Escolar Documentos

Profissional Documentos

Cultura Documentos

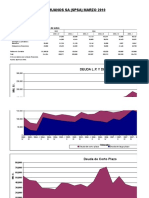

4.04 Interest Rates - Monthly (2003-Sep. 2017)

Enviado por

jeevanTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

4.04 Interest Rates - Monthly (2003-Sep. 2017)

Enviado por

jeevanDireitos autorais:

Formatos disponíveis

4.04 Interest Rates - Monthly (2003- Sep.

2017)

Money Rates

Government Treasury Bills Commercial Bank's Rates on Deposits Commercial Bank's Rates on Advances

Fixed Deposits Loans and Overdrafts

Primary Market (b) Yield Weighted Weighted

Over night

Rates Average Secured by Average

Bank Rate (a) Deposit Rate Bills Prime

End of Period Inter-Bank Call Savings

(AWDR) Purchased and Lending Rate

Loans 3 Months 6 Months 12 Months 24 Months Deposits Stock in Trade Unsecured

12-Month SDF Rate SLF Rate (c) Discounted Immovable (AWPR) (d)

3-Month Others

(e) (f) (f) Property

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) (13) (14) (15) (16) (17) (18)

2014 January 15.00 6.82 7.14 6.50 8.00 7.40-7.50 5.00-15.00 5.00-12.15 5.60-15.60 6.10-15.00 0.75-9.00 9.14 3.75-22.00 8.00-23.00 5.00-25.00 4.75-33.00 7.75-24.00 9.65

February 15.00 6.72 7.07 6.50 8.00 6.90-7.00 5.00-15.00 5.00-12.37 5.60-15.50 6.10-15.00 0.75-9.00 8.83 3.75-22.00 7.60-23.00 5.00-24.00 4.75-33.00 7.75-24.00 9.40

March 15.00 6.65 7.05 6.50 8.00 6.90-7.00 5.00-11.00 5.00-12.15 5.50-14.75 6.10-15.00 0.75-9.00 8.45 3.25-22.00 7.25-23.00 5.00-24.00 4.75-33.00 7.50-24.00 8.81

April 15.00 6.58 7.02 6.50 8.00 6.90-6.95 5.00-11.00 5.00-11.74 5.45-14.50 6.10-15.00 0.75-9.00 8.06 4.25-22.00 7.25-24.00 5.00-24.00 4.75-33.00 7.25-24.00 8.65

May 15.00 6.56 7.02 6.50 8.00 6.95 5.00-9.50 5.00-11.72 5.45-14.50 6.10-14.00 0.75-9.00 7.74 4.25-22.00 7.25-24.00 5.00-24.00 4.75-33.00 7.10-24.00 8.38

June 15.00 6.51 6.99 6.50 8.00 6.95-7.00 4.55-9.50 4.70-10.52 4.75-14.50 5.20-14.00 1.25-8.00 7.40 4.25-22.00 7.25-24.00 4.75-24.00 5.00-33.00 6.75-24.00 8.03

July 15.00 6.43 6.68 6.50 8.00 6.65-6.80 4.45-9.50 4.50-10.25 4.55-13.00 4.85-14.00 0.75-8.00 7.16 3.25-22.00 7.00-23.00 4.75-24.00 5.00-33.00 6.95-24.00 7.64

August 15.00 6.19 6.30 6.50 8.00 6.70 4.20-9.50 4.30-9.75 4.15-12.00 4.30-14.00 0.75-9.50 7.02 3.25-22.00 7.00-24.00 4.75-24.00 5.00-33.00 6.50-24.00 7.28

September 15.00 6.15 5.89 6.50 8.00 5.60-5.80 4.00-7.75 4.30-9.75 4.15-12.00 4.30-14.00 0.75-9.50 6.83 3.25-22.00 6.00-24.00 4.75-24.00 5.67-33.00 5.50-24.00 6.93

October 15.00 6.15 6.00 6.50 8.00 6.00 2.50-8.75 3.90-9.75 3.95-12.00 4.15-14.00 0.75-8.50 6.72 3.75-22.00 6.00-24.00 4.75-24.00 5.00-33.00 5.44-24.00 6.44

November 15.00 6.15 6.00 6.50 8.00 5.95-6.00 3.50-8.75 3.90-9.75 3.95-12.00 4.15-14.00 0.75-8.00 6.42 3.25-22.00 6.00-24.00 4.75-24.00 5.00-32.00 5.44-24.00 6.49

December 15.00 5.74 6.01 6.50 8.00 6.00-6.50 3.50-7.00 3.90-9.75 3.95-12.00 4.15-14.00 0.50-8.00 6.20 3.25-22.00 5.90-24.00 4.75-24.00 5.00-32.00 5.44-24.00 6.35

2015 January 15.00 5.80 6.05 6.50 8.00 5.70-6.50 3.50-9.50 3.90-10.50 3.95-15.00 4.15-14.00 0.50-8.00 5.94 3.25-22.00 5.90-24.00 4.75-24.00 5.00-32.00 5.60-24.00 6.36

February 15.00 5.98 6.13 6.50 8.00 6.00-6.75 0.25-9.50 3.90-7.50 3.95-15.00 4.15-14.00 0.50-8.00 5.90 3.25-22.00 5.90-24.00 4.75-24.00 5.00-32.00 5.70-24.00 6.45

March 15.00 6.55 6.76 6.50 8.00 6.55-6.70 3.50-9.50 3.90-9.75 3.95-15.00 4.15-14.00 0.50-8.00 5.83 3.25-22.00 3.00-24.00 4.75-24.00 5.00-32.00 5.75-24.00 6.90

April 15.00 6.15 6.39 6.00 7.50 6.10-6.20 3.50-9.50 3.90-9.75 3.95-15.00 4.15-14.00 0.50-8.00 5.83 3.75-22.00 6.00-24.00 4.75-24.00 5.00-32.00 5.80-24.00 7.16

May 15.00 6.07 6.29 6.00 7.50 6.00-6.10 3.50-9.50 3.90-9.75 3.95-15.00 4.15-13.50 0.50-8.00 5.95 2.18-22.00 6.00-24.00 4.75-24.00 5.00-32.00 6.00-24.00 7.05

June 15.00 6.11 6.28 6.00 7.50 6.10-6.15 3.25-9.50 3.90-9.75 3.95-15.00 4.15-13.50 0.50-8.00 6.02 2.19-22.00 6.00-24.00 5.00-24.00 5.00-32.00 6.00-24.00 7.00

July 15.00 6.28 6.48 6.00 7.50 6.10 3.40-7.50 3.90-9.75 3.95-15.00 4.15-13.25 0.50-8.00 6.00 2.19-22.00 6.00-24.00 4.19-24.00 5.00-32.00 6.00-24.00 6.91

August 15.00 6.53 6.97 6.00 7.50 6.25-6.30 3.40-7.50 3.90-9.75 3.95-15.00 4.15-13.25 0.50-8.50 6.01 2.19-22.00 6.00-24.00 4.75-24.00 5.00-32.00 6.00-24.00 6.82

September 15.00 6.78 7.18 6.00 7.50 6.35 3.40-8.30 3.90-9.75 3.95-15.00 4.15-13.25 0.50-8.00 6.00 2.19-22.00 5.33-24.00 4.75-24.00 5.00-32.00 6.00-24.00 6.94

October 15.00 6.61 7.06 6.00 7.50 6.25-6.35 3.40-8.30 3.90-8.85 3.95-15.00 4.15-12.75 0.50-8.00 6.05 2.19-22.00 5.31-24.00 4.75-24.00 5.00-32.00 6.00-24.00 7.18

November 15.00 6.44 6.92 6.00 7.50 6.30 3.40-8.25 3.90-8.50 3.95-15.00 4.15-12.50 0.50-8.50 6.11 3.00-22.58 6.00-24.00 4.48-24.00 5.00-32.00 2.50-24.00 7.32

December 15.00 6.45 7.30 6.00 7.50 6.40 3.10-11.10 3.90-9.50 3.95-15.00 4.15-12.50 0.50-8.00 6.20 3.00-22.58 6.00-24.00 4.74-24.00 5.00-32.00 2.50-24.00 7.40

2016 January 15.00 6.78 7.80 6.00 7.50 6.70-6.80 3.75-11.10 3.90-9.50 3.95-15.00 4.15-12.50 0.50-8.50 6.26 3.00-22.58 6.65-24.00 4.74-24.00 5.00-32.00 2.50-24.00 7.76

February 15.00 7.14 8.50 6.50 8.00 7.50-7.55 3.75-10.00 3.90-9.50 3.95-15.00 4.15-12.50 0.50-8.50 6.33 3.00-22.58 6.65-24.00 3.93-24.00 5.00-32.00 2.50-24.00 8.28

March 15.00 8.90 10.64 6.50 8.00 8.00-8.15 3.75-10.25 3.90-10.15 3.95-15.00 4.15-12.50 0.50-8.50 6.44 3.25-22.00 3.25-24.00 2.00-25.00 1.88-30.00 6.00-24.00 8.87

April 15.00 8.45 10.17 6.50 8.00 8.05-8.15 4.00-10.25 4.00-10.75 4.00-15.00 5.00-12.50 0.50-8.50 6.58 2.44-22.00 3.25-24.00 2.00-25.00 1.89-25.00 6.24-24.00 9.55

May 15.00 8.71 10.48 6.50 8.00 8.15-8.17 4.00-11.25 4.50-11.50 4.50-15.00 5.00-12.50 0.50-8.50 6.72 2.46-22.00 3.25-24.00 2.00-24.00 2.00-25.00 6.00-24.00 10.10

June 15.00 8.88 10.55 6.50 8.00 8.18-8.20 4.00-11.25 4.50-11.75 4.50-15.00 5.00-12.50 0.50-9.00 6.87 2.47-22.00 2.00-24.00 2.00-25.00 2.00-24.00 6.00-24.00 10.48

July 15.00 8.80 10.48 7.00 8.50 8.40 4.00-12.00 4.50-12.00 4.50-15.00 5.00-12.75 0.50-9.00 7.10 2.49-22.00 2.00-24.00 2.00-25.00 1.50-24.00 6.00-24.00 10.87

August 15.00 9.03 10.73 7.00 8.50 8.40 4.00-12.90 4.50-12.50 4.50-15.00 5.00-12.75 0.50-9.00 7.32 2.52-24.00 2.66-24.00 2.00-25.00 1.50-25.00 6.00-26.00 11.76

September 15.00 8.55 10.11 7.00 8.50 8.42 4.00-12.95 4.50-12.50 4.50-15.00 5.00-13.00 0.50-9.00 (g) 7.56 2.53-24.00 2.00-24.00 1.50-25.00 1.50-25.00 6.00-26.00 12.29

October 15.00 8.60 10.24 7.00 8.50 8.42 4.00-12.75 4.50-13.00 4.50-15.00 5.00-12.50 0.50-9.00 (g) 7.79 2.53-24.00 3.64-24.00 1.50-25.00 1.00-25.00 6.50-26.00 12.25

November 15.00 8.60 10.10 7.00 8.50 8.42-8.44 4.00-13.50 4.50-13.50 4.50-15.00 5.13-12.75 0.50-9.00 8.00 2.62-24.00 3.71-24.00 2.00-24.00 1.00-25.00 6.00-24.00 11.98

December 15.00 8.72 10.17 7.00 8.50 8.40-8.44 4.00-13.50 4.50-13.50 4.50-15.00 5.40-13.00 0.50-9.00 8.17 2.00-24.00 3.00-24.00 1.50-24.00 1.00-25.00 3.50-24.00 11.73

2017 January 15.00 9.03 10.37 7.00 8.50 8.35-8.40 4.25-13.50 4.50-13.50 4.89-15.00 5.40-13.00 0.50-9.00 8.42 1.03-24.00 3.88-24.00 2.00-24.00 1.00-26.00 6.00-24.00 11.48

February 15.00 9.32 10.58 7.00 8.50 8.49-8.50 4.25-13.25 4.50-13.50 4.89-15.00 5.40-.13.00 0.50-9.00 8.66 1.06-24.00 3.25-24.00 2.00-25.00 1.00-26.00 6.00-24.00 11.55

March 15.00 9.63 10.98 7.25 8.75 8.75 4.25-13.50 4.50-13.50 4.89-15.00 5.40-13.25 0.50-9.00 8.81 3.29-24.00 7.50-24.00 5.00-24.00 6.00-25.00 4.07-24.00 11.56

April 15.00 9.73 11.02 7.25 8.75 8.65-8.75 4.25-13.66 4.50-13.75 4.89-15.00 5.40-14.00 0.50-9.00 8.89 3.29-24.00 7.50-24.00 5.00-24.00 5.00-25.00 7.75-24.00 11.74

May 15.00 9.61 10.71 7.25 8.75 8.70-8.75 4.00-13.60 4.50-14.12 4.89-15.00 5.40-14.00 0.50-9.00 8.99 3.29-24.00 3.98-24.00 5.00-24.00 4.07-25.00 2.00-24.00 11.67

June 15.00 9.60 10.47 7.25 8.75 8.75 4.00-13.60 4.50-14.12 4.89-15.00 5.40-14.00 0.50-9.00 9.13 3.29-24.00 3.92-24.00 5.00-24.00 2.50-25.00 2.00-24.00 11.84

July 15.00 9.44 9.99 7.25 8.75 8.70-8.75 4.00-13.40 4.50-14.12 4.89-15.00 5.40-14.00 0.50-9.50 9.19 6.00-24.00 4.00-28.00 5.00-28.00 5.00-28.00 7.75-28.00 11.88

August 15.00 8.87 9.67 7.25 8.75 7.95-8.30 4.00-13.25 4.50-14.12 4.89-15.00 5.40-14.00 0.50-9.50 9.21 6.00-27.00 3.50-28.00 5.00-30.00 1.50-30.00 3.00-36.87 11.67

September 15.00 8.71 9.10 7.25 8.75 8.00-8.30 4.00-12.50 4.50-13.50 4.89-15.00 5.40-13.00 0.50-9.50 9.25 6.00-27.00 7.50-28.00 4.00-30.00 1.00-30.00 5.50-36.87 11.42

(a) This is the rate at which the Central Bank grants advances to Commercial Banks for their temporary liquidity purposes. With effect from 4 January 1991, the rate was increased to 17 per cent from 15 per cent. As at end of 1999 this rate was 16 per cent. With effect from 2 October 2000, the rate was increased to 18 per

cent and further increased to 25 per cent with effect from 21 November 2000. With effect from 2 July 2001, this rate was brought down to 23 per cent and further reduced to 18 per cent with effect from 27 December 2001. On 15 August 2003, the rate was reduced to 15 per cent.

(b) Yield rates prevailing at the end of the period.

(c) The Average Weighted Deposit Rate is calculated by Central Bank monthly based on the weighted average of all outstanding interest bearing deposits of commercial banks and the corresponding interest rates.

(d) The Weighted Average Prime Lending Rate is estimated by the Central Bank weekly based on commercial banks' lending rates offered to their prime customers during the week. These monthly figures are average values of estimated weekly rates.(commenced in 1986).

(e) 12 month Treasury bills were first introduced in 1989.

(f) Repurchase Rate and Reverse Repurchase Rate were renamed as Standing Deposit Facility Rate (SDFR) and Standing Lending Facilty Rate(SLFR) respectively, with effect from 02 January 2014.

(g) Revised

Você também pode gostar

- Interest Rates 1990-2016Documento1 páginaInterest Rates 1990-2016jeevanAinda não há avaliações

- Management of Interest Rate Risk in BanksDocumento29 páginasManagement of Interest Rate Risk in BanksSmit ParikhAinda não há avaliações

- Accounts 2017 NotesDocumento40 páginasAccounts 2017 Notesaliakhtar02Ainda não há avaliações

- Treasury Focus Oct09Documento11 páginasTreasury Focus Oct09hussainmhAinda não há avaliações

- Annexure MFLDocumento1 páginaAnnexure MFLdabster7000Ainda não há avaliações

- time scedul jepon bogorejoDocumento1 páginatime scedul jepon bogorejoainana151719Ainda não há avaliações

- Garima Bank quarterly financial resultsDocumento1 páginaGarima Bank quarterly financial resultsAman AgrawalAinda não há avaliações

- Abdul Bung Hadi 61101020200001Documento9 páginasAbdul Bung Hadi 61101020200001Faisal Bin RidwanAinda não há avaliações

- Quality Valuation: Update Harga: Real-TimeDocumento13 páginasQuality Valuation: Update Harga: Real-TimeambarAinda não há avaliações

- Managing Interest Rate RiskDocumento28 páginasManaging Interest Rate RiskDevang JoshiAinda não há avaliações

- Reserve Bank of India - NSDP Display 16 JunDocumento1 páginaReserve Bank of India - NSDP Display 16 JunSwatiAinda não há avaliações

- Select Economic IndicatorsDocumento1 páginaSelect Economic Indicatorspls2019Ainda não há avaliações

- Delta4 122006Documento8 páginasDelta4 122006mariaplacerda.fradeAinda não há avaliações

- Strictly Confidential ModelDocumento10 páginasStrictly Confidential Modelww weAinda não há avaliações

- Ie Statement Showing For Local & Foreign Currency PLR +5%Documento7 páginasIe Statement Showing For Local & Foreign Currency PLR +5%n0931995Ainda não há avaliações

- Project Management Assignment (1) 7 SeptDocumento15 páginasProject Management Assignment (1) 7 Septsan sanAinda não há avaliações

- Prepared by Mohammad Maruf ID No: B113119 Program: BBA Semester: Autumn 2015Documento15 páginasPrepared by Mohammad Maruf ID No: B113119 Program: BBA Semester: Autumn 2015Tamim SikderAinda não há avaliações

- Prepared by Mohammad Maruf ID No: B113119 Program: BBA Semester: Autumn 2015Documento16 páginasPrepared by Mohammad Maruf ID No: B113119 Program: BBA Semester: Autumn 2015Tamim SikderAinda não há avaliações

- By: Vinit Mishra SirDocumento109 páginasBy: Vinit Mishra SirgimAinda não há avaliações

- Aldine WestfieldDocumento250 páginasAldine WestfieldJafarAinda não há avaliações

- c APPROVED BUDGET FOR THE CONTRACTDocumento1 páginac APPROVED BUDGET FOR THE CONTRACTalfredo taguianAinda não há avaliações

- 2022-2023 Daily Urban Group Based Reporting FormatDocumento105 páginas2022-2023 Daily Urban Group Based Reporting FormatendaleAinda não há avaliações

- One Page PlanDocumento3 páginasOne Page PlanWalid SolimanAinda não há avaliações

- Monthly: Executive Director (Statistics)Documento114 páginasMonthly: Executive Director (Statistics)Syed Yusuf SaadatAinda não há avaliações

- Portfolio Dashboard - Euro 11Documento1 páginaPortfolio Dashboard - Euro 11kvisaAinda não há avaliações

- Spandana Sphoorty - Stock Update - 010124Documento11 páginasSpandana Sphoorty - Stock Update - 010124sapguru.inAinda não há avaliações

- (A) (B) (C) (D) (E) D/C (F) (G) F/C (H) (I) : Sub-TotalDocumento1 página(A) (B) (C) (D) (E) D/C (F) (G) F/C (H) (I) : Sub-TotalEmosAinda não há avaliações

- Equity Performance Report 09-10-2021Documento26 páginasEquity Performance Report 09-10-2021lalit963Ainda não há avaliações

- Quant MF - Disclosure of Risk ParametersDocumento2 páginasQuant MF - Disclosure of Risk ParametersaarushkadamAinda não há avaliações

- Mitigating FX Risks For TCAS Inc.: Global Vision Financial AdvisorsDocumento13 páginasMitigating FX Risks For TCAS Inc.: Global Vision Financial AdvisorsMaverick GmatAinda não há avaliações

- Evaluating Reliance's Dividend Policy and ValuationDocumento11 páginasEvaluating Reliance's Dividend Policy and ValuationYash Aggarwal BD20073Ainda não há avaliações

- ASIAN PAINTS FINANCIAL ANALYSISDocumento15 páginasASIAN PAINTS FINANCIAL ANALYSISDeepak NechlaniAinda não há avaliações

- Business SlideDocumento1 páginaBusiness Slidehuihuihui100% (1)

- Fortis Healthcare Limited BSE 532843 FinancialsDocumento44 páginasFortis Healthcare Limited BSE 532843 Financialsakumar4uAinda não há avaliações

- Welcome To The Presentation: On Stress Testing of National Housing Finance LimitedDocumento55 páginasWelcome To The Presentation: On Stress Testing of National Housing Finance LimitedOtoshi AhmedAinda não há avaliações

- Client List Meeting information-ORNDocumento13 páginasClient List Meeting information-ORNMohammad Nahid HossainAinda não há avaliações

- PT Suzuki Finance Indonesia Rating SummaryDocumento2 páginasPT Suzuki Finance Indonesia Rating SummaryfirmanAinda não há avaliações

- Jupiter Global Emerging Markets Corporate Bond Factsheet-GB-Retail-LU1551064923-En-GB PDFDocumento4 páginasJupiter Global Emerging Markets Corporate Bond Factsheet-GB-Retail-LU1551064923-En-GB PDFeldime06Ainda não há avaliações

- DSP BlackRock Liquidity Fund - Institutional Plan Rating: Average Risk, Not RatedDocumento4 páginasDSP BlackRock Liquidity Fund - Institutional Plan Rating: Average Risk, Not RatedChirag VoraAinda não há avaliações

- Financing The Growth: 4 March 2011Documento9 páginasFinancing The Growth: 4 March 2011aagarwal_46Ainda não há avaliações

- Anal - Financ. SPSA vs. WongDocumento74 páginasAnal - Financ. SPSA vs. WongGabriel MedinaAinda não há avaliações

- Rab Final Plus Atap Altr-2Documento17 páginasRab Final Plus Atap Altr-2NTho AjachAinda não há avaliações

- Benchmark Report For India AIFs 2022Documento7 páginasBenchmark Report For India AIFs 2022Apurva ChamariaAinda não há avaliações

- Salary Is Based On SSLV First Tranche Salary Schedule Proposed Creation of Plantilla PositionsDocumento12 páginasSalary Is Based On SSLV First Tranche Salary Schedule Proposed Creation of Plantilla PositionsBudget OfficeAinda não há avaliações

- NCUA Static Pool Analysis ToolDocumento5 páginasNCUA Static Pool Analysis Toolaarpee78Ainda não há avaliações

- MD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeDocumento4 páginasMD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeAyushi somaniAinda não há avaliações

- Morning Star Report 20171119125636Documento2 páginasMorning Star Report 20171119125636wesamAinda não há avaliações

- Usman FileDocumento4 páginasUsman FileManahil FayyazAinda não há avaliações

- Performance During Q4/Full Year: FY15-16: A Year of Balance Sheet Consolidation & Capital OptimisationDocumento45 páginasPerformance During Q4/Full Year: FY15-16: A Year of Balance Sheet Consolidation & Capital OptimisationDivya GargAinda não há avaliações

- ValueResearchFundcard AxisBanking&PSUDebtFund 2019jan03Documento4 páginasValueResearchFundcard AxisBanking&PSUDebtFund 2019jan03fukkatAinda não há avaliações

- National Quickstat September2021 - 27Documento6 páginasNational Quickstat September2021 - 27Jibreen TaugAinda não há avaliações

- Frontlit, Backlit & Vinyl Flex Banner Manufacturing For AdvertisingDocumento52 páginasFrontlit, Backlit & Vinyl Flex Banner Manufacturing For AdvertisingSusheel GautamAinda não há avaliações

- Management of Interest Rate Risk in BanksDocumento28 páginasManagement of Interest Rate Risk in BanksSmit ParikhAinda não há avaliações

- Abrar Engro Excel SheetDocumento4 páginasAbrar Engro Excel SheetManahil FayyazAinda não há avaliações

- Rate of Return One ProjectDocumento18 páginasRate of Return One ProjectMalek Marry Anne100% (1)

- EZZ Steel Financial AnalysisDocumento31 páginasEZZ Steel Financial Analysismohamed ashorAinda não há avaliações

- IJM Corporation Berhad: Raising Stakes in Two Indian Units - 06/10/2010Documento3 páginasIJM Corporation Berhad: Raising Stakes in Two Indian Units - 06/10/2010Rhb InvestAinda não há avaliações

- MF COMPARISON - Large & MidDocumento3 páginasMF COMPARISON - Large & MidRajkumar GAinda não há avaliações

- Regional Office Nizamabad assessment of M/s Brindavan Gardens working capital requirementsDocumento63 páginasRegional Office Nizamabad assessment of M/s Brindavan Gardens working capital requirementsUppada SareesAinda não há avaliações

- Credit Securitisations and Derivatives: Challenges for the Global MarketsNo EverandCredit Securitisations and Derivatives: Challenges for the Global MarketsAinda não há avaliações

- Assignment For Employee RelationsDocumento7 páginasAssignment For Employee RelationsjeevanAinda não há avaliações

- Untitled 7Documento1 páginaUntitled 7jeevanAinda não há avaliações

- Online Payment SuccessDocumento1 páginaOnline Payment SuccessjeevanAinda não há avaliações

- Cecb-Avic Letter XXDocumento1 páginaCecb-Avic Letter XXjeevanAinda não há avaliações

- Untitled 8Documento1 páginaUntitled 8jeevanAinda não há avaliações

- 6406886Documento28 páginas6406886jeevanAinda não há avaliações

- SPEC MEP Technical Design CoverDocumento2 páginasSPEC MEP Technical Design CoverjeevanAinda não há avaliações

- B R A N D I X: Ideal Profile Matching - Finishing ManagerDocumento22 páginasB R A N D I X: Ideal Profile Matching - Finishing Managerjeevan100% (1)

- Name: - K.Sanjeevan Index No: - 178666A Course: - MSC Industrial AutomationDocumento5 páginasName: - K.Sanjeevan Index No: - 178666A Course: - MSC Industrial AutomationjeevanAinda não há avaliações

- 9436493Documento15 páginas9436493jeevanAinda não há avaliações

- Protection Against Direct Contact: The Form of Protection Provided by The Insulation of Live Parts Would BeDocumento36 páginasProtection Against Direct Contact: The Form of Protection Provided by The Insulation of Live Parts Would BejeevanAinda não há avaliações

- Upload and Download Documents on ScribdDocumento1 páginaUpload and Download Documents on ScribdjeevanAinda não há avaliações

- Quarterly Report Format New - Consultancy Division - 2019 03 04Documento2 páginasQuarterly Report Format New - Consultancy Division - 2019 03 04jeevanAinda não há avaliações

- BS7671 Formula and TipsDocumento32 páginasBS7671 Formula and TipsjeevanAinda não há avaliações

- Aln (M) EaDocumento1 páginaAln (M) EajeevanAinda não há avaliações

- MJPNKJF Ikj Jpupghy RPWPNRD Mtu FSPDJK Uzpy TPF Ukrpq F Mtu FSPDJKDocumento1 páginaMJPNKJF Ikj Jpupghy RPWPNRD Mtu FSPDJK Uzpy TPF Ukrpq F Mtu FSPDJKjeevanAinda não há avaliações

- Fipps, G. (N.D.) Calculating Horsepower Requirements and Sizing Irrigation Supply Pipelines. Texas Agricultural Extension Service, Texas A&M University System PDFDocumento11 páginasFipps, G. (N.D.) Calculating Horsepower Requirements and Sizing Irrigation Supply Pipelines. Texas Agricultural Extension Service, Texas A&M University System PDFMac ShaikAinda não há avaliações

- Index With Google and Other Search EnginesDocumento1 páginaIndex With Google and Other Search EnginesjeevanAinda não há avaliações

- PSC Vacancies Deputy Superintendent CustomsDocumento3 páginasPSC Vacancies Deputy Superintendent CustomsjeevanAinda não há avaliações

- 2018 July Web Adverteasement VacanciesDocumento11 páginas2018 July Web Adverteasement VacanciesjeevanAinda não há avaliações

- SensorsDocumento41 páginasSensorsjeevanAinda não há avaliações

- Diffusion 2017 Sunderland WhitepaperDocumento5 páginasDiffusion 2017 Sunderland WhitepaperjeevanAinda não há avaliações

- Application Form: Promotion To The Post of Deputy Superintendent of Customs Director General of CustomsDocumento1 páginaApplication Form: Promotion To The Post of Deputy Superintendent of Customs Director General of CustomsjeevanAinda não há avaliações

- Ministry of Finance and Mass Media Sri Lanka Customs DepartmentDocumento8 páginasMinistry of Finance and Mass Media Sri Lanka Customs DepartmentjeevanAinda não há avaliações

- How To Select A Pump For Your BoreholeDocumento2 páginasHow To Select A Pump For Your BoreholejeevanAinda não há avaliações

- Vacancies in NWSDBDocumento9 páginasVacancies in NWSDBBandula PathmasiriAinda não há avaliações

- Drilling Bid Document 2013Documento31 páginasDrilling Bid Document 2013jeevanAinda não há avaliações

- 2018 July Web Adverteasement VacanciesDocumento11 páginas2018 July Web Adverteasement VacanciesjeevanAinda não há avaliações

- Wahl Stu Dien ArbeitDocumento73 páginasWahl Stu Dien ArbeitjeevanAinda não há avaliações

- Application Form: Promotion To The Post of Deputy Superintendent of Customs Director General of CustomsDocumento1 páginaApplication Form: Promotion To The Post of Deputy Superintendent of Customs Director General of CustomsjeevanAinda não há avaliações

- Contemporary: Corporate Training & Development Institute (Ctdi)Documento20 páginasContemporary: Corporate Training & Development Institute (Ctdi)navneet gauravAinda não há avaliações

- Engineering Economic Analysis 11th Edition EbookDocumento61 páginasEngineering Economic Analysis 11th Edition Ebookdebra.glisson665100% (48)

- City College of Calamba: Business Education DepartmentDocumento71 páginasCity College of Calamba: Business Education DepartmentDae JaserAinda não há avaliações

- Oil and Gas Service Contracts: A Review of 8 Countries' StrategiesDocumento21 páginasOil and Gas Service Contracts: A Review of 8 Countries' StrategiesRicardo IbarraAinda não há avaliações

- 2nd Set SVFCDocumento15 páginas2nd Set SVFCim_donnavierojoAinda não há avaliações

- Entre November 16Documento42 páginasEntre November 16Charlon GargantaAinda não há avaliações

- Cash Flow Final PrintDocumento61 páginasCash Flow Final PrintGeddada DineshAinda não há avaliações

- Finance For Non-Financial Managers Final ReportDocumento11 páginasFinance For Non-Financial Managers Final ReportAli ImranAinda não há avaliações

- Doa Borges MT 103 One Way 500m 5bDocumento19 páginasDoa Borges MT 103 One Way 500m 5bMorris Rubio100% (1)

- UMIX Group ENDocumento11 páginasUMIX Group ENLukas AndriyanAinda não há avaliações

- Gift Case InvestigationsDocumento17 páginasGift Case InvestigationsFaheemAhmadAinda não há avaliações

- The Quarters Theory Chapter 1 BasicsDocumento11 páginasThe Quarters Theory Chapter 1 BasicsKevin MwauraAinda não há avaliações

- Bank ManagementDocumento4 páginasBank ManagementsujathalaviAinda não há avaliações

- Pre-Lecture Quiz 6 (For Session 7 - Chapter 10 and 11) - Corporate Finance-T323WSB-7Documento6 páginasPre-Lecture Quiz 6 (For Session 7 - Chapter 10 and 11) - Corporate Finance-T323WSB-722003067Ainda não há avaliações

- IFRS9Documento218 páginasIFRS9Hamza AmiriAinda não há avaliações

- Introduction To Investment MGMTDocumento6 páginasIntroduction To Investment MGMTShailendra AryaAinda não há avaliações

- CGPA Calculator For PGP IDocumento43 páginasCGPA Calculator For PGP IVimal AnbalaganAinda não há avaliações

- Level of Financial Literacy (HUMSS 4, Macrohon Group)Documento37 páginasLevel of Financial Literacy (HUMSS 4, Macrohon Group)Charyl MorenoAinda não há avaliações

- Transfer Register All: Bangladesh Krishi BankDocumento13 páginasTransfer Register All: Bangladesh Krishi Bankabdul kuddusAinda não há avaliações

- Business Finance ExamDocumento5 páginasBusiness Finance Examlope pecayo80% (5)

- APHB Application FormDocumento4 páginasAPHB Application FormtomsraoAinda não há avaliações

- Child Allowance CBA Brief CPSP March 2021Documento10 páginasChild Allowance CBA Brief CPSP March 2021Katie CrolleyAinda não há avaliações

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Documento5 páginasThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsAinda não há avaliações

- Chapter 10 - SolutionsDocumento25 páginasChapter 10 - SolutionsGerald SusanteoAinda não há avaliações

- The Greatest Trade of The CenturyDocumento280 páginasThe Greatest Trade of The Centurysalsa94Ainda não há avaliações

- SLLC - 2021 - Acc - Lecture Note - 02Documento60 páginasSLLC - 2021 - Acc - Lecture Note - 02Chamela MahiepalaAinda não há avaliações

- 1 The Accounting Equation Accounting Cycle Steps 1 4Documento6 páginas1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalAinda não há avaliações

- 12Documento8 páginas12ifowwAinda não há avaliações

- Olino vs Medina land dispute caseDocumento2 páginasOlino vs Medina land dispute caseOyi Lorenzo-Liban0% (1)

- Treehouse Toy Library Business PlanDocumento16 páginasTreehouse Toy Library Business PlanElizabeth BartleyAinda não há avaliações