Escolar Documentos

Profissional Documentos

Cultura Documentos

Day 3 - BO.9.2 - A New Era of Risk and Uncertainty Analysis in Project Evaluation For Improved Decision Making

Enviado por

p-sampurno2855Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Day 3 - BO.9.2 - A New Era of Risk and Uncertainty Analysis in Project Evaluation For Improved Decision Making

Enviado por

p-sampurno2855Direitos autorais:

Formatos disponíveis

Breakout 9

Mining Asset/Extractive Industries Valuation

A New Era of Risk and Uncertainty Analysis

In Project Valuation

Presented by

Nuzulul Haq

Indonesia

Bali International Convention Center

27 – 30 September 2010

A New Era of Risk and Uncertainty Analysis

In Project Valuation

Commonly, business practitioners used “one size fits all” single corporate discount rate

method for valuing uncertainty in the project valuation

A new era is coming for the industry. An era where project, business or commercial analyst,

not only ask themselves the question “what if…?” when evaluating their respective project,

but also want to know what is the effect of these “what if...?” uncertainties on their project

evaluation process, as well as the best strategies to follow when facing either an adverse or

a favorable condition.

On this new approach, we can move beyond the static “now or never” decision framework

that is implicit in most current analysis to an explicit modeling and analysis, using Real

Options Analysis (ROA), to examine the effects of the contingent decision sequences that

actually occur in most business situations.

The paper shows that a project that can be produced and abandoned at will has large values

of flexibility. The conventional Net Present Value (NPV) of such a project will underestimate

the true economic value. A further benefit of using the ROA approach discussed here is that

the valuation procedure produces a strategy map showing actions within the project, not just

a number.

Breakout 9 – Mining Asset/Extractive Industries Valuation 2

I. INTRODUCTION

The era of high uncertain of commodity price requires the economic reassessment of many

mining projects. The primary valuation challenge confronting mining appraiser is to

recognize the uncertainty during the project life and the impact these uncertainties on the

project cash flow uncertainty.

Conventional mining project valuation uses an approach called net present value (NPV)

analysis based on static discounted cash flow (DCF) method.

This method has been used since the late 1800s to value and manage mining projects. This

involves forecasting the cash flows associated with a given mine plan, discounting those

cash flows to the present using a risk-adjusted discount rate (RADR), and then summing the

resultant discounted values.

The mining industry for the most part uses the DCF valuation method to estimate asset

values because it is simple and straight away. However this method is too generalized and

could be misleading especially for valuing mining project.

There are some assumptions behind the DCF valuation method, i.e.:

1. Expected future cash flows from the project are taken as “given”. They are assumed

to be certain to happen

2. Project risk does not change throughout its life

3. The project is a “now or never” opportunity. Once the project is undertaken, it will not

be affected by any future managerial decision.

Since the last two decades, valuation professionals have been actively investigating how to

improve Discounted Cash Flow (DCF) valuation methods by better representing mining

industry complexities in their cash flow models.

They look for the valuation methods that able to:

1. compute and value non linear cash flow pay offs that accrue to project owner

2. asses the impact of the uncertain variables on the project value and risk

3. recognize managerial flexibility to intervene the project in facing either an adverse or

a favorable condition

Breakout 9 – Mining Asset/Extractive Industries Valuation 3

Real Options (RO) is considered as a modern valuation methods that able to accommodate

the above conditions. This method had been introduced to the mining industry as an

alternative to the DCF valuation methods.

This paper will use two valuation approaches (DCF and RO) to assess the impact of the

uncertainty of the commodity price on the projects value and risk. The difference in their

approach to adjusting project cash flow for risk gives the different results of the project value.

An analysis on one Coal Mine Project illustrates how valuation methods affect the

uncertainty, characteristics, and value of project cash flow streams when both discounted

cash flow (DCF) and real options (RO) methods are used to calculate net present value

(NPV) for project cash flow.

A comparison is made between the DCF and RO risk adjustments applied to each cash flow

stream to show how each method deals with the effects on value of the differences in

uncertainty of project cash flows.

In this paper, we also examine the applicability of Real Options in valuing this coal project

having operating flexibility options.

This paper is organized into the following sections: 1 – Introduction, 2 – The Issues of the

Conventional Valuation on Mining Project, 3 – The Difference between DCF and Real

Options, 4 – Case Study on Mining Project Valuation under Uncertainty, and 5 - Conclusion.

II. THE ISSUES OF THE CONVENTIONAL VALUATION ON MINING PROJECT

Currently, appraisers predominantly use single point forecast Net Present Value (NPV)

resulted from Discounted Cash Flow (DCF) method for their mining project valuation.

The primary limitation of cash flow models relying on single point forecasts is their inability to

compute and value non-linear cash flow pay-offs that accrue to project owner. Non-linear

cash flows have a curved dependence on the uncertain variables (like commodity price) that

are inputs into the cash flow model.

Breakout 9 – Mining Asset/Extractive Industries Valuation 4

These cash flow models are best estimated using Monte Carlo on the uncertain input

variables. Monte Carlo simulation is one of several methods of random sampling. This type

of approach is preferred because it is best able to account for high dimensional non-linearity

that arises from path dependence inherent in tax loss carry forwards and profitability triggers.

Monte Carlo simulation is used to characterize the exposures of the project owners to the

risky cash flow streams generated from the project

The other issue is related to the assumption behind the conventional NPV that assumes

cash flow uncertainty is growing over the life of the project.

A fundamental principle of valuation theory is that investors are concerned with net cash flow

uncertainty and require compensations for being exposed to risk (i.e. risk adverse). In reality,

net cash flow uncertainty can vary tremendously over the life of the project due to changes in

cost structure, price levels, uncertainty characteristics and operating strategy.

Figure 1. Profile of Net Cash Flow Discount Factor

As shown in figure 1, the conventional NPV analysis would discount project cash flow using

a constant discount rate. This is problematic since it violates the principle of investor risk

aversion where the net cash flow uncertainty is not increasing at a constant rate (Blais et all,

2006). Using this analysis, longer the project would be put on production, higher discounting

factor would be applied to the cash flow generated from the project. This would penalize the

long-lived project like in mining industry.

The other issues in conventional NPV analysis is once of investment is made, the project will

run its course without intervention (“now or never”). It‟s contrary to the real situation that

Breakout 9 – Mining Asset/Extractive Industries Valuation 5

project owner has a flexibility to intervene that project when there is new information in the

future.

The conventional NPV based DCF looks failed to assess the impact of the uncertainty and

the effect of contingent decision when facing either the adverse or favorable condition in the

future.

III. THE DIFFERENCE BETWEEN DCF AND REAL OPTIONS METHOD

Uncertainty introduces considerable complexity into the mine planning exercise not only

because it makes the problem larger and less tractable, but also because it makes

measuring the value outcomes of the various decision alternatives more difficult.

In the first publishing of Real Options (RO), it is an alternative method for project valuation

that can accommodate managerial flexibility in adapting and revising future decisions in

response to changing circumstances.

Figure 2, Conventional NPV vs. Real Options

As shown in figure 2, this method is mainly based on the flexibility of the project. The more

flexible the project is, the more valuable it is, because it allows the owner to respond to

future events in ways that will increase the value of the firm. Option valuation gives extra

value to the project because of the flexibility.

The NPV resulted from Real Options method is known as Expanded NPV, where the formula

is as follows:

1) Expanded NPV = NPV + Option Value

Breakout 9 – Mining Asset/Extractive Industries Valuation 6

However, in the recent development of Real Options method, there is a fundamental

difference between DCF and RO methods although there is no flexibility in the project. This

new concept of real options rose up after publishing a series of papers in 1998 discussing

modern asset pricing methods for upstream petroleum project (Laughton, 1998).

DCF (net cash flow) Real Options (at source)

Commodity Price Risk Adjustment

(Source of Uncertainty)

Project Financial Model

Project Net Cash Flow

Risk Adjusted Rate Risk Free Rate

Project Value

Figure 3. DCF vs RO (modified from Samis et all, 2006)

Assuming the main source of the uncertainty of the project is the commodity price, figure 3

shows that in the absence of managerial flexibility, the first step in RO valuation is to apply

risk discount factor to each uncertain cash flow element arising in any one period.

The difference in risk adjustment between the DCF and RO valuation methods appears to be

nuanced but its consequences are potentially large. This process allows senior management

to use financial market information to determine the underlying structure of risk adjustments

for the uncertain variables of interest to the corporation. The detailed project cash flow

dependence on these underlying uncertain variables then determines how these underlying

risk adjustments are transformed implicitly into risk discounts for the project cash flow.

Risk discounting the project cash flows in this way ground the valuation in the financial

markets of relevance to investors. It also tunes the risk discounting in a controllable way to

the types and amounts of risk actually in the project cash flows, as opposed to using some

average discounting that it is not likely to be appropriate for the risk involved.

Breakout 9 – Mining Asset/Extractive Industries Valuation 7

All of this rids the valuation process of some biases that are inherent in the DCF method,

which assumes that all projects and claims against those projects have the same structure of

risk. In the mining industry, these biases include a general bias against investment to reduce

future costs, a bias against mine plan designs with long-term production profiles, and, finally,

a bias against projects that face taxes, that are geared toward taking disproportionately more

revenue in realizations of the future characterized by high output prices.

The difference between DCF and RO methods of adjusting for cash flow risk when

calculating a cash flow NPV can be illustrated using the concept of Net Cash Flow Risk

Discount Factors (NCFRDFs). A NCFRDF calculates the magnitude of risk adjustment that

is applied to each dollar of a cash flow in a particular year. It indicates the amount an

investor will pay for a dollar of cash flow from a particular cash flow stream on a risk adjusted

(but not time adjusted) basis.

A NCFRDF is defined as the present value of a cash flow divided by the expected cash flow

after offsetting the adjustment for the time value of money:

CFPV t

2) NCFRDFt

( ECFt * TDFt )

where:

CFPV = the cash flow present value at project time „t‟

ECF = expected cash flow at project time „t‟

TDF = time discount factor at project time „t‟ = 1/(1 + risk free rate)t

RO and DCF have different NCFRDF equations because their respective approaches to risk

discounting differ.

A simple DCF NCFRDF for project owner at time „t‟ can be calculated as follows:

( Mineprod t * Cmdtyprice OpCostt ) * RDFt , DCF * TDFt

3) NCFRDFt, DCF, Project Owner RDFt , DCF

( Mineprod t * Cmdtyprice t OpCostt ) * TDFt

where:

Mineprod = Mine production

Cmdtyprice = expected commodity price

OpCost = expected operating costs

RDFDCF = DCF risk discount factor = 1/(1+risk premium)t

Breakout 9 – Mining Asset/Extractive Industries Valuation 8

The numerator is the present value of the cash flow as calculated using the DCF method.

The product RDFDCF * TDF is an approximate representation of the conventional discrete

DCF discounting formula that combines the risk and time adjustment into one discount rate.

The TDF in the denominator offsets the effects of time discounting so that we can examine

only the discounting for risk.

Equation 3 shows that project structure does not affect DCF risk discounting since the cash

flow equations in the numerator and denominator cancel each other. However, project

structure is very much part of the RO risk discounting mechanics.

The simple RO NCFRDF for project owner at time „t‟ can be calculated as follows:

(( Mineprod t * Cmdtyprice * RDFt ,cmdty ) * TDFt PVOpCost t )

NCFRDFt, RO, Project Owner

4) ( Mineprod t * Cmdtyprice t OpCostt ) * TDFt

(( Mineprod t * Cmdtyprice * RDFt ,cmdty ) PVOpCost t / TDFt )

( Mineprod t * Cmdtyprice t OpCostt )

where:

PVOpCost = PV of expected operating costs

RDFCmdty = a market-based risk adjustment for pure commodity

price uncertainty

In the first line of this derivation the numerator is the present value of the cash flow

calculated using the real option method. The commodity risk adjustments in the RO method

are calculated using formulas that are consistent with the Capital Asset Pricing Model and

are able to recognize commodity price uncertainty. Salahor (1998) provides details of these

risk adjustment formulas.

Equation 4 shows that the cash flow equations cannot be factored out of the value

calculation because RO applies a market-based risk adjustment to the source of uncertainty

and then filters its effect through to the net cash flow stream. The application of a risk-

adjustment to the source of uncertainty results in the effective net cash flow risk adjustment

generated by RO recognizing changes in cash flow uncertainty as operating leverage varies.

Based on the above explanation, basically both DCF and RO has similar mechanism in

modeling future technical and commercial variables within a project, also they can be applied

to model likely managerial reactions to that uncertainty.

Breakout 9 – Mining Asset/Extractive Industries Valuation 9

However, although real options is also used a discounted cash flow technique, it differs from

DCF method in two important ways i.e.:

1. real options uses market information to discount for the risk in the project cash flow to

recognize the unique risk profile of the projects

2. real options analysis puts particular emphasis on dynamic decision making, the “now

or later” alternative.

In essence, real options values the asset while at the same time anticipating how the asset

will be optimally managed, conditional on the market information and options available to the

manager in each decision period (Davis, 2008).

IV. CASE STUDY ON MINING PROJECT VALUATION UNDER UNCERTAINTY

In this section, a coal mine project is selected to carry out the reality investigations. This coal

project is valued using the following approach:

1. DCF vs. Real Options without early closure options (ignore managerial flexibility)

2. DCF vs. Real Options with early closure options (consider managerial flexibility)

In this case study, we assumed the main source of the uncertainty of the project is the coal

price (S) that will follow a one factor Geometric Brownian Motion (GBM):

dS

5) α dt σ dz

S

where:

dS = coal price different

= short term price volatility (%, annualized)

α = short term expected price growth (%, annualized)

dz = an increment of standard winner process

dt = time different

Based on the above price model, coal price uncertainty will increase over the life of the

project.

The technical and commercial data of the coal project is shown in the table 1.

Breakout 9 – Mining Asset/Extractive Industries Valuation 10

Parameter Descriptions

Technical Data

Mineable reserve (million ton) 303.7

Stripping ratio 1:8

Mine life (years) 7

Average Production plan (ton/year) 17.8

Commercial Data

Spot price ($/ton) 60

Long term price forecast ($/ton) 60

Operating Cost ($/ton) 28

Capex ($ millions) 179.2

Closure Cost ($/ton) of the coal produced 0.1

Royalty 13.5%

Income Tax 41.75%

Risk adjusted discount rate 15%

Risk free discount rate 5%

Table 1. Technical and Commercial Data of Coal Project

Since mining is a massive industry, the projects in this industry would potentially damage the

environment. Therefore, the company is obliged to conduct mine reclamation after

completed the project. The cost related to this activity is known as closure cost.

Mining appraisers should recognize the impact the closure cost on the cash flow uncertainty

in their project valuation.

In this case, we investigate how DCF and RO method recognize the unique risk profile of

closure cost spending in the end of the project.

4.1 DCF vs. Real Options without options (ignore managerial flexibility)

In this section, we would analyze how DCF and RO methods affect the uncertainty

characteristics and value of project cash flow stream. We assume management would not

intervene the project in the future.

Breakout 9 – Mining Asset/Extractive Industries Valuation 11

300

Coal price (US$/ton) 250

200

150

100

50

0

0 2 4 6 8 10 12 14 16 18

Project time (years)

Coal price Risk-adjusted Coal price Upper confidence bdy

Lower confidence bdy Long Term Equilibrium Price

Figure 4 - Forward Price Model

The uncertainty characteristics of project cash flow over the life of the project were modeled

with Monte Carlo simulation using the coal price models displayed in figure 4.

To quantify the uncertainty, we use a coefficient of variation (CoV) that was recorded

annually for each cash flow. The coefficient of variation is the standard deviation of an

uncertain variable divided by its expected value, providing an indication of cash flow

dispersion (the higher the number the greater the uncertainty). It is used to highlight the level

of uncertainty in project cash flow stream.

250%

Closure Cost

Cash flow uncertainty (% deviation)

200%

High capital

expenditure

150%

100%

50%

0%

0 2 4 6 8 10 12 14 16 18

Project time (year)

Project

Figure 5 - Coefficients of variation for project owner‟s cash flow stream

Breakout 9 – Mining Asset/Extractive Industries Valuation 12

Calculating values for the project cash flow streams in a manner consistent with the principle

of investor risk aversion is difficult because the uncertainty characteristics of cash flow

stream vary markedly. This task is further complicated because cash flow uncertainty for

project may vary by year as production rates, costs structures and capital depreciation

balances fluctuate.

Figure 5 presents the various cash flow stream CoVs during production operations. The solid

black line delineates the CoVs for the project cash flows as uncertainty of coal price

increase. The increase of deviation percentage in Year 3 and 4 is caused by high capital

expenditure in that period. The profile of project cash flow CoVs indicates that project cash

flow uncertainty varies in the year 1 to year 5 of the project and going increase after Year 5.

This is caused by the volatility tend to increase and profit margin decrease due to decrease

production.

In the end the project, there is a spike of cash flow uncertainty. This is due to cost spending

for mine closure.

250% 1.0

200% 0.8

Net cash flow discount factor

Cash flow deviation (%)

150% 0.6

100% 0.4

50% 0.2

0% 0.0

0 2 4 6 8 10 12 14 16 18

Project time (year)

Project CF deviation DCF NCFDF RO NCFDF

Figure 6 - Project owner cash flow DCF and Real Options NCFRDFs

Figures 6 compare the DCF and RO risk adjustments applied to the various project cash

flow streams and links these adjustments to levels of cash flow uncertainty during each year.

Breakout 9 – Mining Asset/Extractive Industries Valuation 13

In each of these graphs the vertical axis on the left side represents the level of cash flow

uncertainty. These are plotted with a solid black line, taken from Figures 5. The vertical axis

on the right side represents the NCFRDFs. The DCF and RO NCFRDFs are plotted with

grey lines; the dashed line with no data markers delineates the DCF NCFRDF and the lines

with data markers outline the RO NCFRDFs.

The difference between 1.00 and the NCFRDF is the amount of compensation an investor

requires for exposure to uncertainty in project cash flow stream.

The project cash flow uncertainty and risk discounting is provided in Figure 6. Cash flow

uncertainty increases with time as production decline and coal price uncertainty increases.

There is a jump in Year 3 and 4 due to higher capital spending in that period.

The RO NCFRDFs show that the effective project cash flow risk discounting reflects the

cash flow uncertainty. For example, in Year 4 (red circle in figure 6), the risk discount

decreases to $0.45 per dollar of cash flow (i.e. $1 cash flow is worth $0.55 on a risk-adjusted

but not time discounted basis).

Conversely, the DCF NCFRDF reflects a risk adjustment that is increasing over time. This

highlights a DCF assumption that cash flow uncertainty is growing over the life of the project.

The project CoVs show that project cash flow uncertainty in fact rises and falls throughout

the project horizon.

High cash flow risk in the end of the project is described in RO NCFRDFs by applying higher

risk discounting factor than in DCF NCFRDFs.

Static Monte Carlo

Cumulative expected net cash flows ($ thousands)

Project Level 4,047,079 6,659,029

Expected time-discounted stakeholder cash flows ($ thousands)

Project Level 2,680,505 4,212,416

Type of Risk discounting DCF RO

Static Monte Carlo Static Monte Carlo

Expected stakeholder cash flow NPV ($ thousands)

Project Level 1,401,328 2,030,366 1,292,735 2,194,521

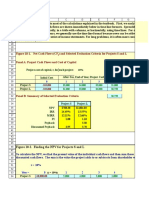

Table 2. Cash Flow Summary

Breakout 9 – Mining Asset/Extractive Industries Valuation 14

The valuation result for the coal project is presented in Table 2. The following cash flows and

Net Present Value (NPV) were calculated for project using both a conventional single-point

forecast cash flow model („Static‟) and a Monte Carlo simulation model:

1. Cumulative expected net cash flow,

2. Time-adjusted cumulative expected net cash flow where discounting is performed at

the risk-free rate of five percent,

3. A DCF NPV calculated using an fifteen per cent discount rate, and

4. A RO NPV calculated with risk-adjusted expected coal price and the risk-free rate of

five percent.

The project in table 2 has an expected cumulative cash flow of US$ 4,047 million using a

spreadsheet model. The Monte Carlo analysis estimates the different value for project

cumulative cash flow of US$ 6,659 million. The difference occurred because as is typical, the

static method underestimates the upside potential value of the project.

US$ 4,047 million cash flow received from project has a present value of US$ 1,401 million

using DCF method with a fifteen per cent discount rate, and the US$ 6,659 million project

cash flow estimated using Monte Carlo analysis has a value of US$ 2,030 million when

discounted at a fifteen per cent discount rate. The difference is true whether Static

spreadsheet or Monte Carlo analysis is used because there are non-linearities in the cash

flows.

None of these values is likely to be correct. However, it is well-recognized that cash flows

that are more sensitive to price variability should be discounted at a higher rate.

Looking back to Figure 5, it is unreasonable to discount the project cash flow in Year 4 at

fifteen per cent, and then discount the project cash flow in Year 5, which has much lower

variability, at the same fifteen per cent. RO valuation methods take this varying cash flow

uncertainty across time and across cash flow type into account.

Under the RO Monte Carlo approach and ignore managerial flexibility, which uses market

information and formal models of risk discounting to estimate appropriate cash flow risk

discounting, the project has a value of US 2,195 million.

Figure 6 also provides an explanation for RO Monte Carlo calculating a higher project NPV

than the DCF Monte Carlo method in Tables 2. On average, the RO method applies a lower

Breakout 9 – Mining Asset/Extractive Industries Valuation 15

risk adjustment to each dollar of project cash flow than the DCF method because it is picking

up coal price uncertainty and the high correlation between coal price and financial market

uncertainty in its risk adjustments. It is indicated that the DCF discount rate of fifteen per

cent was too high for this project.

4.2 DCF vs. Real Options with early closure options (consider managerial flexibility)

In this section, the applicability DCF and RO method to consider managerial flexibility will be

investigated. Using the previous case study, we extend the case by assuming management

has an ability to close the coal project at any time is incorporated into the project model. An

early closure option is included in DCF and RO methods since managers have the ability to

permanently exit this coal project when coal price turn unfavorable.

There are two options available for management, i.e.:

1. Management can close the coal project early by spending closure cost if coal price is

lower than cash cost

2. Management can keep continue the production if the coal price is still higher than

cash cost.

Type of Risk discounting DCF RO

No Flexibility Flexibility No Flexibility Flexibility

Equity Level Include Financing 2,030,366 2,079,042 2,194,521 2,552,922

Option Value 48,675 358,400

Table 3. Comparison Result

As shown in table 3, under DCF method, if we consider the managerial flexibility in the

project, the ability to limit downside risk with an early closure option increases project value

by an estimated over $48.7 million, producing a total estimated project value of $2,079

million.

However, under RO method, there is a significant increase of the project value if we consider

early closure option by an estimated over $358.4 million, producing a total estimated project

value of $2,553 million.

Breakout 9 – Mining Asset/Extractive Industries Valuation 16

Based on this study, the potential value of this coal project would be $2,553 million under

RO valuation method with early closure option.

The results highlight that ignoring managerial flexibility such as early closure option can

generate misleading project value estimates. Managers often have the ability to manage

project risk with operational strategies and this ability can have significantly effect on project

value.

V. CONCLUSIONS

The era of high uncertain of commodity price requires the economic reassessment of many

mining projects. The primary valuation challenge confronting mining appraisers is to

recognize the uncertainty during the project life and the impact these uncertainties on the

project cash flow uncertainty.

This paper investigated the impact of commodity price uncertainty on the cash flows of a

mining project using Monte Carlo simulation. The results show that a conventional cash flow

model using single-point input values may contain important cash flow estimation errors.

The single point forecast can give incorrect result when such non linearity exist in project

cash flow. These errors are corrected in a Monte Carlo analysis.

Monte Carlo simulation corrected these errors by recognizing cash flow non-linearities in the

cash flow stream. Taxes not only introduce complicated non-linearities into the valuation

process, but they also alter the riskiness of the cash flows received by project owner. DCF

method discounts all cash flow streams at the same rate. Real Options method brings this

out, with logically higher discounting of riskier cash flow streams and lower discounting of

less risky cash flow streams.

We have described the concept of Real Options method combined with Monte Carlo

simulation as an alternative method to the DCF method in valuing the mine project.

We have also described how managerial flexibility can be included in both of DCF and RO

method to improve the assessment of project value.

Breakout 9 – Mining Asset/Extractive Industries Valuation 17

The result shows that improper risk assessment on cash flow uncertainty properly and

ignoring managerial flexibility can generate misleading project value estimates.

The results reported in this paper are preliminary, pending a careful statistical examination of

the robustness of the valuation procedure. However, this paper concludes that the Real

Options can be applied in mining project valuation. The RO method is more likely to reveal a

true picture of the value of the mining projects.

REFERENCES

Abdel Sabour, S.A, Poulin, R (2006), Valuing Real Capital Investments Using Least Squares

Monte CaBoyle, P., M. Broadie, a rlo Method. Eng. Econom 51(2), pp. 141-160

Blais, V, Samis, M., and Poulin, R (2006) "Using Real Options to Incorporate Price Risk Into

the Valuation of A Multi-mineral Mine”, MEMS News, winter 2006, issue no.35, pp. 11-16.

Cortazar, G. (2001) "Simulation and numerical methods in real options valuation." In Real

Options and Investment under Uncertainty: Classical Readings and Recent Contributions,

E.S. Schwartz and L. Trigeorgis, Eds., MIT Press, Cambridge, MA. ch. 27, pp. 601-620.

Davis, G A, and Newman, A M , 2008. Modern Strategic Mine Planning, Proceedings of the

2008 Australian Mining Technology Conference, AusIMM, Carlton, Australia (2008), 129-39

Gamba, A. (2003) "Real options valuation: A Monte Carlo approach." Faculty of

Management, University of Calgary WP No. 2002/3, 2003; Presented in the 29th Annual

Meeting of the European Finance Association (EFA), Humboldt University, Berlin, August

21-24, 2002. http://ssrn.com/abstract=302613.

Laughton, D G, 1998. The Potential for Use of Modern Asset Pricing Methods for Upstream

Petroleum Project Evaluation, Energy Journal, 19(1):1-12.

Longstaff, F.A. and E.S. Schwartz. (2001) "Valuing American options by simulation: A simple

least-squares approach." The Review of Financial Studies, Vol. 14, No. 1, pp. 113-147.

Breakout 9 – Mining Asset/Extractive Industries Valuation 18

Salahor, G, 1998. Implications of Output Price Risk and Operating Leverage for the

Evaluation of Petroleum Development Projects, Energy Journal, 19(1):13-46.

Samis, M R, Davis, G A, Laughton, D G and Poulin, R, 2006. Valuing uncertain asset cash

flows when there are no options: A real options approach, Resources Policy, 30:285-298.

Tsekrekos, A.E., M.B. Shackleton, and R. Wojakowski. (2003) Evaluating natural resource

investments using the least-squares Monte Carlo simulation approach. In Proceedings of the

Seventh Annual Real Options Conference, July 10-12, Washington DC.

Breakout 9 – Mining Asset/Extractive Industries Valuation 19

Você também pode gostar

- Critical Path Method A Complete Guide - 2020 EditionNo EverandCritical Path Method A Complete Guide - 2020 EditionAinda não há avaliações

- MisUse of MonteCarlo Simulation in NPV Analysis-DavisDocumento5 páginasMisUse of MonteCarlo Simulation in NPV Analysis-Davisminerito2211Ainda não há avaliações

- Bull 1997 02 01Documento7 páginasBull 1997 02 01Shengan ChengAinda não há avaliações

- Calculate Project ROI Using NPV, IRR and Packback PeriodDocumento5 páginasCalculate Project ROI Using NPV, IRR and Packback PeriodsapsrikaanthAinda não há avaliações

- Mineral Project Evaluation - The Ausimm BulletinDocumento3 páginasMineral Project Evaluation - The Ausimm BulletinMatkusa AkitaAinda não há avaliações

- Mine Project Life Cycle - Massmin 2004 - Cap04-01Documento6 páginasMine Project Life Cycle - Massmin 2004 - Cap04-01Cristian Reyes IlicAinda não há avaliações

- A. RISK - Optimal Capital Structure and Financial Risk of Project InvestmentDocumento18 páginasA. RISK - Optimal Capital Structure and Financial Risk of Project Investmentwidya firdansyahAinda não há avaliações

- The Complete Guide To Mining StocksDocumento24 páginasThe Complete Guide To Mining StocksisheanesuAinda não há avaliações

- Valuation of Mining Projects Using Option Pricing TechniquesDocumento8 páginasValuation of Mining Projects Using Option Pricing TechniquesgeyunboAinda não há avaliações

- Project Financial Risk AnalysisDocumento10 páginasProject Financial Risk AnalysisФранческо Леньяме100% (1)

- 7 Key Stages CAPEX ProcessDocumento9 páginas7 Key Stages CAPEX ProcessІрина ТурецькаAinda não há avaliações

- Economic Risk Assessment of Bioethanol Production in South AfricaDocumento9 páginasEconomic Risk Assessment of Bioethanol Production in South Africawidya firdansyahAinda não há avaliações

- Estimating Costs For Mining Prefeasibility StudiesDocumento5 páginasEstimating Costs For Mining Prefeasibility Studiesdghfhh444t5566gfg0% (1)

- Webinar 2019 Mining Financial Model ValuationDocumento30 páginasWebinar 2019 Mining Financial Model ValuationThanh NguyenAinda não há avaliações

- Kear 2004 - Mine Project Life CycleDocumento4 páginasKear 2004 - Mine Project Life CycleedatgkaAinda não há avaliações

- Financial Risk Analysis, HERO HONDADocumento7 páginasFinancial Risk Analysis, HERO HONDAabhijitsamanta1Ainda não há avaliações

- Evaluation Mining Project (Topal, 2008)Documento15 páginasEvaluation Mining Project (Topal, 2008)LFAinda não há avaliações

- ACCA - Opportunity and Risk Analysis in Straegic Project EvaluationDocumento7 páginasACCA - Opportunity and Risk Analysis in Straegic Project EvaluationYash RajgarhiaAinda não há avaliações

- Real OptionsDocumento8 páginasReal OptionsRohail Khan NiaziAinda não há avaliações

- Technical Operating Flexibility in The Analysis of Mine Layouts and SchedulesDocumento8 páginasTechnical Operating Flexibility in The Analysis of Mine Layouts and SchedulesGaluizu001100% (1)

- All-In Sustaining Cost AnalysisDocumento39 páginasAll-In Sustaining Cost AnalysisГанзориг ЗолбаярAinda não há avaliações

- PMRC 131 - Mining Financial Analysis PDFDocumento26 páginasPMRC 131 - Mining Financial Analysis PDFEmmanuel CaguimbalAinda não há avaliações

- Internal Rate of ReturnDocumento16 páginasInternal Rate of ReturnAnnalie Alsado BustilloAinda não há avaliações

- Chapter 14Documento2 páginasChapter 14jhouvanAinda não há avaliações

- Petroleum Project Economics 06Documento15 páginasPetroleum Project Economics 06ediwskiAinda não há avaliações

- Indicators of Sustainability To The MineDocumento544 páginasIndicators of Sustainability To The Minegeominamb100% (1)

- 130207setsumeikai eDocumento68 páginas130207setsumeikai eShaiju ERecycling VargheseAinda não há avaliações

- CRIRSCO International Reporting Template November 2019 PDFDocumento79 páginasCRIRSCO International Reporting Template November 2019 PDFKevin Bladimir Duque ChavezAinda não há avaliações

- Discounted Cash FlowDocumento36 páginasDiscounted Cash Flowsrinivasan9Ainda não há avaliações

- How Mining Companies Improve Share PriceDocumento17 páginasHow Mining Companies Improve Share PriceEric APAinda não há avaliações

- Valuation of Gold Mining Using Real Options PDFDocumento9 páginasValuation of Gold Mining Using Real Options PDFVinay Tupakula100% (2)

- RealOptions ExampleDocumento33 páginasRealOptions Exampleveda20Ainda não há avaliações

- Financial Statement Analysis and Valuation For Rio Tinto CompanyDocumento9 páginasFinancial Statement Analysis and Valuation For Rio Tinto CompanyBachia Trương100% (1)

- Investment Appraisal MethodsDocumento31 páginasInvestment Appraisal MethodsDELGADO ZEVALLOS ANGIE MELISSAAinda não há avaliações

- Economic Analysis of Mining Projects (Csiminga & Iloiu, 2007)Documento5 páginasEconomic Analysis of Mining Projects (Csiminga & Iloiu, 2007)LFAinda não há avaliações

- Economic Modelling and Its Application in Strategic PlanningDocumento12 páginasEconomic Modelling and Its Application in Strategic Planningminerito2211100% (1)

- Concept of Capital Budgeting: Capital Budgeting Is A Process of Planning That Is Used To AscertainDocumento11 páginasConcept of Capital Budgeting: Capital Budgeting Is A Process of Planning That Is Used To AscertainLeena SachdevaAinda não há avaliações

- Net smelter return calculationDocumento7 páginasNet smelter return calculationlindaAinda não há avaliações

- Stages of MININGDocumento6 páginasStages of MININGRonipet II LopezAinda não há avaliações

- Full Paper Freiberg Conference 2013Documento8 páginasFull Paper Freiberg Conference 2013jlzmotricoAinda não há avaliações

- Valuation of Metals and Mining CompaniesDocumento81 páginasValuation of Metals and Mining CompaniesJon GoldmanAinda não há avaliações

- Analyze Project Risk, Break-Even & LeverageDocumento27 páginasAnalyze Project Risk, Break-Even & LeverageSadman Skib.Ainda não há avaliações

- Valuation of Mining BusinessDocumento35 páginasValuation of Mining BusinessuttamksrAinda não há avaliações

- Ch10 Tool Kit NPV Dan IRRDocumento23 páginasCh10 Tool Kit NPV Dan IRRSyarif Bin DJamalAinda não há avaliações

- Leaching of A Cu-Co OreDocumento7 páginasLeaching of A Cu-Co OreEDWIN LEONARDO ESPINOZA PACHECOAinda não há avaliações

- Managerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreDocumento21 páginasManagerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreDianja ApriandaAinda não há avaliações

- Objectives Feasibility StudiesDocumento5 páginasObjectives Feasibility StudiesMyoungki JungAinda não há avaliações

- Determination of Optimal Cut-Off Grade Policy (Referencia)Documento8 páginasDetermination of Optimal Cut-Off Grade Policy (Referencia)11804Ainda não há avaliações

- Q&E Micro Week 1Documento1 páginaQ&E Micro Week 1Aisha IslamadinaAinda não há avaliações

- Valuing Management Flexibility:: A Basis To Compare The Standard DCF and MAP Valuation FrameworksDocumento19 páginasValuing Management Flexibility:: A Basis To Compare The Standard DCF and MAP Valuation FrameworksWilme NareaAinda não há avaliações

- Mine Project Evaluation Techniques: D. Mirakovski, B. KrstevDocumento7 páginasMine Project Evaluation Techniques: D. Mirakovski, B. KrstevTaurai MudzimuiremaAinda não há avaliações

- Chapter 2Documento24 páginasChapter 2yibeltalbalew0978070004Ainda não há avaliações

- Chapter TwoDocumento24 páginasChapter TwoAli HassenAinda não há avaliações

- Valuing Real Options Projects With Correlated UncertaintiesDocumento15 páginasValuing Real Options Projects With Correlated UncertaintiesmikaelcollanAinda não há avaliações

- Chapter 2'Documento24 páginasChapter 2'tilayeyideg100% (2)

- Chapter 12Documento34 páginasChapter 12LBL_Lowkee100% (1)

- A. Risk - Npv-At-Risk Method in Infrastructure Project Investment EvaluationDocumento7 páginasA. Risk - Npv-At-Risk Method in Infrastructure Project Investment Evaluationwidya firdansyahAinda não há avaliações

- Comparing Engineering Project AlternativesDocumento34 páginasComparing Engineering Project Alternativesrobel popAinda não há avaliações

- 2014. Risk-based Project ValueDocumento10 páginas2014. Risk-based Project ValueVo Minh HuyAinda não há avaliações

- REFERENCE - WK4 - Applying Integrated Project-Management Methodology ToHydrocarbon-Portfolio Analysis and OptimizationDocumento5 páginasREFERENCE - WK4 - Applying Integrated Project-Management Methodology ToHydrocarbon-Portfolio Analysis and OptimizationmachydroAinda não há avaliações

- April 3rd - Asynchronous Class - Questions-4Documento3 páginasApril 3rd - Asynchronous Class - Questions-4alidrissiAinda não há avaliações

- Estwani ISO CodesDocumento9 páginasEstwani ISO Codesनिपुण कुमारAinda não há avaliações

- Published Filer List 06072019 Sorted by CodeDocumento198 páginasPublished Filer List 06072019 Sorted by Codeherveduprince1Ainda não há avaliações

- Assessing Eyes NCM 103 ChecklistDocumento7 páginasAssessing Eyes NCM 103 ChecklistNicole NipasAinda não há avaliações

- HU675FE ManualDocumento44 páginasHU675FE ManualMar VeroAinda não há avaliações

- Panasonic TC-P42X5 Service ManualDocumento74 páginasPanasonic TC-P42X5 Service ManualManager iDClaimAinda não há avaliações

- The Impact of Information Technology and Innovation To Improve Business Performance Through Marketing Capabilities in Online Businesses by Young GenerationsDocumento10 páginasThe Impact of Information Technology and Innovation To Improve Business Performance Through Marketing Capabilities in Online Businesses by Young GenerationsLanta KhairunisaAinda não há avaliações

- Obat LasaDocumento3 páginasObat Lasaibnunanda29Ainda não há avaliações

- 4 - Complex IntegralsDocumento89 páginas4 - Complex IntegralsryuzackyAinda não há avaliações

- HP OpenVMS Alpha Version 8.3 and HP OpenVMS Version 8.3-1H1 For IntegrityDocumento65 páginasHP OpenVMS Alpha Version 8.3 and HP OpenVMS Version 8.3-1H1 For IntegrityAlexandru BotnariAinda não há avaliações

- Analysis of VariancesDocumento40 páginasAnalysis of VariancesSameer MalhotraAinda não há avaliações

- Chapter 1 - IntroductionDocumento42 páginasChapter 1 - IntroductionShola ayipAinda não há avaliações

- Wika Type 111.11Documento2 páginasWika Type 111.11warehouse cikalongAinda não há avaliações

- Zhihua Yao - Dignaga and The 4 Types of Perception (JIP 04)Documento24 páginasZhihua Yao - Dignaga and The 4 Types of Perception (JIP 04)Carlos Caicedo-Russi100% (1)

- Flexible AC Transmission SystemsDocumento51 páginasFlexible AC Transmission SystemsPriyanka VedulaAinda não há avaliações

- Eudragit ReviewDocumento16 páginasEudragit ReviewlichenresearchAinda não há avaliações

- Strain Gauge Sensor PDFDocumento12 páginasStrain Gauge Sensor PDFMario Eduardo Santos MartinsAinda não há avaliações

- Marijuana Grow Basics - Jorge CervantesDocumento389 páginasMarijuana Grow Basics - Jorge CervantesHugo Herrera100% (1)

- Legal Research MethodsDocumento10 páginasLegal Research MethodsCol Amit KumarAinda não há avaliações

- DANZIG, Richard, A Comment On The Jurisprudence of The Uniform Commercial Code, 1975 PDFDocumento17 páginasDANZIG, Richard, A Comment On The Jurisprudence of The Uniform Commercial Code, 1975 PDFandresabelrAinda não há avaliações

- Future Design of Accessibility in Games - A Design Vocabulary - ScienceDirectDocumento16 páginasFuture Design of Accessibility in Games - A Design Vocabulary - ScienceDirectsulaAinda não há avaliações

- The Rich Hues of Purple Murex DyeDocumento44 páginasThe Rich Hues of Purple Murex DyeYiğit KılıçAinda não há avaliações

- EE-434 Power Electronics: Engr. Dr. Hadeed Ahmed SherDocumento23 páginasEE-434 Power Electronics: Engr. Dr. Hadeed Ahmed SherMirza Azhar HaseebAinda não há avaliações

- Principles of Cost Accounting 1Documento6 páginasPrinciples of Cost Accounting 1Alimamy KamaraAinda não há avaliações

- Malaysia Year 2011 Calendar: Translate This PageDocumento3 páginasMalaysia Year 2011 Calendar: Translate This PageStorgas FendiAinda não há avaliações

- Executive Education Portfolio Soft Copy-INSEADDocumento58 páginasExecutive Education Portfolio Soft Copy-INSEADОля КусраеваAinda não há avaliações

- Mesopotamia CivilizationDocumento56 páginasMesopotamia CivilizationYashika TharwaniAinda não há avaliações

- CV Abdalla Ali Hashish-Nursing Specialist.Documento3 páginasCV Abdalla Ali Hashish-Nursing Specialist.Abdalla Ali HashishAinda não há avaliações

- Chapter 08Documento18 páginasChapter 08soobraAinda não há avaliações

- Types of LogoDocumento3 páginasTypes of Logomark anthony ordonioAinda não há avaliações