Escolar Documentos

Profissional Documentos

Cultura Documentos

Prt6,8oo Li (I, Ffi: Ffihouldthecompanyreport?c) P206,800?/rJ.I,,,:Jl, J

Enviado por

Ryan PelitoTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Prt6,8oo Li (I, Ffi: Ffihouldthecompanyreport?c) P206,800?/rJ.I,,,:Jl, J

Enviado por

Ryan PelitoDireitos autorais:

Formatos disponíveis

- .

rt -

t7.dsr.--#clrt

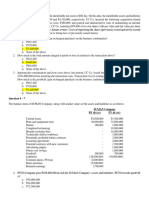

Cheese Company has thc following account balances: Sales revenue, P1,600,000; income

hom continuing

operation, P200,000; net.income, P180,000; income lrom operation, P440,000; selling and administrativc

expenses, I'1,000,000; income before incorrre tax, 11400,000. Wlrat is the amounl of finance

cost?

a) P20,000 c) P160,000

b) P40,000 d) P200,000

16. Ilazel Corporation has an income tax rate of 32Yo and inconre before rlon-ooerati s o1'P524,000. It also

has the following items (at gross amounts): unusual t,rri, t,z+,ooo; air"dffiffi"ration

lgss, 11202,000; gailr

ftun the disposal of equipment, P16,000 ard change in accounting principle increasing prior year's inoqmc,

Pl06'000. What is thc arnount of income tax cxpense llazel Corporation would r"p,i.i on iis statelnent oi'

a) P 84,480 c) P177,920

b) P149,120 d) PI83,040

17, T'he following information pertains to Wencly Company during 2016:

-Ianuaryl' 2016 inventory, P450,000; December 31, 2016 inventory, P480,000; Purchases during thc year.

P1,800,000; Purchase returns and allowances, P105,000; Purchase discounts, P25,000; lransponation in,

Pl0,000; Sales during the year, P3,850.00O; Saies discounts granted, P70,000; Sales rctur4s, Ir120;000; Selling

cxpenses, P990,000; Administrative expenses, P825,000; Rental revcnue, P65,000; Dividen<t received,

P150,000; Income tax expense, fj4QO.igd-BgQlucd-gfnings, r, zul(r, P200,Oo0.I]nrealizcd

January 1.2016,

5s, J4rrud.)/ rzr^r)\r\^t.t)Ilreallzoo gall

sain

equity invcstment at lhir value t6t$i6mpre net of tax, P20,000; Revaluation surplus, fit.h

taxPl0'000andDividendspaidofPl5o.@rcnccssh.aresaccountcdasaliabiliiv.rA.-.)hh(alt0

tax P10,000 and Dividends paid of Pl

ese.stion t : ,'rhc company prcpares *,, ,.offiIffi,iu-f.fgyl"t#,r$""#11:.f;f:*#raruqr .r.

ffihouldthecompanyreport?c)P206,800?\rJ.I,,,:Jl,J

b) Prt6,8oo ti' li.i{ ,t.l."A

ij li[i,ffi

is the amount of comprchensive income assuming rhe company is consiiered rr, *"ul*ffa

Wffirwhat i-f*

a) P176,800 c) PI96,800

b) P186.800 d) P206,800

18. Presented below are year-end balances of thc assets and liabilities pertaining to Glacier Mcrohandising;

2016 2015

Cash Prffi)o P120.000

Equity investrnent at lbir value to prrtlil or loss 260,000 230,000

Accounts receivable, net 360,000 400,000

lnvcntories 705,000 635,000

-130,000

128,000

182,000 r 36,000

Accounts payable

Other current liabi litics 141.000 125,000

Bonds payablc 200.000 200,000

Additional investment made by the owncr during 201 6 was P I 50,000 but a P260,000 personal liabiliry was paid

out of company's l-unds. What is the company's profit or loss for the year ended December 31,20162

a) P 30,000 c) p190,000

b) P 140,000 d) P290,000

19. Monarch company's account balances curing 2016 showed the following changes:

0 Current'assets p 3,000,000 increase

Non-current assets 2,500,000 dccrease

Current liabilities I,600,000 clccrease

)l iV cii,.i:,h, Non-cument liabilitics , 1.000,000 increasc

1,.t ,, ' l 'l'.''' 1, '

Share u^apital 1,200,000 increasc

t Share premium capital 800,000 increase

:t' ir,1',

" 'l'here wcre no changes in retained earnings for 2016 other than a P1,500,000 dividend payment and year-cnd

result of opcrations. Ilow much is Monarchs' net income for 2016?

a) P500,000 c) P700,000

b) P600,000 d) P800,000

I 20; C)n January l,2015,Zhang Inc. had cash and share capital of PI0,000,000. At that date, the company had n<r

other asset, liability, or equity balances. On January 5. 2015. it purchased for cash p6,000.0d0 of equity

securities that il classified as non-trading. It received cash dividends of P{100,000 during the year on tfuese

securities. In addition, it has an unrealized loss on thesc securities of P600,000. The tax rate isZllU. Compule

the amount of comprchensive income.

a) P160,000 c) P600,000

b) P200,000 d) P640,000 3401

Você também pode gostar

- AA 4101 Midterm With AnswersDocumento9 páginasAA 4101 Midterm With AnswersAlyssa AnnAinda não há avaliações

- Exercises (7-27-18)Documento2 páginasExercises (7-27-18)Justin ManaogAinda não há avaliações

- Accounting For Business CombinationsDocumento5 páginasAccounting For Business CombinationsJohn JackAinda não há avaliações

- Bus Com 12Documento3 páginasBus Com 12Chabelita MijaresAinda não há avaliações

- For Questions 6Documento3 páginasFor Questions 6Meghan Kaye LiwenAinda não há avaliações

- Accounting Ae2020Documento3 páginasAccounting Ae2020elsana philipAinda não há avaliações

- CashflowsDocumento6 páginasCashflowsJAN CHRISTOPHER CABADINGAinda não há avaliações

- Various Topics in MANAGEMENT ACCOUNTING (RESA)Documento2 páginasVarious Topics in MANAGEMENT ACCOUNTING (RESA)Denise ChristinaAinda não há avaliações

- Additional Cash Flow ProblemsDocumento3 páginasAdditional Cash Flow ProblemsChelle HullezaAinda não há avaliações

- 1234Documento1 página1234Michael ScofieldAinda não há avaliações

- Equity Method (First Year of Acquisition)Documento3 páginasEquity Method (First Year of Acquisition)Angel Chane OstrazAinda não há avaliações

- Taxation - Final ExamDocumento4 páginasTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- AfarDocumento128 páginasAfarlloyd77% (57)

- Afar PDFDocumento128 páginasAfar PDFMelyn Bustamante100% (1)

- Sample Practice Exam 29 March 2019 Answers - CompressDocumento7 páginasSample Practice Exam 29 March 2019 Answers - CompressShevina Maghari shsnohsAinda não há avaliações

- Pfrs 3 and 10 EXAM - FINALDocumento12 páginasPfrs 3 and 10 EXAM - FINALElizabeth DumawalAinda não há avaliações

- Fine Manufacturing CompanyDocumento4 páginasFine Manufacturing CompanyexquisiteAinda não há avaliações

- Partnership Liquidation. Alynna Joy P. IbanezDocumento32 páginasPartnership Liquidation. Alynna Joy P. IbanezAllynna Joy83% (6)

- Buscom 3Documento4 páginasBuscom 3dmangiginAinda não há avaliações

- Ans 31 To 41Documento2 páginasAns 31 To 41Mallet S. GacadAinda não há avaliações

- Midterm HahaDocumento33 páginasMidterm HahaCarl Elmo Bernardo MurosAinda não há avaliações

- Chapter 8Documento27 páginasChapter 8Francesz VirayAinda não há avaliações

- Adfina 4Documento1 páginaAdfina 4sonly amatosaAinda não há avaliações

- Quiz 2 - Accounting ProcessDocumento3 páginasQuiz 2 - Accounting ProcessPrincess NozalAinda não há avaliações

- Total Assets P670,000 P970,000 P330,000 P535,000Documento1 páginaTotal Assets P670,000 P970,000 P330,000 P535,000Diomaris Cuso BasioAinda não há avaliações

- Cpa ReviewDocumento17 páginasCpa ReviewJericho PedragosaAinda não há avaliações

- Module 7Documento9 páginasModule 7Jacqueline OrtegaAinda não há avaliações

- ACCM343 Advanced Accounting 2011 by Guerrero PeraltaDocumento218 páginasACCM343 Advanced Accounting 2011 by Guerrero PeraltaHujaype Abubakar80% (10)

- Taxsynth Page 25Documento2 páginasTaxsynth Page 25Anne Marieline BuenaventuraAinda não há avaliações

- Cup - Basic ParcorDocumento8 páginasCup - Basic ParcorJerauld BucolAinda não há avaliações

- Follow-Up Problem SubsequentDocumento4 páginasFollow-Up Problem SubsequentasdasdaAinda não há avaliações

- Acctg EquationDocumento4 páginasAcctg EquationMichael John DayondonAinda não há avaliações

- W8 - AS5 - Statement of CashFlowsDocumento1 páginaW8 - AS5 - Statement of CashFlowsJere Mae MarananAinda não há avaliações

- Business Com ActivityDocumento2 páginasBusiness Com ActivityAlyssa AnnAinda não há avaliações

- PDF Partnership Liquidation Alynna Joy P Ibanezdocx DLDocumento32 páginasPDF Partnership Liquidation Alynna Joy P Ibanezdocx DLKrizia Mae Uzielle PeneroAinda não há avaliações

- Business Combi PDF FreeDocumento13 páginasBusiness Combi PDF FreeEricka RedoñaAinda não há avaliações

- Sample/practice Exam 29 March 2019, Answers Sample/practice Exam 29 March 2019, AnswersDocumento8 páginasSample/practice Exam 29 March 2019, Answers Sample/practice Exam 29 March 2019, AnswersRachel Green0% (1)

- FAR Test BankDocumento17 páginasFAR Test BankMa. Efrelyn A. BagayAinda não há avaliações

- Sol ManDocumento144 páginasSol ManShr Bn100% (1)

- Chapter 8 Audit of Intangible AssetsDocumento12 páginasChapter 8 Audit of Intangible AssetsMarkie GrabilloAinda não há avaliações

- Homework CH 5 1Documento46 páginasHomework CH 5 1LAinda não há avaliações

- Accounting Exercises On Cash FlowsDocumento2 páginasAccounting Exercises On Cash FlowsMicaella GoAinda não há avaliações

- Dissolution Exercise 12Documento2 páginasDissolution Exercise 12Alleya. Jane AliAinda não há avaliações

- CombinationDocumento57 páginasCombinationGirl Lang Ako100% (1)

- AKL 2 - Tugas 3 Marselinus A H T (A31113316)Documento3 páginasAKL 2 - Tugas 3 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiAinda não há avaliações

- Advacc - Intercompany PDFDocumento143 páginasAdvacc - Intercompany PDFGelyn CruzAinda não há avaliações

- Revaluation Model, Impairment Loss, and Cash Generating UnitDocumento6 páginasRevaluation Model, Impairment Loss, and Cash Generating UnitKlariza Paula Ng HuaAinda não há avaliações

- Financia,. Accounting: ReportingDocumento1 páginaFinancia,. Accounting: ReportingJohn Francis Raspado AnchetaAinda não há avaliações

- Problem #10 Two Sole Proprietorship Form A PartnershipDocumento2 páginasProblem #10 Two Sole Proprietorship Form A Partnershipstudentone83% (6)

- Final Requirement in AdvaccDocumento143 páginasFinal Requirement in AdvaccShaina Kaye De Guzman100% (1)

- Cost and Financial Accounting in Forestry: A Practical ManualNo EverandCost and Financial Accounting in Forestry: A Practical ManualAinda não há avaliações

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeAinda não há avaliações

- Equity Valuation: Models from Leading Investment BanksNo EverandEquity Valuation: Models from Leading Investment BanksJan ViebigAinda não há avaliações

- Fast-Track Tax Reform: Lessons from the MaldivesNo EverandFast-Track Tax Reform: Lessons from the MaldivesAinda não há avaliações

- Wealth Management Planning: The UK Tax PrinciplesNo EverandWealth Management Planning: The UK Tax PrinciplesNota: 4.5 de 5 estrelas4.5/5 (2)

- The Front Office Manual: The Definitive Guide to Trading, Structuring and SalesNo EverandThe Front Office Manual: The Definitive Guide to Trading, Structuring and SalesAinda não há avaliações

- Loo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Documento1 páginaLoo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Ryan PelitoAinda não há avaliações

- 1,,, A. o 61-Oo, Ooo c.200,000: Tirii.t'Documento1 página1,,, A. o 61-Oo, Ooo c.200,000: Tirii.t'Ryan PelitoAinda não há avaliações

- P1 3401-2 PDFDocumento1 páginaP1 3401-2 PDFRyan PelitoAinda não há avaliações

- Far 34PW-2 PDFDocumento1 páginaFar 34PW-2 PDFRyan PelitoAinda não há avaliações

- P1 3403-2 PDFDocumento1 páginaP1 3403-2 PDFRyan PelitoAinda não há avaliações

- 3j-2Q!7. Iunds Iiot: ,,.rse. O1Documento1 página3j-2Q!7. Iunds Iiot: ,,.rse. O1Ryan PelitoAinda não há avaliações

- Far 34PW-6 PDFDocumento1 páginaFar 34PW-6 PDFRyan PelitoAinda não há avaliações

- P1 3402-2 PDFDocumento1 páginaP1 3402-2 PDFRyan PelitoAinda não há avaliações

- Far 34PW-9 PDFDocumento1 páginaFar 34PW-9 PDFRyan PelitoAinda não há avaliações

- Far 34PW-1 PDFDocumento1 páginaFar 34PW-1 PDFRyan PelitoAinda não há avaliações

- P1 3403-3 PDFDocumento1 páginaP1 3403-3 PDFRyan PelitoAinda não há avaliações

- P1 3401-1Documento1 páginaP1 3401-1Ryan PelitoAinda não há avaliações

- 'iil'ff: Ii:: 2eo, Ooo t5'7,3L3 " 161,104 164,895)Documento1 página'iil'ff: Ii:: 2eo, Ooo t5'7,3L3 " 161,104 164,895)Ryan PelitoAinda não há avaliações

- P1 3402-1 PDFDocumento1 páginaP1 3402-1 PDFRyan PelitoAinda não há avaliações

- Accountin - , I.t,: ,., ResaDocumento1 páginaAccountin - , I.t,: ,., ResaRyan PelitoAinda não há avaliações

- Ap 34PW-1 PDFDocumento1 páginaAp 34PW-1 PDFRyan PelitoAinda não há avaliações

- Ap 34PW2-2 PDFDocumento1 páginaAp 34PW2-2 PDFRyan PelitoAinda não há avaliações

- Ap 34PW2-1 PDFDocumento1 páginaAp 34PW2-1 PDFRyan PelitoAinda não há avaliações

- Ap 34PW2-4Documento1 páginaAp 34PW2-4Ryan PelitoAinda não há avaliações

- Ap 34PW-2 PDFDocumento1 páginaAp 34PW-2 PDFRyan PelitoAinda não há avaliações

- Ap 34PW2-3 PDFDocumento1 páginaAp 34PW2-3 PDFRyan PelitoAinda não há avaliações

- Reyes TacandongDocumento1 páginaReyes TacandongRyan PelitoAinda não há avaliações

- Frequency Polygon: Class Limits Class Boundari Es F X CFDocumento2 páginasFrequency Polygon: Class Limits Class Boundari Es F X CFRyan PelitoAinda não há avaliações

- Market ProjDocumento5 páginasMarket ProjRyan PelitoAinda não há avaliações

- SculptureDocumento2 páginasSculptureRyan PelitoAinda não há avaliações

- Ac Pas 8Documento9 páginasAc Pas 8Ryan PelitoAinda não há avaliações

- Ac Pas 8Documento9 páginasAc Pas 8Ryan PelitoAinda não há avaliações

- Democracy or Aristocracy?: Yasir MasoodDocumento4 páginasDemocracy or Aristocracy?: Yasir MasoodAjmal KhanAinda não há avaliações

- A Structural Modelo of Limital Experienci Un TourismDocumento15 páginasA Structural Modelo of Limital Experienci Un TourismcecorredorAinda não há avaliações

- AN44061A Panasonic Electronic Components Product DetailsDocumento3 páginasAN44061A Panasonic Electronic Components Product DetailsAdam StariusAinda não há avaliações

- Chapter 1 INTRODUCTION TO LITERATUREDocumento4 páginasChapter 1 INTRODUCTION TO LITERATUREDominique TurlaAinda não há avaliações

- SRS For Travel AgencyDocumento5 páginasSRS For Travel AgencyHardik SawalsaAinda não há avaliações

- Big Brother Naija and Its Impact On Nigeria University Students 2 PDFDocumento30 páginasBig Brother Naija and Its Impact On Nigeria University Students 2 PDFIlufoye Tunde100% (1)

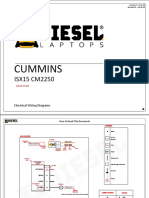

- Cummins: ISX15 CM2250Documento17 páginasCummins: ISX15 CM2250haroun100% (4)

- A Detailed Lesson PlanDocumento5 páginasA Detailed Lesson PlanIsaac-elmar Agtarap74% (23)

- SANDWICH Elisa (Procedure) - Immunology Virtual Lab I - Biotechnology and Biomedical Engineering - Amrita Vishwa Vidyapeetham Virtual LabDocumento2 páginasSANDWICH Elisa (Procedure) - Immunology Virtual Lab I - Biotechnology and Biomedical Engineering - Amrita Vishwa Vidyapeetham Virtual LabsantonuAinda não há avaliações

- LAB REPORT - MGCLDocumento5 páginasLAB REPORT - MGCLKali stringsAinda não há avaliações

- Intercultural Personhood and Identity NegotiationDocumento13 páginasIntercultural Personhood and Identity NegotiationJoão HorrAinda não há avaliações

- AIP 2020 FINAL JuneDocumento5 páginasAIP 2020 FINAL JuneVINA ARIETAAinda não há avaliações

- Matutum View Academy: (The School of Faith)Documento14 páginasMatutum View Academy: (The School of Faith)Neil Trezley Sunico BalajadiaAinda não há avaliações

- 8 Adam AmuraroDocumento28 páginas8 Adam Amurarokmeena73Ainda não há avaliações

- Literature Review - Part Time Job Among StudentDocumento3 páginasLiterature Review - Part Time Job Among StudentMarria65% (20)

- Icc Esr-2302 Kb3 ConcreteDocumento11 páginasIcc Esr-2302 Kb3 ConcretexpertsteelAinda não há avaliações

- HPSC HCS Exam 2021: Important DatesDocumento6 páginasHPSC HCS Exam 2021: Important DatesTejaswi SaxenaAinda não há avaliações

- Data Mining in IoTDocumento29 páginasData Mining in IoTRohit Mukherjee100% (1)

- Swiss Army Triplet 1Documento2 páginasSwiss Army Triplet 1johnpwayAinda não há avaliações

- Immobilization of Rhodococcus Rhodochrous BX2 (An AcetonitriledegradingDocumento7 páginasImmobilization of Rhodococcus Rhodochrous BX2 (An AcetonitriledegradingSahar IrankhahAinda não há avaliações

- UpdateJul2007 3julDocumento10 páginasUpdateJul2007 3julAnshul SinghAinda não há avaliações

- Bhavesh ProjectDocumento14 páginasBhavesh ProjectRahul LimbaniAinda não há avaliações

- Ferrero A.M. Et Al. (2015) - Experimental Tests For The Application of An Analytical Model For Flexible Debris Flow Barrier Design PDFDocumento10 páginasFerrero A.M. Et Al. (2015) - Experimental Tests For The Application of An Analytical Model For Flexible Debris Flow Barrier Design PDFEnrico MassaAinda não há avaliações

- All About TarlacDocumento12 páginasAll About TarlacAnonymous uLb5vOjXAinda não há avaliações

- Su Poder en El Espiritu Santo Your Power in The Holy Spirit Spanish Edition by John G Lake PDFDocumento4 páginasSu Poder en El Espiritu Santo Your Power in The Holy Spirit Spanish Edition by John G Lake PDFRodrigo MendezAinda não há avaliações

- Class InsectaDocumento4 páginasClass InsectaLittle Miss CeeAinda não há avaliações

- M2252D PS PDFDocumento36 páginasM2252D PS PDFCarmen da SilvaAinda não há avaliações

- Citrus Information Kit-Update: Reprint - Information Current in 1998Documento53 páginasCitrus Information Kit-Update: Reprint - Information Current in 1998hamsa sewakAinda não há avaliações

- Abdominal Migraine and HomoeopathyDocumento17 páginasAbdominal Migraine and HomoeopathyDr. Rajneesh Kumar Sharma MD HomAinda não há avaliações

- UserProvisioningLabKit 200330 093526Documento10 páginasUserProvisioningLabKit 200330 093526Vivian BiryomumaishoAinda não há avaliações