Escolar Documentos

Profissional Documentos

Cultura Documentos

Accounting Receivable Accounting

Enviado por

Mega Pop Locker0 notas0% acharam este documento útil (0 voto)

778 visualizações2 páginasd

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentod

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

778 visualizações2 páginasAccounting Receivable Accounting

Enviado por

Mega Pop Lockerd

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 2

Accounting for Receivables

Tutorial-5

Exersise-6

Compute bad debt expense based on the following information:

(a) RLF Company estimates that 2% of net credit sales will become

uncollectible. Sales revenue are $600,000, sales returns and

allowances are $30,000, and the allowance for doubtful accounts has a

$6,000 credit balance.

(b) RLF Company estimates that 10% of accounts receivable will become

uncollectible. Accounts receivable are $100,000 at the end of the year,

and the allowance for doubtful accounts has a $500 debit balance.

Answer

(a) Bad debt expense = $11400 { ($600000-$30000) x .02}

(b) Bad debt expense = $10500 { ($100000 x .10) + $500}

30. Syfy Company on July 15 sells merchandise on account to Eureka Co.

for $5,000, terms 2/10, n/30. On July 20 Eureka Co. returns merchandise

worth $2,000 to Syfy Company. On July 24 payment is received from

Eureka Co. for the balance due. What is the amount of cash received?

a. $2,900

b. $2,940

c. $3,000

d. $5,000

Answer.b

36. An aging of a company's accounts receivable indicates that $14,000

are estimated to be uncollectible. If Allowance for Doubtful

Accounts has a $1100 credit balance, the adjustment to record bad

debts for the period will require a

a. debit to Bad Debts Expense for $14,000.

b. debit to Allowance for Doubtful Accounts for $12,900.

c. debit to Bad Debts Expense for $12,900.

d. credit to Allowance for Doubtful Accounts for $14,000

Answer. C

47.An aging of a company's accounts receivable indicates that $3,000 are

estimated to be uncollectible. If Allowance for Doubtful Accounts has a $800

debit balance, the adjustment to record bad debts for the period will require a

a. debit to Bad Debts Expense for $2,200.

b. debit to Bad Debts Expense for $3,000.

c. debit to Bad Debts Expense for $3,800.

d. credit to Allowance for Doubtful Accounts for $800

Answer. C

50.Kill Corporation's unadjusted trial balance includes the following

balances (assume normal balances):

Accounts Receivable $ 850,000

Allowance for Doubtful Accounts 15,000

Bad debts are estimated to be 6% of outstanding receivables. What amount

of bad debt expense will the company record?

a. $15000

b. $36000

c. $50100

d. $5100 Answer.b

Você também pode gostar

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- Accounting Process With AnsDocumento6 páginasAccounting Process With AnsMichael BongalontaAinda não há avaliações

- Diagnostic Quiz On Accounting 2Documento9 páginasDiagnostic Quiz On Accounting 2Anne Ford67% (3)

- Government Accounting MidtermDocumento8 páginasGovernment Accounting MidtermTan RoncalAinda não há avaliações

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionAinda não há avaliações

- Payroll AcctgDocumento14 páginasPayroll AcctgBeboy Lacre0% (1)

- SCM Budget BSA2ADocumento3 páginasSCM Budget BSA2AKaymark Lorenzo0% (2)

- Korarai 18181881Documento4 páginasKorarai 18181881KyraraAinda não há avaliações

- PAS 12 Accounting For Income TaxDocumento17 páginasPAS 12 Accounting For Income TaxReynaldAinda não há avaliações

- Practical Accounting Part 1Documento18 páginasPractical Accounting Part 1Jonacress Callo CagatinAinda não há avaliações

- Cost Accounting Procedure For Spoiled GoodsDocumento3 páginasCost Accounting Procedure For Spoiled GoodszachAinda não há avaliações

- ADJUSTING Activities With AnswersDocumento5 páginasADJUSTING Activities With AnswersRenz RaphAinda não há avaliações

- S03 - Chapter 5 Job Order Costing Without AnswersDocumento2 páginasS03 - Chapter 5 Job Order Costing Without AnswersRigel Kent MansuetoAinda não há avaliações

- Powerpoint - Reversing EntriesDocumento13 páginasPowerpoint - Reversing EntriesUPHSD JPIAAinda não há avaliações

- 2nd Week - The Master Budget ExercisesDocumento5 páginas2nd Week - The Master Budget ExercisesLuigi Enderez BalucanAinda não há avaliações

- Solved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofDocumento1 páginaSolved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofAnbu jaromiaAinda não há avaliações

- Prepare A Statement of Partnership Liquidation,...Documento3 páginasPrepare A Statement of Partnership Liquidation,...Alene AmsaluAinda não há avaliações

- HOME OFFICE AND BRANCH ACCOUNTING ExprobDocumento9 páginasHOME OFFICE AND BRANCH ACCOUNTING ExprobJenaz Albert CorralesAinda não há avaliações

- Module 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSDocumento7 páginasModule 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSNiño Mendoza MabatoAinda não há avaliações

- Acc 496 Chapter 6Documento2 páginasAcc 496 Chapter 6Abdul HassonAinda não há avaliações

- Revision Question BankDocumento15 páginasRevision Question BankPuneet SharmaAinda não há avaliações

- ACCT 101 Comprehensive Prob 1Documento8 páginasACCT 101 Comprehensive Prob 1Jay NgAinda não há avaliações

- CHAPTER 6 - Adjusting EntriesDocumento25 páginasCHAPTER 6 - Adjusting EntriesMuhammad AdibAinda não há avaliações

- Jawaban Forum 4 - Investasi Proyek Dan KeuanganDocumento7 páginasJawaban Forum 4 - Investasi Proyek Dan KeuanganAlin SuarliakAinda não há avaliações

- MARGA FAR SolutionDocumento5 páginasMARGA FAR SolutionYhancie Mae TorresAinda não há avaliações

- Comprehension Questions: 1. What Are Minimum Lease Payments'?Documento13 páginasComprehension Questions: 1. What Are Minimum Lease Payments'?Amit ShuklaAinda não há avaliações

- AFDM - Assign 4Documento1 páginaAFDM - Assign 4Tausif IlyasAinda não há avaliações

- Fundamentals of AccountancyDocumento17 páginasFundamentals of AccountancyKimberly MilanteAinda não há avaliações

- Background of The CaseDocumento25 páginasBackground of The CaseDiane LockhartAinda não há avaliações

- Revenue Recognition: Long Term ConstructionDocumento2 páginasRevenue Recognition: Long Term ConstructionLee SuarezAinda não há avaliações

- Discussion Problems 1. You Plan To Retire 33 Years From Now. You Expect That You Will Live 27 Years After RetiringDocumento10 páginasDiscussion Problems 1. You Plan To Retire 33 Years From Now. You Expect That You Will Live 27 Years After RetiringJape PreciaAinda não há avaliações

- Activity No 1Documento2 páginasActivity No 1Makeyc Stis100% (1)

- SC PracticeDocumento6 páginasSC Practicefatima airis aradais100% (1)

- Final Exam May 2009 Without AnswersDocumento9 páginasFinal Exam May 2009 Without AnswersrodreluaAinda não há avaliações

- Cash and Cash Equivalents QuizDocumento2 páginasCash and Cash Equivalents QuizMarkJoven Bergantin100% (1)

- Business Combination Drill PDFDocumento2 páginasBusiness Combination Drill PDFMelvin MendozaAinda não há avaliações

- 6 BudgetingDocumento2 páginas6 BudgetingClyette Anne Flores BorjaAinda não há avaliações

- CoMa Quiz 2Documento21 páginasCoMa Quiz 2Antriksh JohriAinda não há avaliações

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityNo EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityAinda não há avaliações

- Example Cash BudgetDocumento1 páginaExample Cash BudgetPamela GalangAinda não há avaliações

- Cost Concept Exercises PDFDocumento2 páginasCost Concept Exercises PDFAina OracionAinda não há avaliações

- Sample Problem of Corporation LiquidationDocumento11 páginasSample Problem of Corporation LiquidationAnne Camille Alfonso50% (4)

- Leonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceDocumento12 páginasLeonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceJohnMurray111100% (1)

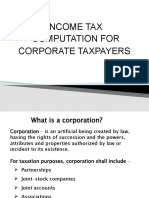

- Income Tax Computation For Corporate TaxpayersDocumento79 páginasIncome Tax Computation For Corporate TaxpayersPATATASAinda não há avaliações

- Bank Reconciliation Lecture NotesDocumento56 páginasBank Reconciliation Lecture NotesMissy Arancon Alfonso CampañaAinda não há avaliações

- Chapter 23 HomeworkDocumento10 páginasChapter 23 HomeworkTracy LeeAinda não há avaliações

- CAT Level 2 QuestionnairesDocumento16 páginasCAT Level 2 QuestionnairesRona Amor MundaAinda não há avaliações

- Chapter 4 - Job Order and Process CostingDocumento12 páginasChapter 4 - Job Order and Process Costingchelsea kayle licomes fuentesAinda não há avaliações

- Finance Review Questions With Answer KeyDocumento14 páginasFinance Review Questions With Answer KeyLoranisa BalorioAinda não há avaliações

- CPA Firm Involved AdelphiaDocumento2 páginasCPA Firm Involved AdelphiaHenny FaustaAinda não há avaliações

- Lecture Chapter 6 Introduction To The Value Added TaxDocumento16 páginasLecture Chapter 6 Introduction To The Value Added TaxChristian PelimcoAinda não há avaliações

- 6902 - Investment Property and Other InvestmentDocumento3 páginas6902 - Investment Property and Other InvestmentAljur SalamedaAinda não há avaliações

- Finman - Q2 Cost Os CaptDocumento2 páginasFinman - Q2 Cost Os CaptJennifer RasonabeAinda não há avaliações

- This Study Resource Was: Problem Set 7 Budgeting Problem 1 (Garrison Et Al. v15 8-1)Documento8 páginasThis Study Resource Was: Problem Set 7 Budgeting Problem 1 (Garrison Et Al. v15 8-1)NCT100% (1)

- Week 2Documento6 páginasWeek 2Maryane AngelaAinda não há avaliações

- Accounting CycleDocumento28 páginasAccounting Cycleyram shinAinda não há avaliações

- Gray Electronic Repair ServicesDocumento1 páginaGray Electronic Repair ServicesFarman AfzalAinda não há avaliações

- Job Order CostingDocumento1 páginaJob Order CostingVincent Pham100% (1)

- Test Bank Advanced Accounting 3e by Jeter 05 ChapterDocumento22 páginasTest Bank Advanced Accounting 3e by Jeter 05 Chapterkevin galandeAinda não há avaliações

- Reviewer in Intermediate Accounting (Midterm)Documento9 páginasReviewer in Intermediate Accounting (Midterm)Czarhiena SantiagoAinda não há avaliações

- Lec3 STATISTICSDocumento9 páginasLec3 STATISTICSMega Pop LockerAinda não há avaliações

- The Major Differences Between U.S GAAP and IFRSDocumento12 páginasThe Major Differences Between U.S GAAP and IFRSMega Pop LockerAinda não há avaliações

- Single AssetsDocumento4 páginasSingle AssetsMega Pop LockerAinda não há avaliações

- UG022527 International GCSE in Mathematics Spec A For WebDocumento77 páginasUG022527 International GCSE in Mathematics Spec A For WebJohn Hopkins100% (1)

- Finncial Statement AnalysisDocumento3 páginasFinncial Statement AnalysisMega Pop LockerAinda não há avaliações

- Long Lived Assets Through U.S. GAAPDocumento17 páginasLong Lived Assets Through U.S. GAAPMega Pop LockerAinda não há avaliações

- Introduction To Statistics: Telephone SurveysDocumento8 páginasIntroduction To Statistics: Telephone SurveysMega Pop LockerAinda não há avaliações

- Advanced TheoraticalDocumento9 páginasAdvanced TheoraticalMega Pop LockerAinda não há avaliações

- CH One QuestDocumento2 páginasCH One QuestMega Pop LockerAinda não há avaliações

- Chapter+15+Monopoly AbbreviatedDocumento7 páginasChapter+15+Monopoly AbbreviatedMega Pop LockerAinda não há avaliações

- Extra QuestionsDocumento2 páginasExtra QuestionsMega Pop LockerAinda não há avaliações

- tb1 ch14Documento84 páginastb1 ch14Mega Pop LockerAinda não há avaliações

- Q1 VBDocumento2 páginasQ1 VBMega Pop LockerAinda não há avaliações

- Acu ch4 MCQDocumento3 páginasAcu ch4 MCQMega Pop LockerAinda não há avaliações

- Questionnaire Grad IIDocumento4 páginasQuestionnaire Grad IIMega Pop LockerAinda não há avaliações

- POM ch1Documento5 páginasPOM ch1Mega Pop LockerAinda não há avaliações

- Chapter 2 The Law of Comparative AdvantageDocumento10 páginasChapter 2 The Law of Comparative AdvantageMega Pop LockerAinda não há avaliações

- Fac 408 NewDocumento7 páginasFac 408 NewMega Pop LockerAinda não há avaliações

- Task 1Documento3 páginasTask 1Mega Pop LockerAinda não há avaliações

- Chapter 2 The Law of Comparative AdvantageDocumento10 páginasChapter 2 The Law of Comparative AdvantageMega Pop LockerAinda não há avaliações

- CH 2 Summer Managerial Account 1Documento4 páginasCH 2 Summer Managerial Account 1Mega Pop LockerAinda não há avaliações

- Questions About Corporate Governance BenefitsDocumento6 páginasQuestions About Corporate Governance BenefitsMega Pop LockerAinda não há avaliações

- Total Cost of Division B: Items Estimate Actual VarainceDocumento1 páginaTotal Cost of Division B: Items Estimate Actual VarainceMega Pop LockerAinda não há avaliações

- H1: There Is Significant Relationship Between Website Quality and The Firm ProfitabilityDocumento2 páginasH1: There Is Significant Relationship Between Website Quality and The Firm ProfitabilityMega Pop LockerAinda não há avaliações

- Chapter 3 OB Organizational Behavior AcuDocumento4 páginasChapter 3 OB Organizational Behavior AcuMega Pop LockerAinda não há avaliações

- Pom After MidDocumento6 páginasPom After MidMega Pop LockerAinda não há avaliações

- The Impact of The Organizational Change On Employees' ProductivityDocumento19 páginasThe Impact of The Organizational Change On Employees' ProductivityMega Pop LockerAinda não há avaliações

- Task 2Documento2 páginasTask 2Mega Pop LockerAinda não há avaliações

- Pom After MidDocumento6 páginasPom After MidMega Pop LockerAinda não há avaliações

- CH 9 Group Behavior OB ACUDocumento6 páginasCH 9 Group Behavior OB ACUMega Pop LockerAinda não há avaliações

- BF Las q4 Week 1 For Qa CheckedDocumento12 páginasBF Las q4 Week 1 For Qa CheckedTrunks KunAinda não há avaliações

- Pay at Any METROBANK Branch: Name And/or USN (Student Number)Documento3 páginasPay at Any METROBANK Branch: Name And/or USN (Student Number)jeff dianaAinda não há avaliações

- Daftar Riwayat HidupDocumento2 páginasDaftar Riwayat HidupYanto ErliAinda não há avaliações

- EGR4 - ATLAS - 29.06.2014 - B&T - (Marcu)Documento1 páginaEGR4 - ATLAS - 29.06.2014 - B&T - (Marcu)Simona MarcuAinda não há avaliações

- MR ACCOUNTING Case Study - Lab SessionDocumento4 páginasMR ACCOUNTING Case Study - Lab Sessionckyn greenleaf100% (3)

- Mental Health Nursing R ShreevaniDocumento3 páginasMental Health Nursing R ShreevaniBalwant SinghAinda não há avaliações

- Scope of Appointment FormDocumento2 páginasScope of Appointment Formapi-260208821Ainda não há avaliações

- Review On "Untraceable Electronic Mail, Return Addresses, and Digital Pseudonyms" by David ChaumDocumento2 páginasReview On "Untraceable Electronic Mail, Return Addresses, and Digital Pseudonyms" by David ChaumSiddartha Ailuri100% (1)

- Transcript Request FormDocumento2 páginasTranscript Request FormJeromeHeadleyAinda não há avaliações

- Daftar PustakaDocumento3 páginasDaftar PustakaFaisal Al IdrusAinda não há avaliações

- Payment Information: Spark Mastercard Business Worldelite Account Ending in 2103Documento11 páginasPayment Information: Spark Mastercard Business Worldelite Account Ending in 2103Lucy Marie RamirezAinda não há avaliações

- M&T Franchising Policy RevisedDocumento7 páginasM&T Franchising Policy RevisedHoward UntalanAinda não há avaliações

- Subject Description Subject Code Section Units Days Time Room CampusDocumento1 páginaSubject Description Subject Code Section Units Days Time Room CampusAngelo FerrerAinda não há avaliações

- Cost of CRR SLRRDocumento18 páginasCost of CRR SLRRSomesh SrivastavaAinda não há avaliações

- Introtociscosafe 2023 PDFDocumento50 páginasIntrotociscosafe 2023 PDFMichael O'ConnellAinda não há avaliações

- Retail Shop Management: Unit - IvDocumento66 páginasRetail Shop Management: Unit - IvmanopavanAinda não há avaliações

- KajalDocumento6 páginasKajalKaju ParmarAinda não há avaliações

- OS21998315 PremiumPaymentCertificateDocumento1 páginaOS21998315 PremiumPaymentCertificateSoumyaranjan SwainAinda não há avaliações

- PolicyBazaar.com PPTDocumento10 páginasPolicyBazaar.com PPTdevendra singh67% (3)

- View Invoice - ReceiptDocumento1 páginaView Invoice - Receiptspeak2ebiniAinda não há avaliações

- AfardocDocumento14 páginasAfardocJhedz CartasAinda não há avaliações

- Associated Students, Inc. Standard Operations Policy & Procedure ManualDocumento4 páginasAssociated Students, Inc. Standard Operations Policy & Procedure ManualLoy BalsAinda não há avaliações

- Make Up Exam 2022-2023Documento3 páginasMake Up Exam 2022-2023Donia RidaneAinda não há avaliações

- New BankDocumento13 páginasNew BankVelayudhan SunkaraAinda não há avaliações

- PROJ 410 Week 3 RFP Requirements Discussion Questions 1 Complete AnswerDocumento8 páginasPROJ 410 Week 3 RFP Requirements Discussion Questions 1 Complete AnswerMicahBittnerAinda não há avaliações

- STB Invoice S2022067Documento2 páginasSTB Invoice S2022067Taufik Iman FauziAinda não há avaliações

- Ekuore PDFDocumento9 páginasEkuore PDFFelipe García EncinaAinda não há avaliações

- CCNA 1 v7 Modules 8 - 10 - Communicating Between Networks Exam AnswersDocumento31 páginasCCNA 1 v7 Modules 8 - 10 - Communicating Between Networks Exam Answerswafa hopAinda não há avaliações

- Class Diagram - Online Railway Reservation System: BooksDocumento1 páginaClass Diagram - Online Railway Reservation System: BooksyfiamataimAinda não há avaliações

- 02 Handout 1Documento7 páginas02 Handout 1lorie janeAinda não há avaliações