Escolar Documentos

Profissional Documentos

Cultura Documentos

Altman 2018 Form 6 Financial Disclosure

Enviado por

Matthew Daniel Nye0 notas0% acharam este documento útil (0 voto)

23 visualizações8 páginasAltman 2018 Form 6 Financial Disclosure

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoAltman 2018 Form 6 Financial Disclosure

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

23 visualizações8 páginasAltman 2018 Form 6 Financial Disclosure

Enviado por

Matthew Daniel NyeAltman 2018 Form 6 Financial Disclosure

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

Você está na página 1de 8

FULL AND PUBLIC DISCLOSURE

OF FINANCIAL INTERESTS

FOR OFFICE USE ONLY:

Hon Thitrel A. Altman ie

State Representative

House Of Representatives

Elected Constitutional Officer

2237 Rockledge Dr : >

Rockledge, FL 32956-5403

Wel eh tele lle

rocode {MIMI

IDNo, 74566

Conf. Code

Altman, Thirrel A.

(CHECK IF THIS IS AFILING BY A CANDIDATE

PART A~ NET WORTH

Please enter the value of your net worth as of December 31, 2017 or a more current date. (Note: Net worth is not cal-

culated by subtracting your reported liabilities from your reported assets, so please see the instructions on page 3.)

My net worth as of Supran, 1% 20\% was s},710, 858.5%

PART B~ ASSETS

HOUSEHOLD GOODS AND PERSONAL EFFECTS:

Household goods and persanaletlecis may be fe2erled in a lump sum if thelr aggregate value exoeeds $1,000, This category includes any of the

followin, not nels for Investment gurposes: Jewsly, collections of stamps, guns. and numismaic items: an objects: household eculpment and

fumishings: clothing. other housahald tems: and Veheles for versanal use. whether owned o lease.

‘The aggregate value of my household goods and personal eens idescated above) iss JUS, 000,00.

[ASSETS INDIVIDUALLY VALUED AT OVER 1,000:

DESCRIPTION OF ASSET apecfic description required - oe insinscons 4) VALUE OF Asser

Sas filaslamact, "Be

tachment “AA

PART C~ LIABILITIES,

LIABILITIES IN EXCESS OF $1,000 (See instructions on page 4:

NAME AND ADDRESS OF CREDITOR AMOUNT OF LIABILITY

See Attach want "B'

“JOINT AND SEVERAL LIABILITIES NOT REPORTED ABOVE:

NAME AND ADDRESS OF CREDITOR AMOUNT OF LIABILITY

+

Toms Game Es Tondo aes TAGET

PART D-- INCOME

arty each separate source and amount of income which exceeded $1,000 during the year, including secondary sources of Income. Oratach «complete

copy of your 2017 lederal income lax return, inluaing al Wes, schedules. ard atachments. Please redsct any Soll secu or account numbers botere

fttching you terns, asthe law requves these documents be posted a the Commons web,

Deve tote a copy of my 2017 federal income tax ratum and all W2's, schedules, and atachmeats

[ityou chock tis tox and atach 2 copy of your 2017 tax return, you need not complete the remainder of Pan

PRIMARY SOURCES OF INCOME (See instructions on page 5)

NAME OF SOURGE OF INCOME EXCEEOING $1,000 ADDRESS OF SOURCE OF INCOME “AsSOUNT

eae Eee

‘SECONDARY SOURCES OF INCOME [Major customers, clens, eto, of businasees owned by reporting pereon-se0 instructions an page 8}

NAME OF NAME OF MAJOR SOURCES ADDRESS PRINCIPAL BUSINESS

BUSINESS ENTITY ‘OF BUSINESS INCOME (OF SOURCE ACTIVITY OF SOURCE

PART E — INTERESTS IN SPECIFIED BUSINESSES [Instructions on page 6)

BUSINESS ENTITY #1 BUSINESS ENTITY # 2 BUSINESS ENTITY #3

WANE OF

BUSINESS ENTITY

‘ADDRESS OF

BUSINESS ENTITY

‘PRINCIPAL BUSINESS

ACTIVITY

POSITION HELD

WiTeNTIY.

TOWN MORE THAN ASS,

INTEREST INTHE BUSINESS,

NATURE OF HY

OWNERSHIP INTEREST

PART F - TRAINING

For officers required to complete annual ethics training pursuant to section 112.3142, FS.

(Q_I CERTIFY THAT | HAVE COMPLETED THE REQUIRED TRAINING.

sare orn

OATH counrvor Y@feyord

pron whos an spear Soro sed) an eaactbatbre a te sayet

beginning of tis form, o depose on oath or affemation oalS

and say thatthe Information dlscosed on this form

and any attachments hereto ie true, accurate,

and completo

ature of Natary Moc

Mas

Lotes Vellore commas 2 eda

Pant Romo Sas Coteonea i oe

Personaly Known OR Produced Idenffication _ oy

ype oF dentrcaton Prcucoe Flodide Diwers Ciceais-e

| certified pubic accountant licensed under Chapter 473, or attorney in good standing with the Florida Bar frepared this form’for you, he or

‘she must complete the following statement:

' prepared the CE Form 6 in accordance with Art, Sec. 8, Florida Constiutos

‘Séalon 112.3144, Fonda Stalites, and the indvucions to the form, Upon my reasonable knowedge and belie, tho disclosure herain is tue

‘ng correct.

‘OFFICIAL OR CANDIDATE

Signature

Preparation of this form by a CPA or attorney does not relieve the filer of the responsibil

IF ANY OF PARTS A

TE Foe tacie aneny 12008 PAGED

Feapartey ran in Re 906021) FAC

2106 Lionel Drive, Melbourne, FL 32940 (Residental)

2287 Rockledge Drive, Rockledge, FL 32955 (House)

‘The Pines Resort LLC (Parcel ID 27-37-11-00-00264,0-0000.00) 114 Snead

Road A-F, Indlan Harbour Beach, FL 32937 (15% Ownership, Banana

River Dr. Resort LLC)

‘Surrender Value of Lite Insurance State Farm 366 North Babcock Street

Sulte 102 Melbourne, FL 32835-6800

TIAA (Retirement Portfolia) “See Attachment B”

Bank of America (Checking) 175 E NASA Blvd. Melbourne, FL.32901

Bank of ‘America (Savings) 175 E /E NASA Bivd, Melbourne, FL 32901

‘Space Coast Credit Union (Savings) 8045 N. Wickham Ra. Melbourne, FL.

32040

1225 N Hwy. AIA, Indialantic, FL: 32003 (Residence 25% Ownership)

219,830.00

762,790.00

870,000.00

15,562.47

93,175.13

7,948.80

30,001.07

6,485.12

186,777.50

$ 2,192,160.09

TIAA Adiac! ment ‘i Account holder: THIRREL A ALTMAN JR

ASTRONAUTS MEMORIAL FOUNDATION

Plan # 320043

This plan includes the following annuity contracts and other investments, The annuity contracts are indicated with

either TIAA or CREF followed by a number.

TIA 0235506-3, CREF V2355060

Summary of your activity

Balance as of Jan 1, 2018 $88,821.34

Employer contributions. 4,125.00

Gainsfloss 228.79

Balance as of Mar 34, 2018 $93,175.13

What you have vested

i yr contains

Anny cata a ee vse Werled erent Vere alee

Annuly Cort. TT 100% $93,175.13

epimers eegegSege

Total $93,175.13,

Your investments

mameerot—_unvanareprc Vale aot Porant ot yur

Aon contrat ae ter merino weitere anotimaran ois Mara 20un “ota plan

Tex Investments

Equities

CREF Stock 28.8613 $481.1069 $13,885.37 14.90%

TAA Acc Int £9 5 TT, 549.4756 318270 17,488.16 18.77%

TIAA Acc Md-Cap Gr 74 a 319.7048 57.4276 18,359.88 19.70%

_——

TIAA Acc Smap Eq 74 AB 542.0022 51.8029 28,126.07 30.19%

—

TIAA Acc Lg-Cap Gr Tae 221.2634 69.2191 15,315.65 16.44%

—

Total Equities 303,175.13 700.0%

Total value of your invostmen s “ $98.175.13 100%

“Youn QUARTERLY REAREMENT SAIINOS PORTFOLIO STATEMENT FOR anon 4.204810 March 3.2038 Page 30°

ASTRONAUTS MEMORIA FOLIN.ATION (Continued)

‘Account holder: THIRREL A ALTMAN JR

How the value of »ur investments changed this period

To view the current performanco for your specific Investments, fog In to your account at TIAA.org or you can visit

TIAA org/performance for genera! performance information.

Vaio as of Netrosuttot TAA intrest” Vale as of

Invostmonts Jan, 2038 transactions ‘Ganorioss mar 34, 2088

CREF Stock RA $13,340.54 $618.75 -$73.92 $13,885.37

TIAA Ace Intl Ea T4 16,913.12 825.00 -249.96 17,488.16

TIAA Ace Mid-Cap Gr T4 47,249.72 825.00 285.16 18,359.88

TIAA Ace Sm-Cap Eq 74 27,130.81 1,237.50 242.24 28,126.07

TIAA Ace Le Cap Gr T4 : 14,187.15 618.75 09.75 15,315.65

Total value of your investnics. > $88,821.34 $4,125.00 $228.79 $93,175.13

Your transaction cctails

Processing Effective Number of tty

ate dato senpton vnltstares share pce Amount

Employer

4/3/2018 1/3/2018 Contributco: VVT 0.4202 $490.8645 $206.25

CREF Stock 1

3/2018 1/3/2018 oni 8.4390 32,5869 275.00

TVA Ace Int Eg T4

4/3/2018 1/3/2018 Cunvibution 4.7782 87.5831 275.00

TIAA Ace Md-Cap Gr T4

1/3/2018 1/3/2018 C wntribution 7.7955 62.9154 412.50

i WAAce Sm-Cap Eq T4

4/3/2018 1/3/2018 Cont"bution TI) 30140 68.4308 206.25

\AAee LesCap Gr T4

2/5/2018 2/5/2018 contribution (AAA 0.4291 480.6952 206.25

CHEF Stock RL

wero 7/5/2018 6 or AT 84259 32.6375 278.00

Wace Intl Eg TH

2/8/2018 2/5/2018 C.nirbution 4.9010 56.1105 275.00

Ace Mid-Cap Gr 14

25/18 2/5/2018 Cb AS 80725 51.0994 412.50

\\Ace Sm-Cap Eq TA

2/8/2018 2/8/2018 tribution 3.0415 67.8122 206.25

WA Ave L6Cap Gr Ta

3/5/2018 3/5/2018 nvrbution 0.4206 490.4050 206.25

(LF Stock RL

3/5/2018 3/8/2018 © ntnbution 85709 32.0852 275.00

\ Ace Int Eg 74

ge2oie 3/5/2018) ivvicn LT) 47511 87.8817 275.00

‘Ace Md-Cap Gr 4

YOUR QUARTERLY RETIAEWENT SAUWGS {FOLIO STATEMENT FOR Januar, 2038 T0 March 34,2028, Pace 40F 8

co Tl AA Account holder: THIRREL A ALTMAN JR

ASTRONAUTS MEMORIAL FOUNDATION (Continued

Your transaction details - continued

Processing Eetvo umnacot ens

ate ane Dosen lar Aenunt

35/2018 3/5/2018 ond i 7.8296 52.6848 «412.50

TIAA Ace Sm-Cap Eq T4

9/5/2018 3/6/2018 Cantibution 28925 71.3049 206.25

TIAA Ace Le-Cap Gr T4 : =

Total employer contributions 34,125.00

How contributions are allocated

To view or change your current assct alocation or afocation of future contributions, vst TIAA.or@ and signin tothe secure

partion of our wensite

GREF Stock RA

TIAA Acc Intl Eq Ta

TAA Ace Mé-Cap. Gr Td

TIAA Ace Sav Cap Eq T4

TIAA Acc Le-Cop Gr 14

Total

Wealth Management Advisor

Your Wealth Management Advisar conduc all advsonyrelated and fnencial planning services such as inital discovery,

diagnosis, ang eresencation meetings, nvestment eviews, and planning for estate and investment management. Neots with

clients by appainament

BARBARA SELIG

‘Wealth Management Advisor

(386) 281-4040

Borbara Selig@tine.org

‘Youn QUARTERLY REMRENENT SAVINGS PORTFOUO STATEMENT FOR Janay 42048 TO Mae 3, 2018, Pace sor

Note Roberta Aitman, PO Box 360911 Melbourne, FL 32936

‘Space Coast Credit Union 8045 N. Wickham Rd. Melbourne, FL.

32940 (Car Loan)

_Nissan Motor Acceptance Corp. PO Box 660360 (Car Loan)

Altman, Thirrel A TR, PO Box 360911, Melbourne, FL 32936

(Mortgage)

‘TD Auto Finance, PO Box 9223, Farmington Hill, Mi 46323-0223 | s

Personal Loan, T.A. and Roberta Altman, PO Box 360911,

Melbourne, FL 329366

100,000.00

1297249

23,900.00

454,692.12

22,796.95

18,000.00

630,901.56

Florida House

‘TARA Management, 10 Palmer Road, IHB, Florida 32937

Astronauts Memorial Foundation, Mall Code AMF DSC

26,646.11

$ 19,000.00

$ 165,516.00

Você também pode gostar

- Florida Medicaid Pharmacy Claims AnalysisDocumento203 páginasFlorida Medicaid Pharmacy Claims AnalysisMatthew Daniel NyeAinda não há avaliações

- Whistleblower Response ProcessDocumento4 páginasWhistleblower Response ProcessMatthew Daniel NyeAinda não há avaliações

- Republican Liberty Caucus of Central East Florida Bylaws: Article I: NameDocumento8 páginasRepublican Liberty Caucus of Central East Florida Bylaws: Article I: NameMatthew Daniel NyeAinda não há avaliações

- RPOF Model Constitution 04-28-17Documento9 páginasRPOF Model Constitution 04-28-17Matthew Daniel NyeAinda não há avaliações

- BREC Bylaws (As Revised On 11-08-2017)Documento5 páginasBREC Bylaws (As Revised On 11-08-2017)Matthew Daniel NyeAinda não há avaliações

- 4 - 17004 Report of InvestigationDocumento29 páginas4 - 17004 Report of InvestigationMatthew Daniel NyeAinda não há avaliações

- 2013-14 Astronuats Memorial Foundation Audited Financial StatementsDocumento28 páginas2013-14 Astronuats Memorial Foundation Audited Financial StatementsMatthew Daniel NyeAinda não há avaliações

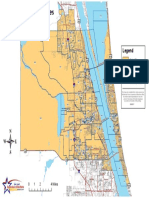

- Florida House District 52 MapDocumento1 páginaFlorida House District 52 MapMatthew Daniel NyeAinda não há avaliações

- Astronaut Memorial Foundation Financials 2013-2014Documento27 páginasAstronaut Memorial Foundation Financials 2013-2014Matthew Daniel NyeAinda não há avaliações

- Jim Barfield Ethics ComplaintDocumento19 páginasJim Barfield Ethics ComplaintMatthew Daniel NyeAinda não há avaliações

- Liberty Index 2015Documento15 páginasLiberty Index 2015Matthew Daniel NyeAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)