Escolar Documentos

Profissional Documentos

Cultura Documentos

TU - Ras Laffan LNG (II) - 21june2018

Enviado por

James La VeleTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

TU - Ras Laffan LNG (II) - 21june2018

Enviado por

James La VeleDireitos autorais:

Formatos disponíveis

Transaction Update: Ras Laffan

Liquefied Natural Gas Co. Ltd. (II)

Primary Credit Analyst:

Rachel C Goult, Paris (33) 06-2009-1284; rachel.goult@spglobal.com

Secondary Contacts:

Tommy J Trask, Dubai (971) 4-372-7151; tommy.trask@spglobal.com

Michela Bariletti, London (44) 20-7176-3804; michela.bariletti@spglobal.com

Andrey Nikolaev, CFA, Paris (33) 1-4420-7329; andrey.nikolaev@spglobal.com

Table Of Contents

Project Description

Rationale

Liquidity

Outlook

Our Operations Phase Base Case And Downside Case Assumptions

Operations Update

Project Counterparties

Other Modifiers Update

Ratings Score Snapshot

Related Criteria

Related Research

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 21, 2018 1

Transaction Update: Ras Laffan Liquefied Natural

Gas Co. Ltd. (II)

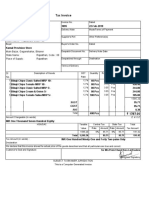

Credit Rating(s)

Senior Secured

US$1.4 bil 5.298% sr secd bnds ser A due 09/30/2020

Foreign Currency A/Stable

Guarantor Ras Laffan Liquefied Natural Gas Co.

Ltd. (3)

*Unless otherwise noted, all ratings in this report are global scale ratings. S&P Global Ratings’ credit ratings on the global scale are comparable

across countries. S&P Global Ratings’ credit ratings on a national scale are relative to obligors or obligations within that specific country.

Project Description

Qatar-based Ras Laffan Liquefied Natural Gas Co. Ltd. (II) (RLII) and Ras Laffan Liquefied Natural Gas Co. Ltd. (3)

(RL3) are liquefied natural gas (LNG) production facilities in the State of Qatar (AA-/Negative/A-1+). The two entities,

collectively known as RL, were set up to enter into limited recourse financings for the purpose of designing, building,

and operating liquefied natural gas (LNG) trains 3, 4, and 5 (in the case of RLII), and trains 6 and 7 (in the case of RL3),

with a design production capacity of 14.1 million metric tons per annum (mtpa) and 15.6 mtpa production capacity,

respectively. The debt issuance was used to refinance the construction costs of RLII, and to fund the remaining

construction activities of RL3, which were fully completed in 2011 following the completion of train 7. RL currently has

a total of $4.3 billion senior debt outstanding (rated and unrated), comprising $908 million at RLII and $3.4 billion at

RL3.

Cash flows are generated predominantly from the sale of liquefied natural gas (LNG) under sale and purchase

agreement (SPAs) with importers of LNG in Europe, Asia and the U.S. Other revenues come from the sale of

condensates and liquefied petroleum gas (LPG). The sale price of all products are linked to oil and gas commodity

prices and are therefore exposed to price volatility.

RLII and RL3 are both owned 70% by Qatar Petroleum (QP; foreign currency AA-/Negative/--) and 30% owned by

Exxon Mobil Corp. (AA+/Negative/A-1+). The two entities guarantee each other's debt and are operationally linked.

Accordingly, we calculate all ratios on a consolidated basis.

Rationale

The 'A' issue credit ratings on the senior secured debt reflect the complexity of operating large-scale LNG facilities, as

well as RL's moderate market risk due to its exposure to inherently volatile commodity prices, which is partially

mitigated by medium- and long-term take-or-pay SPAs that provide about 70% of total revenues. The SPAs cover

virtually all of RL's 30 million tons of annual LNG production and help mitigate the risk of short-term price fluctuations

due to the rolling oil and gas benchmark price indexation. Our expectation of stable production is supported by the

projects' strong historical operational performance, which has demonstrated an excellent safety and availability

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 21, 2018 2

Transaction Update: Ras Laffan Liquefied Natural Gas Co. Ltd. (II)

track-record since operations began. The combined average LNG train availability in 2017 was 97.8% and annual

availability has typically been substantially above the design target of 95.6% for RL3 and 96.0% for RLII since

operations began.

The robust operational performance is supported by RL's low operating cost structure, which boosts its competitive

position in the market. RL has access to Qatar's North Field gas field, which is one of the largest non-associated gas

fields in the world and provides RL with a near-certain supply of feedstock at low cost. The North Field has

recoverable reserves of more than 900 trillion standard cubic feet, or approximately 10% of the world's known

reserves. RL's low production cost is aided by economies of scale of its large production facilities and access to an

experienced and low-cost workforce. Additionally, RL's shareholders, Qatar Petroleum (70%) and ExxonMobil (30%),

each have more than 20 years of experience in the LNG sector, providing knowledge that supports strong operational

performance across the production and marketing activities. Furthermore, RL's cost base benefits from its access to a

fleet of 27 LNG ships in three classes, which keeps down the cost of delivery and ensures shipping availability.

The ratings reflect the strength of RL's financial performance, both under our base case and downside case scenarios.

We forecast robust annual debt service coverage ratios (ADSCR) under our base of 3.3x minimum and 10.6x average,

based on our long-term Brent crude oil and Zeebrugge hub gas price assumptions of $55 per barrel (bbl) and $4 per

million Btu (mmBtu). The minimum occurs in 2019, the year in which RL repays RL3's $879 million bullet maturity. RL

does not have a track record of refinancing debt at maturity and our rating does not factor in any new debt issuance.

We apply a one-notch uplift to long-term issue ratings to reflect the robust average ratio, which could strengthen

further after the bullet repayment. We also apply a two-notch uplift to reflect the project's robust performance under

our downside analysis, a reflection of RL's low cost base. We forecast the project's oil breakeven prices to be around

$US15/bbl.

The positive rating drivers are offset by the single-asset nature of the five LNG trains, which exposes the project to

production risk in the event of a significant force majeure incident, albeit this is partially mitigated by insurance. The

insurance contract has a $1.0 million deductible and a maximum loss amount of $2.0 billion, which are acceptable

terms for the industry. The plant's location in the Middle East also exposes the project to geopolitical risk, if regional

volatility were to temporarily impair production and deliveries beyond the six months of support provided by the debt

service reserve account.

Transaction Structure

• Parent linkage: Delinked

• Structural protection: Neutral

Liquidity

We assess RL's liquidity as neutral. RL's liquidity is supported by a funded debt-service reserve account covering six

months of future debt service. We do not view negatively the lack of major maintenance reserve account. Operations

and maintenance of the facilities are carried out by Qatargas, which passes the maintenance responsibility of large

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 21, 2018 3

Transaction Update: Ras Laffan Liquefied Natural Gas Co. Ltd. (II)

equipment items down to General Electric under a 10-year long-term maintenance contract.

Under the Common Security Agreement (CSA), RL is required to fund all debt service (both principal and interest),

including principal bullet maturities, on a six-month forward-looking basis, before making any distribution to

shareholders. This reflects the project's prudent financial structure, in our view. RL3 fully repaid its US$750 mil 5.832%

senior secured bonds series C in September 2016, as due. RL3's next significant bullet repayment falls due in

September 2019 and totals $879 million (comprising the $615 million 6.75% G series bonds and $264 million of

shareholder co-loans).

Outlook

The stable outlooks reflect our expectation that RLII and RL3 will generate strong consolidated cash flows to enable

full repayment of the US$879 million 2019 bullet maturity and to fully service and repay all other outstanding senior

debt over the next nine years, with a robust debt service cushion. Under our base case, we forecast an ADSCR of 3.3x

in 2019, strengthening materially thereafter as the outstanding senior debt reduces. Our expectation is that RL will

maintain its policy of fully repaying due debt and not refinance at maturity. We also expect that the imposed sanctions

will not have any material impact on the project and Qatar will continue to have access to international waters and

worldwide exports.

Downside Scenario

We could lower the ratings by one notch or more if the project's strong consolidated cash flow generation were to

weaken to put downward pressure on the debt service cover ratios under our base case, or to weaken the project's

resilience under our downside scenario. Reduced cash flows could arise from a sustained period of depressed global oil

and gas prices or if RL's customers were to renegotiate the terms of their long-term LNG offtake contracts, exposing

RL to lower revenues or greater cash flow volatility. An increase in RL's exposure to LNG spot sales could also put the

rating under pressure, particularly if we believe greater spot market exposure would lead to lower revenues or higher

cash flow volatility. Specifically, we would likely lower the ratings if our forecast base-case minimum ADSCR falls

below 2.5x or if the average ratio is no longer comfortably above 5x.

We will continue to monitor the political tensions in the region and may take a negative rating action if we view

developments could be detrimental to RLII's and RL3's ability to generate strong consolidated cash flows. This could

occur, for example, if LNG ships have difficulty in accessing the LNG facilities or face refueling restrictions, or if

international counterparties to the project sever their relationships with Qatar and thereby choke the project's revenue

stream.

Upside Scenario

The project's exposure to commodity price risk and the potential for political tensions in the region limits the potential

for a rating increase.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 21, 2018 4

Transaction Update: Ras Laffan Liquefied Natural Gas Co. Ltd. (II)

Our Operations Phase Base Case And Downside Case Assumptions

Base Case Assumptions

• Train availability: 97%

• Oil price Brent crude US$/bbl: $65, 2018; $60, 2019; $55 2020 and thereafter in line with our assumptions published

on May 7, 2018, "S&P Global Ratings Raises 2018 Brent And WTI Oil Price Assumptions And 2019 Brent Price

Assumptions"; We assume no price differential between JCC and Brent.

• Gas price (Zeegrube Hub): US$4/mmBtu from 2018, which is a price difference of US$1/mmBtu to the Henry Hub

gas price assumptions published in the aforementioned article.

• Capital expenditure: US$200 million per year from 2018 through to the repayment of all existing senior debt in 2027.

• Full repayment of senior debt bullet due in 2019 (i.e., no refinancing).

Base Case Key Metrics

• The project's minimum and average ADSCRs, calculated in line with our criteria, are 3.25x and 10.61x, respectively.

• The minimum ratio is commensurate with a preliminary operations phase SACP of 'bbb'.

Downside Case Assumptions

• Train availability: 92%

• Oil price Brent crude US$/bbl: US$40/bbl from 2018 through the life of the project in line with our assumptions

published in "Market Assumptions Used For Oil And Gas Project Financings" on Jan. 14, 2016." We assume no

price differential between JCC and Brent.

• Gas price (Zeebrugge Hub): 3 US$/mmBtu from 2018, a reduction of $1.0 mmBtu on the base case assumption.

• Royalties: Base case +5%.

• O&M expenditure: Base case +10% 2018-2020, Base case +20% from 2021.

• Capital expenditure: Base case +10% 2018-2020, Base case +20% from 2021.

Downside Case Key Metrics

• Performance under the downside case demonstrates the project's strong resilience to low oil and gas prices. We

assess the project's performance under the downside case as 'aa'.

• Consequently, we make a two-notch positive adjustment to the preliminary operations phase SACP to reflect the

strength of the downside case.

Operations Update

The global hydrocarbon sector has shown stability over the last year, with less volatility in the oil and gas markets.

Hydrocarbon prices have increased materially in 2017 and in 2018 to date, reflecting strong demand globally and

production cuts by OPEC and non OPEC members. The Brent oil price is close to US$80/bbl as of May 2018 and has

been consistently over US$60/bbl since January 2018. In May 2018, we revised upwards our long-term hydrocarbon

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 21, 2018 5

Transaction Update: Ras Laffan Liquefied Natural Gas Co. Ltd. (II)

price deck assumptions for 2018 and 2019 to US$65/bbl and US$60/bbl respectively, while maintaining the long-term

forecast at US$55/bbl. We have reflected this price revision in our base-case analysis, which has resulted in improved

cash flow generation and improves the projects' headroom at the current rating level. The cash flow improvement is

despite the fact that we have revised downward our base-case availability to 97%, from 98% previously, to factor in the

potential for unplanned outages. The minimum forecast DSCR in 2019 is 3.35x under our base-case analysis, up from

3.0x at the time of our last review. The average ratio remains strong at 10.61x (up from 8.4x).

Availability in 2017 was robust at 98.7% for RLII and 96.8% for RL3, above the design availability of 96.0% and 95.6%

respectively. Operational performance continues to be strong and the project has moved the maintenance cycle to a

four-month period, from two months. RL had another strong year in terms of safety performance, with both the total

recordable incident rate and lost time incident rate well below the industry's benchmark level.

RL continues to sell the majority of its LNG under long-term contracts. Its exposure to spot sales is limited and largely

linked to RL's ability to benefit from pricing arbitrate.

RL's operations and maintenance service provider, RasGas Operating Co., has been successfully integrated with that of

the QatarGas operating company. RL has not experienced any operational impact as a result of the merger. The new

combined service provider, Qatargas, officially started providing services at RL in January 2018.

No solution has yet been found for the diplomatic crisis in the region, which began in June 2017 when several

countries abruptly cut off diplomatic relations with Qatar. These countries included Saudi Arabia, United Arab

Emirates, Bahrain, Mauritania, and Egypt. RL's management has confirmed that the imposed sanctions have not had

any material impact on the project, with no disruption to the production, shipping, cash flow, or other activities. Qatar

has access to international waters via the Strait of Hormuz without crossing Saudi, Emirati, or Bahraini national waters

and worldwide exports of products continue unaffected.

Project Counterparties

We assign a counterparty dependency assessment (CDA) to any counterparty that we consider material and not easily

replaceable without significant time or cash flow implications. The issue rating incorporates our CDA criteria during

construction and operations.

Revenue counterparty

RL benefits from multiple long-term SPAs for the LNG production from all trains for the duration of the term of the

debt and beyond. We do not assign a CDA to the SPA counterparties, however, in view of the projects' ability to sell to

the LNG spot market. We would assign a CDA in the future if a change in current sales policy resulted in significant

reliance on established contracts.

Operations and maintenance counterparty

We do not assign a CDA to Qatargas, which performs all operation and maintenance activities for RL since it fully

integrated RasGas Operating Co. in January 2018. We view Qatargas as replaceable, given that the nature of its tasks

is relatively well understood and could be provided by other players in the field, if required. Furthermore, there is a

wide field of replacements and sufficient credit enhancement in the transaction to cover one month's fee for its

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 21, 2018 6

Transaction Update: Ras Laffan Liquefied Natural Gas Co. Ltd. (II)

replacement.

Financial counterparty

The issue rating is weak-linked to the long-term counterparty credit rating on Citibank (A+/Stable/A-1), the account

bank provider, given that the account bank replacement language does not comply with our criteria, "Criteria -

Structured Finance - General: Counterparty Risk Framework Methodology And Assumptions" published June 25, 2013.

Replacement of the account bank provider may not be automatically triggered if our rating on Citibank falls below the

minimum required level of 'A'. The current rating on Citibank meets the rating standards required for a qualifying bank

and does not currently constrain the rating on the project.

Other Modifiers Update

We do not assign any other rating modifiers.

Ratings Score Snapshot

Operations Phase SACP (Senior Debt)

• Operations Phase Business Assessment: 9 (1=best to 12=worst)

• Preliminary SACP: 'bbb'

• Downside Impact on Prelim SACP: 'aa' (+2)

• Capital Structure and Avg. DSCR Impact on Prelim SACP: +1 notch:

• Liquidity: Neutral

• Comparative Analysis Assessment: None

• Operations Phase SACP: a

Modifiers (Senior Debt)

• Parent linkage: Delinked

• Structural protection: Neutral

• Extraordinary government support: Not applicable

• Full credit guarantees: No

• Senior Debt Issue Rating: 'A'

Related Criteria

• Criteria - Corporates - Project Finance: Key Credit Factors For Oil And Gas Project Financings, Sept. 16, 2014

• Criteria - Corporates - Project Finance: Project Finance Operations Methodology, Sept. 16, 2014

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 21, 2018 7

Transaction Update: Ras Laffan Liquefied Natural Gas Co. Ltd. (II)

• Criteria - Corporates - Project Finance: Project Finance Transaction Structure Methodology, Sept. 16, 2014

• Criteria - Corporates - Project Finance: Project Finance Framework Methodology, Sept. 16, 2014

• General Criteria: Country Risk Assessment Methodology And Assumptions, Nov. 19, 2013

• Criteria - Structured Finance - General: Counterparty Risk Framework Methodology And Assumptions, June 25,

2013

• Criteria - Corporates - Project Finance: Project Finance Construction And Operations Counterparty Methodology,

Dec. 20, 2011

• General Criteria: Use Of CreditWatch And Outlooks, Sept. 14, 2009

Related Research

• S&P Global Ratings Raises 2018 Brent And WTI Oil Price Assumptions And 2019 Brent Price Assumptions, May 7,

2018

• Market Assumptions Used For Oil And Gas Project Financings, Jan. 14, 2016.

Additional Contact:

Infrastructure Finance Ratings Europe; InfrastructureEurope@spglobal.com

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 21, 2018 8

Copyright © 2018 by Standard & Poor’s Financial Services LLC. All rights reserved.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be

modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of

Standard & Poor’s Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party

providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or

availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use

of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS

OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM

FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY

SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive,

special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by

negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact.

S&P’s opinions, analyses and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any

investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The

Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making

investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from

sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P

reserves the right to assign, withdraw or suspend such acknowledgment at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the

assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result,

certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the

confidentiality of certain non-public information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate

its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com

and www.globalcreditportal.com (subscription), and may be distributed through other means, including via S&P publications and third-party redistributors. Additional

information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

STANDARD & POOR’S, S&P and RATINGSDIRECT are registered trademarks of Standard & Poor’s Financial Services LLC.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 21, 2018 9

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Risk and Rates of Return: Multiple Choice: ConceptualDocumento79 páginasRisk and Rates of Return: Multiple Choice: ConceptualKatherine Cabading InocandoAinda não há avaliações

- ISU BillingDocumento2 páginasISU BillingsurajsapAinda não há avaliações

- Cost Accounting SeatworkDocumento2 páginasCost Accounting SeatworkLorena TuazonAinda não há avaliações

- Forex Candlestick MagicDocumento70 páginasForex Candlestick MagicAlexsandro Souza de Lima100% (2)

- Magic Formula Tesed by Paiboon On SETDocumento13 páginasMagic Formula Tesed by Paiboon On SETmytheeAinda não há avaliações

- Business Analysis For WalmartDocumento67 páginasBusiness Analysis For Walmartvinod3511100% (1)

- A A 03195973Documento1 páginaA A 03195973Ayden Zaebear RamdyAinda não há avaliações

- Logistics Invoice VerificationDocumento58 páginasLogistics Invoice VerificationPhylax1100% (1)

- 9D Research GroupDocumento8 páginas9D Research Groupapi-291828723Ainda não há avaliações

- ct12005 2009Documento176 páginasct12005 2009nigerianhacksAinda não há avaliações

- The Secrets of Trading Chart Patterns Like The Pros 29 Jan 24Documento51 páginasThe Secrets of Trading Chart Patterns Like The Pros 29 Jan 24VERO NICAAinda não há avaliações

- RJR Nabisco ValuationDocumento33 páginasRJR Nabisco ValuationKrishna Chaitanya KothapalliAinda não há avaliações

- Uniform System of AccountingDocumento1 páginaUniform System of Accountinganon_368154272Ainda não há avaliações

- NIDLP Delivery PlanDocumento258 páginasNIDLP Delivery Planace187Ainda não há avaliações

- Warehouse Clubs in The PhilippinesDocumento6 páginasWarehouse Clubs in The PhilippinesKyle Osbert TolentinoAinda não há avaliações

- Bikaji Bill 2Documento1 páginaBikaji Bill 2PRAMODAinda não há avaliações

- Food and BeverageDocumento28 páginasFood and BeverageMohammad S NokibAinda não há avaliações

- Final Reviewer For TAX 2Documento45 páginasFinal Reviewer For TAX 2Mosarah AltAinda não há avaliações

- Marketing Strategies Term Project OutlineDocumento3 páginasMarketing Strategies Term Project OutlinesaaaruuuAinda não há avaliações

- Microeconomic PPT Mayank and SahilDocumento13 páginasMicroeconomic PPT Mayank and SahilMayank RelanAinda não há avaliações

- A.P.S Iapm Unit 3Documento19 páginasA.P.S Iapm Unit 3vinayak mishraAinda não há avaliações

- AAA StrategyDocumento6 páginasAAA StrategysiddharthAinda não há avaliações

- 15.401 Recitation 15.401 Recitation: 2a: Fixed Income SecuritiesDocumento29 páginas15.401 Recitation 15.401 Recitation: 2a: Fixed Income SecuritieswelcometoankitAinda não há avaliações

- Case of Study Organizational BehaviorDocumento3 páginasCase of Study Organizational BehaviorgabrielasoliisAinda não há avaliações

- Indian Weekender Vol 6 Issue 03Documento40 páginasIndian Weekender Vol 6 Issue 03Indian WeekenderAinda não há avaliações

- 10 - Financing of Railway Projects - IRADocumento34 páginas10 - Financing of Railway Projects - IRAsakethmekalaAinda não há avaliações

- Generation and Screening of Project IdeasDocumento17 páginasGeneration and Screening of Project IdeasAnkit BarjatiyaAinda não há avaliações

- The Race To The BottomDocumento51 páginasThe Race To The BottomtimeupthailandAinda não há avaliações

- Decision AnalysisDocumento2 páginasDecision AnalysisNatalie O'Beefe LamAinda não há avaliações

- GSPARX Residential Solar Package-June2019Documento1 páginaGSPARX Residential Solar Package-June2019يوسف محمد صالحAinda não há avaliações