Escolar Documentos

Profissional Documentos

Cultura Documentos

P45 68148

Enviado por

Эдварт АнтонDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

P45 68148

Enviado por

Эдварт АнтонDireitos autorais:

Formatos disponíveis

Mr Viorel Ungureanu

302 Everton Court

Honeypot Lane

London

HA7 1DZ

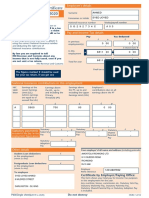

P45 Part 1A

Details of employee leaving work

Copy for employee

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number Student Loan deductions to continue

581 / MH3249

6 Tax Code at leaving date

2 Employee's National Insurance Number

1150L

SZ838346C

If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/Month 1

MR

7 Last entries on P11 Deductions Working Sheet

Surname or family name Complete only if Tax Code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

UNGUREANU

Week number 46 Month number

First or given name(s)

Total pay to date

VIOREL

£ 2810.48 p

4 Leaving date DD MM YYYY Total tax to date

12 02 2018 £ 0.00 p

8 This employment pay and tax. If no entry here, the amounts 12 Employee's private address

are those shown at box 7.

Total pay in this employment 302 Everton Court

Honeypot Lane

£ p London

Total tax in this employment

£ p

Postcode

HA7 1DZ

9 Works number/Payroll number and Department or branch

(if any) 13 I certify that the details entered in items 1 to 11 on

this form are correct.

Number: 68148 Employer name and address

Dept: OFFICE

OMNI FACILITIES MANAGEMENT LTD

11 Beavor Lane

10 Gender. Enter 'X' in the appropriate box London

Male X Female

Postcode

11 Date of birth DD MM YYYY

W6 9AR

26 09 1993 Date DD MM YYYY

06 03 2018

To the employee Tax credits

The P45 is in three parts. Please keep this part (Part 1A) safe. Tax credits are flexible. They adapt to changes in your life,

Copies are not available. You might need the information in such as leaving a job. If you need to let us know about a

Part 1A to fill in a Tax Return if you are sent one. change in your income, phone 0845 300 3900.

To the new employer

Please read the notes in Part 2 that accompany Part 1A. If your new employee gives you this Part 1A, please return

The notes give some important information about what you should it to them. Deal with Parts 2 and 3 as normal.

do next and what you should do with Parts 2 and 3 of this form.

P45(Online) Part 1 A HMRC 01/08

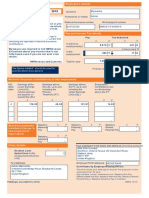

P45 Part 2

Details of employee leaving work

Copy for new employer

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number Student Loan deductions to continue

581 / MH3249

6 Tax Code at leaving date

2 Employee's National Insurance Number

1150L

SZ838346C

If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/Month 1

MR

7 Last entries on P11 Deductions Working Sheet

Surname or family name Complete only if Tax Code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

UNGUREANU

Week number 46 Month number

First or given name(s)

Total pay to date

VIOREL

£ 2810.48 p

4 Leaving date DD MM YYYY Total tax to date

12 02 2018 £ 0.00 p

To the employee

This form is important to you. Take good care of it and Claiming Jobseeker's Allowance or

keep it safe. Copies are not available. Please keep Employment and Support Allowance (ESA)

Parts 2 and 3 of the form together and do not alter them Take this form to your Jobcentre Plus Office. They will pay you

in any way. any tax refund you may be entitled to when your claim ends,

or at 5 April if this is earlier.

Going to a new job

Give Parts 2 and 3 of this form to your new employer, Not working and not claiming Jobseeker's Allowance or

or you will have tax deducted using the emergency Employment and Support Allowance (ESA)

code and may pay too much tax. If you do not want If you have paid tax and wish to claim a refund ask for

your new employer to know the details on this form, form P50 Claiming tax back when you have stopped working

send it to your HM Revenue & Customs (HMRC) office from any HMRC office or Enquiry Centre.

immediately with a letter saying so and giving the

name and address of your new employer. HMRC can

make special arrangements, but you may pay too

much tax for a while as a result of this.

Help

If you need further help you can contact any HMRC office

Going abroad

or Enquiry Centre. You can find us in The Phone Book under

If you are going abroad or returning to a country HM Revenue & Customs or go to www.hmrc.gov.uk

outside the UK ask for form P85 Leaving the United Kingdom

from any HMRC office or Enquiry Centre.

To the new employer

Check this form and complete boxes 8 to 18 in Part 3

Becoming self-employed

and prepare a form P11 Deductions Working Sheet.

You must register with HMRC within three months of Follow the instructions in the Employer Helpbook

becoming self-employed or you could incur a penalty. E13 Day-to-day payroll, for how to prepare a P11 Deductions

To register as newly self-employed see The Phone Book Working Sheet. Send Part 3 of this form to your HMRC

under HM Revenue & Customs or go to www.hmrc.gov.uk office immediately. Keep Part 2.

to get a copy of the booklet SE1 Are you thinking of working

for yourself?.

P45(Online) Part 2 HMRC 01/08

P45 Part 3

New employee details

For completion by new employer

File your employee's P45 online at www.hmrc.gov.uk Use capital letters when completing this form

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number Student Loan deductions to continue

581 / MH3249

6 Tax Code at leaving date

2 Employee's National Insurance Number

1150L

SZ838346C

If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/Month 1

MR

7 Last entries on P11 Deductions Working Sheet

Surname or family name Complete only if Tax Code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

UNGUREANU

Week number 46 Month number

First or given name(s)

Total pay to date

VIOREL

£ 2810.48 p

4 Leaving date DD MM YYYY Total tax to date

12 02 2018 £ 0.00 p

To the new employer Complete boxes 8 to 18 and send P45 Part 3 only to your HMRC office immediately.

8 New Employer PAYE reference 15 Employee's private address

Office number Reference number

/

9 Date new employment started DD MM YYYY

Postcode

10 Works number/Payroll number and Department or branch

(if any) 16 Gender. Enter 'X' in the appropriate box

Male Female

17 Date of birth DD MM YYYY

11 Enter 'P' here if employee will not be paid by you

between the date employment began and the

next 5 April.

Declaration

12 Enter Tax Code in use if different to the Tax Code at box 6.

18 I have prepared a P11 Deductions Working Sheet in

accordance with the details above.

If week 1 or month 1 applies, enter 'X' in the box below.

Employer name and address

Week 1/Month 1

13 If the tax figure you are entering on P11 Deductions

Working Sheet differs from box 7 (see the E13 Employer

Helpbook Day-to-day payroll) please enter the

figure here.

Postcode

£ p

14 New employee's job title or job description Date DD MM YYYY

P45(Online) Part 3 HMRC 01/08

Você também pode gostar

- Copy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnDocumento3 páginasCopy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnZavache DanaAinda não há avaliações

- Inspired Sisters LTD Online) AUDocumento3 páginasInspired Sisters LTD Online) AUthankksAinda não há avaliações

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocumento3 páginasCopy For Employee: P45 Part 1A Details of Employee Leaving WorkDenis VitalieviciAinda não há avaliações

- p45 Tomasz Jureczko Diamonds Digital LTDDocumento3 páginasp45 Tomasz Jureczko Diamonds Digital LTDTomasz JureczkoAinda não há avaliações

- P45 Part 1A Details of Employee Leaving WorkDocumento6 páginasP45 Part 1A Details of Employee Leaving WorkCatalin FandaracAinda não há avaliações

- 5184 P45 (Online) PDFDocumento3 páginas5184 P45 (Online) PDFAlejandroe AuditoreAinda não há avaliações

- Tax Return 2018Documento15 páginasTax Return 2018Arnaud CalisteAinda não há avaliações

- Staff - p45Documento4 páginasStaff - p45velorutionAinda não há avaliações

- P45 Part 1A DetailsDocumento3 páginasP45 Part 1A DetailsCaleb PriceAinda não há avaliações

- PrintP45 PDFDocumento3 páginasPrintP45 PDFIstoc AngelaAinda não há avaliações

- P45 Part 1A Details of Employee Leaving WorkDocumento3 páginasP45 Part 1A Details of Employee Leaving WorkDan NolanAinda não há avaliações

- Ion Onl Y: Copy For HM Revenue & CustomsDocumento4 páginasIon Onl Y: Copy For HM Revenue & CustomsM Muneeb SaeedAinda não há avaliações

- UK Legal Entity: Assets TransferredDocumento3 páginasUK Legal Entity: Assets Transferredshu1706Ainda não há avaliações

- P45 (ONLINE) Duc Trong Duong 2Documento3 páginasP45 (ONLINE) Duc Trong Duong 2Duc Trong DuongAinda não há avaliações

- Ep60 2016-17 PDFDocumento1 páginaEp60 2016-17 PDFAnonymous ZoN0SOKzVAinda não há avaliações

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocumento3 páginasCopy For Employee: P45 Part 1A Details of Employee Leaving WorkSteve OrtonAinda não há avaliações

- Tax Return 2018-19Documento18 páginasTax Return 2018-19Kasam AAinda não há avaliações

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Documento1 páginaAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaAinda não há avaliações

- P45 - Ms Wenyi Zhao (2022) - Employee 4Documento3 páginasP45 - Ms Wenyi Zhao (2022) - Employee 4Ming WuAinda não há avaliações

- P60single 2Documento1 páginaP60single 2Claira JervisAinda não há avaliações

- LicenseDocumento6 páginasLicenseRazvannusAinda não há avaliações

- P 50Documento2 páginasP 50Emily DeerAinda não há avaliações

- Payslip Month Ending 30 November 2022Documento1 páginaPayslip Month Ending 30 November 2022zeppo1234Ainda não há avaliações

- Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocumento1 páginaTax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsNatalino GuterresAinda não há avaliações

- Tax Return 2016Documento18 páginasTax Return 2016kezia dugdale0% (1)

- 64-8 Form (Másolat)Documento2 páginas64-8 Form (Másolat)Molnar FerencneAinda não há avaliações

- R43 2019 PDFDocumento4 páginasR43 2019 PDFDavid Mark AldridgeAinda não há avaliações

- Leaving UK - Getting Tax RightDocumento4 páginasLeaving UK - Getting Tax RightAbhay PatodiAinda não há avaliações

- Inbound Paper SA1 Form With Instruction - SignedDocumento3 páginasInbound Paper SA1 Form With Instruction - SignedKushal SharmaAinda não há avaliações

- Tax Year To 5 April: P60 End of Year CertificateDocumento1 páginaTax Year To 5 April: P60 End of Year CertificateВолодимир МельникAinda não há avaliações

- Claim For Repayment of Tax Deducted From Savings and InvestmentsDocumento4 páginasClaim For Repayment of Tax Deducted From Savings and InvestmentsxzmangeshAinda não há avaliações

- Your National Insurance Number: About This FormDocumento4 páginasYour National Insurance Number: About This FormTatyana TerziyskaAinda não há avaliações

- Confirming Your Eligibility For Tax ReliefDocumento4 páginasConfirming Your Eligibility For Tax ReliefNurullah GuzelAinda não há avaliações

- Tax Return 2018Documento16 páginasTax Return 2018Robert GyetwayAinda não há avaliações

- P60 End of Year Certificate 10 05 19 16 14 16 5273Documento1 páginaP60 End of Year Certificate 10 05 19 16 14 16 527313KARATAinda não há avaliações

- UK State Pension StatementDocumento7 páginasUK State Pension StatementElmer LeonardAinda não há avaliações

- Proof of DeliveryDocumento1 páginaProof of DeliveryAbdulmalik Muhammad ElAinda não há avaliações

- 2021 FullDocumento14 páginas2021 FullDamian MikaAinda não há avaliações

- Construction Industry Scheme Payment and Deduction StatementDocumento1 páginaConstruction Industry Scheme Payment and Deduction Statement13KARATAinda não há avaliações

- File 2018 Tax Return ElectronicallyDocumento3 páginasFile 2018 Tax Return Electronicallymuhammad afiqAinda não há avaliações

- StatusOutcome 04 February 2020Documento6 páginasStatusOutcome 04 February 2020Takacs Marcel100% (1)

- Payslip 6 (31-08-2014)Documento1 páginaPayslip 6 (31-08-2014)shirmin1997Ainda não há avaliações

- PAYE/USC Statement of Liability for 2019Documento2 páginasPAYE/USC Statement of Liability for 2019Viorica Zaporojan IascerinschiAinda não há avaliações

- Tax Return 2012 Guide EnclosedDocumento16 páginasTax Return 2012 Guide EnclosedNatalia Ciocirlan100% (1)

- 2020-11-01 19-23-53 Bunq Transaction DetailsDocumento1 página2020-11-01 19-23-53 Bunq Transaction Details13KARATAinda não há avaliações

- Form To Get NinoDocumento3 páginasForm To Get NinoFrancisco Vergara PerucichAinda não há avaliações

- ETL AuthorizationDocumento1 páginaETL AuthorizationЖагаа ЖагааAinda não há avaliações

- Print VAT Registration - GOV - UkDocumento11 páginasPrint VAT Registration - GOV - Uksiva kumarAinda não há avaliações

- View Tax Return PDFDocumento14 páginasView Tax Return PDFEmil AndriesAinda não há avaliações

- CA5403: Your National Insurance Number: About This FormDocumento4 páginasCA5403: Your National Insurance Number: About This FormluzipopAinda não há avaliações

- P 85Documento5 páginasP 85bhavik24Ainda não há avaliações

- HMRC Tax Calculation & Tax Year Overview RequirementsDocumento7 páginasHMRC Tax Calculation & Tax Year Overview RequirementsbswaminaAinda não há avaliações

- Pay Slip for Jamie ElliottDocumento1 páginaPay Slip for Jamie ElliottJamie ElliottAinda não há avaliações

- IRDDocumento6 páginasIRDKKAinda não há avaliações

- Starter Checklist: Instructions For EmployersDocumento2 páginasStarter Checklist: Instructions For EmployersTareqAinda não há avaliações

- P45 94142 (1) bunDocumento4 páginasP45 94142 (1) bunCosty DutaAinda não há avaliações

- P45 (Online) - LJDocumento3 páginasP45 (Online) - LJGreat EmmanuelAinda não há avaliações

- P45 Part 1A Details of Employee Leaving WorkDocumento3 páginasP45 Part 1A Details of Employee Leaving WorkPapa JP JohnAinda não há avaliações

- BERAYDocumento3 páginasBERAYberaylyatif2Ainda não há avaliações

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionAinda não há avaliações

- BPC 10.0 Planning ScenariosDocumento16 páginasBPC 10.0 Planning ScenariosDinakaran KailasamAinda não há avaliações

- Renewal Form for CR and CRTEDocumento1 páginaRenewal Form for CR and CRTEMarkyAinda não há avaliações

- Offer Letter HakkimDocumento9 páginasOffer Letter Hakkimsenthil_kumaran_9100% (1)

- BondAnalytics GlossaryDocumento4 páginasBondAnalytics GlossaryNaveen KumarAinda não há avaliações

- Chap09 Guerrero Consolidated FsDocumento50 páginasChap09 Guerrero Consolidated FsMARTINEZ Wyssa ElaineAinda não há avaliações

- BIR RULING (DA-545-04) : Atty. Miguel Romualdo T. SanidadDocumento3 páginasBIR RULING (DA-545-04) : Atty. Miguel Romualdo T. SanidadRod Ralph ZantuaAinda não há avaliações

- The Economic Cycle ExplainedDocumento12 páginasThe Economic Cycle ExplainedayushiAinda não há avaliações

- Jawaban Soal ExerciseDocumento13 páginasJawaban Soal Exerciseqinthara alfarisiAinda não há avaliações

- Domestic Work Contract PDFDocumento3 páginasDomestic Work Contract PDFGo DedeAinda não há avaliações

- Financial Management Practices of Small Firms in Ghana:-An Empirical Study. BY Ben K. Agyei-MensahDocumento24 páginasFinancial Management Practices of Small Firms in Ghana:-An Empirical Study. BY Ben K. Agyei-MensahLaylyDwi_RAinda não há avaliações

- Banking of BPMDocumento20 páginasBanking of BPMSai DheerajAinda não há avaliações

- Managerial Accounting Relevant Costing Decision MakingDocumento10 páginasManagerial Accounting Relevant Costing Decision MakingGenalin Muaña EbonAinda não há avaliações

- The 16 FrameworksDocumento21 páginasThe 16 Frameworksarif420_999Ainda não há avaliações

- SAP CO-PC Product Costing in SAP ERP6.0 OneDocumento34 páginasSAP CO-PC Product Costing in SAP ERP6.0 Onefaysal2523535100% (3)

- Hoa (All)Documento2 páginasHoa (All)Balasubramaniam ElangovanAinda não há avaliações

- Practice Exercises # 2 - CH 14Documento4 páginasPractice Exercises # 2 - CH 14Hamna AzeezAinda não há avaliações

- Pre Mid Sem Family Law NotesDocumento11 páginasPre Mid Sem Family Law NoteshaloXDAinda não há avaliações

- CombinepdfDocumento2 páginasCombinepdfakhil sinhaAinda não há avaliações

- Internship Report ON F.E.S.C.O of PakistanDocumento54 páginasInternship Report ON F.E.S.C.O of PakistanBILALAinda não há avaliações

- 20140918Documento24 páginas20140918កំពូលបុរសឯកាAinda não há avaliações

- Master Budget Example MC Watters AIP8-13Documento2 páginasMaster Budget Example MC Watters AIP8-13Muhammed muhabaAinda não há avaliações

- Keyman Insurance Policy-White PaperDocumento12 páginasKeyman Insurance Policy-White PaperbeingviswaAinda não há avaliações

- Chapter 4 Land Value Determination and Tax Maps 353172 7Documento38 páginasChapter 4 Land Value Determination and Tax Maps 353172 7Andri SuhartoAinda não há avaliações

- Company financial statements and key metricsDocumento6 páginasCompany financial statements and key metricsAther RamzanAinda não há avaliações

- BondsDocumento17 páginasBondsjaneAinda não há avaliações

- Taxation Law Question Bank BALLBDocumento49 páginasTaxation Law Question Bank BALLBaazamrazamaqsoodiAinda não há avaliações

- Ms - MuffDocumento17 páginasMs - MuffDayuman LagasiAinda não há avaliações

- Financial Ratio Analysis Aldar UpdatedDocumento36 páginasFinancial Ratio Analysis Aldar UpdatedHasanAinda não há avaliações

- Conventional BricksDocumento8 páginasConventional BricksChenna Vivek KumarAinda não há avaliações