Escolar Documentos

Profissional Documentos

Cultura Documentos

Document

Enviado por

Jonabell MipalarTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Document

Enviado por

Jonabell MipalarDireitos autorais:

Formatos disponíveis

1. I.

The deductions from the gross state are valued at the fair market value at the time of filing

and paying the estate tax.

II. Outstanding obligations by a person during his lifetime are terminated upon death.

a. Only statement 1 is true

b. Only statement 2 is true

c. Both statements are correct

d. Both statements are incorrect

2. I. Deductions from the gross estate are allowed to protect the interest of the innocent third

party who have claims over the properties of the decedent

II. The claims against an insolvent person are deductible only If included in the gross estate.

a. Only statement 1 is true

b. Only statement 2 is true

c. Both statements are correct

d. Both statements are incorrect

3. I. The share of the surviving spouse is a special deduction.

II. Donations to foreign government are deductible from gross estate.

a. Only statement 1 is true

b. Only statement 2 is true

c. Both statements are correct

d. Both statements are incorrect

4. I. A vanishing deduction is not allowed for the current decedent if his immediate predecessor

deducted the same from his gross estate.

II. Property tax not accrued before the decedent’s death is deductible from the gross estate.

a. Only statement 1 is true

b. Only statement 2 is true

c. Both statements are correct

d. Both statements are incorrect

5. I. The share of the surviving spouse in the estate shall be deducted equal to ½ of the gross

conjugal property.

II. Standard deductions are in lieu of actual itemized deductions from the gross estate.

a. Only statement 1 is true

b. Only statement 2 is true

c. Both statements are correct

d. Both statements are incorrect

6. I. All claims against the insolvent person are deductible from the decedent’s gross estate.

II. Estate tax is deductible from the gross estate to determine the taxable base.

a. Only statement 1 is true

b. Only statement 2 is true

c. Both statements are correct

d. Both statements are incorrect

7. Deduction from the gross taxable estate are broadly classified as follows except:

a. Ordinary deduction

b. Special deduction

c. Share of the surviving spouse

d. Amount exempted from tax

8. These decedents with properties located outside the Philippines are entitled to tax credit except

a. Resident citizen

b. Resident alien

c. Non resident alien

d. Non resident citizen

9. The following taxes are not deductible against the gross estate except

a. Income tax on compensation income prior to the decedent’s death

b. Estate tax

c. Property tax accruing after death

d. Income tax on business earned after death

10. Under NIRC, the notice of death shall be filed_________________________.

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Uas Bahasa InggrisDocumento2 páginasUas Bahasa InggrisKiki AfridaAinda não há avaliações

- Igcse o Level Frankwoods Business Accounting 1 by Frank Wood Alan SangsterDocumento2 páginasIgcse o Level Frankwoods Business Accounting 1 by Frank Wood Alan SangsterNasir AliAinda não há avaliações

- Paysera Statement - 2023 08 21 - 23 22 12Documento1 páginaPaysera Statement - 2023 08 21 - 23 22 12Jovica CaricicAinda não há avaliações

- PLEDGELTR11711Documento1 páginaPLEDGELTR11711MarkYamaAinda não há avaliações

- Finman2 Quiz # 1 Summer Ay 10-11Documento2 páginasFinman2 Quiz # 1 Summer Ay 10-11Pierre Capati100% (1)

- Exam Routin of 96 Banking Deploma PDFDocumento1 páginaExam Routin of 96 Banking Deploma PDFMamunur RahmanAinda não há avaliações

- CTBC App-SignedDocumento2 páginasCTBC App-SignedLloyd MoloAinda não há avaliações

- WILL FormatDocumento3 páginasWILL FormatBrig. Baldev SinghAinda não há avaliações

- EFIN 519 Lecture 01Documento8 páginasEFIN 519 Lecture 01Irfan Sadique IsmamAinda não há avaliações

- FM ReportDocumento2 páginasFM Reportcaiden dumpAinda não há avaliações

- Ahmed Manzoor-Roll No 7-Class AssignmentDocumento7 páginasAhmed Manzoor-Roll No 7-Class AssignmentMansoor AhmedAinda não há avaliações

- Debhie Cesilia - 5213418072 - TugasDocumento6 páginasDebhie Cesilia - 5213418072 - TugasFenita Yuni PratiwiAinda não há avaliações

- 1.economics Material - Tamil (2022)Documento56 páginas1.economics Material - Tamil (2022)SowmiyaAinda não há avaliações

- Fortune Guarantee BrochureDocumento7 páginasFortune Guarantee BrochureGautamAinda não há avaliações

- Module 1Documento2 páginasModule 1Unknown Engr.Ainda não há avaliações

- 2024 28 2 19 11 02 Passbookstmt - 1709127662016Documento7 páginas2024 28 2 19 11 02 Passbookstmt - 1709127662016tuhincoregymAinda não há avaliações

- Introduction To Bankruptcy Law 6Th Edition Frey Test Bank Full Chapter PDFDocumento31 páginasIntroduction To Bankruptcy Law 6Th Edition Frey Test Bank Full Chapter PDFchastescurf7btc100% (10)

- Simple Interest AssignmentDocumento3 páginasSimple Interest AssignmentMaria Jessica AboAinda não há avaliações

- AYYUB KHAN VisionEndPlus 17.09.2019 17.30.29 PDFDocumento5 páginasAYYUB KHAN VisionEndPlus 17.09.2019 17.30.29 PDFgoluAinda não há avaliações

- Session 4 Life Insurance Products: Unit Linked PlansDocumento23 páginasSession 4 Life Insurance Products: Unit Linked Plansm_dattaiasAinda não há avaliações

- WEEK 1 - TVM and GrowthDocumento32 páginasWEEK 1 - TVM and GrowthowenAinda não há avaliações

- MPL FLEX Application Form2Documento3 páginasMPL FLEX Application Form2emmanuel cantones, jr.Ainda não há avaliações

- Jeevan Kishore T - 102Documento3 páginasJeevan Kishore T - 102lalithmohan100% (2)

- Chapter 3 Practice QuestionsDocumento10 páginasChapter 3 Practice QuestionshahaheheAinda não há avaliações

- Kairos LetterDocumento2 páginasKairos LettersebeastyforeverAinda não há avaliações

- Quiz 2 - Income Tax Concepts and ComplianceDocumento3 páginasQuiz 2 - Income Tax Concepts and CompliancelcAinda não há avaliações

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocumento3 páginasBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviAinda não há avaliações

- Ai TGL TXNS List-2Documento11 páginasAi TGL TXNS List-2Abduselam TayeAinda não há avaliações

- Compound InterestDocumento19 páginasCompound InterestCASANDRA LascoAinda não há avaliações

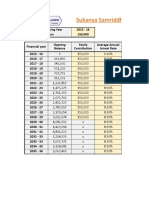

- Sukanya Samriddhi Yojana - CalculatorDocumento4 páginasSukanya Samriddhi Yojana - CalculatorIndiran100% (1)