Escolar Documentos

Profissional Documentos

Cultura Documentos

3j-2Q!7. Iunds Iiot: ,,.rse. O1

Enviado por

Ryan PelitoTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

3j-2Q!7. Iunds Iiot: ,,.rse. O1

Enviado por

Ryan PelitoDireitos autorais:

Formatos disponíveis

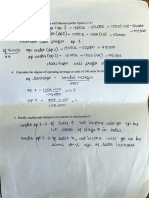

Ttre Ccniic Sans Company self-constructed an asset for rts own ,,.rse.

Cc:rstruction started o1- J-a1q-ary 7,2017 and the asset was

conrple:tecl on Decemlg-1 3j-2Q!7. The company had a two-year, lBrr, loan of -IS-Q-Q,QpO,-specificail.Dobtained to finance the asset

corrsrruction iunds iiot yet needed during the construction were tehporarily'invested in a short-term debt securities yielding a

pt C.00C interest revenue. The company also had a rP-68,qrqq9 ,S-year term with interest of 20o/o

_general borrowings amounting to

;, .t ir,,r)00,00O, l0-year term with interest of 18o/o were used in part in the self -construction "^, . ,

Costs incurred during the year were as follows:

January 1 - P400,000 - P500,000

April 1

August 1 - P480,000 December 1 - P180,000

o,'a,-

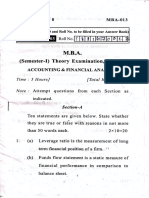

32. t{ow much is the total capitalized interes-t?

)'^1", a. 155,000 t. 8O,OOO

b', 165,000 d. 91,875 - ... -,i-

. 33. How much interest shoutd be recognized as interest expense? t

' :' -'. ,'- ' ];

\r'

, a. 0 c.300,000 l.r;-.lr,r:;

"'l,'

j

;. iOe,rZS d. 135,000 ; ' 7,

,1 't.

.,-,. , -

The Optima Corporation rncurred the following expenditures which it had charged to Propedy, plant and equipment account, at"th'e

beoinnin{ o1' 2017:

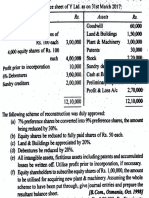

l. Castr paid on purchase of land P220,000

','' Demoiition of a building erected on the purchased land 100,000

_ Legal fees for the land acquisition ' 25,000

.- Interest on loan for construction ",'.'.-it ""' 27,OOO

i- Labor and materials for the construction df the building 500,000

t: Architect's fees for the building 37,OAO

i; Excavation expenses 45,000

? Frxed overhead charged to the building 100,000

g Cost of Iemporary safety fence 50,000

10,000

? Pavment to squatteri to vaCate the premises -' r" - ' i " '1 t

30,000

'1_ 'a..t.>^d

_'':"_y_ -ssun"ed on the Iand purchaSed "'1't) 80,000

"'

i' :r.: :':ar33r-ar, oJarters for construction crew 50,000

, .. ,-_'_: :- c:-s:-.;ctron of the building equal to tne ditference beiween the appraised

vr -i E^C ac!ila, a31st-uction ccsts 120,000

c- ::-:, :-teS :. :a^j :.,e,,n9 :,..1e pe- :.j 20i4 _ 2Ol7 80,000

* .'--::::e lss--e: =".'? z^=:-.,::as:c 140,000

- :::: : aSsessn,eli-< 25,000

-.C.:st 3f cPt,on 9d:c to DUY i'e lano

''., Landscaping cost

15,000

_ 40,000

- " Cost of paving driveway and parking lot 20,000

,1,.u) ;.;"t Proceeds from sale of saivage materials 30,000

Ccc':ite'c- the ccrrect 2C17 baia:,ces of the fc: c,.,rnE

A BED

34. Land 565,000 585,000 605,000 625,000

35. Building 9 i 9.000 949,000 869,000 819,000

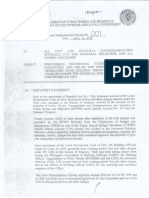

in January 2017, Nadeem Mining Company purchased a mineral mine for, P3.600,000 with removal ore estimates by geographicai

surveys qP,160,QOO tols. The property has an estimated vaiue of-P360,900-after the ore has been extraeted. Nadeem Company

incurred P1,O_Bqr_00_qpf development costs preparing the property for extiaction of ore. During 2017,-!-'---

270,000)tons were extraqtedr

and 240,Of'Oiona wErrlqol!.r - ',:-,:.,.;

- , .. t-.-',1 ' : l -H*L ' 1,,

,' 36. For th-e year ended December ?\, 2Ot7 , Nadeem should include what armount of depletio n? '-' : .. ;

a. 360,000 c. 52O,OOO -:. n '.)t..

'

On January t,z[l2,Franklin

Gothic Company purchased a machinery for!600,00Or'with an estimated economic ,r*rr, ,,L L, ,,

years. Straight line method of depreciation is to be used. On December 31,2015, it was properly determined that the_.fair: villg

less cost of disposal is !235,0O0-'while the value in use is P240,00_9, -Qn.J_a1uary l, 2018, it was Frep.,i-ly computed that the

r*ecoverableamountof theassetisf_]50r0!-0, --",..,.,.

.\, ! ,.,^-,0,.r.., -'t .' .'

' 37. HourmuchistheampairmentlossonDecembersr;zOiie -:r".r'. F i )-t,.- l

\ s. 0 c. 165,000 "

b. 110,000 d. 160,000 ,./ - t

l. ' 38. How much impairment recovery should be reported on January l, 2O1B?

' a. 5O,OO0 c. 120,000 * ' --.frl 'i 1r, jir,::fi.'f). I

b. 70,000 d. 0

Bodoni Corp. purchased a machinery January t,2015, at a cost of P1,000,000-" I[ is being depreciated using the straighi l:i

method over its projected.useful life o.[--1!-Vears.. At December 31,2m6, the asset's fair value was P1,200,0_00. Accordingly, ;

entry was made on that date to recognize the revaluation write up.

A revaluation was made again on December 31, 2018 wherein the sound value of the asset was determined to be p570,000.

company has the policy of transferring any revaluation surpius to retdinedG-#iiifigs as the asset is being used up. ' -;-

39. How much is the revaluation surplus on December 31, 2016?

{ a. 500,000 c. 1,200,000

b. 400,000 d. 0 "- ), r

Você também pode gostar

- Loo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Documento1 páginaLoo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Ryan PelitoAinda não há avaliações

- Accountin - , I.t,: ,., ResaDocumento1 páginaAccountin - , I.t,: ,., ResaRyan PelitoAinda não há avaliações

- Partnership Formation ProblemsDocumento24 páginasPartnership Formation ProblemsHazel Bianca GabalesAinda não há avaliações

- Adobe Scan 28 Mar 2024Documento1 páginaAdobe Scan 28 Mar 2024santhoshsrinivas111Ainda não há avaliações

- ABC AnalysisDocumento3 páginasABC Analysisvjpalan081Ainda não há avaliações

- Far 34PW-9 PDFDocumento1 páginaFar 34PW-9 PDFRyan PelitoAinda não há avaliações

- RESA First Pre-Board ExamDocumento14 páginasRESA First Pre-Board ExamMark LagsAinda não há avaliações

- 1 - + - : - 47.suu:ooDocumento9 páginas1 - + - : - 47.suu:ooRAJORAJI CO.Ainda não há avaliações

- AccountDocumento3 páginasAccountkarangasharon9Ainda não há avaliações

- Finnncial AnalysisDocumento8 páginasFinnncial Analysisharish chandraAinda não há avaliações

- Business Combination and Consolidated FS Part 1Documento6 páginasBusiness Combination and Consolidated FS Part 1markAinda não há avaliações

- Errors and Accounting ChangesDocumento8 páginasErrors and Accounting ChangesAndrew Benedict PardilloAinda não há avaliações

- Jan-Feb2023 18Documento1 páginaJan-Feb2023 18Umera AhmedAinda não há avaliações

- Art. 3.2.2.2 PD 1096 PDFDocumento22 páginasArt. 3.2.2.2 PD 1096 PDFdizonabigailmaereyesAinda não há avaliações

- Inventories Are Asfollows:: Gu Errero/German/De J Esu S/Lim/Ferrer/Laco/ValixDocumento28 páginasInventories Are Asfollows:: Gu Errero/German/De J Esu S/Lim/Ferrer/Laco/ValixJaira EbronAinda não há avaliações

- Iiloop Tenslorr 7-To: Eda - Ro.GDocumento11 páginasIiloop Tenslorr 7-To: Eda - Ro.GAchara100% (1)

- My AMCDocumento1 páginaMy AMCanilAinda não há avaliações

- Sol Q6Documento4 páginasSol Q6yen c aAinda não há avaliações

- Tybms Sem5 SM Nov19Documento2 páginasTybms Sem5 SM Nov19chirag guptaAinda não há avaliações

- Concrete SpecificationDocumento16 páginasConcrete SpecificationHunaid ElkamushiAinda não há avaliações

- Applied-Mech1 2Documento46 páginasApplied-Mech1 2mivel82872Ainda não há avaliações

- Far 34PW-1 PDFDocumento1 páginaFar 34PW-1 PDFRyan PelitoAinda não há avaliações

- Accolnting: A. B. D. 20liDocumento10 páginasAccolnting: A. B. D. 20liAnonymous Labnk7jU2VAinda não há avaliações

- FASCIKEL 2 - Tovorni List Za Podjetja Orbis (Str.260)Documento1 páginaFASCIKEL 2 - Tovorni List Za Podjetja Orbis (Str.260)ResnicaoorozjuAinda não há avaliações

- Book 27 Nov 2023Documento11 páginasBook 27 Nov 2023maulivora310Ainda não há avaliações

- Additional BillDocumento2 páginasAdditional BillReynaldo PesqueraAinda não há avaliações

- Amalgamation Illustration PDFDocumento25 páginasAmalgamation Illustration PDFyash nawariyaAinda não há avaliações

- Dpwh-Dilg JMC 001 07-04-13 & MC 2014-153Documento4 páginasDpwh-Dilg JMC 001 07-04-13 & MC 2014-153Arch. Steve Virgil SarabiaAinda não há avaliações

- Img 20210610 0002Documento3 páginasImg 20210610 0002Sridhar KodaliAinda não há avaliações

- BRC - Bananaman Review Center Set2Documento16 páginasBRC - Bananaman Review Center Set2Paul AbonitaAinda não há avaliações

- TL M Ry: Distributed: C. Outstanding:....... / C. No - Otsslettersoutstanding:....... ."/.. E. Issuecl:.Documento1 páginaTL M Ry: Distributed: C. Outstanding:....... / C. No - Otsslettersoutstanding:....... ."/.. E. Issuecl:.Osman BanguraAinda não há avaliações

- Amul Business ModelDocumento8 páginasAmul Business ModelSʜʌʜwʌj HʋsʌɩŋAinda não há avaliações

- L Agreement Document: The Procurement ofDocumento65 páginasL Agreement Document: The Procurement ofBishnu Thapa MagarAinda não há avaliações

- Paper Publication 20.12.2022Documento2 páginasPaper Publication 20.12.2022Ravi MoneAinda não há avaliações

- Working: ComprehensiveDocumento10 páginasWorking: Comprehensiveapi-253275095Ainda não há avaliações

- Wipro DocumentDocumento8 páginasWipro Documentarvindvijay09Ainda não há avaliações

- Preweek Practical Accounting 2-20Documento1 páginaPreweek Practical Accounting 2-20adssdasdsadAinda não há avaliações

- PreparationsDocumento1 páginaPreparationsAl Wahdani RambeAinda não há avaliações

- BCIS-OS Agreement - 20230924 - 0001Documento3 páginasBCIS-OS Agreement - 20230924 - 0001dhanbahadurthapa52Ainda não há avaliações

- Management Accounting, 4th Edition (Chapter 2)Documento5 páginasManagement Accounting, 4th Edition (Chapter 2)Harrison HuAinda não há avaliações

- Prob 6.1Documento4 páginasProb 6.1Kristal Jasmin CortunaAinda não há avaliações

- Boston Creamery, IncDocumento4 páginasBoston Creamery, IncAto SumartoAinda não há avaliações

- Statement Showing The Adjustment To Be Made: '.J, Oot)Documento1 páginaStatement Showing The Adjustment To Be Made: '.J, Oot)khgngy5bbkAinda não há avaliações

- Ffi,:Ilril, T ': Il Fiflb Ilfffi 1.Documento30 páginasFfi,:Ilril, T ': Il Fiflb Ilfffi 1.sourav8450% (2)

- IMG - 0201 PSME Code 2008 190Documento1 páginaIMG - 0201 PSME Code 2008 190Arwyn BermasAinda não há avaliações

- Solution 34-6 Answer CDocumento1 páginaSolution 34-6 Answer CChammy TeyAinda não há avaliações

- RR No. 22-2021 - Deadline Extension Due To Typhoon OdetteDocumento5 páginasRR No. 22-2021 - Deadline Extension Due To Typhoon OdetteCarl GoAinda não há avaliações

- BCIS-OS Agreement - 20230914 - 0002Documento3 páginasBCIS-OS Agreement - 20230914 - 0002dhanbahadurthapa52Ainda não há avaliações

- Ffi&ffii : of As AreDocumento7 páginasFfi&ffii : of As AreSwetaMallickAinda não há avaliações

- Accountant Sample PaperDocumento10 páginasAccountant Sample PaperAgastya KarnwalAinda não há avaliações

- Nistir90 4229Documento28 páginasNistir90 4229Oleg ChudovAinda não há avaliações

- A Celebration of NationhoodDocumento11 páginasA Celebration of Nationhoodmau seranAinda não há avaliações

- Problems - Chapter 1 - Partnership and CorporationDocumento20 páginasProblems - Chapter 1 - Partnership and CorporationAntioco Rhino S RafalAinda não há avaliações

- Pages From 2010 EW Certs Brady To CaoDocumento56 páginasPages From 2010 EW Certs Brady To CaoJoshtaxpayerAinda não há avaliações

- Hardship Exemption ApplicationDocumento18 páginasHardship Exemption ApplicationWLANCAinda não há avaliações

- Is Is: of IndiaDocumento5 páginasIs Is: of IndiaKanchan GundalAinda não há avaliações

- Csec Poa June 2006 p1Documento10 páginasCsec Poa June 2006 p1Dianna Lawrence100% (1)

- Acct 385 Blocher El1-33Documento14 páginasAcct 385 Blocher El1-33Queen Jean MielAinda não há avaliações

- 02 - Death Certificate of Prakash ReddyDocumento1 página02 - Death Certificate of Prakash ReddyR GautamAinda não há avaliações

- Far 34PW-9 PDFDocumento1 páginaFar 34PW-9 PDFRyan PelitoAinda não há avaliações

- Far 34PW-2 PDFDocumento1 páginaFar 34PW-2 PDFRyan PelitoAinda não há avaliações

- P1 3403-2 PDFDocumento1 páginaP1 3403-2 PDFRyan PelitoAinda não há avaliações

- Far 34PW-6 PDFDocumento1 páginaFar 34PW-6 PDFRyan PelitoAinda não há avaliações

- 1,,, A. o 61-Oo, Ooo c.200,000: Tirii.t'Documento1 página1,,, A. o 61-Oo, Ooo c.200,000: Tirii.t'Ryan PelitoAinda não há avaliações

- P1 3401-2 PDFDocumento1 páginaP1 3401-2 PDFRyan PelitoAinda não há avaliações

- Far 34PW-1 PDFDocumento1 páginaFar 34PW-1 PDFRyan PelitoAinda não há avaliações

- P1 3402-2 PDFDocumento1 páginaP1 3402-2 PDFRyan PelitoAinda não há avaliações

- P1 3403-3 PDFDocumento1 páginaP1 3403-3 PDFRyan PelitoAinda não há avaliações

- Prt6,8oo Li (I, Ffi: Ffihouldthecompanyreport?c) P206,800?/rJ.I,,,:Jl, JDocumento1 páginaPrt6,8oo Li (I, Ffi: Ffihouldthecompanyreport?c) P206,800?/rJ.I,,,:Jl, JRyan PelitoAinda não há avaliações

- 'iil'ff: Ii:: 2eo, Ooo t5'7,3L3 " 161,104 164,895)Documento1 página'iil'ff: Ii:: 2eo, Ooo t5'7,3L3 " 161,104 164,895)Ryan PelitoAinda não há avaliações

- P1 3402-1 PDFDocumento1 páginaP1 3402-1 PDFRyan PelitoAinda não há avaliações

- P1 3401-1Documento1 páginaP1 3401-1Ryan PelitoAinda não há avaliações

- Ap 34PW2-3 PDFDocumento1 páginaAp 34PW2-3 PDFRyan PelitoAinda não há avaliações

- Ap 34PW-2 PDFDocumento1 páginaAp 34PW-2 PDFRyan PelitoAinda não há avaliações

- Ap 34PW2-2 PDFDocumento1 páginaAp 34PW2-2 PDFRyan PelitoAinda não há avaliações

- Ap 34PW2-4Documento1 páginaAp 34PW2-4Ryan PelitoAinda não há avaliações

- Ap 34PW2-1 PDFDocumento1 páginaAp 34PW2-1 PDFRyan PelitoAinda não há avaliações

- Market ProjDocumento5 páginasMarket ProjRyan PelitoAinda não há avaliações

- Ap 34PW-1 PDFDocumento1 páginaAp 34PW-1 PDFRyan PelitoAinda não há avaliações

- Reyes TacandongDocumento1 páginaReyes TacandongRyan PelitoAinda não há avaliações

- Frequency Polygon: Class Limits Class Boundari Es F X CFDocumento2 páginasFrequency Polygon: Class Limits Class Boundari Es F X CFRyan PelitoAinda não há avaliações

- Ac Pas 8Documento9 páginasAc Pas 8Ryan PelitoAinda não há avaliações

- SculptureDocumento2 páginasSculptureRyan PelitoAinda não há avaliações

- Ac Pas 8Documento9 páginasAc Pas 8Ryan PelitoAinda não há avaliações

- Littérature Russe I Cours 1-3PDFDocumento45 páginasLittérature Russe I Cours 1-3PDFSarah DendievelAinda não há avaliações

- Xeridt2n cbn9637661Documento7 páginasXeridt2n cbn9637661Naila AshrafAinda não há avaliações

- Item 10 McDonalds Sign PlanDocumento27 páginasItem 10 McDonalds Sign PlanCahanap NicoleAinda não há avaliações

- The History of Sewing MachinesDocumento5 páginasThe History of Sewing Machinesizza_joen143100% (2)

- Indicator - Individual Dietary Diversity ScoreDocumento3 páginasIndicator - Individual Dietary Diversity Scorehisbullah smithAinda não há avaliações

- Scraper SiteDocumento3 páginasScraper Sitelinda976Ainda não há avaliações

- MCQ Chapter 1Documento9 páginasMCQ Chapter 1K57 TRAN THI MINH NGOCAinda não há avaliações

- Toms River Fair Share Housing AgreementDocumento120 páginasToms River Fair Share Housing AgreementRise Up Ocean CountyAinda não há avaliações

- Blind DefenseDocumento7 páginasBlind DefensehadrienAinda não há avaliações

- CRM AssignmentDocumento43 páginasCRM Assignmentharshdeep mehta100% (2)

- Lon L. Fuller The Problem of The Grudge InformerDocumento9 páginasLon L. Fuller The Problem of The Grudge InformerNikko SarateAinda não há avaliações

- 2015 BT Annual ReportDocumento236 páginas2015 BT Annual ReportkernelexploitAinda não há avaliações

- Ky Yeu Hoi ThaoHVTC Quyen 1Documento1.348 páginasKy Yeu Hoi ThaoHVTC Quyen 1mmmanhtran2012Ainda não há avaliações

- Marketing ManagementDocumento228 páginasMarketing Managementarpit gargAinda não há avaliações

- MONITORING Form LRCP Catch UpDocumento2 páginasMONITORING Form LRCP Catch Upramel i valenciaAinda não há avaliações

- COWASH Federal Admin Manual v11 PDFDocumento26 páginasCOWASH Federal Admin Manual v11 PDFmaleriAinda não há avaliações

- Mollymawk - English (Çalışma)Documento8 páginasMollymawk - English (Çalışma)Fatih OguzAinda não há avaliações

- Account Statement 2012 August RONDocumento5 páginasAccount Statement 2012 August RONAna-Maria DincaAinda não há avaliações

- The Ethiopian Electoral and Political Parties Proclamation PDFDocumento65 páginasThe Ethiopian Electoral and Political Parties Proclamation PDFAlebel BelayAinda não há avaliações

- Late Night Activity Review ReportDocumento65 páginasLate Night Activity Review ReportCharlestonCityPaperAinda não há avaliações

- Philippine Stock Exchange: Head, Disclosure DepartmentDocumento58 páginasPhilippine Stock Exchange: Head, Disclosure DepartmentAnonymous 01pQbZUMMAinda não há avaliações

- EGYPTIAN LITERA-WPS OfficeDocumento14 páginasEGYPTIAN LITERA-WPS OfficeLemoj CombiAinda não há avaliações

- S.No. Deo Ack. No Appl - No Emp Name Empcode: School Assistant Telugu Physical SciencesDocumento8 páginasS.No. Deo Ack. No Appl - No Emp Name Empcode: School Assistant Telugu Physical SciencesNarasimha SastryAinda não há avaliações

- Microsoft Logo Third Party Usage Guidance: June 2021Documento7 páginasMicrosoft Logo Third Party Usage Guidance: June 2021Teo HocqAinda não há avaliações

- Rhonda Taube - Sexuality Meso FigurinesDocumento5 páginasRhonda Taube - Sexuality Meso FigurinesSneshko SnegicAinda não há avaliações

- Schonsee Square Brochure - July 11, 2017Documento4 páginasSchonsee Square Brochure - July 11, 2017Scott MydanAinda não há avaliações

- BBA (4th Sem) (Morning) (A) (Final Term Paper) PDFDocumento5 páginasBBA (4th Sem) (Morning) (A) (Final Term Paper) PDFZeeshan ch 'Hadi'Ainda não há avaliações

- Problem 1246 Dan 1247Documento2 páginasProblem 1246 Dan 1247Gilang Anwar HakimAinda não há avaliações

- X30531Documento48 páginasX30531Conrado Pinho Junior50% (2)

- Bible Who Am I AdvancedDocumento3 páginasBible Who Am I AdvancedLeticia FerreiraAinda não há avaliações