Escolar Documentos

Profissional Documentos

Cultura Documentos

Baml Hy Index

Enviado por

John HanDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Baml Hy Index

Enviado por

John HanDireitos autorais:

Formatos disponíveis

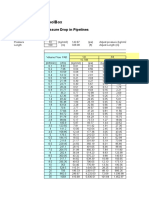

US High Yield Master II Index (H0A0) - distribution characteristics as of 5/23/2018

Index distribution by Rating # FullVal %Full Val Eff Dur Contr EffDur Eff Yld OAS TRR%MTD ExRtn%MTD

AAA 0 3,869.900 0.30570 0.00 0.00 1.78 0 N/A N/A

BB 824 575,176.480 45.43633 4.71 2.14 5.23 238 -0.471 -0.384

B 796 536,563.154 42.38605 3.85 1.63 6.53 369 0.156 0.179

CCC 238 143,779.444 11.35792 3.25 0.37 9.35 658 0.794 0.782

CC 15 6,245.644 0.49338 2.53 0.01 18.96 1,658 7.159 7.094

C 1 261.062 0.02062 1.13 0.00 46.94 4,441 7.643 7.549

Grand Total 1,874 1,265,895.683 100.00000 4.15 4.15 6.31 348 -0.025 0.023

Index distribution by Maturity # FullVal %Full Val Eff Dur Contr EffDur Eff Yld OAS TRR%MTD ExRtn%MTD

0-1 Year 10 10,248.339 0.80957 0.33 0.00 2.06 49 N/A N/A

1-2 Year 96 59,306.222 4.68492 1.32 0.06 5.82 335 0.488 0.397

2-3 Year 156 91,674.891 7.24190 1.82 0.13 6.22 363 0.453 0.369

3-4 Year 237 162,730.761 12.85499 2.51 0.32 6.54 383 0.428 0.363

4-5 Year 323 213,762.130 16.88624 3.12 0.53 6.32 352 0.265 0.218

5-6 Year 216 154,615.459 12.21392 3.69 0.45 6.25 338 0.418 0.398

6-7 Year 316 217,350.026 17.16966 4.69 0.81 6.27 336 -0.189 -0.147

7-8 Year 231 167,438.098 13.22685 5.27 0.70 6.68 373 -0.501 -0.410

8-9 Year 92 64,950.804 5.13082 6.20 0.32 6.04 308 -0.715 -0.547

9-10 Year 80 55,377.364 4.37456 6.89 0.30 5.91 293 -0.773 -0.501

10-15 Year 29 21,127.019 1.66894 7.98 0.13 6.95 395 -1.017 -0.605

15-20 Year 43 24,618.416 1.94474 9.89 0.19 6.64 361 -1.180 -0.562

20-25 Year 32 15,433.215 1.21915 11.36 0.14 6.99 390 -0.592 0.134

25+ Year 13 7,262.941 0.57374 12.38 0.07 6.86 374 0.199 0.942

Grand Total 1,874 1,265,895.683 100.00000 4.15 4.15 6.31 348 -0.025 0.023

Index distribution by Duration # FullVal %Full Val Eff Dur Contr EffDur Eff Yld OAS TRR%MTD ExRtn%MTD

0-1 Year 95 66,566.860 5.25848 0.52 0.03 4.45 202 0.307 0.205

1-2 Year 200 129,560.904 10.23472 1.52 0.16 6.02 339 0.427 0.342

2-3 Year 290 187,781.863 14.83391 2.53 0.38 6.59 386 0.350 0.286

3-4 Year 356 234,142.119 18.49616 3.49 0.65 6.51 370 0.267 0.234

4-5 Year 333 238,676.922 18.85439 4.50 0.85 6.65 375 0.164 0.189

5-6 Year 322 224,738.092 17.75329 5.41 0.96 6.29 336 -0.457 -0.355

6-7 Year 126 89,258.552 7.05102 6.45 0.45 6.05 307 -0.913 -0.692

7-8 Year 55 39,479.333 3.11869 7.30 0.23 6.15 315 -0.928 -0.600

8-9 Year 16 11,508.244 0.90910 8.52 0.08 6.74 374 -1.317 -0.848

9-10 Year 24 11,513.169 0.90949 9.59 0.09 7.55 451 -0.229 0.349

10-11 Year 27 15,249.760 1.20466 10.43 0.13 6.16 311 -1.824 -1.155

11-12 Year 12 6,826.599 0.53927 11.54 0.06 6.67 358 0.039 0.767

12+ Year 18 10,593.266 0.83682 12.90 0.11 6.09 297 -1.013 -0.206

Grand Total 1,874 1,265,895.683 100.00000 4.15 4.15 6.31 348 -0.025 0.023

Refer to important disclosures at the end of the document. 1

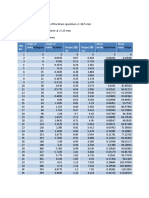

US High Yield Master II Index (H0A0) - distribution characteristics as of 5/23/2018

Index distribution by Industry # FullVal %Full Val Eff Dur Contr EffDur Eff Yld OAS TRR%MTD ExRtn%MTD

Banking 42 41,514.521 3.27946 5.48 0.18 5.21 235 -0.700 -0.544

Brokerage 5 2,750.839 0.21730 3.36 0.01 6.67 390 0.060 0.054

Cons/Comm/Lease Financing 62 36,793.004 2.90648 3.36 0.10 5.64 295 0.133 0.121

Investments & Misc Financial 11 10,130.914 0.80030 2.56 0.02 5.31 255 -0.195 -0.242

Financial Services (Sub Total) 78 49,674.757 3.92408 3.19 0.13 5.63 292 0.062 0.043

Insurance Brokerage 7 5,247.749 0.41455 4.66 0.02 7.16 423 0.252 0.319

Life Insurance 7 3,284.577 0.25947 4.67 0.01 4.85 204 -0.167 -0.088

Monoline Insurance 3 1,125.238 0.08889 4.59 0.00 5.88 301 -0.068 -0.042

Multi-Line Insurance 7 2,890.556 0.22834 4.04 0.01 8.00 522 3.546 3.597

P&C 1 852.215 0.06732 10.52 0.01 5.99 293 -0.206 0.477

Insurance (Sub Total) 25 13,400.336 1.05857 4.90 0.05 6.59 372 0.780 0.883

Financial (Total) 145 104,589.614 8.26210 4.32 0.36 5.59 280 -0.151 -0.084

Auto Parts & Equipment 25 13,984.345 1.10470 4.62 0.05 6.70 380 -0.996 -0.929

Automakers 10 8,373.806 0.66149 3.77 0.02 5.30 252 -0.338 -0.324

Automotive (Sub Total) 35 22,358.151 1.76619 4.30 0.08 6.18 332 -0.752 -0.704

Building & Construction 73 29,876.909 2.36014 4.14 0.10 5.48 268 -0.550 -0.494

Building Materials 35 18,431.910 1.45604 4.28 0.06 5.67 278 -0.951 -0.906

Chemicals 56 33,801.020 2.67013 4.12 0.11 5.88 313 -0.051 0.007

Forestry/Paper 15 5,486.700 0.43342 4.19 0.02 5.77 292 -0.164 -0.122

Metals/Mining Excluding Steel 70 44,320.534 3.50112 4.72 0.17 6.46 361 -0.220 -0.120

Steel Producers/Products 29 15,205.645 1.20118 4.65 0.06 5.34 249 -0.223 -0.108

Basic Industry (Sub Total) 278 147,122.717 11.62203 4.38 0.51 5.89 307 -0.339 -0.264

Aerospace/Defense 24 18,286.752 1.44457 3.52 0.05 5.67 285 -0.078 -0.081

Diversified Capital Goods 20 8,263.304 0.65276 3.16 0.02 5.80 300 -0.372 -0.398

Machinery 16 7,194.117 0.56830 4.13 0.02 7.26 439 -0.747 -0.713

Packaging 50 34,901.167 2.75703 3.82 0.11 5.23 245 -0.650 -0.638

Capital Goods (Sub Total) 110 68,645.339 5.42267 3.69 0.20 5.63 283 -0.475 -0.470

Beverage 1 744.823 0.05884 5.16 0.00 5.64 271 -0.400 -0.331

Food - Wholesale 26 16,921.449 1.33672 4.99 0.07 6.08 317 -0.241 -0.155

Personal & Household Products 34 15,590.996 1.23162 3.92 0.05 6.92 410 -0.622 -0.597

Tobacco 3 1,773.650 0.14011 3.50 0.00 8.77 597 -0.842 -0.858

Consumer Goods (Sub Total) 64 35,030.918 2.76728 4.44 0.12 6.58 372 -0.445 -0.392

Energy - Exploration & Production 149 89,388.674 7.06130 3.87 0.27 6.90 406 0.645 0.664

Gas Distribution 103 60,755.076 4.79937 4.97 0.24 5.70 288 0.032 0.135

Oil Field Equipment & Services 78 38,555.702 3.04573 5.00 0.15 7.68 481 2.463 2.581

Oil Refining & Marketing 10 6,836.331 0.54004 2.89 0.02 6.38 365 0.511 0.471

Energy (Sub Total) 340 195,535.784 15.44644 4.40 0.68 6.67 383 0.800 0.863

Health Facilities 58 62,183.645 4.91223 3.91 0.19 6.53 374 0.348 0.371

Health Services 22 16,084.542 1.27061 4.02 0.05 6.17 330 -0.310 -0.287

Managed Care 9 10,028.270 0.79219 3.49 0.03 5.31 247 0.879 0.868

Medical Products 17 11,511.799 0.90938 3.90 0.04 6.72 387 0.096 0.120

Pharmaceuticals 32 29,815.803 2.35531 3.68 0.09 7.50 466 2.040 2.044

Healthcare (Sub Total) 138 129,624.059 10.23971 3.84 0.39 6.63 381 0.668 0.684

Gaming 42 32,058.491 2.53247 3.93 0.10 5.40 256 -0.205 -0.178

Hotels 15 9,545.662 0.75406 4.71 0.04 5.47 257 -0.704 -0.640

Recreation & Travel 13 7,139.066 0.56395 4.70 0.03 6.01 310 -0.927 -0.857

Theaters & Entertainment 9 4,321.026 0.34134 4.59 0.02 5.55 266 0.117 0.170

Leisure (Sub Total) 79 53,064.245 4.19183 4.23 0.18 5.50 264 -0.366 -0.324

Advertising 19 14,520.075 1.14702 2.55 0.03 6.30 355 -0.637 -0.693

Cable & Satellite TV 68 81,539.829 6.44128 4.38 0.28 6.43 356 0.185 0.239

Media - Diversified 3 1,527.149 0.12064 3.64 0.00 5.52 270 -0.081 -0.082

Media Content 51 33,136.671 2.61765 4.63 0.12 5.80 293 -0.398 -0.325

Printing & Publishing 17 8,210.675 0.64861 3.77 0.02 7.59 476 -0.163 -0.154

Refer to important disclosures at the end of the document. 2

US High Yield Master II Index (H0A0) - distribution characteristics as of 5/23/2018

Index distribution by Industry # FullVal %Full Val Eff Dur Contr EffDur Eff Yld OAS TRR%MTD ExRtn%MTD

Media (Sub Total) 158 138,934.398 10.97519 4.21 0.46 6.32 347 -0.065 -0.021

RealEstate Dev & Mgt 9 5,435.716 0.42940 4.30 0.02 6.03 315 -0.331 -0.303

REITs 14 6,482.734 0.51211 3.12 0.02 5.64 289 0.724 0.706

Real Estate (Sub Total) 23 11,918.449 0.94150 3.65 0.03 5.82 301 0.239 0.243

Department Stores 8 2,966.722 0.23436 4.26 0.01 17.96 1,514 -0.782 -0.691

Food & Drug Retailers 14 9,855.293 0.77852 4.75 0.04 7.72 485 1.817 1.935

Restaurants 19 13,727.961 1.08445 4.83 0.05 5.97 309 -0.470 -0.396

Specialty Retail 58 28,420.507 2.24509 4.60 0.10 7.26 440 -1.417 -1.326

Retail (Sub Total) 99 54,970.483 4.34242 4.66 0.20 7.60 473 -0.580 -0.488

Environmental 12 5,490.799 0.43375 2.77 0.01 5.04 228 -0.457 -0.482

Support-Services 104 63,412.646 5.00931 4.20 0.21 6.75 388 -0.885 -0.848

Services (Sub Total) 116 68,903.445 5.44306 4.08 0.22 6.61 376 -0.851 -0.819

Electronics 24 13,611.069 1.07521 3.82 0.04 4.89 208 0.497 0.526

Software/Services 46 36,751.393 2.90319 2.95 0.09 6.02 319 -0.199 -0.223

Tech Hardware & Equipment 26 21,101.517 1.66692 3.82 0.06 5.02 221 0.006 0.035

Technology & Electronics (Sub Total) 96 71,463.979 5.64533 3.37 0.19 5.51 269 -0.007 -0.005

Telecom - Satellite 17 17,135.323 1.35361 3.30 0.04 8.16 540 3.240 3.227

Telecom - Wireless 33 44,029.927 3.47816 4.35 0.15 6.14 329 -1.922 -1.859

Telecom - Wireline Integrated & 72 55,472.122 4.38205 4.84 0.21 7.87 499 0.202 0.311

Telecommunications (Sub Total) 122 116,637.372 9.21382 4.43 0.41 7.26 441 -0.185 -0.111

Air Transportation 10 4,255.145 0.33614 2.18 0.01 5.31 274 0.042 -0.025

Rail 1 415.254 0.03280 1.81 0.00 5.14 230 0.394 0.331

Transport Infrastructure/Services 14 7,017.706 0.55437 2.60 0.01 7.90 544 0.775 0.735

Trucking & Delivery 2 729.671 0.05764 5.84 0.00 6.84 391 0.111 0.335

Transportation (Sub Total) 27 12,417.776 0.98095 2.62 0.03 6.86 432 0.471 0.437

Industrials (Total) 1,685 1,126,627.116 88.99842 4.16 3.70 6.41 358 -0.007 0.040

Electric-Generation 30 23,478.179 1.85467 3.72 0.07 5.45 266 -0.151 -0.126

Electric-Integrated 14 7,330.874 0.57911 4.30 0.02 6.53 376 -0.612 -0.573

Utility (Total) 44 30,809.053 2.43378 3.86 0.09 5.70 292 -0.262 -0.233

Corporate (Total) 1,874 1,262,025.784 99.69430 4.17 4.15 6.33 350 -0.025 0.023

Cash 0 3,869.900 0.30570 0.00 0.00 1.78 0 0 0

Grand Total 1,874 1,265,895.683 100.00000 4.15 4.15 6.31 348 -0.025 0.023

Refer to important disclosures at the end of the document. 3

Any unauthorized use or disclosure is prohibited. Nothing herein should in any way be deemed to alter the legal rights and obligations contained in

agreements between any ICE Data Services entity ("ICE") and their clients relating to any of the Indices or products or services described herein. The

information provided by ICE and contained herein is subject to change without notice and does not constitute any form of representation, or

undertaking. ICE and its affiliates make no warranties whatsoever, either express or implied, as to merchantability, fitness for a particular purpose, or

any other matter in connection with the information provided. Without limiting the foregoing, ICE and its affiliates makes no representation or warranty

that any information provided hereunder are complete or free from errors, omissions, or defects. All information provided by ICE is owned by or

licensed to ICE. ICE retains exclusive ownership of the ICE Indices, including the ICE BofAML Indexes, and the analytics used to create this analysis

ICE may in its absolute discretion and without prior notice revise or terminate the ICE information, Indices and analytics at any time. The information in

this analysis is for internal use only and redistribution of this information to third parties is expressly prohibited.

Neither the analysis nor the information contained therein constitutes investment advice or an offer or an invitation to make an offer to buy or sell any

securities or any options futures or other derivatives related to such securities. The information and calculations contained in this analysis have been

obtained from a variety of sources including those other than ICE and ICE does not guarantee their accuracy. Prior to relying on any ICE information

and/or the execution of a security trade based upon such ICE information, you are advised to consult with your broker or other financial representative

to verify pricing information. There is no assurance that hypothetical results will be equal to actual performance under any market conditions. THE ICE

INFORMATION IS PROVIDED TO THE USERS "AS IS." NEITHER ICE, NOR ITS AFFILIATES, NOR ANY THIRD PARTY DATA PROVIDER WILL BE

LIABLE TO ANY USER OR ANYONE ELSE FOR ANY INTERRUPTION, INACCURACY, ERROR OR OMISSION, REGARDLESS OF CAUSE, IN THE

ICE INFORMATION OR FOR ANY DAMAGES RESULTING THEREFROM. In no event shall ICE or any of its affiliates, employees officers directors

or agents of any such persons have any liability to any person or entity relating to or arising out of this information, analysis or the indices contained

herein.

Você também pode gostar

- NEC - Table 8 Conductor PropertiesDocumento1 páginaNEC - Table 8 Conductor PropertiesRogelio Revetti25% (4)

- Wire GuageDocumento13 páginasWire GuageAkd DeshmukhAinda não há avaliações

- Stowage Factor Conversion TableDocumento3 páginasStowage Factor Conversion TableGary LampenkoAinda não há avaliações

- Statistical Constants FileDocumento12 páginasStatistical Constants FileAnandhi ChidambaramAinda não há avaliações

- Foreign Exchange RiskDocumento16 páginasForeign Exchange RiskPraneela100% (1)

- MGH GroupDocumento2 páginasMGH GroupEzaz Leo67% (3)

- The Engineering Toolbox: Compressed Air - Pressure Drop in PipelinesDocumento6 páginasThe Engineering Toolbox: Compressed Air - Pressure Drop in PipelinesSobhy GendykhelaAinda não há avaliações

- SIEMENS Analysis of Financial StatementDocumento16 páginasSIEMENS Analysis of Financial StatementNeelofar Saeed100% (1)

- Case Study 3 - Heldon Tool Manufacturing CaseDocumento3 páginasCase Study 3 - Heldon Tool Manufacturing CasethetinkerxAinda não há avaliações

- IATF by MauryaDocumento91 páginasIATF by MauryaManoj MauryaAinda não há avaliações

- India Cements FADocumento154 páginasIndia Cements FARohit KumarAinda não há avaliações

- Miscellaneous FA SoftwareDocumento5 páginasMiscellaneous FA SoftwareArnold Roger CurryAinda não há avaliações

- Company Finance Profit & Loss (Rs in CRS.) : Company: State Bank of India Industry: Banks - Public SectorDocumento4 páginasCompany Finance Profit & Loss (Rs in CRS.) : Company: State Bank of India Industry: Banks - Public Sectorprasadkh90Ainda não há avaliações

- Canaleta Parshall2Documento5 páginasCanaleta Parshall2MartinGraciaAinda não há avaliações

- 5 Company FileDocumento16 páginas5 Company FileRofsana AkterAinda não há avaliações

- 3Documento81 páginas3Suraj DasAinda não há avaliações

- AMTEK PNL-G4CorDocumento7 páginasAMTEK PNL-G4CorAyush KapoorAinda não há avaliações

- Tabla de Equivalencias de Valores DCP Vrs CBRDocumento1 páginaTabla de Equivalencias de Valores DCP Vrs CBRJulesAinda não há avaliações

- Rainfall-Log Pierson Type IIIDocumento4 páginasRainfall-Log Pierson Type IIIisnanhidayAinda não há avaliações

- NMDC AnalysisDocumento59 páginasNMDC Analysisshivani guptaAinda não há avaliações

- J K Cement LTD.: Consolidated Income & Expenditure Summary: Mar 2009 - Mar 2018: Non-Annualised: Rs. CroreDocumento21 páginasJ K Cement LTD.: Consolidated Income & Expenditure Summary: Mar 2009 - Mar 2018: Non-Annualised: Rs. CroreMaitreyee GoswamiAinda não há avaliações

- Assignment FileDocumento359 páginasAssignment FileVasu PothunuruAinda não há avaliações

- SR No. Year Face Value No. of Shares Dividend Per Share EPSDocumento10 páginasSR No. Year Face Value No. of Shares Dividend Per Share EPSPraharsha ChowdaryAinda não há avaliações

- Commetrce StudyDocumento2 páginasCommetrce StudyPB electronicsAinda não há avaliações

- OT Assignment Subham 2Documento19 páginasOT Assignment Subham 2S SubhamAinda não há avaliações

- Financial Statements Analysis Analysis and Interpretation of Companies Dawood Equities Limited Ratio Analysis Year Rati OsDocumento8 páginasFinancial Statements Analysis Analysis and Interpretation of Companies Dawood Equities Limited Ratio Analysis Year Rati OsSamsam RaufAinda não há avaliações

- Sana 33Documento8 páginasSana 33Samsam RaufAinda não há avaliações

- Lucr 6 CalculeDocumento7 páginasLucr 6 CalculeDumitru CorbuAinda não há avaliações

- FUNGILAB Patrones de Viscosidad para Usos GeneralesDocumento5 páginasFUNGILAB Patrones de Viscosidad para Usos GeneralesOscar Guzman CastroAinda não há avaliações

- FM Project2Documento20 páginasFM Project2Triptasree GhoshAinda não há avaliações

- Real EstateDocumento72 páginasReal EstateBAU UnirowAinda não há avaliações

- Value Research Stock AdvisorDocumento5 páginasValue Research Stock AdvisortansnvarmaAinda não há avaliações

- Practical Electronics - SWG - Wikibooks, Open Books For An Open WorldDocumento4 páginasPractical Electronics - SWG - Wikibooks, Open Books For An Open WorldZia ur rehmanAinda não há avaliações

- Date New Entry In3 Months: YES YES YES YES YES YES YES YES YESDocumento6 páginasDate New Entry In3 Months: YES YES YES YES YES YES YES YES YEShamsAinda não há avaliações

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocumento57 páginasTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaAinda não há avaliações

- Areva DLF Limited Bharti Airtel Tata Motors Siemens SBIDocumento13 páginasAreva DLF Limited Bharti Airtel Tata Motors Siemens SBIilovetrouble780Ainda não há avaliações

- Convert Your Bearing Numbers To Bearing Dimensions HereDocumento4 páginasConvert Your Bearing Numbers To Bearing Dimensions HereNeviemakyAinda não há avaliações

- Steam Saturation Tables MetricDocumento2 páginasSteam Saturation Tables MetricEniabire AyodejiAinda não há avaliações

- Al Kasyaf Nur (202010073) - PERBAIKANDocumento36 páginasAl Kasyaf Nur (202010073) - PERBAIKANTiara FelisAinda não há avaliações

- Adani PowerDocumento17 páginasAdani Powerनिशांत मित्तलAinda não há avaliações

- Bharath Beam LayoutDocumento30 páginasBharath Beam LayoutANIL KUMAR H CAinda não há avaliações

- Company Name Last Historical Year CurrencyDocumento55 páginasCompany Name Last Historical Year Currencyshivam vermaAinda não há avaliações

- Hidrostatic Bonjean - 0216030029 - Abdul Azis Rev2 - Area 20m2Documento43 páginasHidrostatic Bonjean - 0216030029 - Abdul Azis Rev2 - Area 20m2Abdul AzisAinda não há avaliações

- Volumen en Tanques Cilindricos HorizontalesDocumento2 páginasVolumen en Tanques Cilindricos HorizontalessmalealAinda não há avaliações

- LhsDocumento4 páginasLhs000Ainda não há avaliações

- Statistika Eryanti Silaban - NEWDocumento12 páginasStatistika Eryanti Silaban - NEWDaud PanggabeanAinda não há avaliações

- Daksh Agarwal FSA&BV Project On Ratio Analysis of United BreweriesDocumento42 páginasDaksh Agarwal FSA&BV Project On Ratio Analysis of United Breweriesdaksh.agarwal180Ainda não há avaliações

- Experimental Data: Length of The Brass Specimen, L 80.5 MMDocumento2 páginasExperimental Data: Length of The Brass Specimen, L 80.5 MMal imranAinda não há avaliações

- 31 - 2023 - Aiboc - Revision in Dearness AllowanceDocumento3 páginas31 - 2023 - Aiboc - Revision in Dearness AllowanceSachin DakahaAinda não há avaliações

- Square Hs Final EnglishDocumento3 páginasSquare Hs Final EnglishVasilis LappasAinda não há avaliações

- GROWTH - RATIODocumento4 páginasGROWTH - RATIOngbopAinda não há avaliações

- Maryam Finance Project-1-11Documento1 páginaMaryam Finance Project-1-11Tutii FarutiAinda não há avaliações

- ArunAAssignments IuiDocumento5 páginasArunAAssignments IuiArun Jung RanaAinda não há avaliações

- UntitledDocumento1 páginaUntitledHamed basalAinda não há avaliações

- 3Documento1 página3Hamed basalAinda não há avaliações

- Занятие 07 ForecastingDocumento39 páginasЗанятие 07 Forecastingyana.marchenkoo.uaAinda não há avaliações

- Tata SteelDocumento66 páginasTata SteelSuraj DasAinda não há avaliações

- 4 Point 09.05.17book1Documento41 páginas4 Point 09.05.17book1নীল জোছনাAinda não há avaliações

- Chi-Square Distribution TableDocumento4 páginasChi-Square Distribution TableKent CoronelAinda não há avaliações

- TablesTime ValueofMoneyDocumento2 páginasTablesTime ValueofMoneycAinda não há avaliações

- 33 - 2022 - Aiboc - Revision in DADocumento3 páginas33 - 2022 - Aiboc - Revision in DAsengaraaradhanaAinda não há avaliações

- Bang Tra Gia Tri Toi HanDocumento16 páginasBang Tra Gia Tri Toi HanPhan DiệpAinda não há avaliações

- Calculating Industry Debt: Shaiham Hwawell Family Prime Safko Daccadye TunnghaiDocumento4 páginasCalculating Industry Debt: Shaiham Hwawell Family Prime Safko Daccadye TunnghaikajalAinda não há avaliações

- PC Device Sales FinishedDocumento6 páginasPC Device Sales FinishedSeemaAinda não há avaliações

- Process Costing Tutorial SheetDocumento3 páginasProcess Costing Tutorial Sheets_camika7534Ainda não há avaliações

- Sohail Copied Black Book ProjectDocumento84 páginasSohail Copied Black Book ProjectSohail Shaikh64% (14)

- BIR Form No. 1801 (Estate Tax Return)Documento2 páginasBIR Form No. 1801 (Estate Tax Return)Juan Miguel UngsodAinda não há avaliações

- Decision Trees Background NoteDocumento14 páginasDecision Trees Background NoteibrahimAinda não há avaliações

- Re-Engineering Agricultural Education For Sustainable Development in NigeriaDocumento5 páginasRe-Engineering Agricultural Education For Sustainable Development in NigeriaPremier PublishersAinda não há avaliações

- A Presentation On Sales Forecasting: by Prof. (DR.) J. R. DasDocumento20 páginasA Presentation On Sales Forecasting: by Prof. (DR.) J. R. DasShubrojyoti ChowdhuryAinda não há avaliações

- Shweta Final RCCDocumento65 páginasShweta Final RCCidealAinda não há avaliações

- Your Guide To Employing A Foreign Domestic Worker in QatarDocumento20 páginasYour Guide To Employing A Foreign Domestic Worker in QatarMigrantRightsOrg100% (1)

- CitizenM Hotel InnovationDocumento9 páginasCitizenM Hotel InnovationDydda 7Ainda não há avaliações

- GPNR 2019-20 Notice and Directors ReportDocumento9 páginasGPNR 2019-20 Notice and Directors ReportChethanAinda não há avaliações

- Plans and Policies 2080 81englishDocumento52 páginasPlans and Policies 2080 81englishYagya Raj BaduAinda não há avaliações

- 5-Vendors Are The King MakerDocumento2 páginas5-Vendors Are The King Makersukumaran3210% (1)

- Project Cooperative BankDocumento33 páginasProject Cooperative BankPradeepPrinceraj100% (1)

- Gacutan - CIR vs. Basf CoatingDocumento1 páginaGacutan - CIR vs. Basf CoatingAnneAinda não há avaliações

- Capacity ManagementDocumento16 páginasCapacity ManagementHitesh BabbarAinda não há avaliações

- Competitive Analysis of Stock Brokers ReligareDocumento92 páginasCompetitive Analysis of Stock Brokers ReligareJaved KhanAinda não há avaliações

- Chapter 2 Test BankDocumento7 páginasChapter 2 Test Bankrajalaxmi rajendranAinda não há avaliações

- BAPTC Mock TradingDocumento6 páginasBAPTC Mock TradingNgan TuyAinda não há avaliações

- Islamic Modes of Financing: Diminishing MusharakahDocumento40 páginasIslamic Modes of Financing: Diminishing MusharakahFaizan Ch0% (1)

- DigitalDocumento4 páginasDigitalideal assignment helper 2629Ainda não há avaliações

- What Is Budget?Documento23 páginasWhat Is Budget?pRiNcE DuDhAtRaAinda não há avaliações

- K. Marx, F. Engels - The Communist Manifesto PDFDocumento77 páginasK. Marx, F. Engels - The Communist Manifesto PDFraghav vaid0% (1)

- Type YZ - FLO - 251123Documento5 páginasType YZ - FLO - 251123Oky Arnol SunjayaAinda não há avaliações

- Dire-Dawa University Institute of Technology: Construction Technology and Management Chair Course Code: byDocumento34 páginasDire-Dawa University Institute of Technology: Construction Technology and Management Chair Course Code: bySemAinda não há avaliações

- Conceptual Framework: Amendments To IFRS 3 - Reference To TheDocumento3 páginasConceptual Framework: Amendments To IFRS 3 - Reference To TheteguhsunyotoAinda não há avaliações