Escolar Documentos

Profissional Documentos

Cultura Documentos

2018 Miami-Dade Ret Inv Forecast

Enviado por

Anonymous Feglbx5Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

2018 Miami-Dade Ret Inv Forecast

Enviado por

Anonymous Feglbx5Direitos autorais:

Formatos disponíveis

Retail Research

2018 INVESTMENT FORECAST

Miami-Dade Metro Area

Miami Retail Remains Popular Among Investors; Net- Employment vs. Retail Sales Trends

Leased Assets Particularly Favored Employment Growth Retail Sales Growth

10%

Year-over-Year Change

Additional world-class shopping locations coming online in 2018. Miami continues

5%

to be recognized as an established global shopping destination, fueled by its robust tour-

ism activity and an affluent population. Exceptional job growth and in-migration trends un- 0%

derpin strong retail performance, leading to a vacancy rate that has held under 4 percent

for four years now as space demand remains robust. In the face of the mounting pressures -5%

the retail sector has witnessed, retailers remain confident in the local market, encouraging

-10%

Target, Walmart and Dick’s Sporting Goods to take up new space. Publix has also been in

08 09 10 11 12 13 14 15 16 17 18*

expansion mode, adding several locations last year to meet the needs of a growing pop-

ulation. A number of projects are anticipated for delivery this year, bringing completions to

their highest level since 2008, led by Miami Worldcenter with 450,000 square feet of retail

Retail Completions

space and the 315,000-square-foot expansion of the Aventura Mall.

Completions Absorption

3,000

Positive long-term outlook generates investment across Miami-Dade. A surge

Square Feet (thousands)

in leasing activity and new construction has fueled investor demand for retail assets as 2,250

buyers recognize that Miami’s gateway status positions the market to weather future

turmoil felt in the sector. Quality credit single-tenant net-lease properties hold their ap- 1,500

peal among a broad base of investors for their hands-off approach to creating cash flow,

bringing a wide mix of private and institutional capital to the market. Properties occupied 750

by tenants such as CVS and Starbucks traded at cap rates in the mid-4 percent to

0

low-5 percent band in 2017, marking little movement from the previous year. Grocery

08 09 10 11 12 13 14 15 16 17 18*

stores and discount retailers continue to gain ground among investors, recording first-

year yields in the mid-5 to mid-6 percent range. The strength of the local retail market,

driven by favorable demographics and strong job growth, will hold transaction velocity Asking Rent and Vacancy Trends

elevated, potentially adding to the rise in deal flow registered last year. Vacancy Y-O-Y Rent Growth

6% 10%

2018 Market Forecast

Year-over-Year Rent Change

5% 5%

Employment Job creation surged following Hurricane Irma, bringing 2017

Vacancy Rate

up 2.2% employment growth to 35,300. The labor force will tighten and 4% 0%

hiring will slow to 26,000 jobs this year.

3% -5%

Construction Completions reach their highest level since 2008 this year as 2

2% -10%

2 million sq. ft. million square feet is anticipated for completion, rising from the

08 09 10 11 12 13 14 15 16 17 18*

1.2 million square feet added in 2017.

* Forecast

Vacancy Heightened construction pushes the vacancy rate up to a still- Sources: CoStar Group, Inc.; Real Capital Analytics

Price Per Square Foot Trends

up 40 bps tight 4.1 percent this year, adding to a 10-basis-point increase Single-Tenant Multi-Tenant

registered last year. Miami Office

Year-over-Year Appreciation

24%

Scott Lunine Regional Manager

Rent Asking rent growth slows from the 5.3 percent pace posted in 520112%

Blue Lagoon Drive, Suite 100

up 1.9% 2017 as vacancy climbs, bringing the average rate to $35.82 Miami, FL 33126

per square foot. (786) 0%

522-7000 | scott.lunine@marcusmillichap.com

For information on national retail trends, contact:

-12%

Investment Strong asset appreciation over the past several years combined

John Chang First Vice President | National Director

with this year’s rising costs to finance could bring multiple as- Research

-24% Services

sets to market as owners exchange into new investments. 07 08 09

Tel: (602) 707-9700 10 11 12 13 14 15 16 17

| john.chang@marcusmillichap.com

Metro-level employment, vacancy and asking rents are year-end figures and are based on the most up-to-date information available as of January 2018. Asking rent is based on the full service marketed rental rate.

Average prices and cap rates are a function of the age, class and geographic area of the properties trading and therefore may not be representative of the market as a whole. Sales data includes transactions valued at

$1,000,000 and greater unless otherwise noted. Forecasts for employment and office data are made during the fourth quarter and represent estimates of future performance. No representation, warranty or guarantee,

express or implied may be made as to the accuracy or reliability of the information contained herein. This is not intended to be a forecast of future events and this is not a guaranty regarding a future event. This is not

intended to provide specific investment advice and should not be considered as investment advice.

© Marcus & Millichap 2018 | www.marcusmillichap.com

Você também pode gostar

- CIO Bulletin - DiliVer LLC (Final)Documento2 páginasCIO Bulletin - DiliVer LLC (Final)Anonymous Feglbx5Ainda não há avaliações

- Progress Ventures Newsletter 3Q2018Documento18 páginasProgress Ventures Newsletter 3Q2018Anonymous Feglbx5Ainda não há avaliações

- 4Q18 South Florida Local Apartment ReportDocumento8 páginas4Q18 South Florida Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- 4Q18 North Carolina Local Apartment ReportDocumento8 páginas4Q18 North Carolina Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocumento6 páginasHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5Ainda não há avaliações

- 4Q18 Atlanta Local Apartment ReportDocumento4 páginas4Q18 Atlanta Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- The Woodlands Office Submarket SnapshotDocumento4 páginasThe Woodlands Office Submarket SnapshotAnonymous Feglbx5Ainda não há avaliações

- ValeportDocumento3 páginasValeportAnonymous Feglbx5Ainda não há avaliações

- Houston's Office Market Is Finally On The MendDocumento9 páginasHouston's Office Market Is Finally On The MendAnonymous Feglbx5Ainda não há avaliações

- 4Q18 Washington, D.C. Local Apartment ReportDocumento4 páginas4Q18 Washington, D.C. Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- 4Q18 Philadelphia Local Apartment ReportDocumento4 páginas4Q18 Philadelphia Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- THRealEstate THINK-US Multifamily ResearchDocumento10 páginasTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5Ainda não há avaliações

- 4Q18 Houston Local Apartment ReportDocumento4 páginas4Q18 Houston Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- 4Q18 New York City Local Apartment ReportDocumento8 páginas4Q18 New York City Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- 4Q18 Dallas Fort Worth Local Apartment ReportDocumento4 páginas4Q18 Dallas Fort Worth Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- Asl Marine Holdings LTDDocumento28 páginasAsl Marine Holdings LTDAnonymous Feglbx5Ainda não há avaliações

- Wilmington Office MarketDocumento5 páginasWilmington Office MarketWilliam HarrisAinda não há avaliações

- 4Q18 Boston Local Apartment ReportDocumento4 páginas4Q18 Boston Local Apartment ReportAnonymous Feglbx5Ainda não há avaliações

- 3Q18 Philadelphia Office MarketDocumento7 páginas3Q18 Philadelphia Office MarketAnonymous Feglbx5Ainda não há avaliações

- 2018 U.S. Retail Holiday Trends Guide - Final PDFDocumento9 páginas2018 U.S. Retail Holiday Trends Guide - Final PDFAnonymous Feglbx5Ainda não há avaliações

- Fredericksburg Americas Alliance MarketBeat Office Q32018Documento1 páginaFredericksburg Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5Ainda não há avaliações

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocumento9 páginasMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5Ainda não há avaliações

- Roanoke Americas Alliance MarketBeat Retail Q32018 FINALDocumento1 páginaRoanoke Americas Alliance MarketBeat Retail Q32018 FINALAnonymous Feglbx5Ainda não há avaliações

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocumento7 páginasUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5Ainda não há avaliações

- Fredericksburg Americas Alliance MarketBeat Retail Q32018Documento1 páginaFredericksburg Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5Ainda não há avaliações

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Documento2 páginasHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5Ainda não há avaliações

- Fredericksburg Americas Alliance MarketBeat Industrial Q32018Documento1 páginaFredericksburg Americas Alliance MarketBeat Industrial Q32018Anonymous Feglbx5Ainda não há avaliações

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDocumento1 páginaRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5Ainda não há avaliações

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDocumento1 páginaRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5Ainda não há avaliações

- Hampton Roads Americas Alliance MarketBeat Office Q32018Documento2 páginasHampton Roads Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5Ainda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Suzuki Project NewDocumento98 páginasSuzuki Project NewRohan Somanna67% (3)

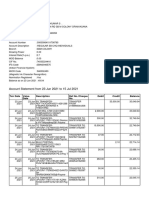

- Account Statement From 23 Jun 2021 To 15 Jul 2021Documento8 páginasAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseAinda não há avaliações

- Det Syll Divisional Accountant Item No 19Documento2 páginasDet Syll Divisional Accountant Item No 19tinaantonyAinda não há avaliações

- Βιογραφικά ΟμιλητώνDocumento33 páginasΒιογραφικά ΟμιλητώνANDREASAinda não há avaliações

- Roberto Guercio ResumeDocumento2 páginasRoberto Guercio Resumeapi-3705855Ainda não há avaliações

- LGEIL competitive advantagesDocumento3 páginasLGEIL competitive advantagesYash RoxsAinda não há avaliações

- 3.cinthol "Alive Is Awesome"Documento1 página3.cinthol "Alive Is Awesome"Hemant TejwaniAinda não há avaliações

- TD Bio-Flex F 1100 enDocumento1 páginaTD Bio-Flex F 1100 enKaren VeraAinda não há avaliações

- ANFARM HELLAS S.A.: Leading Greek Pharma Manufacturer Since 1967Documento41 páginasANFARM HELLAS S.A.: Leading Greek Pharma Manufacturer Since 1967Georgios XydeasAinda não há avaliações

- Parked Tank LayoutDocumento1 páginaParked Tank LayoutAZreen A. ZAwawiAinda não há avaliações

- Settlement Rule in Cost Object Controlling (CO-PC-OBJ) - ERP Financials - SCN Wiki PDFDocumento4 páginasSettlement Rule in Cost Object Controlling (CO-PC-OBJ) - ERP Financials - SCN Wiki PDFkkka TtAinda não há avaliações

- Customer Profitability in A Manufacturing Firm Bizzan ManufactuDocumento2 páginasCustomer Profitability in A Manufacturing Firm Bizzan Manufactutrilocksp SinghAinda não há avaliações

- Reporting Outline (Group4 12 Abm1)Documento3 páginasReporting Outline (Group4 12 Abm1)Rafaelto D. Atangan Jr.Ainda não há avaliações

- Contract CoffeeDocumento5 páginasContract CoffeeNguyễn Huyền43% (7)

- Letter To Builder For VATDocumento5 páginasLetter To Builder For VATPrasadAinda não há avaliações

- North IrelandDocumento6 páginasNorth IrelandnearwalllAinda não há avaliações

- Get Surrounded With Bright Minds: Entourage © 2011Documento40 páginasGet Surrounded With Bright Minds: Entourage © 2011Samantha HettiarachchiAinda não há avaliações

- Contract: Organisation Details Buyer DetailsDocumento4 páginasContract: Organisation Details Buyer DetailsMukhiya HaiAinda não há avaliações

- Balance ScorecardDocumento11 páginasBalance ScorecardParandeep ChawlaAinda não há avaliações

- Sap V0.0Documento20 páginasSap V0.0yg89Ainda não há avaliações

- Employee Training at Hyundai Motor IndiaDocumento105 páginasEmployee Training at Hyundai Motor IndiaRajesh Kumar J50% (12)

- Analysis Working Capital Management PDFDocumento5 páginasAnalysis Working Capital Management PDFClint Jan SalvañaAinda não há avaliações

- IB Economics Notes - Macroeconomic Goals Low Unemployment (Part 1)Documento11 páginasIB Economics Notes - Macroeconomic Goals Low Unemployment (Part 1)Pablo TorrecillaAinda não há avaliações

- Israel SettlementDocumento58 páginasIsrael SettlementRaf BendenounAinda não há avaliações

- 048 Barayuga V AupDocumento3 páginas048 Barayuga V AupJacob DalisayAinda não há avaliações

- SC upholds conviction for forgery under NILDocumento3 páginasSC upholds conviction for forgery under NILKobe Lawrence VeneracionAinda não há avaliações

- General Mcqs On Revenue CycleDocumento6 páginasGeneral Mcqs On Revenue CycleMohsin Kamaal100% (1)

- 1-Loanee Declaration PMFBYDocumento2 páginas1-Loanee Declaration PMFBYNalliah PrabakaranAinda não há avaliações

- Cabanlit - Module 2 SPDocumento2 páginasCabanlit - Module 2 SPJovie CabanlitAinda não há avaliações

- Paper 5 PDFDocumento529 páginasPaper 5 PDFTeddy BearAinda não há avaliações