Escolar Documentos

Profissional Documentos

Cultura Documentos

FM1 04 Investment Risk and Return Excercises

Enviado por

Gabrielle Marie CrucilloDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

FM1 04 Investment Risk and Return Excercises

Enviado por

Gabrielle Marie CrucilloDireitos autorais:

Formatos disponíveis

Financial Management

Required rate of return 0.2 2 0

Assume that the risk-free rate is 6 percent and the expected 0.4 12 20

return on the market is 13 percent. What is the required rate 0.2 20 25

of return on a stock with a beta of 0.7? 0.1 38 45

Expected and required rates of return a. Calculate the expected rate of return.

Assume that the risk-free rate is 5 percent and the market b. Calculate the standard deviation of expected returns.

risk premium is 6 percent. What is the expected return for

the overall stock market? What is the required rate of return Portfolio beta

on a stock with a beta of 1.2? An individual has P35,000 invested in a stock with a beta of

0.8 and another P40,000 invested in a stock with a beta of

Required rate of return 1.4. If these are the only two investments in her portfolio,

Stock R has a beta of 1.5, Stock S has a beta of 0.75, the what is her portfolio’s beta?

expected rate of return on an average stock is 13 percent, and

the risk-free rate of return is 7 percent. By how much does Portfolio beta

the required return on the riskier stock exceed the required A mutual fund manager has a P20,000,000 portfolio with a

return on the less risky stock? beta of 1.5. The risk-free rate is 4.5 percent and the market

risk premium is 5.5 percent. The manager expects to receive

Beta and required rate of return an additional P5,000,000, which she plans to invest in a

A stock has a required return of 11 percent; the risk-free rate number of stocks. After investing the additional funds, she

is 7 percent; and the market risk premium is 4 percent. wants the fund’s required return to be 13 percent. What

should be the average beta of the new stocks added to the

a. What is the stock’s beta? portfolio?

b. If the market risk premium increased to 6 percent, what

would happen to the stock’s required rate of return? Portfolio required return

Assume the risk-free rate and the beta remain Suppose you are the money manager of a P4 million

unchanged. investment fund. The fund consists of 4 stocks with the

following investments and betas:

Beta coefficient Stock Investment Beta

Given the following information, determine the beta A P400,000 1.50

coefficient for Stock J that is consistent with equilibrium: r = B 600,000 1.25

12.5%; rf = 4.5%; rm = 10.5%. C 1,000,000 1.25

D 2,000,000 0.75

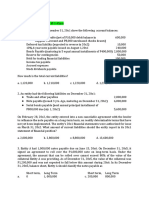

Expected return, Standard deviation, Coefficient of

variation If the market’s required rate of return is 14 percent and the

A stock’s returns have the following distribution: risk-free rate is 6 percent, what is the fund’s required rate of

Demand for the Rate of Return If return?

Company’s Probability of This This Demand

Products Demand Occurring Occurs Revised portfolio beta

Weak 0.1 (50%) Suppose you held a diversified portfolio consisting of a

Below average 0.2 (5) P7,500 investment in each of 20 different common stocks.

Average 0.4 16 The portfolio’s beta is 1.12. Now suppose you decided

Above average 0.2 25 to sell one of the stocks in your portfolio with a beta of 1.0 for

Strong 0.1 60 P7,500 and to use these proceeds to buy another stock with a

1.0 beta of 1.75. What would your portfolio’s new beta be?

Calculate the stock’s expected return, standard deviation, and CAPM and required return

coefficient of variation. HR Industries (HRI) has a beta of 1.8, while LR Industries’

(LRI) beta is 0.6. The risk-free rate is 6 percent, and the

Expected return, Standard deviation, Coefficient of required rate of return on an average stock is 13 percent.

variation Now the expected rate of inflation built into rRF falls by 1.5

Stocks X and Y have the following probability distributions of percentage points, the real risk-free rate remains constant,

expected future returns: the required return on the market falls to 10.5 percent, and

Probability X Y all betas remain constant. After all of these changes, what will

0.1 (10%) (35%) be the difference in the required returns for HRI and LRI?

Investment risk and return 1

Financial Management

CAPM and required return each year? What would the average return on the

Bradford Manufacturing Company has a beta of 1.45, while portfolio have been during this period?

Farley Industries has a beta of 0.85. The required return on c. Calculate the standard deviation of returns for each stock

an index fund that holds the entire stock market is 12.0 and for the portfolio.

percent. The risk-free rate of interest is 5 percent. By how d. Calculate the coefficient of variation for each stock and

much does Bradford’s required return exceed Farley’s for the portfolio.

required return? e. Assuming you are a risk-averse investor, would you

prefer to hold Stock A, Stock B, or the portfolio? Why?

CAPM and required return

Calculate the required rate of return for Manning Enterprises, Comprehensive problem

assuming that investors expect a 3.5 percent rate of inflation You plan to invest in the Kish Hedge Fund, which has total

in the future. The real risk-free rate is 2.5 percent and the capital of P500 million invested in five stocks:

market risk premium is 6.5 percent. Manning has a beta of Stock Investment Stock’s Beta Coefficient

1.7, and its realized rate of return has averaged 13.5 percent A P160,000,000 0.5

over the past 5 years. B 120,000,000 2.0

C 80,000,000 4.0

CAPM and market risk premium D 80,000,000 1.0

Consider the following information for three stocks, Stocks X, 60,000,000 3.0

Y, and Z. The returns on the three stocks are positively

correlated, but they are not perfectly correlated. (That is, Comprehensive problem

each of the correlation coefficients is between 0 and 1.) Stock X has a 10 percent expected return, a beta coefficient of

Stock Expected Return Deviation Beta 0.9 and a 35 percent standard deviation of expected returns.

X 9.00% 15% 0.8 Stock Y has a 12.5 percent expected return, a beta coefficient

Y 10.75 15 1.2 of 1.2, and a 25 percent standard deviation. The risk-free rate

Z 12.50 15 1.6 is 6 percent, and the market risk premium is 5 percent.

Fund P has half of its funds invested in Stock X and half a. Calculate each stock’s coefficient of variation.

invested in Stock Y. Fund Q has one-third of its funds b. Which stock is riskier for a diversified investor?

invested in each of the three stocks. The risk-free rate is c. Calculate each stock’s required rate of return.

5.5 percent, and the market is in equilibrium. (That is, d. On the basis of the two stocks’ expected and required

required returns equal expected returns.) What is the market returns, which stock would be more attractive to a

risk premium? diversified investor? Calculate the required return of a

portfolio that has P7,500 invested in Stock X and P2,500

CAPM and portfolio return invested in Stock Y. If the market risk premium increased

You have been managing a P5 million portfolio that has a to 6 percent, which of the two stocks would have the

beta of 1.25 and a required rate of return of 12 percent. The larger increase in its required return?

current risk-free rate is 5.25 percent. Assume that you

receive another P500,000. If you invest the money in a stock

with a beta of 0.75, what will be the required return on your

P5.5 million portfolio?

Comprehensive problem

Stocks A and B have the following historical returns:

Year Stock A returns Stock B returns

2001 (18.00%) (14.50%)

2002 33.00 21.80

2003 15.00 30.50

2004 (0.50) (7.60)

2005 27.00 26.30

a. Calculate the average rate of return for each stock during

the period 2001 through 2005.

b. Assume that someone held a portfolio consisting of 50

percent of Stock A and 50 percent of Stock B. What would

the realized rate of return on the portfolio have been in

Investment risk and return 2

Você também pode gostar

- Tutorial Questions Unit 2-AnsDocumento9 páginasTutorial Questions Unit 2-AnsPrincessCC20Ainda não há avaliações

- Chapter 7 ProblemsDocumento6 páginasChapter 7 ProblemsOkabe RinAinda não há avaliações

- Valuation of Bonds and Shares WorkbookDocumento3 páginasValuation of Bonds and Shares Workbookkrips16100% (1)

- IFRS Functional Currency CaseDocumento23 páginasIFRS Functional Currency CaseDan SimpsonAinda não há avaliações

- What's A Bond?: What's A Bond? Types of Bonds Bond Valuation Techniques The Bangladeshi Bond Market Problem SetDocumento30 páginasWhat's A Bond?: What's A Bond? Types of Bonds Bond Valuation Techniques The Bangladeshi Bond Market Problem SetpakhijuliAinda não há avaliações

- WACC CALCULATIONSDocumento4 páginasWACC CALCULATIONSshan50% (2)

- Leverage: Presented by Sandesh YadavDocumento14 páginasLeverage: Presented by Sandesh YadavSandesh011Ainda não há avaliações

- BFC5935 - Tutorial 1 Solutions PDFDocumento7 páginasBFC5935 - Tutorial 1 Solutions PDFXue Xu100% (1)

- Risk and Return AssignmentDocumento2 páginasRisk and Return AssignmentHuzaifa Bin SaeedAinda não há avaliações

- 2 Risk&ReturnDocumento23 páginas2 Risk&ReturnFebson Lee MathewAinda não há avaliações

- Security Market Indicator Series - STDocumento36 páginasSecurity Market Indicator Series - STEng Hams100% (1)

- Cost of Capital ProblemsDocumento5 páginasCost of Capital ProblemsYusairah Benito DomatoAinda não há avaliações

- Introduction to Accounting and Business FundamentalsDocumento147 páginasIntroduction to Accounting and Business Fundamentalsannie100% (1)

- Fernandez Corporation Financial StatementsDocumento20 páginasFernandez Corporation Financial StatementsKhánh Huyền0% (2)

- Financial Statement Analysis PPT 3427Documento25 páginasFinancial Statement Analysis PPT 3427imroz_alamAinda não há avaliações

- Formulae Sheets: Ps It Orp S It 1 1Documento3 páginasFormulae Sheets: Ps It Orp S It 1 1Mengdi ZhangAinda não há avaliações

- Tutorial 3 Cost of CapitalDocumento1 páginaTutorial 3 Cost of Capitaltai kianhongAinda não há avaliações

- Ch01 SMDocumento33 páginasCh01 SMcalz_ccccssssdddd_550% (1)

- Financial Statement Ratio Analysis PresentationDocumento27 páginasFinancial Statement Ratio Analysis Presentationkarimhisham100% (1)

- Lecture 2 Behavioural Finance and AnomaliesDocumento15 páginasLecture 2 Behavioural Finance and AnomaliesQamarulArifin100% (1)

- Investment Analysis and Portfolio Management Christmas Worksheet 2009Documento2 páginasInvestment Analysis and Portfolio Management Christmas Worksheet 2009farrukhazeemAinda não há avaliações

- Valuation of Stocks & Bonds: Bfinma2: Financial Management P-2Documento47 páginasValuation of Stocks & Bonds: Bfinma2: Financial Management P-2Dufuxwerr WerrAinda não há avaliações

- Cost Volume ProfitDocumento4 páginasCost Volume ProfitProf_RamanaAinda não há avaliações

- Lecture SixDocumento10 páginasLecture SixSaviusAinda não há avaliações

- Consolidated Financial StatementsDocumento41 páginasConsolidated Financial StatementsBethelhemAinda não há avaliações

- Solution To Right Issue CA FINAL SFM by PRAVINN MAHAJANDocumento15 páginasSolution To Right Issue CA FINAL SFM by PRAVINN MAHAJANPravinn_Mahajan100% (1)

- Expected Returns, Variance, and Portfolio DiversificationDocumento7 páginasExpected Returns, Variance, and Portfolio DiversificationLavanya KosuriAinda não há avaliações

- Residual Income ValuationDocumento21 páginasResidual Income ValuationqazxswAinda não há avaliações

- 07 Multinational Financial ManagementDocumento61 páginas07 Multinational Financial Managementeunjijung100% (1)

- Ch. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFDocumento43 páginasCh. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFRahul NagrajAinda não há avaliações

- Chapter 4 Financing Decisions PDFDocumento72 páginasChapter 4 Financing Decisions PDFChandra Bhatta100% (1)

- Weighted Average Cost of Capital: Banikanta MishraDocumento21 páginasWeighted Average Cost of Capital: Banikanta MishraManu ThomasAinda não há avaliações

- Telecom Egypt Credit RatingDocumento10 páginasTelecom Egypt Credit RatingHesham TabarAinda não há avaliações

- E-14 AfrDocumento5 páginasE-14 AfrInternational Iqbal ForumAinda não há avaliações

- Answers To Chapter 7 - Interest Rates and Bond ValuationDocumento8 páginasAnswers To Chapter 7 - Interest Rates and Bond ValuationbuwaleedAinda não há avaliações

- CFA 3 FormulasDocumento5 páginasCFA 3 FormulasChan Sai CheungAinda não há avaliações

- Dividend PolicyDocumento44 páginasDividend PolicyShahNawazAinda não há avaliações

- Chapter 11 - Cost of Capital - Text and End of Chapter QuestionsDocumento63 páginasChapter 11 - Cost of Capital - Text and End of Chapter QuestionsSaba Rajpoot50% (2)

- Ma'am MaconDocumento7 páginasMa'am MaconKim Nicole Reyes100% (1)

- Consolidated Financial Statements and Outside Ownership: Chapter OutlineDocumento44 páginasConsolidated Financial Statements and Outside Ownership: Chapter OutlineJordan Young100% (2)

- Flirting with Risk: Managing Investment PortfoliosDocumento13 páginasFlirting with Risk: Managing Investment PortfoliosKristin Joy Villa PeralesAinda não há avaliações

- Numericals On Stock Swap - SolutionDocumento15 páginasNumericals On Stock Swap - SolutionAnimesh Singh GautamAinda não há avaliações

- Time Value Money Calculations University NairobiDocumento2 páginasTime Value Money Calculations University NairobiDavidAinda não há avaliações

- Examples WACC Project RiskDocumento4 páginasExamples WACC Project Risk979044775Ainda não há avaliações

- Cost of Capital Lecture Slides in PDF FormatDocumento18 páginasCost of Capital Lecture Slides in PDF FormatLucy UnAinda não há avaliações

- Portfolio Management: Lecturer: Th.S. Le Phuoc Thanh (NCS)Documento47 páginasPortfolio Management: Lecturer: Th.S. Le Phuoc Thanh (NCS)Eli ZabethAinda não há avaliações

- Lecture NotesDocumento32 páginasLecture NotessamgoshAinda não há avaliações

- Chapter # 1 Risk Management & Leverage AnalysisDocumento160 páginasChapter # 1 Risk Management & Leverage AnalysisJerome MogaAinda não há avaliações

- Basics of Capital BudgetingDocumento81 páginasBasics of Capital Budgetingwsnarejo100% (1)

- FEU Institute of Accounts midterm exam multiple choice questionsDocumento9 páginasFEU Institute of Accounts midterm exam multiple choice questionsRizelle MillagraciaAinda não há avaliações

- Money Market Hedges-PaymentDocumento3 páginasMoney Market Hedges-PaymentMoud KhalfaniAinda não há avaliações

- FMI7e ch06Documento44 páginasFMI7e ch06lehoangthuchien100% (1)

- GoodwillDocumento14 páginasGoodwillsandeep44% (9)

- BFC5935 - Tutorial 10 SolutionsDocumento8 páginasBFC5935 - Tutorial 10 SolutionsAlex YisnAinda não há avaliações

- FMI7e ch11Documento54 páginasFMI7e ch11lehoangthuchienAinda não há avaliações

- Stock Exercises Calculating Expected Returns, Betas, and Portfolio DiversificationDocumento2 páginasStock Exercises Calculating Expected Returns, Betas, and Portfolio DiversificationMon Ram0% (1)

- Risk and ReturnDocumento4 páginasRisk and ReturnHira MohsinAinda não há avaliações

- 16 Risk and Rates of Return Problems For Online ClassDocumento6 páginas16 Risk and Rates of Return Problems For Online ClassJemAinda não há avaliações

- Practice QuestionsDocumento6 páginasPractice QuestionsAashish SharmaAinda não há avaliações

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)No EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Nota: 4.5 de 5 estrelas4.5/5 (5)

- To The Board of Directors or The Appropriate Representative of Senior ManagementDocumento2 páginasTo The Board of Directors or The Appropriate Representative of Senior ManagementGabrielle Marie CrucilloAinda não há avaliações

- Partnership essentials under 40 charsDocumento26 páginasPartnership essentials under 40 charskat perezAinda não há avaliações

- San Beda PartnershipDocumento32 páginasSan Beda PartnershipLenard Trinidad79% (14)

- OBLICON ReviewerDocumento54 páginasOBLICON ReviewerMaria Diory Rabajante93% (300)

- AuthorizationDocumento1 páginaAuthorizationGabrielle Marie CrucilloAinda não há avaliações

- NFJPIA1819 - Resume Pro FromaDocumento2 páginasNFJPIA1819 - Resume Pro FromaGabrielle Marie CrucilloAinda não há avaliações

- Nick Joaquin Explores the Philippines' Heritage of SmallnessDocumento17 páginasNick Joaquin Explores the Philippines' Heritage of SmallnessRolther Villaflor Capio100% (5)

- Crucillo, Gabrielle Marie R. PE12J - Group Exercise W 9:00-11:00AM Weight in KG 53 KG Height in M 1.55mDocumento9 páginasCrucillo, Gabrielle Marie R. PE12J - Group Exercise W 9:00-11:00AM Weight in KG 53 KG Height in M 1.55mGabrielle Marie CrucilloAinda não há avaliações

- A Guide To Investing in REITs - Intelligent Income by Simply Safe Dividends PDFDocumento30 páginasA Guide To Investing in REITs - Intelligent Income by Simply Safe Dividends PDFRuTz92Ainda não há avaliações

- REVIEW OF LITERATURE - Asset and Liability ManagementDocumento3 páginasREVIEW OF LITERATURE - Asset and Liability ManagementSherl AugustAinda não há avaliações

- PrefaceDocumento49 páginasPrefaceManish RajakAinda não há avaliações

- MCQ NpoDocumento6 páginasMCQ NpoSurya ShekharAinda não há avaliações

- RevenueDocumento105 páginasRevenueanbugobiAinda não há avaliações

- PRINCIPLES OF APPRAISAL PRACTICE AND CODE OF ETHICSDocumento20 páginasPRINCIPLES OF APPRAISAL PRACTICE AND CODE OF ETHICSnaren_3456Ainda não há avaliações

- Freay Hans BillDocumento1 páginaFreay Hans BillJohn Bean100% (2)

- Epicor ERP 10 Malaysia Country Specific Functionality Guide 10.0.700Documento30 páginasEpicor ERP 10 Malaysia Country Specific Functionality Guide 10.0.700nerz8830Ainda não há avaliações

- Vizco, Krizia Mae H.Documento11 páginasVizco, Krizia Mae H.Meng VizcoAinda não há avaliações

- Effectiveness of Monetary Policy in Algeria (2000-2015Documento16 páginasEffectiveness of Monetary Policy in Algeria (2000-2015zaka ricoseAinda não há avaliações

- Basic Financial Statement TemplateDocumento1 páginaBasic Financial Statement Templateahmedabutalib10Ainda não há avaliações

- Employee Loan ApplicationDocumento2 páginasEmployee Loan Applicationdexdex110% (1)

- NPC Guidelines 2019Documento119 páginasNPC Guidelines 2019nihajnoorAinda não há avaliações

- Accounting For Lawyers Notes, 2022Documento114 páginasAccounting For Lawyers Notes, 2022Nelson burchard100% (1)

- Basic Accounting Terms: Name-Ritumbra Chilwal CLASS - 11 Subject - AccountancyDocumento66 páginasBasic Accounting Terms: Name-Ritumbra Chilwal CLASS - 11 Subject - AccountancyAashray BehlAinda não há avaliações

- Importance of TaxDocumento6 páginasImportance of Taxmahabalu123456789Ainda não há avaliações

- Leveraging The Credit Shelter Trust W/Sun Protector VULDocumento4 páginasLeveraging The Credit Shelter Trust W/Sun Protector VULBill BlackAinda não há avaliações

- Power Exchange OperationDocumento114 páginasPower Exchange OperationNRLDCAinda não há avaliações

- Test 2 FarDocumento3 páginasTest 2 FarMa Jodelyn RosinAinda não há avaliações

- School Finance Team TORDocumento2 páginasSchool Finance Team TORGrace Music100% (1)

- FIDIC Contracts Claims Management Dispute ResolutionDocumento3 páginasFIDIC Contracts Claims Management Dispute ResolutionadamcyzAinda não há avaliações

- CRYPTO TRADING GUIDEDocumento46 páginasCRYPTO TRADING GUIDELudwig VictoryAinda não há avaliações

- Future Generali India: IND-0208352-01-R-1Documento2 páginasFuture Generali India: IND-0208352-01-R-1SamaAinda não há avaliações

- CORPORATE TAX PLANNINGDocumento48 páginasCORPORATE TAX PLANNINGShakti TandonAinda não há avaliações

- CKSBDocumento23 páginasCKSBayushiAinda não há avaliações

- A Brief History of BankingDocumento42 páginasA Brief History of Bankingtasaduq70% (1)

- Accounting As The Language of BusinessDocumento2 páginasAccounting As The Language of BusinessjuliahuiniAinda não há avaliações

- Week 15 - Revision 2Documento113 páginasWeek 15 - Revision 2Trung Nguyễn QuangAinda não há avaliações