliações

- Financial RatiosDocumento30 páginasFinancial RatiosSumitt AgrawalAinda não há avaliações

- CH 26 Analysis of Accounts PptsDocumento27 páginasCH 26 Analysis of Accounts Pptschild anaAinda não há avaliações

- Accounting RatiosDocumento23 páginasAccounting RatiosPratyush SainiAinda não há avaliações

- Usese & Profitability Ratio AnalysisDocumento3 páginasUsese & Profitability Ratio AnalysisztgaffAinda não há avaliações

- Financial Modeling Chapter - 1Documento20 páginasFinancial Modeling Chapter - 1bhanu.chandu100% (1)

- Management ReportingDocumento22 páginasManagement ReportingAmala SibyAinda não há avaliações

- Private Equity Case Studies in 3017 WordsDocumento7 páginasPrivate Equity Case Studies in 3017 Wordsmayor78100% (1)

- Profitability Measures Business&StrategyDocumento1 páginaProfitability Measures Business&StrategymaxmikleAinda não há avaliações

- How To Choose The Best Stock Valuation MethodDocumento3 páginasHow To Choose The Best Stock Valuation MethodAGHAYASIR8003Ainda não há avaliações

- Theoretical Framework of The Study: Ratio AnalysisDocumento39 páginasTheoretical Framework of The Study: Ratio AnalysisKurt CaneroAinda não há avaliações

- Term Paper On MFDDocumento14 páginasTerm Paper On MFDYousufAinda não há avaliações

- NCERT Class 12 Accountancy Accounting RatiosDocumento47 páginasNCERT Class 12 Accountancy Accounting RatiosKrish Pagani100% (1)

- Solution Manual For Business Analysis and Valuation Ifrs EditionDocumento24 páginasSolution Manual For Business Analysis and Valuation Ifrs EditionWilliamHammondcgaz100% (38)

- 5.5 Analysis of AccountsDocumento3 páginas5.5 Analysis of AccountsannabellAinda não há avaliações

- MIS AaDocumento42 páginasMIS AaTiny GechAinda não há avaliações

- Ratio AnalysisDocumento4 páginasRatio AnalysisKartikeyaDwivediAinda não há avaliações

- HCM-Questionnaire - Personnel AdministrationDocumento7 páginasHCM-Questionnaire - Personnel AdministrationTofi Al-sAinda não há avaliações

- Finance Interview QuestionsDocumento17 páginasFinance Interview Questionsfilmy.photographyAinda não há avaliações

- Leac 205Documento47 páginasLeac 205Jyoti SinghAinda não há avaliações

- Accounting Ratios: Inancial Statements Aim at Providing FDocumento53 páginasAccounting Ratios: Inancial Statements Aim at Providing FPathan Kausar100% (1)

- Chapter 1: Introduction To Business AnalyticsDocumento5 páginasChapter 1: Introduction To Business AnalyticsRuiz, CherryjaneAinda não há avaliações

- C. People Metrics: Case Exercise B: Application of Enterprise Delivery SystemDocumento14 páginasC. People Metrics: Case Exercise B: Application of Enterprise Delivery SystemMark Nel VenusAinda não há avaliações

- Howard B Bandy Quantitative Trading Systems Practical Methods ForDocumento370 páginasHoward B Bandy Quantitative Trading Systems Practical Methods ForMega SaputraAinda não há avaliações

- Analysis of AccountsDocumento4 páginasAnalysis of AccountsTYDK MediaAinda não há avaliações

- Minhaj University: Corporate Finance AssignmentDocumento6 páginasMinhaj University: Corporate Finance AssignmentNEHA BUTTTAinda não há avaliações

- Span of Management: Amazon Now - Grocery ShoppingDocumento7 páginasSpan of Management: Amazon Now - Grocery ShoppingSameerAinda não há avaliações

- Constitutional Law 1Documento2 páginasConstitutional Law 1FelAinda não há avaliações

- Problem Q On Consideration WalkthroughDocumento3 páginasProblem Q On Consideration WalkthroughFel100% (1)

- AP Answer TemplateDocumento7 páginasAP Answer TemplateFelAinda não há avaliações

- Consumers and The Law Case Studies: Kramzil Pty LTD Trading As Academic Teacher ResourcesDocumento3 páginasConsumers and The Law Case Studies: Kramzil Pty LTD Trading As Academic Teacher ResourcesFelAinda não há avaliações

- Financial Statement AnalysisDocumento6 páginasFinancial Statement AnalysisFelAinda não há avaliações

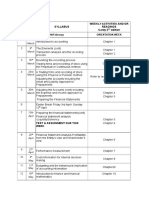

- Unit Schedule: WEE K Begin Syllabus Weekly Activities And/Or Readings Carey 2 EditionDocumento10 páginasUnit Schedule: WEE K Begin Syllabus Weekly Activities And/Or Readings Carey 2 EditionFelAinda não há avaliações